Overview

This article delineates a four-step process for identifying small business loan banks in your vicinity. It underscores the necessity of comprehending different loan types, leveraging local resources, assessing banks based on their loan terms and customer service, and crafting a persuasive loan proposal. Such a structured methodology is bolstered by evidence indicating that access to funding is vital for the growth of small businesses. Numerous resources and strategies exist to improve the chances of obtaining suitable financing.

Introduction

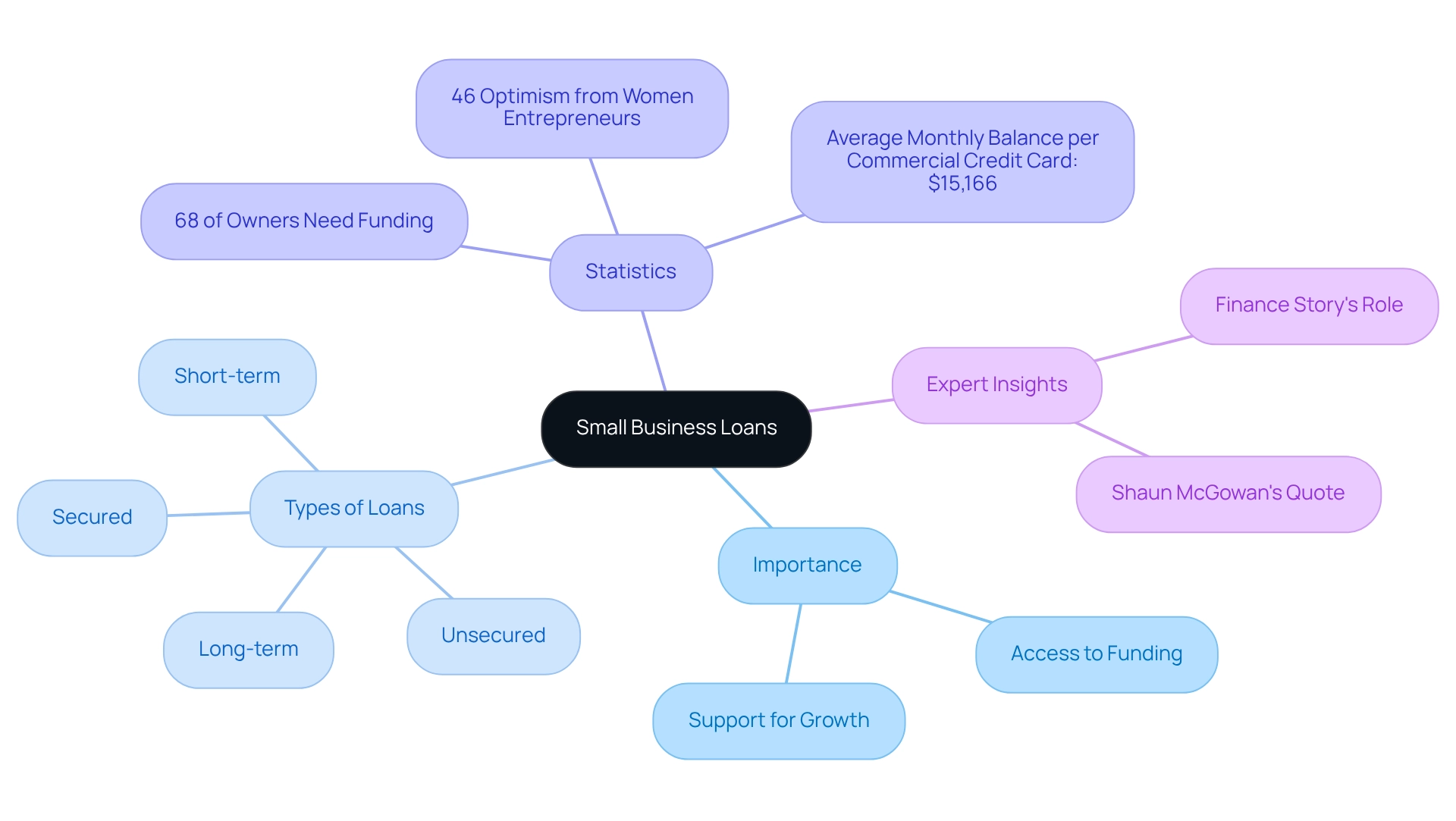

Navigating the world of small business loans is often a daunting task for entrepreneurs; however, it is a crucial element for fostering growth and sustainability. With 68% of small business owners identifying access to financing as a pivotal factor in their success, understanding the intricacies of various loan types—from secured to unsecured options—becomes imperative. As the landscape evolves, particularly in 2025, the ability to leverage capital for essential needs such as equipment, staffing, and marketing can decisively determine the trajectory of a business.

