Overview

This article presents eight essential steps to secure an owner-occupied commercial real estate loan. Key actions include:

- Determining eligibility

- Gathering necessary documentation

- Selecting the right lender

Each step is enriched with detailed insights into requirements, challenges, and best practices. The emphasis on thorough preparation and informed decision-making is crucial for enhancing the chances of loan approval. By understanding these steps, readers can navigate the complexities of securing financing with confidence.

Introduction

In the realm of commercial real estate, owner-occupied properties present a unique opportunity for businesses to establish stability and exert control over their operational environments. As interest in these loans surges—driven by rising rental costs and a desire for long-term investment—understanding the intricacies of owner-occupied commercial real estate loans becomes essential.

Business owners must:

- Evaluate eligibility criteria

- Gather necessary documentation

- Select the right lender

- Navigate the approval process

Are you prepared to make informed decisions? This article delves into the critical aspects of securing owner-occupied commercial real estate loans, offering insights that empower entrepreneurs to seize opportunities and enhance their growth potential.

Understand Owner-Occupied Commercial Real Estate Loans

Owner occupied commercial real estate loan financing is tailored for businesses that plan to utilize the assets they acquire. These loans typically present more favorable conditions compared to investment real estate financing, featuring lower interest rates and higher loan-to-value ratios. Key aspects to consider include:

- Down payment requirements, which usually range from 10% to 25%

- The types of properties eligible for financing, such as office spaces, retail locations, and warehouses

The structure of these financial products often mirrors that of residential mortgages, making them accessible for entrepreneurs.

In 2025, the landscape for owner-occupied commercial financing is evolving, marked by a significant increase in demand as businesses seek to secure their own spaces in response to rising rental costs. Recent statistics indicate that these financial products are gaining traction, with many institutions reporting an uptick in applications. For instance, comprehensive property information—such as valuation, purchase price, and condition—is essential for lenders to assess the suitability and value of the property as collateral, which is crucial for approval.

The benefits of owner occupied commercial real estate loan financing extend beyond favorable terms; they also provide businesses with stability and control over their operational environments. Successful examples of companies leveraging these funds illustrate their potential to enhance growth and profitability. As the market continues to evolve, staying informed about the latest trends and expert insights regarding the advantages of these financial products will empower business owners to make informed financial decisions.

Determine Eligibility Criteria for Borrowing

Qualifying for an owner occupied commercial real estate loan is a critical step for many entrepreneurs, necessitating the fulfillment of several key criteria. To begin, borrowers typically need a minimum credit score of around 650, reflecting their financial responsibility and enhancing their appeal to lenders. A robust operational strategy is essential, demonstrating the feasibility of the enterprise and its capability to generate sufficient revenue to meet repayment obligations.

Furthermore, lenders will meticulously evaluate the financial condition of the company, requiring documentation such as cash flow statements and tax returns from the past two years. This thorough assessment aids lenders in determining the business's capacity to fulfill its financial commitments. In addition, the property in question must be zoned for commercial use and ideally located in a market characterized by stable demand, ensuring its long-term viability.

Recent trends reveal that states with larger populations, such as Georgia, have significantly improved access to higher financial amounts, with an average SBA approval of $840,145. This underscores the necessity of understanding state-specific borrowing opportunities. As Kiah Treece observes, "These findings illuminate the priorities of company owners as they seek methods to expand and enhance their enterprises." By remaining informed about eligibility criteria and market conditions, entrepreneurs can effectively enhance their chances of securing favorable financing options.

Gather Necessary Documentation for Your Application

Gathering the right documentation is crucial when applying for an owner occupied commercial real estate loan. At Finance Story, we specialize in creating polished and highly customized proposals to enhance your application and improve your chances of approval. Here are the essential documents you will need:

- Personal and Business Financial Statements: Recent financial statements for both your business and personal finances are vital. These documents offer financial institutions a clear view of your economic well-being.

- Tax Returns: Include the last two years of tax returns for both your enterprise and personal income. This information assists financial institutions in evaluating your income stability and tax obligations.

