Overview

SMSF loans are primarily regulated to protect individuals' retirement savings and uphold the integrity of the superannuation system. This regulation is enforced through strict guidelines established by the Superannuation Industry (Supervision) Act 1993 and the Australian Taxation Office. These regulations play a crucial role in mitigating financial risks associated with borrowing. Furthermore, they ensure compliance to prevent conflicts of interest and safeguard the interests of fund members. This reinforces the necessity for adherence to these rules, especially in the evolving financial landscape.

Introduction

Navigating the complex landscape of Self-Managed Superannuation Fund (SMSF) loans can be daunting for many investors. However, it presents a unique opportunity to leverage retirement savings for real estate investments. These financial instruments, governed by stringent regulations, are designed to protect the integrity of the superannuation system while allowing fund members to capitalize on their investments.

With the Australian Taxation Office (ATO) closely monitoring compliance, understanding the regulatory framework surrounding SMSF loans is essential for ensuring both financial success and adherence to the law. As the popularity of SMSFs continues to rise, so too does the necessity for investors to grasp the implications of borrowing within this context. This includes potential tax benefits and the consequences of non-compliance.

This article delves into the critical aspects of SMSF loans, exploring their regulatory underpinnings, the rationale behind stringent controls, and the ongoing debate over the flexibility of these regulations.

