Overview

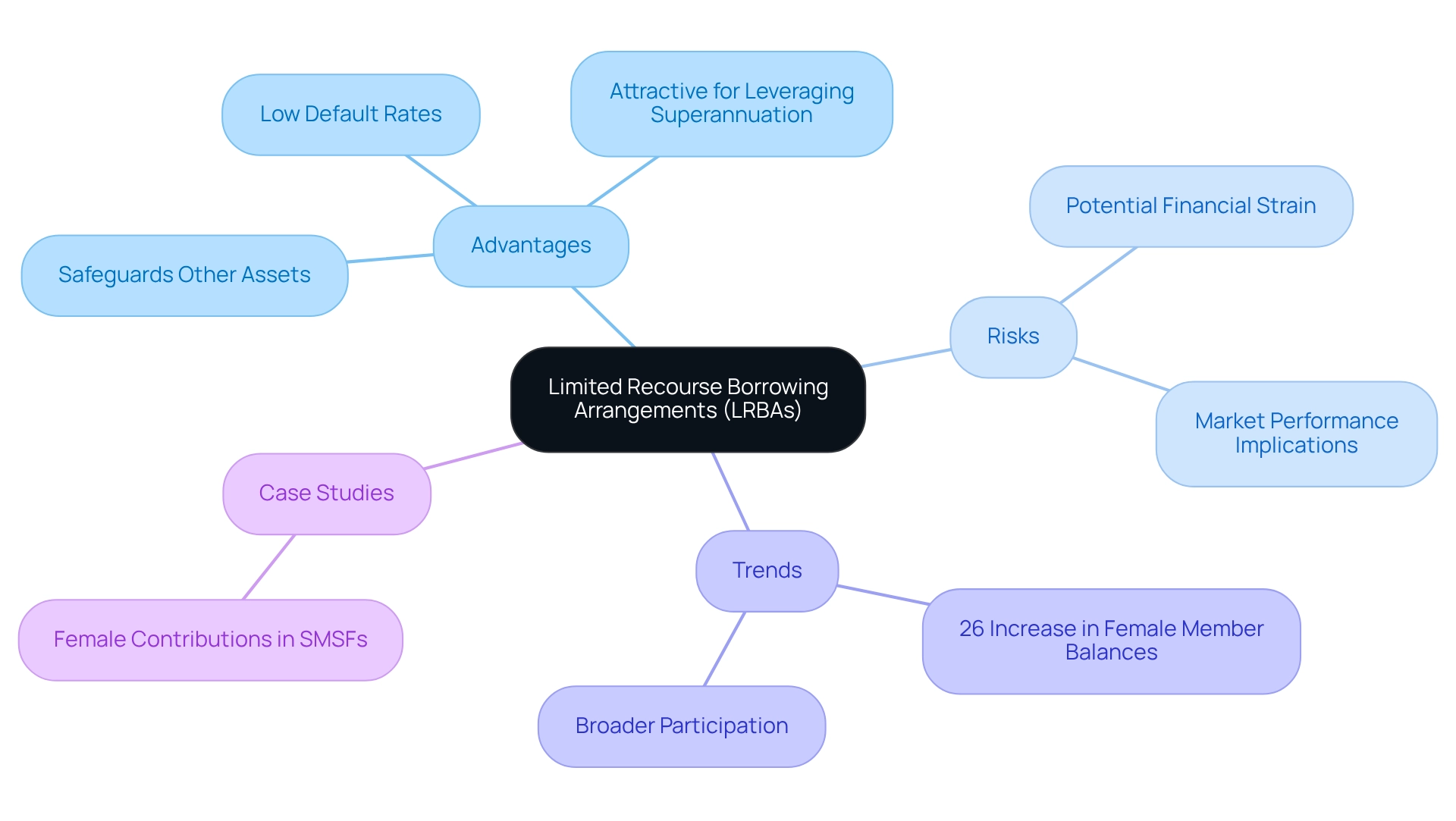

This article delves into the essential insights surrounding the SMSF (Self-Managed Superannuation Fund) Limited Recourse Borrowing Arrangements (LRBA) rules for investors. LRBAs present a unique opportunity for SMSFs to acquire assets, such as real estate, with limited recourse. In the event of a default, only the specific asset can be claimed by the lender, thereby safeguarding the other assets within the fund. This crucial aspect not only enhances asset protection but also underscores the importance of adherence to regulatory requirements. Compliance is vital to mitigate the risks associated with these borrowing arrangements, ensuring a secure investment environment for SMSF investors.

Introduction

In the dynamic world of investment, self-managed super funds (SMSFs) have emerged as a formidable resource for discerning investors aiming to leverage their superannuation for property acquisitions. With customized loan solutions and strategic insights, Finance Story stands at the forefront of this movement, providing tailored guidance to navigate the complexities of SMSF borrowing.

As interest in SMSF loans continues to escalate across Australia, grasping the nuances of Limited Recourse Borrowing Arrangements (LRBAs) becomes crucial for optimizing returns while mitigating risks. This article explores the intricacies of SMSF loans, encompassing:

- Compliance with regulatory frameworks

- The strategic benefits of acquiring single assets

This equips investors with the essential knowledge to make informed financial decisions in a competitive market.

