Overview

This article outlines the essential steps for securing a commercial property loan through a Self-Managed Superannuation Fund (SMSF). Understanding SMSF regulations is vital; it forms the foundation of your investment strategy. Are you familiar with these regulations? Gathering the necessary documentation is the next critical step. This includes financial statements and property details, which are crucial for a successful application.

Once you have your documentation in order, it’s time to apply for the loan. This process can seem daunting, but it’s important to approach it with confidence. After applying, you will need to review the loan terms carefully. What are the interest rates, and how do they align with your financial goals? Managing the loan effectively is essential to ensure compliance with SMSF regulations. Adherence to these steps is not just a formality; it is crucial for optimizing your investment potential and maintaining financial health within the SMSF framework.

In conclusion, following these steps will empower you to navigate the complexities of securing a commercial property loan through an SMSF. Are you ready to take control of your investment journey?

Introduction

Navigating the world of self-managed superannuation funds (SMSFs) presents both exciting opportunities and daunting challenges, particularly when securing a commercial property loan.

With a growing number of SMSFs investing in commercial real estate, grasping the intricacies of this financial strategy is essential for investors aiming to diversify their portfolios and bolster their retirement savings.

However, the path to successfully obtaining an SMSF commercial property loan is laden with compliance requirements and documentation hurdles.

How can aspiring investors ensure they fulfill these criteria while maximizing their investment potential?

Understand SMSF and Its Role in Commercial Property Loans

A Self-Managed Superannuation Fund (SMSF) is a private retirement fund that empowers members to take control of their savings for the future. By utilizing a commercial property loan SMSF, members can access funds to purchase commercial real estate that can subsequently be rented to a business owned by the SMSF members. This strategy not only generates potential rental income but also presents opportunities for capital appreciation over time.

To effectively leverage an SMSF for real estate acquisition, compliance with the guidelines established by the Australian Taxation Office (ATO) is essential. A key requirement is the sole purpose test, which mandates that the fund's allocations must solely benefit the retirement savings of its members. Additionally, adhering to legal obligations is crucial, which includes the necessity for a corporate trustee and a well-documented strategy that explicitly incorporates real estate involvement.

As of 2025, SMSFs are increasingly popular, with approximately 25% of SMSFs investing in commercial property. This trend reflects a growing interest among investors seeking diversification and control over their assets. The self-managed super fund sector has witnessed remarkable growth, with total estimated assets surpassing $1.02 trillion, indicating a strong inclination towards utilizing SMSFs for various financial opportunities, including a commercial property loan SMSF for investing in commercial real estate. Recent regulatory changes in self-managed superannuation funds underscore the importance of strategic planning and compliance, enabling members to optimize their investment potential while adhering to the legal framework.

