Overview

This article delves into the essential factors that small business loan banks evaluate for approval. It underscores the significance of:

- Character

- Capacity

- Collateral

- Capital

- Business plans

- Financial history

- Cash flow

- Market conditions

- Lender relationships

Each of these elements is pivotal in the lending process. Lenders meticulously assess the business owner's reputation, their ability to repay the loan, the security provided, and the overall financial health and strategy of the business. This thorough evaluation ultimately determines the likelihood of loan approval.

Introduction

In the competitive landscape of small business financing, securing the right loan can often feel like navigating a labyrinth. With a myriad of options available, understanding the intricacies of the lending process is crucial for business owners seeking growth and stability.

Finance Story, a boutique mortgage brokerage based in Melbourne, distinguishes itself by offering tailored financial solutions that cater specifically to the diverse needs of small businesses. By focusing on key factors such as:

- Character

- Capacity

- Market conditions

this brokerage not only simplifies the loan application process but also empowers entrepreneurs to present compelling cases to lenders.

Furthermore, as the economic environment continues to evolve, the importance of personalized support and strategic planning in securing funding cannot be overstated.

Finance Story: Tailored Financial Solutions for Small Business Loans

Finance Story, a boutique mortgage brokerage based in Melbourne, stands out by delivering tailored financial solutions specifically designed for small enterprises. By prioritizing a thorough understanding of each client's unique needs, Finance Story provides a wide range of financing options, including:

- Commercial property loans

- Corporate finance

- SMSF loans

- Residential home loans

- Expat mortgages

This comprehensive approach not only addresses the varied financial requirements of small business owners but also positions Finance Story as a trusted partner in securing small business loan banks for their growth and expansion endeavors.

The brokerage's dedication to innovation and flexibility in the lending process guarantees that clients receive the most suitable funding options tailored to their specific circumstances. With access to an extensive array of financial institutions, including small business loan banks, boutique firms, private investors, and mainstream banks, Finance Story is well-equipped to offer clients a variety of options, ensuring they discover the best financial products to meet their needs.

Recent statistics reveal that small enterprise loan approval rates in Australia have improved, with many lenders now processing applications in under two minutes. This efficiency is complemented by Finance Story's client-centric approach, emphasizing the importance of building long-term relationships through exceptional service and personalized support.

A significant case study highlights how this method has led to high levels of customer satisfaction, resulting in repeat patronage and referrals. This case study illustrates how Finance Story's commitment to understanding client needs has fostered a supportive environment for small business owners. As Stuart Lawson, Chief Commercial Officer, states, "Once you’ve received your company funding estimate through us, we can assist you in discovering the top monetary product available that suits your requirements and guide you through the process to guarantee you secure the best offer."

Insights from industry experts further underscore the importance of tailored financial solutions, reinforcing Finance Story's position as a leader in the mortgage brokerage sector.

Character: The Business Owner's Reputation and Background

Lenders prioritize the character of the owner when evaluating loan applications, focusing on credit history, reputation, and overall integrity. A strong personal and professional background significantly enhances an organization's credibility, increasing the likelihood of securing funding. Business proprietors must be prepared to demonstrate their history, including previous achievements and adept handling of obstacles, to foster trust with prospective financiers.

At Finance Story, we specialize in crafting refined and highly personalized cases that effectively showcase your strengths to banks, greatly enhancing your likelihood of approval. Statistics indicate that a strong credit history is essential for small enterprises, with numerous lenders viewing it as a vital sign of dependability. Enhancing personal credit scores can significantly boost the likelihood of securing company funding; prompt bill payments and reduced debt are successful tactics in this context. As noted, "Paying bills on time and reducing debt are good starting points" for enhancing creditworthiness.

