Overview

The article identifies the premier commercial mortgage lenders in the UK specifically catering to small business owners. It highlights various lenders that provide tailored mortgage solutions, competitive rates, and personalized services. This emphasis on customized financing options underscores the critical need to address the unique requirements of small enterprises, particularly in a fluctuating market. By focusing on these tailored offerings, the article aims to guide small business owners toward making informed financing decisions that align with their specific needs.

Introduction

In the competitive landscape of small business financing, securing the right commercial mortgage can indeed be a daunting task. With a plethora of options available—from tailored solutions to fixed-rate offerings—small business owners are tasked with navigating a complex web of lenders and products to identify the best fit for their unique financial needs.

This article delves into the diverse landscape of commercial mortgage services, highlighting key providers such as:

- Finance Story

- Barclays

- KIS Bridging Loans

Each offering distinct advantages and personalized support. Furthermore, by exploring the latest trends and insights in the commercial mortgage sector, small business owners can gain valuable knowledge to make informed decisions that propel their enterprises forward.

Finance Story: Tailored Commercial Mortgage Solutions for Small Business Owners

This boutique mortgage brokerage, located in Melbourne, specializes in delivering customized commercial mortgage solutions designed specifically for local entrepreneurs. By prioritizing a thorough understanding of each client's unique needs, the organization presents innovative lending options that effectively tackle the challenges faced by small enterprises. With a comprehensive panel of lenders—including mainstream banks, private lenders, and angel investors—the firm guarantees that clients have access to a complete suite of financing alternatives. With over 25 years of experience in the financial sector, Fiscal Narrative adeptly navigates complex monetary environments, crafting tailored and highly refined proposals to secure the most suitable funding for specific circumstances.

Whether clients are pursuing acquisitions or property purchases, Finance Story is committed to guiding them through their financial journeys with personalized support and expert advice. The firm's expertise in creating customized loan proposals is vital for owners seeking to refinance or acquire new properties, ensuring they meet the increasingly stringent standards of lenders.

Recent trends indicate a growing reliance on personalized mortgage services among small enterprises, with approximately 70% opting to collaborate with mortgage brokers to enhance their financing options. This trend underscores the importance of customized solutions in a competitive market, where understanding the nuances of each company's financial needs can lead to more favorable loan terms and conditions.

In the UK, business mortgage lending has seen fluctuations, with interest rates ranging from 2% to 13%, as influenced by factors such as loan type, value, and the borrower's credit history, especially among the best commercial mortgage lenders UK. According to a case study on interest rates for UK loans, understanding these rates is essential for SMEs when choosing the best commercial mortgage lenders UK for their financing options. Moreover, London's total loan value of £192 million highlights the significant market opportunities available for entrepreneurs seeking commercial mortgages. Finance Story distinguishes itself in this landscape by offering bespoke services that not only simplify the loan acquisition process but also empower clients to make informed financial decisions. As Cameron Jaques, SME Commercial Relations Manager, notes, "Personalized lending is crucial for enterprises to navigate their distinct financial challenges effectively.

Barclays: Comprehensive Commercial Mortgages with Fixed Rates

Barclays emerges as a premier provider of fixed-rate mortgages, making it an excellent choice for entrepreneurs in search of financial stability. Their extensive range of products from the best commercial mortgage lenders UK caters to diverse corporate needs, whether acquiring new premises or refinancing existing loans. With fixed-rate options, borrowers enjoy predictable monthly payments, a crucial element for effective financial planning. In 2025, Barclays continues to offer competitive fixed rates, such as a two-year fixed rate for remortgage at 4.42% with a £1,499 fee for borrowers with 25% equity. These statistics suggest that minor enterprises can secure favorable terms, enhancing their financial predictability.