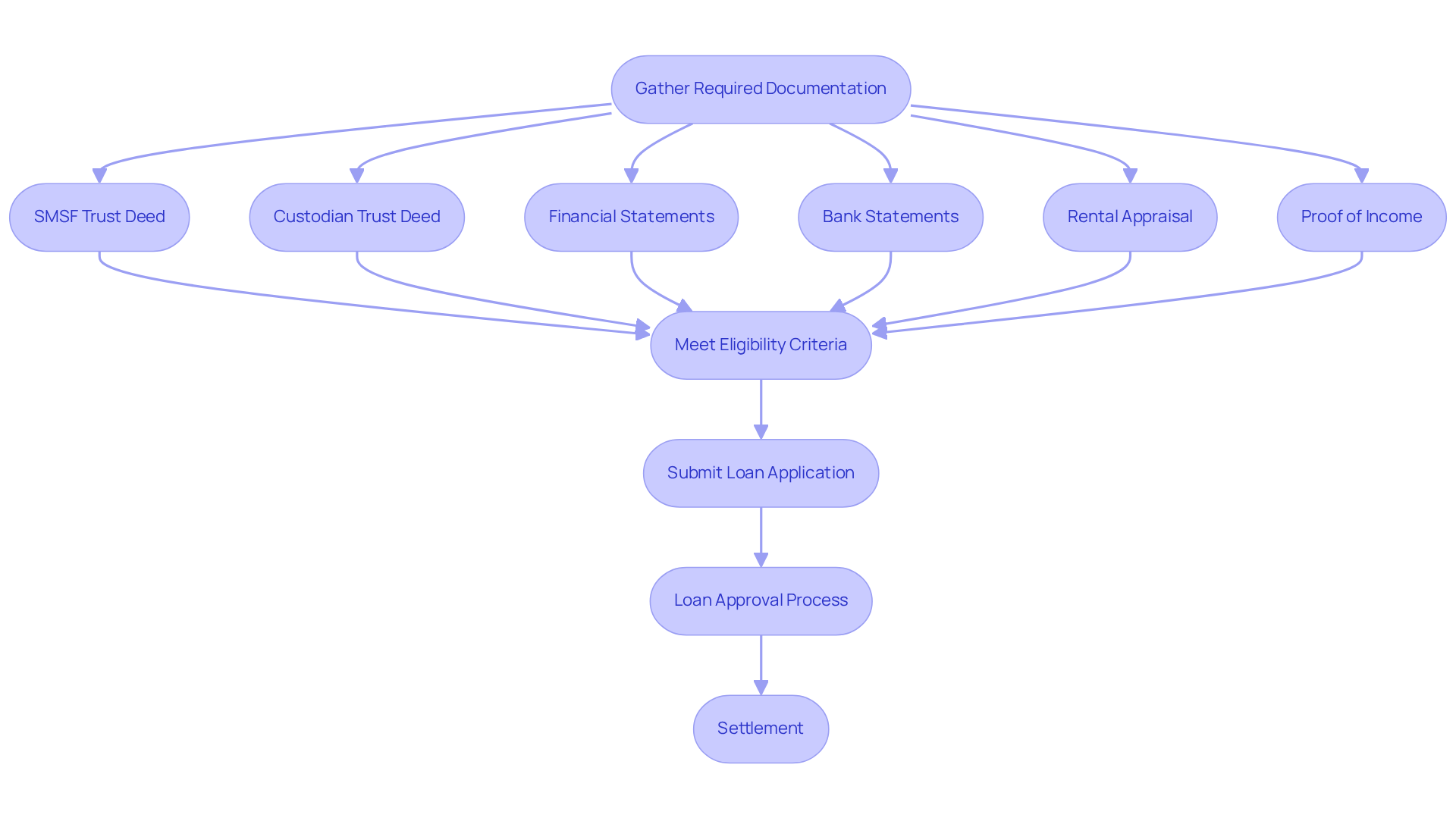

Gather Required Documentation and Meet Eligibility Criteria

To successfully apply for an SMSF commercial property loan, it is essential to compile several key documents, including:

- Certified copy of the SMSF Trust Deed: This document outlines the governing rules of the SMSF.

- Certified copy of the Custodian Trust Deed: Required if the property is held in a bare trust.

- Financial statements: At least two years of audited financial statements for the self-managed superannuation fund are necessary.

- Bank statements: Recent bank statements that illustrate the fund's cash flow.

- Rental appraisal: A letter from a qualified valuer estimating the rental income for the property.

- Proof of income: Documentation demonstrating the earnings of all fund members.

In addition to collecting these documents, ensure that your self-managed super fund meets the eligibility requirements. Typically, this involves maintaining a minimum balance of approximately $200,000 and complying with ATO regulations. Notably, there are fewer limitations on commercial real estate compared to residential assets, making a commercial property loan SMSF an appealing choice for self-managed super fund investors. As we look ahead to 2025, the self-managed superannuation fund sector continues to expand, with over 625,609 self-managed superannuation funds established in Australia. This growth underscores the rising interest in utilizing self-managed superannuation funds for a commercial property loan smsf investment.

Understanding these requirements is crucial for navigating the application process effectively and securing the best financing options available. The self-managed super fund financing request process typically requires 4 to 8 weeks from initial submission to completion. Therefore, it is advisable to seek expert guidance from self-managed super fund specialists at Finance Story to ensure a seamless application experience.

