Overview

Investment loans generally carry higher interest rates, primarily due to the perceived risks associated with rental properties, economic conditions, and the credit quality of borrowers. Lenders regard investment properties as riskier ventures, which often leads to larger down payment requirements and more stringent credit assessments. These factors collectively contribute to the increased costs of borrowing. Understanding these elements is crucial for potential investors looking to navigate the complexities of financing their investments.

Introduction

Investment loans are an essential financial tool for individuals aiming to generate income through properties. However, these loans frequently come with elevated interest rates that can confuse even the most seasoned investors. By understanding the underlying factors—such as perceived risk, economic conditions, and borrower creditworthiness—investors can better navigate the complexities of these financing options.

As the landscape of investment financing continues to evolve, a pressing question emerges: how can investors effectively tackle the challenges posed by high interest rates while optimizing their financial strategies?

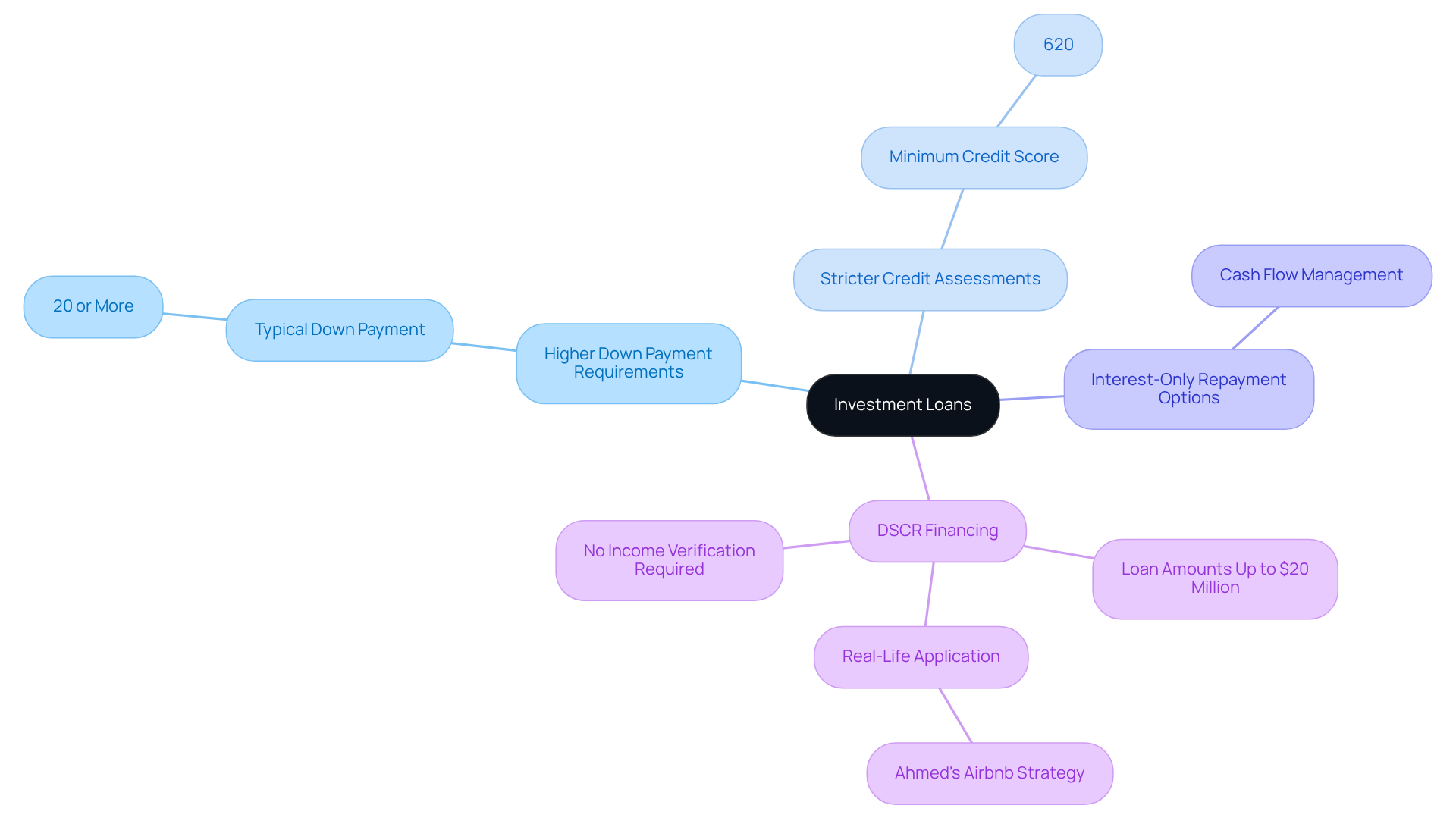

Define Investment Loans and Their Characteristics

Investment financing is tailored specifically for funding properties or assets designed to generate income, such as rental properties or commercial real estate. Unlike conventional home financing, which is typically secured against a primary residence, property financing is evaluated based on the income potential of the asset. Key characteristics of investment loans include:

- Higher Down Payment Requirements: Investors often encounter larger down payments, usually around 20% or more, to secure favorable loan terms.

- Stricter Credit Assessments: Lenders generally impose elevated credit score standards for funding, with many requiring a minimum score of 620.