Furthermore, Barclays is committed to providing expert guidance throughout the application process, empowering clients to make informed decisions tailored to their unique circumstances. As Jo Thornhill noted, despite various lenders reducing fixed rates, Barclays remains dedicated to offering reliable financing options that support the objectives of minor enterprises. With the upcoming Bank of England interest rate decision scheduled for 3 August, owners of minor enterprises stand to benefit from Barclays' proactive approach in navigating potential market shifts.

Success stories from local entrepreneurs highlight the positive impact of Barclays' financial loans, illustrating how these funds have facilitated growth and stability in their operations. For those looking to refine their funding strategies, collaborating with specialists like Story can further streamline the process of securing customized loans and understanding repayment terms, ensuring entrepreneurs are well-prepared to navigate the complexities of financing.

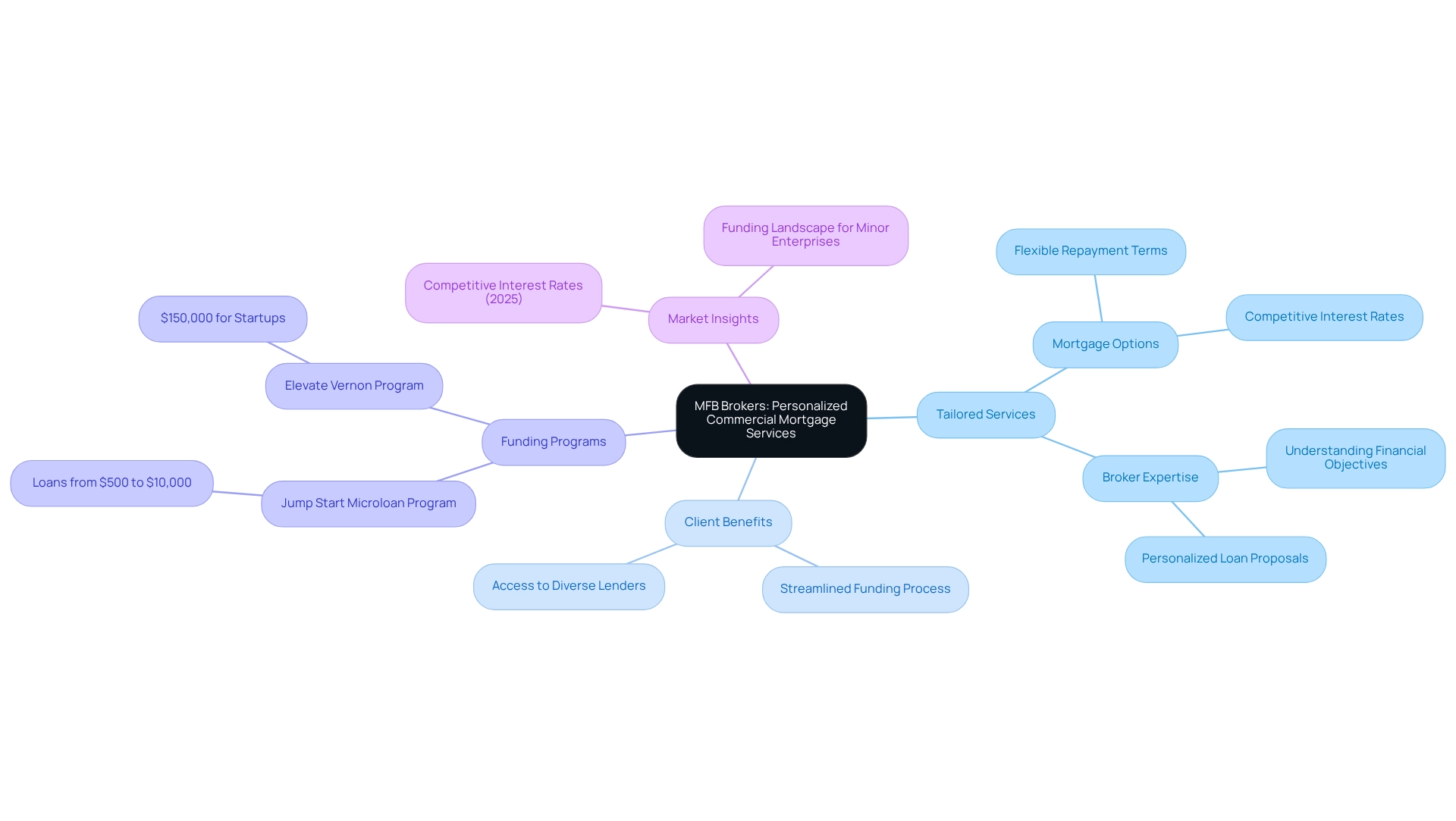

MFB Brokers: Personalized Commercial Mortgage Services for Small Businesses

The organization Story distinguishes itself as one of the best commercial mortgage lenders UK by offering tailored mortgage services specifically designed for minor enterprises. Their dedicated team of experienced brokers works closely with clients to gain a thorough understanding of their financial objectives and challenges, ensuring access to the best commercial mortgage lenders UK and the most suitable mortgage products available.

With a diverse array of options, including flexible repayment terms and competitive interest rates, this service streamlines the process for entrepreneurs seeking funding for growth and expansion. This commitment to exceptional customer service, combined with extensive market knowledge, positions Story as one of the best commercial mortgage lenders UK for minor enterprises navigating the complexities of commercial financing.

Crafting a loan proposal for your upcoming project requires expertise, understanding, and skill to meet the rising expectations surrounding fund acquisition. Finance Story specializes in developing refined and highly personalized proposals for banks, ensuring clients successfully achieve their goals.

Recent statistics underscore the importance of customized mortgage solutions, with initiatives such as the Jump Start Microloan Program providing essential funding to enterprises in underserved communities, offering loans ranging from $500 to $10,000. In addition, the Elevate Vernon Program allocated $150,000 to enhance funding opportunities for startups, further illustrating the financial landscape accessible to entrepreneurs.

