Overview

This article delineates five essential steps for navigating commercial real estate lending in Australia. It emphasizes the importance of:

- Understanding the lending process

- Gathering the necessary documentation

- Selecting the right lender

- Completing the loan application

- Troubleshooting common challenges

Each step is underpinned by critical metrics such as the Loan-to-Value Ratio (LVR) and Debt Service Coverage Ratio (DSCR). Furthermore, it provides practical advice on documentation and lender selection, equipping investors with the tools needed to effectively secure financing for their commercial property ventures.

Introduction

Navigating the world of commercial real estate lending in Australia can indeed be a daunting task, particularly due to the unique complexities and requirements that distinguish it from residential financing. Investors and business owners can gain significant insights by understanding the foundational concepts, key metrics, and current trends that shape this dynamic sector.

However, with a multitude of lenders and financing options available, how does one effectively choose the right path to secure the necessary funding?

This guide outlines essential steps designed to simplify the lending process and empower investors to make informed decisions within a competitive marketplace.

Understand the Basics of Commercial Real Estate Lending

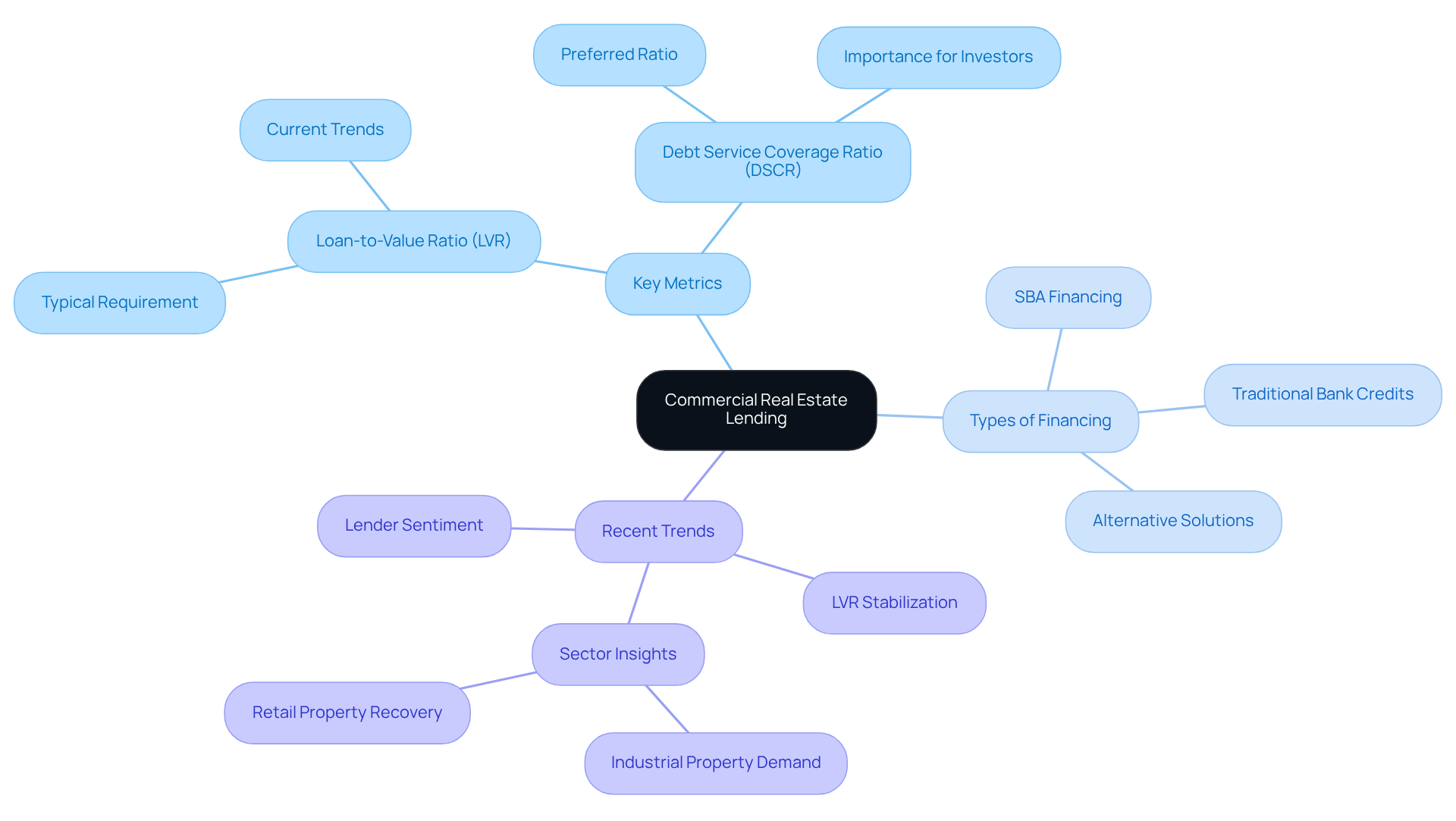

Commercial real estate lending Australia refers to the process of obtaining financing to acquire or develop properties designated for business purposes, including office buildings, retail spaces, and warehouses. This type of lending differs from residential financing in several key aspects: it typically features shorter terms, higher interest rates, and more stringent qualification criteria. Understanding these foundational concepts is crucial for navigating this complex landscape.

