Overview

Financing stands as a cornerstone for small businesses, empowering them to invest in essential resources, manage cash flow, and effectively navigate challenges. This support is vital for their growth and sustainability. Adequate funding not only enables entrepreneurs to seize opportunities but also allows them to implement strategic initiatives, thereby maintaining a competitive edge in a dynamic market. This underscores the fundamental role of financing in their success.

Introduction

In the dynamic realm of entrepreneurship, financing emerges as a vital pillar for the success of small businesses. With nearly 10 million small and medium-sized enterprises making significant contributions to economies worldwide, securing capital is not merely a necessity; it represents a strategic advantage.

Whether it involves:

- Purchasing inventory

- Hiring skilled personnel

- Launching innovative marketing campaigns

Access to financing empowers entrepreneurs to navigate challenges and seize growth opportunities. As the business landscape evolves towards 2025, it becomes essential for small business owners to comprehend the diverse financing options available and the barriers many encounter in obtaining them.

This exploration delves into the multifaceted role of financing, offering insights into effective strategies and underscoring the importance of cultivating strong relationships with lenders to ensure long-term success.

The Role of Financing in Small Business Success

Understanding the significance of financing is paramount for the success of small businesses. It empowers entrepreneurs to invest in essential resources, expand their operations, and adeptly navigate unexpected challenges. Financing is vital for accessing capital necessary to purchase inventory, hire skilled staff, and implement marketing strategies that drive growth. Notably, nearly 10 million small and medium-sized enterprises (SMEs) in Bangladesh contribute to 23% of the GDP, underscoring the profound impact of funding on economic vitality.

Furthermore, the World Bank Group is actively supporting leasing operations in Ethiopia and Guinea to enhance access to finance for SMEs, reflecting global initiatives aimed at improving financial accessibility.

For leasehold enterprises or those without a physical structure, conventional commercial property financing may be out of reach. In these instances, entrepreneurs can leverage cash savings or the equity in owned property to secure funding. For example, if a residence is appraised at $1.3 million with $300,000 owed, borrowing up to 80% LVR can yield $740,000 in equity. This amount can be combined with cash savings to acquire a business.

This approach illustrates how comprehending loan repayment criteria and utilizing available resources can facilitate acquisitions.

Without sufficient funding, small enterprises frequently face challenges in sustaining operations, highlighting the critical nature of financing, particularly during economic downturns or periods of low cash flow. Recognizing the importance of financing reveals that the ability to secure funds not only supports stability but also fosters innovation, enabling companies to develop new products or services that meet evolving market demands. As we approach 2025, the relevance of funding remains crucial, with projections indicating a 22% increase in small enterprises, resulting in over 804,000 new positions over the next decade.

Successful small enterprises often leverage funding as a strategic tool for expansion, exemplifying the importance of financing. For instance, data-driven decision-making, supported by robust economic statistics from reputable sources like the Bureau of Labor Statistics and the U.S. Small Business Administration, allows these enterprises to gain insights into the market landscape and strategize effectively for the future. This method not only provides a competitive edge but also enhances operational efficiency.

A pertinent case study titled "Utilizing Business Statistics for Planning" demonstrates how small enterprises can harness statistics to guide their strategic decisions, further emphasizing the practical application of funding.

In summary, understanding the importance of financing is essential, as it serves not merely as a means to an end but as a strategic asset that enables small enterprises to achieve their long-term objectives and maintain a competitive advantage in their respective sectors. As the landscape of commercial funding evolves, grasping the significance of financing will be vital for entrepreneurs aiming to thrive in an increasingly competitive market. Finance Story distinguishes itself as a tailored mortgage brokerage solution provider, adept at navigating the complexities of funding in challenging situations.

As one satisfied client, Natasha B. from VIC, expressed, "I will definitely be recommending your company to anyone." We have moved beyond constant worry. Once again, thank you for being part of our journey."

This testimonial underscores the effectiveness of Finance Story's services in supporting entrepreneurs throughout their funding journeys.

