Overview

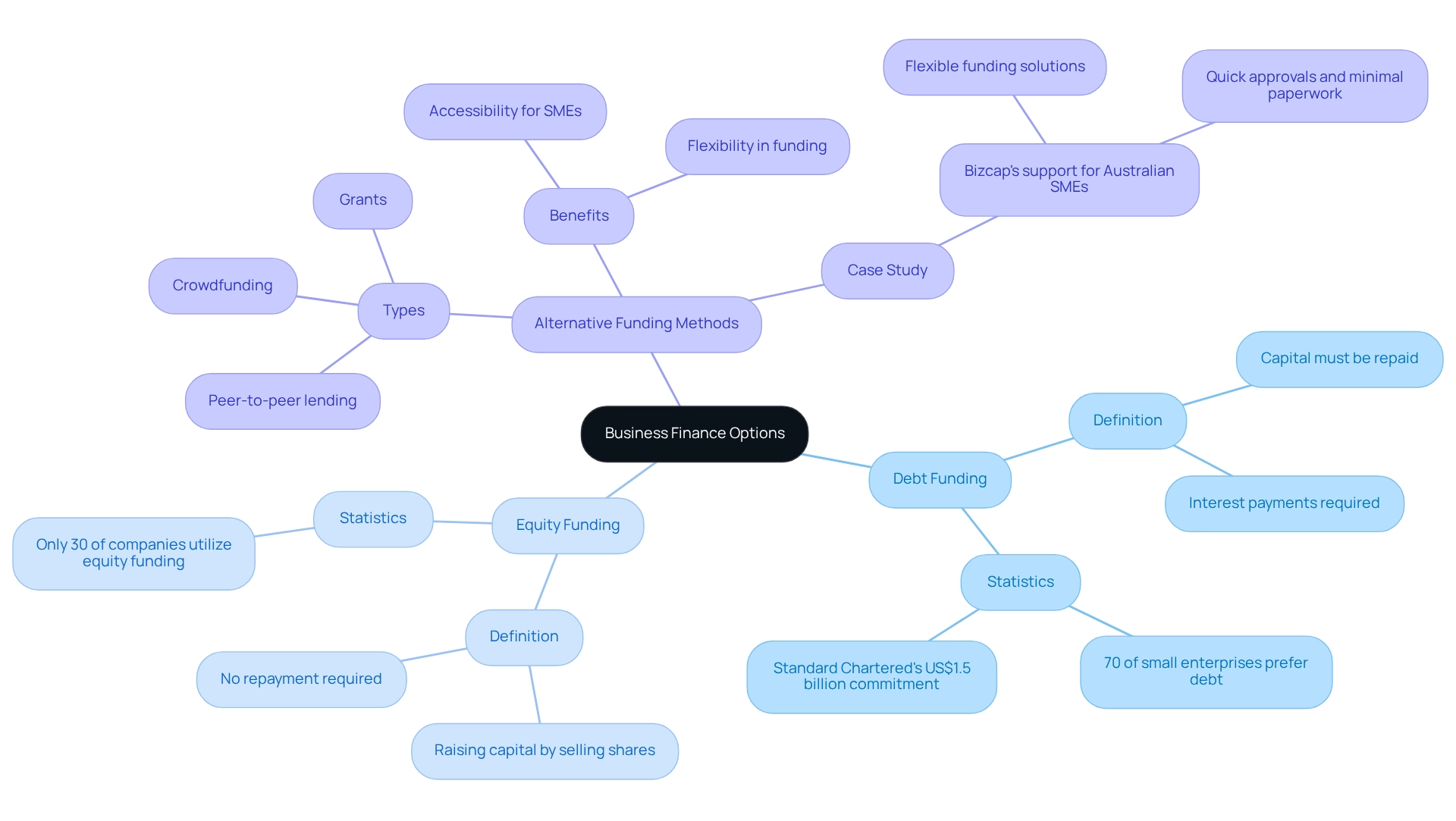

The finance options available for businesses encompass:

- Debt financing

- Equity financing

- Alternative funding methods

Each option is tailored to meet distinct needs and circumstances. Notably, debt financing remains the most widely utilized option. However, there is a notable surge in interest toward alternative methods such as crowdfunding and grants. This shift reflects the evolving landscape of business funding, particularly for small and medium-sized enterprises (SMEs) that encounter unique financial challenges. As businesses navigate these options, understanding the implications of each can empower them to make informed decisions.

Introduction

In the dynamic world of business finance, understanding the multitude of funding options available is essential for entrepreneurs navigating their growth journey. As businesses confront increasing challenges in securing necessary capital, they must evaluate the merits of debt, equity, and alternative financing methods.