- Loan-to-Value Ratio (LVR): The LVR is a critical metric that reflects the proportion of the loan relative to the property's appraised value. In 2025, most lenders uphold an LVR requirement of 60-70% for business properties, with over 85% of surveyed lenders showing a preference for LVRs of 50% or higher. This cautious approach highlights the significance of equity in business transactions.

- Debt Service Coverage Ratio (DSCR): This ratio evaluates a property's ability to produce adequate income to fulfill its financial commitments. Lenders typically favor a DSCR of 1.25 or higher, indicating that the property earns 25% more than the amount needed for debt repayment. This metric is essential for assessing the financial feasibility of a business investment.

- Types of Commercial Financing: Various funding options are available, including traditional bank credits, Small Business Administration (SBA) financing, and alternative funding solutions. Each type has distinct features and requirements, making it essential to understand which option aligns best with your investment strategy.

At Finance Story, we provide access to a complete array of financial institutions, including high street banks and creative private lending groups, ensuring you obtain the appropriate funding for your property investments. Our expertise in refinancing and customized loan proposals enables us to manage the intricacies of business financing efficiently.

Recent trends in commercial real estate lending Australia show a growing interest among lenders, with 56% expressing a desire to expand their real estate portfolios. The average LVR for business properties has stabilized around 65%, reflecting a cautious yet optimistic lending environment. Additionally, the industrial property sector remains robust, driven by low vacancy rates and strong demand, while retail properties are increasingly recognized as viable investment opportunities despite their historical volatility.

In summary, understanding the basics of real estate financing, including LVR and DSCR, is essential for making informed investment choices. By grasping these concepts and staying informed about current trends, investors can navigate the intricacies of commercial real estate lending in Australia more effectively.

