Overview

The article examines nine distinct types of SME loans that play a crucial role in fostering business growth for small and medium enterprises. It underscores the significance of tailored financing solutions, such as the 7(a) loan and microloans, which deliver essential capital for various operational needs. By leveraging these financial tools, SMEs can effectively align their financial strategies with growth objectives, while adeptly navigating the challenges they encounter.

Introduction

In the dynamic landscape of small and medium enterprises (SMEs), securing the right financing is paramount for fostering growth and ensuring sustainability. As businesses navigate the complexities of their financial needs, tailored loan solutions emerge as essential resources, enabling them to align their funding strategies with unique operational goals.

Customized SME loans that cater to specific circumstances, along with innovative options like microloans and equipment financing, empower entrepreneurs to make informed decisions. This article explores the various financing avenues available to SMEs, illustrating how a comprehensive understanding of these options can significantly influence their success in an increasingly competitive market.

Finance Story: Tailored SME Loan Solutions for Business Growth

Finance Story excels in providing tailored financing solutions, including various types of SME loans, specifically designed for small and medium businesses aiming for growth and expansion. By emphasizing a thorough understanding of each client's unique financial landscape, Finance Story offers a diverse range of funding options, including:

- Types of SME loans

- Commercial property mortgages

- Business finance

- SMSF options

- Residential home mortgages

- Expat financial products

This personalized approach not only ensures that small to medium enterprises receive the most suitable types of SME loans tailored to their specific situations but also establishes Finance Story as a trusted partner in their financial journey.

In 2025, the demand for financing among small and medium enterprises in Australia remains robust, with approximately 70% of these businesses opting for customized funding solutions to meet their evolving needs. Expert insights underscore the critical role of types of SME loans in fostering growth for enterprises, as they empower small and medium-sized companies to align their financial strategies with their operational goals. Sheila Johnson, co-founder of BET, emphasizes the importance of passion in entrepreneurship, stating, "When I was younger, there was something in me. I had passion... it’s this little engine that roars inside of me, and I just want to keep going and going." This sentiment resonates with the necessity for SMEs to pursue customized funding options, such as the types of SME loans, that supports their aspirations.

Finance Story is dedicated to developing refined and highly personalized cases to present to lenders, ensuring that clients can secure the appropriate types of SME loans that meet their needs. Case studies reveal effective funding strategies where organizations have successfully aligned their budgets with their priorities. For instance, the case study titled 'Aligning Budget with Priorities' illustrates how an enterprise reassessed its spending to ensure it matched its financial objectives. As the OECD continues to monitor types of SME loans and funding trends, it is evident that personalized support is not merely a trend but a necessity for SMEs striving to thrive in a competitive landscape. Vidal Sassoon humorously reminds us that success comes before work only in the dictionary, reinforcing that hard work is essential in achieving financial goals.

