Overview

The article presents a comprehensive strategy for entrepreneurs aiming to locate business loan brokers in their vicinity. It underscores the critical importance of selecting qualified intermediaries who can effectively link them to appropriate financing options. Key criteria for choosing brokers are detailed, including:

- Experience

- Specialization

- Communication skills

Furthermore, the article outlines practical steps for identifying and assessing potential brokers in one's area. This ultimately boosts the likelihood of securing favorable loan terms.

Introduction

Navigating the complex world of business financing can be a daunting task for many entrepreneurs. With an overwhelming array of loan options and stringent lending criteria, the role of business loan brokers has become increasingly vital. These professionals act as intermediaries, connecting business owners with lenders while leveraging their expertise to secure favorable terms and tailored solutions. As the financial landscape evolves, particularly in 2025, understanding how to select the right broker becomes essential for small businesses seeking growth and stability.

This article delves into the significance of business loan brokers, the criteria for choosing the right one, and practical steps to find local options, empowering entrepreneurs to make informed financing decisions.

Understand the Role of Business Loan Brokers

Business loan brokers near me serve as vital connectors between entrepreneurs and lenders, expertly navigating the intricate funding landscape. At Finance Story, we understand enterprise like no other, working closely with our clients to ensure they achieve optimal outcomes tailored to their specific needs. Our extensive network of financiers, which includes traditional banks, private funding sources, and angel investors, empowers us to connect clients with a diverse range of financing options that suit their unique circumstances.

Utilizing an intermediary not only conserves considerable time and effort for entrepreneurs in researching and applying for funding but also ensures they benefit from the intermediary's expertise in negotiating favorable terms. In Australia, intermediaries facilitate over 76% of all home financing, underscoring their essential role in the lending process. Furthermore, nearly 80% of first-time home buyers engage agents under federal programs, highlighting the trust and reliance placed on these professionals.

As the financial landscape evolves in 2025, the role of commercial financing representatives becomes increasingly critical. They assist small businesses in navigating the challenges posed by stringent banking regulations that often lead to financing denials. By advocating for their clients and understanding the unique aspects of each business, agents ensure that owners feel supported and recognized throughout the funding journey with business loan brokers near me. This advocacy is particularly crucial in an era marked by rising living costs and delayed borrower repayments, where access to working capital is more vital than ever.

Moreover, a cost analysis comparing loan acquisition through an intermediary versus directly from a lender reveals that intermediaries can negotiate superior rates despite their fees, rendering them a cost-effective choice for many businesses. At Finance Story, we prioritize crafting refined and customized cases to present to banks, ensuring our clients secure the appropriate funding solutions for their growth and development needs. This insight reinforces the essential value that intermediaries provide to small businesses navigating the complex lending landscape.