With a significant preference for debt financing dominating the landscape in 2025, innovative approaches like crowdfunding are gaining traction. Business owners now have a wealth of resources at their disposal. However, the complexities of each financing type demand careful consideration and strategic planning.

This article delves into various financing avenues, the critical role of financial advisors, and practical tips for successfully securing the funding needed to thrive in today’s competitive market.

Understanding Business Finance Options

The finance options available for businesses encompass a diverse array of funding sources that companies can leverage to enhance operations, growth, and expansion. These finance options can be broadly categorized into three primary types: debt, equity, and alternative funding methods. Understanding these classifications is crucial for entrepreneurs seeking the most suitable monetary solutions tailored to their specific needs.

Debt funding involves acquiring capital that must be repaid over time, typically with interest. This approach remains a preferred option among companies, with approximately 70% of small enterprises opting for debt support in 2025. This statistic underscores a significant reliance on loans to drive growth and manage cash flow. Furthermore, Standard Chartered's commitment of US$1.5 billion over the next three years for its 'Fit for Growth' program highlights the increasing preference for debt solutions, providing substantial financial backing.

Conversely, equity funding entails raising capital by selling shares of the company, allowing owners to secure funds without incurring debt. However, only about 30% of companies currently utilize equity funding, indicating a prevailing inclination towards debt solutions in the current economic climate.

Recent trends reveal a growing interest in alternative funding methods, such as crowdfunding, grants, and peer-to-peer lending. These options have gained traction due to their accessibility and flexibility, particularly for small and medium-sized enterprises (SMEs) that may encounter difficulties securing traditional loans. For instance, Finance Story focuses on crafting refined and highly customized cases to present to banks, ensuring that small business owners can secure appropriate funding for their commercial property investments, including warehouses, retail locations, factories, and hospitality projects.

This approach addresses the financial challenges faced by SMEs, enabling them to access essential funding for expansion and stability.

As enterprises navigate the complexities of funding, the conversation surrounding finance options, including debt and equity support, continues to evolve. Experts suggest that while debt funding can provide immediate capital, it also introduces financial risk due to repayment obligations. On the other hand, equity funding may dilute ownership but offers the advantage of not requiring repayment, making it an attractive choice for companies aiming to grow without the burden of debt.

Deloitte's MarginPLUS survey indicates that nearly half of global banking and capital markets participants plan to conduct an enterprise-wide assessment of cost structures prior to implementing an expense management program to achieve savings by 2026. This highlights the importance of strategic financial planning.

In conclusion, the landscape of finance options for businesses in 2025 is characterized by a significant preference for debt funding, a rising interest in alternative methods, and a cautious approach to equity funding. Entrepreneurs must carefully evaluate their funding needs and consider the implications of each option to make informed decisions that align with their growth objectives. Additionally, regulatory changes, such as the Basel III Endgame re-proposal, may impact debt financing options for companies, providing timely context for the audience.