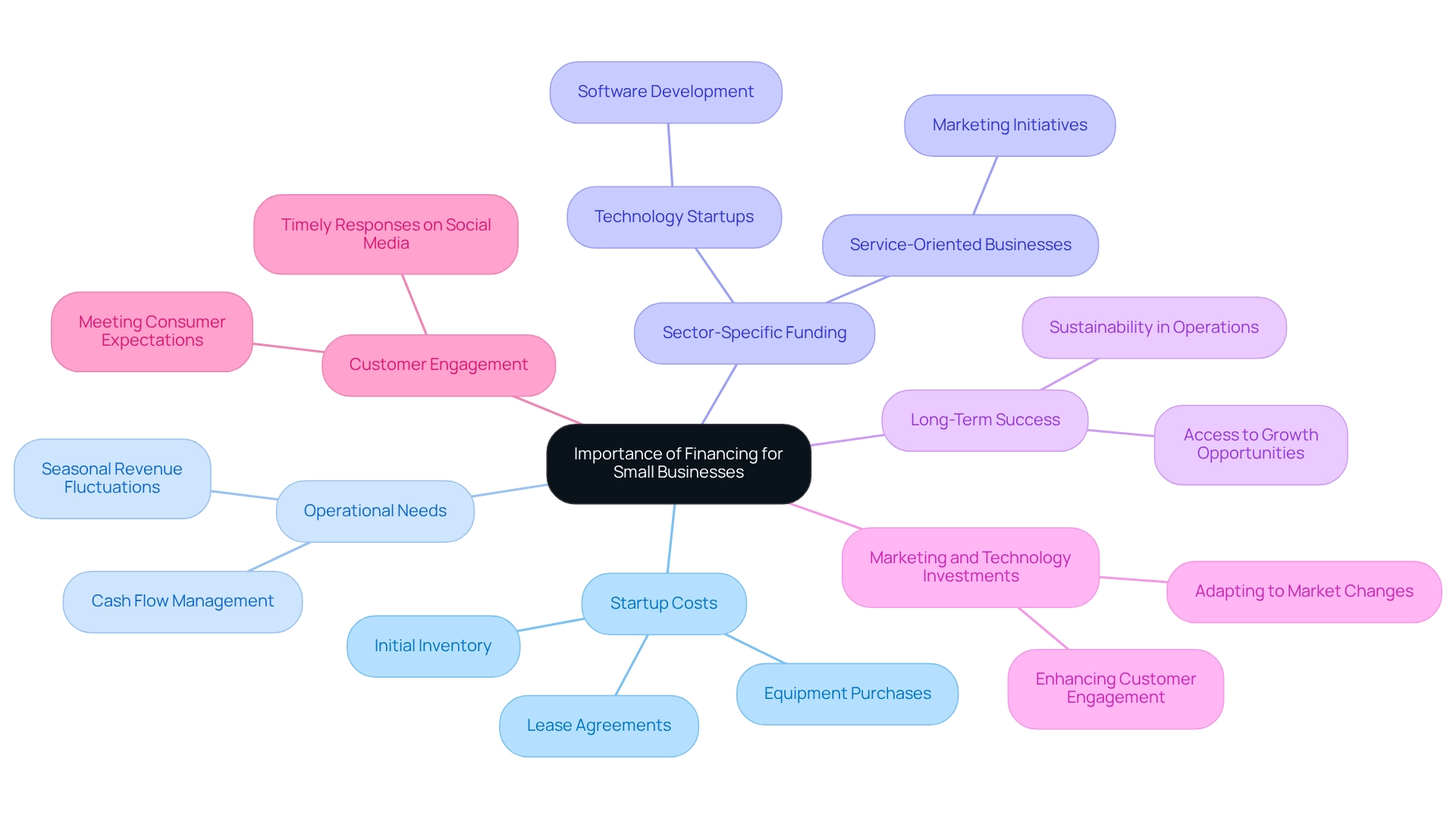

Why Small Businesses Need Financing: Key Reasons

Small enterprises require funding for various critical factors, underscoring the significance of financing for their survival and growth. By 2025, the average startup costs for small businesses are projected to be substantial, often exceeding $30,000. This figure includes essential expenses such as equipment purchases, lease agreements, and initial inventory. As businesses expand, they frequently need to invest in marketing, technology, and human resources to stay competitive in an evolving marketplace, especially as sustainability gains prominence in operational models.