Understanding SMSF Loans and Their Regulatory Framework

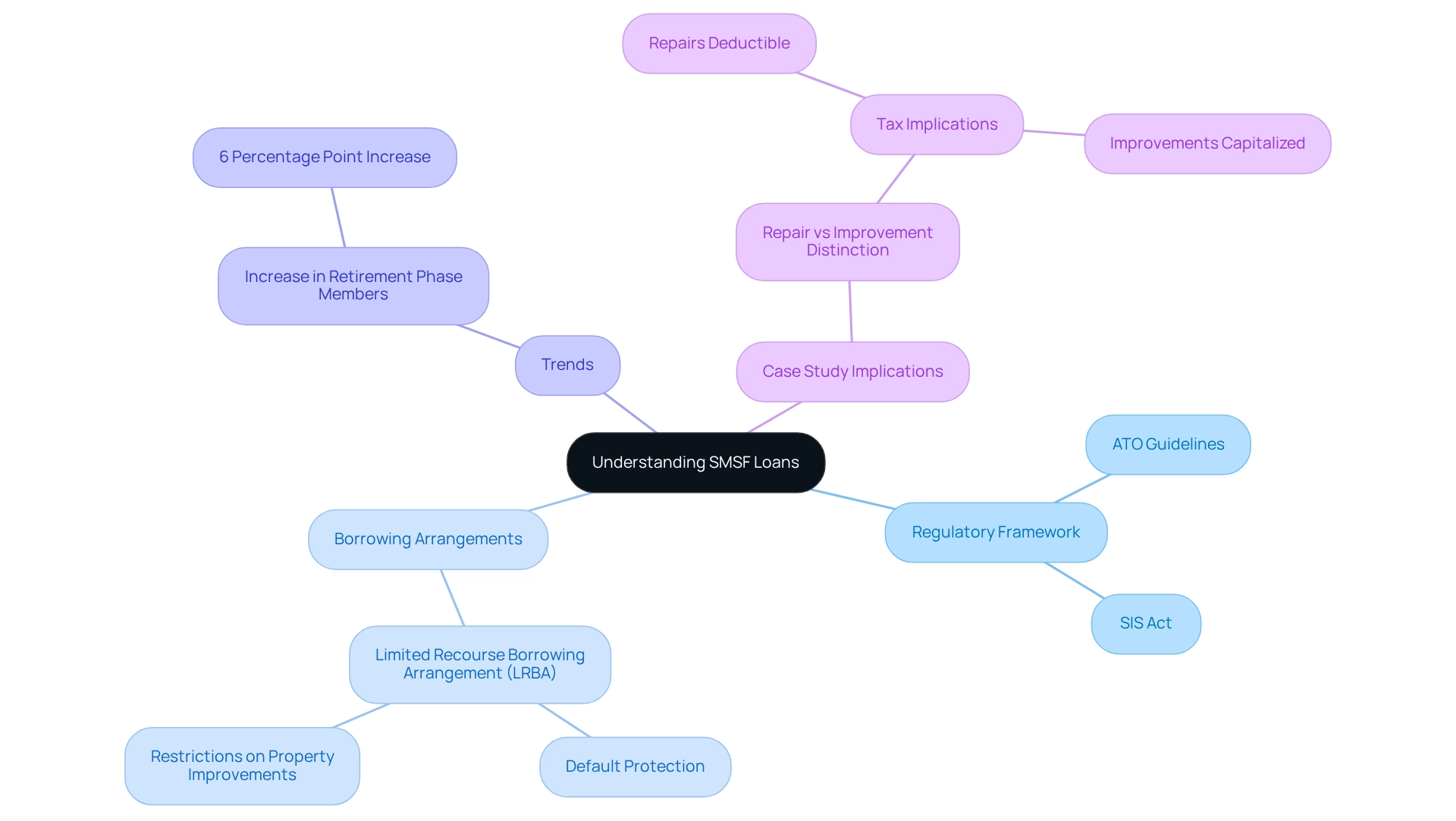

Self-Managed Superannuation Funds (SMSFs) financing serves as a customized financial tool that enables SMSFs to secure capital for investment objectives, particularly in real estate. These financial aids raise the question of how are SMSF loans regulated, as they are governed by stringent regulations that ensure proper fund usage and preserve the integrity of the superannuation system. Central to this regulatory framework is the Superannuation Industry (Supervision) Act 1993 (SIS Act), along with guidelines established by the Australian Taxation Office (ATO).

Typically, self-managed superannuation fund borrowing operates under a Limited Recourse Borrowing Arrangement (LRBA). This arrangement stipulates that in the event of a default, the lender's claim is confined to the asset acquired through the financing, thereby safeguarding the other assets within the fund. This protective measure is crucial for preserving the retirement savings of fund members while allowing them to utilize their resources effectively.

Recent statistics reveal a significant six percentage point increase in self-managed superannuation fund members fully in the retirement phase, indicating a growing trend in the utilization of loans from self-managed superannuation funds. However, it is vital to understand that borrowed funds cannot be allocated for property enhancements under LRBA rules, which can substantially impact financial strategies.

A relevant case study illustrates the distinction between repairs and enhancements on self-managed superannuation fund properties, highlighting the tax implications involved. Repairs can be quickly deducted, whereas enhancements must be capitalized, influencing the overall tax strategy for property investments. This differentiation underscores the importance of comprehending the legal framework surrounding self-managed superannuation fund financing, particularly in understanding how are SMSF loans regulated, as it directly affects financial outcomes. As we approach 2025, adherence to the existing rules about how are SMSF loans regulated in Australia remains essential. Financial specialists emphasize the importance of proactively managing these guidelines to prevent minor issues from escalating into major violations or financial difficulties. This proactive approach is critical for ensuring that self-managed superannuation fund financing is utilized efficiently and in accordance with the established regulatory framework.

