Overview

The article highlights seven essential equity finance options available to small business owners, underscoring their importance in raising capital and fostering growth. Understanding these options—such as angel investors, venture capital, and crowdfunding—is crucial for entrepreneurs. This knowledge enables them to navigate the complexities of funding and align their financial strategies with long-term business objectives. By exploring these avenues, business owners can effectively position themselves for success in a competitive landscape.

Introduction

In the dynamic realm of small business financing, equity financing emerges as a powerful strategy for entrepreneurs eager to propel their growth without the encumbrance of debt. By selling shares of their business, owners can not only secure vital capital but also align their interests with those of investors, paving a collaborative path toward success.

As the funding landscape evolves, grasping the intricacies of equity financing becomes essential for small business owners navigating an increasingly competitive market. With a notable increase in transactions and capital raised, delving into the diverse options available—from angel investors to crowdfunding—can empower businesses to thrive and innovate well into 2025 and beyond.

Understanding Equity Financing: A Primer for Small Business Owners

The equity finance option serves as a strategic method for entrepreneurs to raise capital by selling shares of their enterprise to investors. This approach not only provides vital resources without the burden of debt but also allows investors to become part-owners of the company, aligning their interests with the firm's success. Understanding ownership funding is essential for small business proprietors, as it can significantly influence their growth strategies and overall financial well-being.