Furthermore, by exploring local resources and online tools, entrepreneurs can effectively identify suitable lenders while ensuring their proposals resonate with bank expectations. This article delves into the significance of small business loans, evaluates banks based on loan terms and customer service, and outlines the preparation needed to approach lenders confidently—all aimed at empowering small business owners to thrive in a competitive environment.

Understand Small Business Loans and Their Importance

Small business loan banks near me serve as a critical financial tool for small enterprise financing, empowering entrepreneurs to address various operational needs, from startup costs to growth and cash flow management. Notably, 68% of small business owners identify access to funding from small business loan banks near me as the most vital factor for expansion, underscoring the pressing need for financial support.

It is essential to grasp the different types of loans—secured, unsecured, short-term, and long-term—offered by small business loan banks near me to make informed financial decisions. Secured loans require collateral, which can lower interest rates, whereas unsecured loans typically carry higher rates due to the increased risk for lenders.

In 2025, the importance of small business loan banks near me for small enterprise financing is especially pronounced, as they enable entrepreneurs to leverage capital for growth and sustainability. For example, turning to small business loan banks near me can provide a modest financial advance, offering the necessary funds to acquire equipment, hire staff, or invest in marketing initiatives, all critical for increasing revenue and achieving long-term success.

The resilience of SMEs, as highlighted in the Australian Small Business & Family Enterprise Report, emphasizes their need for support from small business loan banks near me to navigate ongoing challenges and sustain operations. Current statistics show that 46% of women entrepreneurs express optimism about accessing the capital they require, indicating a growing confidence in the financing landscape.

Expert insights further validate the significance of small business loan banks near me for small enterprises. Finance Story is dedicated to developing refined and highly customized cases for presentation to financial institutions, ensuring that entrepreneurs secure the appropriate funding tailored to their unique needs. By providing access to a comprehensive array of lenders, including small business loan banks near me and innovative private lending panels, Finance Story facilitates financing for various commercial properties, such as warehouses, retail spaces, factories, and hospitality ventures.

This strategy not only helps minimize costs associated with financial products but also enhances the likelihood of approval by aligning proposals with lender expectations, especially when dealing with small business loan banks near me. By understanding and effectively utilizing options from small business loan banks near me, entrepreneurs can navigate financial challenges and seize opportunities for growth.