Finance Story: Tailored SMSF Loan Solutions for Investors

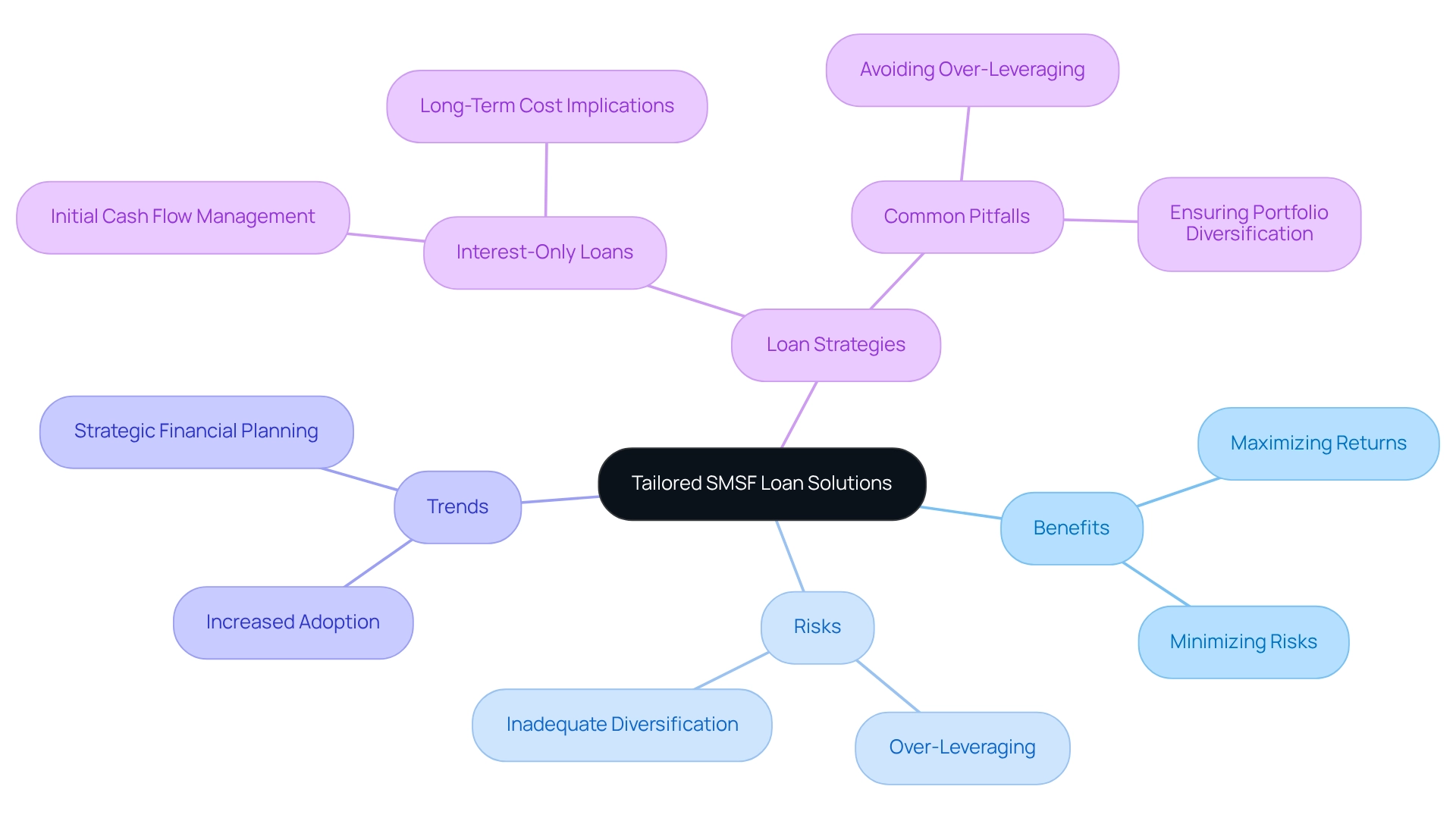

Finance Story specializes in providing tailored SMSF loan solutions that cater to the distinct needs of investors. By emphasizing a thorough comprehension of each client's financial situation, the brokerage offers a variety of lending choices that align with specific financial goals. This tailored approach enables clients to effectively leverage their superannuation funds for real estate financing, maximizing potential returns while minimizing risks often associated with conventional lending solutions.

Recent trends indicate a growing interest in self-managed superannuation fund loans, with a notable increase in adoption across Australia. As of 2025, average loan amounts for self-managed superannuation fund property investments have risen, reflecting a shift towards more strategic financial planning among investors. Experts highlight the necessity of avoiding common pitfalls, such as over-leveraging and inadequate portfolio diversification, to ensure sustainable growth.

Effective loan strategies for self-managed super funds frequently include interest-only loans, allowing investors to manage initial cash flow challenges by paying only the interest for a specified duration. However, it is essential to consider the long-term implications, as this may result in higher overall costs. Financial advisors advocate for tailored self-managed superannuation fund lending options, emphasizing that if a self-managed superannuation fund defaults on a loan, the lender can only claim the specific asset involved, thereby protecting other assets held within the fund.

By staying attuned to regulatory changes and market conditions, Finance Story remains at the forefront of self-managed superannuation fund lending, ensuring compliance with the smsf lrba rules while providing clients with innovative solutions that reflect the evolving landscape of property investment. This commitment to tailored service ensures that investors are well-equipped to navigate the complexities of SMSF LRBA rules and successfully achieve their financial objectives.

Understand Limited Recourse Borrowing Arrangements (LRBAs)