- Enterprise Strategy: A comprehensive enterprise strategy is essential. It should outline your enterprise model, market analysis, and financial forecasts, demonstrating to financiers that you have a clear strategy for success.

- Real Estate Information: Provide detailed information about the real estate, including its location, size, and intended use. This assists financiers in assessing the asset's potential worth and appropriateness for your enterprise.

- Identification: Valid identification for all individuals involved in the credit application process is necessary to verify identities and ensure compliance with lending regulations.

By preparing these documents, you can effectively communicate your financing needs. Furthermore, at Finance Story, we provide access to a complete range of financial institutions, including high street banks and creative private financing panels, to guarantee you obtain the appropriate business funding for your commercial property investment or refinancing requirements. A thorough documentation package can improve your likelihood of obtaining a positive reply from financial institutions.

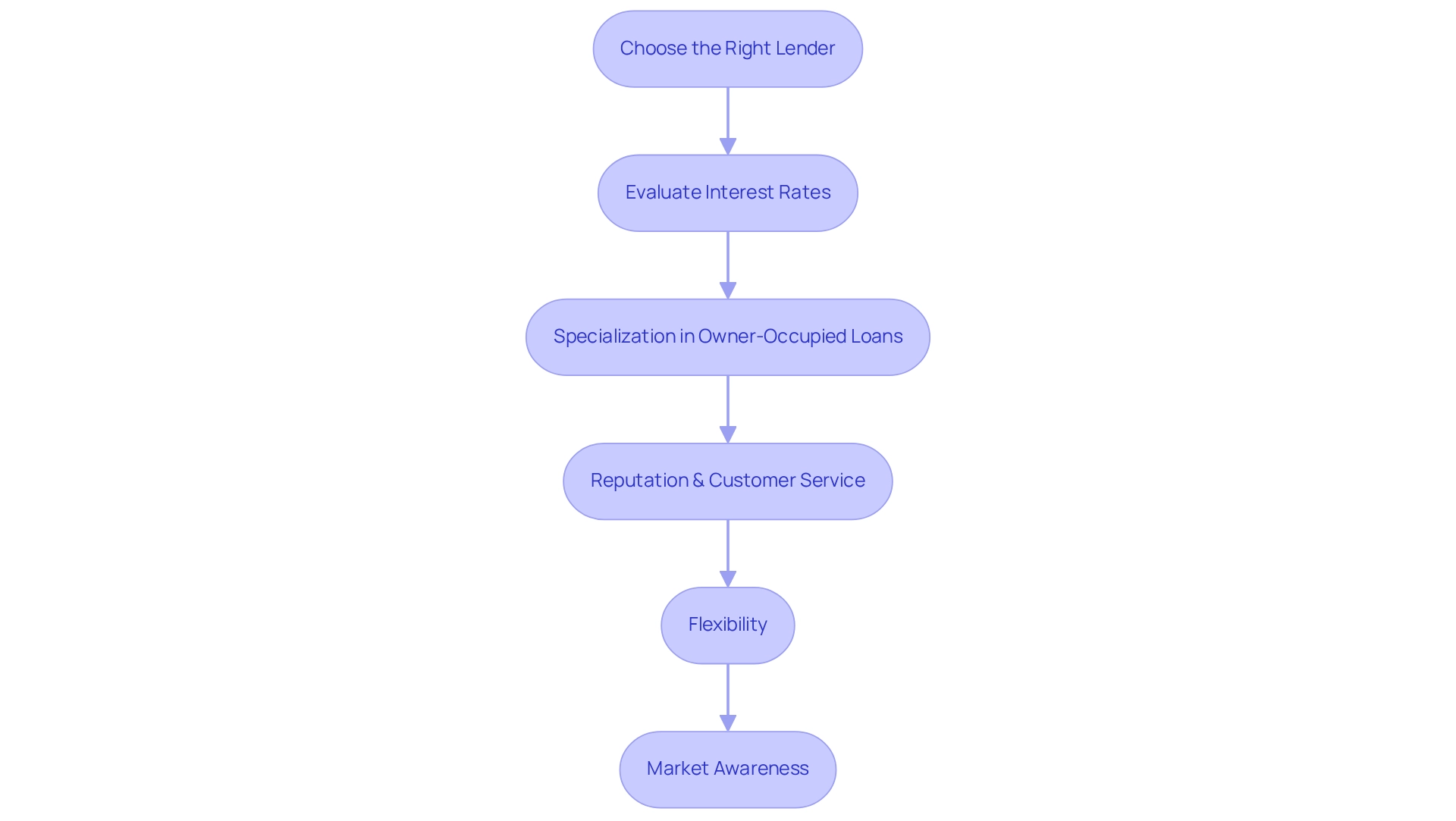

Choose the Right Lender for Your Needs

Choosing the right financial institution for an owner occupied commercial real estate loan requires a thorough assessment of various essential elements. Begin by evaluating interest rates and financing terms among different providers; these factors can significantly impact your total borrowing expenses. It is crucial to prioritize financial institutions that specialize in owner occupied commercial real estate loans, as they are more likely to offer tailored solutions that meet your specific needs.

Reputation and customer service are paramount in this decision-making process. Have you examined creditors' histories? Reading evaluations and obtaining recommendations from fellow entrepreneurs can provide valuable insights. High customer satisfaction ratings often correlate with a financial institution's reliability and responsiveness—attributes that are essential for a seamless borrowing experience.

Flexibility is another key consideration. Assess each lender's willingness to accommodate varying funding amounts and repayment options, ensuring they align with your business's financial strategy. Furthermore, staying informed about prevailing market trends and rates will empower you to make educated choices, ultimately securing the most favorable agreement for your commercial property.