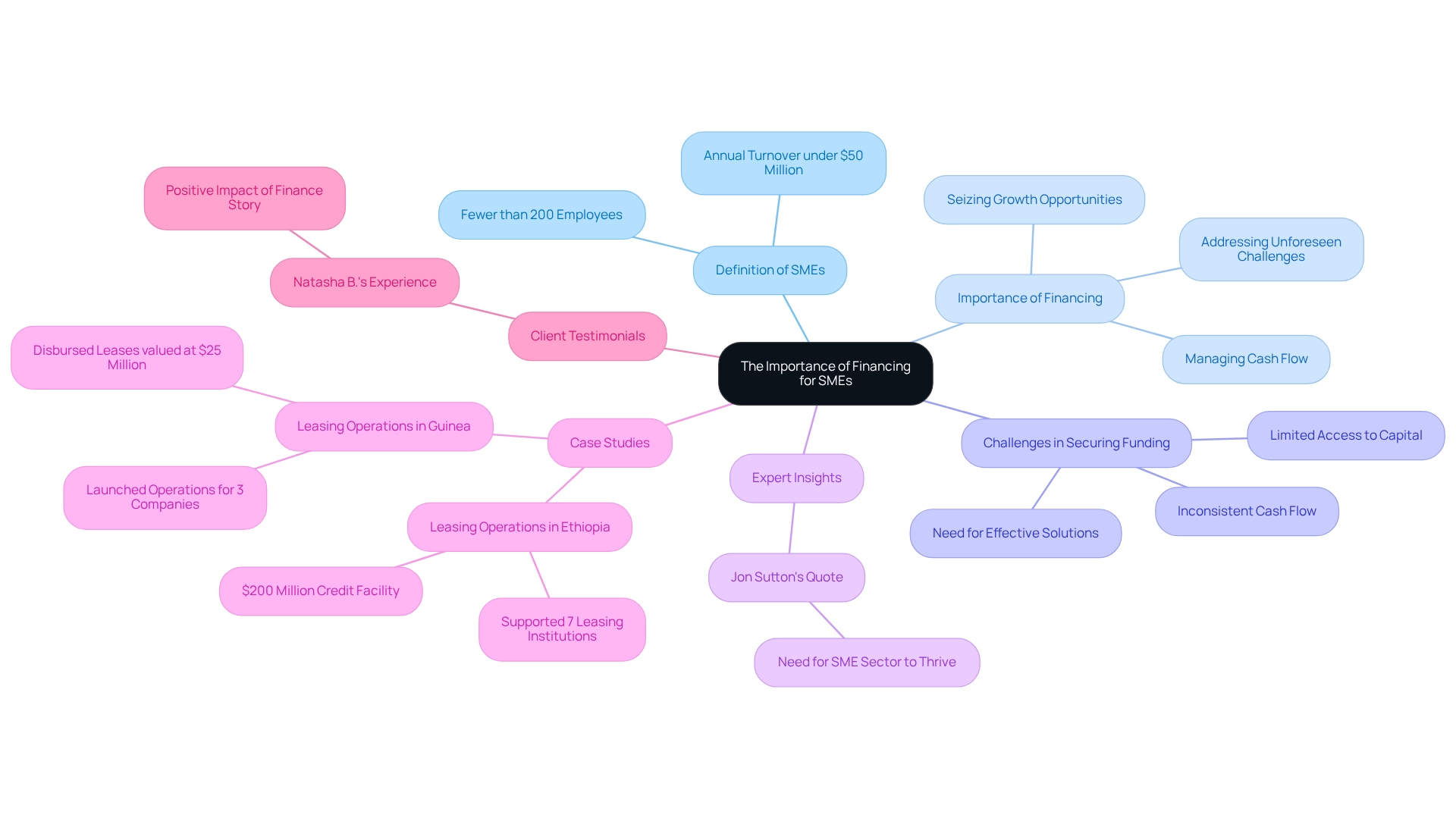

The Importance of Financing for SMEs

Financing is pivotal for small and medium-sized enterprises (SMEs), defined as entities with fewer than 200 employees or an annual turnover of under $50 million. This financial support empowers SMEs to seize growth opportunities, manage cash flow effectively, and address unforeseen challenges. In 2024, Australia is home to approximately 2.66 million SMEs, accounting for over 99% of all enterprises, with many operating in sectors such as construction, retail, professional services, and real estate.

However, these businesses frequently encounter significant hurdles in securing funding, including limited access to capital, inconsistent cash flow, and an urgent need for effective funding solutions. Without adequate funding, SMEs may struggle to maintain operations, invest in innovative technologies, or expand their market presence. The ability to secure funding is essential for hiring new staff, purchasing inventory, and covering vital operational expenses. This financial support not only aids in day-to-day operations but also plays a crucial role in the long-term sustainability and growth of these enterprises.

Expert insights underscore the importance of funding for SMEs. Jon Sutton, CEO of non-bank ScotPac, emphasizes the necessity for the SME sector to thrive, stating, "We really need the SME sector to be firing on all cylinders." This sentiment reflects a broader understanding that robust funding options are vital for fostering a healthy business environment.

Case studies further illustrate the impact of funding on SME growth. For instance, the World Bank Group's initiatives in Ethiopia and Guinea have successfully enhanced access to finance for SMEs through leasing operations. In Ethiopia, a $200 million credit facility supported seven leasing institutions, while Guinea's efforts led to the launch of leasing operations for three companies, disbursing leases valued at $25 million.

These examples highlight how focused economic solutions can significantly bolster the growth and sustainability of SMEs, enabling them to navigate challenges and capitalize on opportunities.

Finance Story, established by Shane, a seasoned funding expert director with extensive experience in enhancing operations, is well-equipped to assist SMEs in securing the financing they require to thrive. With a comprehensive understanding of loan repayment criteria and access to a diverse range of lenders—including boutique lenders, private investors, and mainstream banks—Finance Story offers tailored financial solutions that empower organizations to overcome the challenges of obtaining funding. This ensures that SMEs can concentrate on growth and innovation, even in challenging circumstances.

As one satisfied client, Natasha B. from VIC, remarked, "I will certainly be suggesting your service to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." This testimonial illustrates the positive impact Finance Story has on its clients, further emphasizing the significance of robust business cases in obtaining funding.