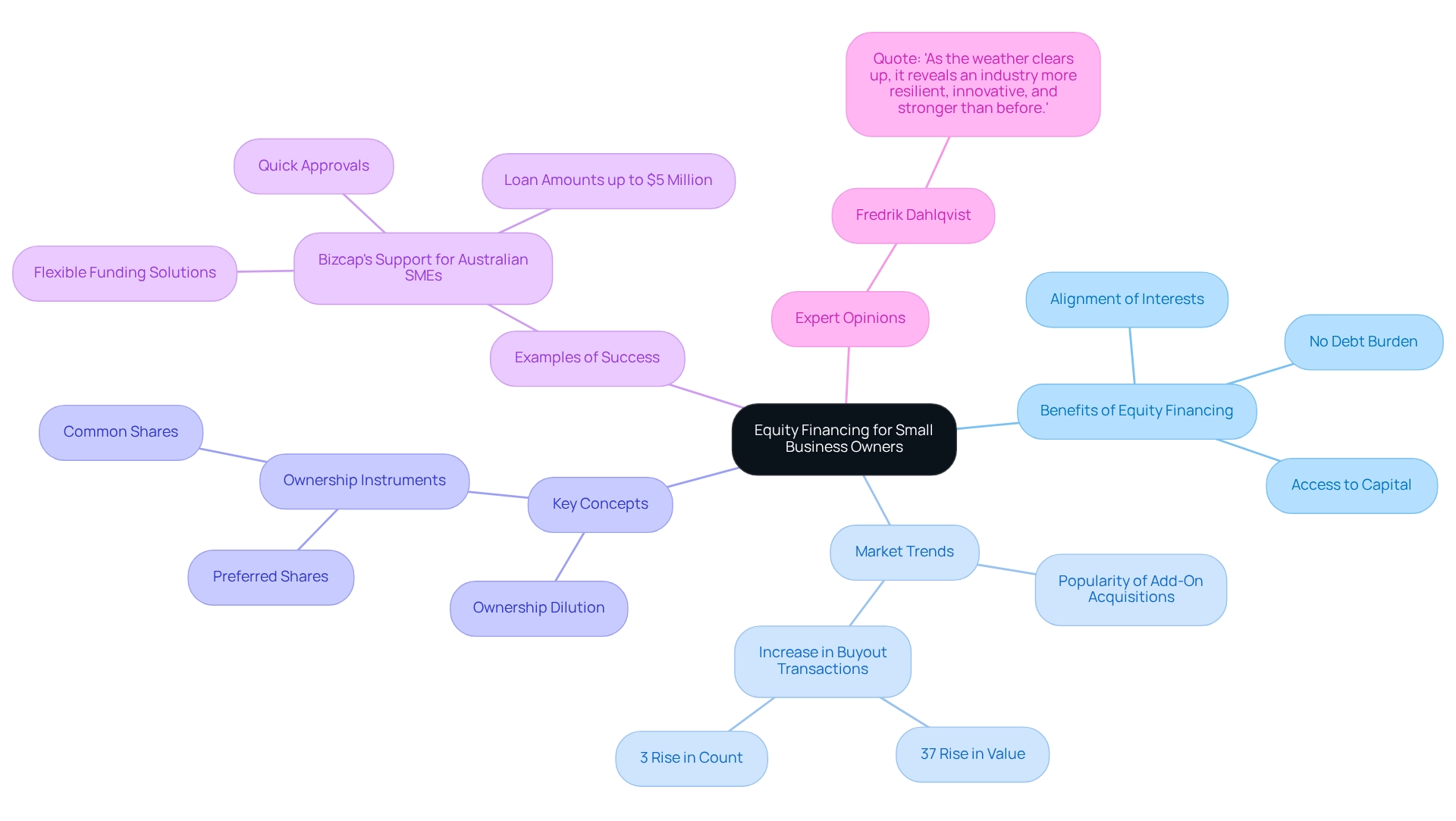

In 2025, the equity finance option remains critical in the realm of small enterprise support. Recent statistics indicate that small businesses are increasingly opting for share capital as a viable choice, evidenced by a notable increase in the number of transactions and the total funds raised. This trend illustrates a growing awareness of the advantages of the equity finance option, particularly in an environment where conventional lending may be more challenging to secure.

Importantly, substantial buyout deals in North America and Europe have seen a 37 percent rise in value, suggesting a market recovery and underscoring the significance of robust investment strategies.

Key concepts of capital raising involve distinguishing between various ownership instruments, such as common and preferred shares, as well as understanding the implications of ownership dilution. For small business owners, grasping these concepts enables informed decisions that align with their long-term business objectives.

Numerous successful instances of shared funding exist, particularly among startups that have leveraged this approach to accelerate their growth. Firms that have adeptly navigated the capital raising landscape frequently report enhanced operational capabilities and increased market competitiveness. A notable example is Bizcap, which offers flexible funding solutions to SMEs, allowing them to access up to $5 million with quick approvals and minimal paperwork.

This method has proven essential in helping companies stabilize cash flow and pursue growth opportunities, demonstrating how ownership funding can directly contribute to the success of smaller enterprises.

Expert opinions emphasize the importance of understanding the equity finance option through shares. Industry leaders assert that as market dynamics shift, entrepreneurs must adapt their funding strategies to incorporate the equity finance option as a viable ownership alternative. Fredrik Dahlqvist, a senior partner, states, "As the weather clears up, it reveals an industry more resilient, innovative, and stronger than before."

This flexibility is critical, especially given recent trends indicating a market recovery, with add-on acquisitions gaining popularity and representing a substantial portion of overall private investment deal value in 2024.

Moreover, the impact of ownership capital as an equity finance option on the growth of small enterprises is significant. Statistics reveal that companies opting for equity finance often experience accelerated growth trajectories compared to those relying solely on debt. This growth is not merely quantitative; it also enhances qualitative aspects of an organization, including innovation and resilience.

