Overview

Commercial construction loans in Australia serve as specialized financial products tailored to fund the construction or refurbishment of business properties. With their short-term durations and structured disbursement processes aligned with project milestones, these loans play a crucial role in the construction landscape. They provide essential capital for various construction-related expenses.

Furthermore, engaging with knowledgeable finance brokers is vital; their expertise can significantly ease the complexities involved in securing such financing effectively. Are you aware of how these professionals can streamline your journey toward obtaining the necessary funds?

Understanding the intricacies of commercial construction loans and the guidance of finance brokers can empower you to make informed decisions that bolster your business's growth.

Introduction

In the dynamic realm of commercial real estate, securing the right financing is crucial for the success of any project. Commercial construction loans serve as an essential resource for developers and business owners aiming to build or renovate properties. Unlike traditional mortgages, these specialized loans are designed to meet the unique challenges of construction financing, offering tailored solutions that align with project timelines and cash flow needs.

As the landscape evolves, particularly in Australia, understanding the intricacies of these loans—from their types and benefits to the application processes—is vital for navigating the complexities of commercial construction. This article delves into current trends, challenges, and opportunities in commercial construction financing, empowering borrowers to make informed decisions in a competitive market.

What Are Commercial Construction Loans?

Business development financing options, particularly commercial construction loans in Australia, serve as specialized resources tailored to assist in the construction or refurbishment of business properties. Unlike conventional mortgages, which are typically long-term and secured by an existing property, commercial construction loans are generally short-term, designed to cover various expenses associated with building projects. These costs encompass materials, labor, permits, and other essential expenditures.

A defining characteristic of commercial construction loans in Australia is their structured disbursement process. Funds are released in stages, aligned with the progress of the building project. This method not only aids in managing cash flow efficiently but also ensures that borrowers can access these loans to secure essential funds during critical phases of construction.

In 2025, the landscape of business financing for building projects in Australia is evolving. The Australian Prudential Regulation Authority (APRA) is set to update its data gathering techniques for commercial real estate (CRE) lending. This initiative aims to enhance prudential monitoring, potentially leading to more informed lending practices and improved outcomes for borrowers. For small business owners, this modernization could translate into more tailored financing options and better access to necessary funds.

Statistics indicate that the typical mortgage amount for owner-occupier homes in Western Australia is around $383,000, underscoring the substantial capital required for business ventures. Annually, thousands of commercial construction loans are made available throughout the country, highlighting the ongoing demand for financing in this sector.

Successful business building endeavors financed by credit often emphasize the importance of collaborating with knowledgeable finance brokers. Finance Story specializes in crafting polished and highly individualized business cases for presentation to banks, ensuring that small business owners possess the expertise needed to navigate the complexities of securing funding. A case study titled 'Navigating Commercial Construction Loans Australia' illustrates the advantages of consulting with experienced brokers.

As noted by Nadine Connell, Co-Founder of Smart Business Plans, "Working with an experienced finance broker will mean you have all the facts before you submit an application, including preliminary discussions with the lender on potential requirements." This insight highlights the necessity of thoroughly understanding potential lender requirements prior to application submission, which is crucial for achieving success.

Finance Story offers a comprehensive range of lenders, including high street banks and innovative private lending panels, catering to various circumstances when seeking commercial construction loans. Whether financing a large warehouse, retail premise, factory, or hospitality venture, current trends in business development financing reveal an increasing interest in creative funding options that address the distinct needs of borrowers. Key features of these financial products include adaptable repayment conditions, the ability to fund a wide array of endeavors, and the potential for favorable interest rates.

As the market continues to evolve, staying informed about these advancements will be essential for small business owners looking to capitalize on business building opportunities.

Key Features and Benefits of Commercial Construction Loans

Key features of commercial construction loans include:

- Flexible Funding: These loans are tailored to meet the specific requirements of each project, allowing for customized amounts and repayment terms that align with the borrower’s financial strategy. Finance Story specializes in crafting polished and highly individualized business cases to present to lenders, ensuring that your loan proposal meets the increasingly heightened expectations of banks.

- Progressive Drawdowns: Funds are allocated in stages, dependent on the completion of set milestones. This approach ensures that borrowers incur interest only on the amounts they have accessed, optimizing cash flow management.

- Interest-Only Payments: During the building phase, borrowers typically make interest-only payments, which can significantly alleviate immediate cash flow pressures.

