Overview

Acquisition finance in Australia plays a pivotal role for small business owners aiming to grow through acquisitions. This term specifically refers to the capital obtained for purchasing other companies or significant assets. Understanding the various funding options available—such as bank loans, equity financing, and mezzanine funding—is essential.

Furthermore, conducting thorough due diligence is crucial to navigate the complexities of securing acquisition finance effectively. By familiarizing themselves with these options, business owners can make informed decisions that drive their growth strategy.

Introduction

In the dynamic world of business, acquisition finance serves as a pivotal avenue for growth, particularly for small enterprises aiming to expand their operations and market presence.

As the landscape evolves, understanding the diverse financing options available becomes crucial for entrepreneurs eager to seize opportunities that can propel their businesses forward.

From traditional bank loans to innovative equity financing, the choices are varied and tailored to meet specific needs.

However, navigating the complexities of acquisition finance necessitates a strategic approach, encompassing thorough due diligence and awareness of legal considerations.

As small business owners in Australia increasingly recognize the potential of acquisitions, this guide explores the intricacies of acquisition finance, offering insights and practical steps to empower them on their journey toward successful growth.

What is Acquisition Finance?

Acquisition finance in Australia refers to the capital specifically obtained for the purpose of acquiring another company or significant assets. This funding is vital for companies aiming to expand operations, penetrate new markets, or strengthen their competitive position. As we look towards 2025, the landscape of procurement funding in Australia is characterized by a variety of financial tools, including loans, equity support, and alternative funding sources, all tailored to meet the unique needs associated with acquisition finance.

For small enterprise owners, understanding funding for acquisitions is crucial, as it directly influences their ability to seize growth opportunities through mergers. The importance of funding cannot be overstated; it serves as a catalyst for growth, enabling companies to leverage existing resources and capabilities to enhance their market presence.

Current statistics reveal that funding for small enterprises in Australia is increasingly recognized as an essential resource. In recent years, there has been a notable rise in the number of small enterprises utilizing financing to bolster their growth strategies. This trend underscores the growing awareness among small business owners of the strategic advantages that acquisitions can provide.

Moreover, Australia has ratified all ten International Labor Organization Fundamental Conventions, reflecting a regulatory environment that fosters equitable practices in commerce.

Key components of acquisition finance in Australia encompass thorough due diligence, valuation of the target company, and deal structuring to optimize financial outcomes. For example, when acquiring a freehold property venture, small entrepreneurs often need to explore financing options such as borrowing against commercial property. Typically, lenders allow a maximum loan-to-value ratio (LVR) of 70% for commercial properties, which means that for a property valued at $1 million, an enterprise could secure a loan of $700,000, necessitating a deposit of $300,000.

Furthermore, if the commercial aspect of the purchase is valued at $400,000, the total funds required would amount to $700,000, excluding additional expenses like legal fees and valuation costs. This financing frequently derives from equity in existing properties, emphasizing the importance of effectively leveraging property equity.

Small enterprises often face unique challenges in securing funding for acquisitions, yet with the right guidance and support, they can navigate these complexities successfully. As Michael Barr, Federal Reserve Vice Chair, noted, there are 'key broad and material changes to the original proposal' regarding financial strategies, highlighting the evolving nature of procurement funding and its implications for small business owners.

Professional insights stress that funding procurement transcends mere monetary exchange; it is a strategic decision that can significantly steer a company's direction. As industry leaders assert, "Acquisition funding is a vital facilitator of growth, enabling enterprises to expand and innovate in an increasingly competitive landscape."

Case studies illustrate successful funding examples in Australia, showcasing how small enterprises have adeptly utilized this capital to achieve remarkable growth. These real-world instances exemplify the transformative potential of funding in positioning small enterprises as formidable competitors in their respective markets.

In summary, acquisition finance in Australia is a crucial element for funding takeovers, essential for the growth of small companies. By grasping its components and leveraging available resources, small enterprise owners can strategically position themselves to capitalize on opportunities that drive their success. Finance Story's reputation for professionalism and comprehensive understanding of the financial sector further solidifies it as a trusted ally for small enterprises seeking funding for acquisitions.

