Overview

Key steps in commercial property investment are crucial for success. Understanding the various types of properties is the first step, followed by evaluating location and market potential. Are you aware of the different lease structures? Knowing these can significantly impact your investment. Assessing financial requirements is vital, as is identifying opportunities for value addition.

This article emphasizes the importance of:

- Demographic analysis

- Financial planning

- Strategic renovations

These elements are essential for enhancing property value and ensuring informed investment decisions. Furthermore, by focusing on these areas, you position yourself to make sound choices that align with your financial goals.

Introduction

Investing in commercial real estate offers a distinctive opportunity for wealth generation, yet it presents a set of complexities that can perplex even the most experienced investors. Grasping the fundamental aspects of commercial property investment is crucial for navigating this intricate landscape—from identifying the right type of property to evaluating market potential and financing options. However, the allure of higher returns is accompanied by the challenge of making informed decisions amid fluctuating market conditions and varying tenant obligations.

What essential steps can investors take to not only enter the commercial property market but also thrive within it?

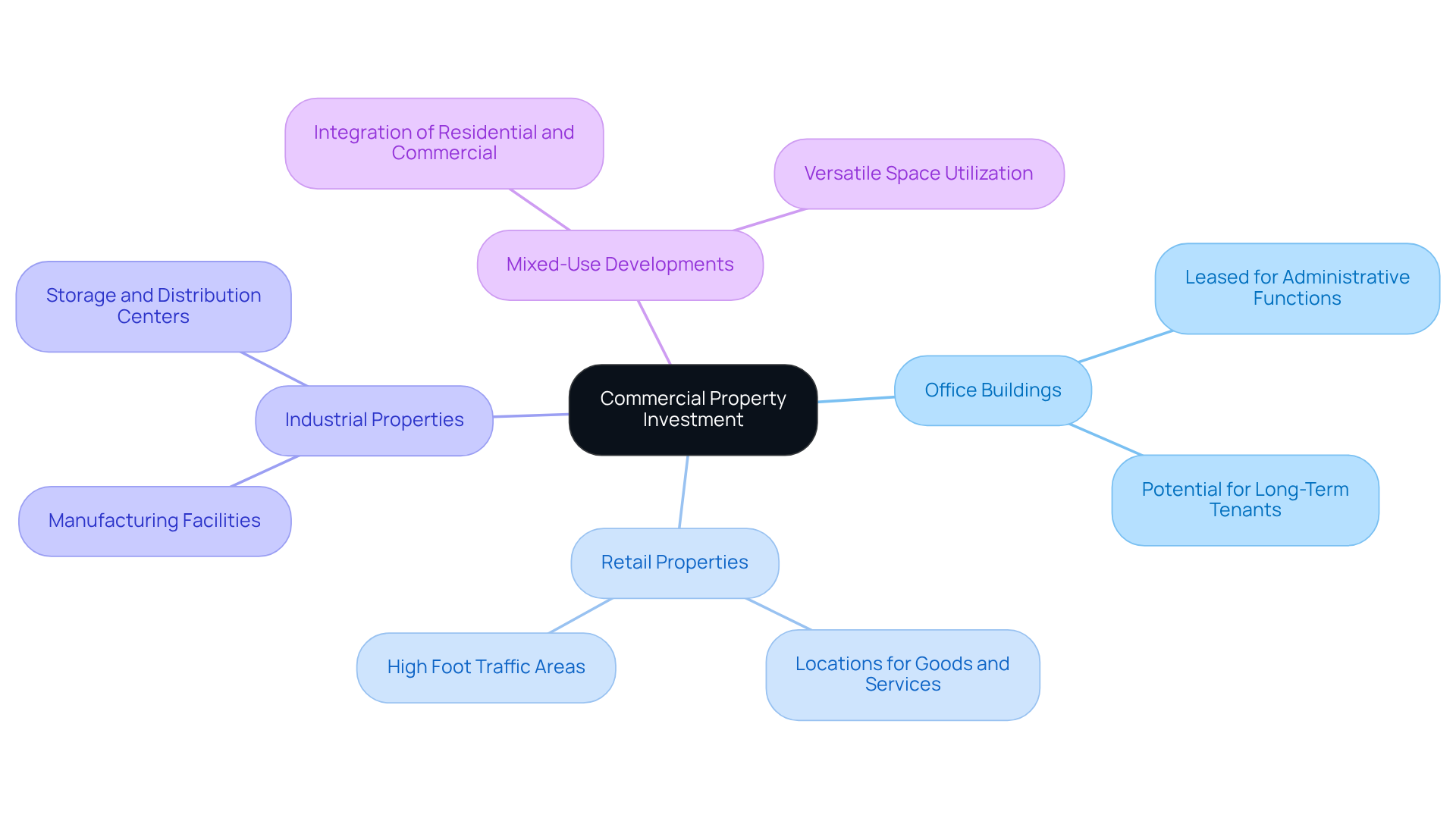

Understand the Basics of Commercial Property Investment

Commercial real estate investment entails the acquisition of properties utilized for business purposes, including office buildings, retail spaces, and warehouses. Investors typically consider what to look for in commercial property investment, focusing on assets that generate rental income and appreciate in value over time. Understanding the key types of commercial properties is essential:

- Office Buildings: Spaces leased to businesses for administrative functions.

- Retail Properties: Locations where goods and services are offered to consumers.

- Industrial Properties: Facilities designated for manufacturing, storage, and distribution.

- Mixed-Use Developments: Properties that integrate residential, commercial, and sometimes industrial spaces.

Recognizing what to look for in commercial property investment enables investors to identify which type aligns with their financial goals and risk tolerance. Furthermore, it is important to acknowledge the potential for higher returns compared to residential real estate, while also being aware of associated risks, such as market fluctuations and tenant turnover. How do these factors align with your investment strategy?