Understanding the importance of financing for small businesses is vital, as funding is crucial for managing cash flow, particularly for enterprises experiencing seasonal revenue fluctuations. For example, a retail operation may require additional funds to stock up before the holiday season, ensuring they can meet customer demand without straining their finances. Moreover, recognizing the importance of financing enables small enterprises to access funding that empowers them to seize growth opportunities, such as entering new markets or launching innovative products.

Statistics reveal that nearly 70% of small enterprises seek funding to address their operational needs, with varying requirements across sectors. For instance, technology startups often necessitate significant upfront investments for software development, while service-oriented businesses may prioritize funding for marketing initiatives. This highlights the need for tailored funding solutions that cater to the distinct challenges faced by different sectors.

Expert opinions reinforce the necessity of funding in 2025, with numerous industry leaders advocating for a proactive approach to securing resources. As Josh Howarth, Co-Founder & CTO, remarked, "Despite being in an entrepreneurial country, only one in ten startups in the United States survive and achieve rapid growth over the long haul." This statement underscores the critical role financing plays in achieving long-term success for small businesses.

Practical examples illustrate the impact of funding on small enterprises. A local cafe, for instance, utilized a loan to enhance its marketing efforts, resulting in a 25% increase in customer traffic within six months. Similarly, a tech startup leveraged funds to invest in advanced technology, significantly improving its operational efficiency and market reach.

The evolving landscape for small enterprises, emphasizing online and mobile-first strategies, further underscores the necessity for adequate funding to adapt to these changes.

Ultimately, recognizing the importance of financing for small businesses is essential, as it serves not merely as a means to an end but as a fundamental element for ensuring operational stability and fostering long-term growth in the dynamic business environment. Additionally, as consumer expectations shift—such as the 30% of users who expect brands to respond to complaints on social media the same day—funding becomes crucial in supporting initiatives that enhance customer engagement and satisfaction. At Finance Story, we focus on developing refined and highly customized cases to present to lenders, ensuring that small enterprises can secure the appropriate funding solutions tailored to their unique needs.

We provide access to a comprehensive range of lenders, including mainstream banks and innovative private lending groups, to facilitate both initial funding and refinancing options for existing obligations.

Exploring Financing Options for Small Businesses

Small businesses today have access to a diverse array of funding options, underscoring the critical importance of financing for small business. Each option presents distinct advantages and challenges. Traditional bank financing remains a prevalent choice, characterized by structured repayment plans and potentially lower interest rates. However, these credits often require strong credit histories and collateral, posing obstacles for many entrepreneurs.

On the other hand, alternative funding methods, such as peer-to-peer lending and crowdfunding, have surged in popularity. These options generally provide more adaptable terms and faster access to funds, making them particularly appealing for entrepreneurs who need swift capital to seize opportunities or address pressing needs. For instance, companies employing flexible credit servicing have reported an impressive 30% increase in repayment rates, highlighting the effectiveness of adaptable funding solutions.

Furthermore, this aligns with Finance Story's reputation for professionalism and a thorough understanding of the finance sector. They assist clients in reaching their financial objectives effectively through customized loan proposals and funding solutions for commercial property investments and refinances.

Moreover, smaller enterprises can access government grants and subsidies, which offer funding without the obligation of repayment. While these choices can be extremely advantageous, they frequently have specific eligibility requirements that must be satisfied.

Current trends indicate a rising transition towards alternative funding methods, with 2025 anticipated to witness increased acceptance among minor enterprises. A recent study revealed that 77% of small enterprise owners are diversifying their marketing strategies, which aligns with the trend of exploring various funding options to support growth. This diversification not only enhances customer loyalty but also drives overall growth.

