Overview

This article presents a comprehensive six-step process for locating small business loan companies in your area. It underscores the necessity of understanding various loan types, evaluating financial situations, and meticulously preparing application documents. Each step is bolstered by practical guidance and expert insights, demonstrating how thorough research and preparation can significantly improve your chances of securing favorable financing options tailored to your specific business needs.

Introduction

In the dynamic landscape of small business financing, understanding the myriad of loan options available in 2025 is crucial for entrepreneurs aiming to thrive. Are you aware of the various choices at your disposal? From traditional term loans to innovative financing solutions tailored specifically for leasehold businesses, the options can indeed be overwhelming.

As business owners navigate this complex terrain, a comprehensive assessment of their financial situation becomes imperative. This enables them to make informed decisions that align with their unique needs.

This article delves into the essential steps for securing small business loans, including:

- Identifying loan types

- Researching lenders

- Preparing application documents

- Finalizing the loan process

By equipping themselves with the right knowledge and strategies, entrepreneurs can significantly enhance their chances of obtaining the funding necessary for growth and success.

Identify Different Types of Small Business Loans

Before seeking financing firms, it is crucial to understand the various small enterprise funding options available in 2025, particularly for leasehold enterprises. Here’s an overview of the most common options:

- Term Financing: These traditional arrangements provide a lump sum upfront, which is repaid over a predetermined period with interest. They are ideal for companies seeking a straightforward financing solution.

- Lines of Credit: Offering flexibility, lines of credit allow you to borrow up to a specified limit, incurring interest only on the amount utilized. This option is especially advantageous for managing cash flow variations.

- SBA Financing: Supported by the Small Business Administration, these loans typically offer favorable conditions and lower interest rates, making them an appealing choice for numerous entrepreneurs.

- Equipment Financing: Specifically intended for acquiring equipment, this funding type uses the equipment itself as collateral, enabling enterprises to obtain essential tools without significant upfront expenses.

- Invoice Financing: This option allows enterprises to borrow against unpaid invoices, delivering immediate cash flow without incurring additional debt.

For leasehold enterprises or those lacking a physical property, financing choices may be more restricted. In such cases, utilizing cash savings or the equity in any owned property becomes essential. For instance, if a property owner has a residence valued at $1.3M with $300k owed, they could potentially access $740k in equity by borrowing up to 80% LVR, which can be combined with cash savings to finance acquisitions. It is important to recognize that without commercial property, funding options can be limited, making it vital for leasehold proprietors to explore these avenues thoroughly.

Understanding these financing types and the constraints faced by leasehold operations is essential for determining which option aligns best with your requirements and economic situation. Current statistics indicate that 70% of small enterprise loans are provided by banks with less than $250 billion in assets, highlighting the importance of exploring various financing avenues. As trends evolve, particularly in supporting diverse entrepreneurs, being knowledgeable about these choices can significantly influence your business's economic well-being.