The benefits of commercial construction loans are substantial:

- Access to Capital: These loans empower businesses to secure the necessary funding for large-scale projects that may be unattainable through conventional financing methods. This is especially vital in a competitive market where timely task completion can lead to significant advantages. With access to a full suite of lenders, including high street banks and innovative private lending panels, Finance Story ensures that you find the right financing solution for your needs.

- Tax Advantages: Interest payments on business financing are frequently tax-deductible, which can result in a decrease in overall tax obligation, improving the financial feasibility of endeavors.

Statistics show that business building financing has gained significant popularity, with a marked increase in requests demonstrating a rising trust in the market. For instance, recent data indicates that companies using these funds report a 30% rise in project completion rates compared to those depending exclusively on conventional financing. Additionally, corrected statistics from September 2024 highlight the importance of external and internal refinancing options available to borrowers, further supporting their financing strategies.

Practical instances demonstrate the adaptability of financing in business development projects. A case study titled "Exploring Quick Property Financing" highlights how bridging resources facilitate rapid funding for urgent needs, enabling borrowers to act swiftly in property transactions. This adaptability is essential for businesses looking to capitalize on immediate opportunities.

Current specialist views underscore the significance of adaptable financing choices, including commercial construction loans in Australia, in business construction funding. These options not only assist project completion but also encourage business expansion. As the landscape of commercial financing evolves, these financial options remain a crucial resource for small enterprises seeking to grow their operations and improve their market presence. It is also important to note the distinction between small businesses, which have fewer than 20 employees, and micro-businesses, which have fewer than 5 employees, as this may influence the types of funding they pursue.

As mentioned by the group at Finance Story, "We work hard to support as many small enterprises as possible, offering adaptable financing options to our clients.

Types of Commercial Construction Loans Available

In Australia, various forms of commercial construction loans cater to different funding requirements. Understanding these loans is crucial for making informed decisions in the property development landscape. The main categories consist of:

- Building-Only Financing: These funds are specifically intended to support the building phase of a project, handling expenses related to construction. They must be reimbursed in full once the project is completed. This type of financing is ideal for developers who possess a clear exit strategy.

- Construction-to-Permanent Financing: These options provide a seamless transition from building funding to a permanent mortgage once the structure is completed. This streamlines the funding process, enabling borrowers to bypass the difficulty of obtaining a separate mortgage after construction, making it a favored choice among developers.

- Bridge Financing: These short-term funds offer immediate capital to address expenses until a more permanent financial solution is secured. They are particularly beneficial for developers needing swift access to funds to capitalize on opportunities or manage cash flow during the construction phase.

- Hard Money Financing: These asset-based options are generally easier to secure than traditional financing methods but come with higher interest rates. They are often used by developers who may not meet the criteria for conventional financing due to credit issues or other factors.

As we look toward 2025, the Australian market shows a rising trend in commercial construction loans, indicating a shift in borrower preferences towards simplified construction-to-permanent financing solutions. Statistics reveal that construction-only financing maintains a significant market share, yet the appeal of these loans is increasing as developers seek efficiency and reduced administrative burdens.

Expert opinions underscore the advantages of commercial construction loans, particularly in long-term financial planning. Industry leaders emphasize that these loans not only streamline the financing process but also provide stability in budgeting for future mortgage payments. Hunter Galloway, a mortgage broker, notes that refinancing can be a strategic choice for developers seeking to secure these loans, allowing them to lower repayments or leverage equity for additional investments.

A notable case study highlighting the effectiveness of customized financing solutions is Finance Story's provision of a $10,590,000 financing package with a 65% loan-to-value ratio (LVR) for a townhouse project in Harristown, QLD. This initiative, which included a $2,840,000 mezzanine financing at a 77% LVR, successfully facilitated the development of 33 townhouses, showcasing Finance Story's capability in supporting large-scale building endeavors with tailored financial solutions. With access to over 30 banks and lenders, Finance Story is strategically positioned to provide competitive options, including commercial construction loans, that meet the diverse needs of developers, such as refinancing alternatives for various business properties like warehouses, retail spaces, factories, and hospitality ventures.

By understanding the nuances of these financial types, developers can navigate the complexities of funding their initiatives more effectively, ensuring they select the most suitable options for their specific needs.

