Overview

This article delves into the banks that offer loans to Self-Managed Super Funds (SMSFs), providing a comprehensive examination of the options available for prospective borrowers. Understanding the unique features and borrowing standards of different banks is crucial. Moreover, we will explore the pros and cons of SMSF loans, which are vital for making informed financial decisions in retirement planning and property investment. Are you ready to navigate the complexities of SMSF loans? By grasping these key elements, you can enhance your financial strategy and secure your future.

Introduction

In the realm of retirement planning, Self-Managed Super Fund (SMSF) loans have emerged as powerful tools for investors looking to enhance their portfolios. By enabling individuals to borrow against their superannuation, these loans unlock opportunities for lucrative property investments, ranging from residential homes to commercial spaces.

As an increasing number of Australians turn to SMSFs to take control of their financial futures, understanding the intricacies of SMSF loans becomes essential. This article explores the significance of SMSF loans, providing insights into their structure, the banks that offer these financial products, and a comparative analysis of their advantages and disadvantages.

With expert guidance and real-world examples, it aims to equip investors with the knowledge necessary to navigate this complex landscape effectively.

Understanding SMSF Loans and Their Importance

Self-Managed Super Funds (SMSFs) serve as tailored financial instruments that empower individuals to access capital through their fund for investing in real estate or other assets. These financial products are essential for investors seeking to leverage their superannuation savings, thereby strengthening their retirement portfolios. By utilizing self-managed superannuation fund financing, trustees can acquire both residential and commercial properties, including office buildings, warehouses, and retail spaces, which can lead to potentially higher returns and significant tax advantages.

Understanding the structure and regulatory framework surrounding self-managed superannuation fund loans is vital for anyone contemplating this strategy. Notably, over 65 percent of SMSFs have been established for more than a decade, underscoring a robust trend towards long-term financial planning within this sector. The ability to borrow within a self-managed super fund greatly amplifies the fund's purchasing power, allowing access to diverse opportunities that traditional superannuation funds may not offer.

Moreover, self-managed superannuation fund financing is increasingly recognized for its importance in retirement planning strategies. Financial consultants emphasize that leveraging superannuation savings through self-managed funds can yield enhanced financial returns. Finance Story provides expert guidance to assist small business owners in navigating the complexities of commercial property investments, ensuring compliance with regulations and facilitating lender selection. Barbara Drury, a financial reporter, notes that "the strategic application of self-managed superannuation fund borrowing can significantly impact retirement strategies, empowering individuals to maximize their funding potential." Real-world examples illustrate how self-managed superannuation fund financing has effectively bolstered investment strategies, enabling individuals to secure their financial futures.

However, it is essential to remain cognizant of the ongoing legislative challenges confronting SMSFs, such as the opposition to Division 296 tax, which has raised concerns among investors. Finance Story aids clients in addressing these issues, ensuring they stay informed about legislative changes and market trends, which is crucial for optimizing the benefits of these financial products. Current statistics indicate that self-managed superannuation fund financing is gaining traction among investors, reflecting a growing recognition of its potential to enhance retirement portfolios.