Types of Financing Available for Businesses

In 2025, businesses have access to a diverse array of finance options, each tailored to meet specific needs and circumstances. The primary types of financing available include:

- Debt Financing: This encompasses traditional bank loans, lines of credit, and bonds. Businesses borrow funds that must be repaid with interest, making it a common choice for those looking to maintain ownership while accessing capital. Significantly, 70% of small enterprises hold some level of debt, with the total sum owed approaching around $18 trillion by the conclusion of 2022. As finance author Janet Gershen-Siegel mentions, "70% of small enterprises hold some level of debt with a total of $18 trillion owed by the end of 2022."

- Equity Financing: This method involves selling shares of the company to raise capital. It can be obtained through venture capital, angel investors, or public offerings, enabling enterprises to secure funding without taking on debt.

- Grants and Subsidies: These are non-repayable funds provided by governments or organizations aimed at supporting specific projects or initiatives. They represent an appealing choice for enterprises seeking financial aid without the obligation of repayment.

- Crowdfunding: This innovative approach involves raising small amounts of money from a large number of people, typically through online platforms. Crowdfunding has gained momentum as a practical funding approach, especially for startups and creative initiatives, with many small enterprises successfully utilizing this model to support their endeavors.

- Alternative Funding: This category includes peer-to-peer lending, invoice funding, and merchant cash advances. These choices present finance options for a business by offering adaptable financing solutions that frequently circumvent standard banking criteria, catering to enterprises that may face challenges in securing traditional loans.

Alongside these conventional and alternative funding methods, Finance Story specializes in crafting refined and highly customized cases to present to banks, ensuring that small enterprise owners can obtain the appropriate financing for their commercial property investments. This comprises refinancing alternatives that can be utilized to address the changing requirements of enterprises. Recent statistics indicate that over 70% of small enterprises hold some level of debt, with the average SBA loan totaling $538,903.

By the conclusion of 2022, small enterprises collectively owed around $18 trillion, emphasizing the considerable dependence on debt support within this sector. Additionally, since over two in five companies (41%) indicated experiencing supply chain disruptions, the necessity for accessible funding solutions has never been more crucial.

Expert insights highlight the effectiveness of crowdfunding for small enterprises, particularly in fostering community support and engagement. Successful case studies demonstrate how companies have employed various finance options for a business to overcome obstacles and achieve growth, emphasizing the significance of understanding the complete range of available resources in today’s dynamic financial environment. Furthermore, Finance Story's committed lending ally in the UK for expat loans expands the scope of funding alternatives accessible to enterprises, especially for expats.