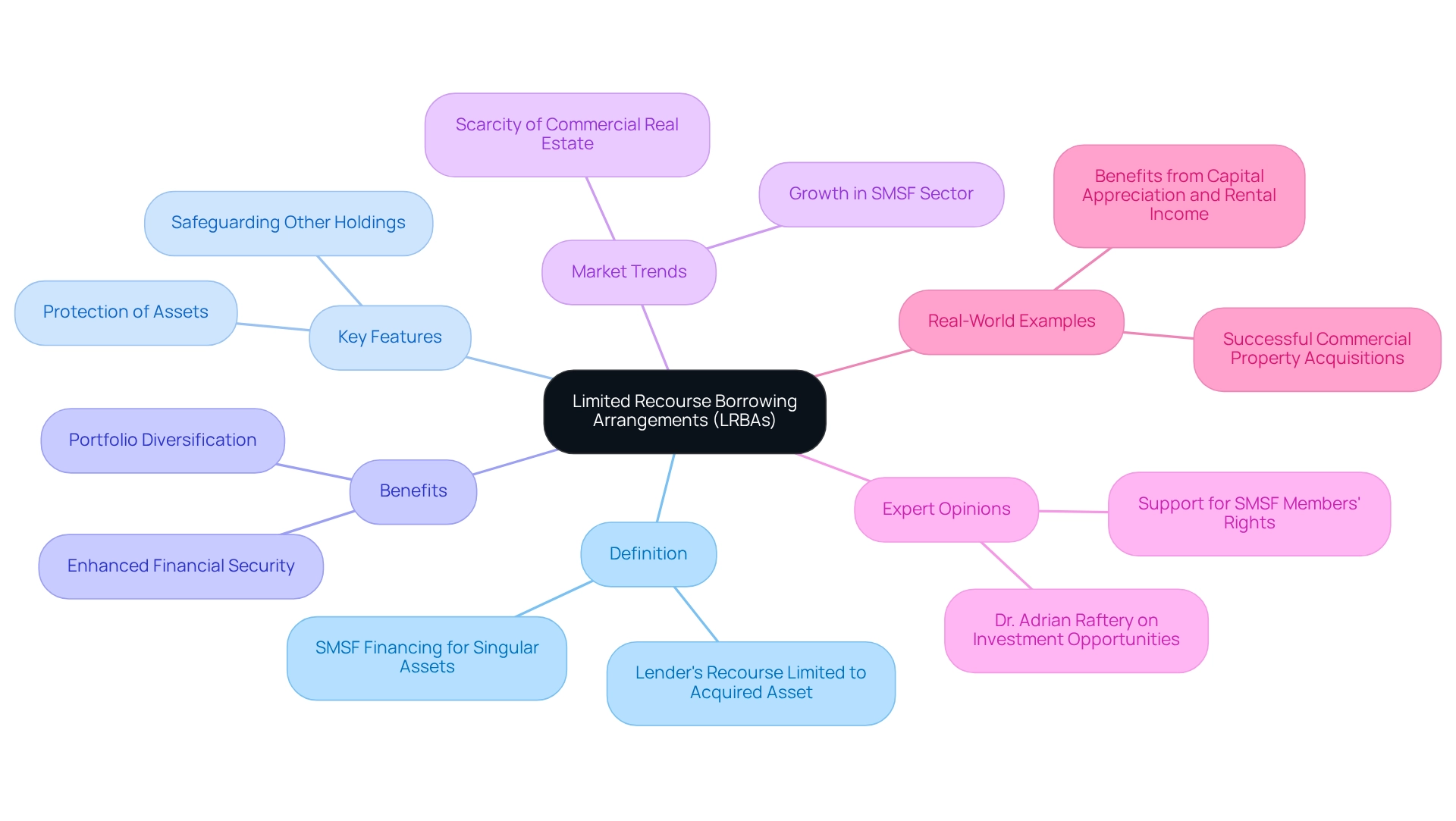

Limited Recourse Borrowing Arrangements (LRBAs) allow self-managed super funds (SMSFs) to secure financing for the acquisition of a singular asset, such as real estate, under the SMSF LRBA rules. A key feature of LRBAs is the limitation of the lender's recourse to the property acquired. In the event of a default, the lender can only seize the asset in question, safeguarding the fund's other holdings from potential loss. This protective attribute has contributed to the rising popularity of LRBAs among self-managed superannuation fund investors, particularly as the self-managed superannuation fund sector continues to experience robust growth, underscored by recent statistics from the ATO.

In 2025, enhancements to the SMSF LRBA rules have strengthened the rights of SMSF members, enabling them to make informed financial decisions without substantial changes to existing borrowing frameworks. Financial specialists emphasize the advantages of LRBAs, asserting that they can serve as a strategic tool for SMSFs seeking to diversify their portfolios while following the SMSF LRBA rules to capitalize on real estate market opportunities. For instance, Dr. Adrian Raftery, a chartered accountant, highlights that the current scarcity of commercial real estate inventory—including office buildings, warehouses, and retail spaces—has led to increased values, rendering early investments through SMSFs particularly lucrative.

Real-world instances illustrate the efficacy of LRBAs in real estate acquisitions. Numerous SMSFs have effectively leveraged these arrangements to obtain commercial properties, reaping benefits from both capital appreciation and rental income. As the trend of utilizing LRBAs continues, self-managed superannuation fund investors are increasingly recognizing the potential for enhanced financial security and growth in their retirement savings in accordance with the SMSF LRBA rules.

Identify Single Acquirable Assets Under LRBA Rules

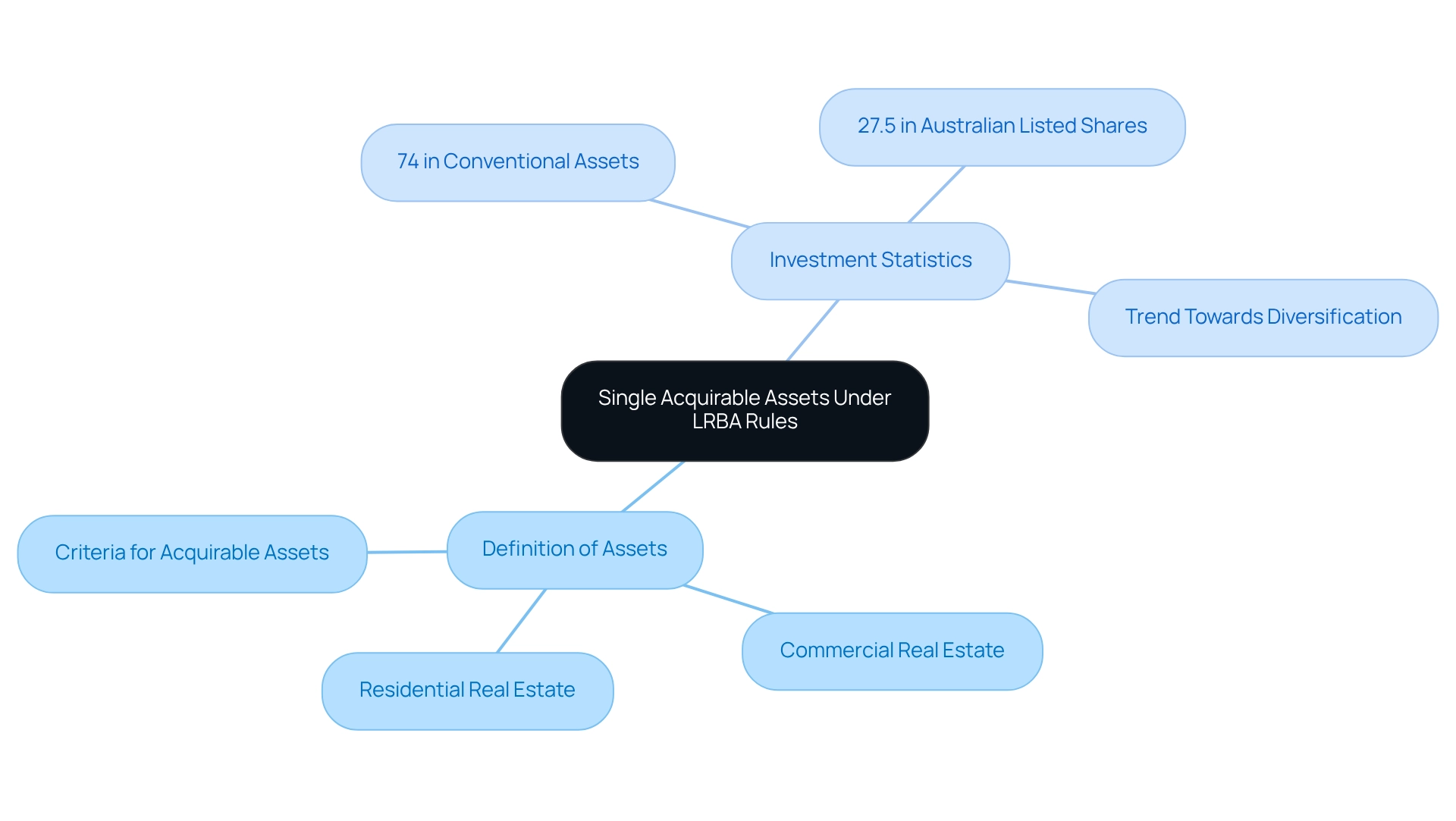

Under the SMSF LRBA rules, a single acquirable item is defined as a resource that can be purchased outright by the SMSF. This encompasses both residential and commercial real estate, provided they are not part of a set unless the items are identical and share the same market value. For instance, an individual apartment or a plot of land qualifies as a single acquirable resource, whereas a varied collection of real estate cannot be financed under the SMSF LRBA rules.

Statistics reveal that self-managed super funds are increasingly favoring conventional asset classes, with a striking 74% of their holdings concentrated in five categories. Notably, a significant 27.5% is invested in Australian listed shares. This trend underscores the growing importance of real estate within self-managed superannuation fund portfolios, as trustees strive to diversify their assets while adhering to regulatory frameworks.