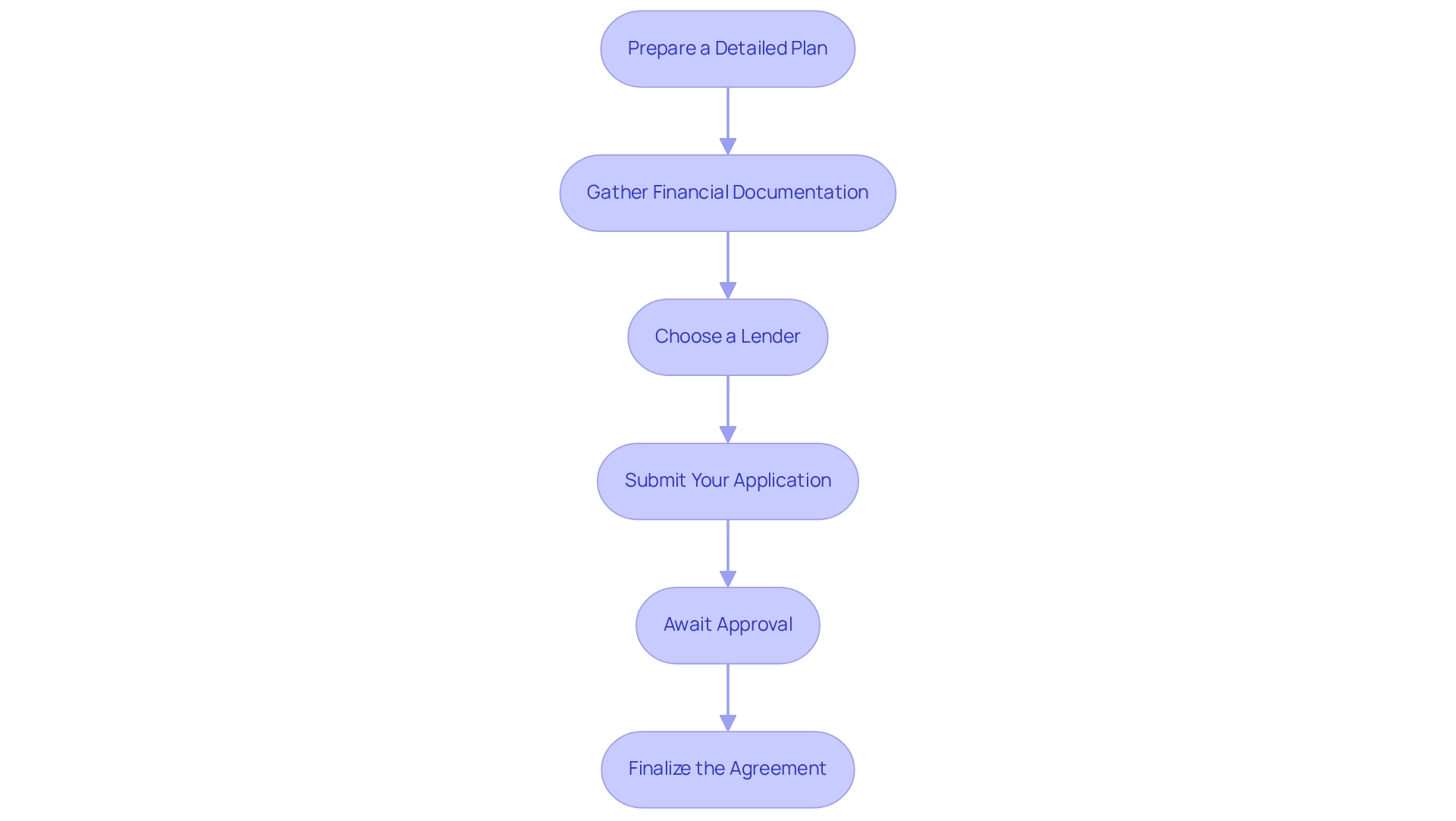

How to Apply for a Commercial Construction Loan: A Step-by-Step Guide

Applying for commercial construction loans in Australia involves several critical steps to ensure a smooth process and successful funding. Here’s a comprehensive guide to help you navigate the application:

- Prepare a Detailed Plan: Start by outlining the scope, budget, and timeline of your construction project. A well-structured project plan clarifies your vision and demonstrates to lenders that you understand the project’s requirements. This is crucial, as lenders expect polished and individualized business cases, a specialty of Finance Story.

