Overview

This article explores the essential question of which type of loan is most suitable for purchasing investment property, focusing on various financing options specifically designed for real estate investments. Understanding these loan types—such as:

- Conventional loans

- FHA financing

- Commercial financing

- Hard money loans

- Portfolio financing

is vital for investors. Each option presents distinct requirements and implications for cash flow and profitability, making it crucial to align financial strategies with investment goals. By recognizing these factors, investors can make informed decisions that enhance their investment outcomes.

Introduction

Navigating the world of investment property loans can be a daunting task for many aspiring investors, particularly as the real estate market continues to evolve. Understanding the various financing options available is essential for maximizing potential returns and ensuring a sound investment strategy. However, with a multitude of loan types and requirements, how can investors determine which option aligns best with their financial goals? This article delves into the intricacies of investment property loans, offering key insights and practical guidance designed to empower investors in making informed decisions.

Defining Investment Property Loans: What They Are and Why They Matter

Financing options for acquiring real estate involve specialized solutions that assist individuals or organizations in understanding what type of loan to buy investment property for profit rather than personal use. Unlike conventional home financing, these financial products often come with elevated interest rates and stricter lending standards, reflecting the heightened risk associated with rental assets. Understanding what type of loan to buy investment property and the nuances of these financial products is essential for stakeholders, as these factors can significantly influence cash flow, return on capital, and overall financial strategy.

In 2025, average interest rates for financing real estate are expected to remain competitive, presenting an opportune moment for investors to explore funding options. These financial aids can be utilized for various types of real estate, including:

- warehouses

- retail locations

- residential rental houses

- commercial spaces

- multi-family dwellings

This versatility underscores their importance as a vital instrument for wealth growth through real estate.

Understanding what type of loan to buy investment property is crucial, as a well-structured financing option for real estate can yield substantial long-term profits, reinforcing the notion that real estate remains one of the most secure and rewarding avenues for investment when approached strategically. Success stories abound, with numerous investors achieving financial independence through calculated real estate purchases, showcasing the transformative potential of these specialized financing options.

Exploring Loan Options for Investment Properties: Types and Characteristics

Investors have access to a variety of financing options for acquiring investment properties, including guidance on what type of loan to buy investment property, each tailored to meet distinct requirements. Understanding these options is crucial for aligning financial strategies with investment goals. The primary financing avenues include:

-

Conventional Loans: These traditional loans, offered by banks and credit unions, generally necessitate a higher credit score and a significant down payment. They are ideal for individuals with strong financial profiles, providing competitive interest rates and extended repayment terms.

-

FHA Financing: The Federal Housing Administration (FHA) offers funding with lower down payment requirements, making it especially accessible for first-time investors. However, this financing is typically limited to owner-occupied residences, which may restrict its use for investment purposes.

-

Commercial Financing: Specifically designed for purchasing commercial real estate, these financial products often present different terms than residential options, including shorter repayment periods and higher interest rates due to the increased risk associated with commercial investments. Finance Story specializes in developing tailored business cases for banks, ensuring stakeholders secure the necessary funding for their commercial properties.

-

Hard Money Financing: These short-term loans, secured by real estate, are frequently sought by investors in need of immediate capital. While they come with higher interest rates, they provide rapid access to funds, making them suitable for time-sensitive opportunities.

-

Portfolio Financing: Offered by lenders who retain the loans in-house rather than selling them on the secondary market, portfolio financing can provide more flexible qualification criteria. This flexibility makes it a viable option for unique funding scenarios that may not fit conventional lending standards.

By understanding these diverse financing alternatives, including what type of loan to buy investment property, investors can better align their choices with their financial objectives and risk tolerance, ensuring they select the most suitable funding type for their specific circumstances.