Furthermore, preserving a favorable credit history is crucial, as financial hardship agreements are removed after 12 months, positively influencing borrowing requests. Case studies reveal that the reputation of entrepreneurs directly affects loan approval rates. For instance, a study on the effects of pre-approvals on credit scores highlighted that while a single pre-approval application has minimal impact, multiple applications in a short timeframe can lower credit scores and signal risk to lenders. This underscores the significance of maintaining a positive credit history and reputation, as these factors are essential in the competitive landscape of small business loan banks. Additionally, entrepreneurs should remain vigilant against identity theft by routinely examining their credit reports for unfamiliar debts, thereby safeguarding their reputation.

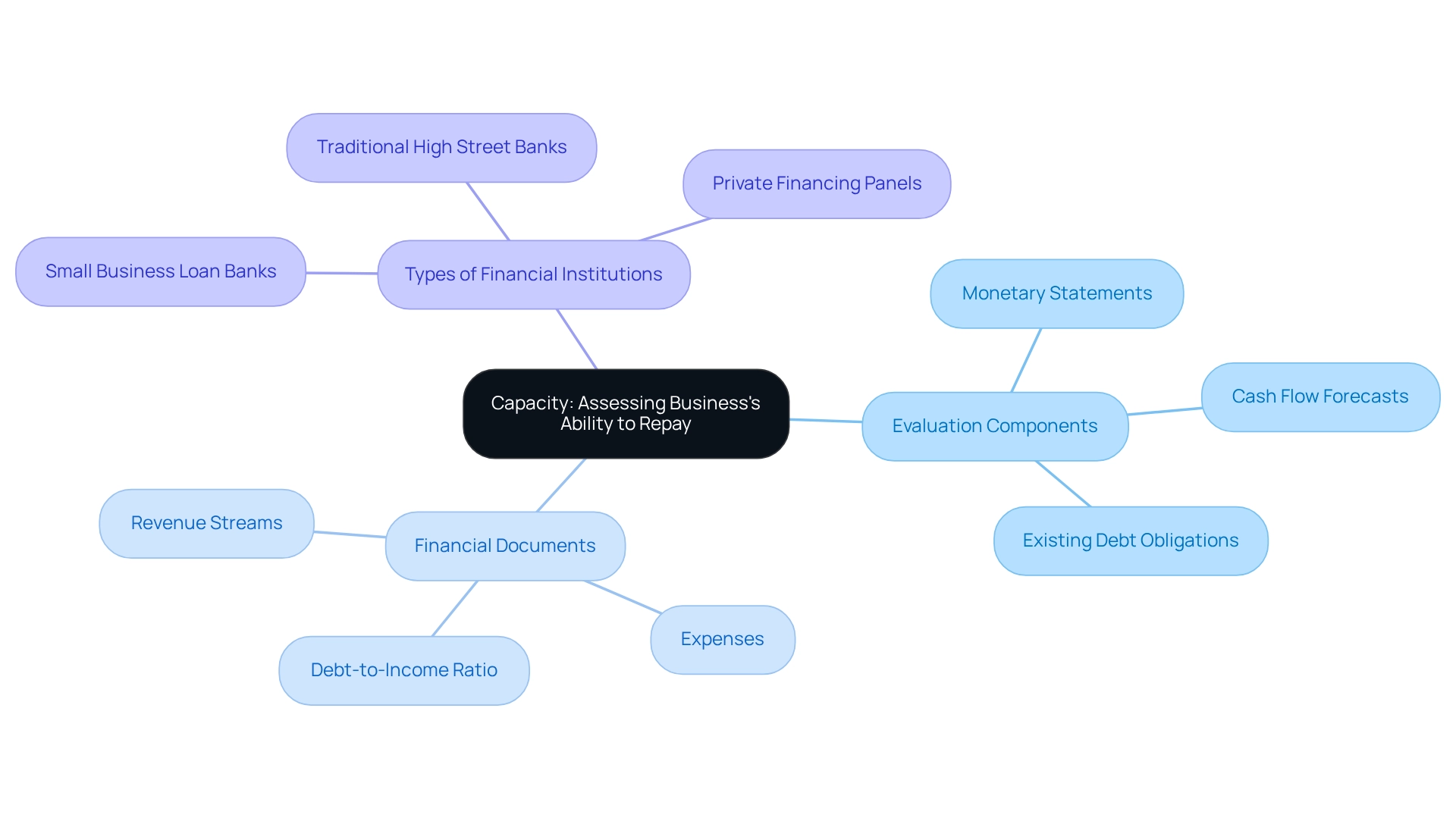

Capacity: Assessing the Business's Ability to Repay

Capacity is a critical factor that small business loan banks assess to determine a business's ability to repay its loan. This evaluation typically involves a thorough examination of monetary statements, cash flow forecasts, and existing debt obligations. At Finance Story, we recognize the increasing expectations surrounding funding for commercial property investments, including warehouses, retail spaces, factories, and hospitality ventures. Business owners should prepare comprehensive financial documents that effectively showcase their revenue streams, expenses, and overall financial health.

Our expertise in developing refined and personalized financing proposals can significantly enhance your business's prospects for securing funding by demonstrating a healthy debt-to-income ratio and consistent cash flow. Furthermore, we offer access to a diverse range of financial institutions, including small business loan banks, traditional high street banks, and innovative private financing panels, ensuring you have the best options available for both acquiring and refinancing your commercial property.

Are you ready to elevate your financing strategy? With our support, you can navigate the complexities of financial assessments confidently and position your business for success.