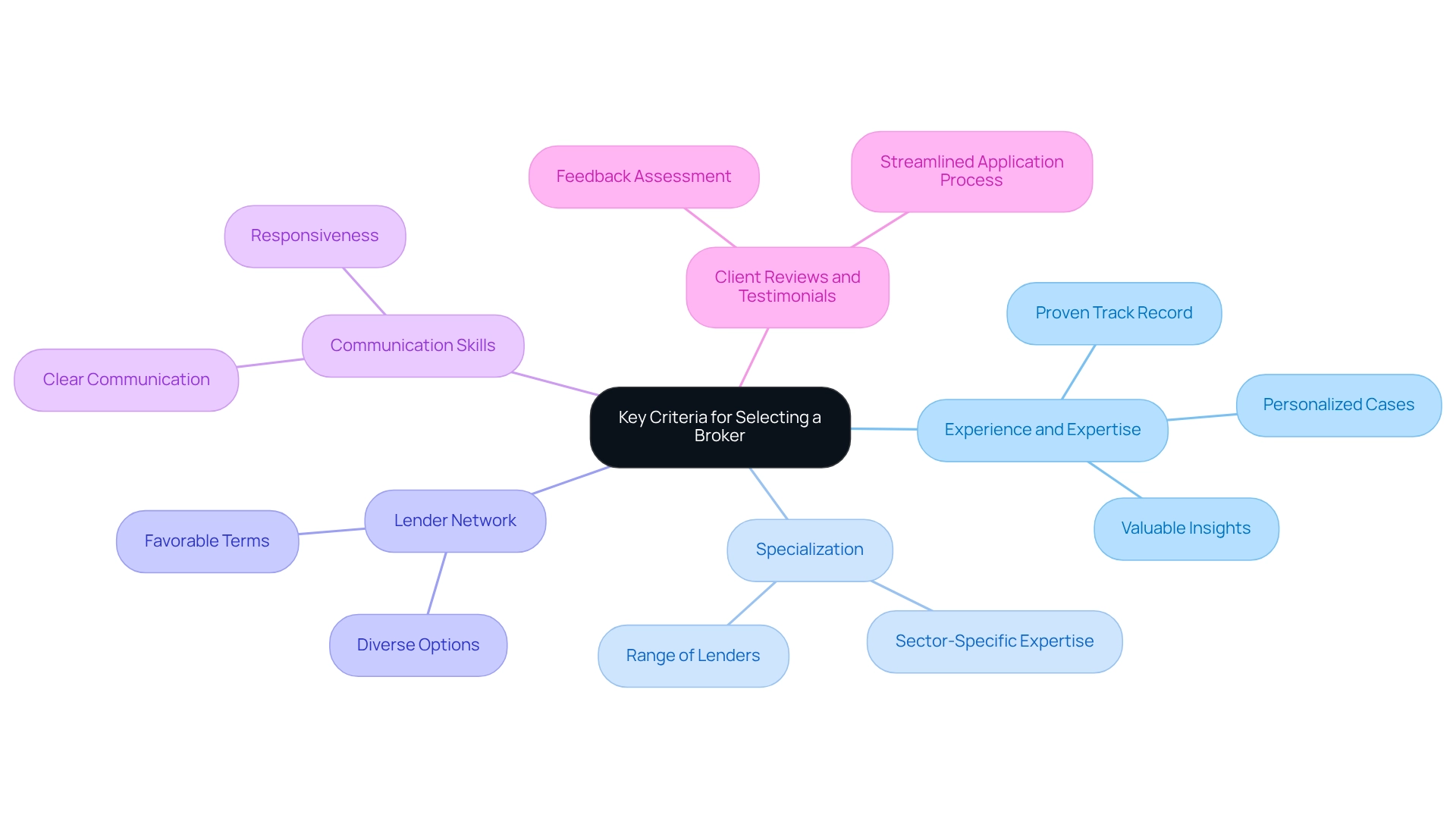

Identify Key Criteria for Selecting a Broker

When selecting business loan brokers near me, it is crucial to evaluate several key factors to ensure you find the right partner for your financial needs.

-

Experience and Expertise: Opt for brokers with a proven track record in financing. Their extensive experience can offer valuable insights into the most suitable financing options available, significantly influencing your funding success. Finance Story specializes in crafting refined and highly personalized cases to present to banks, ensuring that your proposal aligns with the increasingly elevated expectations for securing funds.

-

Specialization: Some agents focus on specific sectors or types of loans. It’s vital to choose business loan brokers near me whose expertise corresponds with your business sector, as this can enhance their ability to address your unique requirements. For instance, Finance Story boasts a comprehensive range of lenders to accommodate various situations, whether you are seeking to acquire a warehouse, retail space, factory, or hospitality venture.

-

Lender Network: An intermediary with a diverse network of lenders can offer you a broader selection of options and potentially more favorable terms. Finance Story provides access to a complete suite of lenders, including high street banks and innovative private lending panels, making it easier to find business loan brokers near me and increasing your chances of securing the best deal.

-

Communication Skills: Select an agent who demonstrates clear communication and responsiveness. Effective communication is essential for navigating the complexities of the financing process, ensuring that your needs are understood and addressed in a timely manner.