Types of Acquisition Finance Available in Australia

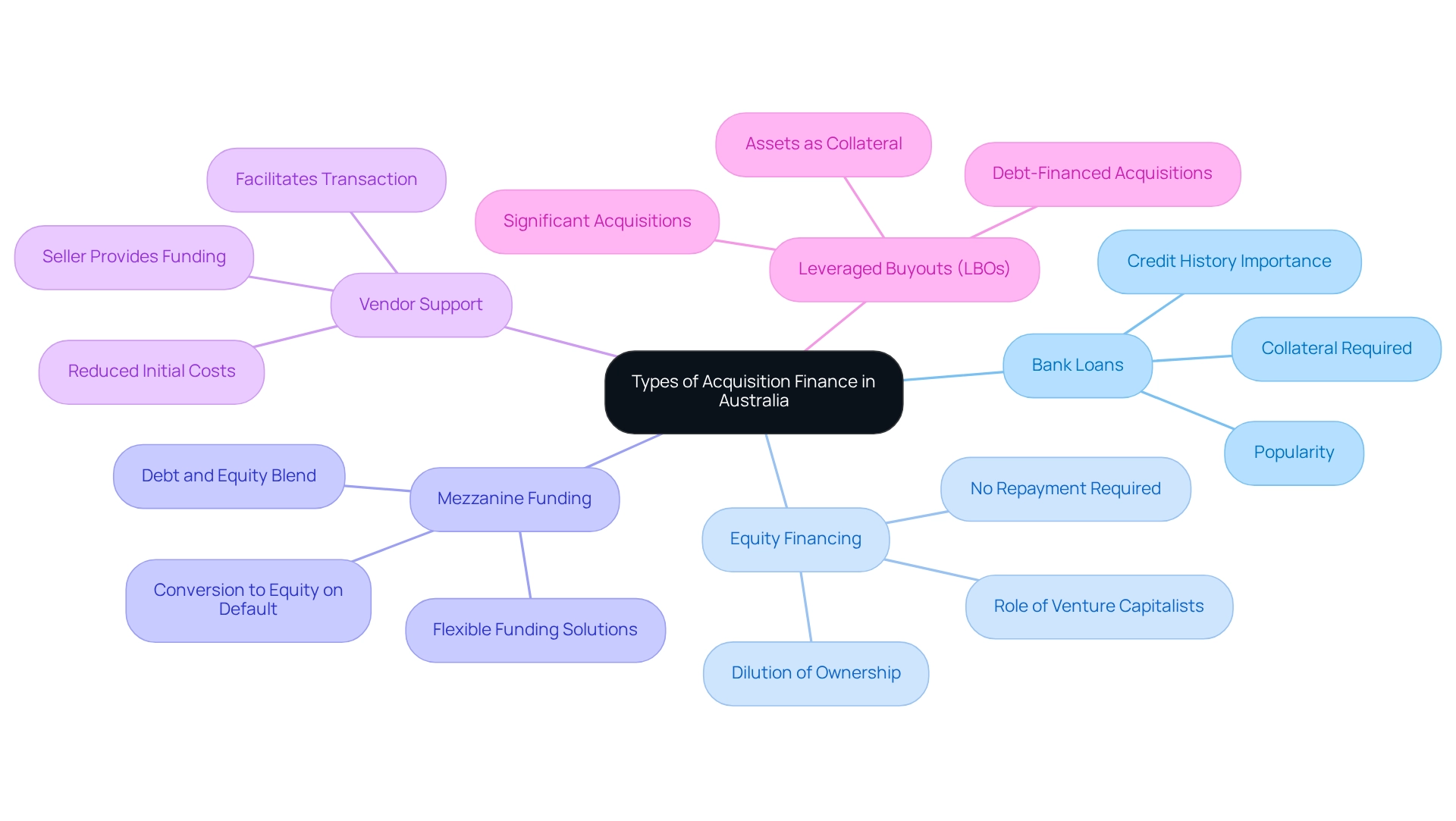

In Australia, small enterprise owners have access to a diverse array of funding options, each tailored to meet specific needs and circumstances. Understanding these options is essential for making informed financial decisions. The primary forms of acquisition finance include:

- Bank Loans: Conventional bank loans remain a popular choice, with approximately 60% of small enterprises utilizing them for acquisitions. These loans typically necessitate collateral and a robust credit history, providing lenders with security against the borrowed amount.

- Equity Financing: This method entails raising capital by selling shares of the company. While it may dilute ownership, equity funding does not require repayment, making it an attractive option for businesses aiming to maintain cash flow. Notably, venture capitalists and private equity firms play a significant role in acquisition finance in Australia, investing in early-stage companies for substantial returns.

- Mezzanine Funding: A blend of debt and equity, mezzanine funding allows lenders to convert their loans into equity if the borrower defaults. This option is particularly appealing for companies seeking flexible funding solutions that can adapt to their growth trajectories.

- Vendor Support: In vendor support arrangements, the seller provides funding to the buyer, facilitating a smoother transaction process. This can benefit both parties, as it often leads to quicker deal completions and reduced initial costs.

- Leveraged Buyouts (LBOs): LBOs are acquisitions primarily financed through debt, where the assets of the acquired company serve as collateral. This strategy empowers companies to pursue significant acquisitions without substantial upfront capital.

For leasehold enterprises, financing options are more limited, as they lack a commercial property element to secure loans against. In such cases, small enterprise owners may need to rely on cash savings or the equity in any owned property. For instance, if a business owner possesses a home valued at $1.3 million with $300,000 owed, they could potentially access $740,000 in equity to support their acquisition.