The pandemic has disrupted many entrepreneurs’ plans, making it essential for them to adapt and explore new funding alternatives.

By understanding why financing is important for small business—including the complete range of funding options available, insights into repayment criteria, and access to specialized lenders—owners can make informed choices that align with their unique circumstances. This ensures they effectively support their operations and growth initiatives. Finance Story is well-equipped to assist clients in navigating these complex financial situations, providing tailored solutions that meet their specific needs.

Challenges in Accessing Financing for Small Businesses

Many minor enterprises face significant obstacles in acquiring the necessary capital, raising the critical question of why financing is vital for small businesses. High interest rates, projected to remain elevated in 2025, create a substantial barrier. These rates can deter potential borrowers, increasing the overall cost of credit and complicating cash flow management for minor enterprises.

Moreover, strict lending standards often leave modest enterprise owners feeling overwhelmed, particularly if they lack a robust credit history or sufficient collateral.

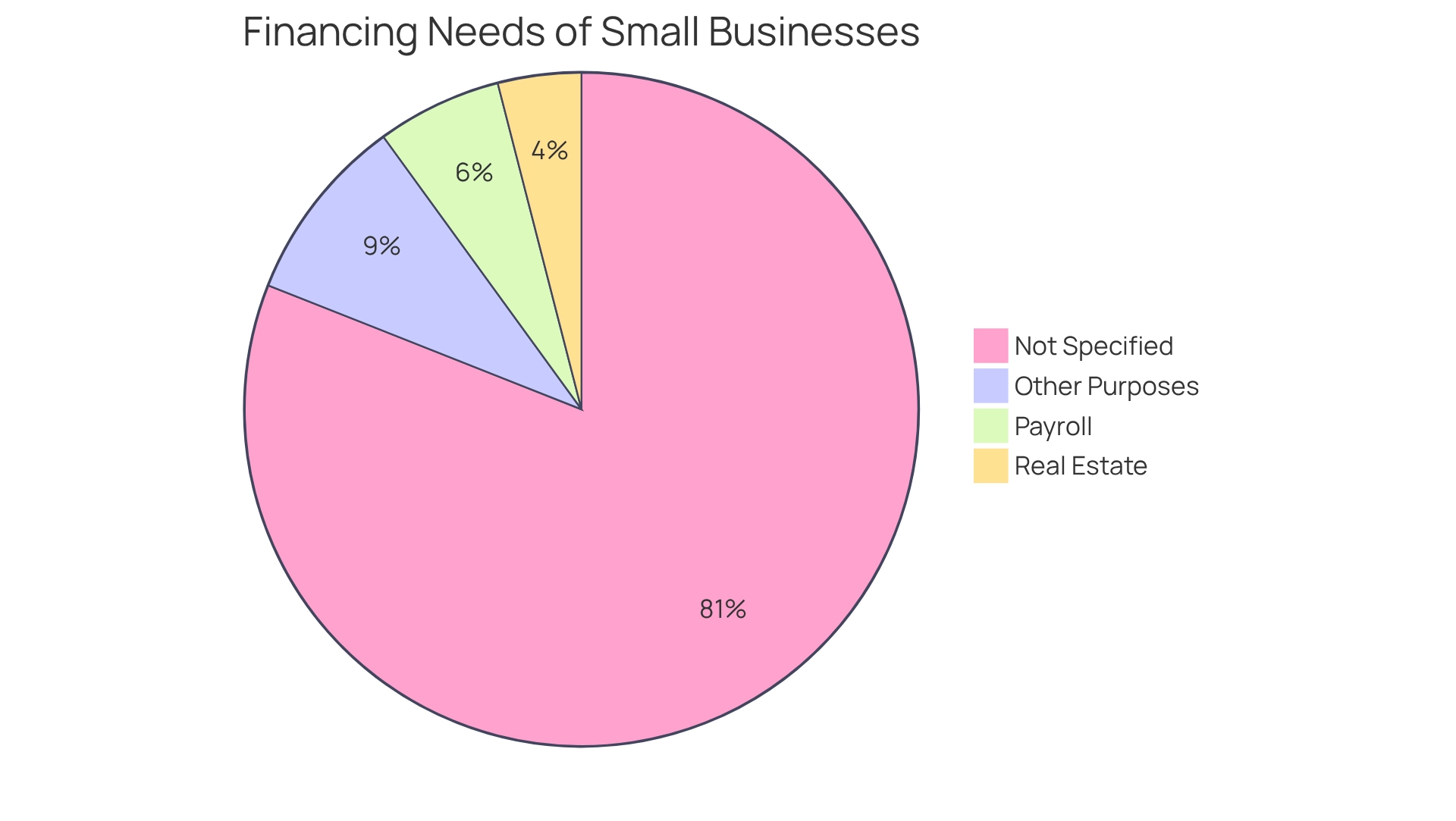

A compelling statistic reveals that:

- 6% of minor enterprises seek financing specifically for payroll

- 4% aim to support real estate

- 9% require capital for various other purposes

This underscores the significance of financing for small businesses, as many struggle to meet lenders' criteria. Additionally, a lack of financial knowledge can complicate the funding application process, emphasizing the need for financing among small business owners who may not fully understand the terms of financing agreements or how to present their enterprises favorably to potential lenders.

Economic factors, such as market volatility and changing regulatory environments, further exacerbate these challenges. For instance, the Australian Banking Association (ABA) has noted that while overall lending to minor enterprises remains stagnant, the average value of credits to minor and medium-sized firms has been increasing. Anna Bligh, CEO of the ABA, stated, "While the growth of total lending to enterprises remains flat, data received from ABA member banks shows that the average value of credits extended to minor and medium-sized companies has been increasing."

This indicates a shift in lending dynamics, where larger loans may be available, yet access remains challenging for many.