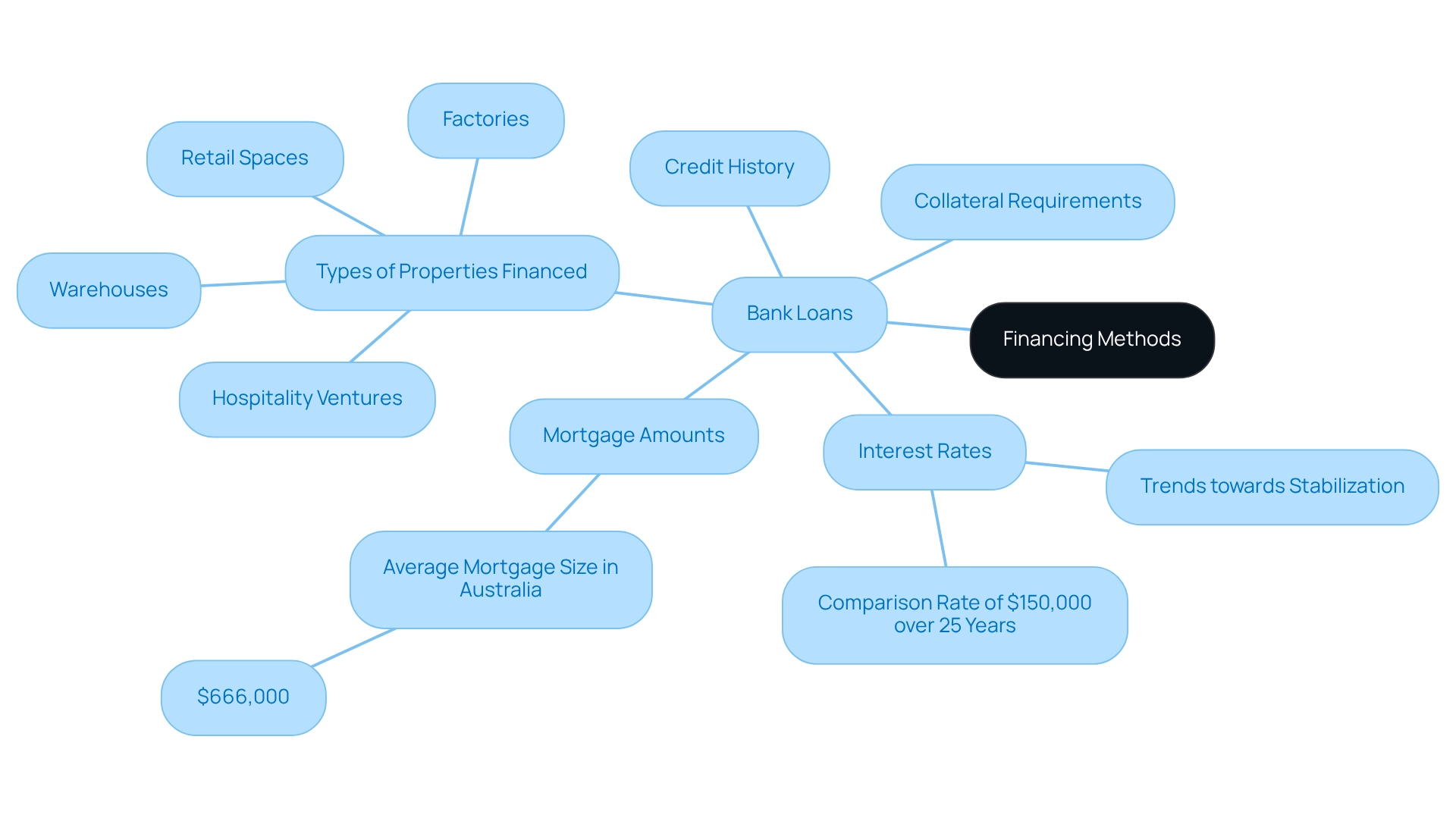

Exploring Specific Financing Methods: Loans, Equity, and More

Bank Loans: Traditional bank loans are a prevalent means of debt funding for small businesses. These loans generally necessitate collateral and a solid credit history, with interest rates fluctuating based on the lender and the borrower's creditworthiness. As of 2025, average interest rates for bank loans have shown a trend towards stabilization, influenced by both variable and fixed-rate offerings from financial institutions, as reported by APRA and RBA. The typical mortgage amount in Australia stands at $666,000, according to the Australian Bureau of Statistics, providing context for the funding options discussed.

Understanding how these finance options function is crucial for small enterprises looking to leverage them for growth. Finance Story is dedicated to developing refined and highly personalized cases to present to banks, ensuring that small business owners can access the necessary finance options to secure appropriate funding for their commercial property investments.

We provide access to a comprehensive range of lenders, including high street banks and private lending panels, tailored to various circumstances. Furthermore, specific types of commercial properties—such as warehouses, retail spaces, factories, and hospitality ventures—can be financed through these loans. A comparison rate of $150,000 for a secured loan over 25 years exemplifies the loan terms that small business owners may encounter. In addition, there are finance options available to meet the evolving needs of enterprises.

Challenges in Securing Business Financing

Navigating finance options for a business presents a myriad of challenges for small and medium-sized enterprises (SMEs), particularly in 2025. Key obstacles include:

- Strict Lending Criteria: Lenders often impose stringent requirements, such as minimum credit scores, detailed monetary statements, and comprehensive plans. These criteria can be particularly daunting for SMEs, which may struggle to meet the expectations set by financial institutions. At Finance Story, we specialize in crafting refined and highly personalized case studies that assist you in navigating these stringent lending criteria, enhancing your likelihood of obtaining the necessary funds.

- High-Interest Rates: The effective interest rate on new SME loans was recorded at 5.92% as of January 2023. For many businesses, especially those with less established credit histories, these rates can be prohibitively high, impacting their ability to invest and grow. Understanding the implications of these rates is crucial, and our team can provide insights into how to manage repayment effectively.

- Lack of Collateral: Traditional funding options frequently require collateral, which many SMEs may not possess. This lack of assets can severely limit their access to essential funding, forcing them to explore finance options for a business. Finance Story offers a full range of lenders, including innovative private lending panels, to help you find solutions that do not rely solely on collateral.

- Complex Application Processes: The application procedure for loans can be intricate and time-consuming, often involving extensive paperwork and documentation. This complexity can lead to delays in funding or even outright rejections, further complicating the financial landscape for SMEs. Our expertise in crafting tailored loan proposals simplifies this process, ensuring that your application stands out.

