Overview

This article presents a robust five-step process for investing in commercial property in Australia. It underscores the necessity of grasping the fundamentals, ensuring financial readiness, evaluating potential properties, exploring financing avenues, and conducting thorough due diligence. Each step is enriched with critical insights, highlighting the importance of:

- Net operating income

- Comprehensive market research

- Legal and financial assessments to secure a successful investment outcome

Introduction

Navigating the world of commercial property investment can feel overwhelming; however, it presents lucrative opportunities for those ready to learn the ropes. With a multitude of factors to consider—from understanding essential financial metrics like Net Operating Income and Capitalization Rates to evaluating property conditions and tenant quality—investors must arm themselves with crucial knowledge. As the market evolves, strategic financial planning and thorough market research become vital components in identifying profitable investments.

This guide explores the critical steps necessary to embark on a successful commercial property journey, ensuring investors are well-prepared to make informed decisions that align with their financial goals.

Understand the Basics of Commercial Property Investment

Before embarking on how to invest in commercial property Australia, it is crucial to grasp its fundamental aspects. Commercial real estate encompasses spaces designated for business purposes, including office buildings, retail areas, and industrial facilities. Familiarizing yourself with key terms is vital:

- Net Operating Income (NOI): This figure represents the income generated from the property after deducting operating expenses, serving as a critical indicator of profitability.

- Capitalization Rate (Cap Rate): This metric estimates the return on capital by dividing NOI by the asset's value. Understanding cap rates is particularly crucial, as they help investors identify undervalued or overvalued assets, shaping strategic financial decisions.

- Lease Terms: Comprehending the duration and conditions of leases is essential, as they can significantly influence your asset's profitability.

In 2025, the average cap rates for business properties in Australia are expected to reflect the market's dynamic nature, with effective utilization of cap rates being vital for success. By mastering these concepts, you will be better positioned to evaluate potential opportunities and make informed decisions about how to invest in commercial property Australia in the ever-evolving landscape of commercial real estate. Furthermore, collaborating with Finance Story can enhance your funding strategy, as they specialize in developing refined and customized business cases to secure the appropriate loans tailored to your needs. As Daniel Liberman, an auctioneer, remarked, 'We are happy, the tenants are happy, and the whole process was made simple.' This underscores the positive experiences that can arise from a solid understanding of these foundational concepts.