- Gather Financial Documentation: Compile essential financial documents, including tax returns, financial statements, and your credit history. These documents provide lenders with insight into your financial stability and ability to repay the debt. Understanding the repayment criteria is essential; thorough financial documentation can significantly enhance your credibility.

- Choose a Lender: Research and select a lender that specializes in commercial construction loans. Look for institutions offering competitive loan-to-value ratios, typically ranging from 65% to 75%. This indicates that you may need a down payment of at least 25% to 35% of the project's value. Partnering with Finance Story grants you access to a diverse range of lenders, including high street banks and innovative private lending panels, tailored to your specific needs.

- Submit Your Application: Complete the application form and submit it along with your plan and financial documentation. Ensure that all information is accurate and comprehensive to facilitate a quicker review process. A well-prepared application can significantly expedite the approval process.

- Await Approval: After submission, the lender will review your application. This phase may include a site visit and requests for additional documentation to evaluate the feasibility of your initiative. Having a team of professionals, like those at Finance Story, can effectively manage this process and mitigate risks.

- Finalize the Agreement: Once your application is approved, complete the financing contract. This step allows you to access funds as needed for your construction project.

The typical duration for approving commercial construction loans in Australia can vary, but being well-prepared can greatly accelerate the process. Industry specialists stress the importance of having a strong plan. Nadine Connell, Co-Founder and Business Finance Broker, emphasizes, "The process can be complex – it’s essential for potential investors to have a team of professionals that can guide them through the process to best manage risk."

Upon completion of your building project, you can transition to long-term financing or repay the debt through property sale or leasing, providing flexibility in managing your financial obligations. Additionally, consider exploring successful case studies, such as Trilogy Funds, which has effectively expanded its portfolio through strategic development initiatives in financing building projects. By following these steps and ensuring you have all essential paperwork ready, you can enhance your chances of securing business building financing effectively.