- Economic Conditions: The current economic climate plays a significant role in lenders' willingness to extend credit. As of 2024, with roughly 2.66 million SMEs functioning in Australia, changing economic conditions can generate uncertainty, making it essential for enterprises to stay alert regarding market trends and lender behaviors. At Finance Story, we stay current with these trends to provide you with the best finance options for a business.

A 2020 survey showed that 56% of companies sought funding mainly to cover operating costs, while others aimed to expand, acquire assets, or refinance debt. This highlights the diverse motivations behind seeking funding, yet the challenges remain consistent across the board. As Janet Gershen-Siegel pointed out, "The pandemic disrupted many entrepreneurs’ strategies for their small enterprises," highlighting the persistent challenges encountered by SMEs in maneuvering through the financing environment.

In 2025, the average credit score requirement for commercial loans remains a hurdle, with many lenders anticipating scores above 680. This requirement can exclude a significant number of SMEs from accessing necessary funds, further complicating their financial journeys. Comprehending these difficulties is crucial for small enterprise owners as they strive to explore finance options for a business required to succeed in a competitive market.

With Finance Story's expertise, you can overcome these obstacles and discover the appropriate funding solutions customized to your needs, whether you aim to acquire a warehouse, retail space, factory, or hospitality venture. Furthermore, if you are contemplating refinancing your commercial loan, we can help you investigate options that match your changing organizational needs. Contact Finance Story today to discuss how we can help you achieve your financial goals.