In summary, the equity finance option represents a vital pathway for small enterprise owners seeking to expand their operations and achieve their financial goals. By understanding the nuances of ownership funding, entrepreneurs can more effectively navigate their funding choices and position their enterprises for sustained success.

Exploring Different Types of Equity Financing Options

Small enterprise owners have access to a variety of capital funding alternatives, including the equity finance option, each offering distinct advantages and considerations. Understanding the equity finance option is crucial for making informed financial decisions. Here are some key types of equity financing available:

-

Angel Investors: These affluent individuals invest their personal funds into startups and small businesses in exchange for ownership equity or convertible debt. Angel investors not only provide funding but often contribute valuable guidance and industry connections, which can be essential for growth. In 2025, statistics indicate that angel investors are increasingly focusing on startups with robust growth potential, making them a vital resource for entrepreneurs.

-

Venture Capital: This involves investment funds that pool capital from various investors to invest in high-growth startups. In exchange for their investment, venture capitalists typically seek equity stakes in the companies they fund. As of 2025, venture capital funding in minor enterprises has shown a notable increase, demonstrating a rising trust in the entrepreneurial environment. Significantly, 78% of founders expressed intentions to broaden their ventures internationally within the upcoming year, emphasizing the necessity of obtaining adaptable funding solutions to facilitate this expansion.

-

Crowdfunding: This approach enables entrepreneurs to gather modest amounts of money from a large number of individuals, typically via online platforms. Crowdfunding has gained popularity as a means to validate entrepreneurial concepts while simultaneously securing funding. Recently, platforms have emerged that cater specifically to small enterprises, making this choice more accessible than ever.

-

Private Investment: Firms that engage in private investment acquire ownership stakes in companies, frequently taking an active role in management. This type of funding is generally suited for enterprises seeking significant capital and strategic assistance to expand operations.