Conversely, when acquiring a freehold property enterprise, lenders typically permit borrowing against the commercial property but not the enterprise itself unless it has considerable assets. For example, if a commercial property is valued at $1 million and the enterprise at $400,000, the total funds required would amount to $700,000, which could be sourced from the equity in owned properties, factoring in the lender's maximum loan-to-value ratio (LVR) of 70% for commercial properties.

Recent insights from financial experts indicate that decisions regarding acquisition finance in Australia—encompassing bank loans, equity options, and mezzanine funding—should align with an organization's operational objectives and risk tolerance. Companies should evaluate their creditworthiness, repayment capacity, and long-term profitability before selecting a funding option. As highlighted in a case study, these considerations aid businesses in aligning their funding strategies with their operational goals and risk appetite.

Furthermore, data suggests that by 2025, the acquisition finance landscape in Australia is evolving, with a notable increase in the use of equity funding among small enterprises, driven by the growing involvement of venture capitalists and private equity firms in early-stage investments. This trend underscores the importance of understanding the implications of each financing type, along with the potential for substantial returns on investment.

By carefully assessing these various funding options, small entrepreneurs can strategically position themselves to secure the necessary capital for successful acquisitions. As marketing specialist Suzy Strutner observes, companies typically maintain a master budget and may have separate sub-documents addressing cash flow and operations; budgets can be static or flexible. This comprehension is vital for financial strategy when considering acquisition funding.