Review Loan Terms and Conditions Thoroughly

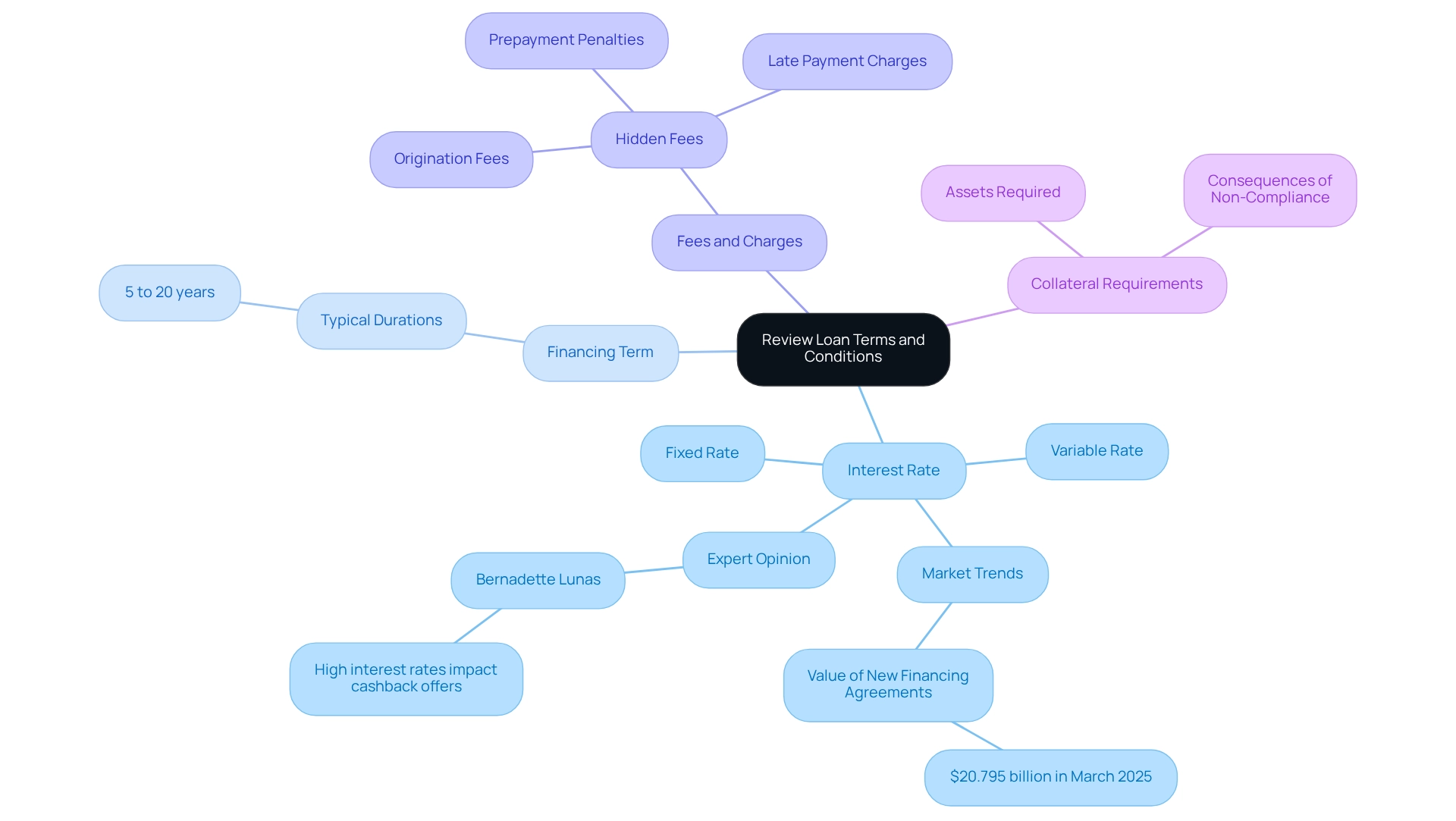

Before finalizing any financing agreement, a comprehensive review of the terms and conditions is crucial. Consider these key aspects:

- Interest Rate: Determine whether the interest rate is fixed or variable, as this will significantly influence your payment structure throughout the loan's duration. Understanding current market trends, such as the value of new financing agreements for property purchases reaching $20.795 billion in March 2025, can provide valuable context for your decision. As finance journalist Bernadette Lunas notes, 'High interest rates put an end to the plethora of cashback offers available, but there are still several institutions providing competitive rates.'

- Financing Term: Familiarize yourself with the duration of the financing and the repayment schedule. Typical commercial real estate financing options may range from 5 to 20 years, depending on the lender and specific terms.

- Fees and Charges: Carefully scrutinize the agreement for any hidden fees, including origination fees, prepayment penalties, or late payment charges. Being aware of these costs can help you avoid unexpected financial burdens.

- Collateral Requirements: Understand what assets will be required as collateral and the potential consequences of failing to meet obligations. This knowledge is essential for safeguarding your organization's financial health.