The environment for equity funding is evolving, with 78% of founders expressing intentions to grow their enterprises internationally in the coming year. This trend underscores the significance of adaptable equity finance options. As Isabelle Comber observed, "Flexibility was another prevalent theme throughout our research," highlighting how adaptable funding solutions can assist minor enterprises in their growth journeys.

Moreover, the growth of online commerce has created a favorable environment for capital investment, with over 26.5 million e-commerce sites globally, a significant rise from 9.2 million in 2019. This expansion illustrates the flourishing online retail landscape, particularly in the U.S., and the increasing prospects for local enterprises to attract investment. The fact that 80% of billion-dollar firms established since 2005 have multiple founders emphasizes the importance of teamwork and diverse funding options in capital raising.

Additionally, firms such as Airwallex are championing digital-first adaptable tools as potential finance tech collaborators for startups aiming to expand, demonstrating how financial technology is evolving to assist smaller enterprises in securing capital.

By examining these funding alternatives, owners of modest enterprises can enhance their ability to obtain the necessary capital through equity finance options, which will help stimulate their growth and navigate the complexities of the financial landscape.

Key Benefits of Choosing Equity Financing for Your Business

Equity financing offers numerous advantages for small business owners, making it an appealing option for those aiming to improve their financial standing:

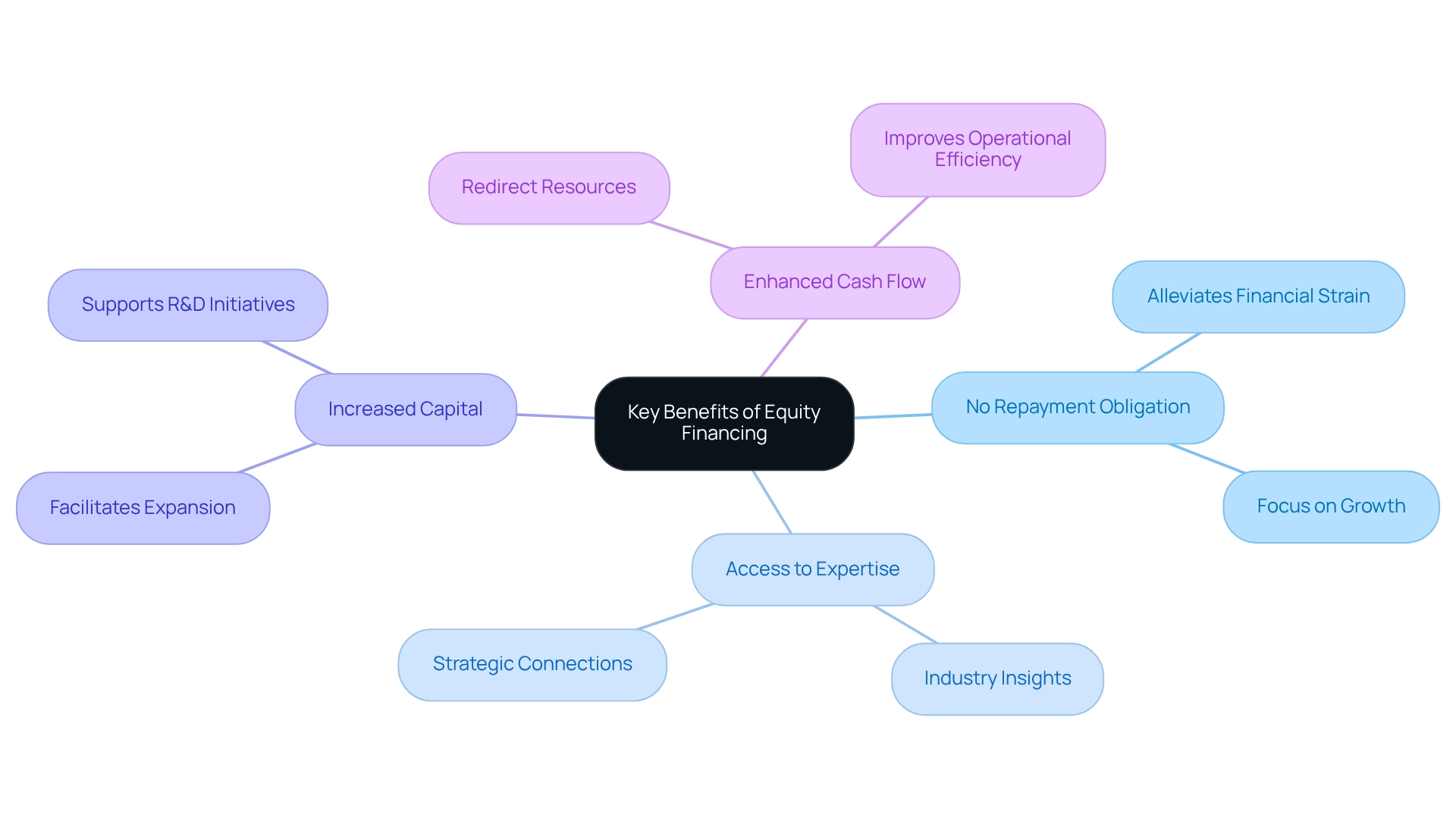

- No Repayment Obligation: Unlike traditional loans, equity financing does not require repayment, alleviating financial strain and allowing businesses to concentrate on growth rather than debt management.

- Access to Expertise: Investors often provide not only funding but also invaluable industry insights and connections, significantly enhancing development and strategic positioning.

- Increased Capital: This funding method can inject substantial resources into the company, facilitating expansion, research, and development initiatives that might otherwise be unattainable.

- Enhanced Cash Flow: By eliminating the obligation of monthly loan repayments, companies can redirect resources towards growth-focused projects, improving overall operational efficiency.

These advantages are particularly significant in 2025, as small enterprises increasingly leverage ownership capital to navigate a competitive landscape. Recent trends indicate that over half of small businesses with revenues exceeding $1 million are now employing funding strategically, rather than merely as a necessity. This shift underscores the growing recognition of shared capital as a vital equity finance option for achieving sustainable growth.

Furthermore, case studies illustrate that companies utilizing equity-based funding have experienced improved cash flow, enabling them to invest in innovation and market expansion. As Fredrik Dahlqvist, Senior Partner, remarked, "As the weather clears up, it reveals an industry more resilient, innovative, and stronger than before." This sentiment reflects the evolving financial environment where the strategic application of capital funding is poised to play a crucial role in the success of small enterprises.

Additionally, the case study titled "Small Enterprise Lending Trends: Opportunities in 2025" highlights the rise of digital-first solutions, expected to capture a significant portion of the market, further enhancing the efficiency of capital support in fostering enterprise growth.

Potential Drawbacks of Equity Financing: What to Consider

While equity financing can offer significant advantages, it is crucial for small business owners to be aware of its potential drawbacks:

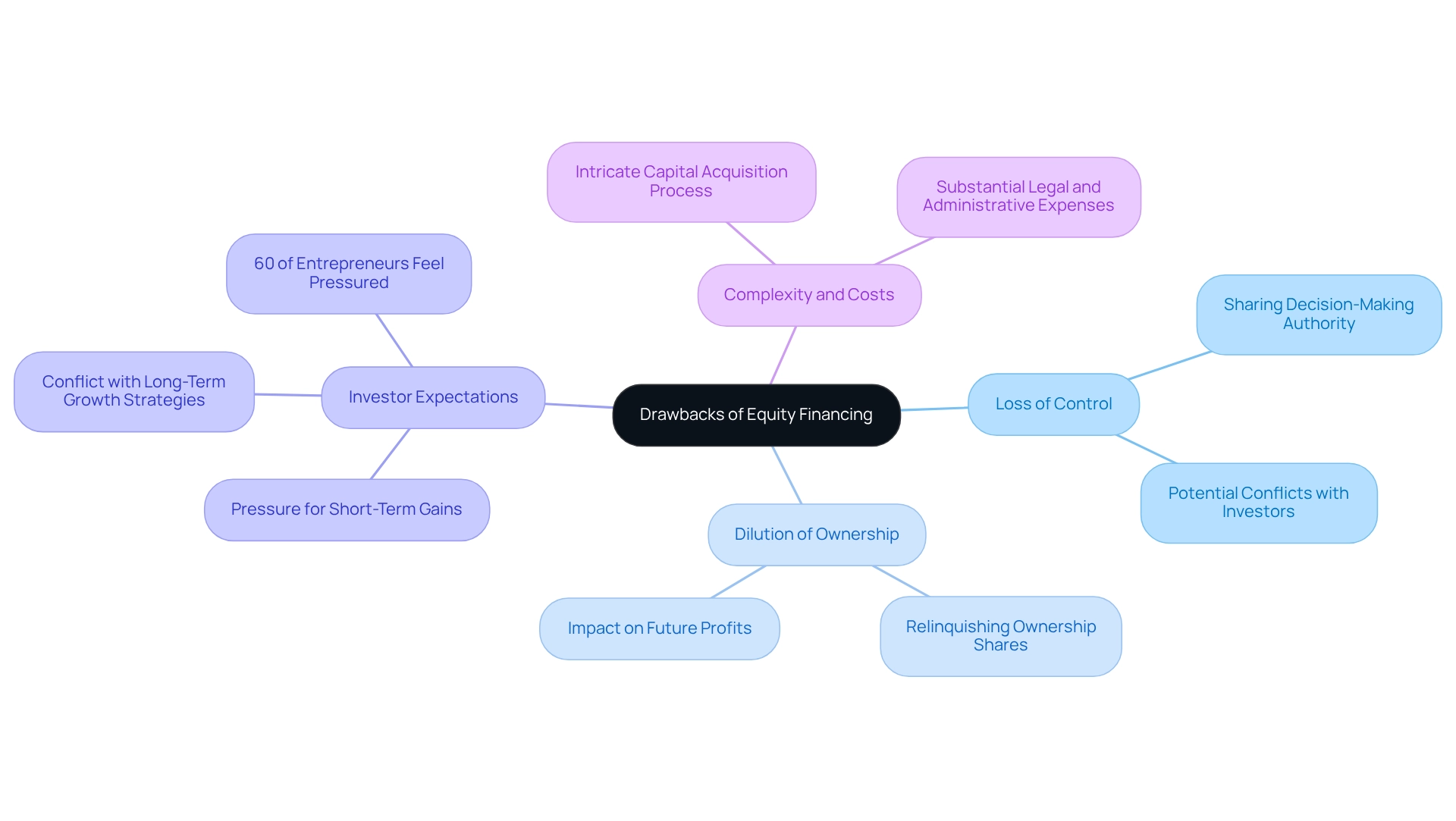

- Loss of Control: Introducing investors into the business often necessitates sharing decision-making authority. This shift can lead to conflicts, particularly if investors have differing visions for the company's future.

- Dilution of Ownership: Selling equity means relinquishing a portion of ownership, which can diminish the owner's share of future profits. This dilution can be especially troubling for entrepreneurs who have invested significant time and resources into developing their ventures.

- Investor Expectations: Investors generally look for a return on their investment, which can create pressure on owners to concentrate on short-term gains instead of long-term growth strategies. This shift in priorities can hinder innovation and sustainable development. Indeed, a recent study emphasized that 60% of entrepreneurs indicated feeling pressured to meet investor demands, which often conflicted with their initial objectives.

- Complexity and Costs: The procedure of obtaining capital can be intricate, often involving substantial legal and administrative expenses. These expenses can accumulate rapidly, affecting the overall financial condition of the company.

In 2025, the terrain of equity finance options continues to develop, with statistics showing that numerous minor enterprises encounter difficulties related to ownership dilution and investor expectations. The move towards smaller-scale, short-term funding for urgent needs has effects on investment, productivity, competitiveness, and resilience, further complicating the funding environment for local enterprises.

Furthermore, case studies show that companies that faced substantial ownership dilution frequently found it challenging to uphold their core values and operational independence. For example, the resurgence in significant buyout transactions in 2024, where both the value and number of deals exceeding $500 million rose, indicates a shifting dynamic in capital that small enterprises must manage.

Entrepreneurs have expressed worries regarding the difficulties of the equity finance option, with many mentioning that while it can provide essential capital, the compromises in control and direction can be overwhelming. As Chad Brooks, Managing Editor at Business.com, points out, "Business.com earns commissions from some listed providers," emphasizing the complexities and potential conflicts of interest in the funding landscape.

Grasping these drawbacks is crucial for small enterprise owners as they explore their financing options, ensuring they make informed choices that align with their long-term goals.

How to Attract Equity Investors to Your Small Business

Attracting investors for the equity finance option necessitates a strategic approach that can significantly enhance your chances of securing funding. Consider these key strategies:

-

Develop a Solid Business Plan: A comprehensive business plan is essential. It should clearly outline your vision, conduct thorough market analysis, and provide detailed financial projections. This document serves as a roadmap for your enterprise and a persuasive tool for potential investors. As renowned VC Marc Andreessen states, "The only thing that matters is getting to product-market fit," highlighting the critical need for alignment between your offerings and market demands.

-

Network Effectively: Building connections is vital. Attend industry events, join entrepreneurial groups, and utilize social media platforms to engage with potential investors. Networking not only opens doors but also allows you to gain insights and advice from experienced entrepreneurs.