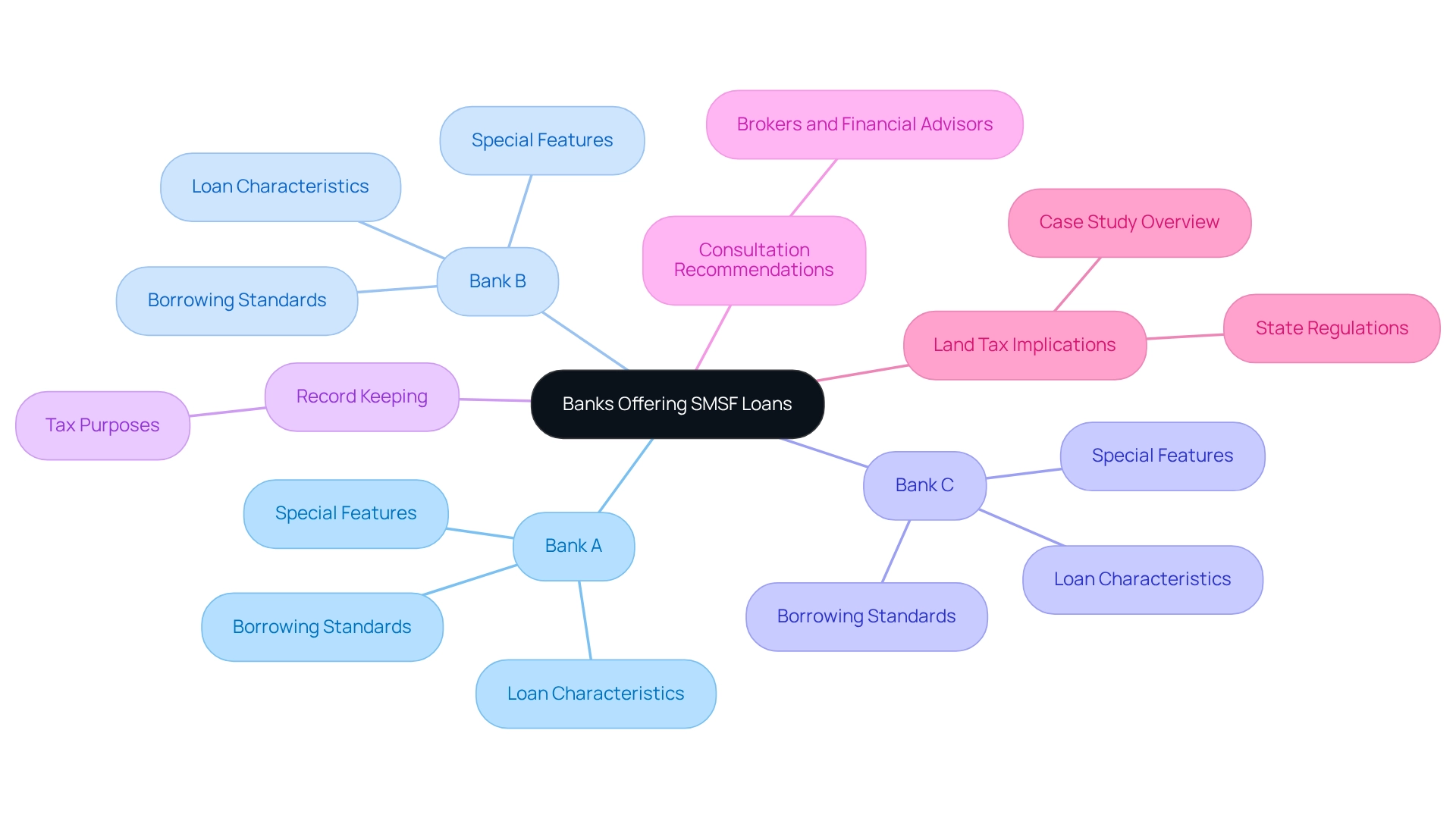

Overview of Banks Offering SMSF Loans

In Australia, various banks and financial organizations provide self-managed super fund financing, raising the question of which banks give loans to SMSF, as each showcases unique characteristics and borrowing standards designed to address varied financial requirements. This overview underscores the variety of self-managed super fund loan products available, particularly highlighting which banks give loans to SMSF, empowering potential borrowers to compare features and select the most suitable options for their funding strategies.

As the SMSF landscape evolves, staying informed about these offerings is crucial for making sound financial decisions. Finance Story is here to assist you in building a solid case and ensuring adherence to the regulations, guiding you in locating the appropriate lender for your commercial investment asset.

Investors are advised to maintain accurate records of real estate expenses to categorize them appropriately for tax purposes. Furthermore, as Per Amundsen, Director at Thinktank, observed, 'Yet the high-quality performance of LRBA credits over a prolonged period has now helped to alleviate many of these concerns.'

Moreover, prospective borrowers ought to examine the land tax consequences linked to self-managed superannuation fund assets, as emphasized in the case study named 'Land Tax Implications for Self-Managed Superannuation Fund Assets.' Consulting with brokers or financial advisors is also recommended to navigate upcoming trends and changes effectively.