Experts in real estate emphasize the strategic advantages of acquiring individual holdings through SMSFs, noting that this approach facilitates targeted financing and potential capital appreciation. As the market evolves, understanding the nuances of SMSF LRBA rules becomes essential for trustees of self-managed super funds looking to refine their investment strategies.

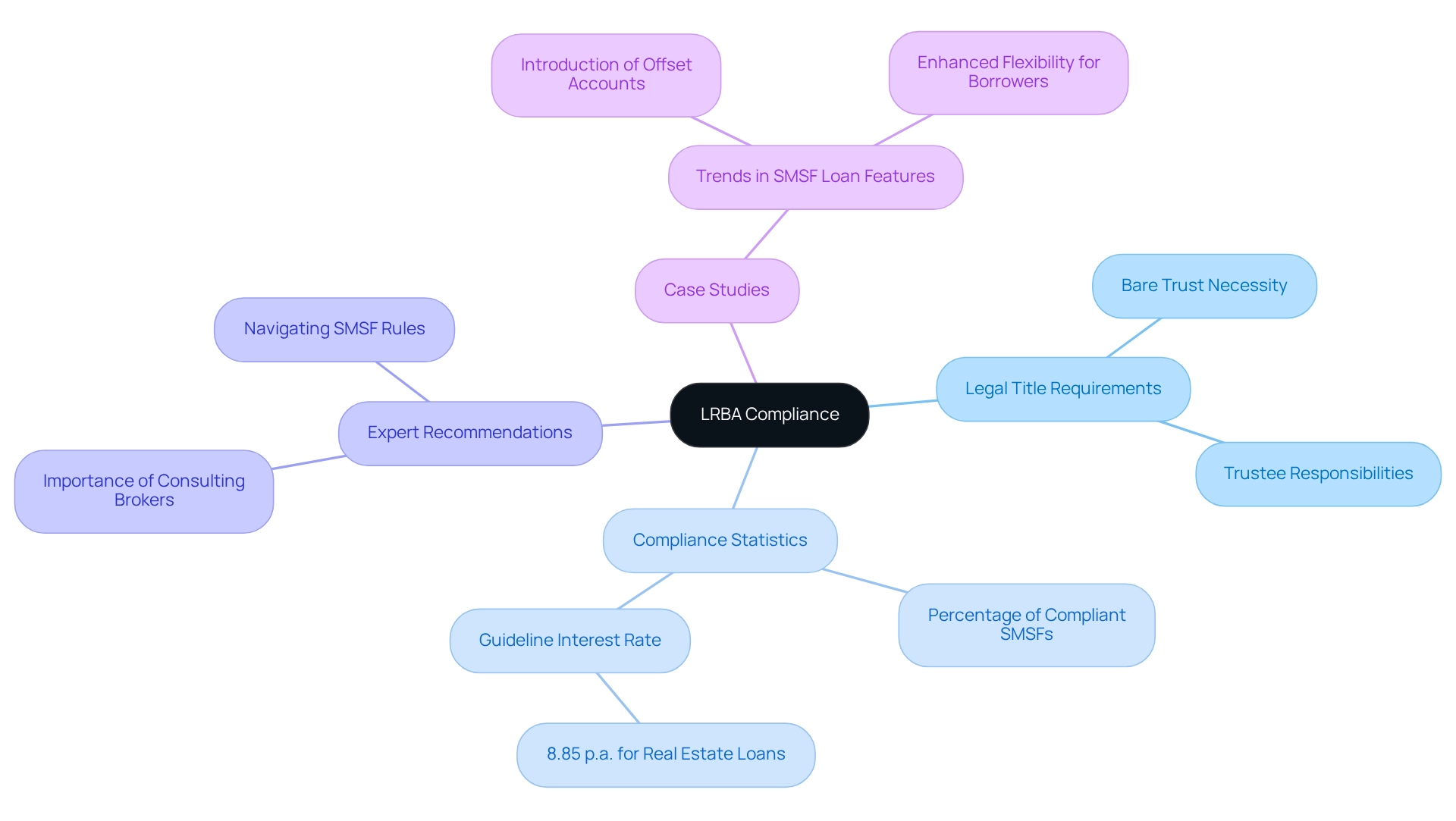

Ensure Separate Legal Title for LRBA Assets

To ensure adherence to regulatory requirements, it is crucial that resources acquired through a Limited Recourse Borrowing Arrangement (LRBA) are held in a separate legal title, as specified by the SMSF LRBA rules, typically through a bare trust. In this arrangement, the legal ownership of the resource is entrusted to a trustee on behalf of the Self-Managed Superannuation Fund. This structure not only complies with legal requirements but also protects the fund's other resources from any obligations arising from the borrowed funds.

Recent statistics indicate that a significant percentage of SMSFs are now compliant with these legal title requirements, reflecting a growing awareness of the importance of proper asset structuring. Legal specialists stress that employing a bare trust is essential for self-managed superannuation fund borrowing to adhere to the SMSF LRBA rules, as it defines the responsibilities and safeguards the fund's integrity.

Furthermore, case studies reveal that SMSFs employing bare trusts for compliance with SMSF LRBA rules have successfully navigated complex regulatory landscapes, ensuring their investments remain secure and compliant. As the self-managed superannuation fund lending market develops, comprehending these legal frameworks becomes increasingly vital for investors seeking to enhance their financial strategies. The guideline interest rate for property LRBAs was around 8.85% p.a. for real estate loans in 2023–24, highlighting the need for strategic planning in this changing landscape.

Recognize the Limited Recourse Nature of LRBAs

The restricted recourse characteristic of LRBAs offers significant advantages for self-managed super fund (SMSF) investors under the SMSF LRBA rules. In the event of a loan default, lenders can only seize the asset acquired with the borrowed funds, thereby safeguarding the fund's other assets from potential losses. This feature renders LRBAs particularly attractive for those aiming to leverage their superannuation while minimizing risk exposure.

Recent trends reveal a burgeoning interest in SMSFs, highlighted by a 26% increase in female member balances, compared to a 22% rise for male members. This shift underscores a broader participation in financial decision-making within the self-managed super fund landscape, emphasizing the increasing role of female members in utilizing their superannuation for financial ventures.

However, while LRBAs provide a protective layer, they are not devoid of risks. Investors must remain cognizant of the implications of leveraging their superannuation, including the potential for heightened financial strain if assets do not perform as expected. Understanding the limited recourse nature of LRBAs is essential for effective risk management according to the smsf lrba rules.

Statistics indicate that default rates for self-managed superannuation fund loans under LRBAs, governed by smsf lrba rules, remain relatively low, suggesting that numerous investors are effectively navigating these arrangements. Case studies illustrate SMSFs that have benefited from LRBAs, showcasing how these structures can enhance funding opportunities while protecting the overall fund.

In summary, the restricted recourse aspect of LRBAs not only shields superannuation fund assets from lender claims but also empowers investors to pursue new growth opportunities within their retirement savings, particularly in commercial real estate investments. To discover how Finance Story can assist you in crafting a compelling case and ensuring compliance, BOOK A CHAT today.