Real-world examples illustrate how certain local enterprises have successfully navigated these challenges. Companies affected by recent natural disasters, such as the flooding in Queensland, have received targeted assistance from banks, highlighting the significance of adaptive lending practices. The ABA emphasizes that customers should not face financial challenges alone, stressing the necessity for entrepreneurs to seek support and advocate for their funding needs.

In fact, banks are actively assisting customers impacted by disasters, as evidenced by the ABA's initiatives during the FNQ flood recovery.

Furthermore, it is noteworthy that 59% of SBA credits are approved, which underscores the approval rates and provides a comprehensive view of the funding landscape for enterprises. By understanding these challenges and the impact of high interest rates on loan accessibility, entrepreneurs can better equip themselves to approach lenders with confidence and clarity, reinforcing the importance of financing for small businesses. At Finance Story, we specialize in crafting refined and highly customized proposals for banks, ensuring that you have the best opportunity to secure the appropriate funding for your commercial property investments and refinances.

We collaborate with a diverse range of lenders, including high street banks and innovative private lending panels, to meet your specific needs, whether you are looking to finance a warehouse, retail premise, factory, or hospitality venture.

Tips for Securing Financing: A Guide for Small Business Owners

Understanding the critical role of financing for small businesses is essential in navigating the challenging endeavor of securing funds. Several strategies can significantly enhance the likelihood of success. A well-prepared plan is paramount; it should clearly outline the organization's objectives, financial projections, and specific funding requirements. This document serves as a roadmap for potential lenders, highlighting the viability and growth potential of the enterprise.

In 2025, maintaining a strong credit score is more essential than ever, acting as a key indicator of the entity's creditworthiness. Business owners should proactively monitor their credit scores and take necessary steps to improve them. Furthermore, collecting all required documentation—such as financial statements, tax returns, and pertinent licenses—can simplify the application process and demonstrate readiness to lenders.