Assess Your Financial Situation

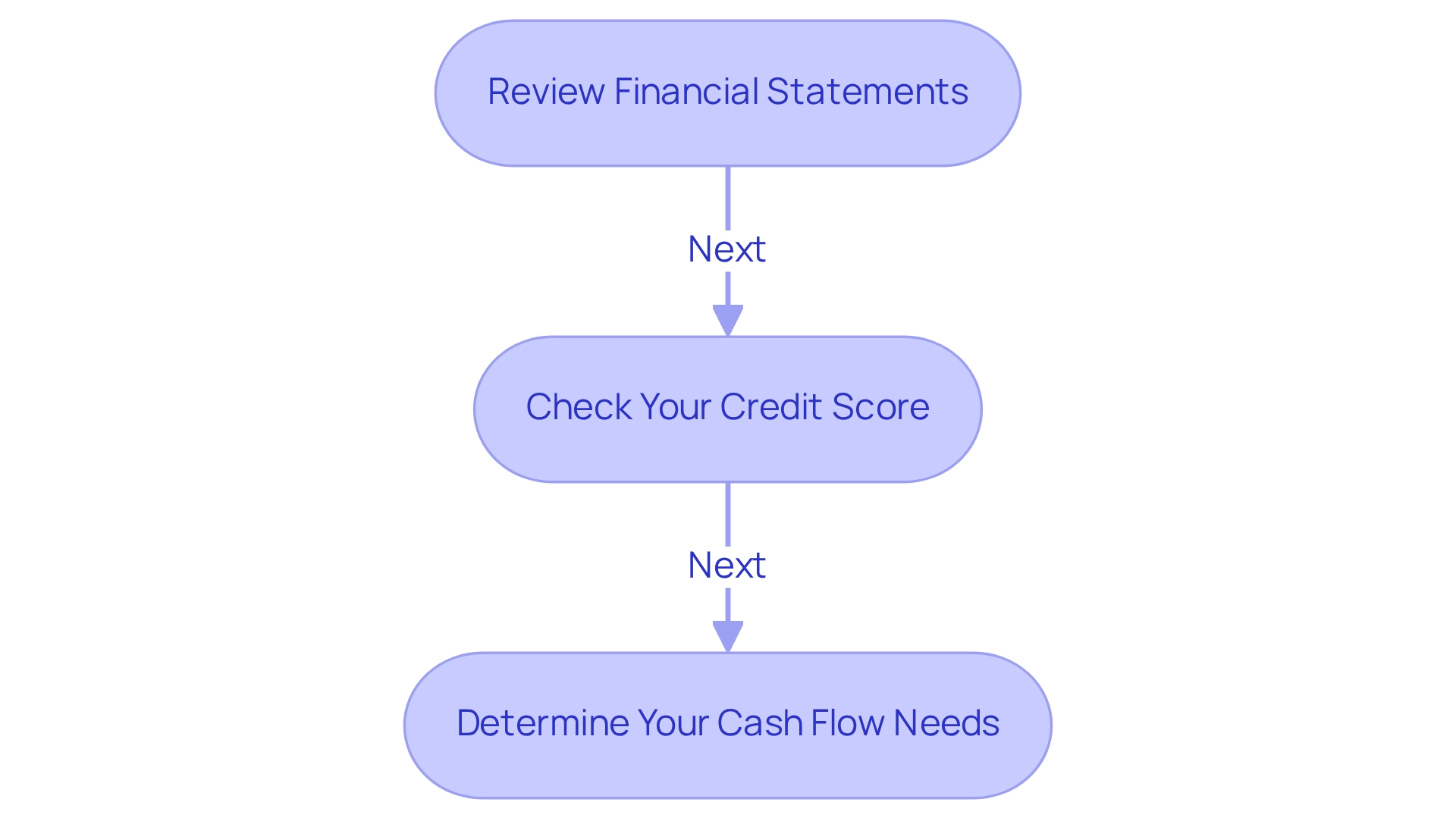

To effectively evaluate your monetary situation, follow these steps:

- Review Financial Statements: Compile your balance sheet, income statement, and cash flow statement. This comprehensive overview will provide insight into your monetary health and help identify areas for improvement.

Calculate Your Debt-to-Income Ratio: This essential ratio reflects your capacity to handle monthly payments and repay debts. For small business proprietors in 2025, keeping a debt-to-income ratio beneath 36% is typically viewed as advantageous, indicating improved stability and enhancing your likelihood of approval. Understanding the distinction between good debt and bad debt can guide your financial decisions, ensuring you leverage good debt for wealth accumulation. - Check Your Credit Score: Your credit score plays a pivotal role in determining eligibility for borrowing and interest rates. Consistently examine your credit report for errors and take actions to enhance your score if needed, as a higher score can result in more advantageous borrowing conditions.

It's essential to recognize that the sector in which your company functions can influence funding amounts; higher-risk sectors may receive reduced proposals from financiers to manage risks. Additionally, working with experts like Finance Story can help you navigate these complexities and secure the best financing options tailored to your needs, with access to a full range of lenders. - Determine Your Cash Flow Needs: Analyze your cash flow to ascertain the amount of funding required and the timeline for repayment. Comprehending your cash flow will assist you in selecting the appropriate credit options that match your enterprise's monetary abilities.

Finance Story focuses on developing refined and customized case presentations to showcase to financiers, guaranteeing you possess the optimal opportunity to obtain the essential resources for your commercial property investments.

By comprehensively evaluating your financial condition, you can make educated choices regarding the kinds of financing you should seek, ultimately improving your prospects of acquiring the capital required for your enterprise expansion.

Research and Compare Loan Companies

When researching loan companies, it is essential to follow these steps to find the best financing options for your small business:

- Identify potential financial institutions by investigating a mix of banks, credit unions, and small business loan companies near me that specialize in providing small business loans. Utilize resources such as business.gov.au and various comparison websites to compile a list of potential creditors. Finance Story provides access to a comprehensive array of financial institutions, including small business loan companies near me, high street banks, and innovative private financing panels, ensuring you have a variety of choices tailored to your needs.