Identify Local Resources and Online Tools for Your Search

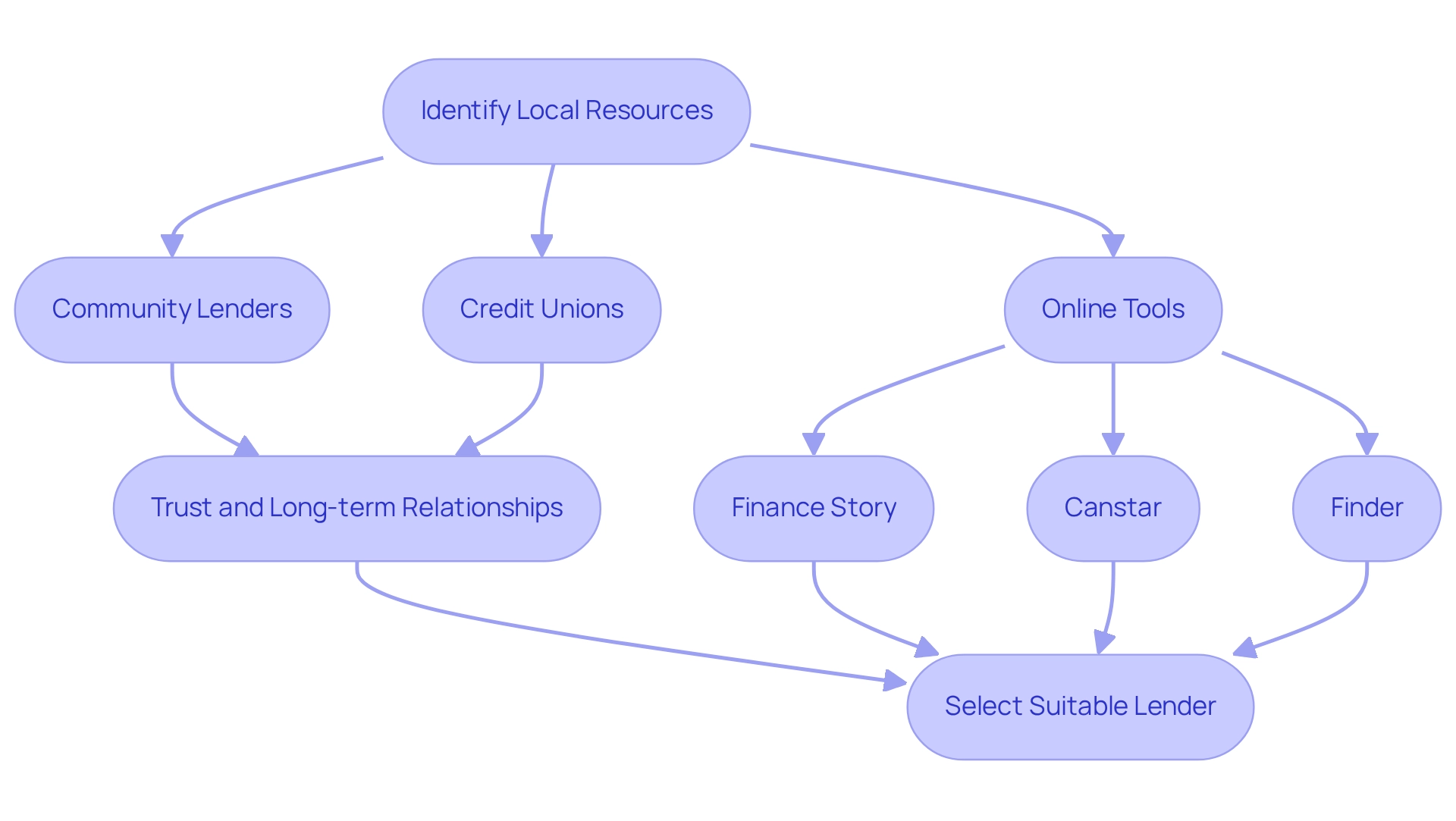

To efficiently locate small business loan banks near me, begin by leveraging local resources such as community lenders and credit unions, which are renowned for their commitment to supporting entrepreneurs. These institutions often emphasize trust and long-term relationships, making them ideal partners for business owners. As highlighted in the case study 'Ethics and Stability in Regional Banking,' community banks focus on maintaining stability and trust—elements that are crucial for long-term success. Websites like the Australian Banking Association and business.gov.au provide extensive directories and resources to assist you in identifying lenders that cater specifically to small enterprises.

In addition to local resources, collaborating with Finance Story can significantly enhance your search for tailored financial solutions. Their expertise in crafting polished and individualized business cases ensures that you can present compelling proposals to lenders, thereby increasing your chances of securing the right financing. Finance Story partners with a broad array of lenders, including major financial institutions and private lenders, to offer a comprehensive selection of options for your financing needs. Online platforms such as Canstar and Finder are invaluable for comparing loan products and interest rates across various banks. These tools enable you to assess which lenders align best with your requirements and financial situation.

With small enterprises owing approximately $18 trillion by the end of 2022, utilizing these resources is essential for obtaining the appropriate financing options. As Jim Hackett noted, "Small enterprises are the engines of local economies and the building blocks of vibrant communities," underscoring the importance of supporting local ventures through suitable financing options. By harnessing both local and online tools, you can streamline your search for small business loan banks near me and enhance your chances of finding a suitable lender. Furthermore, organizations like Abrigo play a vital role in fostering community development, illustrating how financial institutions can positively impact local economies. By selecting lenders that prioritize customer service, you can ensure a more favorable lending experience.