In addition to these factors, seeking advice from financial specialists can provide insights into the nuances of commercial financing terms. For example, when acquiring a freehold property business, consider the total funds required, which includes a deposit and additional capital for the business segment. Recent case studies reveal that while asset quality remains robust, borrowers are increasingly making excess repayments, which can improve their financial standing. Engaging with professionals can assist you in navigating these complexities and securing the most favorable terms for your commercial real estate investment. Furthermore, always review the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD) before obtaining any financial product to ensure you fully understand the implications of your credit agreement.

Submit Your Loan Application

Once you have gathered all essential documentation and selected a financial institution, it is time to submit your loan application. Ensure that all forms are filled out accurately and completely. Double-check that you have included all required documents, as incomplete applications can lead to delays or denials. Some financial institutions may allow you to submit your application online, while others may require a physical submission. Be prepared to respond promptly to any follow-up questions from the lender.

Statistics reveal that in the March quarter of 2025, there were 50,822 loan commitments for non-first home buyers, reflecting a competitive lending landscape. Understanding common pitfalls can significantly enhance your chances of success. For instance, many candidates neglect to submit sufficient financial documentation or misrepresent their income from operations, which can lead to complications. A recent case study highlighted a 12.1% growth in industrial property lending, showcasing the robust demand in this sector, which can be advantageous for applicants in similar markets.