- Compare Interest Rates: Investigate the interest rates offered by different lenders. In 2025, average interest rates for small enterprises in Australia fluctuate, so obtaining a lower rate can significantly reduce your total repayment expenses. Finance Story's expertise in refinancing can help you navigate these rates effectively, ensuring you find the best deal.

- Evaluate Loan Terms: Carefully assess the repayment terms, associated fees, and any penalties for early repayment. Ensure these terms align with your business's cash flow to avoid financial strain. Understanding the repayment criteria is crucial, and Finance Story can provide insights to help you make informed decisions about small business loan companies near me that offer loans for various commercial properties.

- Read Reviews and Testimonials: Look into customer experiences with each provider to evaluate their reliability and quality of service. Positive testimonials can indicate a provider's commitment to customer satisfaction. Finance Story focuses on developing refined and highly personalized case studies, increasing your proposal's attractiveness to financiers.

- Check for Special Programs: Some lenders offer tailored programs for startups or specific industries, which may provide more favorable terms. Exploring these options can give your company a competitive advantage. Finance Story can assist in recognizing such programs from small business loan companies near me that align with your objectives, including refinancing options for your commercial property.

- Utilize Expert Insights: Financial specialists emphasize the importance of comparing interest rates and understanding the implications of various credit options. As Phil Collard, a business lending specialist, observes, "The appropriate financing option can be a very powerful tool to accelerate growth, so be sure to have your plans clearly outlined, including expected ROI." With Finance Story's expertise, you can ensure your financing proposal is well-prepared and tailored to meet lender expectations.

Additionally, consider the typical amounts applicable to your needs: the average sum for daily capital is $75,552, whereas for other objectives, it is $112,047. This information can help set realistic expectations when seeking loans.

Moreover, recent trends indicate that corporate credit card usage has surged post-COVID-19, with many companies increasingly relying on credit facilities to manage cash flow and operational expenses. This context underscores the significance of thorough research and efficient resource management.

By conducting comprehensive research and utilizing expert suggestions, including those from Finance Story, you can find small business loan companies near me that not only meet your monetary needs but also provide competitive terms customized to your enterprise's distinct circumstances.