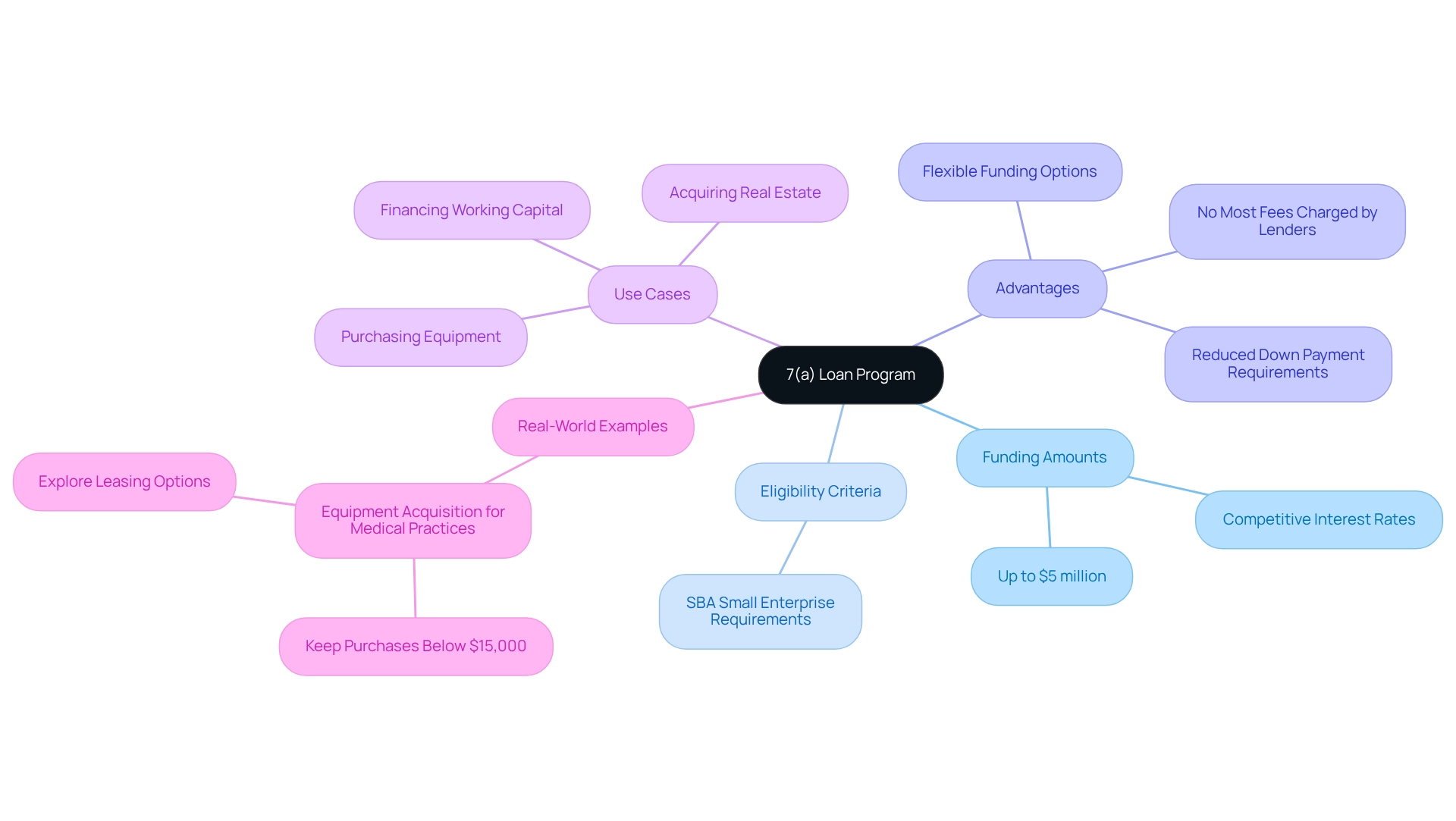

7(a) Loan: Versatile Financing for Various Business Needs

The 7(a) financing program, backed by the U.S. Small Business Administration (SBA), provides small enterprises with flexible funding options tailored to diverse needs. This program allows funding amounts of up to $5 million, making it ideal for various purposes such as purchasing equipment, acquiring real estate, or financing working capital. To qualify for 7(a) financing, companies must meet the SBA's criteria for a small enterprise, ensuring that the program serves its intended audience. In 2025, small enterprises increasingly turned to 7(a) loans, with average loan amounts reflecting a growing demand for accessible funding. The program's competitive interest rates, averaging around [insert specific interest rate], along with reduced down payment requirements, further enhance its appeal, enabling SMEs to manage their financial responsibilities effectively.

For enterprises operating under leasehold arrangements or lacking a physical structure, funding alternatives may be limited to cash savings or the equity in any owned property. For instance, if an entrepreneur possesses a home valued at $1.3 million with $300,000 owed, they could potentially access $740,000 in equity by borrowing up to 80% LVR. This equity can be combined with cash savings to facilitate company acquisitions, providing a practical alternative to traditional financing options like the 7(a) funding.

Real-world examples illustrate the program's impact; for example, medical practices have successfully utilized 7(a) funding to acquire essential equipment, often keeping individual purchases below $15,000 to enhance budgeting. By exploring leasing options for rapidly evolving technology, these companies have effectively managed costs while ensuring they remain equipped for operational demands. The SBA's regulations also play a crucial role in making these financial products accessible, as they prohibit lenders from charging most fees, allowing only a flat fee of $2,500 per transaction. This structure not only alleviates the financial burden on borrowers but also encourages more small enterprises to consider the 7(a) program as a viable funding option. With its diverse applications and advantageous framework, the 7(a) financing program emerges as a vital resource among the types of SME loans for small and medium enterprises aiming to foster their growth.