Prepare Financially and Conduct Market Research

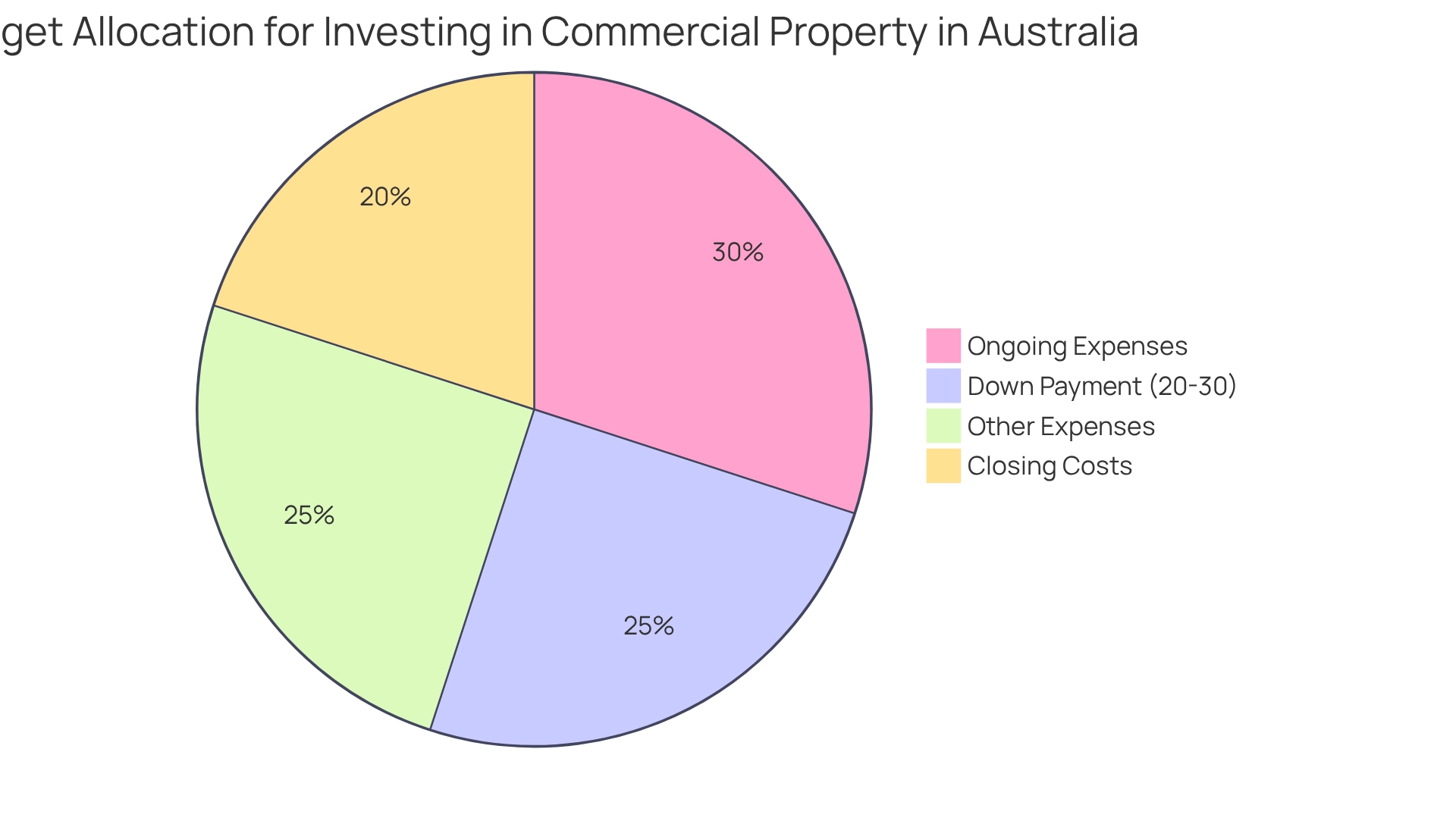

Begin by evaluating your financial landscape. Determine the capital you can allocate for investment and assess your financing needs. Establish a comprehensive budget that encompasses:

- Down Payment: Generally, expect to allocate 20-30% of the property's purchase price.

- Closing Costs: Include fees associated with the transaction, such as legal expenses and inspections of the real estate.

- Ongoing Expenses: Include costs for real estate management, maintenance, and insurance.

After completing your financial assessment, conduct thorough market research on how to invest in commercial property Australia. Examine local market dynamics, asset valuations, and rental yields. Utilize resources such as real estate platforms, regional market reports, and connections with industry experts to gather relevant data. For instance, Darwin currently boasts the highest rental yields at 6.86%, with Melbourne and Perth following at 5.60% and 5.27%, respectively. A strong comprehension of the market environment will enable you to learn how to invest in commercial property Australia by identifying lucrative investment prospects and preventing overpaying for real estate.