Prepare Your Loan Application Documents

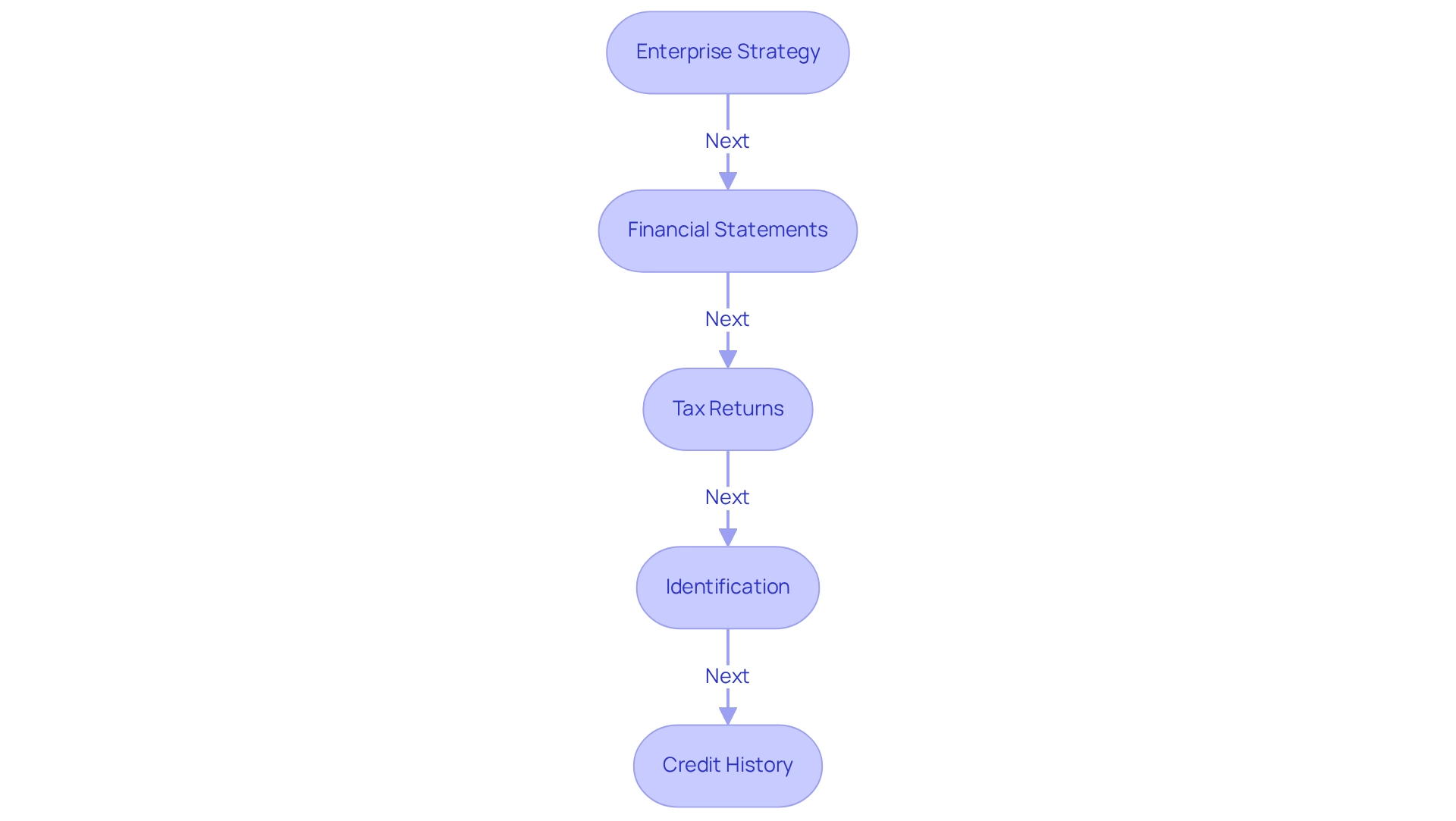

To effectively prepare your loan application, gathering the following documents is essential:

-

Enterprise Strategy: A comprehensive enterprise strategy that outlines your model, market analysis, and financial forecasts is crucial. This document not only articulates your vision but also showcases your preparedness to lenders. At Finance Story, we excel in crafting polished and personalized cases that can significantly enhance your application, ensuring you meet the heightened expectations of lenders.

-

Financial Statements: Include your balance sheet, income statement, and cash flow statement for the past two years. These declarations provide insight into your company's economic condition and are vital for assessing your capacity to repay the loan. Understanding your financial situation is key to making a compelling argument to prospective lenders.

-

Tax Returns: Submit personal and business tax returns for the last two years. This information is instrumental in confirming your income and economic stability, both of which are critical factors in the lending decision. A robust financial history can bolster your application.

-

Identification: Personal identification, such as a driver's license or passport, along with your registration documents, is necessary to verify your identity and the legitimacy of your enterprise.

-

Credit History: Prepare a summary of your credit history, including any outstanding debts. A favorable debt ratio, typically between 1 and 1.5, can enhance your application to small business loan companies near me.

By organizing these documents in advance, you will not only streamline the application process but also significantly improve your chances of securing the funding you need. With 17% of small and midsize businesses carrying debts between $100,000 and $250,000, the importance of a solid application to small business loan companies near me cannot be overstated. Furthermore, collaborating with Finance Story grants you access to a comprehensive suite of lenders, including high street banks and innovative private lending panels, which can provide tailored financing options for your commercial property investments and refinancing needs.

Understand Loan Terms and Conditions

Before signing a credit agreement, it is crucial to grasp the following terms:

- Interest Rate: Determine whether the rate is fixed or variable. Fixed rates remain stable throughout the financing term, offering predictability in repayments, whereas variable rates may fluctuate, impacting your total payment amounts. According to the SBA, average interest rates for commercial financing range from 2.54% to 7.01%, with typical rates falling between 5.50% and 8%. Understanding these rates is essential for organizing your repayment strategy.

- Repayment Schedule: Familiarize yourself with payment due dates and the overall duration of the repayment period. This comprehension aids in budgeting and ensures timely payments. Furthermore, collaborating with professionals such as Finance Story can provide guidance on effectively organizing your repayment strategy based on your company’s cash flow.

- Fees and Charges: Be vigilant about additional costs, such as origination fees, late payment penalties, or prepayment fees. Common charges associated with small enterprises in 2025 may include application fees, processing fees, and annual fees. These can significantly influence the overall expense of the credit. Finance Story specializes in creating polished and individualized business cases that can help you navigate these costs more effectively.