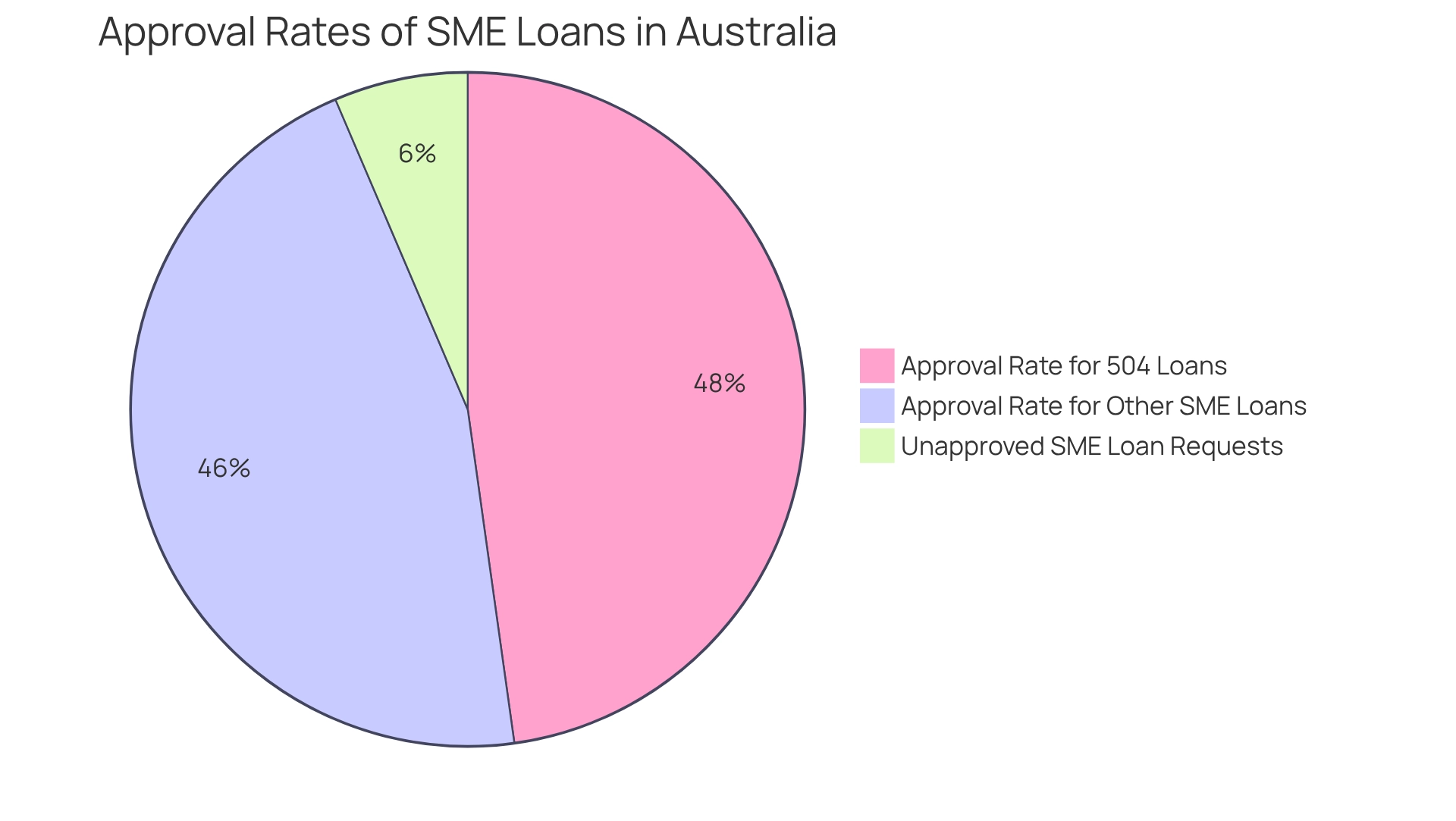

504 Loan: Long-Term Financing for Real Estate and Equipment

The 504 program offers long-term, fixed-rate funding tailored for the acquisition of significant fixed assets, including real estate and equipment. This funding option is particularly advantageous for small and medium enterprises (SMEs) seeking types of SME loans to expand while safeguarding their cash flow. In 2025, typical amounts for 504 mortgages in Australia range from $50,000 to $5 million, allowing enterprises to secure up to 90% funding. Such substantial financing can significantly bolster expansion efforts and enhance operational facilities, positioning the 504 loan as an essential resource for firms aiming for growth, particularly in light of the various types of SME loans available. Current trends indicate a robust demand for long-term funding alternatives among SMEs, with approval rates for debt support from financial institutions reaching an impressive 90.8%. This statistic reflects a favorable lending environment for small enterprises, particularly those looking to invest in real estate and equipment. Furthermore, since 2010, over 87% of small enterprise financing requests in Canada have been approved annually, underscoring a supportive landscape for SMEs in need of financial assistance.