As of 2025, average interest rates for minor enterprise commercial mortgages remain competitive, facilitating access to vital capital for growth. The financial narrative shines in this context, ensuring that lesser enterprises receive the tailored services they require to thrive.

As Lenny Mendonca, a respected financial specialist, emphasizes, the best commercial mortgage lenders UK offer customized mortgage solutions that are crucial for modest enterprises aiming to effectively navigate their financial paths. Furthermore, the financial service grants access to a comprehensive range of lenders, including high street banks and innovative private lending panels, ensuring clients have access to the best commercial mortgage lenders UK for their financing needs.

Commercial Trust: Expert Guidance for Small Business Commercial Mortgages

The company provides invaluable knowledge for small enterprises navigating the mortgage landscape. Their team of experts is well-versed in the nuances of business lending, offering customized guidance that empowers clients throughout the application process. By focusing on securing optimal terms, Finance Story helps enterprises comprehend their financing options, including average loan-to-value ratios, which typically range from 60% to 80% for commercial properties. This understanding is crucial, as it directly impacts the amount of capital an enterprise can access.

The firm’s commitment to client education fosters confidence among small business owners, ensuring they are well-informed about repayment structures and potential pitfalls. Success stories illustrate how Finance Story has assisted clients in navigating complex financing situations, including the efficient application of family trusts for succession planning in commercial property deals. Such strategies not only facilitate smooth asset transfers but also align with broader estate planning objectives.

This organization, with access to the best commercial mortgage lenders UK, including high street banks and innovative private lending panels, tailors solutions to meet the unique needs of each client. Statistics reveal that since 2004, Finance Story has successfully aided hundreds of organizations in securing the funding they require, showcasing their effectiveness in the market. As Mike Willetts states, "We’ll use that knowledge to provide tailored solutions and recommendations and work with you to implement those solutions to meet your needs." With an emphasis on personalized service and professional advice, Finance Story positions itself as a trusted ally for enterprises pursuing mortgages.