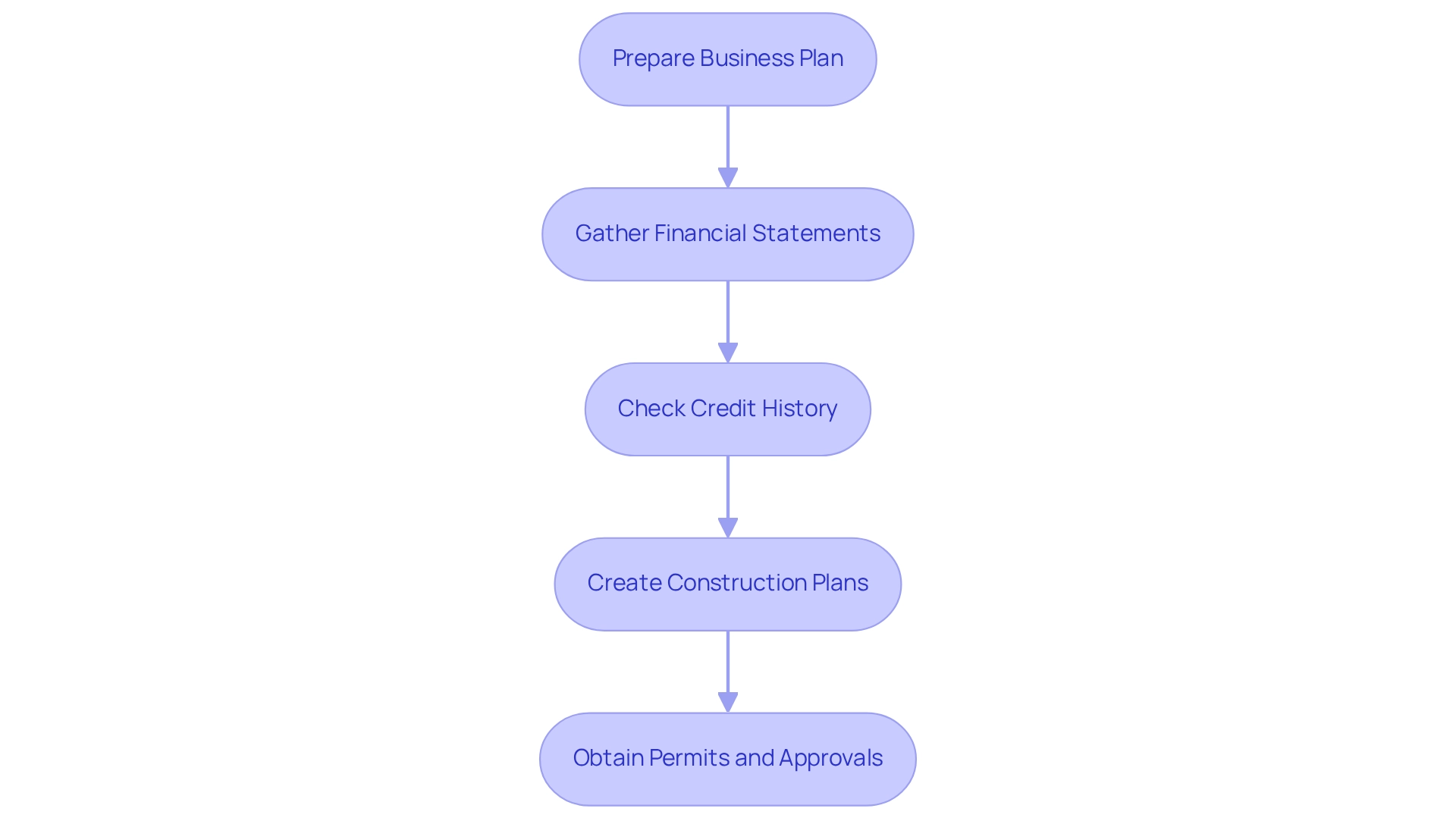

Documentation and Requirements for Approval

To obtain approval for commercial construction loans in Australia, borrowers must prepare a comprehensive set of documentation that showcases the feasibility and financial stability of their endeavor. The essential documents usually comprise:

- Business Plan: A well-organized business plan is vital, outlining the scope, financial forecasts, and timelines. This document acts as a roadmap for the lender, illustrating how the initiative aligns with market demands and financial goals. Nadine Connell, Owner-Operator of Smart Business Plans Australia, stresses that a solid business plan is essential for obtaining funding and overseeing the initiative efficiently. At Finance Story, we specialize in creating polished and highly individualized business cases that enhance your chances of approval.

- Financial Statements: Lenders require recent financial statements, including income statements, balance sheets, and cash flow statements. These documents provide insight into the borrower's financial health and ability to manage the loan.

- Credit History: A strong credit score is vital for loan approval; lenders generally look for a minimum score of 680. This benchmark reflects the borrower's creditworthiness and reliability in repaying debts.

- Construction Plans: Detailed blueprints and specifications are necessary to outline the project's design and scope. These plans assist lenders in evaluating the feasibility and possible risks linked to the building process.

- Permits and Approvals: Securing the required local government approvals and permits is crucial before the project can begin. This documentation guarantees adherence to zoning laws and safety standards.

In 2025, the documentation prerequisites for business building financing remain strict, reflecting the necessity for comprehensive evaluation by lenders. Early evidence indicates a trend towards higher loan-to-income ratios among non-bank lenders, following recent changes to serviceability buffers, which may influence the approval landscape. Additionally, in Australia, lenders typically offer commercial construction loans with Loan-to-Value Ratio (LVR) limits ranging from 62% to 82% of total construction costs.

Borrowers may need to contribute up to 25% of the costs upon completion, depending on the lender's assessment.

Recognizing the significance of a strong business plan cannot be emphasized enough. Financial advisors stress that a well-designed plan not only increases the chances of obtaining funding but also acts as a strategic instrument for managing the undertaking efficiently. Effective instances of business plans frequently feature thorough market evaluation, risk analyses, and distinct financial strategies, which together strengthen the borrower's argument for funding approval.

In conclusion, assembling the appropriate documentation is an essential phase in the funding approval process for commercial construction loans in Australia. By ensuring that all required documents are meticulously prepared and presented, borrowers can significantly improve their chances of obtaining the necessary financing. Moreover, the recent statistic showing that owner-occupier first home buyers' seasonally adjusted value of new financial commitments reached $16.05 billion emphasizes the current lending trends and market environment.

At Finance Story, we offer access to a comprehensive selection of lenders, including major banks and creative private lending groups, to address the changing requirements of businesses, including refinancing solutions for business financing.