At Finance Story, we specialize in crafting refined and highly customized proposals for banks, empowering small business owners to navigate the complexities of securing the right funding. Our expertise in refinancing and obtaining tailored business financing for commercial property investments equips us to provide valuable insights into repayment criteria, enabling businesses to make informed decisions. The 504 financing program emerges as a strategic choice for SMEs, providing them with types of SME loans that allow for significant funding while preserving financial stability.

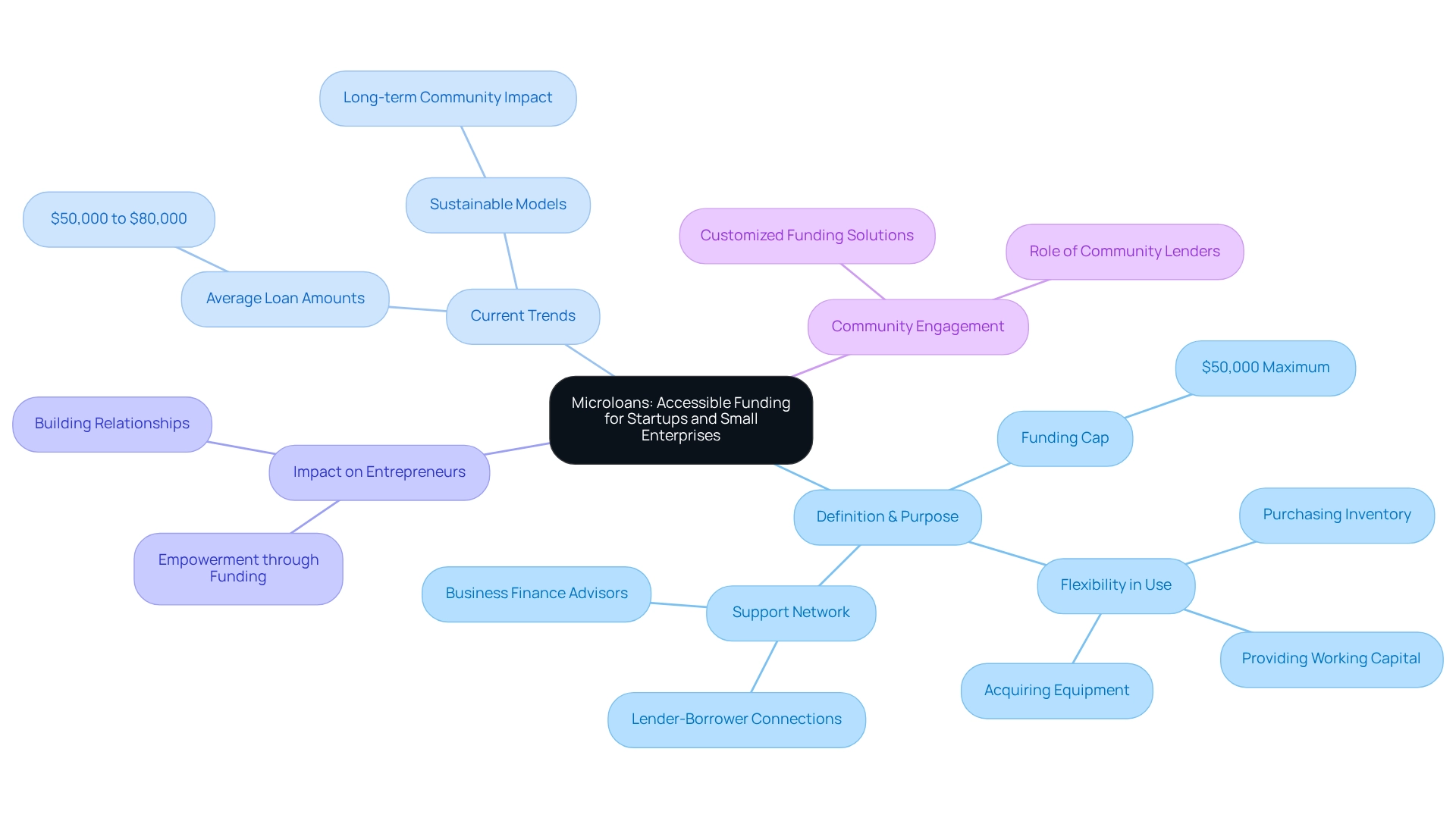

Microloans: Accessible Funding for Startups and Small Enterprises

Microfinancing represents a crucial financial aid mechanism, typically capped at $50,000, specifically designed to empower startups and small enterprises with the capital necessary for growth. These credits are primarily provided by non-profit entities and community financiers, enhancing their accessibility for businesses that may struggle to secure conventional bank funding. Microloans serve diverse purposes, including purchasing inventory, acquiring equipment, or providing essential working capital. This flexibility renders them an invaluable resource for entrepreneurs seeking to establish or expand their ventures.

As we look to 2025, the landscape for microloans continues to evolve, with a growing emphasis on sustainable microfinance models aimed at generating long-term positive impacts on communities. Current statistics indicate that microloans are increasingly becoming a preferred choice for new enterprises, with average loan amounts for online lenders typically ranging from $50,000 to $80,000. This trend reflects a nurturing environment for startups, evidenced by the thriving small enterprises financed through microloans, which underscore the potential of these financial solutions to foster entrepreneurial success.

Expert insights reveal that microloans not only grant access to essential funds but also foster connections between lenders and borrowers, thereby enhancing the overall support network for small ventures. For instance, National Business Capital connects enterprises with a diverse lender marketplace, streamlining the search for capital and providing tailored assistance through knowledgeable Business Finance Advisors. As the demand for microloans surges, particularly among startups in Australia, community lenders are stepping up to offer customized funding solutions that meet the specific needs of these enterprises. A quote from a community lender encapsulates this trend: 'Microloans are not just about funding; they are about building relationships that empower entrepreneurs to succeed.

Working Capital Loans: Essential for Daily Operations