Evaluate Banks Based on Loan Terms and Customer Service

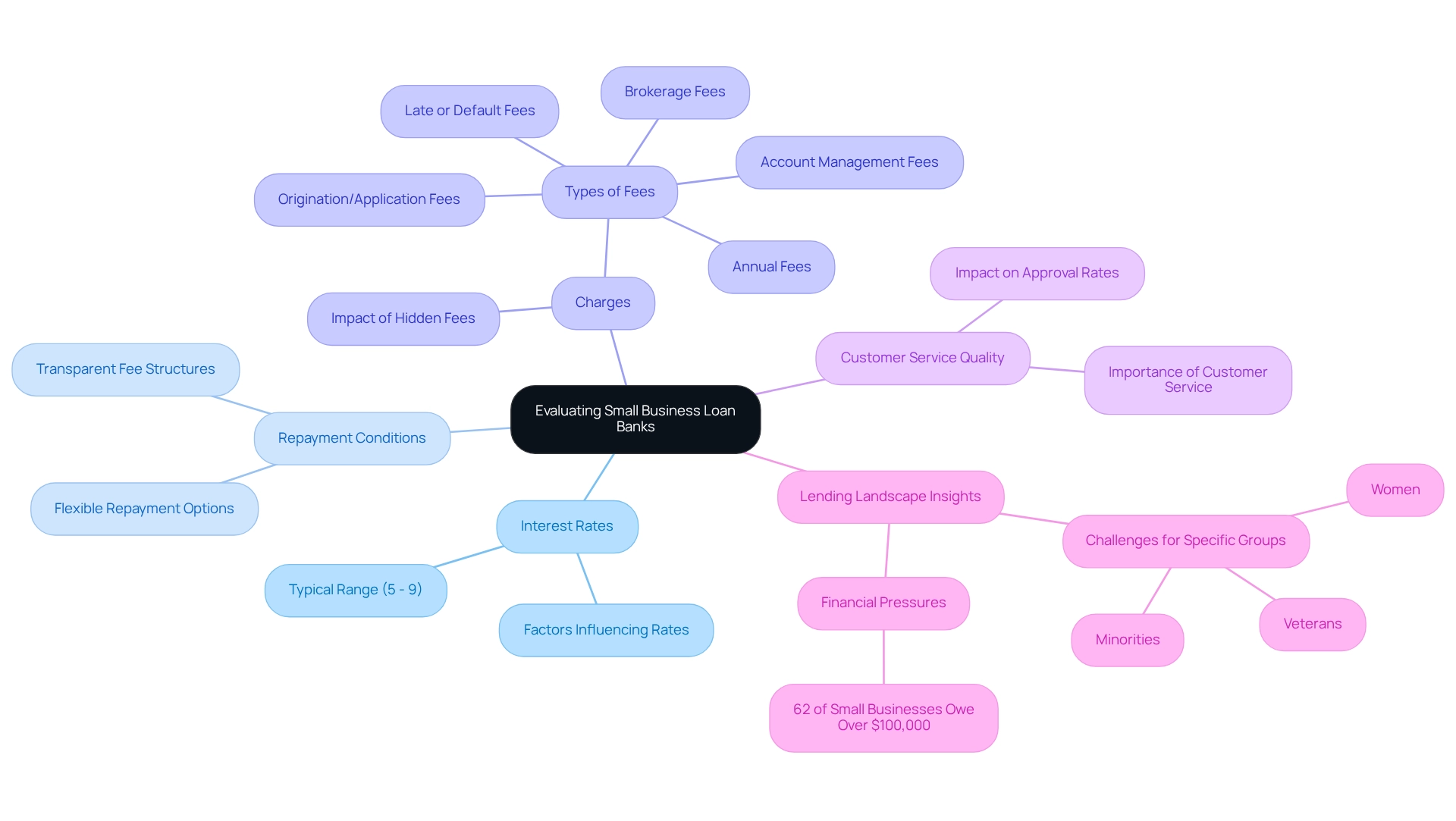

When evaluating small business loan banks near me for minor enterprise financing, it is essential to consider several critical factors: interest rates, repayment conditions, charges, and customer support quality. In Australia, interest rates for minor enterprise financing in 2025 typically range from 5% to 9%, depending on the lender and specific financing terms.