The Acquisition Finance Process: Step-by-Step Guide

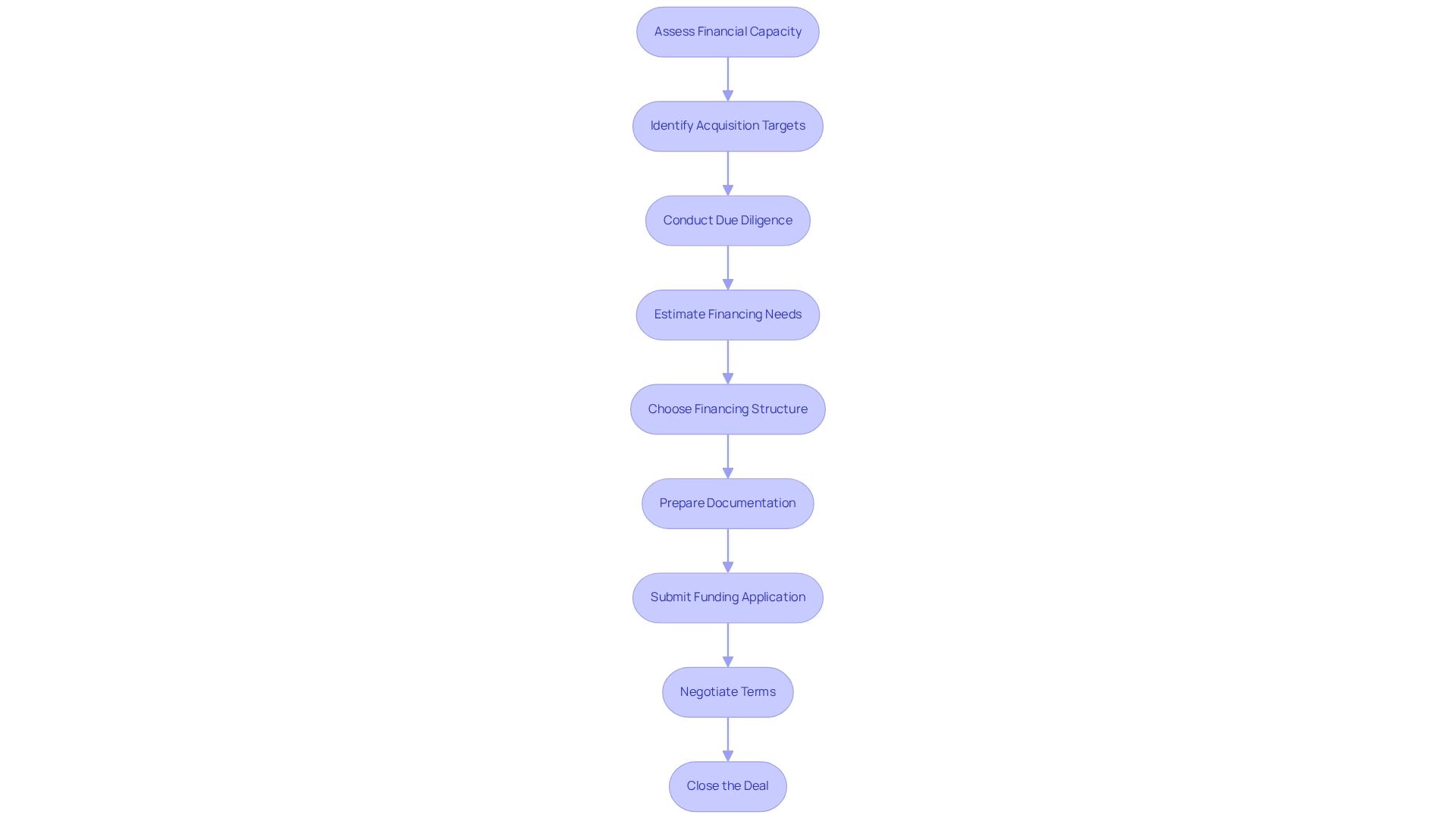

The acquisition finance process in Australia is a vital pathway for small enterprise owners aiming to grow through purchases, particularly when dealing with leasehold properties or entities without a physical structure. It typically unfolds in a structured manner:

-

Assess Financial Capacity: Begin by evaluating your current financial situation. This involves analyzing cash reserves, existing debts, and overall financial health to determine how much you can invest in an acquisition. As Sid Roche emphasizes, understanding your financial capacity is essential for making informed decisions and positioning yourself favorably in negotiations with potential lenders. For leasehold enterprises, this may involve considering cash savings or leveraging equity from any owned properties, as there won't be a commercial property component to borrow against. For instance, if your residence is valued at $1.3M with $300k owed, borrowing up to 80% LVR would yield $740k in equity available for acquiring a venture, to which you would then add any cash savings.

-

Identify Acquisition Targets: Conduct thorough research to shortlist potential enterprises or assets that align with your strategic goals. This step is crucial for ensuring that the purchase will add value to your existing operations.

-

Conduct Due Diligence: Perform an in-depth analysis of the target company. This involves reviewing financial statements, operational processes, and market position to understand its financial health and any associated risks.

-

Estimate Financing Needs: Calculate the total cost of the purchase, which should encompass the purchase price, transaction fees, and any additional working capital required to support the business post-acquisition. If you own a property, for example, you might have significant equity available to support this financing.

-

Choose Financing Structure: Decide on the most suitable type of acquisition finance. Options may consist of debt funding, equity funding, or a blend of both, depending on your financial strategy and risk tolerance. Significantly, the private non-financial corporations' debt-to-equity ratio was 0.74 in March 2009, indicating a considerable level of financial leverage that small enterprises should consider when structuring their financing.

-

Prepare Documentation: Collect all essential paperwork to support your funding application. This typically includes financial statements, business plans, and legal agreements that outline the terms of the acquisition.

-

Submit Funding Application: Approach lenders or investors with your funding proposal. Ensure that your application is well-prepared and includes all supporting documents to enhance your chances of approval.

-

Negotiate Terms: Engage in discussions with lenders to finalize the terms of the financing agreement. This includes negotiating interest rates, repayment schedules, and any covenants that may be attached to the financing.

-

Close the Deal: Once terms are agreed upon, finalize the purchase and secure the necessary funds to complete the transaction. This step signifies the peak of your efforts and the start of a new chapter for your enterprise.

In Australia, the average duration required for small enterprises to obtain funding can differ, but it generally spans from several weeks to a few months, based on the complexity of the arrangement and the responsiveness of lenders. Understanding your financial capacity before seeking acquisition finance in Australia is crucial; it not only assists in assessing the viability of the purchase but also places you advantageously in discussions with potential lenders.

Real-life instances demonstrate the significance of each phase in the process. For example, a modest enterprise owner who carefully evaluated their financial capabilities and performed extensive due diligence was able to secure advantageous funding conditions, ultimately resulting in a successful takeover that greatly enhanced their market presence. Additionally, recent trends indicate a preference for equity assets over fixed income assets, as seen in the latest report on pension funds' financial assets, which increased by 2.3% due to significant investments in equities.

By adhering to this organized method, small enterprise owners can navigate the intricacies of funding with increased assurance and clarity.

Challenges in Securing Acquisition Finance and How to Overcome Them

Securing acquisition finance presents significant challenges for small businesses, including:

- Limited Credit History: Many small businesses struggle to obtain financing due to a lack of established credit history. To overcome this hurdle, it is crucial to build a robust credit profile by responsibly managing existing debts and ensuring timely payments. As Sid Roche notes, addressing credit history issues is essential for securing acquisition finance in Australia. This proactive strategy enhances an enterprise's credibility in the eyes of potential lenders.

- Insufficient Documentation: Incomplete or poorly prepared documentation can severely hinder financing applications. It is essential to ensure that all financial statements, operational plans, and supporting documents are thorough, accurate, and well-organized. This not only simplifies the application process but also instills confidence in lenders regarding the enterprise's viability.

- High Debt Levels: Elevated debt may discourage lenders from granting further funding. Small enterprises should focus on reducing their debt levels prior to seeking new loans. This may involve restructuring existing debts or implementing cost-cutting measures to improve overall financial health.