Types of SME loans, such as working capital financing, represent essential short-term funding solutions tailored to support the daily operations of small and medium-sized businesses. These funds empower companies to manage critical operational costs, including payroll, rent, and inventory acquisitions, thereby ensuring they maintain liquidity and operational effectiveness. As we look towards 2025, the landscape for working capital financing has evolved, with a growing number of small and medium enterprises recognizing their importance in navigating cash flow fluctuations.

The approval processes for working capital financing have become increasingly efficient, allowing companies to secure funds swiftly when needed. This agility proves vital, particularly during times of economic uncertainty or unforeseen expenses. Current trends indicate that small and medium enterprises are progressively seeking various types of SME loans to sustain their operations, with average amounts typically ranging from $10,000 to $500,000, depending on the organization's size and requirements. Repayment terms generally span from six months to three years, providing flexibility for companies to manage their cash flow effectively.

Data from 2025 reveals that a significant portion of credit applications—approximately 18%—are denied due to inadequate business performance, underscoring the necessity for SMEs to maintain robust financial stability to secure funding. This statistic holds particular relevance for underrepresented entrepreneurs, who often face additional obstacles in accessing financing. Furthermore, common reasons for loan application rejections include excessive existing debt (44%) and insufficient collateral (33%). This highlights the importance of understanding the lending landscape and adequately preparing before pursuing types of SME loans for funding. As Shane Duffy, founder of Finance Story, emphasizes, lenders assess the strength of a company's profits, personal finances, and existing debts. They require a solid operational strategy and cash flow forecasts for at least the next 12 months to ascertain that the venture can sustain itself and meet repayment obligations. Successful case studies illustrate how working capital financing has enabled small and medium-sized enterprises to thrive. For instance, a local retail company utilized a working capital advance to replenish inventory during peak seasons, resulting in a 30% increase in sales. This growth was facilitated by the loan, allowing the company to effectively meet customer demand, showcasing the transformative potential of these loans when used strategically.

As the lending environment continues to evolve, resources such as the SBA’s Lender Match are becoming indispensable for small and medium enterprises seeking competitive funding options. By connecting businesses with suitable lenders, these resources enhance access to necessary capital, fostering growth and stability within the small business sector. Small and medium-sized enterprises are encouraged to leverage the SBA’s Lender Match tool to identify appropriate lenders for their working capital needs. In conclusion, working capital financing remains a cornerstone for SMEs striving to navigate the complexities of daily operations and achieve sustainable growth.