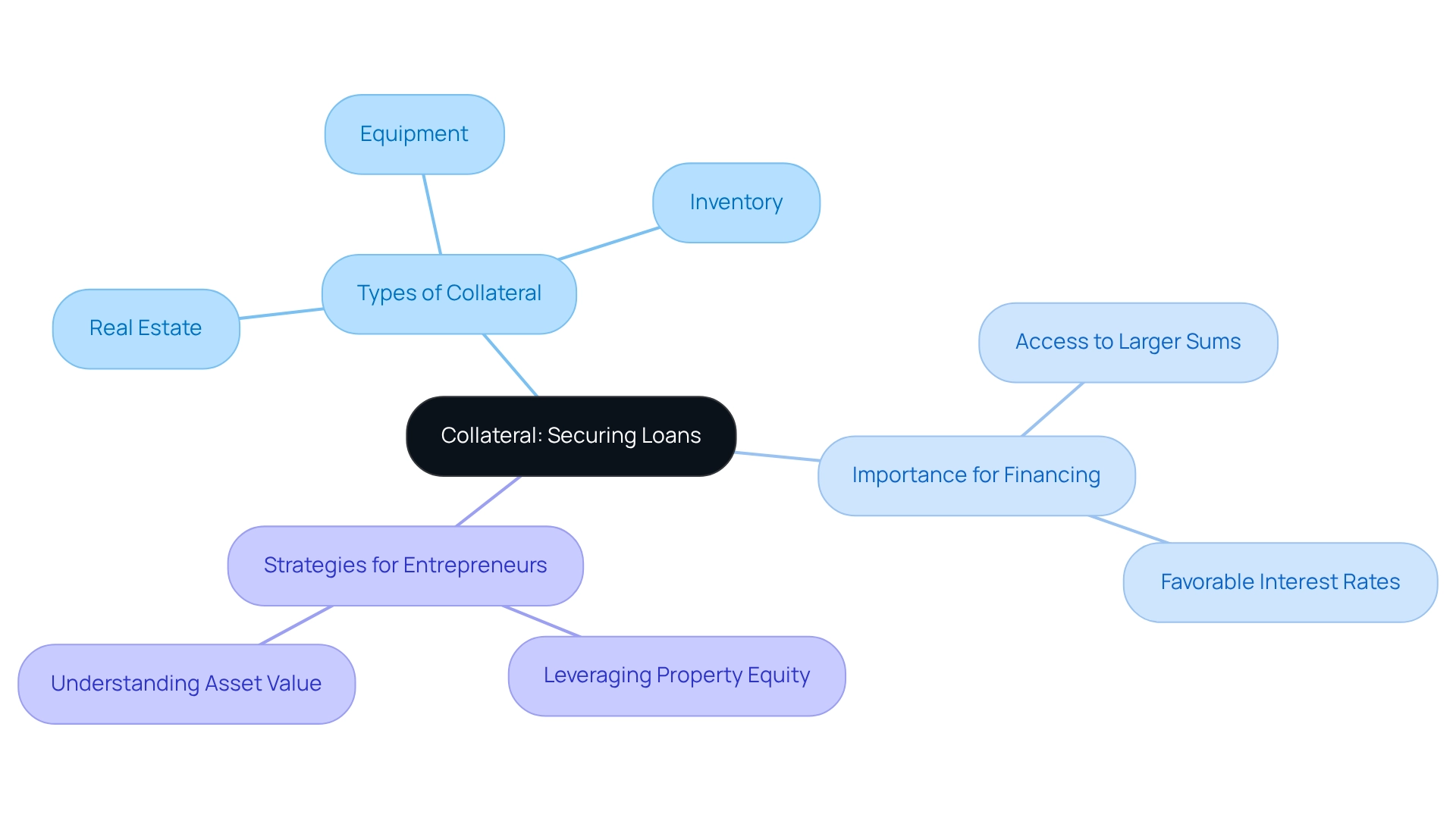

Collateral: Securing Loans with Business Assets

Collateral represents an asset that a borrower provides to secure credit, offering lenders a safety net in the event of default. Common forms of collateral include real estate, equipment, and inventory. For small enterprise owners, understanding the value of their assets is crucial, especially when assessing financing options for leasehold or freehold property ventures.

Consider this: if a company operates under a lease, owners might need to rely on cash savings or the equity in any owned property to secure financing. On the other hand, when acquiring a freehold property, the equity in real estate can be leveraged to obtain larger financing amounts. By providing collateral, enterprises can often access greater financing sums and more favorable interest rates.

It is essential for entrepreneurs to grasp how their property equity can be utilized to enhance their financing applications, ensuring they meet the creditor's requirements effectively. Are you aware of how your assets can work for you in securing the funding your business needs? Understanding this can be the key to unlocking greater financial opportunities.