- Market Volatility: Economic fluctuations can significantly influence lender confidence and the availability of funding. Staying informed about current market conditions and trends is vital. Small enterprise owners should be prepared to adjust their financing approaches in response to economic shifts, ensuring they remain competitive and resilient. Currently, profit margins for most small enterprises are near their pre-pandemic averages, indicating a challenging financial environment.

- Regulatory Hurdles: Navigating the complex landscape of legal and regulatory requirements can be daunting. Involving legal and financial consultants can assist small enterprises in efficiently managing compliance matters, ensuring that all required regulations are met and minimizing the likelihood of application delays.

Statistics indicate that the initial three to five years are particularly crucial for small enterprises, with success rates increasing as they gain access to funding. During the pandemic, many small enterprises built substantial cash reserves, which have since returned to pre-pandemic levels, underscoring the importance of sustaining financial resilience. The case study titled 'Resilience of Small Enterprises Through Cash Holdings' illustrates how these cash buffers have impacted small enterprises during and after the pandemic, highlighting the need for ongoing financial management.

Furthermore, for companies operating under leasehold agreements, funding options may be limited to cash reserves or equity from owned assets. Without commercial property to leverage, these enterprises face significant constraints in their financing options. For example, if an owner has a residence valued at $1.3M with $300k owed, they could potentially access $740k in equity to support company acquisition, supplemented by any cash savings.

Expert insights reveal that while the journey to secure financing can be fraught with challenges, understanding these obstacles and implementing effective strategies can lead to successful outcomes. By focusing on establishing a solid credit history and compiling comprehensive documentation, small enterprise owners can enhance their prospects of obtaining the necessary acquisition finance in Australia to support their growth and purchasing objectives. Additionally, recent policies supporting SMEs, including incentives for SME lending and government support programs, create a more favorable financing environment for small businesses.