-

Create a Compelling Pitch: Your pitch must be persuasive and succinct, clearly communicating your venture's value proposition and growth potential. Emphasize what distinguishes your enterprise and why it represents a valuable investment opportunity.

-

Showcase Traction: Investors are more likely to be interested in enterprises that demonstrate existing traction. This could include metrics such as sales growth, user engagement, or successful pilot programs. Showing that your venture is already gaining momentum can significantly enhance its attractiveness.

-

Emphasize Sustainability: With ESG assets projected to surpass $50 trillion globally by 2025, highlighting your commitment to sustainable practices can attract investors who prioritize environmental, social, and governance factors.

-

Diversity in Entrepreneurship: The realm of entrepreneurship is diverse, with over 8 million minority-owned enterprises in the US. This diversity illustrates the potential for different backgrounds to thrive in attracting investors, making it crucial to highlight your distinctive story and viewpoint.

By applying these tactics, owners of modest enterprises can effectively position themselves to attract the appropriate investors, utilizing an equity finance option that ultimately leads to successful funding outcomes. Furthermore, staying updated on significant trends for 2024, including the growth of e-commerce and the importance of sustainability, can further enhance your appeal to potential investors.

Navigating Legal and Regulatory Considerations in Equity Financing

Navigating the legal and regulatory environment of ownership financing is essential for business proprietors aiming to secure funding effectively. To achieve this, consider the following key factors:

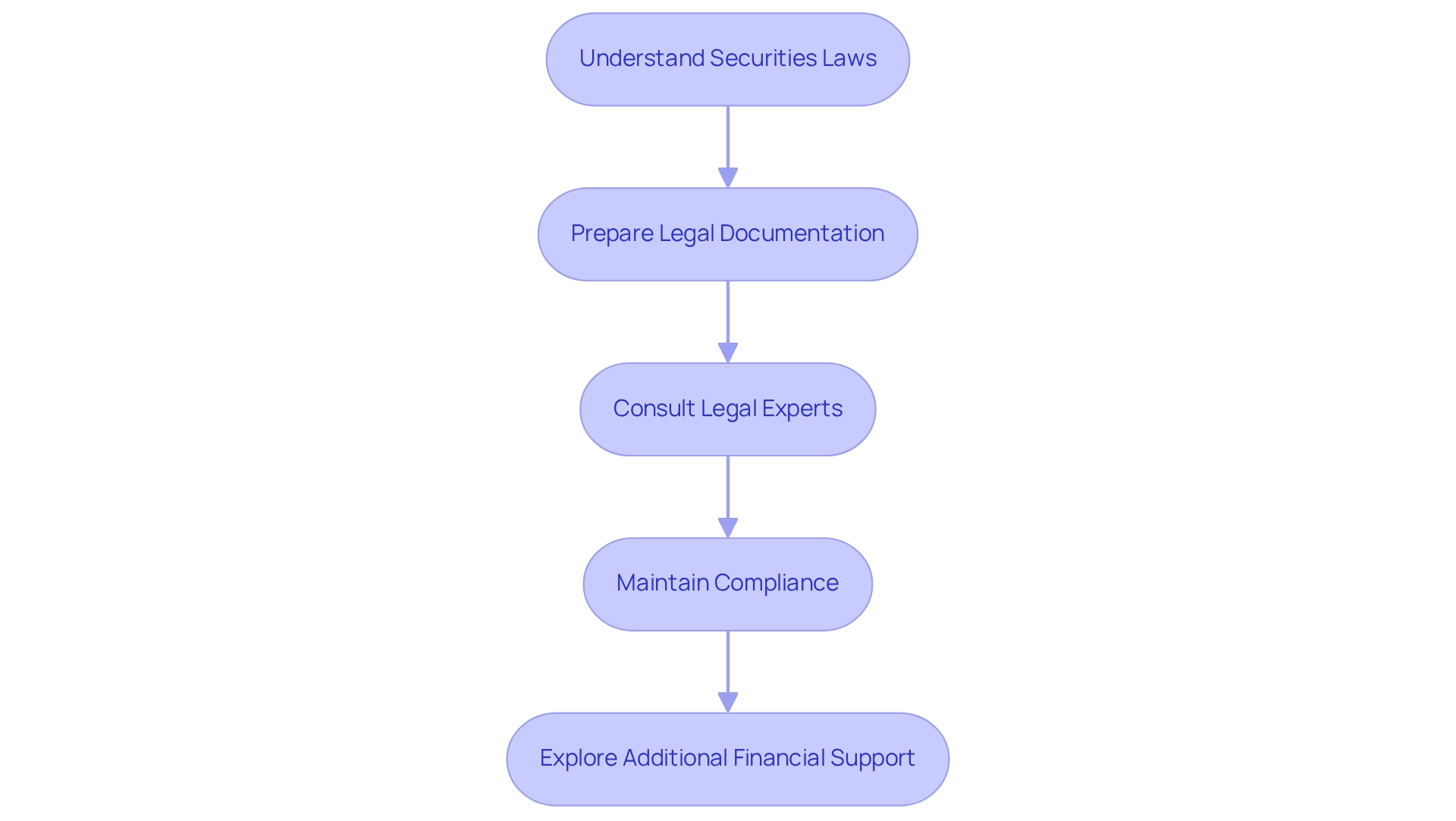

- Understand Securities Laws: Familiarize yourself with the laws governing the sale of shares. This includes understanding registration requirements and available exemptions that can simplify the process for minor businesses.

- Prepare Legal Documentation: Ensure that all necessary legal documents are meticulously prepared. This encompasses shareholder agreements, disclosure statements, and any other pertinent contracts that detail the conditions of the capital investment.

- Consult Legal Experts: Collaborating with legal professionals who specialize in capital investment is invaluable. Their expertise can help you navigate complex regulations, ensuring that you remain compliant and avoid potential legal pitfalls.

- Maintain Compliance: Regularly review and update your compliance practices to align with evolving regulations. This proactive approach is essential, particularly given recent dialogues from the Reserve Bank of Australia’s Small Enterprise Finance Advisory Panel, which underscored persistent difficulties in the funding environment for enterprises and stressed their crucial role in the economy.

- Explore Additional Financial Support: Consider government grants and private investors as potential sources of funding. These choices can offer crucial monetary assistance, enhancing your equity funding efforts.

By addressing these legal factors and exploring various funding pathways, entrepreneurs can safeguard their interests and promote a successful equity finance option. Statistics indicate that compliance issues continue to be a major concern, highlighting the necessity of thorough preparation and expert guidance in achieving funding objectives. Furthermore, Finance Story provides an extensive selection of funding options, including commercial property loans and enterprise finance, which can further aid entrepreneurs in their funding efforts.