-

Client Reviews and Testimonials: Examine feedback from previous clients to assess the firm's reliability and effectiveness. Positive testimonials often reflect a financial professional's ability to streamline the application process and enhance the likelihood of obtaining the right financial solution. As Yvonne McKeown noted, intermediaries connect SMEs and financial providers, simplifying the application journey. Furthermore, consider the effectiveness of secured financing as a resource for businesses in need of capital for growth, equipment acquisition, or cash flow management. By focusing on these criteria, you can make an informed decision when selecting a financing intermediary, ultimately reducing stress and uncertainty in your funding journey.

Explore Local Options for Business Loan Brokers

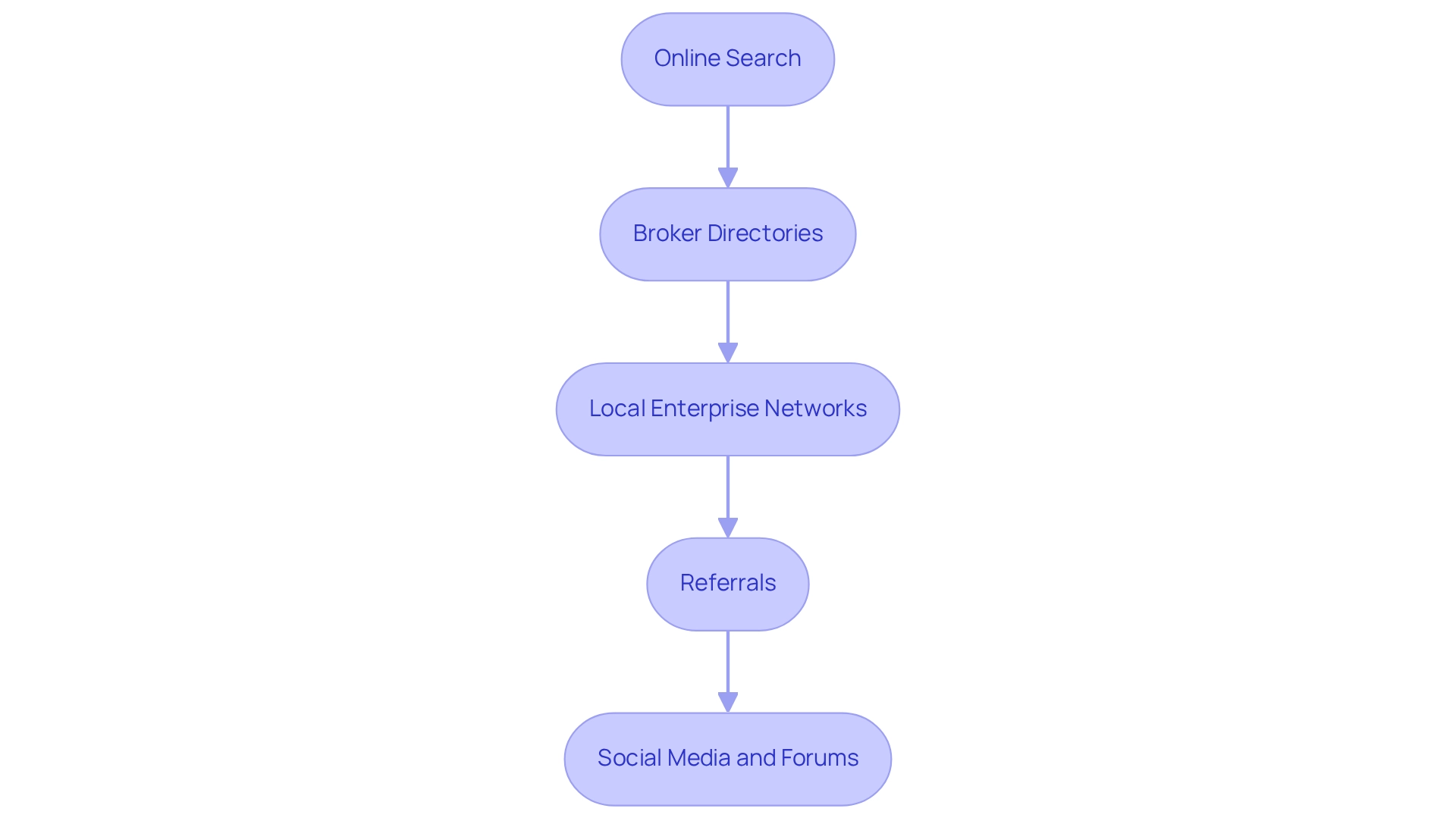

To effectively locate business loan brokers in your vicinity, consider the following steps:

- Online Search: Utilize search engines to find business loan consultants in your area. Incorporating your city or region in the search query will produce more localized results, facilitating the identification of agents who understand your market.

- Broker Directories: Explore resources like the Mortgage and Finance Association of Australia (MFAA), which provides listings of accredited financial agents. These directories enable you to filter by location and specialization, ensuring you find agents tailored to your specific needs.

- Local Enterprise Networks: Connect with local enterprise associations or chambers of commerce. These organizations frequently keep lists of suggested agents who have a proven track record in your community.

- Referrals: Seek recommendations from fellow entrepreneurs. Personal recommendations can guide you to reliable agents who have effectively helped others in your region, offering reassurance in your decision-making process.

- Social Media and Forums: Utilize platforms such as LinkedIn or local trade forums to collect insights and evaluations about agents in your area. Engaging with these communities can assist you in recognizing agents with strong reputations and positive client experiences.

As small enterprises constitute approximately 97% of all businesses in Australia, locating a local intermediary is essential for navigating the financial landscape effectively. Finance Story, a Melbourne-based boutique mortgage brokerage, excels in creating tailored funding solutions that cater to both commercial and residential needs, including refinancing options for various property types such as warehouses, retail