Recent guidance on enterprise funding eligibility underscores the importance of financing for small businesses by emphasizing the significance of having these documents prepared to ease initial steps toward obtaining funding.

Establishing strong connections with lenders is another essential strategy. Engaging with lenders can provide valuable insights into their specific requirements and preferences, which can improve the chances of securing favorable terms. Studies show that minor enterprises with a robust strategy have greater success rates in securing funding, illustrating why financing is crucial for small businesses, as financiers are more likely to invest in well-organized proposals.

For instance, personal financing, which can range from $1,000 to $50,000, is frequently available through credit unions and banks. These financial aids can be crucial in accelerating company growth, illustrating the importance of financing for small businesses, although they generally necessitate strong personal credit and do not contribute to establishing company credit. Additionally, SBA financing provides substantial amounts of capital accessible for extended periods, further emphasizing the necessity of financing for small business funding.

At Finance Story, we specialize in crafting refined and highly personalized proposals for creditors, ensuring your submission meets the elevated criteria for securing resources for your growth. We offer a full range of lenders, including high street banks and innovative private lending panels, to accommodate any circumstances, whether you are financing a warehouse, retail premise, factory, or hospitality venture. Our Head of Funding Solutions, Shane Duffy, brings extensive experience in growth and funding strategies, uniquely positioning us to assist you in crafting compelling proposals tailored to your needs.

Moreover, we can assist you in refinancing your commercial loan to adapt to the evolving requirements of your enterprise. Arrange your complimentary customized consultation with Shane to discuss your objectives and allow us to help you navigate the funding landscape effectively. By utilizing these strategies, owners of modest enterprises can grasp the importance of financing for small businesses and position themselves for long-term success.

Building Strong Relationships with Lenders

Establishing strong connections with lenders is essential for small enterprises, underscoring the importance of financing in this sector. A robust rapport can lead to more favorable loan terms, enhanced access to credit, and tailored support during challenging financial times. Consistent interaction with lenders—by sharing updates on operational performance and financial health—promotes transparency and trust.

This proactive communication encourages lenders to be more accommodating when companies request additional funding or flexible repayment options.

Considering that roughly 79% of small enterprises in the U.S. find it challenging to obtain affordable funding, maintaining open channels of communication with lenders becomes even more critical. This statistic highlights the difficulties that small enterprises face and illustrates why financing is vital for cultivating relationships that enable access to essential funding. Furthermore, approximately 20% of small enterprise financing applications are rejected due to credit concerns, reinforcing the necessity of solid connections with lenders to alleviate these challenges.

Case studies demonstrate the positive impact of strong lender relationships. Community banks, for instance, have become crucial players in lending to small enterprises, with such financing constituting 12.6% of their assets compared to only 3.6% for larger institutions. In 2023, 82% of small enterprise applicants received at least partial loan approval from these institutions, showcasing their commitment to supporting local ventures.

This stands in stark contrast to the lower approval rates often encountered at larger financial institutions, emphasizing the need for enterprises to cultivate connections with lenders who understand their unique situations.

As Jim Pendergast aptly stated, 'Your working capital is one of the most important measurements,' highlighting the significance of maintaining strong lender relationships for effective financial management. Ultimately, the benefits of these connections extend beyond immediate funding needs, providing enterprises with a competitive edge that enables them to thrive in an increasingly challenging economic landscape. By leveraging the expertise of esteemed firms such as Finance Story, known for its professionalism and tailored mortgage services, smaller enterprises can navigate the complexities of funding more effectively.

Finance Story focuses on crafting refined loan proposals and refinancing alternatives, ensuring that companies receive customized assistance aligned with their specific financing needs. With extensive access to various lending options, including boutique lenders and private investors, Finance Story is committed to understanding and meeting the distinct financial requirements of enterprises.

The Essential Role of Financing in Small Business Growth

Understanding the importance of financing for small businesses is crucial, as funding serves as a vital foundation for the success of these enterprises. It enables entrepreneurs to invest in expansion, manage cash flow efficiently, and tackle various obstacles. In 2025, the landscape of small business funding is more dynamic than ever, with numerous options available to support diverse needs. Comprehending these options is essential for small enterprises seeking to establish themselves for long-term success.