Practical Tips for Leveraging Equity Financing for Business Success

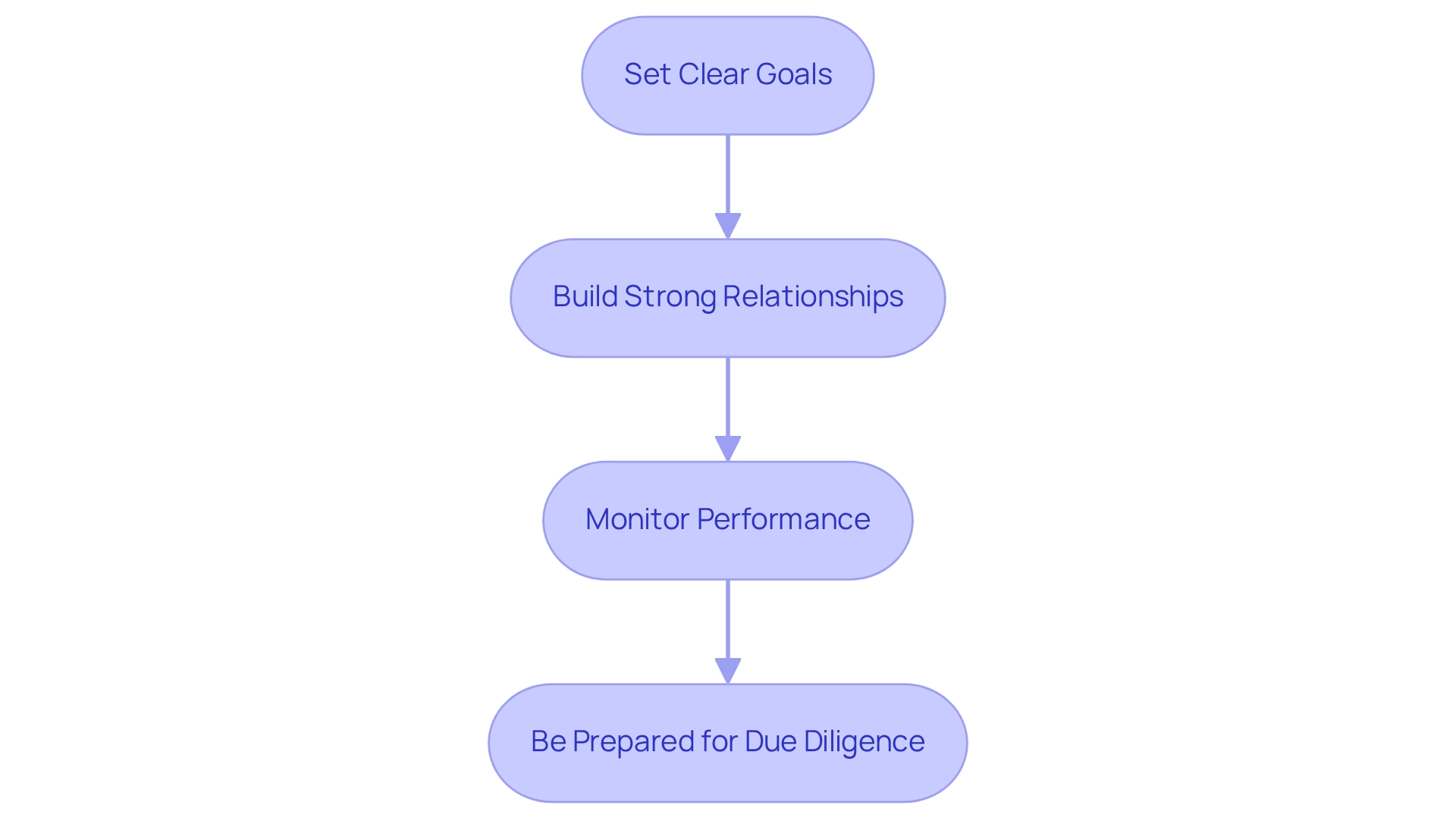

To effectively utilize equity funding for organizational success, entrepreneurs should consider the following strategies:

-

Set Clear Goals: Clearly define your objectives for the funds raised, whether it’s for expansion, product development, or entering new markets. Studies show that companies with clear objectives are 30% more likely to meet their funding targets. Involving employees in goal setting enhances commitment and innovation, leading to better organizational outcomes.

-

Build Strong Relationships: Cultivating robust relationships with investors is crucial. Maintain open lines of communication and actively involve them in significant decisions. This not only fosters trust but also enhances investor commitment, which is vital for long-term success. As Michael J. Hsu observed, some banks may "feel like hostages" to their legacy technology, which can influence the funding environment for lesser enterprises.

-

Monitor Performance: Regularly assess your company's performance and share updates with your investors. Keeping them informed not only engages them but also demonstrates accountability, which can lead to further investment opportunities. With more than a fifth of employees reporting minimal to no support for generative AI, it’s essential to ensure that your team is equipped to contribute to these evaluations effectively.

-

Be Prepared for Due Diligence: Investors will conduct comprehensive due diligence before committing funds. Ensure that your financial records and operational processes are transparent and meticulously documented. This preparation can significantly streamline the investment process and build investor confidence. Additionally, insights from case studies on modernizing legacy banking systems can provide strategies for navigating challenges in securing equity finance options, especially in light of potential macroeconomic shifts affecting asset and liability management at banks. By implementing these strategies, small business owners can effectively harness equity finance options to propel their businesses forward, ensuring they are well-positioned to meet their financial goals.

Conclusion

Equity financing emerges as a vital strategy for small business owners seeking to secure capital while fostering collaborative relationships with investors. By understanding the diverse options available—from angel investors and venture capital to crowdfunding and private equity—entrepreneurs can customize their financing approach to align with their specific needs and growth objectives. The surge in equity financing activity in 2025 underscores its increasing significance in a competitive market where traditional lending may not suffice.

The advantages of equity financing are substantial; it alleviates the burden of debt repayment, provides access to invaluable expertise, boosts cash flow, and empowers businesses to pursue expansion and innovation. Nonetheless, it is crucial to remain aware of potential drawbacks, such as ownership dilution and the pressure to meet investor expectations. Striking a balance between these factors is essential for ensuring long-term success while navigating the complexities of the financial landscape.

Attracting equity investors necessitates a strategic approach, which includes:

- Crafting a robust business plan

- Effective networking

- Demonstrating traction

Moreover, comprehending the legal and regulatory framework is paramount for successfully securing funding. By implementing practical tips and nurturing strong relationships with investors, small business owners can leverage equity financing to meet immediate capital needs and position their companies for sustainable growth.

In conclusion, equity financing transcends mere funding; it serves as a pathway to innovation and resilience in the ever-evolving realm of small business. Entrepreneurs who embrace this strategy and adeptly navigate its intricacies will be better equipped to thrive in a landscape abundant with opportunities.