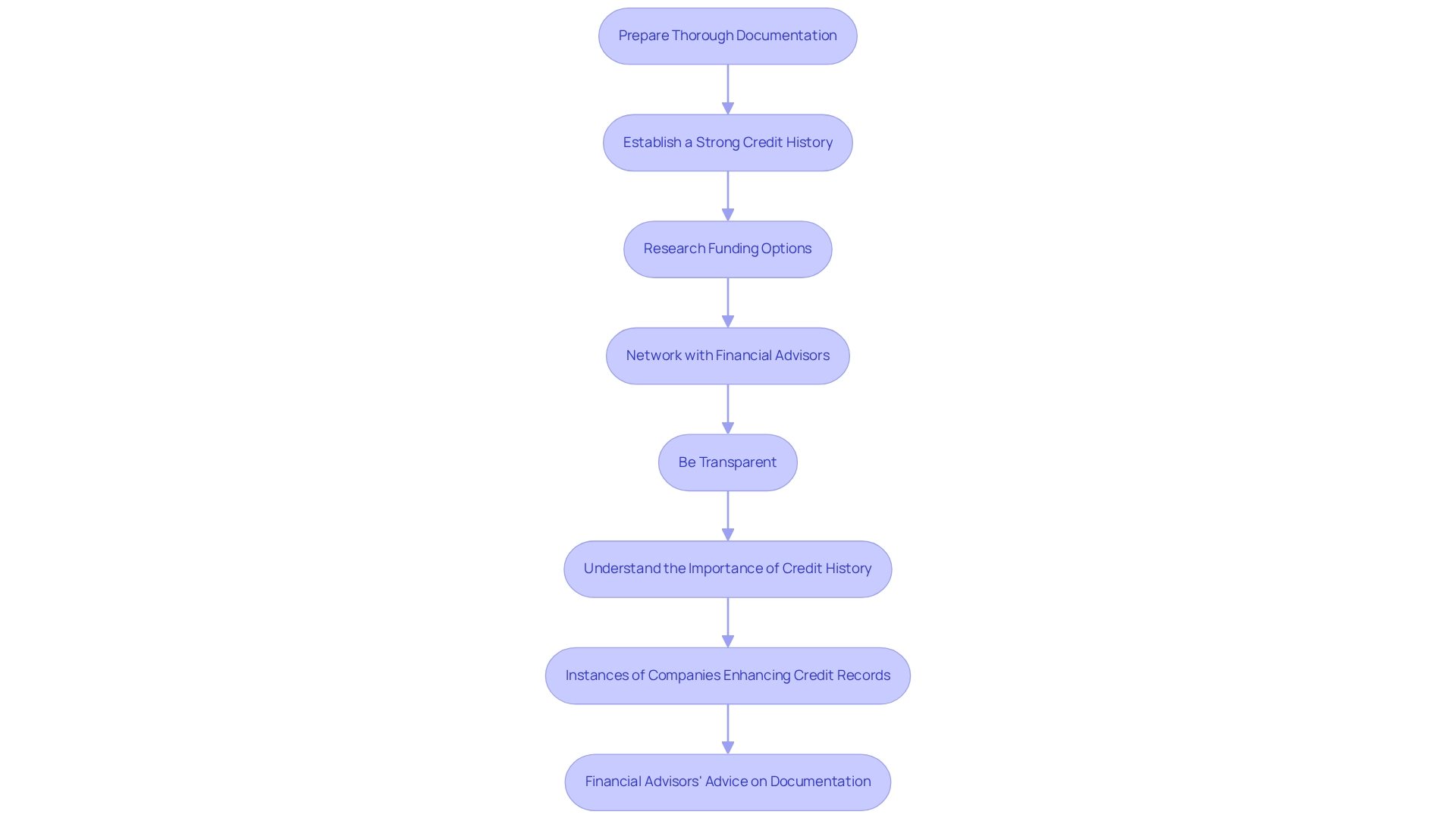

Tips for Successfully Securing Business Financing

-

Prepare Thorough Documentation: Compiling comprehensive monetary statements, detailed operational plans, and realistic projections is crucial. Lenders require a clear perspective on your company's economic status, and well-structured documentation significantly enhances your trustworthiness. At Finance Story, we specialize in crafting refined and highly tailored proposals for banks, ensuring you meet the elevated expectations for securing finance options for business development. Financial advisors stress the importance of thorough documentation preparation, advising companies to consistently update their financial records and seek professional assistance to ensure all required documents are organized before approaching lenders.

-

Establish a Strong Credit History: A solid credit score is essential for obtaining favorable loan conditions. Consistently paying bills on time and managing debts responsibly not only enhances your credit history but also positions your enterprise as a trustworthy candidate for loans. In 2025, a robust credit history will be more critical than ever for corporate funding success, as lenders increasingly rely on credit scores to evaluate risk. Understanding the repayment criteria set by lenders is vital, and at Finance Story, we can guide you through this process.

-

Research Funding Options: Explore a variety of funding sources to determine the most suitable choice for your business needs. This includes both traditional avenues, such as banks, and alternative finance options, like private lenders or crowdfunding, which can offer unique benefits. Finance Story provides access to a complete range of lenders, including high street banks and creative private lending panels, ensuring you discover the right finance options for your commercial property investment.

-

Network with Financial Advisors: Cultivating relationships with financial advisors or brokers can offer invaluable guidance. These experts assist you in navigating the funding environment and connect you with potential lenders who align with your objectives. Handling vendor connections and third-party risk is a top priority for many firms, underscoring the significance of transparency and networking in the funding process. At Finance Story, we emphasize the importance of these connections to enhance your funding journey.

-

Be Transparent: Honesty about your business's monetary condition and future strategies is essential when seeking funding. Openness cultivates confidence among lenders, leading to more advantageous outcomes and a smoother funding process. As Andrea Sugden, Chief Sales and Customer Relationship Officer, states, "Let’s Talk to get started with a Viking Cloud cybersecurity and compliance assessment," highlighting the need for proactive measures in financial practices.

-

Understand the Importance of Credit History: In 2025, a robust credit history will be more essential than ever for financial success in enterprises. Lenders increasingly depend on credit scores to evaluate risk, making it crucial for companies to maintain a favorable credit profile. Finance Story can assist you in understanding these criteria and improving your credit standing.

-

Instances of Companies Enhancing Credit Records: Numerous enterprises have successfully improved their credit records by adopting strategic monetary practices, such as reducing outstanding debts and ensuring timely payments. These enhancements not only facilitate access to funding but also contribute to the overall growth of the enterprise. Companies are increasingly adopting identity-first security measures, with over 86% implementing zero trust models to combat evolving cyber threats, reflecting a proactive approach to modern challenges.

-

Financial Advisors' Advice on Documentation: Financial advisors emphasize the importance of meticulous documentation preparation. They recommend that companies routinely refresh their financial records and seek expert assistance to ensure that all essential documents are organized before contacting lenders. With Finance Story's expertise, you can ensure your documentation is polished and ready for lender review.

The Role of Financial Advisors in Business Financing

Financial consultants are vital in guiding businesses through the intricate funding landscape. They offer tailored advice on the most suitable financing options that align with a company's unique needs and objectives. By assisting in the preparation of essential financial documents, improving credit ratings, and identifying potential lenders, these advisors streamline the funding process for their clients.

Their expansive networks within financial institutions empower them to negotiate more favorable terms, significantly increasing the chances of securing necessary funding.

Looking ahead to 2025, the role of financial consultants is expected to become even more critical. Data from IBISWorld indicates that lending to private non-financial corporations (PNFCs) is projected to reach £496 billion, marking a 4% increase. This growth highlights the necessity of expert guidance in navigating the evolving financing options available to businesses, particularly for small and medium-sized enterprises (SMEs). Notably, 91.7% of advisory private firms employ fewer than 100 staff and manage total assets valued at $114.1 trillion, underscoring the substantial impact advisors have on small businesses.