premises, factories, and hospitality ventures. Their expertise in developing polished loan proposals ensures that you receive the best possible support in securing financing. According to Steve Sampson, CEO, "2025 is shaping up to be a stellar year for commercial finance, and we are ready to assist our agents in seizing the opportunity and expanding their market share." This emphasizes the significance of interacting with agents who are knowledgeable about current market trends.

Furthermore, consider the insights from the case study titled "Move Forward with Technology," which highlights how mortgage professionals are encouraged to adopt innovative tools and platforms to enhance their operations and client experiences. By embracing technology, firms like Finance Story can streamline operations, enhance service delivery, and sustain competitiveness in the market.

By following these steps, you can navigate the landscape of local financial service providers effectively, ensuring you find the right partner to support your monetary needs.

Evaluate Brokers Based on Expertise and Client Reviews

To effectively evaluate potential business loan brokers near me, consider the following key factors:

- Check Qualifications: Verify that the agent is licensed and holds relevant certifications. This not only demonstrates professionalism but also guarantees adherence to industry standards, which is vital for obtaining favorable financing terms. Recognizing that invoice financing may require 3-6 weeks due to additional compliance guidelines highlights the intricacies involved in securing loans and underscores the importance of collaborating with skilled professionals like Finance Story, who focus on developing refined and tailored business cases for banks.

- Review Client Testimonials: Explore feedback on platforms like Google, Trustpilot, or the firm's website. Positive feedback from prior clients frequently signifies trustworthiness and efficiency, offering insight into the agent's history. Finance Story's clients have effectively managed the funding process, showcasing the agent's capacity to address various financing requirements.

- Ask for Case Studies: Request specific examples of how the financial advisor has successfully assisted other businesses in securing loans. For instance, the case study titled 'Adapting to Market Changes in 2025' illustrates how agents can navigate challenges in the industry, showcasing their problem-solving abilities and expertise in complex financial situations, akin to the customized solutions provided by Finance Story for commercial property investments.