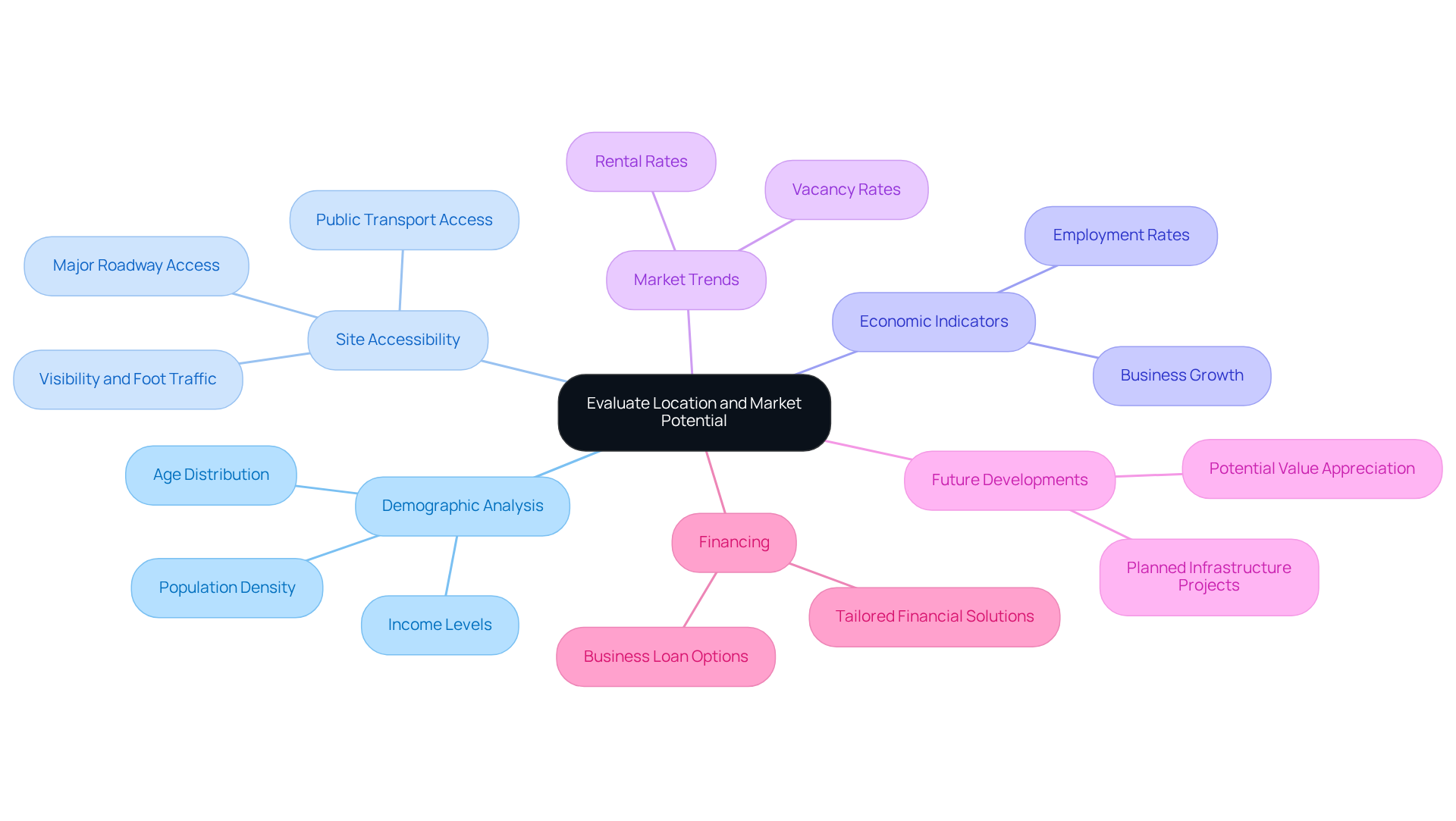

Evaluate Location and Market Potential

When evaluating a commercial property, it's important to understand what to look for in commercial property investment to ensure a sound decision.

Understanding the population density, income levels, and age distribution in the area is crucial when considering what to look for in commercial property investment. A rising population frequently indicates heightened demand for commercial areas, which highlights what to look for in commercial property investment, making demographic analysis an essential element of your financial strategy.

When considering what to look for in commercial property investment, the site's accessibility via public transport and major roadways is essential. High visibility and foot traffic can significantly enhance rental potential, making location a critical factor in achieving success.

It is essential to thoroughly research local economic indicators, including employment rates and business growth. A strong economy typically correlates with increased demand for commercial real estate, which indicates what to look for in commercial property investment within a positive market climate.

Staying informed about current market trends, such as rental and vacancy rates, is essential for understanding what to look for in commercial property investment and assessing the potential profitability of your venture. Understanding what to look for in commercial property investment provides insights into market dynamics and future performance.

Future Developments: Understanding what to look for in commercial property investment, such as planned infrastructure projects or developments in the area, can unveil opportunities for real estate value appreciation. Such developments often lead to increased demand and can positively impact what to look for in commercial property investment.

Moreover, securing the appropriate business loan is essential for funding your commercial real estate venture. Finance Story specializes in crafting polished and individualized business cases to present to lenders, ensuring you have access to a comprehensive suite of financing options tailored to your specific needs—whether you are looking to purchase a warehouse, retail space, factory, or hospitality venture. By carefully assessing these factors and utilizing expert financing solutions, investors can determine what to look for in commercial property investment to make informed choices regarding the viability and potential success of their investments.