Gather Required Documentation and Meet Eligibility Criteria

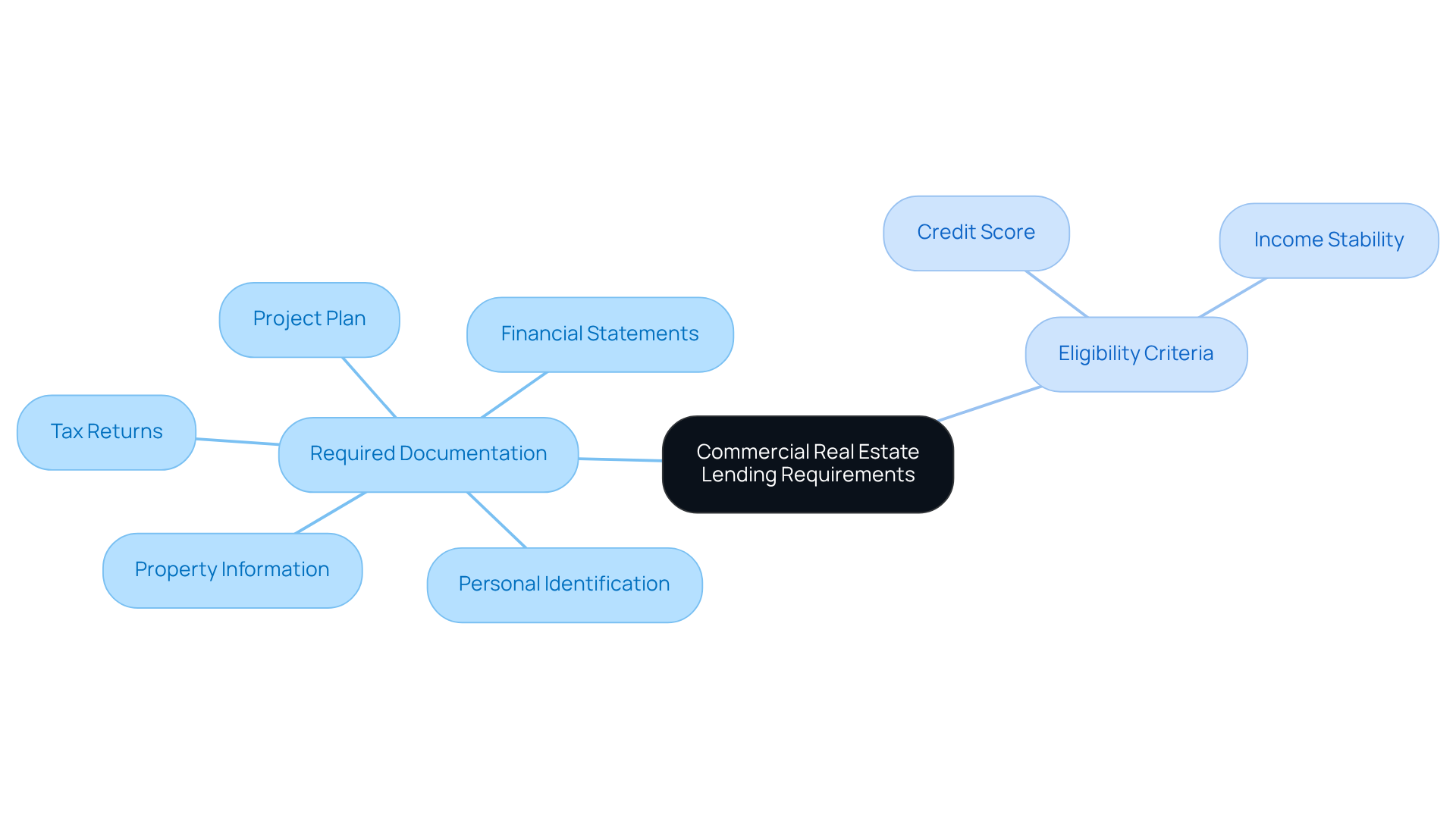

To successfully apply for commercial real estate lending in Australia, it is crucial to compile several key documents that demonstrate your financial stability and business viability.

-

Financial Statements: Include profit and loss statements, balance sheets, and cash flow statements for the past two years. This provides a clear picture of your financial health.

-

Tax Returns: Submit personal and corporate tax returns for the last two years. These documents help lenders assess your income consistency and tax compliance.

-

Project Plan: A comprehensive project plan is essential. Detail your operational model, market assessment, and financial forecasts to demonstrate your strategy and potential for success.

-

Property Information: Provide detailed information about the property you intend to purchase. Include appraisals and lease agreements, if applicable, to demonstrate its value and income potential.

-

Personal Identification: Valid identification and proof of income for all owners are necessary to verify identities and financial backgrounds.

Eligibility standards for business financing typically necessitate a favorable credit score, generally over 680, along with a stable income and a strong business background. In the realm of commercial real estate lending in Australia, lenders evaluate these factors to establish your capacity to manage the debt, concentrating on the property's income potential and your overall financial profile.

As the business financing environment evolves, understanding these criteria is essential for obtaining advantageous financing conditions in 2025.

Choose the Right Lender for Your Commercial Loan

Choosing the right financial institution for your commercial real estate lending Australia is crucial for securing favorable terms and ensuring a seamless financing process. Consider these key factors:

- Lending Source: Evaluate your options among conventional banks, credit unions, and alternative finance providers. Each type has unique lending criteria and product offerings that can greatly influence your financing experience. Finance Story provides access to a comprehensive portfolio of financial institutions, including commercial real estate lending Australia, helping you find the perfect fit for your business needs.