The Role of Due Diligence in Acquisition Finance

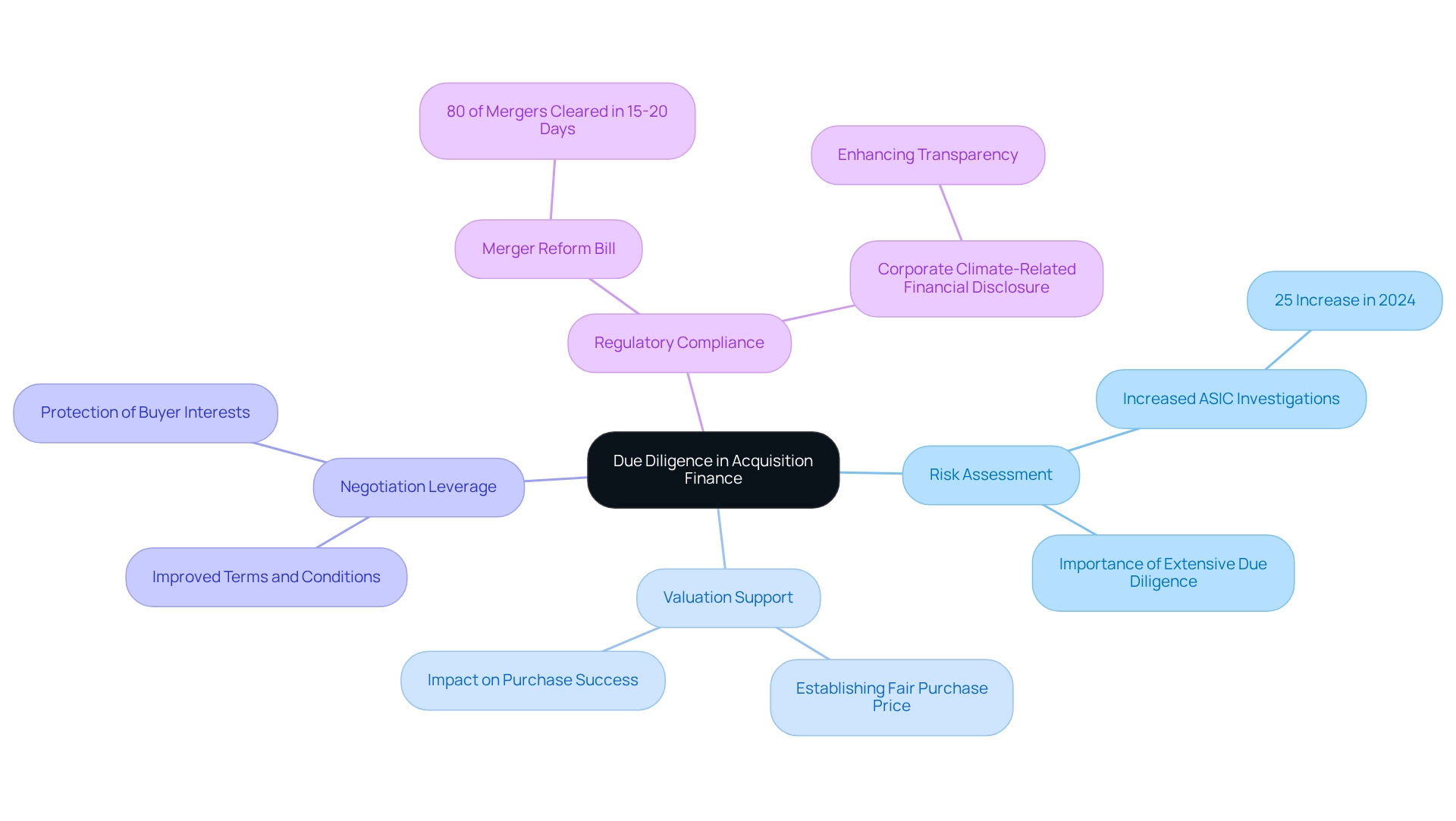

Due diligence is a vital process that involves a thorough investigation into a target company's operations, financial health, and legal compliance. This thorough evaluation serves multiple important functions in the context of procurement funding:

- Risk Assessment: It plays a crucial role in recognizing potential risks related to the procurement, including financial, operational, and legal matters. In 2025, the landscape of acquisition finance in Australia emphasizes the need for meticulous risk assessment, especially as ASIC's investigations have surged by 25% compared to previous years, highlighting the increasing scrutiny on financial transactions. This trend underscores the importance for small enterprise owners to perform extensive due diligence to effectively reduce risks.

- Valuation Support: Due diligence offers essential insights that assist in establishing a fair purchase price based on the target's financial performance and market position. Financial analysts emphasize that precise valuation is essential, as it directly impacts the success of the purchase.

- Negotiation Leverage: Equipped with detailed information from due diligence, buyers can negotiate improved terms and conditions in the agreement. This leverage is essential in ensuring that the buyer's interests are protected throughout the transaction.

- Regulatory Compliance: Ensuring adherence to all relevant laws and regulations is another key aspect of due diligence. This process reduces the risk of legal complications post-acquisition, which is increasingly important given the recent introduction of the merger reform bill. As ACCC Chair Gina Cass-Gottlieb pointed out, this bill seeks for around 80 percent of mergers to be approved by the ACCC within 15 to 20 working days, highlighting the necessity for comprehensive due diligence to manage these regulatory changes efficiently.

The significance of due diligence in purchasing capital cannot be overstated. Statistics suggest that the typical expenses related to due diligence in acquisition finance in Australia can vary greatly, frequently mirroring the complexity of the transaction. For instance, successful due diligence examples in corporate takeovers demonstrate how thorough investigations can lead to more favorable outcomes and reduced risks.

Expert opinions consistently highlight that due diligence is not merely a formality but a critical component of the funding process. By investing time and resources into this investigation, small enterprise owners can make informed choices that significantly reduce risks related to their purchases. Case studies on the role of due diligence further illustrate its impact, showcasing how companies that prioritize this process often achieve better financial and operational results post-acquisition.

Additionally, the recent policy designs for corporate climate-related financial disclosure requirements underscore the importance of transparency and compliance in the due diligence process, further reinforcing its necessity in today's financial landscape.

Legal Considerations in Acquisition Finance

When participating in funding finance, small enterprises must navigate a range of critical legal factors to protect their interests and ensure adherence to Australian regulations:

- Contractual Obligations: Understanding the terms of financing agreements is essential. This includes repayment schedules, interest rates, and covenants. Poorly managed contracts can lead to legal disputes, financial losses, and reputational harm, making it vital to approach these agreements with diligence. A comprehensive understanding of legal frameworks is crucial for both individual ownership and the rights of marginalized communities.

- Regulatory Compliance: Adherence to laws governing mergers and acquisitions is paramount. Compliance with the Corporations Act and competition laws is designed to maintain fair market practices. As the regulatory environment evolves, owners must remain aware of any modifications that could affect their transactions. Notably, criminal confiscation laws in the Northern Territory and Western Australia have faced criticism for being excessive, impacting individuals' rights to possess property even if it was not linked to criminal activity.

- Intellectual Property Rights: Acquiring intellectual property can significantly enhance a company's value. However, it is essential to evaluate the implications of such purchases and ensure the proper transfer of rights to prevent future disputes.

- Liabilities and Indemnities: Identifying potential liabilities associated with the target company is a critical step in the purchase process. Negotiating indemnities can provide protection against unforeseen issues that may arise post-acquisition, thereby mitigating risks.

- Confidentiality Agreements: Implementing confidentiality agreements is essential to protect sensitive information during negotiations and due diligence processes. This ensures that proprietary information remains secure and that trust is upheld between parties.