Key Reasons for Regulating SMSF Loans

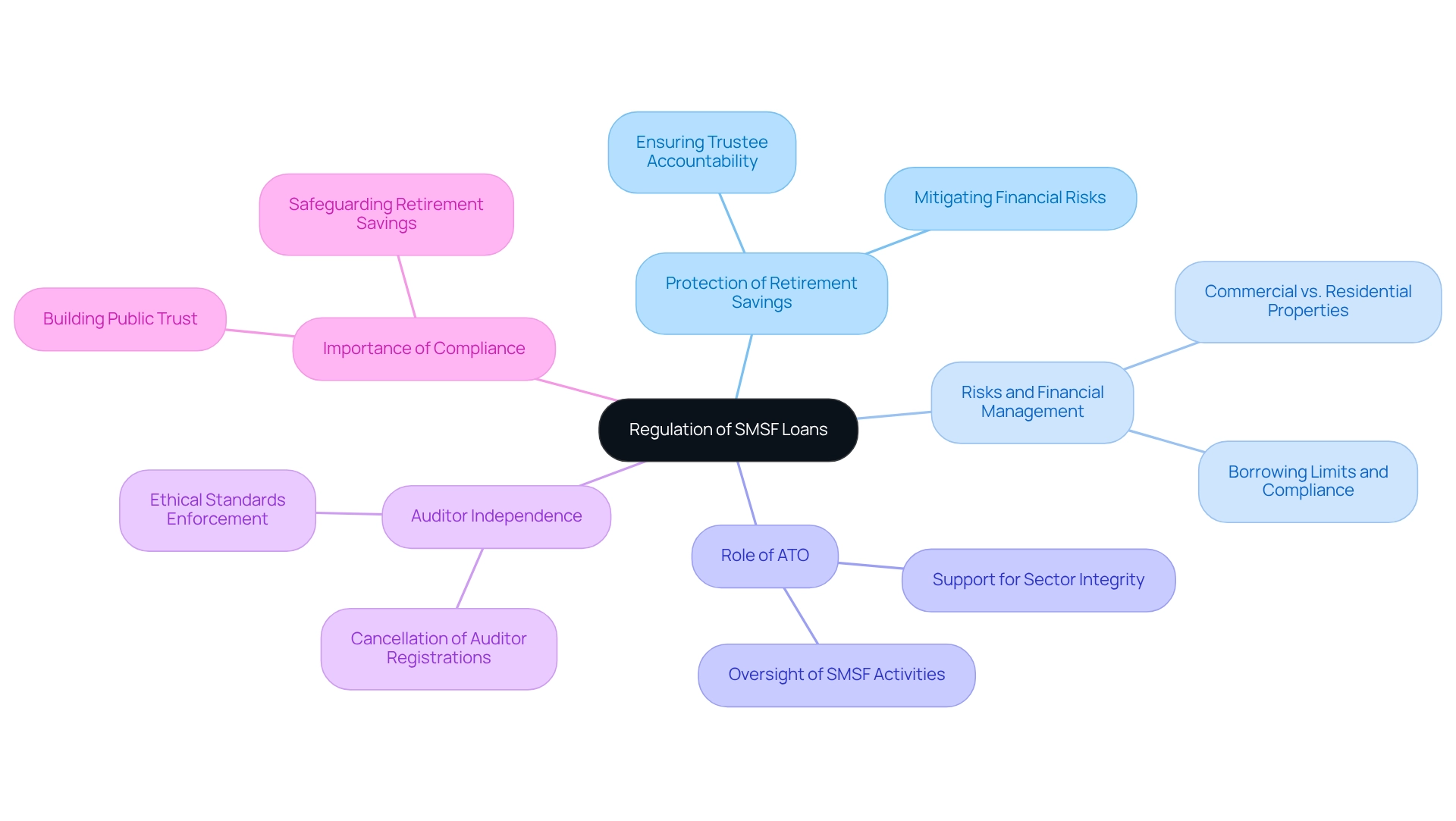

The question of how are SMSF loans regulated is primarily focused on protecting individuals' retirement savings, particularly when utilizing funds for commercial properties such as office buildings, warehouses, and retail spaces. A key motivation behind this oversight is to mitigate the risks associated with these ventures, which can result in significant financial losses if not managed prudently. By enforcing strict borrowing limits and compliance requirements, regulators ensure that SMSFs do not overextend their financial capabilities. This is especially crucial given that the projected return for SMSFs was 10.1% in 2022-23, a remarkable increase from 0.6% in the previous year, underscoring the potential for both gains and losses in this financial landscape. Notably, there are fewer limitations on commercial property ventures compared to residential properties, allowing for greater flexibility in financial strategies. Furthermore, regulations are established to prevent conflicts of interest, ensuring that trustees act in the best interests of fund members. The Australian Taxation Office (ATO) plays a vital role in overseeing self-managed superannuation fund activities to ensure compliance with superannuation laws, thereby safeguarding the integrity of the entire superannuation system. This oversight is essential for maintaining public trust in the self-managed superannuation fund sector, which is critical for its ongoing growth and acceptance as a viable financial option.

In recent developments, the ATO has focused on ensuring that self-managed superannuation fund auditors maintain independence and adhere to ethical standards, particularly concerning in-house audits. This initiative has resulted in the cancellation of registrations for auditors involved in reciprocal audit arrangements, reinforcing the importance of auditor independence in safeguarding retirement savings. Such measures contribute to creating a robust oversight structure that enhances the overall integrity of the question of how are SMSF loans regulated. Financial experts emphasize that these regulations are not mere administrative hurdles; they are essential for protecting retirement savings through self-managed superannuation fund guidelines. With fewer restrictions on business property ventures compared to residential properties, the ongoing support from the ATO is crucial for the self-managed superannuation fund sector to operate effectively and with integrity, ensuring these funds remain a reliable means for retirement planning. In conclusion, the oversight of how are SMSF loans regulated is vital for protecting retirement savings, maintaining public trust, and ensuring the integrity of the superannuation system, particularly as Finance Story offers tailored advice for navigating these investments. To explore how we can assist you further, BOOK A CHAT.