When exploring small business loan banks near me, it's essential to consider flexible repayment options and transparent fee structures, as hidden fees can significantly inflate the overall cost of borrowing. Additionally, customer service is a pivotal aspect of the lending process. An institution, like small business loan banks near me, that offers attentive and helpful service can greatly simplify the application process, especially when challenges arise.

Research indicates that small business loan banks near me with outstanding customer service ratings often achieve higher approval rates for small enterprise financing, with non-traditional financing options boasting an approval rate of nearly 25%. This underscores the importance of choosing a lender that prioritizes client assistance. Moreover, collaborating with professionals like Finance Story can enhance your financing proposal, ensuring it meets the elevated standards of lenders. Their expertise in crafting refined and customized proposals can substantially improve your chances of securing the right funding for your commercial property projects or refinances.

Examining feedback and testimonials from fellow entrepreneurs can provide valuable insights into others' experiences with specific financial institutions. For example, small business loan banks near me that are renowned for exceptional customer service are often more inclined to work with borrowers to navigate any hurdles during the loan process.

Additionally, understanding the lending landscape is crucial. An analysis of lending to enterprises reveals that various groups, including women, minorities, and veterans, face unique challenges in securing capital. Addressing these disparities is vital for fostering growth and success among minor enterprises. Notably, 62% of all small enterprises owe more than $100,000, emphasizing the financial pressures they face. By evaluating small business loan banks near me based on these criteria, entrepreneurs can make informed decisions that align with their financial needs and objectives.