- Interest-Only Repayment Options: Certain financing options provide the flexibility of interest-only repayment plans, enabling investors to manage cash flow more effectively.

These financial products are crafted to align with the distinct financial strategies of investors, offering adaptability in repayment conditions that cater to the income-generating nature of the investment. Recent trends reveal a growing preference for Debt Service Coverage Ratio (DSCR) financing among real estate investors, as these options allow qualification based on the rental income generated rather than traditional income verification methods. For instance, DSCR financing can offer amounts up to $20 million, making them an attractive choice for those looking to expand their portfolios.

Furthermore, refinancing options are available for investors seeking to access equity or capitalize on lower rates, which can significantly enhance their financial strategies. Practical examples illustrate the effectiveness of these funding options. For instance, Ahmed, a high-income professional, transformed his home into an Airbnb rental to cover mortgage payments, leveraging the income potential of his property. This strategy not only assisted him in managing his existing debt but also enabled him to build an emergency fund.

In summary, investment financing stands apart from traditional home mortgages due to its emphasis on income generation, higher down payment requirements, and flexible repayment options, which leads to the question of why are investment loans higher interest, making it an essential tool for discerning investors aiming to optimize their financial strategies. As Bill Lyons noted, DSCR financing is grounded in the property's operational data and frequently has no income criteria, further enhancing its appeal for investors.