Consequences of Non-Compliance in SMSF Lending

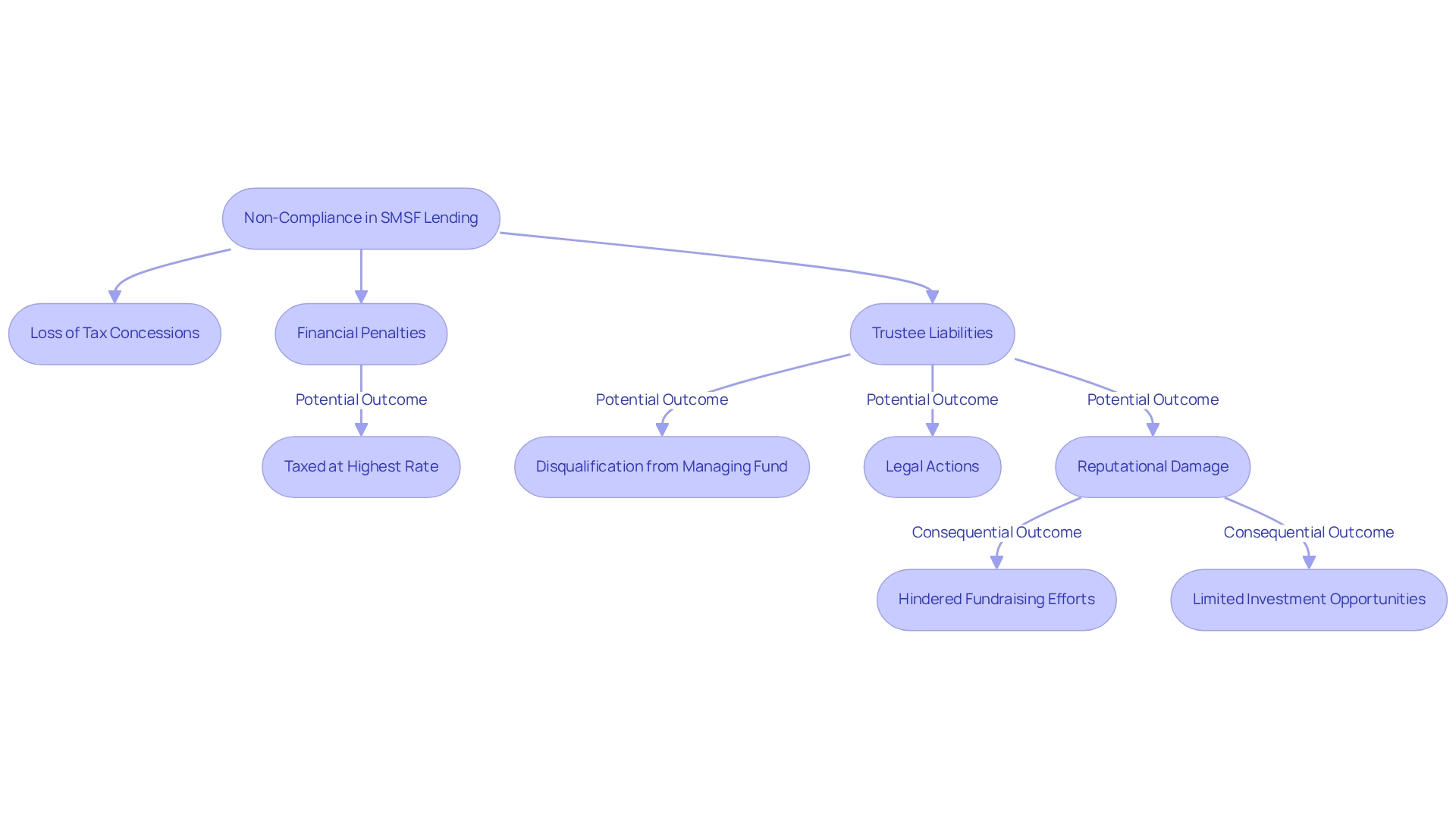

Failure to comply with regulations regarding how SMSF loans are regulated can lead to severe repercussions for both trustees and the fund itself. When a self-managed superannuation fund is deemed non-compliant, it risks being classified as a non-complying fund. This classification results in the loss of valuable tax concessions and the imposition of significant financial penalties. For instance, the Australian Taxation Office (ATO) possesses the authority to levy fines, and the fund's income may be taxed at the highest marginal rate, which can significantly impact its financial health.