Equipment Loans: Financing for Machinery and Technology

Equipment financing is specifically designed to assist businesses in acquiring or leasing the machinery and technology essential for their operations. These financial products typically cover up to 100% of the equipment expense and offer adaptable repayment conditions. By obtaining equipment credit, small and medium enterprises can secure the tools they need to enhance productivity and efficiency without depleting their cash reserves. This strategy positions equipment financing as a vital funding option for growth.

Consider how equipment financing could transform your business operations. With the right tools, you can significantly boost your efficiency and output. Furthermore, this financing option allows you to invest in crucial technology while preserving your working capital, making it a strategic choice for businesses looking to thrive in a competitive landscape.

Invoice Financing: Unlocking Cash Flow from Outstanding Invoices

Invoice funding empowers enterprises to access essential cash flow by leveraging unpaid invoices as collateral for loans. This funding option provides immediate access to resources, allowing small and medium enterprises to effectively manage operational expenses while awaiting customer payments. By converting receivables into cash, companies can sustain liquidity and capitalize on growth opportunities without the delays tied to payment cycles.

In 2025, invoice funding has emerged as a vital resource for SMEs, with numerous successful enterprises adopting this method to enhance their cash flow management. Reports indicate a significant increase in the average amounts released through invoice funding in Australia, reflecting a growing trend among small businesses to bolster their financial health. Effective cash flow management is crucial for navigating challenges and seizing opportunities in today's dynamic economic environment.

Expert insights underscore the critical role of invoice financing in preserving liquidity. Financial professionals emphasize that using invoices as collateral not only provides instant cash but also contributes to long-term sustainability. As Anthony Caie, Director of B2B & Services, remarked, "Being able to offer flexible payment terms to our B2B customers underpins our market offering." This flexibility is paramount, as many companies have faced difficulties in maintaining profitability due to increased access to credit and the economic downturn triggered by the pandemic.

Furthermore, specific case studies illustrate how successful businesses have harnessed invoice funding to overcome financial hurdles and invest in growth. For instance, companies that have adopted innovative invoice funding solutions report enhanced cash flow management and improved operational efficiency.

Overall, invoice funding is one of the types of SME loans that emerges as a strategic asset for small and medium-sized enterprises, enabling them to effectively manage cash flow and invest in their growth without the limitations of traditional funding methods.