Prepare to Approach Banks with Your Loan Proposal

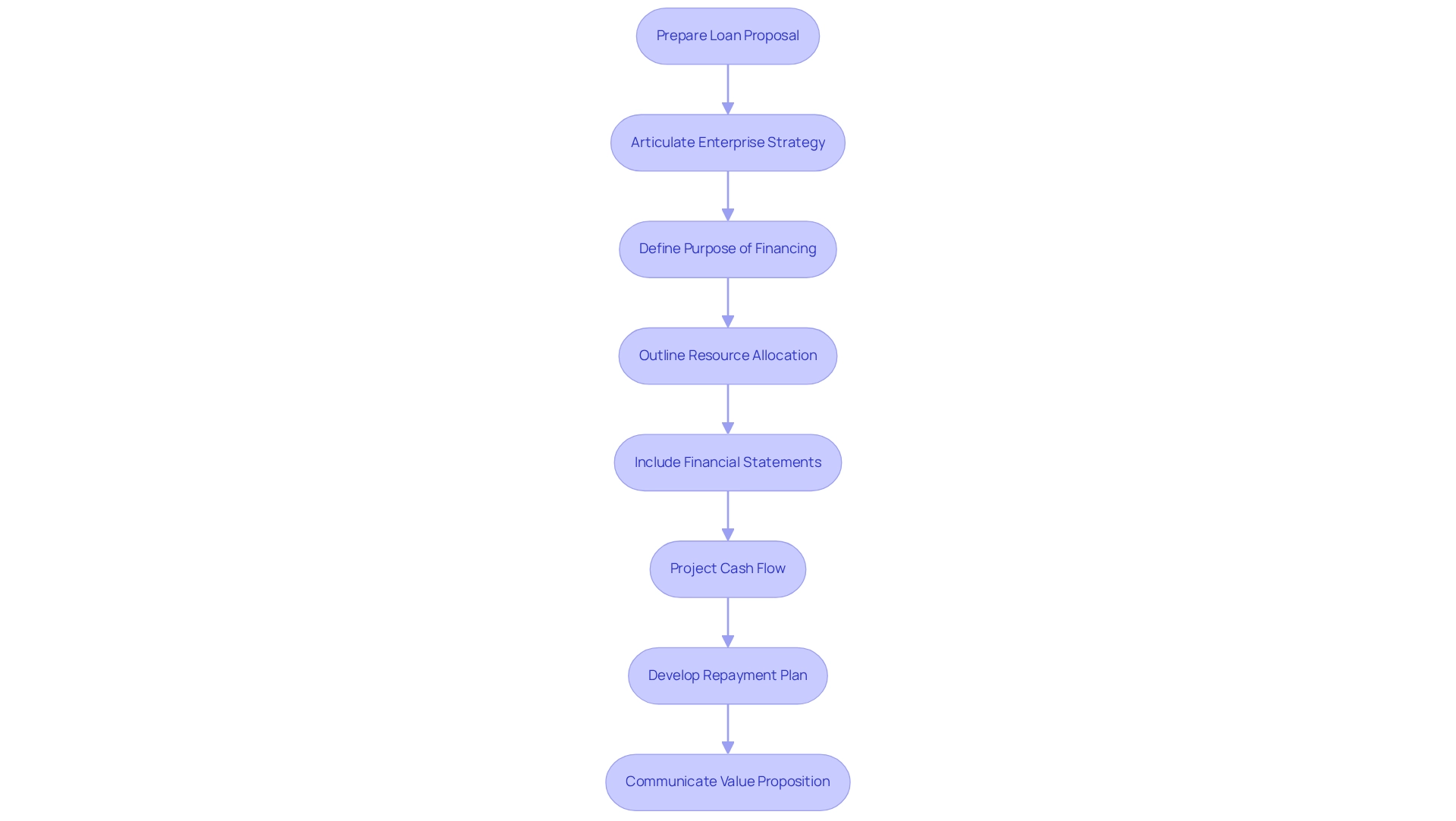

Before reaching out to financial institutions, it is essential to craft a detailed funding proposal. This proposal should clearly articulate your enterprise strategy, the purpose of the financing, and how the resources will be allocated. Include financial statements, projected cash flow, and a repayment plan. Effectively communicating your company's value proposition is vital, as it illustrates how the loan will drive growth.

At Finance Story, we specialize in developing refined and highly customized case studies tailored to meet the unique needs of each financial institution, ensuring that your proposal aligns with their priorities. For example, if a financial institution prioritizes community impact, highlight how your enterprise fosters local employment and stimulates economic growth.

Furthermore, we provide access to a comprehensive range of lenders, including high street banks and innovative private lending panels, to accommodate your specific circumstances. This meticulous preparation not only bolsters your credibility but also significantly enhances your chances of securing funding.

Statistics reveal that access to financing is crucial for the success of small enterprises, as many entrepreneurs seek funds for various purposes, such as asset acquisition and operational expenses. Notably, approximately one in four companies fail within their first year, underscoring the necessity of obtaining funding and the importance of a solid loan proposal in mitigating this risk.

A well-crafted proposal can substantially influence the approval process, particularly in a lending landscape that poses challenges for underrepresented entrepreneurs, including women, minorities, and veteran owners. Additionally, a survey by Lendio indicated that 84% of enterprises led by individuals of color relied on personal savings or support from friends or family to finance their ventures, highlighting the complexities of the funding landscape. Moreover, 24% of businesses sought funding to refinance or reduce debt, reinforcing the significance of a comprehensive loan proposal.

Conclusion

Securing a small business loan is vital for entrepreneurs seeking to foster growth and navigate financial challenges. With 68% of small business owners recognizing the importance of financing, understanding the different loan types—secured and unsecured—is essential for informed decision-making. These loans provide crucial capital for equipment, staffing, and marketing, all of which contribute to long-term success.

Leveraging local resources and online tools can streamline the search for suitable lenders. Community banks and credit unions often prioritize personalized service, while platforms like Finance Story can enhance loan proposals to align with lender expectations. Additionally, online comparison tools enable entrepreneurs to evaluate loan products and interest rates effectively.

It's crucial to assess banks based on loan terms, customer service, and transparency. Interest rates, repayment options, and fee structures directly impact borrowing costs, while responsive customer service can ease the application process and improve approval odds. A well-crafted loan proposal that articulates the business's value and financial needs can significantly enhance credibility and increase the likelihood of securing funding.

In summary, while obtaining a small business loan can be challenging, it is a pathway to growth and opportunity. By understanding the financing landscape and preparing compelling proposals, entrepreneurs can confidently navigate the lending process and empower their businesses to succeed in a competitive market.