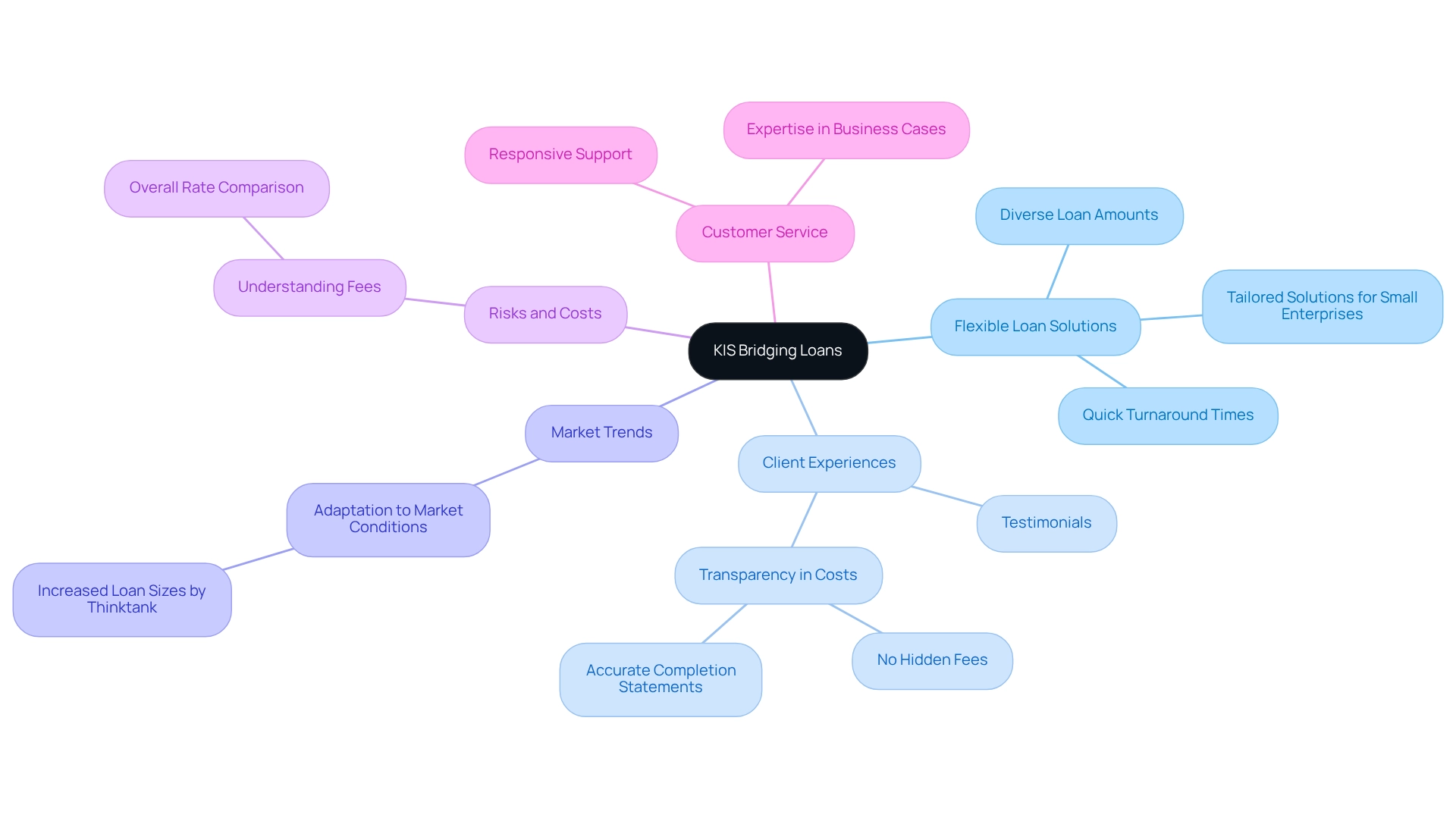

KIS Bridging Loans: Flexible Commercial Mortgage Solutions for Small Enterprises

KIS Bridging Loans is recognized as one of the best commercial mortgage lenders UK, providing flexible commercial mortgage solutions tailored specifically for small enterprises. Their offerings from the best commercial mortgage lenders UK are specifically designed to meet the urgent financial needs of businesses, whether for acquiring new properties or addressing temporary cash flow challenges. With a diverse range of loan amounts and terms, small business owners can choose options that align with their unique financial situations. Notably, KIS Bridging Loans boasts impressive turnaround times, often finalizing applications swiftly, which is crucial for businesses requiring immediate financing. Their dedication to responsive customer service further cements their reputation as a preferred choice for quick financing solutions.

However, potential borrowers must be mindful of the risks and costs associated with bridging loans. As Tomer Aboody, director at the specialized lender MT, advises, "Make sure you consider all fees related to the bridging loan, along with the total rate you’ll pay, when comparing various offers." This insight highlights the necessity of transparency in loan agreements.

Finance Story enhances this landscape by offering expertise in crafting refined and highly tailored business cases for the best commercial mortgage lenders UK, ensuring that business owners secure the right funding for their property investments. Recent case studies demonstrate how KIS has effectively assisted small enterprises in overcoming financial challenges, showcasing their adaptability in a dynamic market. For instance, in response to changing market conditions, Thinktank has raised its maximum loan sizes for business and SMSF transactions, reflecting confidence in the property market. This adjustment is aimed at meeting the increasing demand for business property financing and helping brokers capitalize on market opportunities.

As trends in bridging loans evolve, KIS remains at the forefront, ensuring that small enterprises have access to the best commercial mortgage lenders UK to thrive. Clients have reported that the initial costs quoted were exactly what they paid on the completion statement, with no hidden fees, reinforcing the reliability and transparency of KIS Bridging Loans. Furthermore, the Financial Narrative collaborates with a wide range of lenders, including high street banks and private lending panels, to provide customized funding solutions for various business properties such as warehouses, retail spaces, factories, and hospitality projects. Testimonials from satisfied clients further underscore the effectiveness of their services, highlighting the positive impact on their financing journeys.