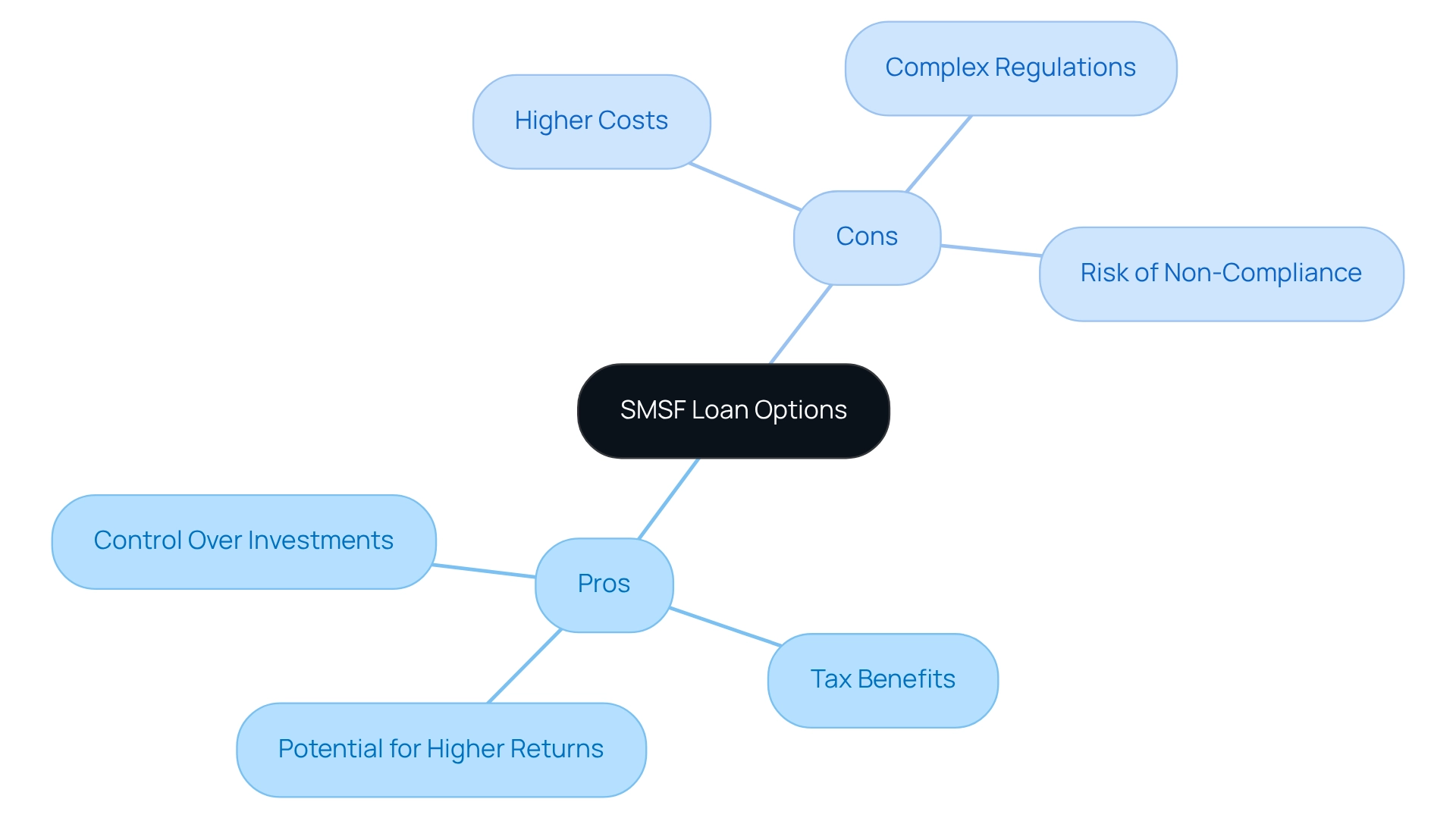

Comparative Analysis: Pros and Cons of SMSF Loan Options

Assessing loans from Self-Managed Superannuation Funds (SMSFs) necessitates a comprehensive evaluation of their benefits and drawbacks, particularly when investing in commercial real estate. Finance Story offers expert guidance to empower small business owners in navigating this complex landscape effectively.

Pros:

- Control Over Investments: SMSF trustees possess the autonomy to select their investments, encompassing various property types and locations. This flexibility allows for tailored investment strategies, particularly beneficial in commercial real estate, where fewer restrictions apply compared to residential ventures.

- Tax Benefits: SMSFs enjoy concessional tax rates on income and capital gains, significantly enhancing overall returns. Property investments through SMSFs can yield substantial tax advantages, making them an appealing option for investors.

- Potential for Higher Returns: By leveraging superannuation funds, investors can realize considerable capital growth, especially in thriving property markets, leading to increased wealth accumulation over time.

Cons:

- Higher Costs: SMSF loans generally entail elevated interest rates and setup fees compared to traditional loans, potentially impacting overall profitability.

- Complex Regulations: The legal and compliance landscape surrounding SMSF loans can be intricate, often necessitating professional guidance for effective navigation. Finance Story assists in constructing a robust argument and ensuring adherence to SMSF regulations, which is vital for successful financial growth.

- Risk of Non-Compliance: Failure to adhere to SMSF regulations can incur severe penalties, including the loss of tax concessions, underscoring the critical importance of maintaining compliance.

This analysis highlights the essential need for prospective borrowers to grasp both the advantages and challenges associated with SMSF loans, particularly when considering commercial real estate investments. By doing so, they can make informed decisions that align with their financial objectives, especially in light of the SMSF industry's ongoing growth and the evolving landscape of property investment.

Conclusion

The exploration of Self-Managed Super Fund (SMSF) loans has illuminated their vital role in empowering Australian investors to maximize their retirement portfolios. By understanding the intricacies of SMSF loans, including their structure and the regulatory environment, individuals can leverage their superannuation savings for lucrative property investments. This financial strategy not only enhances purchasing power but also opens doors to diverse investment opportunities that traditional superannuation funds may not provide.

Furthermore, the landscape of SMSF loans is enriched by a variety of lending options available from prominent banks, each catering to distinct investment needs. This diversity allows potential borrowers to compare features and select loans that align with their financial strategies. As the SMSF sector continues to evolve, staying informed about these offerings is crucial for making sound investment decisions.

However, navigating the complexities of SMSF loans requires careful consideration of their pros and cons. While the potential for higher returns and tax benefits is significant, the higher costs and regulatory complexities cannot be overlooked. Investors must remain vigilant in maintaining compliance with SMSF regulations to avoid penalties and safeguard their tax advantages.

In conclusion, SMSF loans represent a powerful tool for retirement planning, enabling individuals to take charge of their financial futures. By equipping themselves with the right knowledge and guidance, investors can effectively navigate this complex landscape, ultimately securing their financial goals and enhancing their retirement outcomes. As interest in SMSF loans grows, so does the opportunity for savvy investors to capitalize on these financial instruments for long-term success.