Furthermore, consumer lending trends point to a strong environment for unsecured credit lending, with expectations of stable default rates attributed to high employment levels and accumulated savings. This optimistic outlook reinforces the importance of advisors in helping companies identify financing options that leverage favorable lending conditions. As one consultant aptly noted, "Navigating the funding terrain demands not only expertise but also a profound comprehension of each client's distinct circumstances."

As businesses increasingly seek personalized service, financial advisors are well-positioned to meet these expectations, ensuring clients receive customized support throughout the financing journey. With access to a diverse range of boutique lenders, private investors, and mainstream banks, Finance Story exemplifies a commitment to developing robust cases tailored to varied lending needs. Their expertise not only facilitates funding acquisition but also fosters long-term relationships that empower owners to achieve their growth ambitions.

In a landscape where consumers anticipate higher levels of personalization, financial advisors play a crucial role in delivering tailored solutions that resonate with their clients' needs.

Key Takeaways for Business Owners on Financing Options

Comprehending the various finance options for a business is essential for entrepreneurs seeking to obtain capital for expansion and sustainability. In 2025, the environment of enterprise funding is changing, and awareness among proprietors is crucial. Here are key takeaways to consider:

- Assess your business's unique financial needs by exploring a variety of financing options, including debt, equity, and alternative methods. This tailored approach can significantly enhance your chances of finding the right funding solution. At Finance Story, we specialize in creating polished and highly individualized business cases to present to lenders, ensuring you have the best chance of securing the necessary funds for your next commercial investment. We work with a full range of lenders, from high street banks to innovative private lending panels, to meet your specific circumstances.

- Recognize the importance of maintaining a robust credit history. A robust credit profile not only enhances your eligibility for funding but also enables you to negotiate more favorable terms. Thorough documentation is essential to present a compelling case to lenders, and our expertise can guide you through this process.

- Utilize the knowledge of financial advisors who can assist you in navigating the complexities of the funding landscape. At Finance Story, our Head of Funding Solutions, Shane Duffy, is available for a free personalized consultation to discuss your needs and objectives, whether for commercial or personal funding.

Stay informed about market trends and economic conditions that may affect your financing choices. For instance, API-first lending solutions are projected to account for 40% of the lending market by 2026, enabling faster loan processing and improved customer satisfaction. These innovations are transforming the lending landscape, improving loan repayment rates and customer satisfaction.

Consider refinancing options for your commercial loans to adjust to your changing enterprise needs. This can provide you with the flexibility to manage your finances more effectively.

Real-world examples illustrate the importance of assessing financial needs for funding. For instance, small enterprises encounter considerable challenges, with approximately 21.9% failing within their first year and the failure rate rising to 39.7% by the third year. Moreover, it is significant that 70% of small enterprises hold some level of debt, with a total of $18 trillion owed by the end of 2022.

Understanding finance options for a business can be a crucial element in overcoming these obstacles.

In summary, by taking proactive steps to understand and evaluate finance options for a business, owners can position themselves for success in securing the resources they need. The landscape is changing, and those who adapt will thrive in the competitive market. Schedule your free consultation with Finance Story today to explore tailored mortgage brokerage solutions for your commercial and residential financing needs.

As one pleased client, Natasha B. from VIC, mentioned, "I will certainly be suggesting your service to anyone." We are finished with the constant worry. Once again, thank you so much for being a part of our journey.

Conclusion

In the dynamic realm of business finance, grasping the array of funding options is crucial for entrepreneurs seeking the capital necessary for growth and sustainability. The data reveals a pronounced preference for debt financing, with nearly 70% of small businesses choosing this route in 2025. This trend highlights the reliance on loans to manage cash flow and fuel growth, while also indicating a rising interest in alternative financing methods, such as crowdfunding, which provide accessibility and flexibility for small and medium-sized enterprises.

Furthermore, small and medium enterprises (SMEs) encounter significant challenges in securing financing. These include:

- Stringent lending criteria

- Elevated interest rates

- Complexities inherent in the application process

Such obstacles underscore the necessity for meticulous documentation, a robust credit history, and the strategic use of financial advisors' expertise to navigate the intricate financing landscape. As financial advisors play an increasingly vital role, their ability to offer tailored guidance can markedly improve a business's prospects of obtaining the right funding.

Ultimately, the essential takeaway for business owners is to proactively evaluate their distinct financial needs and investigate a diverse array of financing options. By remaining informed about market trends and leveraging expert advice, entrepreneurs can strategically position themselves for success in a competitive environment. Adapting to these changes is imperative; those who do will not only navigate the complexities of financing but also flourish in their growth journey.