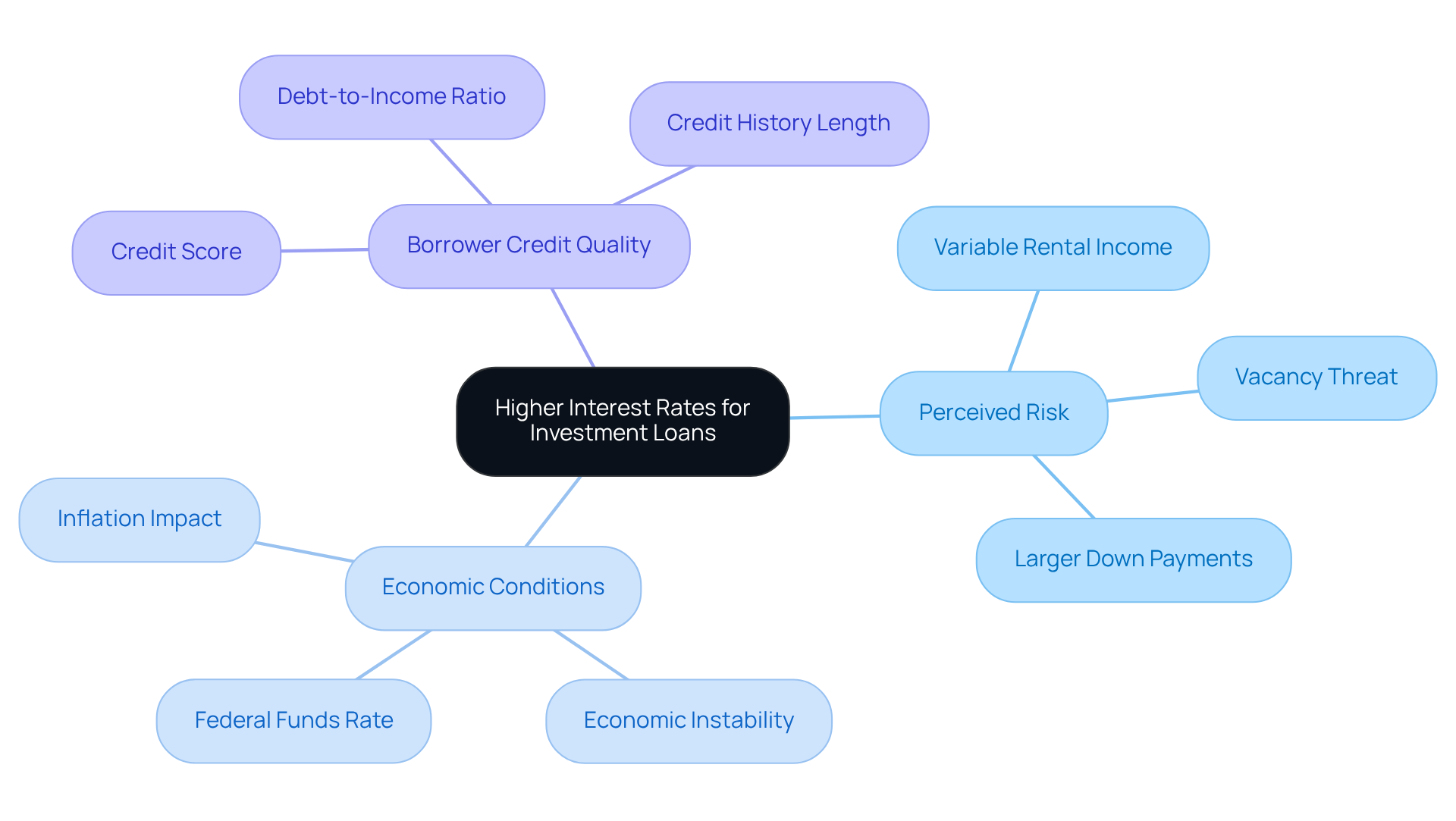

Examine Factors Influencing Higher Interest Rates for Investment Loans

Investment loans typically have higher interest rates, which raises the question of why investment loans have higher interest due to several key factors. Lenders perceive rental properties as higher risk compared to owner-occupied homes, primarily because of the potential for variable rental income and the threat of vacancies, which can hinder a borrower's ability to repay. This perception of risk is further compounded by the requirement for larger down payments on investment properties, increasing the lender's exposure.

Economic conditions significantly affect interest levels. For instance, during periods of inflation or economic instability, lenders may raise charges to safeguard against potential losses. The current federal funds rate, ranging from 4.25% to 4.50%, reflects this cautious approach, as lenders adjust their rates based on broader economic indicators.

Moreover, a borrower's creditworthiness is crucial in determining the cost of investment loans. Key factors such as credit score and debt-to-income ratio are essential; borrowers with lower credit scores often face higher costs. A robust credit history can lead to more favorable terms, while a poor credit profile may result in significantly increased expenses.

Case studies illustrate these dynamics effectively. One study highlights that borrowers with higher credit scores generally secure lower borrowing costs, underscoring the importance of maintaining good credit. Another case study investigates the impact of economic conditions on borrowing costs, showing that lenders become more cautious during economic downturns, leading to increased financing charges.

In summary, the interplay of perceived risk, economic conditions, and borrower credit quality raises the question of why investment loans have higher interest due to the elevated costs associated with financing projects. Understanding these factors can empower borrowers to make informed decisions and potentially reduce their financing costs.