Common Challenges in Securing Commercial Construction Loans and How to Overcome Them

Obtaining commercial construction financing in Australia presents several typical obstacles that borrowers must navigate:

- High Interest Rates: Commercial construction financing often comes with elevated interest rates due to the perceived risks associated with construction projects. As of 2025, average interest rates for these loans are expected to exceed standard residential rates, with current figures indicating an increase to approximately 7.5%. To counteract this, it is advisable to shop around for competitive rates and consider enlisting the assistance of a mortgage broker. Such professionals can provide access to a broader range of lenders and negotiate better terms on your behalf.

- Strict Lending Criteria: Lenders typically impose stringent requirements on borrowers, which may include detailed documentation of financial health, project plans, and timelines. A recent case study highlighted the pre-approval process for development financing, where lenders mitigated risks by confirming estimated building expenses and gathering essential paperwork from borrowers, such as permits and contracts. To enhance your chances of approval, it is crucial to prepare comprehensive documentation and maintain a robust credit profile. This preparation not only demonstrates your reliability but also aids in meeting the strict criteria set by lenders. Engaging with experts like Finance Story can provide tailored loan proposals that align with your specific needs, ensuring you present a compelling case to lenders. Finance Story has access to a comprehensive range of lenders, including high street banks and creative private lending panels, to provide you with the finest options available.

- Delays: Setbacks in construction can significantly impact funding and overall viability. Establishing a realistic timeline for the project and maintaining open lines of communication with your lender regarding any potential delays is essential. Frequent updates can assist in managing expectations and ensure that funding remains aligned with the project's progress.

- Navigating High Loan-to-Income Ratios: Recent trends indicate an increase in high loan-to-income lending by non-bank lenders, complicating the borrowing landscape. Early evidence suggests that the share of high loan-to-income lending by non-banks rose following changes to the serviceability buffer. Understanding these dynamics and how they affect your borrowing capacity is vital. Engaging with financial specialists can provide insights on how to tackle these challenges effectively.

- Case Studies of Successful Borrowers: For instance, the previously mentioned case study on the pre-approval process illustrates how lenders can reduce risks by validating estimated building expenses and gathering required documentation. This proactive approach not only ensured project viability but also helped borrowers meet their contractual obligations, underscoring the importance of thorough preparation. By collaborating with Finance Story, you can leverage their expertise in refinancing and securing customized business financing, including commercial construction loans in Australia, for your property investments—be it a warehouse, retail space, factory, or hospitality project.

By addressing these challenges head-on and employing strategic methods, borrowers can enhance their likelihood of securing favorable business development funding, even in a competitive and evolving financial environment.

The Role of Mortgage Brokers in Commercial Construction Financing

Mortgage brokers play a pivotal role in commercial construction financing by offering a suite of services that significantly benefit borrowers.

- Providing Access to Multiple Lenders: Brokers have established relationships with a diverse array of lenders, broadening the options available to borrowers. This access enhances the possibility of obtaining advantageous financing conditions through commercial construction loans in Australia, customized to particular project requirements. Finance Story, for example, boasts a comprehensive portfolio of private and boutique investors, ensuring clients have a wide range of options to discuss. This extensive network allows us to find the best financing solutions for every unique situation.

- Expert Guidance: Navigating the complexities of commercial construction financing can be daunting. Brokers provide invaluable insights into the lending process, helping borrowers understand intricate requirements and streamline documentation, essential for a successful application. Finance Story specializes in creating polished and highly individualized business cases to present to banks, enhancing the chances of approval. As one satisfied client, Natasha B. from VIC, stated, "I will definitely be recommending your business to anyone. We are finished with the constant worry."

- Negotiating Terms: One of the key advantages of working with a mortgage broker is their ability to negotiate on behalf of borrowers. They utilize their industry expertise and connections to secure better interest rates and more advantageous financing terms, ultimately saving clients money throughout the duration of the financing. For instance, the comparison rate calculated on a $150,000 borrowing over 25 years can be considerably enhanced through efficient negotiation.

Statistics show that a substantial portion of borrowers in Australia—around 60%—use mortgage brokers for commercial construction loans, highlighting their significance in the financial sector. This trend reflects a growing recognition of the value brokers bring in terms of expertise and negotiation power.

In recent years, particularly during the economic fluctuations caused by the Covid pandemic, the role of mortgage brokers has become even more critical. Many borrowers sought refinancing options as interest rates fell and property values rose. A case study from this period revealed that borrowers with at least 20% equity were more likely to benefit from refinancing, underscoring the strategic advice brokers provide in assessing equity and loan viability.