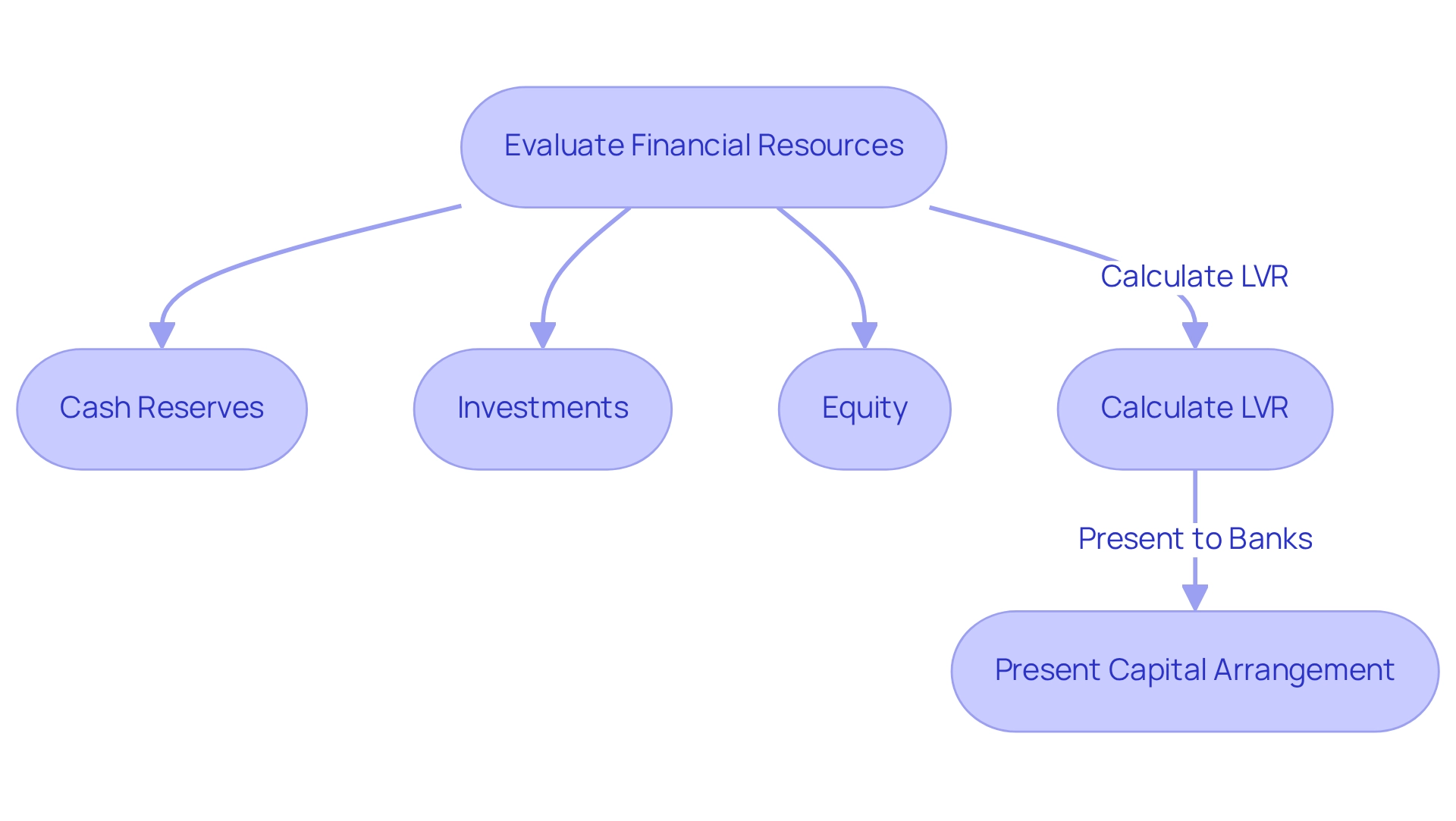

Capital: Evaluating Financial Resources Available to the Business

Capital plays a pivotal role for financial institutions when evaluating a loan application. It encompasses the financial resources available to the enterprise, including cash reserves, investments, and equity. A strong capital position signals to lenders that the entity is financially stable and adept at managing its obligations.

When pursuing a freehold property venture, comprehending the loan-to-value ratio (LVR) is essential. Lenders typically allow a maximum LVR of 70% for commercial properties. This means that for a $1M commercial asset, a borrower could secure funding of $700k, necessitating a deposit of $300k. Furthermore, if the commercial portion of the purchase is $400k, the total funds required would amount to $700k, which could be sourced from equity in existing properties. It is crucial to recognize that this total does not encompass additional costs such as valuation, legal, and stamp duty fees.

Business proprietors should be prepared to present their capital arrangement, including any equity available from residential or commercial investments, to small business loan banks. They must also articulate strategies for utilizing the funds to enhance their economic position. Are you ready to showcase your capital effectively and leverage it for growth?

Business Plan: Presenting a Viable Strategy to Lenders

A comprehensive financial plan is an essential tool for securing a loan from small business loan banks. It outlines the company's objectives, strategies, and financial forecasts, providing small business loan banks with a clear understanding of how the funds will be utilized. At Finance Story, we specialize in developing refined and highly customized proposals tailored to meet the increasing demands of financiers. Our extensive network includes a diverse array of lenders, including small business loan banks, high street banks, and innovative private lending panels, accommodating various commercial properties such as warehouses, retail premises, factories, and hospitality ventures.