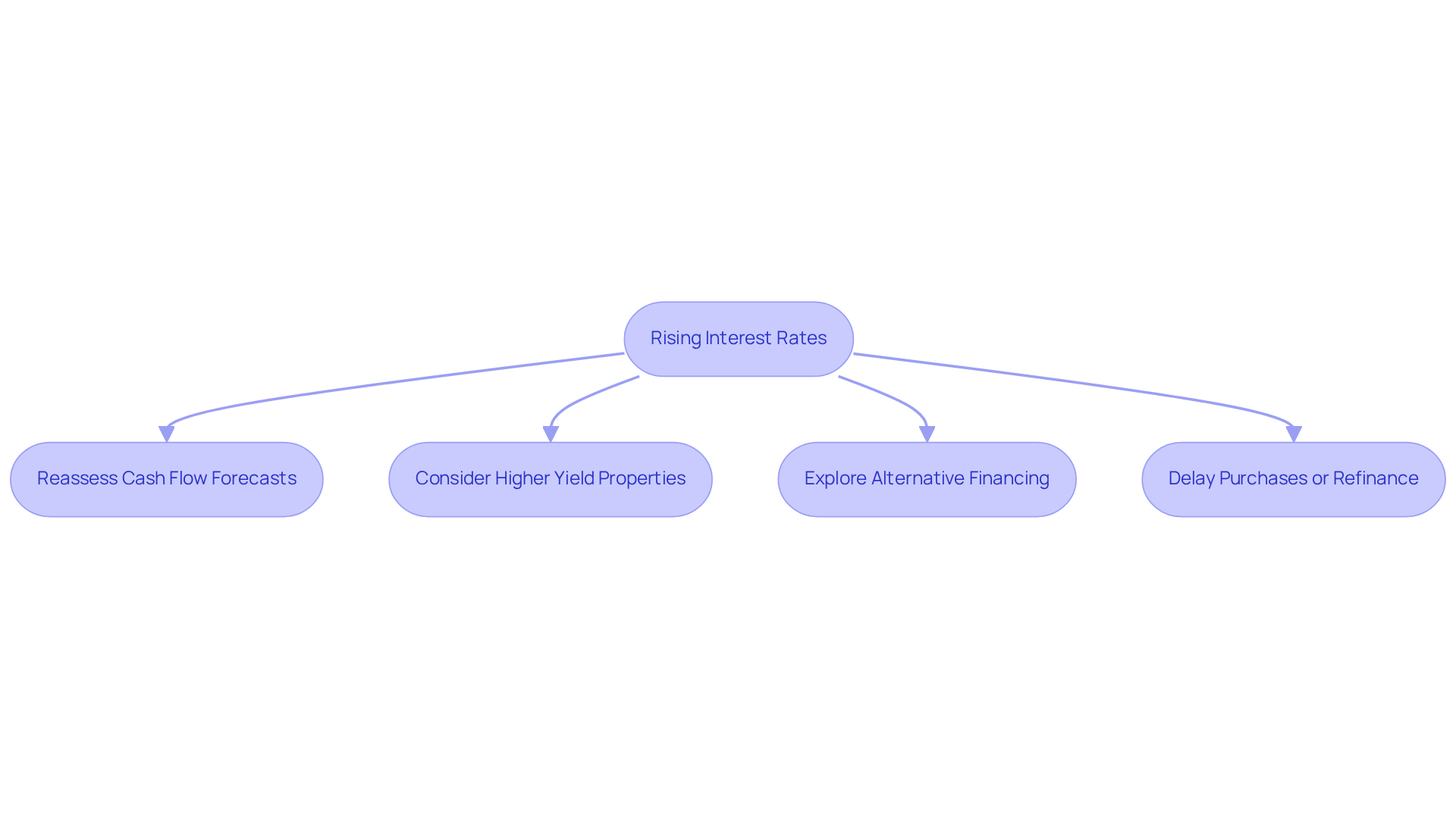

Analyze the Impact of Higher Interest Rates on Borrowers' Financial Strategies

The significant rise in interest charges on financing leads to concerns about why investment loans are higher interest, which greatly impacts borrowers' financial plans. Investors are compelled to reassess their cash flow forecasts and the overall feasibility of their assets, as elevated borrowing costs can significantly compress profit margins. For instance, many investors may pivot towards properties that offer higher rental yields to counterbalance the increased cost of financing. Furthermore, the current landscape may prompt borrowers to explore alternative financing avenues, such as partnerships or joint ventures, to distribute the financial load more effectively.