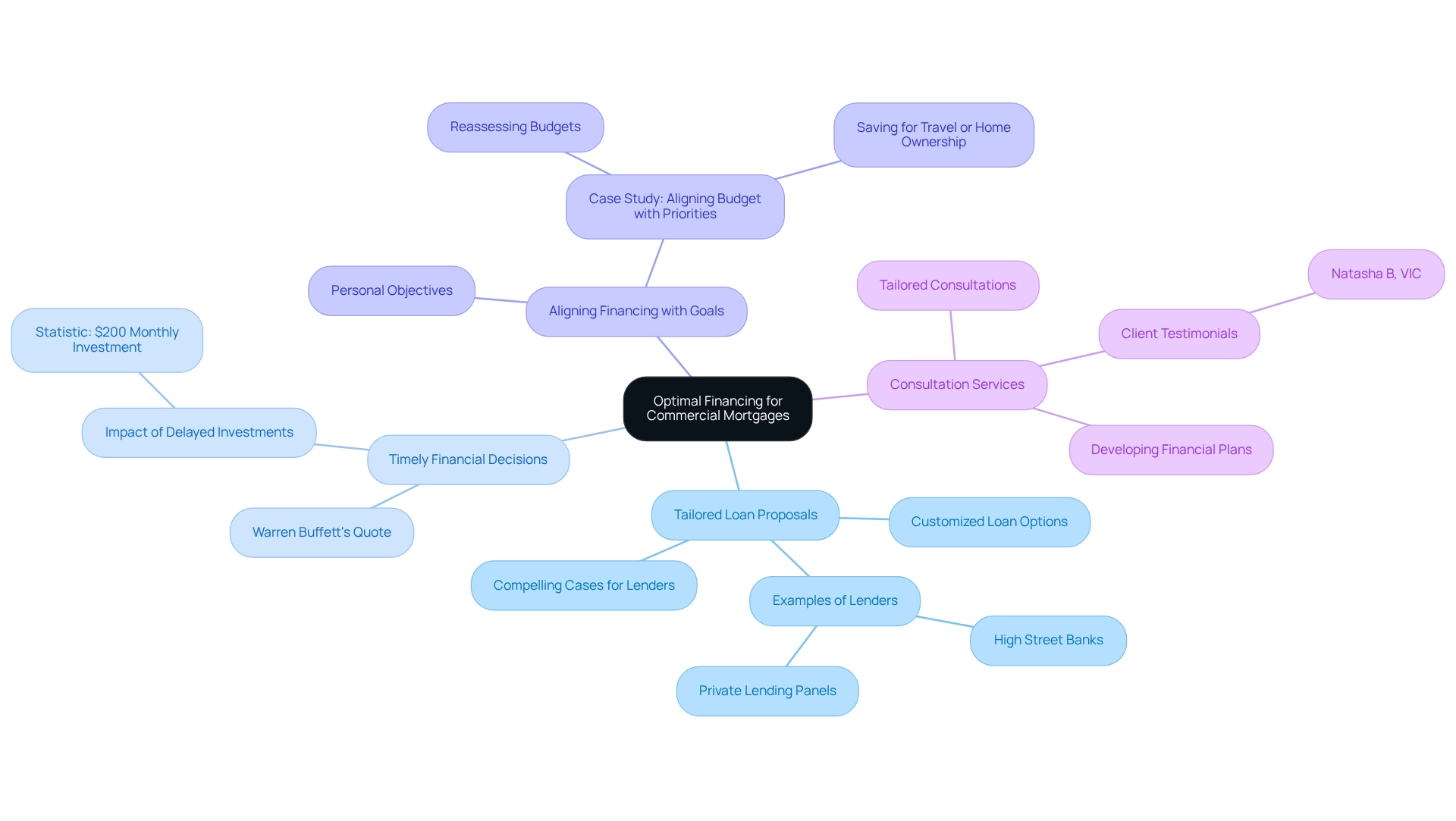

Uswitch: Compare Commercial Mortgage Rates for Optimal Financing

This narrative about finance serves as an essential resource for owners of modest enterprises aiming to secure optimal mortgage rates and funding options from the best commercial mortgage lenders UK tailored to their unique needs. By concentrating on the development of refined and distinctly customized loan proposals, this service empowers companies to present compelling cases to the best commercial mortgage lenders UK, ensuring they can secure the necessary resources for their commercial property investments. With a comprehensive portfolio that includes the best commercial mortgage lenders UK, ranging from high street banks to innovative private lending panels, Story aids entrepreneurs in navigating the complexities of financing, whether they are purchasing a warehouse, retail space, or hospitality venture.

In today’s evolving financial landscape, making timely financial decisions is crucial; for instance, delaying a $200 monthly investment for 10 years can reduce potential wealth by over half. This highlights the significance of promptly securing competitive mortgage rates from the best commercial mortgage lenders UK. As Warren Buffett wisely stated, "We never want to count on the kindness of strangers in order to meet tomorrow's obligations." This reinforces the necessity of informed decision-making in financing and underscores the value of collaborating with specialists in financial matters.

Moreover, for small business owners, aligning financing choices with personal objectives is vital when seeking the best commercial mortgage lenders UK. By leveraging Story's tailored mortgage brokerage solutions, individuals can effectively navigate funding challenges and ensure their financing strategies align with their long-term goals through the best commercial mortgage lenders UK.

"I will certainly be suggesting your services to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." - Natasha B, VIC.

Arrange your complimentary tailored consultation with Story's Head of Funding Solutions to explore your requirements and develop a financial plan that suits you. Don't miss the opportunity to secure financing options from the best commercial mortgage lenders UK.