A robust commercial plan should encompass:

- Market analysis

- Competitive positioning

- Detailed financial forecasts

By presenting a well-organized strategy, entrepreneurs can demonstrate their commitment to success and their ability to repay credit, ultimately enhancing their chances of approval. Furthermore, we offer refinancing alternatives to help businesses adapt to their evolving requirements. Have you considered how a strong financial plan could impact your business's future? Let us guide you in crafting a proposal that stands out.

Financial History: Analyzing Past Performance and Creditworthiness

Lenders meticulously evaluate a company's financial history to determine its creditworthiness, a critical factor in loan approval. This assessment involves a thorough review of past financial statements, payment records, and any existing debts. A robust financial history, marked by timely payments and steady revenue growth, significantly enhances an enterprise's prospects for securing funding. For instance, businesses that consistently demonstrate responsible financial management often see improved credit ratings, which correlate directly with better loan terms and conditions.

At Finance Story, we specialize in crafting tailored and sophisticated business cases that align with creditor expectations, ensuring your financial history is showcased effectively. We provide access to a comprehensive array of lenders, including traditional banks and innovative private lending panels, tailored to your unique circumstances. Statistics reveal that asset restructuring is a common strategy among distressed companies, underscoring the importance of effective resource management in maintaining creditworthiness. In emerging markets, businesses face unique challenges that can complicate their financial histories, making it essential for small business owners to navigate these complexities with care.

Moreover, expert insights emphasize the need for maintaining accurate and up-to-date financial records, as this transparency builds trust with lenders. As noted by credit analyst Amy Kam, government ownership can negatively impact companies' distress-resolution strategies, highlighting the necessity for small enterprises to proactively manage their financial histories. Case studies illustrate that companies that actively oversee their financial records, such as a local café that improved its credit score by 50 points through diligent payment practices, often experience a smoother application process. Additionally, research on the valuation impacts of restructuring announcements in China indicates that effective resource management can enhance a company's value, further reinforcing the significance of financial history in credit applications.

As we approach 2025, the importance of financial history in credit applications remains paramount, with timely payments being a vital component in securing funds. Ultimately, a solid financial history not only boosts creditworthiness but also positions enterprises favorably in the eyes of potential small business loan banks, especially when supported by customized proposals from experts like Finance Story. Whether you are seeking to finance a warehouse, retail space, factory, or hospitality venture, we are here to assist you.