Considering these challenges, some investors may opt to delay buying choices or actively pursue refinancing current loans to obtain more advantageous terms. This strategic adjustment is crucial, as the interaction between potential returns and increasing costs requires a more sophisticated approach to financial planning. Finance Story offers access to a comprehensive range of lenders, ensuring that small business owners can find tailored financing solutions that meet their unique needs.

Case studies indicate that investors who actively modify their strategies in response to changes in borrowing costs can better maneuver through the shifting market environment. For example, a recent survey indicated that 68% of commercial real estate executives expect to increase their M&A activity in the coming year, reflecting a shift towards enhancing organizational capabilities amidst rising costs.

Ultimately, the effect of elevated borrowing costs emphasizes why investment loans are higher interest, highlighting the significance of strategic foresight in investment choices and urging borrowers to balance expected returns with the realities of increased financing expenses. The approaching barrier of debt maturities presents refinancing difficulties, especially for commercial mortgages backed at reduced levels, leading to concerns about why investment loans are higher interest, and emphasizing the urgency for investors to modify their strategies given increasing borrowing costs. With Finance Story's expertise in refinancing and securing customized business financing, small business owners can navigate these challenges more effectively.

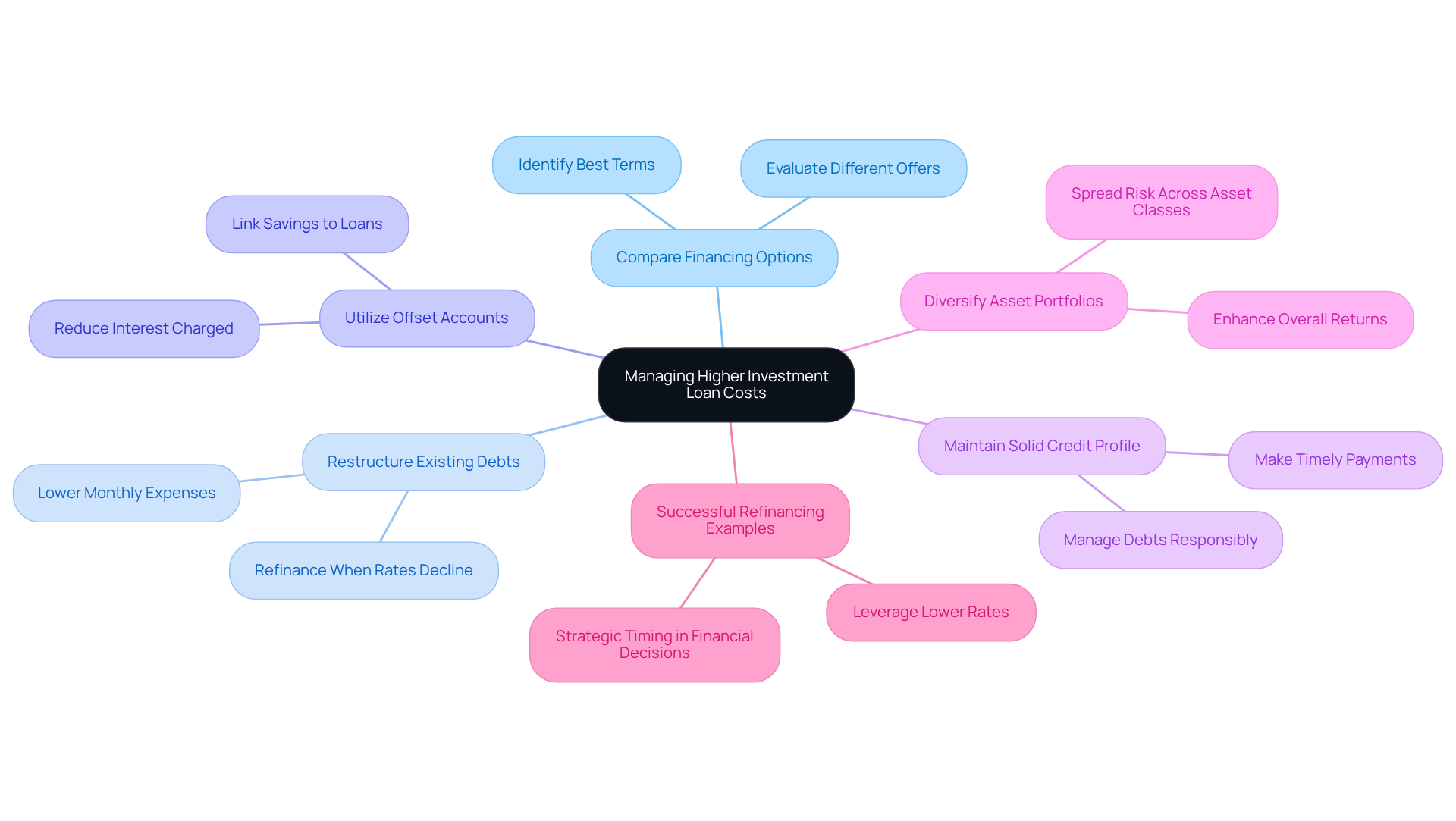

Explore Alternatives and Strategies for Managing Higher Investment Loan Costs

Addressing the expenses associated with why investment loans are higher interest requires a comprehensive strategy. One of the most effective approaches is to compare financing options for the best terms, as providers frequently present varying offers and conditions. This diligence can yield substantial savings over the duration of the mortgage. Furthermore, restructuring existing debts when rates decline can significantly enable borrowers to lower their monthly expenses and overall financial burden.

Utilizing offset accounts linked to investment financing represents another effective method for reducing borrowing costs. By offsetting the balance with savings, borrowers can decrease the interest charged, thereby enhancing cash flow. It is crucial to maintain a solid credit profile; managing debts responsibly and making timely payments can lead to more favorable borrowing conditions in the future.