Key Commercial Finance: Affordable Commercial Mortgages for Small Business Owners

Key Commercial Finance specializes in providing affordable commercial mortgages that are uniquely tailored for minor enterprise owners, using the best commercial mortgage lenders UK. With competitive rates and flexible terms, the best commercial mortgage lenders UK empower businesses to secure essential financing without overextending their budgets. Numerous lenders, such as the best commercial mortgage lenders UK, currently offer online applications with quick decision-making times, often within 24 hours, enhancing the efficiency of the lending process crucial for entrepreneurs. Recognizing the unique challenges faced by minor enterprises, Key Commercial Finance emphasizes personalized service, guiding clients throughout the mortgage application process with expertise and care, positioning themselves as one of the best commercial mortgage lenders UK.

Their commitment to affordability and customer satisfaction solidifies their reputation as one of the best commercial mortgage lenders UK, establishing them as a trustworthy ally in financing for startups. As of 2025, average rates for affordable loans in the UK remain competitive, making it an ideal time for entrepreneurs to explore financing options with the best commercial mortgage lenders UK. Success stories, such as Daisy’s Delights, illustrate the impact of effective financial solutions; by utilizing invoice financing, they unlocked £50,000 in cash flow, showcasing how tailored financial strategies can significantly enhance operational capabilities. This example demonstrates how Key Commercial's services can assist similar enterprises in thriving.

Moreover, various categories of properties for trade, including warehouses, hotels, and retail centers, can be financed through the best commercial mortgage lenders UK, presenting diverse opportunities for minor enterprises. This company, recognized as one of Australia’s most innovative funding experts, offers a comprehensive selection of lenders to accommodate any situation, ensuring that minor enterprises have access to the right financing options. Their dedication to supporting local enterprises with affordable loans positions them among the best commercial mortgage lenders UK in the mortgage industry.

As William Shatner aptly put it, "If saving money is wrong, I don’t want to be right!" This sentiment resonates with the core mission of Key Commercial Lending, highlighting the importance of affordability among the best commercial mortgage lenders UK. Furthermore, thorough preparation and discussions with financial advisors can enhance loan application success, equipping entrepreneurs to effectively navigate the financing landscape with the best commercial mortgage lenders UK.

British Business Bank: Supportive Resources for Small Business Mortgages

The lending narrative is crucial in providing essential resources for minor enterprise mortgages, particularly through our extensive access to diverse financing options, including boutique lenders, private investors, and mainstream banks. We understand the unique challenges that minor enterprises face in securing traditional loans and are committed to developing customized financial solutions tailored to their specific needs. Our ongoing connections with clients empower us to craft refined and highly tailored cases that effectively present to lenders, ensuring you have the optimal opportunity to secure the financing necessary for your property investments.

Recent statistics indicate that many entrepreneurs are benefiting from innovative funding alternatives, underscoring the importance of having an informed partner like Story. We have successfully supported enterprises of all sizes, from minor start-ups to large-scale ventures, by curating expert funding solutions that align with their goals. Furthermore, our expertise in understanding loan repayment criteria and the intricacies of financing enables us to guide clients through the complexities of securing mortgages efficiently. By collaborating with a financial advisory service, owners of modest enterprises can navigate the lending landscape confidently, assured that they have a dedicated ally committed to their financial success.

To maximize these resources effectively, owners of modest enterprises are encouraged to reach out to the advisory service for comprehensive information on available funding options and tailored guidance suited to their specific needs.

Fleet Mortgages: Quick and Tailored Commercial Mortgage Solutions

This company specializes in delivering rapid and customized mortgage solutions from the best commercial mortgage lenders UK, tailored to the needs of small enterprises. Their streamlined application process is designed to provide swift access to funds, which is essential for businesses looking to seize opportunities or tackle immediate financial challenges.

By offering a diverse range of products, including buy-to-let and commercial property loans, Story empowers entrepreneurs to select financing options from the best commercial mortgage lenders UK that align with their unique financial situations. This focus on speed and customization has positioned this lending solution as one of the best commercial mortgage lenders UK for small enterprises.