Comprehending these legal factors assists owners in navigating the intricacies of acquisition finance in Australia and enables informed choices that align with their strategic objectives. Furthermore, when evaluating funding alternatives, small enterprise owners should be mindful of the loan arrangements accessible for freehold property enterprises, such as borrowing against commercial real estate with a maximum loan-to-value ratio (LVR) of 70%. For example, if a commercial property is valued at $1M, the maximum loan amount would be $700K, requiring a deposit of $300K.

For leasehold enterprises, utilizing property equity and cash savings becomes crucial, especially when the operation runs without a physical building. This thorough method of acquisition finance in Australia ensures that entrepreneurs are well-prepared to handle their purchases efficiently. Additionally, a statistic indicating that 21% of participants were unsure about freedom of association underscores the need for clarity in legal compliance and contractual obligations, reinforcing the importance of diligence in these areas.

Financial Implications of Acquisition Finance

Acquisition funding encompasses several critical financial implications that small enterprise owners must carefully evaluate:

- Cost of Capital: A thorough understanding of the costs associated with various funding options, including interest rates and associated fees, is essential for effective budgeting. As of 2025, the average cost of capital for acquisition finance in Australia is anticipated to be approximately 6.5%, mirroring current market conditions, which can greatly affect financing choices.

- Impact on Cash Flow: It is crucial to evaluate how a purchase will influence cash flow, especially regarding debt servicing and operational expenses. This assessment aids in guaranteeing that the company sustains financial stability after the takeover, enabling ongoing investment in growth and operations.

- Return on Investment (ROI): Assessing the potential ROI from a takeover is essential for deciding if the investment corresponds with the company's strategic objectives. A well-calculated ROI can provide insights into the long-term benefits of the purchase, guiding decision-making processes.

- Tax Implications: Understanding the tax consequences of a purchase, including potential deductions and liabilities, is important for comprehensive financial planning. Small enterprise owners should contemplate how these implications can influence overall profitability and cash flow.

- Long-term Financial Strategy: It is crucial to evaluate how the purchase fits into the broader financial approach of the enterprise. This encompasses evaluating growth forecasts and market positioning to ensure that the purchase aligns with the corporation's long-term goals.

- Regulatory Considerations: The Australian Foreign Acquisitions and Takeovers Act 1975 governs foreign investments in Australian companies and assets. Understanding these regulations is crucial, as they categorize actions into significant actions, notifiable actions, and reviewable national security actions, each with specific approval requirements. Legal counsel is suggested to manage this intricate approval procedure, particularly regarding debt financing.

- Financing Options for Leasehold Enterprises: When obtaining a leasehold enterprise, small owners may lack a commercial property element to secure funding against. In such cases, utilizing cash savings or the equity in any owned property becomes essential. For instance, if a residence is valued at $1.3 million with $300,000 owed, borrowing up to 80% LVR could yield $740,000 in equity available for purchase, supplemented by any cash savings.

By thoroughly analyzing these financial implications, small enterprise owners can make informed decisions regarding acquisition finance in Australia, ultimately enhancing their ability to navigate the complexities of the financial landscape in the country. As noted by Finance Story, understanding these factors is crucial for effective financial strategies.

Why Engage Professional Help for Acquisition Finance?

Seeking expert assistance for funding opportunities presents a multitude of benefits that can significantly impact the success of small enterprises.

Financial consultants possess the expertise and knowledge essential for navigating acquisition finance in Australia. They provide entrepreneurs with the insights necessary to effectively maneuver through complex funding options. Their grasp of current market trends and lending criteria proves invaluable for making informed decisions. Shane, the Founder and Funding Specialist Director at Finance Story, brings extensive experience in commercial and technical growth, ensuring that clients receive tailored financial solutions that cater to their unique needs.

- Access to Networks: Established relationships with lenders enable financial consultants and brokers to facilitate connections that may not be available to business owners independently. This network enhances the likelihood of securing favorable terms and conditions for funding. Finance Story's access to a comprehensive portfolio of private and boutique commercial investors amplifies these opportunities, particularly in challenging circumstances.

- Risk Mitigation: Experts excel at identifying potential risks associated with funding acquisitions. They offer strategies to mitigate these risks, ensuring a smoother acquisition process and reducing the chances of unforeseen complications. Shane's background in high-level consultancy positions equips him with unique insights into the risks and rewards of various funding alternatives.

- Time Savings: By involving specialists, owners can concentrate on their core operations while experts manage the complexities of funding. This delegation allows for a more effective use of time and resources, ultimately benefiting the organization. Finance Story's customized mortgage service is designed to support clients throughout their funding journey, enabling them to focus on growth.