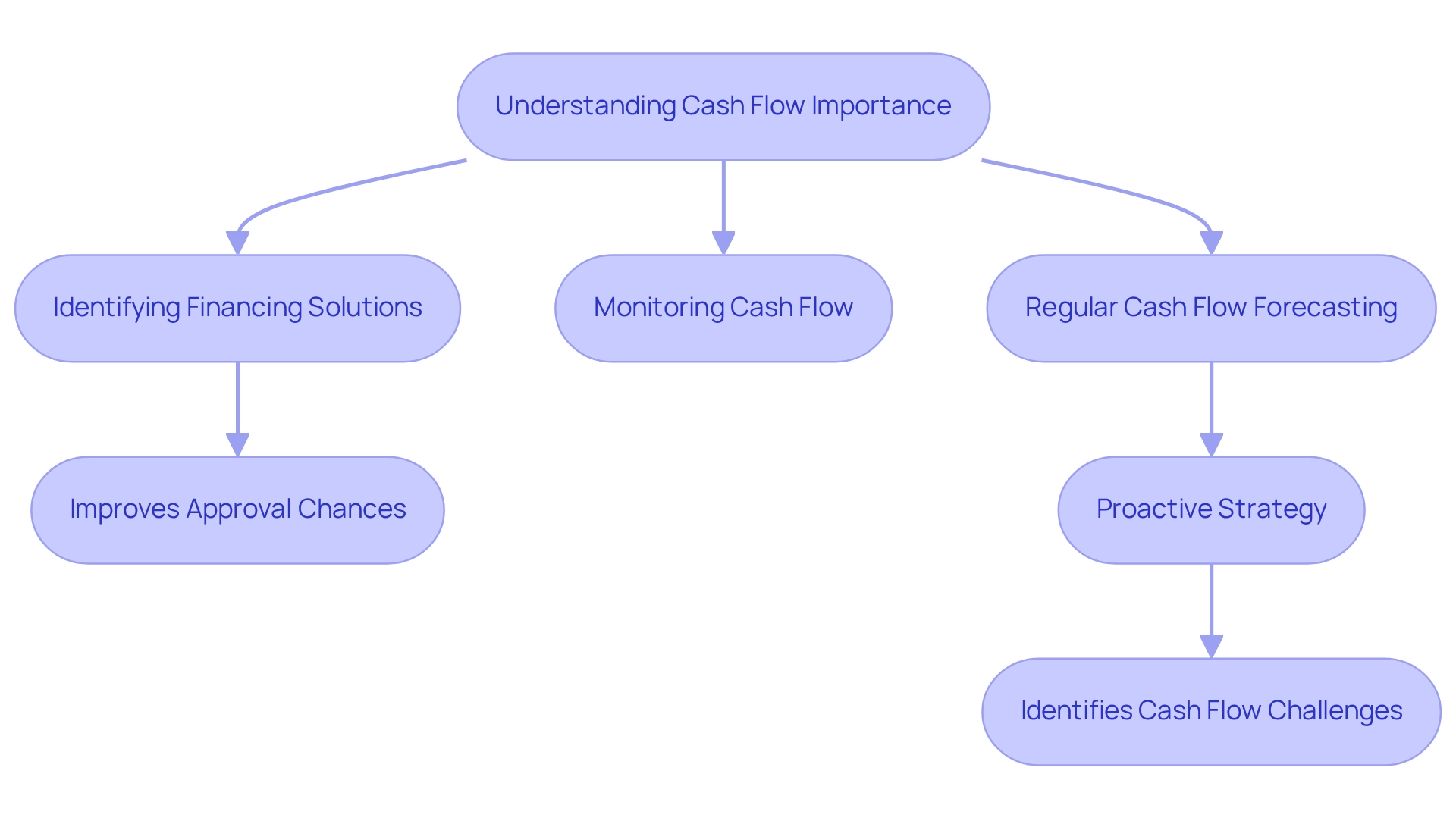

Cash Flow: Ensuring Sufficient Funds for Repayment

Cash flow is a vital indicator of an organization's financial health and its ability to meet debt obligations. Lenders scrutinize cash flow to confirm that a company generates adequate income to cover its expenses and debt repayments. At Finance Story, we understand that effective cash flow management is crucial for securing tailored financial solutions and refinancing options. Our expertise in developing refined funding proposals significantly enhances your chances of approval by effectively presenting your business case to financial institutions.

Business owners should adopt practices such as regular cash flow forecasting and monitoring to sustain a positive cash flow position. This proactive strategy can help identify potential cash flow challenges before they escalate, ultimately improving your prospects of securing the right financing for your commercial property investments. Furthermore, with access to a diverse range of financial institutions, including high street banks and innovative private lending panels, we can assist you in identifying the best financing solution tailored to your specific needs.

Market Conditions: Understanding Economic Influences on Lending

Market conditions significantly influence the borrowing environment, directly impacting interest rates, availability of credit, and risk evaluations of financial institutions. Key economic indicators, such as inflation and unemployment rates, along with prevailing industry trends, play a pivotal role in determining a financial institution's willingness to extend credit. For instance, as inflation increases, creditors may tighten their standards, leading to higher interest rates and decreased availability of financing. Conversely, a stable economic environment can foster more favorable lending conditions.