Recognizing why financing is important can illuminate the impact of funding on cash flow and stability. For instance, businesses in the agriculture, forestry, and fishing support services sector enjoy a profit margin of 20.2%, demonstrating how strategic financing can enhance profitability. However, the reality is stark; approximately 60% of small businesses in Australia fail within the first three years, often due to insufficient financial planning and access to funds. This raises the critical question: why is financing important for small businesses?

This statistic underscores the necessity for effective exit strategies and robust financial management.

To secure funding, small business owners should adopt several strategies. First, clearly outlining strategic plans, including expected return on investment (ROI), is vital. As Phil notes, "The right loan facility can be a very powerful tool to accelerate growth, so be sure to have your plans clearly mapped out, including expected ROI."

This approach not only assists in conveying the vision to potential lenders but also demonstrates readiness and foresight. Establishing strong connections with lenders is essential for understanding why financing is important for small businesses, as these relationships can facilitate access to essential capital and tailored funding options.

At Finance Story, we focus on developing refined and highly customized cases to present to banks, ensuring that entrepreneurs can secure the appropriate funding for their commercial property investments, whether it be a warehouse, retail location, factory, or hospitality venture. With access to a comprehensive range of lenders, including high street banks and creative private lending panels, we assist enterprises in refinancing their debts to meet evolving requirements. Our expertise in crafting impactful funding proposals is crucial in navigating the complexities of capital, reinforcing our commitment to supporting local entrepreneurs.

Professional perspectives indicate that understanding why financing is important for small businesses is essential, as funding acts as a strategic facilitator for these enterprises. Recognizing this significance can greatly enhance growth, empowering companies to seize opportunities and expand their operations. Profitable businesses often thrive through efficient funding, utilizing loans to invest in technology, recruit talent, or increase inventory, thereby improving their competitive advantage.

In summary, understanding why financing is important for small businesses transcends being a mere transactional requirement; it serves as a strategic facilitator that empowers enterprises to flourish in a competitive environment. By comprehending the various funding alternatives available and acknowledging the challenges in securing resources, entrepreneurs can grasp the significance of financing and implement effective strategies to navigate the complexities of the financial landscape and achieve their growth aspirations. Moreover, with the mining sector generating the highest profits of all industries in Australia, small businesses must be prepared to adapt and thrive within this broader economic framework.

The recent data revealing around 436,018 company entries and 362,893 exits underscores the importance of financing for small businesses in addressing these challenges. We encourage small business owners to reach out to Finance Story for assistance with their financing needs.

Conclusion

Financing is an indispensable cornerstone for the success and growth of small businesses, serving as a vital resource that empowers entrepreneurs to invest in essential areas such as inventory, talent, and marketing. As we approach 2025, understanding the myriad options available in small business financing becomes increasingly crucial. From traditional bank loans to alternative methods like crowdfunding, each option presents unique advantages and challenges that small business owners must navigate effectively.

Statistics underscore the significance of financing, with projections indicating substantial growth in small businesses and job creation in the coming years. However, many entrepreneurs encounter barriers such as high interest rates and stringent lending criteria that can hinder access to capital. To overcome these challenges, small business owners must adopt proactive strategies, including:

- Building strong relationships with lenders

- Preparing detailed business plans that clearly articulate their financial needs and growth potential

Ultimately, financing transcends mere transactional necessity; it serves as a strategic enabler that allows small businesses to thrive in an increasingly competitive environment. By leveraging the right financing solutions and gaining a comprehensive understanding of the financial landscape, entrepreneurs can position their businesses for long-term success. As the importance of financing continues to grow, seeking expert guidance from specialized firms like Finance Story can provide the tailored support needed to navigate these complexities and achieve business goals. Embracing these insights equips small business owners to capitalize on opportunities and secure their place in the evolving marketplace.