Evaluate and Select Suitable Commercial Properties

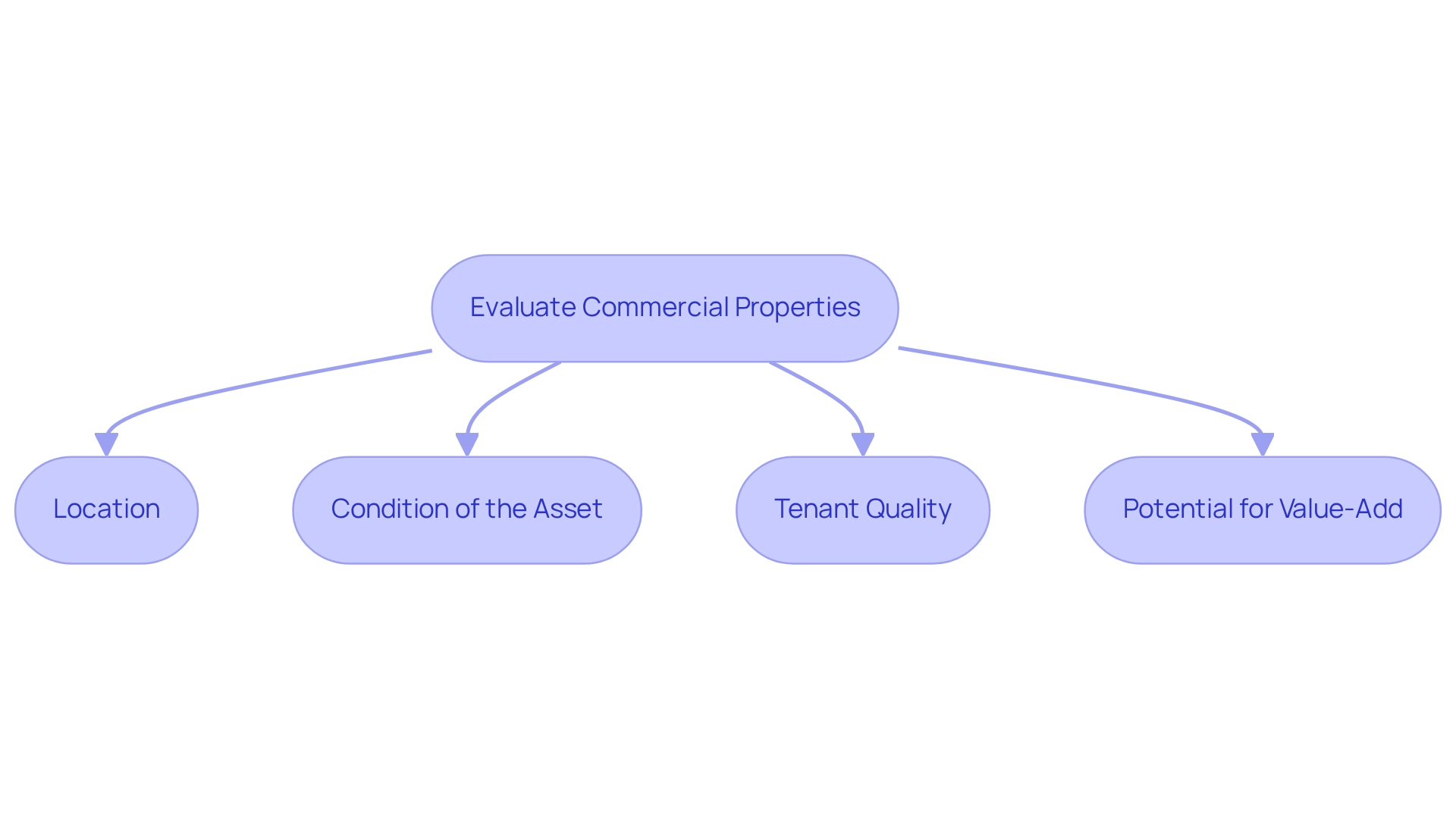

When evaluating commercial properties, several key factors should guide your decision-making process:

- Location: The significance of location cannot be overstated. Properties situated in high-demand areas tend to yield superior returns. Prioritize locations with easy access to transport links, essential amenities, and neighborhoods that are experiencing growth. For instance, Newman in Western Australia boasts a remarkable rental return of 10.83%, highlighting the potential of strategically chosen locations.

- Condition of the Asset: A thorough assessment of the physical state of the asset is crucial. Engaging a professional inspector can help uncover any underlying issues that may lead to unexpected costs down the line. Understanding the average condition ratings for commercial real estate in Australia is essential for learning how to invest in commercial property Australia, as it provides valuable context for your assessment.

- Tenant Quality: Investigate the current tenants and their lease agreements. Reliable tenants contribute to stable income streams, making it essential to assess their financial health and lease terms. A robust tenant profile can greatly improve the appeal of a real estate asset.