Positive client experiences underscore the efficiency of their online application system and responsive customer service. One satisfied client highlighted the ease of the online application and the prompt responses from the team, contributing to an excellent experience.

In a landscape where the best commercial mortgage lenders UK often favor businesses with steady cash flow—indicative of an organization's ability to manage loan repayments—Financial Narrative distinguishes itself by offering flexible repayment terms that cater to varying cash flow scenarios, ensuring clients can effectively manage their loan obligations.

Furthermore, organizing financial records, including profit and loss statements and tax returns, is crucial for obtaining a business loan, and Story assists clients in navigating this process to enhance their chances of approval.

With typical processing times for mortgage applications being a significant consideration, Finance Story remains committed to offering effective solutions tailored to the needs of independent owners by collaborating with the best commercial mortgage lenders UK.

Brickflow: Compare Commercial Mortgage Lenders for Informed Choices

Brickflow serves as an essential digital marketplace, enabling entrepreneurs to compare commercial mortgage lenders effortlessly. By offering access to a diverse array of lenders and their respective offerings, Brickflow empowers businesses to make informed financing decisions. The platform's user-friendly interface allows users to filter and assess various mortgage options tailored to their specific needs, ensuring they secure the most favorable terms and rates available.

As we look to 2025, the significance of digital marketplaces in financing for entrepreneurs continues to grow, with over 70% of business owners now relying on these platforms to manage their funding options. This trend underscores the critical nature of informed decision-making when it comes to securing business mortgages.

Success stories from Brickflow illustrate its impact on small business financing. For example, the implementation of Brickflow technology has provided users with comprehensive information packs, enhancing their understanding of lending options. A representative from Concept Group noted, "A comprehensive and clear information pack from Brickflow allows for a full understanding of the proposition, allowing me to assess and provide robust Indicative Terms for the Client." This clarity facilitates the presentation of robust indicative terms, ultimately leading to improved financing outcomes.

Industry specialists emphasize the necessity of comparing mortgage lenders through platforms like Brickflow for independent owners. Julian Ingall from Sancus Lending Group highlights the difficulties of keeping pace with lenders' pricing in a fluctuating market, stating, "Having comprehensive information to assess lending propositions is vital." This insight showcases how Brickflow addresses these challenges, streamlining the financing process and fostering a competitive environment among lenders, which drives down costs and enhances service quality. By leveraging such digital tools, small business owners can navigate the complexities of financial funding with confidence and transparency.

Moreover, this organization is dedicated to developing refined and highly customized cases to present to banks, ensuring that small business owners can secure the appropriate funding for their property investments. With access to a full suite of lenders, including high street banks and innovative private lending panels, Finance Story is well-positioned to assist businesses in refinancing their commercial loans and addressing their evolving needs.

Conclusion

Navigating the world of commercial mortgages can be a complex journey for small business owners. However, understanding the options available empowers them to make informed decisions. This article has explored various key providers, including:

- Finance Story

- Barclays

- KIS Bridging Loans

Each offering unique advantages tailored to the diverse needs of small enterprises. Finance Story stands out with its personalized service and extensive lender network, ensuring clients receive the best possible mortgage solutions. Barclays provides stability with its fixed-rate offerings, while KIS Bridging Loans caters to urgent financial needs with flexible solutions.

Furthermore, trends in the commercial mortgage sector highlight the growing importance of personalized approaches and digital platforms like Brickflow, which enable business owners to compare lenders and secure favorable financing terms. As the market continues to evolve, leveraging these resources becomes essential for small business owners looking to thrive in a competitive landscape.

Ultimately, the right commercial mortgage can be a crucial factor in a small business's success. By partnering with knowledgeable brokers and utilizing innovative platforms, business owners can navigate the complexities of financing with confidence. This ensures they are well-equipped to seize opportunities and achieve their long-term goals.