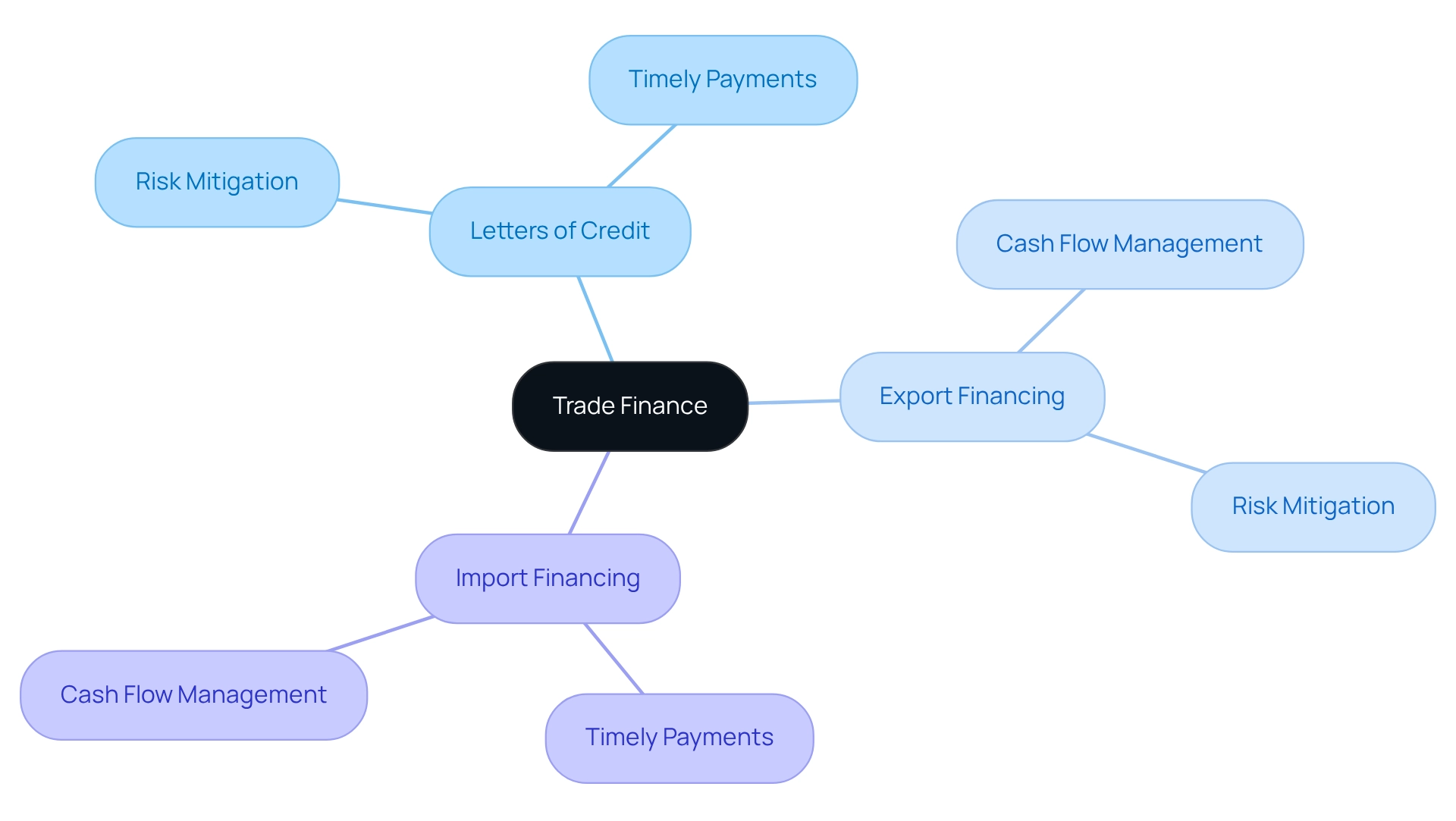

Trade Finance: Supporting International Business Transactions

Trade finance is a critical component of international trade, encompassing a variety of financial products designed to facilitate transactions across borders. This includes essential tools such as:

- Letters of credit

- Export financing

- Import financing

All of which serve to mitigate the risks inherent in cross-border dealings.

For small and medium-sized enterprises seeking to expand into global markets, trade finance provides indispensable support. It enables these businesses to manage cash flow effectively, ensure timely payments, and navigate the complexities of international trade. By leveraging trade finance, companies can position themselves for growth and success in an increasingly competitive landscape.

In sum, trade finance is not just a financial service; it is a vital element of a robust growth strategy for enterprises aiming to thrive on the global stage.

Credit Line/Overdraft Facility: Flexible Access to Funds

A credit line or overdraft facility grants companies flexible access to funds, empowering them to manage unforeseen expenses or seize immediate opportunities. These types of SME loans are funding alternatives that enable small and medium enterprises to tap into resources as needed, up to a predetermined limit, incurring interest solely on the amount utilized. This adaptability is vital for effective cash flow management, allowing companies to respond swiftly to evolving financial conditions without the delays associated with traditional financing approval processes.

In 2025, statistics reveal that 22% of large firms and 5% of small enterprises anticipate enhancing their investments, highlighting the growing reliance on credit lines and overdraft options. Moreover, firms express optimism regarding future turnover and investment, with a net 6% reporting increased turnover and a particularly pronounced expectation for investment growth among larger enterprises. This trend underscores the importance of flexible funding alternatives, such as types of SME loans, in promoting business expansion and stability within a shifting economic landscape.

For leasehold enterprises, funding options may be limited to cash reserves or equity from owned assets, emphasizing the need for tailored credit proposals that can effectively present business cases to lenders. Additionally, 14% of firms perceive downside risks to their inflation outlook, a decrease from 16%, reflecting the economic challenges faced by small and medium-sized enterprises.

Resources such as those offered by Finance Story can assist clients in understanding their commercial credit statements, providing valuable insights into their funding options. By leveraging types of SME loans, such as credit lines and overdraft facilities, SMEs can navigate these economic uncertainties while capitalizing on growth opportunities.