- Potential for Value-Add: Identify assets that offer opportunities for enhancement or repositioning. This could involve renovations, improved management practices, or other enhancements that can increase the asset's value over time. A clearly outlined strategy and a disciplined mentality are crucial for maximizing potential risk-adjusted returns, as demonstrated by successful case studies in real estate.

After evaluating these elements, compile a shortlist of assets that correspond with your criteria for investment. Conducting site visits will provide a clearer understanding of each option, allowing you to make informed decisions that align with your financial objectives.

Explore Financing Options and Secure Funding

Explore Financing Options Available for Commercial Property Investment:

- Traditional Bank Loans: These loans are the most prevalent choice for investors, typically offering competitive interest rates. To qualify, applicants must prepare comprehensive financial statements and a robust business plan, showcasing their capability to manage the funding effectively.

- Business Mortgages: Specifically designed for acquiring business assets, these loans often require a larger down payment compared to residential mortgages. However, they can provide favorable conditions that align with the cash flow of the asset.

- Private Lenders: For those who may not qualify for traditional financing, private lenders offer a viable alternative. Although they frequently provide more flexible terms, it's crucial to recognize that these loans typically come with higher interest rates, reflecting the increased risk. Finance Story can connect you with innovative private lending panels to identify the right fit.

- Self-Managed Super Funds (SMSF): Utilizing an SMSF to invest in business real estate can yield significant tax advantages. This option enables investors to leverage their retirement savings while adhering to strict regulatory requirements. Finance Story offers expert advice on managing SMSF business real estate ventures to secure customized lending options.

Once you identify the best financing option for how to invest in commercial property Australia, gather the necessary documentation and submit your application. Be prepared for a thorough review process, and consider collaborating with Finance Story to enhance your loan proposal and improve your chances of approval. Reach out to us today to explore how we can assist you in securing the appropriate financing for your commercial property.