Business owners must remain vigilant about current market dynamics, as these factors can greatly influence their financing options. Understanding the relationship between economic circumstances and lending practices allows enterprises to enhance their readiness for credit applications and negotiate more favorable terms. Recent trends indicate that private financiers are offering returns exceeding 10% to investors, reflecting a competitive yet cautious borrowing environment. This situation can result in stricter borrowing terms for small enterprises, as creditors may favor greater returns over more precarious loans.

Furthermore, the resilience and adaptability of small enterprise owners are crucial in navigating these challenges. As emphasized in a recent case study on digital transformation, early adoption of technologies such as Artificial Intelligence can assist small enterprises in automating processes and lowering operating expenses, thus increasing their attractiveness to lenders. By leveraging such innovations, entrepreneurs can position themselves favorably in the eyes of potential financiers.

In 2025, the economic landscape in Australia continues to evolve, with indicators such as GDP growth and consumer confidence influencing lending decisions. It is crucial for entrepreneurs to seek funding when their economic status is robust, as this timing can greatly influence the conditions they obtain. Staying aware of these economic elements not only assists in obtaining financing but also enables entrepreneurs to make strategic financial choices that align with market conditions.

Moreover, collaborating with specialists such as Finance Story can offer customized insights into refinancing choices and obtaining the appropriate loans for commercial property investments, including warehouses, retail spaces, factories, and hospitality projects. As Jay Patel, owner of Desi Bazzar, noted, "The situation right now is very tough for everyone, not only me," underscoring the challenges faced by many in the current economic climate. To navigate these challenges effectively, consider contacting Finance Story to explore the complete array of financing sources available and find the best funding options for your requirements.

Lender Relationships: Building Trust for Better Loan Terms

Establishing robust connections with small business loan banks is crucial for small business owners pursuing funding. A positive relationship can lead to better loan terms, faster approvals, and increased trust. Business owners should maintain open communication with their lenders, provide timely updates on their financial status, and demonstrate their commitment to responsible borrowing. As Natasha B. from VIC mentioned, 'I will certainly be recommending your services to anyone.' We are finished with the constant worry. By nurturing a cooperative partnership, organizations can significantly improve their likelihood of obtaining the funding they require from small business loan banks.

Finance Story exemplifies this approach by offering tailored mortgage brokerage solutions that cater to both commercial and residential financing needs, even in challenging circumstances. Their expertise in crafting refined and personalized loan proposals guarantees that owners can present convincing cases to small business loan banks, thus enhancing their likelihood of approval and advantageous terms. Furthermore, in situations where financing may seem difficult, Finance Story's access to a comprehensive portfolio of private and boutique commercial investors allows them to find solutions that meet the unique needs of each business.

Conclusion

Navigating the intricate world of small business financing requires a strategic approach, and understanding the factors that influence loan approval is essential. Finance Story stands out by offering tailored financial solutions that align with the specific needs of business owners. By focusing on key elements such as:

- Character

- Capacity

- Collateral

- Capital

- Cash flow

they empower entrepreneurs to present compelling cases to lenders. This comprehensive perspective not only enhances the likelihood of securing funding but also nurtures lasting relationships with lenders.

As the economic landscape continues to evolve, staying informed about market conditions and leveraging strong financial histories becomes increasingly important. Business owners who actively manage their financial profiles and maintain open lines of communication with lenders can significantly improve their chances of obtaining favorable loan terms. Moreover, the role of a well-structured business plan cannot be understated, as it serves as a roadmap for both the business and potential financiers.

In conclusion, securing the right loan is not merely about meeting criteria; it’s about building a robust case that reflects the unique strengths and circumstances of a business. With the right support and a strategic approach, small business owners can navigate the complexities of financing with confidence, ensuring they are well-prepared for growth and success in an ever-changing economic environment.