Apply for the SMSF Commercial Property Loan

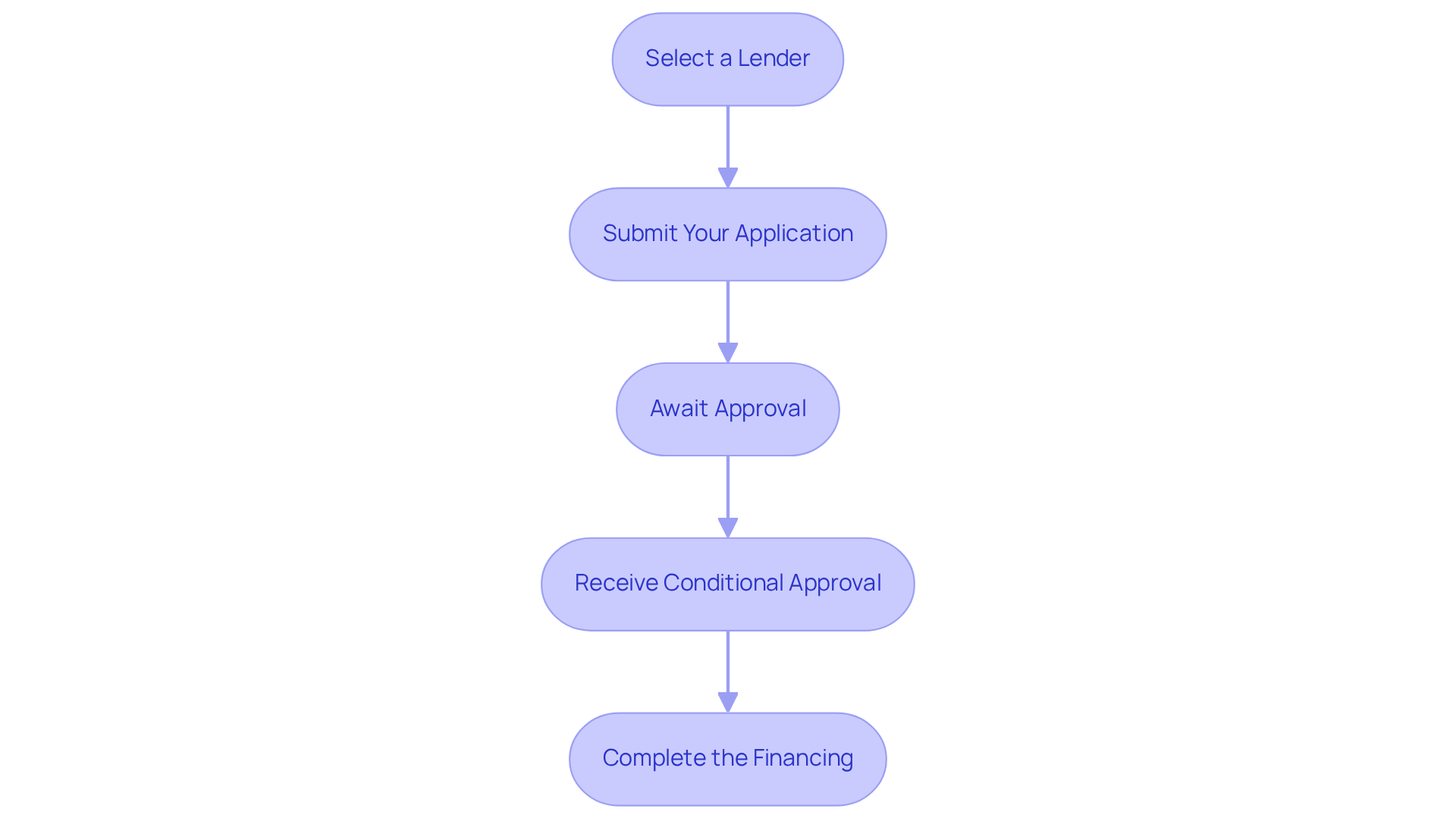

To apply for an SMSF commercial property loan, follow these essential steps:

- Select a Lender: Begin by investigating lenders that specialize in self-managed superannuation fund financing. Compare interest rates, fees, and financing features to identify the best fit for your needs. As of 2025, self-managed super fund loan interest rates typically range from 6.74% to 7.00%. Non-bank lenders, such as Pepper Money, offer competitive options. Finance Story can assist you in developing a robust argument and ensuring compliance with superannuation fund regulations to find the right lender for your commercial property loan smsf investment asset.

- Submit Your Application: Complete the lender's application form and submit it along with all necessary documentation. Ensure that all information is accurate and complete to avoid delays in processing.

- Await Approval: After submission, the lender will review your application. This process may take several weeks as they assess your SMSF's financial health and the property's value. It is crucial to maintain liquidity during this period to cover any unexpected expenses.