Understand Interest Rates and Lender Terms for LRBAs

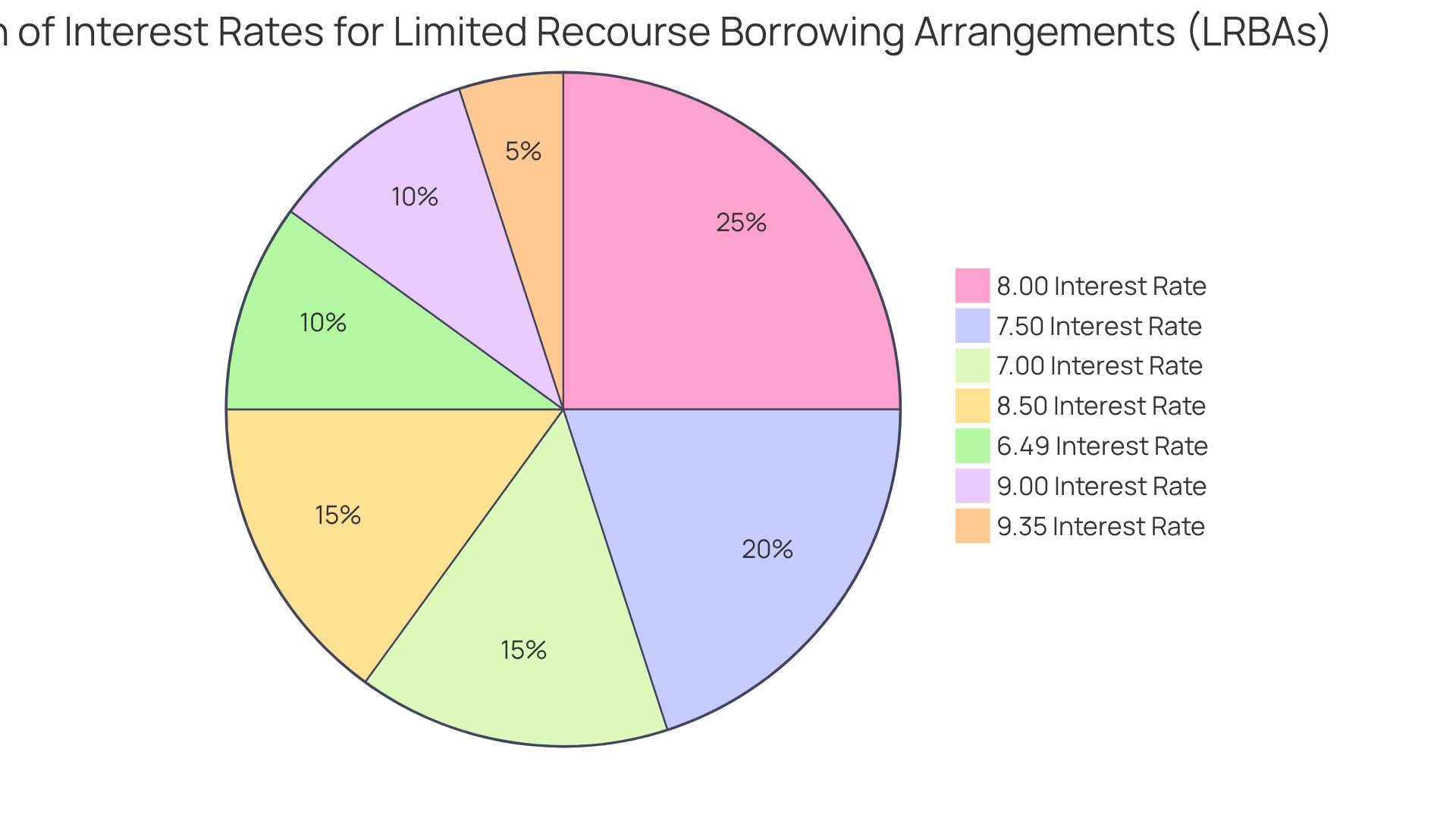

Interest rates for Limited Recourse Borrowing Arrangements (LRBAs) typically exceed those of standard mortgages, which is in accordance with the smsf lrba rules reflecting the specialized nature of these loans. As of mid-2025, LRBAs are offered at interest rates ranging from 6.49% to 9.35%, influenced by lender policies and specific loan details. Investors must diligently compare lender terms, including associated fees and repayment structures, to secure the most advantageous borrowing conditions as outlined by the SMSF LRBA rules for their Self Managed Super Funds (SMSFs).

Self-managed super funds (SMSFs) present an opportunity to invest in commercial real estate with fewer restrictions than residential properties, making them an appealing choice for investors. Understanding the nuances of lender terms is crucial. For instance, a recent case study illustrates the distinction between repairs and enhancements in self-managed superannuation fund properties, highlighting the tax consequences of these choices. Repairs can be promptly deducted, whereas enhancements must be capitalized, impacting the fund's taxable income and capital gains. This underscores the importance of professional assistance in navigating the complexities of self-managed superannuation funds.

Expert commentary emphasizes that investors should seek independent financial advice prior to making decisions regarding SMSF LRBA rules. By thoroughly evaluating lender options and understanding the current interest rate landscape, SMSF investors can make informed choices that align with their financial goals. For tailored guidance and support, BOOK A CHAT with Finance Story.