- Assess Communication Style: During initial consultations, observe how the agent communicates. An effective intermediary should simplify intricate financial concepts, ensuring you fully grasp your options and the implications of your decisions. As Anja Pannek, CEO of the Mortgage & Finance Association of Australia, notes, the industry is striving to enhance diversity and inclusion, which can also influence how intermediaries communicate and connect with clients.

- Compare Fees and Services: Gain a clear understanding of the agent's fee structure and the services included. This will help you determine if their offerings align with your budget and specific financial needs. It’s important to mention that Finance Story provides access to a comprehensive range of lenders, including business loan brokers near me, high street banks, and private lending panels, assisting enterprises in navigating the application process effectively and maximizing approval likelihood for various types of commercial properties, such as warehouses, retail locations, factories, and hospitality ventures.

By concentrating on these factors, you can make a more informed choice when selecting a financing intermediary, ultimately improving your chances of obtaining the best funding options available.

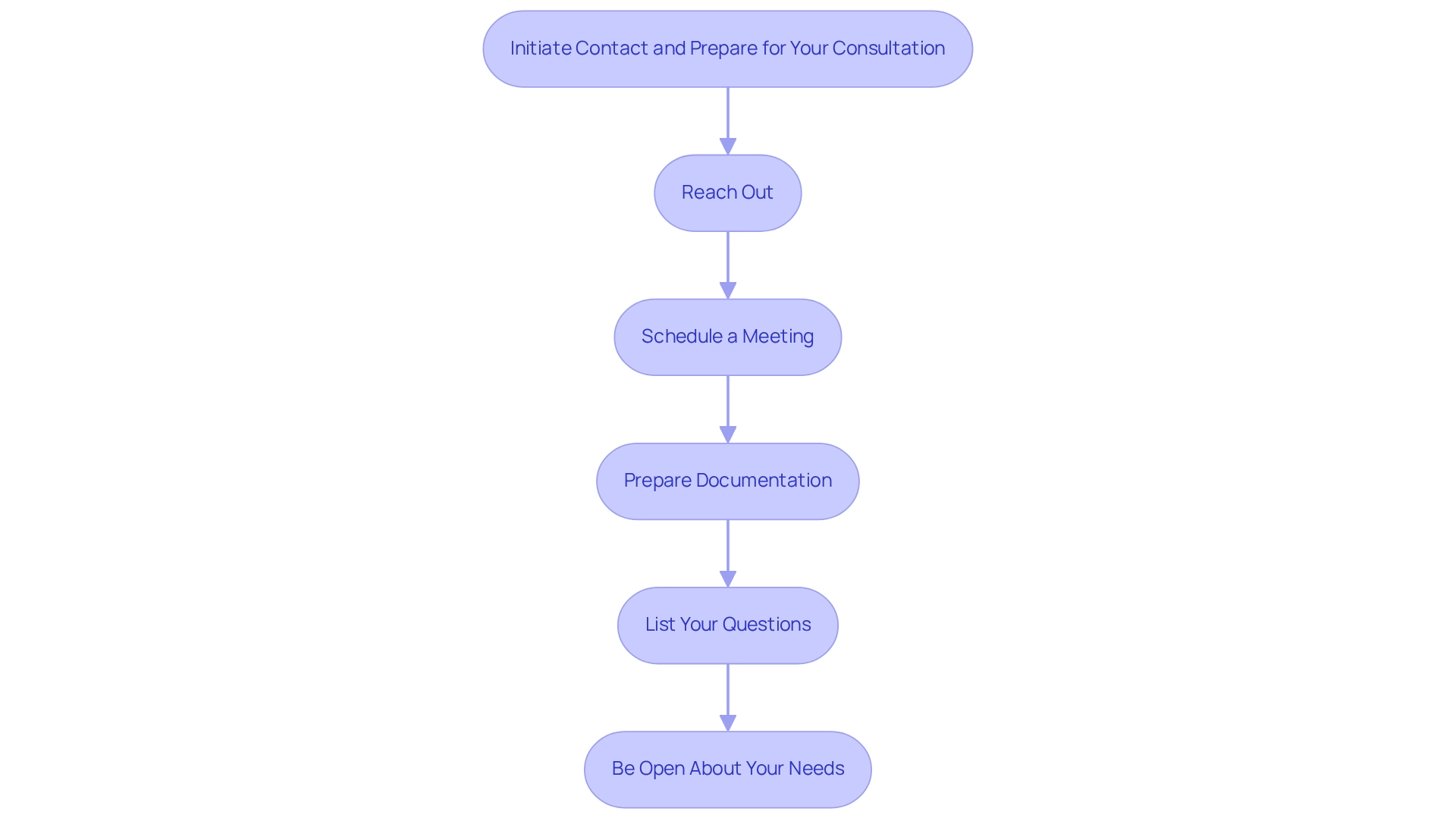

Initiate Contact and Prepare for Your Consultation

To effectively engage with potential business loan brokers, follow these essential steps to initiate contact and prepare for your consultation:

- Reach Out: Begin by contacting brokers through phone or email. Introduce yourself and succinctly outline your requirements to set the stage for a productive conversation.

- Schedule a Meeting: Arrange a consultation, whether in-person or virtually, to explore your funding needs further. This meeting is crucial for establishing rapport and understanding your options. At Finance Story, you can book a free personalized 30-minute meeting with Shane Duffy, Head of Funding Solutions, to discuss your specific needs and goals.

- Prepare Documentation: Compile relevant financial documents, including your business plan, financial statements, and tax returns. Some lenders may request a detailed cash flow forecast for the next 6–12 months, so be ready to provide this information. It's important to note that documentation requirements can vary significantly depending on the lender and the type of financing sought. Grasping these differences will assist you in customizing your documentation efforts and enhancing your chances of approval.

- List Your Questions: Create a list of questions to guide your discussion during the consultation. Ask about the agent's experience with companies like yours, the kinds of loans they suggest, and their fee arrangement. This will help you gauge their expertise and suitability for your needs.