- Negotiation Support: Experienced advisors play a pivotal role in negotiating terms and conditions that align with the organization’s goals. Their negotiation expertise can lead to more favorable financing agreements, enhancing the overall financial health of the organization. Shane's extensive experience in improvement consulting positions him to craft persuasive cases for lenders, maximizing the chances of securing the best terms.

Statistics indicate that small enterprises typically retain a larger portion of their total assets as cash compared to larger firms, underscoring their challenges in securing external funding. This underscores the importance of expert support in navigating the complexities of acquisition finance in Australia. Furthermore, as Yanir Yakutiel, CEO of Lumi, remarked, "Continued RBA rate increases have put further pressure on house prices and development," emphasizing the current financial landscape's challenges.

In conclusion, expert assistance can significantly enhance the funding process, yielding better outcomes for small enterprise owners. Finance Story's professionalism and deep understanding of the financial sector further underscore the necessity of engaging specialists in this field. A case study involving Specialty Products illustrates this point: after collaborating with a consulting firm for procurement funding, they successfully implemented new strategies that improved their market presence and operational efficiency.

This example highlights the tangible advantages of expert advice in managing the complexities of obtaining funding. Additionally, clients such as Natasha B from VIC have expressed their satisfaction, stating, "I will certainly be recommending your services to anyone." We are finished with the constant worry.

Once again, thank you so much for being a part of our journey.

Key Takeaways for Small Business Owners on Acquisition Finance

Small business owners must consider these key takeaways regarding acquisition finance:

- Explore Diverse Financing Options: Familiarize yourself with the various types of acquisition finance available, such as traditional loans, private equity, and Rollovers as Business Startups (ROBS), which over half of all small businesses use as their primary source of funding. Understanding these options is crucial for determining which aligns best with your needs. For leasehold enterprises, it’s vital to recognize that without a commercial property element to secure a loan, you may have to rely on cash savings or the equity in any property you own. Finance Story emphasizes the importance of understanding these financing choices to address the unique challenges faced by leasehold enterprises.

- Conduct Comprehensive Due Diligence: Thoroughly assess potential risks associated with any purchase. This process is essential for identifying financial, operational, and market-related challenges that could impact your business. As highlighted in the case study titled "Importance of Understanding Small Business Finances," having a solid grasp of your financial situation is critical for effectively navigating challenges.

- Understand Legal and Financial Consequences: Be aware of the legal factors involved in funding purchases. Engaging legal counsel can assist in navigating contracts and compliance issues, ensuring you are fully aware of your obligations and rights.

- Seek Professional Guidance: Navigating the complexities of procurement finance can be daunting. Collaborating with financial consultants or external accounting agencies can enhance your decision-making process and increase your chances of a successful purchase. For example, if your home is valued at $1.3M with $300k owed, you could potentially access $740k in equity to support your purchase, supplemented by any cash savings.

- Align with Long-Term Objectives: Continuously evaluate how the purchase aligns with your long-term strategic plan. This alignment is essential for ensuring that the purchase positively contributes to your overall growth and financial objectives.

By following these insights, small enterprise owners can effectively utilize acquisition finance in Australia to foster growth and achieve their aspirations. With small enterprises constituting 99.9% of all companies in Australia and employing millions, understanding acquisition finance is vital for maintaining economic vitality. As Jessica Baker aptly states, "Small enterprises are indeed the backbone of American communities," underscoring their significance in the economy.

Moreover, access to financing is crucial for the growth and success of small businesses, particularly for women, minority, and veteran entrepreneurs. Finance Story recognizes this as a key factor in fostering inclusive economic growth.

Conclusion

Acquisition finance serves as a crucial instrument for small business owners in Australia, providing a range of options tailored to their distinct needs and growth aspirations. By grasping the different financing avenues—ranging from traditional bank loans and equity financing to mezzanine and vendor financing—entrepreneurs are empowered to make informed decisions that align with their strategic objectives. As the advantages of acquisitions gain recognition, small businesses are increasingly positioned to harness acquisition finance as a means to fuel expansion and enhance market presence.

Navigating the intricacies of the acquisition finance process entails several pivotal steps, including:

- Evaluating financial capacity

- Conducting comprehensive due diligence

- Comprehending the legal ramifications tied to financing agreements

Through meticulous documentation preparation and the negotiation of favorable terms, business owners can improve their prospects of securing the essential resources for successful acquisitions. Challenges such as limited credit history and market volatility can be effectively addressed through proactive strategies and expert guidance, ensuring that small businesses maintain resilience in the face of adversity.

Ultimately, collaborating with financial professionals can streamline the acquisition finance process, offering invaluable insights and access to networks that may otherwise be inaccessible to individual business owners. As the acquisition finance landscape continues to evolve, small business owners must stay vigilant and informed, utilizing these strategies to unlock growth opportunities that propel their success. By prioritizing acquisition finance, entrepreneurs can elevate their enterprises, significantly contributing to the economic vitality of their communities.