Consider Strategic Factors When Using LRBAs

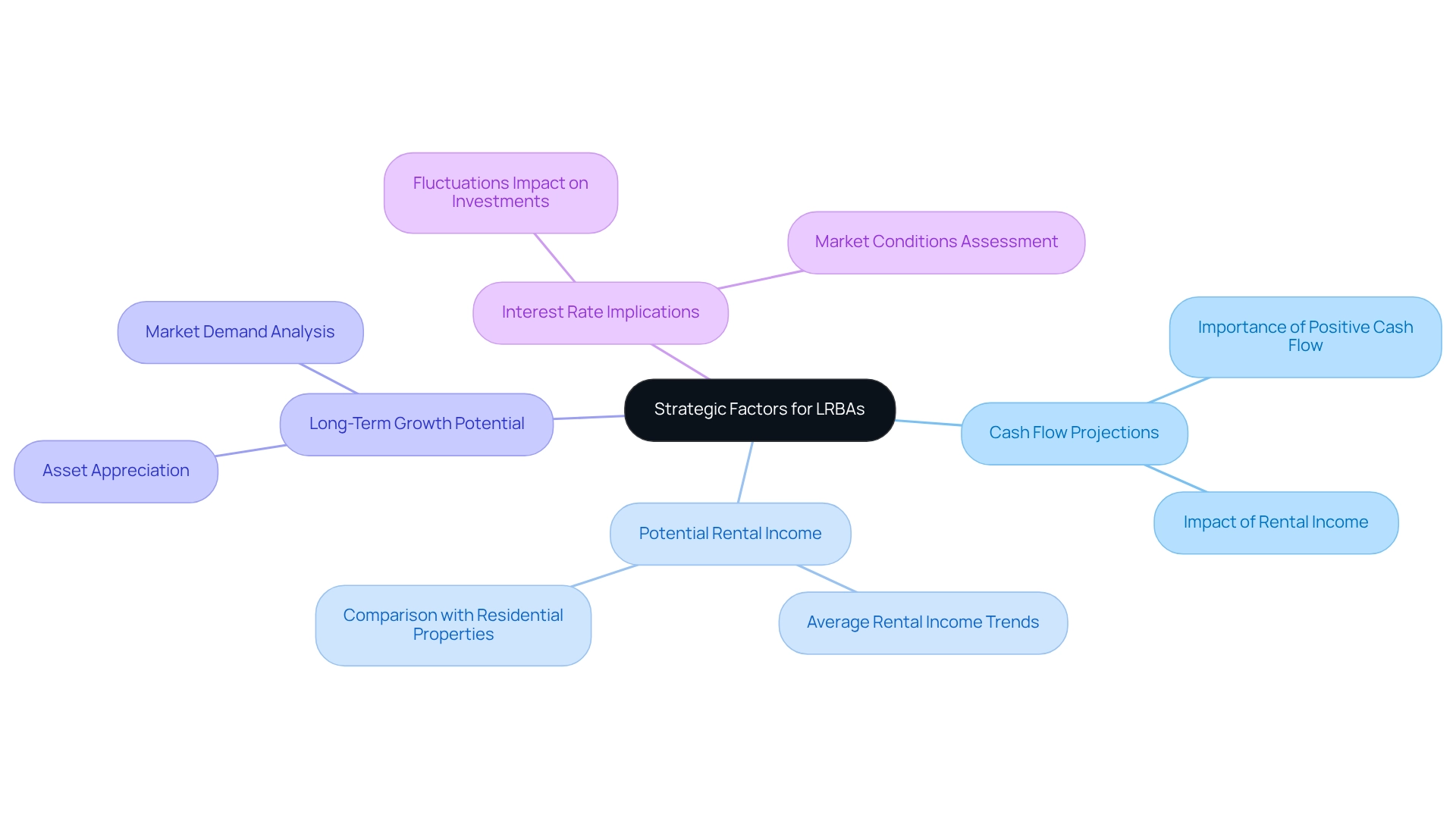

Investors utilizing Limited Recourse Borrowing Arrangements (LRBAs) must conduct a comprehensive evaluation of their overall financial strategy, particularly when leveraging Self-Managed Super Funds (SMSF) while adhering to SMSF LRBA rules for commercial real estate acquisitions. Key considerations include:

- Cash flow projections

- Potential rental income

- Long-term growth potential of the asset

With fewer restrictions on commercial real estate compared to residential properties, recent trends indicate that assets acquired through LRBAs have shown promising average rental income, which is crucial for sustaining positive cash flow.

Furthermore, understanding the implications of interest rate fluctuations and prevailing market conditions is essential for making informed decisions about effectively leveraging superannuation funds. Significantly, the self-managed superannuation fund sector has demonstrated strong performance, with an estimated return of 10.1% for the year, underscoring the potential advantages of strategic assessment.

Finance Story is here to assist you in building a robust case and ensuring compliance with regulations, guiding you to identify the right lender for your commercial property. As Shaun Backhaus, Director of DBA Lawyers, emphasizes, obtaining expert guidance is vital when managing ventures under the SMSF LRBA rules. Strategic elements such as these not only enhance financial outcomes but also align with the broader objective of achieving sustainable economic growth within a self-managed superannuation fund framework.

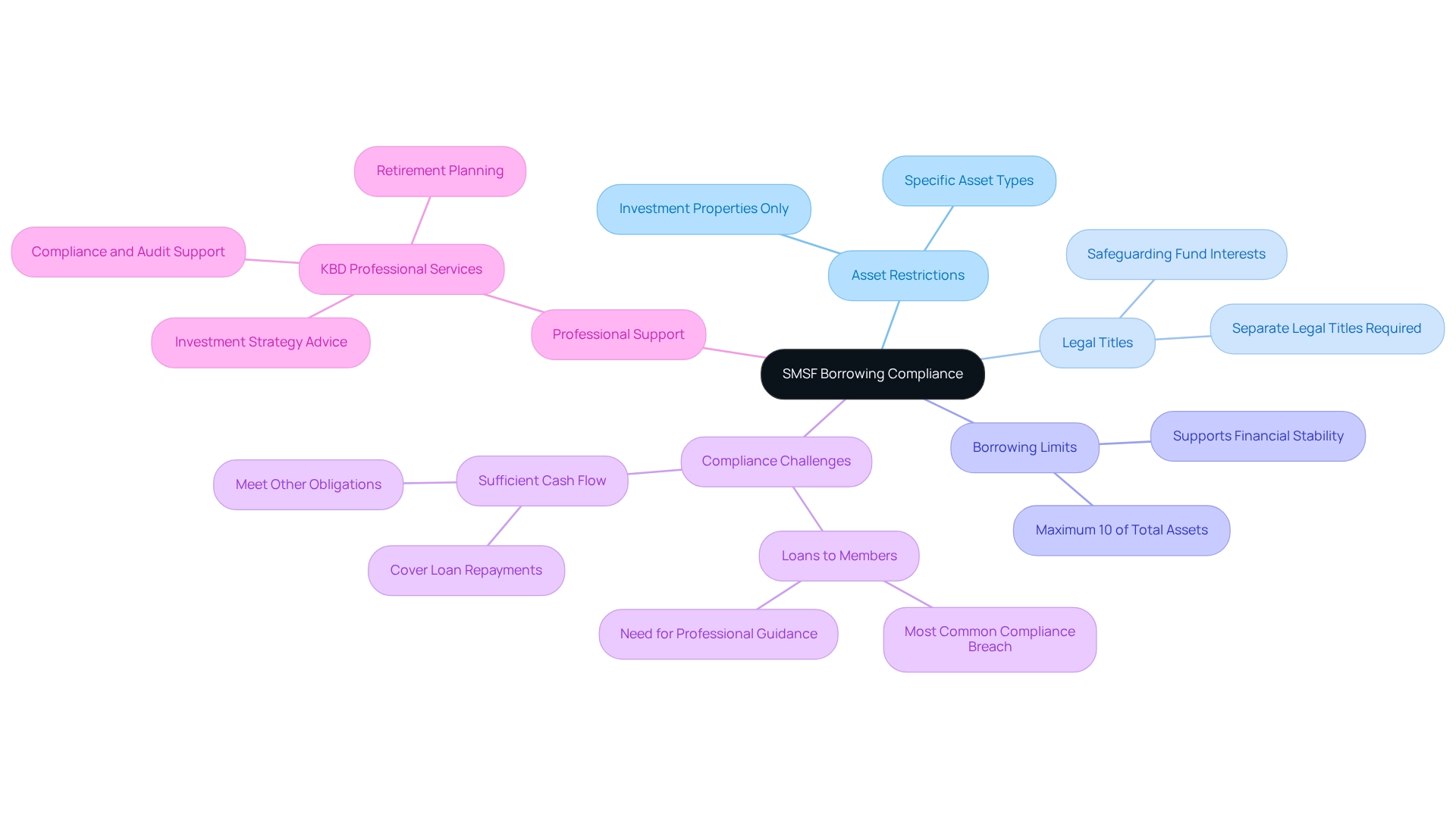

Comply with Regulatory Restrictions on SMSF Borrowing

Self-managed superannuation fund borrowing operates under stringent guidelines as outlined in the Superannuation Industry (Supervision) Act. Trustees must navigate the smsf lrba rules meticulously to ensure that any borrowing arrangement, including Limited Recourse Borrowing Arrangements (LRBAs), remains compliant. Key requirements include:

- Asset Restrictions: Borrowing must be exclusively utilized for acquiring specific asset types, primarily investment properties.