- Collateral Requirements: Assess whether collateral is necessary and identify acceptable assets. This is particularly crucial as it can affect your ability to secure the funds. Understanding collateral requirements can also assist you in preparing a stronger financing proposal, thereby enhancing your chances of approval.

- Default Terms: Understand the repercussions of defaulting on the debt, which may include legal actions or loss of collateral. Knowing these terms can empower you to negotiate better conditions and avoid potential pitfalls.

- Lenders and Property Types: Finance Story provides access to a comprehensive range of lenders, including high street banks and innovative private lending panels, suitable for various commercial properties such as warehouses, retail premises, factories, and hospitality ventures. This diversity can enhance your funding options.

By thoroughly understanding these terms, you can negotiate more favorable conditions and steer clear of potential pitfalls in your financing agreement. With approximately 20% of small enterprise financing being rejected due to credit issues, being well-prepared can significantly improve your chances of acceptance and favorable terms. Additionally, consider that non-bank credit has an approval rate of nearly 25%, which may present alternative financing options. Engaging with a knowledgeable partner like Finance Story can further empower you in this process, including exploring refinancing options to meet your evolving business needs.

Finalize Your Loan Process

To successfully complete your financing process, adhere to the following steps:

- Submit Your Application: Ensure that all necessary documents are complete and submit your application to your selected financial institution. This initial step is crucial, as 82% of small enterprise applicants receive at least partial loan approval from small banks, compared to 68% from larger institutions. Selecting the appropriate small business loan companies near me greatly influences your likelihood of approval. At Finance Story, we specialize in creating polished and highly individualized business cases to present to banks, enhancing your chances of securing the necessary funds for your commercial investment. We collaborate with a comprehensive selection of financial institutions, including small business loan companies near me, high street banks, and creative private lending groups, to accommodate your unique situation.

- Follow Up: Maintain regular communication with the financing institution to check on the status of your application. This proactive strategy assists you in supplying any extra information swiftly, which is crucial considering that 14% of small enterprises seek funding for starting a venture and 6% for payroll. Additionally, 9% of small businesses seek financing for other purposes, highlighting the diverse needs that lenders can address.

- Review the Financing Agreement: Upon approval, meticulously examine the financing agreement before signing. Ensure that all terms align with what was discussed during the application process. Statistics indicate that a thorough review can prevent misunderstandings and ensure favorable terms.

- Prepare for Closing: Get ready for the closing meeting, where you will sign the final documents and receive the funds. Recent advancements in technology are making the financing process more user-friendly, enhancing your experience during this critical transition from application to funding.

- Plan for Repayment: Develop a repayment plan that fits your cash flow to ensure timely payments. This foresight is essential for maintaining economic health and avoiding potential pitfalls. Comprehending the average time to process small enterprise funding applications in 2025 can also assist you in planning your finances more effectively.

- Schedule Your Free Personalized Consultation: To further enhance your financing strategy, consider booking a free personalized 30-minute meeting with Finance Story's Head of Funding Solutions, Shane Duffy. Discuss your needs and goals, and allow us to assist you in developing a customized financial strategy that aligns with your objectives.

By following these steps, you can effectively navigate the loan process and secure the necessary funding to support your growth. The evolving landscape of small business financing, as highlighted in recent case studies, promises to democratize access to necessary capital, making it easier for entrepreneurs to achieve their goals.

Conclusion

Understanding the landscape of small business financing in 2025 is essential for entrepreneurs seeking to secure the right funding. By familiarizing themselves with various loan types—from traditional term loans to innovative financing solutions—business owners can identify which options best suit their unique needs.

Assessing one’s financial situation, including reviewing financial statements and calculating the debt-to-income ratio, is a crucial step in making informed decisions about loan applications.

Furthermore, thorough research and comparison of lenders are equally important, allowing entrepreneurs to find competitive interest rates and favorable terms. Preparing detailed application documents, such as a comprehensive business plan and accurate financial statements, can significantly enhance the chances of securing a loan. Moreover, understanding the terms and conditions associated with loans, including interest rates and repayment schedules, empowers business owners to negotiate better deals.

Finally, successfully finalizing the loan process hinges on a proactive approach—from submitting a complete application to maintaining communication with lenders. By following these outlined steps, entrepreneurs can navigate the complexities of small business financing with confidence. Ultimately, being well-informed and prepared not only increases the likelihood of obtaining necessary funds but also positions businesses for sustainable growth and success in a competitive marketplace.