- Receive Conditional Approval: If your application is successful, you will receive a conditional approval letter detailing the terms and conditions of the financing.

- Complete the Financing: Upon accepting the terms, the lender will provide a formal financing agreement. It is vital to review this document thoroughly before signing to ensure all details align with your expectations. After completing the financing, you can proceed with the asset acquisition and ongoing management of your self-managed super fund.

Review Loan Terms and Conditions Thoroughly

Upon receiving your self-managed superannuation fund agreement, it is crucial to conduct a thorough examination of the terms and conditions, especially when utilizing your Self-Managed Superannuation Fund for a commercial property loan smsf for real estate investments. Focus on the following critical aspects:

- Interest Rate: Is the interest rate fixed or variable? For instance, starting in 2025, typical commercial property financing rates range from 7.44% to 8.09%, with some providers offering rates as low as 7.74% for financing with a 20% minimum deposit. This can significantly impact your repayment amounts over time.

- Borrowing Period: What is the length of the credit, and are there penalties for early repayment? Most self-managed super fund borrowings offer terms between 15 to 25 years, but understanding the consequences of an early exit is essential.

- Fees and Charges: Are you familiar with all applicable fees, including upfront, ongoing, and exit fees? Common charges for self-managed superannuation fund financing can include application costs ranging from $0 to $3,000 and legal expenses between $3,000 and $7,000, which can accumulate rapidly.

- Repayment Structure: What does the repayment schedule look like? Is it structured as principal and interest or interest-only? Monthly repayments for self-managed superannuation fund borrowings can vary greatly depending on the selected structure and interest rates. For example, estimates indicate repayments of approximately $3,157 for a variable self-managed superannuation fund borrowing at 6.49% p.a., $3,327 for a variable borrowing at 7.00% p.a., and $3,240 at 6.74% p.a.

- Compliance Requirements: Are you aware of the ongoing compliance obligations related to the financing and the SMSF's investment strategy? Lenders typically require SMSFs to maintain a liquidity buffer of 10-15% of the borrowing amount, ensuring that the fund can fulfill its obligations without violating covenants. Additionally, lenders often require SMSFs to maintain at least 12 months' worth of loan repayments.

Taking the time to grasp these terms can help you avoid unforeseen expenses and ensure your self-managed super fund remains compliant with ATO regulations, thereby protecting your financial future. Finance Story is here to assist you in building a solid case and ensuring compliance, guiding you in locating the appropriate lender for your commercial property loan smsf investment.