Trustees face personal liabilities as well, including the potential for disqualification from managing the fund and exposure to legal actions. The consequences extend beyond mere financial fines; they can severely damage the reputation of the trustees and the fund, undermining trust among members and prospective investors. This loss of credibility can hinder future fundraising efforts and limit investment opportunities.

Recent statistics reveal that trustees who fail to comply with ATO rectification directions may face disqualification, underscoring the importance of proactive engagement with the ATO to resolve compliance issues effectively. For example, serious violations of self-managed superannuation fund legislation—such as not meeting the sole purpose test or permitting members to access funds early—can result in substantial penalties, including civil or criminal actions against trustees. Industry professionals emphasize the necessity of adhering to the regulatory framework to ensure that SMSF loans are regulated, which is essential for the sustainability and success of self-managed superannuation funds. Legal professionals note that trustees wishing to vary an ATO rectification direction must submit a written request within the specified timeframe, highlighting the importance of timely and informed action in compliance matters. Ultimately, comprehending and navigating the intricacies of self-managed superannuation fund rules is crucial for safeguarding both the fund's integrity and the trustees' professional reputation.

Alternative Views on SMSF Loan Regulations

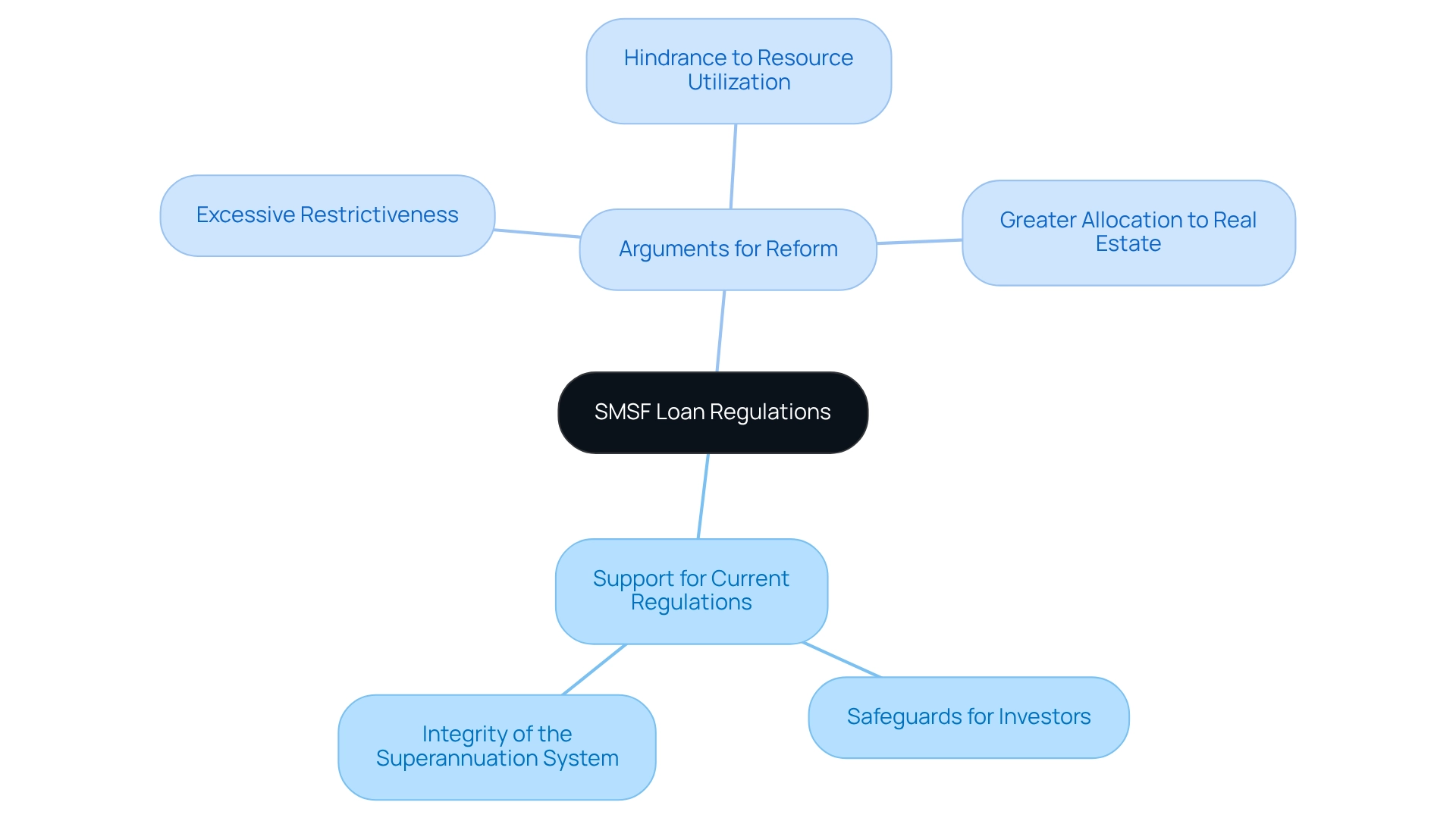

The regulatory framework in place raises the question of how SMSF loans are regulated to safeguard investors and uphold the integrity of the superannuation system. However, many industry experts argue that these regulations can be excessively restrictive. Critics emphasize that strict borrowing limits and intricate compliance obligations, such as the necessity for appropriate documentation and adherence to financial strategies, may hinder SMSFs from effectively utilizing their resources. For instance, in the greater than $2 million asset range, median expenses reached $15,900, illustrating the financial burden that can accompany compliance. This circumstance is especially challenging for smaller SMSFs, which frequently lack the resources to manage these intricacies.