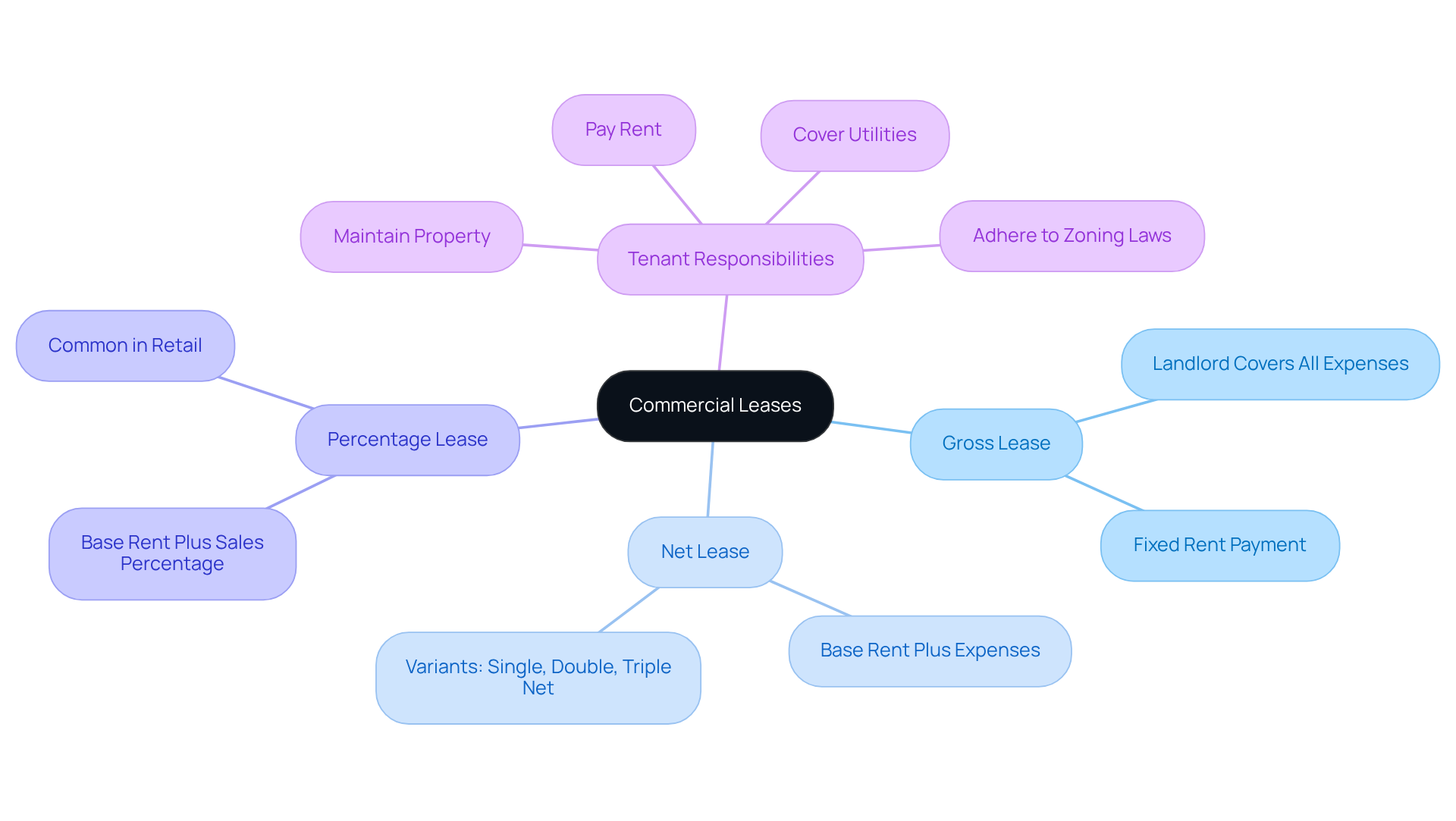

Learn About Commercial Leases and Tenant Responsibilities

Commercial leases differ significantly from residential leases, presenting unique structures that every investor should understand. The primary types of commercial leases include:

- Gross Lease: In this arrangement, the landlord assumes responsibility for all property expenses, including taxes, insurance, and maintenance. Tenants are required to pay a fixed rent.

- Net Lease: Here, tenants pay a base rent alongside a portion of the expenses associated with the premises, such as taxes, insurance, and maintenance costs. Variants include single net, double net, and triple net leases, each differing in the expenses covered.

- Percentage Lease: Commonly utilized in retail, this type involves tenants paying a base rent plus a percentage of their sales revenue.

Tenant Responsibilities: Tenants typically bear several obligations, which may include:

- Maintaining the property in good condition.

- Paying rent punctually.

- Covering utility costs.

- Adhering to zoning laws and lease terms.

For investors, understanding what to look for in commercial property investment, including these lease structures and the associated responsibilities, is vital. It ensures compliance and protects their investments, ultimately leading to informed decision-making in the commercial property market.