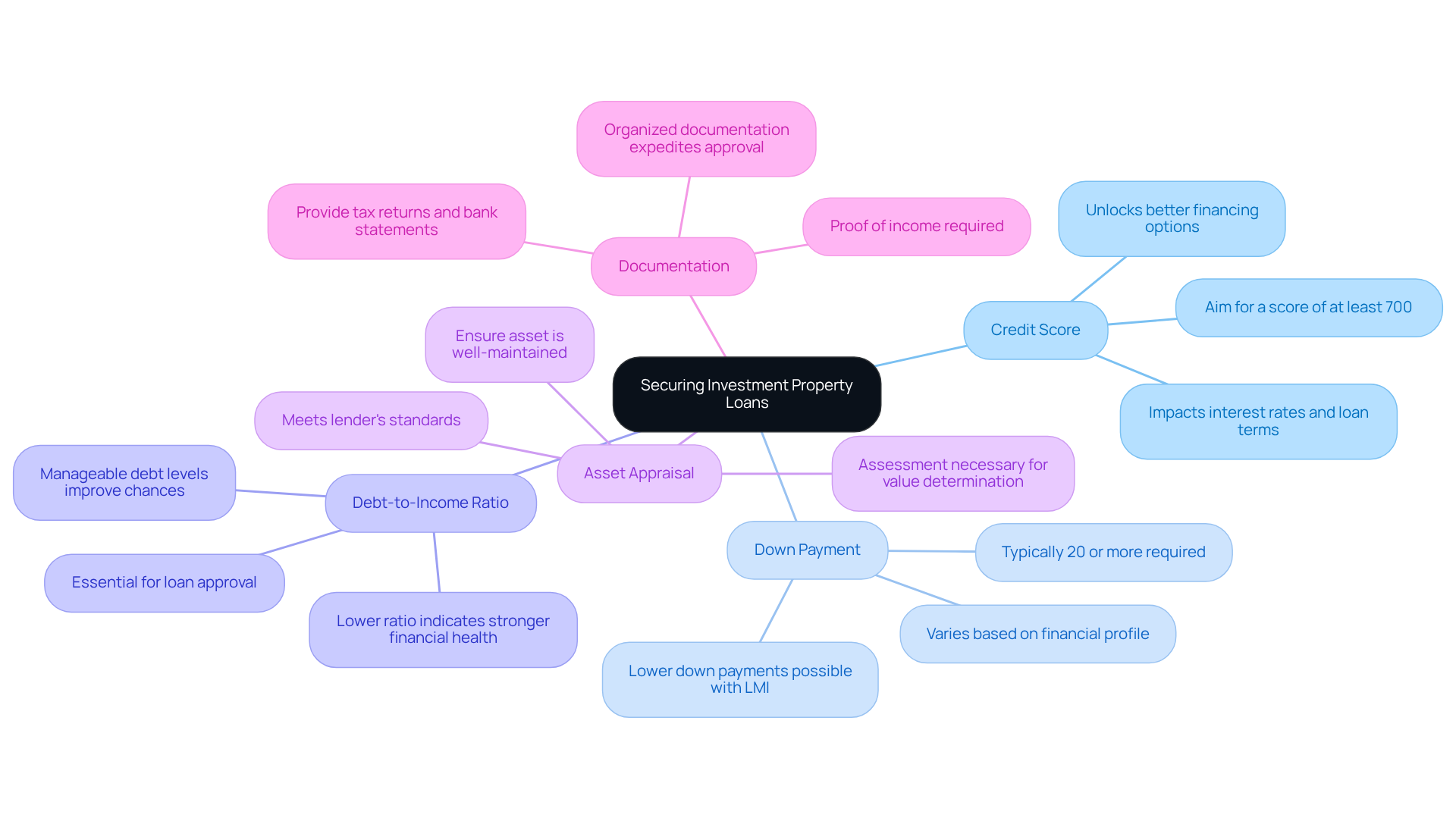

Key Considerations for Securing Investment Property Loans: Requirements and Best Practices

Acquiring financing for an investment property necessitates thorough preparation and a clear understanding of what type of loan to buy investment property. Key considerations include:

-

Credit Score: A robust credit score is crucial, as it significantly impacts the interest rate and terms of the loan. Investors should aim for a score of at least 700 to qualify for the most favorable rates. Financial specialists stress that a strong credit score not only aids in securing approvals but also opens doors to improved financing alternatives. Jessica Willens, a content manager at RealWealth, observes, "A strong credit score is not merely a figure; it’s a key that unlocks better financing conditions and prospects for stakeholders."

-

Down Payment: Typically, lenders require a down payment of 20% or more for investment properties. However, some loan types may permit lower down payments, especially if the borrower is prepared to pay Lenders Mortgage Insurance (LMI). According to the Australian Bureau of Statistics, understanding the down payment landscape is essential, as it can vary based on the individual's financial profile and the lender's policies.

-

Debt-to-Income Ratio: Lenders evaluate an investor's debt-to-income ratio to gauge their capacity to manage additional debt. A lower ratio indicates stronger financial health, thereby enhancing the likelihood of loan approval. Investors should strive to keep their debt levels manageable to improve their chances of securing financing.

-

Asset Appraisal: An assessment is typically necessary to ascertain the asset's value and ensure it meets the lender's standards. Investors should be prepared for this step by ensuring the asset is well-maintained and presents positively to appraisers.

-

Documentation: Comprehensive documentation is essential for the borrowing application process. Investors must provide tax returns, bank statements, and proof of income. Being organized and transparent can significantly expedite the approval process.

Optimal strategies for securing financing for real estate include comparing various terms, collaborating with an experienced mortgage broker, and being ready to negotiate with lenders. By understanding these requirements and implementing these strategies, individuals can significantly enhance their chances of determining what type of loan to buy investment property and securing favorable financing. Furthermore, successful investors often highlight the importance of maintaining a strong credit score, as it directly correlates with their ability to secure advantageous loan terms.

Conclusion

Understanding the nuances of investment property loans is essential for anyone looking to venture into real estate for profit. These specialized financial products not only differ from conventional home loans but also carry unique characteristics that can significantly impact an investor's financial strategy. By grasping the various types of loans available and their respective requirements, investors can make informed decisions that align with their goals and risk tolerance.

The article highlights several key loan options, including:

- Conventional loans

- FHA financing

- Commercial financing

- Hard money loans

- Portfolio financing

Each type has its own set of advantages and considerations, emphasizing the importance of selecting the right financing that suits individual circumstances. Furthermore, critical factors such as credit scores, down payments, debt-to-income ratios, asset appraisals, and thorough documentation play a pivotal role in securing favorable loan terms and conditions.

Ultimately, the journey towards successful real estate investment hinges on understanding what type of loan to buy investment property and how to navigate the complexities of financing. By being proactive, conducting thorough research, and leveraging available resources, investors can position themselves for success in the dynamic landscape of real estate. Embracing these principles not only fosters financial growth but also underscores the transformative potential of strategic investment in property, paving the way for a more secure financial future.