Diversifying asset portfolios is equally essential. By spreading risk across various asset classes, investors can bolster overall returns, which raises the question of why investment loans are higher interest due to the absorption of higher borrowing costs. For example, real estate assets have historically shown resilience, often appreciating in value even during economic downturns, which can help mitigate the impact of elevated loan costs.

Successful refinancing examples highlight how investors have leveraged lower rates to enhance their financial positions. As Warren Buffett famously stated, 'The best opportunity to allocate capital is when things are declining,' underscoring the significance of strategic timing in financial decisions. By implementing these strategies, borrowers can effectively navigate the complexities related to why investment loans are higher interest costs. To further explore tailored financial strategies and the extensive range of lenders available through Finance Story, consider booking your free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy, to discuss your specific needs and goals.

Conclusion

Investment loans are essential financial instruments for investors aiming to generate income through properties or assets. Their distinct characteristics—such as higher down payment requirements, stricter credit assessments, and flexible repayment options—set them apart from traditional home financing. Yet, the question of why investment loans carry higher interest rates is significant, rooted in perceived risks associated with rental properties, economic conditions, and borrower creditworthiness.

This article explores multiple factors influencing these elevated interest rates. It highlights:

- How lenders perceive rental properties as riskier investments

- The impact of economic fluctuations on borrowing costs

- The necessity of maintaining a robust credit profile

Furthermore, it underscores the need for investors to adapt their strategies in response to rising interest rates, potentially leading them to consider alternative financing options or postpone purchases. By understanding these dynamics, borrowers can make informed decisions and strategically manage their financial commitments.

Ultimately, the implications of higher interest rates on investment loans emphasize the importance of strategic foresight in financial planning. Investors are encouraged to:

- Actively seek competitive financing options

- Consider refinancing when advantageous

- Diversify their portfolios to mitigate risks

Embracing these strategies not only aids in managing costs but also positions investors to capitalize on future opportunities, reinforcing the article's central message about navigating the complexities of investment financing.