- Interest Rates and Fees: Conduct a thorough comparison of interest rates and associated charges across different providers. With the average interest rate for commercial loans expected to be competitive in 2025, identifying the most cost-effective option is essential for your bottom line. Finance Story offers insights into the lending landscape, guiding you through these costs effectively.

- Creditor Reputation: Assess creditor reliability by reviewing customer testimonials and ratings. A creditor's reputation can reveal insights into their service quality and responsiveness, which are vital for a successful borrowing relationship. As one satisfied client stated, "I will certainly be suggesting your service to anyone. We are finished with the constant worry."

- Specialization: Certain financial institutions focus on specific commercial loan categories or sectors. If your business aligns with these specialties, you may gain access to tailored advice and more favorable terms. Finance Story can connect you with financiers that suit your unique enterprise requirements.

- Flexibility: Seek out financial institutions that offer adaptable terms and are open to negotiation. Flexibility can be a game-changer, particularly in a dynamic economic environment where your business needs may change. In 2025, the borrowing landscape in commercial real estate lending Australia is characterized by increased competition, with non-bank entities gaining prominence for their ability to provide more flexible financing solutions. As you explore your options, consider these factors to ensure you choose a lender that aligns with your business financing needs.

Complete the Loan Application Process

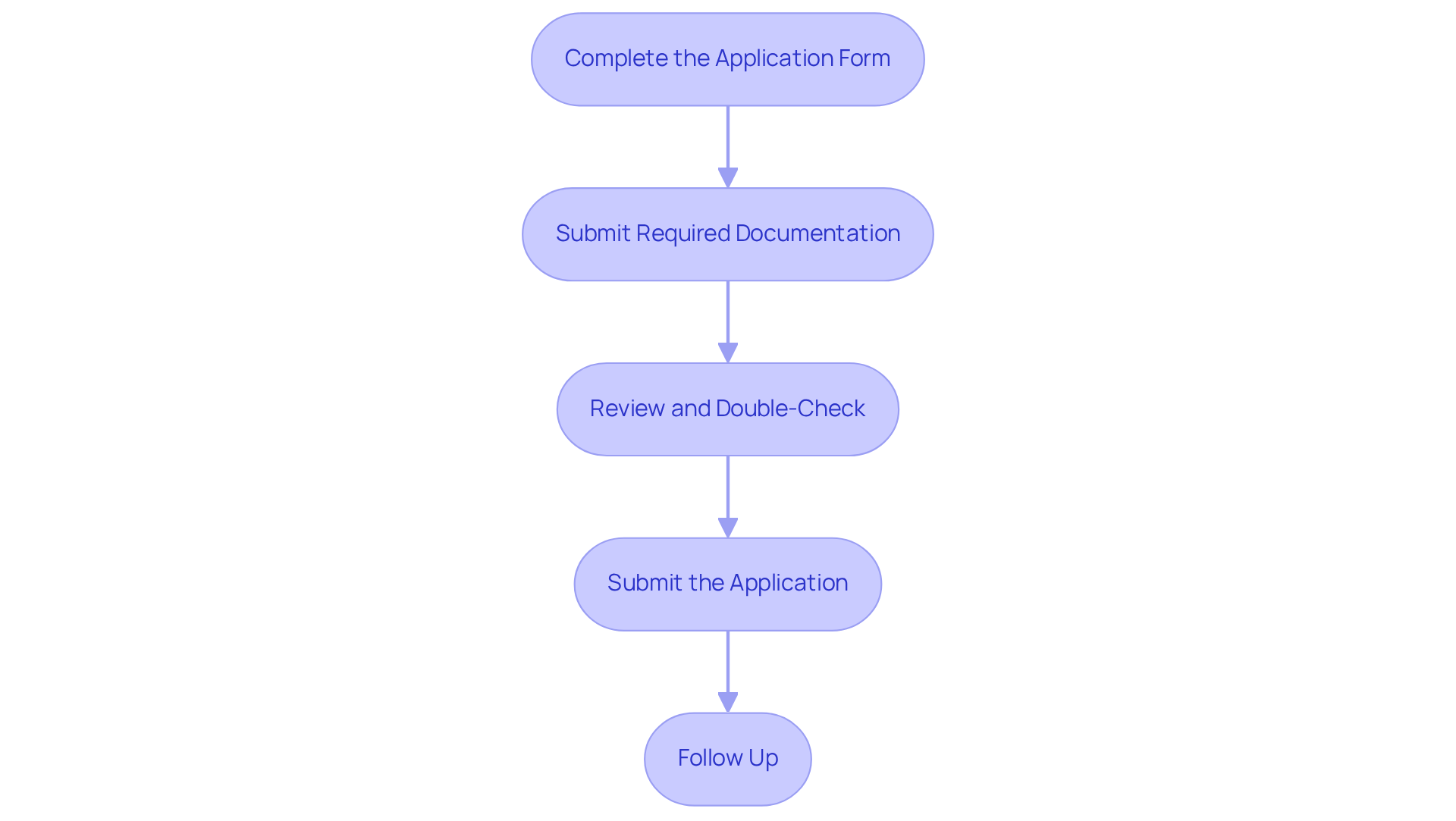

To successfully navigate the loan application process for your commercial property investment, adhere to the following steps:

- Complete the Application Form: Provide precise information about your enterprise, the loan amount requested, and the purpose of the loan. A polished and tailored case, developed with the expertise of Finance Story, can significantly enhance your chances of securing approval for commercial real estate lending in Australia.

- Submit Required Documentation: Attach all necessary documents, including financial statements, tax returns, and your project plan. Ensure these documents accurately reflect your evolving business needs, particularly if you are refinancing.

- Review and Double-Check: Ensure that all information is complete and accurate to avoid processing delays. A thorough evaluation can aid in meeting the heightened expectations of financial institutions.

- Submit the Application: Forward your application to the financial institution, either online or in person, depending on their specific requirements. Remember, you have access to a broad spectrum of financial institutions for commercial real estate lending in Australia, ranging from high street banks to innovative private lending panels.

- Follow Up: After submission, follow up with the lender to confirm receipt and inquire about the approval timeline. This proactive approach can facilitate your navigation through the complexities of securing funds for your commercial property.