Supporters of regulatory reform contend that a more adaptable strategy could encourage greater allocation in real estate and other assets, possibly resulting in higher returns for fund members. They propose that relaxing limitations could enable trustees of self-managed super funds to make more strategic financial choices, ultimately benefiting the wider economy. Expert views highlight the necessity for a balanced regulatory structure that maintains crucial safeguards while improving funding flexibility. This viewpoint is reflected in case studies showing that appropriate preparation for self-managed superannuation fund financing applications—such as confirming the fund is properly established and assessing its financial status—can significantly enhance the likelihood of approval.

As the environment of self-managed fund borrowing guidelines evolves, the decision between self-managed funds and APRA funds may vary depending on personal situations and investment choices. The ongoing debate surrounding whether SMSF loans are regulated highlights the importance of informed decision-making for investors looking to leverage their superannuation savings while mitigating risks.

Conclusion

Navigating the intricacies of Self-Managed Superannuation Fund (SMSF) loans is crucial for investors aiming to leverage their retirement savings effectively. The regulatory framework governing SMSF loans, primarily dictated by the Superannuation Industry (Supervision) Act 1993 and enforced by the Australian Taxation Office, is designed to protect members' retirement savings while facilitating strategic investment opportunities, particularly in real estate. Understanding the unique nature of Limited Recourse Borrowing Arrangements (LRBAs) and the distinctions between repairs and improvements is essential for optimizing financial outcomes and ensuring compliance.

The rationale behind stringent regulations is evident: they protect individual retirement savings and uphold the integrity of the superannuation system. By imposing borrowing limits and compliance requirements, regulators help mitigate the risks associated with property investments, which can result in significant financial losses if mismanaged. Furthermore, the ATO's oversight ensures that trustees act in the best interests of fund members, thereby reinforcing public confidence in the SMSF sector.

However, non-compliance carries severe consequences, including substantial financial penalties and potential disqualification of trustees. The complexities of SMSF regulations demand proactive engagement with the ATO to mitigate these risks. While some industry experts advocate for more flexible regulations to enhance investment strategies, the importance of adhering to the established framework cannot be overstated.

Ultimately, understanding the regulatory landscape of SMSF loans is paramount for investors who wish to capitalize on the benefits while minimizing risks. As discussions regarding the flexibility of these regulations continue, informed decision-making will be crucial for successfully leveraging superannuation savings in the evolving investment landscape.