To avoid common mistakes, consider seeking expert advice on your application. Finance Story specializes in creating polished and highly individualized business cases to present to lenders, ensuring that your application stands out. Engaging with professionals who understand the nuances of commercial lending can provide insights that streamline your submission process. Remember, a well-prepared application not only showcases your professionalism but also enhances your chances of obtaining favorable financing terms. Additionally, be aware that the average time required to process commercial financing applications can vary; thus, establishing realistic expectations is essential.

Navigate Challenges During Loan Approval

Borrowers face several challenges when navigating the financing approval process for an owner-occupied commercial real estate loan. Understanding these common issues is crucial for a successful application:

- Insufficient Credit History: A limited credit history can hinder approval chances. To mitigate this, borrowers should provide supplementary documentation that showcases their financial responsibility, such as bank statements or proof of timely payments on other obligations. At Finance Story, we assist you in crafting a tailored loan proposal that highlights your strengths and addresses concerns about credit history.

- Low Appraisal Value: If a real estate asset appraises below expectations, it complicates financing. Borrowers should be ready to negotiate with financiers or consider alternative properties that may better satisfy appraisal criteria. Our expertise in crafting refined case studies can assist you in presenting a compelling argument to lenders.

- Inconsistent Financial Statements: Accurate financial statements are vital. Discrepancies can raise red flags; thus, borrowers must ensure their documents reflect the current status of their business and be ready to clarify any inconsistencies. We provide personalized support to help you prepare these documents effectively.

- Delays in Documentation: Timeliness is key in the loan approval process. Proactive communication with financial institutions can help ensure that all necessary documentation is submitted and processed without unnecessary delays. With Finance Story, you gain access to a full suite of lenders, including high street banks and innovative private lending panels, streamlining the process and reducing potential delays.

Efficiently tackling these challenges can greatly improve the chances of obtaining an owner occupied commercial real estate loan, which ultimately aids the economic prosperity of local communities through successful small enterprise financing. Additionally, refinancing options are available to meet the evolving needs of your business, ensuring you have the right financial support as you grow.

Take Action: Final Steps to Secure Your Loan

After receiving loan approval, several final steps must be completed to secure your loan with Finance Story.

- Review Closing Documents: Carefully read through all closing documents to ensure accuracy and understanding. Our team is here to assist you in this process, ensuring you feel confident in every detail.

- Sign the Loan Agreement: Once satisfied, sign the loan agreement along with any other required documents. We provide personalized support to guide you through this important step.

- Fund Disbursement: Confirm when the funds will be disbursed and how they will be allocated for the property purchase. With Finance Story, you have access to the latest products and can trust that we will help you make the best decisions.

- Post-Closing Responsibilities: Be aware of your responsibilities post-closing, including repayment schedules and any ongoing reporting requirements to the lender. Our expertise ensures you are well-informed and prepared for the next steps in your investment journey.

Conclusion

Owner-occupied commercial real estate loans present a vital opportunity for business owners to achieve stability and exert control over their operational environments while navigating the complexities of financing. By comprehensively understanding the eligibility criteria, meticulously gathering the necessary documentation, and judiciously selecting the right lender, entrepreneurs can strategically position themselves for success in securing these advantageous loans. The evolving market landscape, marked by rising rental costs and an increasing demand for ownership, underscores the necessity of being well-informed and thoroughly prepared throughout the loan application process.

As highlighted in this article, meticulous attention to detail in reviewing loan terms and conditions is paramount. Key factors such as interest rates, loan terms, and potential fees can profoundly influence the overall financial commitment. Furthermore, proactively addressing common challenges during the approval process—such as credit history and appraisal values—can significantly enhance the likelihood of securing favorable financing.

Ultimately, taking informed action and adopting a proactive stance in the loan application process not only paves the way for successful outcomes but also empowers business owners to leverage their real estate investments for sustained growth and profitability. With the right knowledge and resources, entrepreneurs can confidently navigate the journey of securing an owner-occupied commercial real estate loan, transforming their vision into reality.