- Be Open About Your Needs: Clearly articulate your funding goals and any challenges you encounter. Transparency is key; it allows the broker to tailor their advice and identify the best solutions for your unique circumstances. Finance Story specializes in crafting refined and highly personalized cases to present to lenders, ensuring you have the best opportunity for obtaining the appropriate financing.

As one small business owner remarked, "We likely wouldn’t still exist if it weren't for the funding and assistance we received from Bizcap." This emphasizes the significance of effective communication with intermediaries in obtaining the necessary support. By following these steps, you can optimize your chances of a successful consultation and ensure that you receive the most relevant and effective guidance from your loan broker. Finance Story is recognized for its professionalism and deep understanding of the finance sector, assisting clients in achieving their financial goals, making it a trusted partner in your financing journey.

Conclusion

The significance of business loan brokers in facilitating access to financing for entrepreneurs is paramount. Acting as intermediaries, they effectively bridge the gap between small business owners and lenders, offering invaluable expertise and tailored solutions to navigate the intricate financial landscape. Given the increasing challenges posed by stringent lending criteria, brokers have become essential allies for businesses aiming to secure favorable loan terms and foster growth.

Choosing the right broker necessitates careful consideration of several key criteria, including:

- Experience

- Specialization

- Communication skills

By evaluating these factors, entrepreneurs can significantly enhance their chances of finding a broker who aligns with their specific needs and can effectively advocate on their behalf. Furthermore, leveraging local resources such as broker directories and referrals from fellow business owners can streamline the search process, leading to trustworthy partnerships.

Engaging with brokers requires preparation and transparency. By compiling relevant documentation and clearly articulating financing goals, business owners can foster productive consultations that culminate in informed decisions. Brokers like Finance Story exemplify the value of personalized service and industry knowledge, empowering clients to navigate the financing process with confidence.

Ultimately, the right business loan broker can be pivotal in securing the funding necessary for business stability and growth. As the financial landscape continues to evolve, entrepreneurs must prioritize finding a trusted partner who can help them thrive in an increasingly competitive market.