- Legal Titles: It is imperative to maintain separate legal titles for the fund and the property being acquired, thereby safeguarding the fund's interests.

- Borrowing Limits: The total borrowing should not exceed 10% of the fund's total assets, a crucial threshold that supports financial stability.

Recent statistics reveal that a notable portion of SMSFs, approximately 31%, also holds non-SMSF super funds, underscoring the varied investment strategies employed by members. However, compliance breaches pose a significant concern, with loans to members identified as the most prevalent issue within SMSFs. This underscores the importance of seeking expert advice to adeptly manage the complexities of the smsf lrba rules and self-managed superannuation fund regulations. As the landscape of self-managed superannuation funds continues to evolve, it is essential for trustees to remain informed about regulatory updates and compliance requirements, ensuring they can make strategic financial decisions.

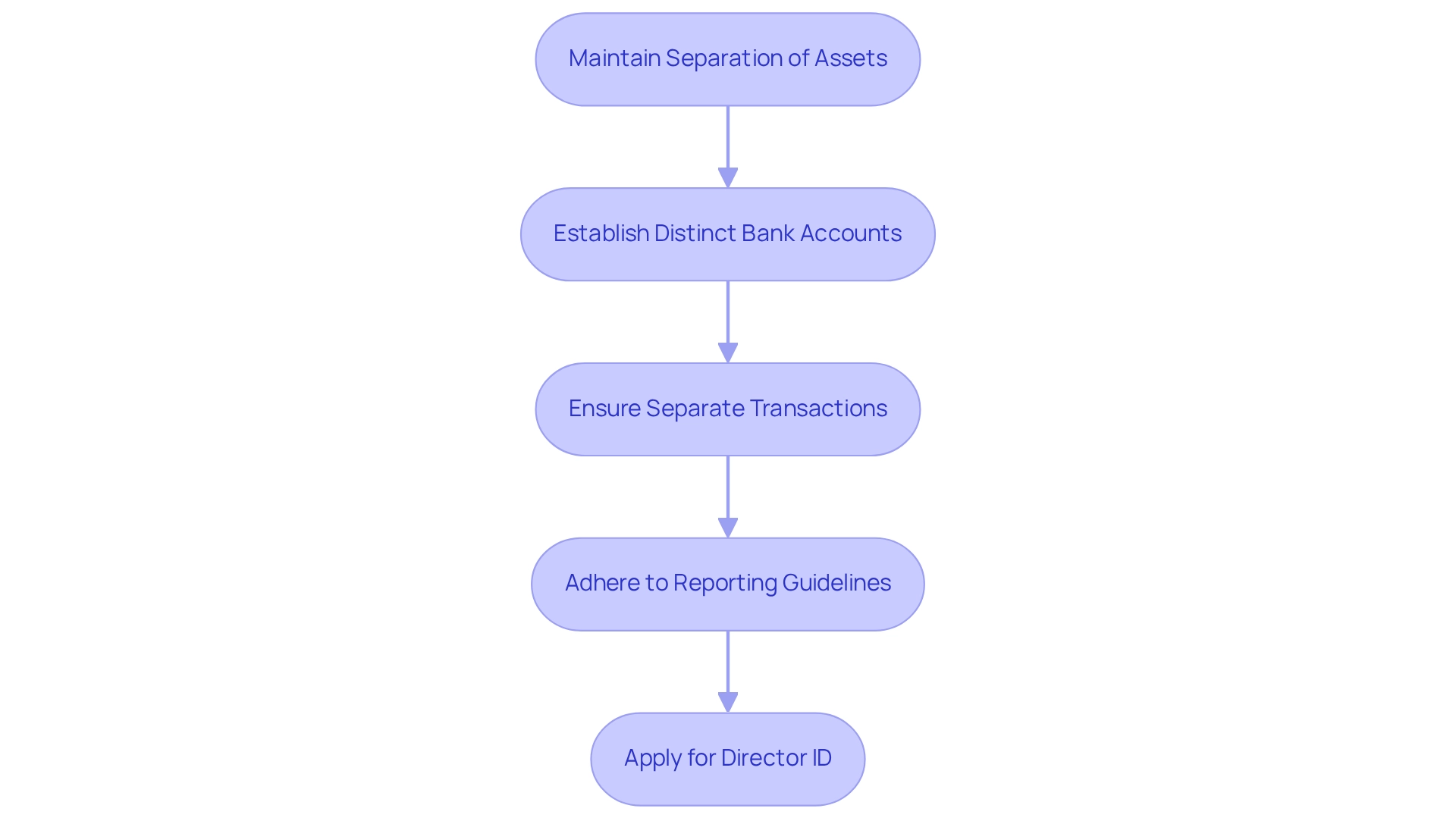

Avoid Mixing Personal and SMSF Assets

For SMSF trustees, maintaining a clear separation between personal and SMSF resources is essential, especially when considering investments in commercial properties, which present fewer limitations than residential properties. The consequences of merging these resources can be severe, leading to compliance violations and significant fines from regulatory bodies. Notably, recent statistics reveal that a considerable percentage of compliance breaches stem from insufficient resource segregation, highlighting the inherent risks. To mitigate these risks, trustees should establish distinct bank accounts for their self-managed superannuation fund, ensuring that all transactions related to the fund are conducted separately from personal finances.

Expert opinions underscore that asset segregation is not merely a regulatory requirement; it is a vital practice that upholds the integrity of the self-managed super fund. Financial compliance specialists assert that maintaining this separation is crucial for fostering trust and confidence within the self-managed superannuation fund sector. Finance Story can assist trustees in building a robust case for compliance and identifying suitable lenders for their commercial real estate ventures.