Understanding SME Loans: Key to Financial Success

Understanding the different types of SME loans is crucial for entrepreneurs aiming to secure capital for growth and expansion. Each of the types of SME loans is tailored to meet specific financial needs, offering unique advantages that can profoundly affect a business's operational capabilities and cash flow management. By carefully evaluating their requirements, SMEs can select the most suitable types of SME loans to drive their success, including conventional loans like Term Loans, which offer fixed repayment plans ideal for financing substantial purchases or expansions. Typically, they present lower interest rates compared to alternative options, rendering them a cost-effective choice for long-term investments.

Line of Credit serves as a flexible funding option, enabling companies to borrow up to a predetermined limit and incur interest solely on the amount utilized. This option is particularly advantageous for managing cash flow fluctuations and unforeseen expenses.

Invoice Financing allows businesses to borrow against outstanding invoices, providing immediate cash flow relief. This strategic choice is especially beneficial for companies with slow-paying clients, ensuring operational continuity without delays.

Equipment Financing is specifically designed for acquiring or leasing essential equipment, enabling companies to obtain necessary tools without a significant initial investment. Often, the equipment itself serves as collateral, minimizing risk for lenders.

Commercial Real Estate Financing is tailored for acquiring or refinancing commercial properties, typically featuring longer terms and lower interest rates. Understanding the loan-to-value ratio (LVR) is vital, as lenders often allow borrowing against the commercial property rather than the business itself. For instance, if a commercial property is appraised at $1M, a lender might permit a maximum financing amount of $700k (70% LVR), requiring a $300k deposit along with additional funds for operational needs.

SBA Loans, backed by the Small Business Administration, offer favorable terms and reduced down payments, making them accessible for small enterprises—particularly beneficial for startups and those with limited credit histories.

Merchant Cash Advances provide a lump sum payment in exchange for a percentage of future sales. While this option grants quick access to funds, it often entails higher costs, necessitating careful evaluation of repayment capabilities.

Peer-to-Peer Lending connects borrowers directly with individual investors, frequently resulting in lower interest rates and more flexible terms. This alternative is excellent for businesses that may face challenges with traditional lending criteria, as there are various types of SME loans, including crowdfunding, which utilizes platforms to gather small contributions from numerous individuals, serving as a valuable method for SMEs to finance projects without incurring debt while also generating interest in the business.

The importance of financial education in successfully obtaining these funds cannot be overstated. Business owners who understand the nuances of types of SME loans and each credit type are better equipped to make informed decisions, ultimately enhancing their chances of securing favorable funding. Recent data indicates that understanding the types of SME loans is vital for growth, with a significant portion of small enterprises still lacking comprehensive awareness of available financing solutions. For example, as of 2025, only 40% of small business owners in Australia are fully informed about the various types of SME financing options available to them.

Case studies, such as Nethone's successful funding through the European Fund for Strategic Investments, illustrate how targeted financial assistance can enable SMEs to effectively tackle challenges such as cybercrime. By employing the right funding strategies, owners can not only address their immediate financial needs but also position themselves for sustained success. Moreover, borrowers should remain vigilant regarding loans with risky features, such as prepayment penalties, balloon payments, negative amortization, or interest-only terms, and should seek alternative estimates for safer loan options. Engaging with insights from financial educators can further assist business owners in selecting the most appropriate financing options.

Conclusion

Navigating the financial landscape of small and medium enterprises (SMEs) is no small feat. Understanding the various financing options available is crucial for success. Tailored loan solutions, such as the 7(a) and 504 loan programs, microloans, and working capital loans, provide SMEs with the flexibility and resources needed to achieve their operational goals. Each financing avenue offers distinct benefits, allowing businesses to align their funding strategies with specific needs—whether it's for equipment acquisition, real estate investment, or managing day-to-day operations.

As the demand for personalized financing continues to grow, it is evident that SMEs must prioritize a comprehensive understanding of these options to secure the right funding. The landscape reflects a supportive environment for businesses that are proactive in exploring available resources. Options such as invoice financing and trade finance can enhance cash flow management and facilitate international transactions.

The key to thriving in a competitive market lies in leveraging customized financing solutions that cater to the unique requirements of each business. By making informed decisions based on a thorough evaluation of available loan types, SMEs can not only meet immediate financial needs but also position themselves for sustainable growth. The emphasis on financial education and strategic planning cannot be overstated. These elements empower entrepreneurs to navigate challenges and seize opportunities effectively, ultimately driving their success in the ever-evolving business landscape.