As noted by Harrison Astbury, "Refinancing is generally only recommended if borrowers have at least 20% equity, lest they want to pay lenders mortgage insurance (LMI)."

Expert insights emphasize that mortgage brokers not only facilitate access to capital but also enhance the overall financing experience for clients seeking commercial construction loans in Australia. Their capability to maneuver through the business building funding environment effectively establishes them as vital allies for borrowers aiming to engage in substantial endeavors. Successful negotiations by brokers have led to numerous instances where clients secured funding that might have otherwise been unattainable, showcasing the tangible benefits of their expertise in this sector.

Finance Story, with its reputation for professionalism and a deep understanding of the finance sector, exemplifies the critical role that mortgage brokers play in helping clients achieve their financial goals.

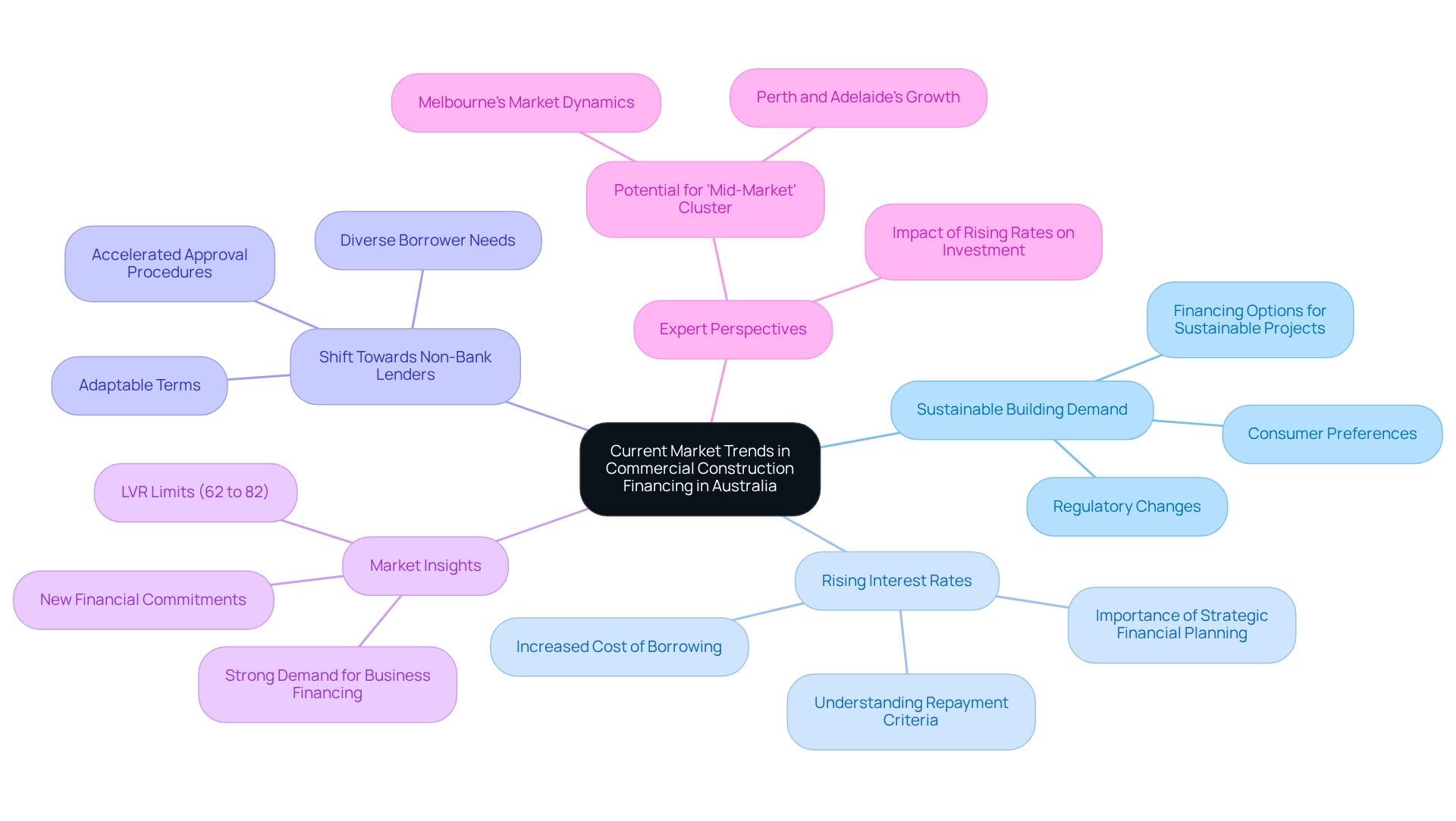

Current Market Trends in Commercial Construction Financing in Australia

Current trends in commercial construction financing in Australia reveal several key dynamics shaping the market:

- Increased Demand for Sustainable Building: A notable surge in interest towards environmentally sustainable construction practices is evident. This shift is driven not only by regulatory changes but also by consumer preferences, leading to a greater availability of financing options tailored for sustainable projects. Financial institutions increasingly recognize the long-term value of green buildings, which can enhance asset performance and reduce operational costs.

- Rising Interest Rates: The landscape of commercial financing is significantly affected by rising interest rates. As rates climb, the cost of borrowing increases, prompting borrowers to act swiftly to secure favorable terms. This trend highlights the significance of strategic financial planning; securing lower rates can result in considerable savings throughout the duration of a debt. Understanding repayment criteria is essential for small business owners to navigate these changes effectively.

- Shift Towards Non-Bank Lenders: In response to evolving borrower needs, there has been a marked shift towards non-bank lenders. These institutions frequently offer more adaptable terms and accelerated approval procedures, making them appealing options for many seeking business construction financing. This trend reflects a broader transformation in the lending landscape, where the availability of commercial construction loans in Australia indicates that traditional banks may not always meet the diverse needs of borrowers. Finance Story specializes in connecting clients with a full suite of lenders, ensuring tailored financing solutions that align with specific business circumstances.

- Market Insights: Recent information from the Australian Bureau of Statistics indicates that the demand for business financing has remained strong, with a substantial amount of new financial commitments approved in the last quarter of 2024. This suggests a strong desire for investment in business properties, despite challenges posed by rising interest rates. Furthermore, Australian financiers generally provide commercial construction loans, with Loan-to-Value Ratio (LVR) limits varying from 62% to 82% of total building expenses, enabling borrowers to cover a portion of the costs in advance.

- Expert Perspectives: Financial analysts closely monitor the impact of rising rates on construction loans. Insights suggest that while higher rates may deter some investment, they could also lead to a more discerning market where only the most viable projects receive funding. This could ultimately improve the quality of advancements in the business sector. As noted by Atom Go Tian, Senior Data Analyst at Ray White, "Melbourne’s decrease has the potential for a 'mid-market' cluster, with Perth and Adelaide foreshadowing a takeover of Melbourne in price."

In summary, the current trends in commercial construction loans in Australia reflect a complex interplay of sustainability, interest rates, and evolving lending practices, all of which are crucial for small business owners to consider when navigating their financing options. The impact of tailored financing solutions is evident, as Finance Story has helped numerous business owners secure the right loans for their commercial property investments, including refinancing options for warehouses, retail premises, factories, and hospitality ventures. If you're a small business owner looking to secure financing, Finance Story is here to assist you in achieving your business goals with individualized financial strategies.

Conclusion

Understanding the landscape of commercial construction loans is essential for any developer or business owner looking to embark on a construction project. These specialized loans offer flexible funding options, structured disbursement processes, and tailored solutions that align with the unique challenges of construction financing. By exploring the various types of loans available—including construction-only, construction-to-permanent, and bridge loans—borrowers can select the most suitable option for their specific project needs.

Navigating the application process can be daunting. However, being prepared with a comprehensive project plan and relevant financial documentation can significantly enhance the chances of securing funding. Engaging with experienced mortgage brokers provides invaluable guidance, helping borrowers access a wider range of lenders and negotiate favorable terms. The role of brokers becomes increasingly critical, especially in a competitive market marked by rising interest rates and stringent lending criteria.

As trends in commercial construction financing evolve, staying informed about current market dynamics—such as the increasing demand for sustainable building practices and the shift towards non-bank lenders—is vital for making informed financial decisions. By leveraging the expertise of professionals and understanding the intricacies of commercial construction loans, borrowers can navigate the complexities of financing and seize opportunities for growth in the dynamic realm of commercial real estate.

In conclusion, securing the right financing transcends merely obtaining funds; it empowers businesses to realize their construction aspirations. With the right approach and resources, small business owners can confidently pursue their commercial projects, ensuring they are well-positioned for success in an ever-changing marketplace.