Moreover, as self-managed super fund trustees explore commercial real estate opportunities, case studies illustrate successful strategies employed by individuals who have effectively maintained resource separation, showcasing exemplary methods that others can adopt. In light of recent changes in reporting requirements, such as the ATO's initiative to enhance compliance oversight, it is imperative for trustees to adhere to these guidelines. Beginning July 2023, all events related to transfer balance accounts must be reported within 28 days, underscoring the significance of accurate reporting and compliance. Additionally, trustees are required to apply for a director ID prior to registering their self-managed superannuation fund, a critical step in ensuring adherence to evolving regulations. By prioritizing fund separation, SMSF trustees can safeguard their resources and ensure compliance with the SMSF LRBA rules while navigating the complexities of commercial real estate.

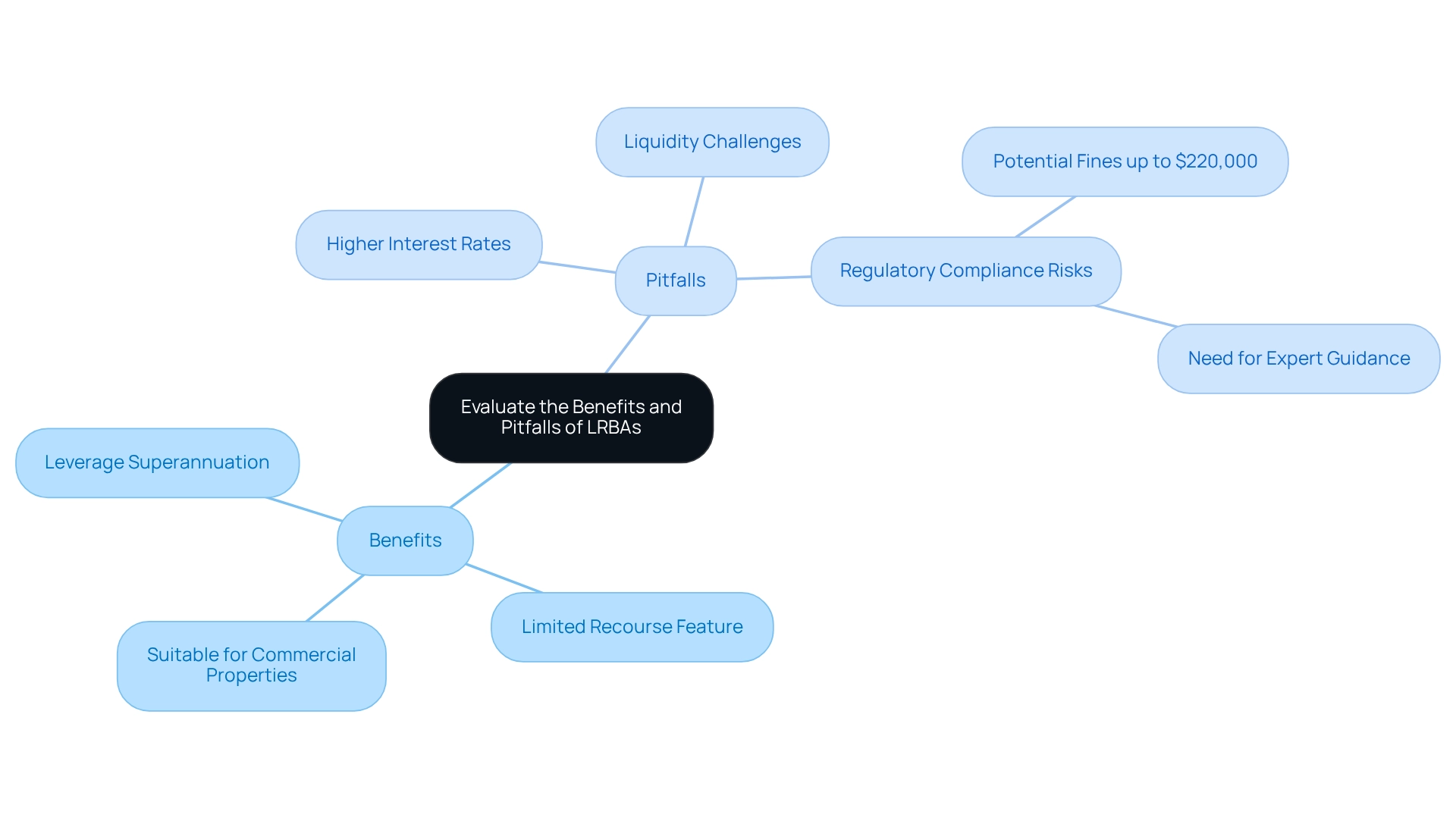

Evaluate the Benefits and Pitfalls of LRBAs

Limited Recourse Borrowing Arrangements (LRBAs) provide a significant opportunity for investors eager to leverage their superannuation funds for property investment, particularly under the smsf lrba rules. This is particularly true for commercial properties, including office buildings, warehouses, and retail premises, which come with fewer restrictions compared to residential properties. The key advantage of LRBAs lies in their limited recourse feature, which protects other assets in the event of a default.

However, it is crucial to consider potential risks. Investors may encounter higher interest rates and liquidity challenges, alongside the complexities of regulatory compliance. Breaches of the smsf lrba rules can result in maximum fines of up to $220,000, highlighting the importance of adherence. Statistics indicate that while LRBAs can enhance asset portfolios, they also carry considerable risks that may impact overall financial well-being.

Therefore, it is essential for investors to carefully assess these factors and seek guidance from expert advisers. At Finance Story, we are dedicated to helping you ensure that LRBAs align with your financial strategy. Our team can assist in creating a robust case for compliance and guide you in selecting the right lender for your commercial property investments. We provide valuable insights into the suitability of LRBAs for your individual circumstances, helping you navigate the intricate landscape of SMSF borrowing in accordance with the smsf lrba rules.

BOOK A CHAT.

Conclusion

The exploration of self-managed super funds (SMSFs) and Limited Recourse Borrowing Arrangements (LRBAs) reveals a wealth of opportunities for investors aiming to optimize their superannuation for property acquisitions. By understanding the intricacies of SMSF loans, including compliance with regulatory frameworks and the strategic advantages of acquiring single assets, investors can make informed decisions that align with their financial goals.

As interest in SMSF loans continues to surge across Australia, the importance of tailored guidance cannot be overstated. Finance Story's commitment to providing customized loan solutions empowers clients to navigate the complexities of SMSF borrowing, ensuring they are well-equipped to mitigate risks while maximizing potential returns. The protective nature of LRBAs, which limits lender recourse to the purchased asset, serves as a significant advantage, allowing investors to explore new avenues for growth without jeopardizing their entire portfolio.

However, while the benefits of LRBAs are substantial, they are not without risks. Investors must remain vigilant about compliance requirements and the potential pitfalls associated with leveraging superannuation. By seeking expert advice and understanding market dynamics, SMSF trustees can strategically position themselves to capitalize on property market opportunities, thereby enhancing their financial security and retirement savings.

In summary, the landscape of SMSF borrowing presents both challenges and rewards. By leveraging the insights shared in this article and working with knowledgeable professionals like Finance Story, investors can navigate this evolving market with confidence, ensuring that their investment strategies are both compliant and effective in achieving long-term financial success.