Troubleshoot Common Challenges in Securing Financing

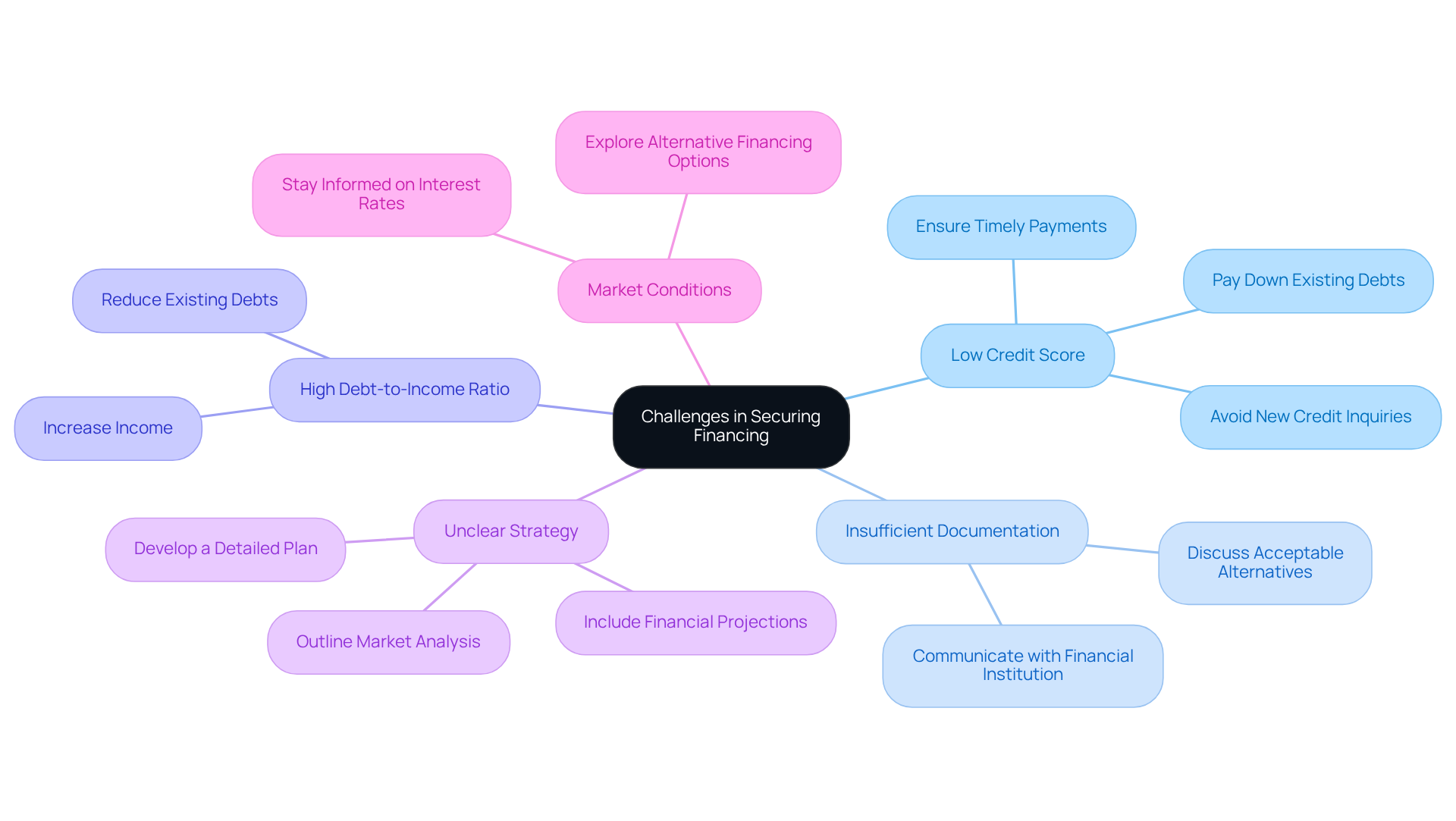

Securing financing presents various challenges for small enterprise owners. Understanding these common issues and effective strategies to address them is crucial for success.

- Low Credit Score: A credit score below the necessary threshold can significantly impede approval for financing. To improve your score, focus on paying down existing debts, ensuring timely payments, and avoiding new credit inquiries. Statistics indicate that many small business owners in Australia struggle with credit scores, with a notable percentage falling below the ideal range for commercial real estate lending Australia.

- Insufficient Documentation: Lenders require comprehensive documentation to assess your application. If you lack certain documents, proactively communicate with your financial institution to discuss acceptable alternatives. This transparency can help mitigate delays in the approval process.

- High Debt-to-Income Ratio (DTI): A high DTI can be a warning sign for creditors. To improve your chances, consider strategies to reduce existing debts or increase your income before applying. In 2025, the impact of DTI on commercial real estate lending Australia remains significant, with many lenders closely scrutinizing this metric.

- Unclear Strategy: A vague or poorly structured plan can hinder your chances of securing financing. Ensure your plan is detailed, clearly outlining your strategy, market analysis, and financial projections. A well-prepared financial plan not only enhances your credibility but also shows your dedication to the lender.

- Market Conditions: Stay informed about current market conditions that may affect lending. If interest rates are high, consider waiting for a more favorable environment or exploring alternative financing options. Understanding the broader economic landscape can help you make informed decisions about your financing strategy.

By addressing these common challenges with proactive strategies, small business owners can significantly enhance their chances of securing the necessary financing for commercial real estate lending in Australia.

Conclusion

Navigating the landscape of commercial real estate lending in Australia demands a comprehensive understanding of foundational principles and current market trends. By mastering the intricacies of metrics such as Loan-to-Value Ratio (LVR) and Debt Service Coverage Ratio (DSCR), investors position themselves to make informed decisions that align with their business objectives.

Key insights from this discussion emphasize the necessity of thorough documentation, the careful selection of the right lender, and the proactive management of common challenges encountered during the financing process. From gathering essential financial statements to identifying a lender that meets your unique needs, each step is vital in securing favorable lending terms. Furthermore, recognizing and addressing potential obstacles, such as low credit scores or inadequate documentation, can significantly enhance the chances of loan approval.

Ultimately, the capacity to navigate commercial real estate lending in Australia not only empowers investors to secure essential funding but also positions them for long-term success in a competitive market. Engaging with knowledgeable financial institutions and remaining informed about the evolving lending landscape will further strengthen one's investment strategy. By taking these steps, aspiring property owners can unlock the potential of commercial real estate and contribute to a thriving business environment.