Conduct Due Diligence and Finalize the Purchase

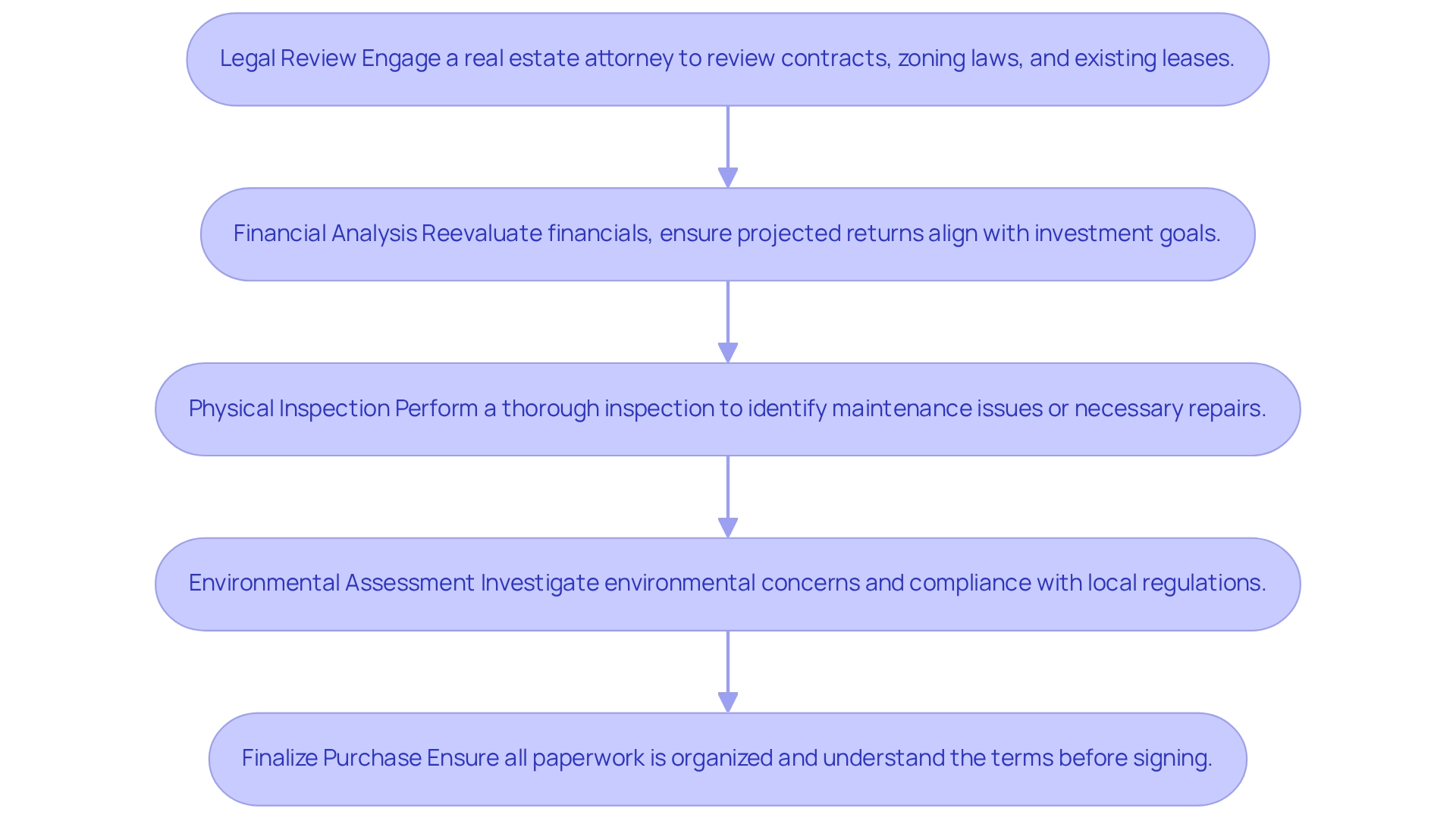

Before finalizing your purchase, conducting comprehensive due diligence is crucial to safeguard your investment.

- Legal Review: Engage a real estate attorney to meticulously review contracts, zoning laws, and existing leases. This step is essential to reveal any possible legal concerns that could affect your financial commitment.

- Financial Analysis: Reevaluate the asset's financials, including income statements and expense reports. Ensure that the projected returns align with your investment goals, utilizing benchmarks that reflect current market conditions. Furthermore, consider working with Finance Story to create a polished and individualized business case that can enhance your chances of securing the right business loan tailored to your needs, leveraging the full range of lenders available through us.

- Physical Inspection: Perform a thorough inspection of the property to identify any maintenance issues or necessary repairs. This proactive approach can prevent unexpected costs post-purchase.

- Environmental Assessment: Investigate any environmental concerns, such as contamination or compliance with local regulations. Understanding these factors is essential for long-term sustainability and legal compliance.

Once due diligence is complete and you are satisfied with the findings, proceed to finalize the purchase. Ensure all paperwork is meticulously organized and that you fully understand the terms of the sale before signing. This careful approach not only mitigates risks but also positions you for success in the commercial real estate market.

Conclusion

Successfully navigating the world of commercial property investment demands a solid understanding of fundamental concepts, thorough financial planning, and diligent market research. Grasping key metrics, such as Net Operating Income and Capitalization Rates, is essential for evaluating potential investments. Moreover, recognizing the importance of location, property condition, and tenant quality can significantly influence the profitability of an investment.

Financial preparation is paramount; establishing a comprehensive budget and exploring various financing options ensures that investors are well-equipped to secure suitable properties. Conducting meticulous due diligence before finalizing any purchase further safeguards investments by addressing potential legal, financial, and environmental concerns.

Ultimately, entering the commercial property market presents both a challenge and an opportunity. By arming oneself with knowledge and strategic insights, investors can make informed decisions that align with their financial goals. With the right preparation and resources—including expert guidance from professionals like Finance Story—the path to successful commercial property investment is not only attainable but can also lead to substantial financial rewards.