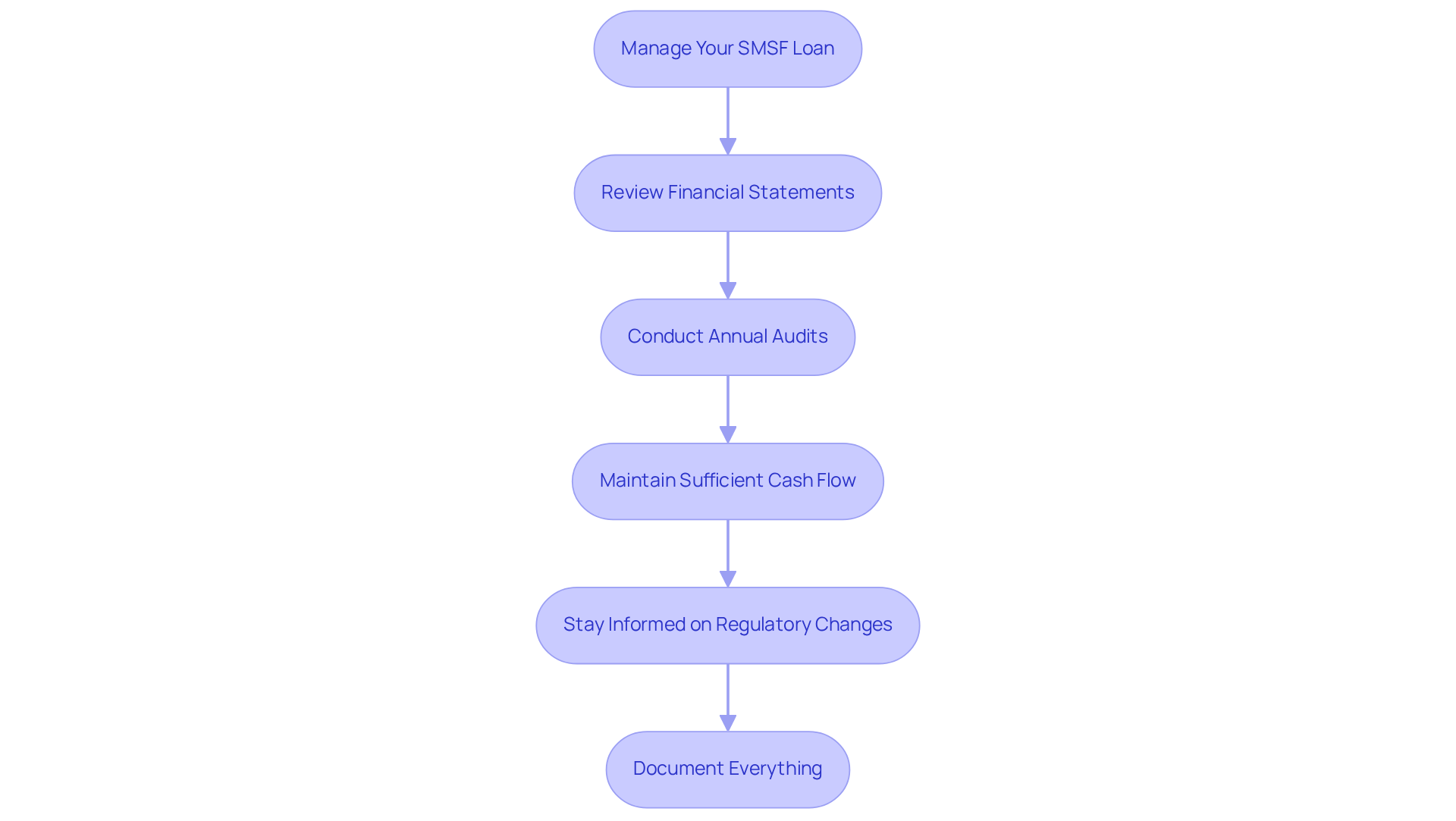

Manage Your Loan and Ensure Compliance with SMSF Regulations

Effective management of your commercial property loan SMSF financing is essential for ensuring compliance and maintaining financial health. To achieve this, consider the following crucial steps:

- Regularly Review Financial Statements: Consistently monitoring your SMSF's financial statements is vital for assessing its health. This practice ensures that you can meet repayment obligations and adhere to compliance requirements.

- Conduct Annual Audits: Annual audits serve not only as a legal obligation but also as a critical measure for verifying compliance with ATO regulations. These audits help identify potential issues early, safeguarding your investment.

- Maintain Sufficient Cash Flow: It is imperative that your SMSF maintains sufficient cash flow to cover loan repayments and property-related expenses for the commercial property loan SMSF. Financial advisors frequently stress that well-managed cash flow is essential for the sustainability of your fund.

- Stay Informed on Regulatory Changes: Regularly updating yourself on changes in SMSF regulations is crucial, as these can affect your financial strategy or compliance obligations. Being proactive in this area can prevent costly mistakes.

- Document Everything: Keeping meticulous records of all transactions, communications, and decisions related to your SMSF and property investment is essential. Comprehensive documentation is vital for audits and compliance checks, ensuring transparency and accountability.

Conclusion

Understanding the process of securing a commercial property loan through a Self-Managed Superannuation Fund (SMSF) is crucial for investors aiming to diversify their portfolios and take control of their retirement savings. By following the outlined steps, individuals can effectively navigate the complexities of financing commercial real estate, ensuring compliance and optimizing their investment potential.

Key aspects include:

- The significance of gathering the necessary documentation

- Comprehending eligibility criteria

- Thoroughly reviewing loan terms and conditions

Each of these components plays a vital role in the application process, helping to mitigate risks and ensure that the SMSF remains compliant with Australian Taxation Office regulations. Furthermore, ongoing management of the loan and awareness of regulatory changes are essential for maintaining financial health and safeguarding investments.

Ultimately, leveraging an SMSF for commercial property investment presents a unique opportunity for growth and financial independence. By taking proactive steps to educate oneself about the process, adhering to compliance requirements, and seeking expert guidance, investors can unlock the full potential of their SMSF while securing a stable financial future. Embracing this strategy not only enhances investment prospects but also empowers individuals to take charge of their retirement journey.