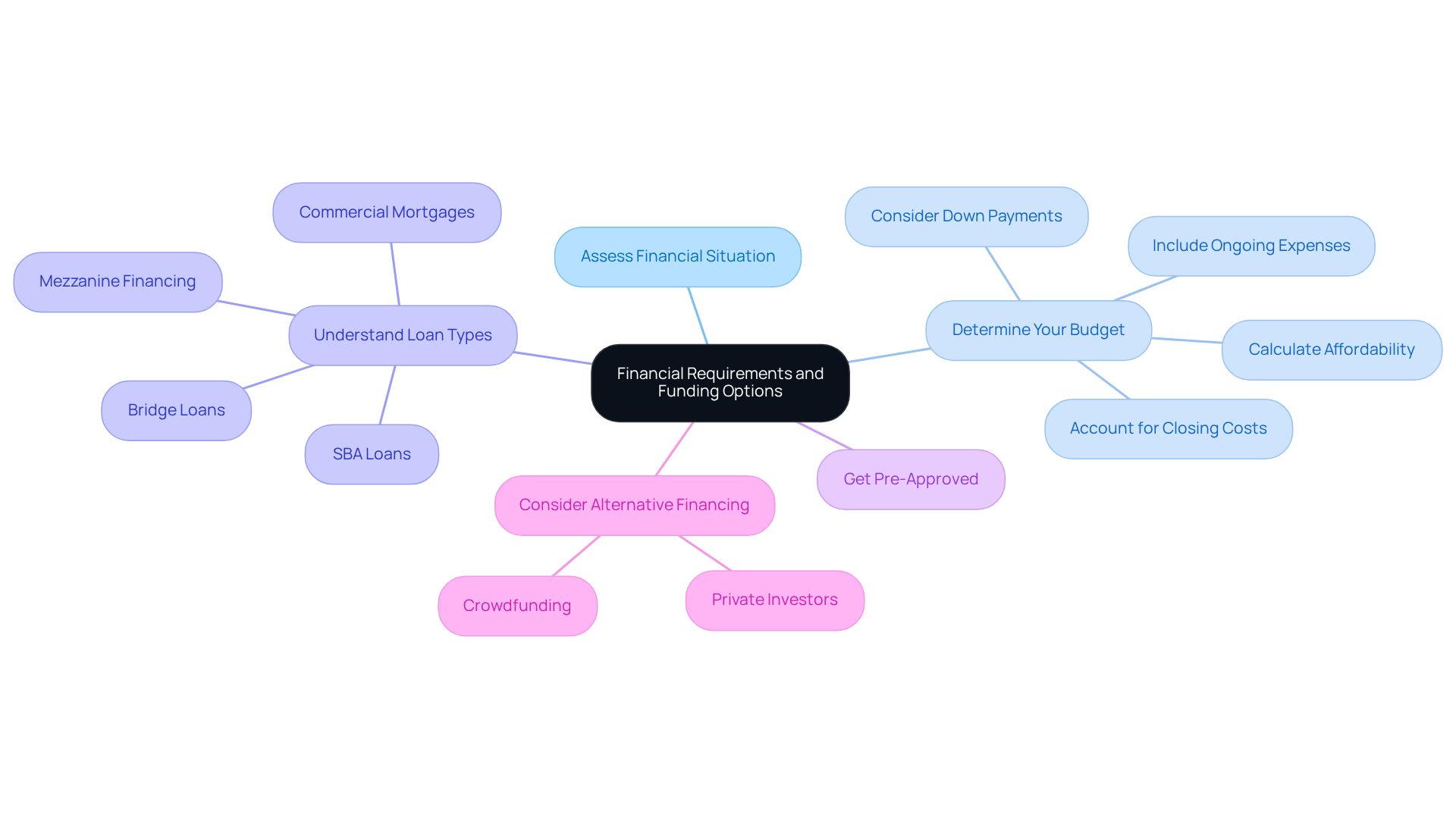

Assess Financial Requirements and Funding Options

Before investing in commercial property, it is crucial to assess your financial situation.

Determine Your Budget: Calculate how much you can afford to invest, taking into account down payments, closing costs, and ongoing expenses. Understanding your financial limits is the first step toward successful investment.

Understand Loan Types: Familiarize yourself with various financing options available to you.

- Commercial Mortgages: These are traditional loans specifically designed for purchasing commercial properties.

- Bridge Loans: Short-term loans that cater to immediate financing needs can be essential for seizing opportunities.

- Mezzanine Financing: This hybrid of debt and equity financing is often utilized for larger projects, providing flexibility.

- SBA Loans: Backed by the Small Business Administration, these loans are suitable for small business owners looking for reliable funding.

Get Pre-Approved: Seeking pre-approval from lenders is a strategic move. It not only clarifies your borrowing capacity but also streamlines the purchasing process, making you a more attractive buyer.

Consider Alternative Financing: If traditional financing proves challenging, explore options like crowdfunding or private investors. These avenues can open doors to essential capital.

By thoroughly evaluating your financial needs and examining funding alternatives, you can secure the necessary capital to pursue your investment objectives in real estate.

Identify Opportunities for Value Addition

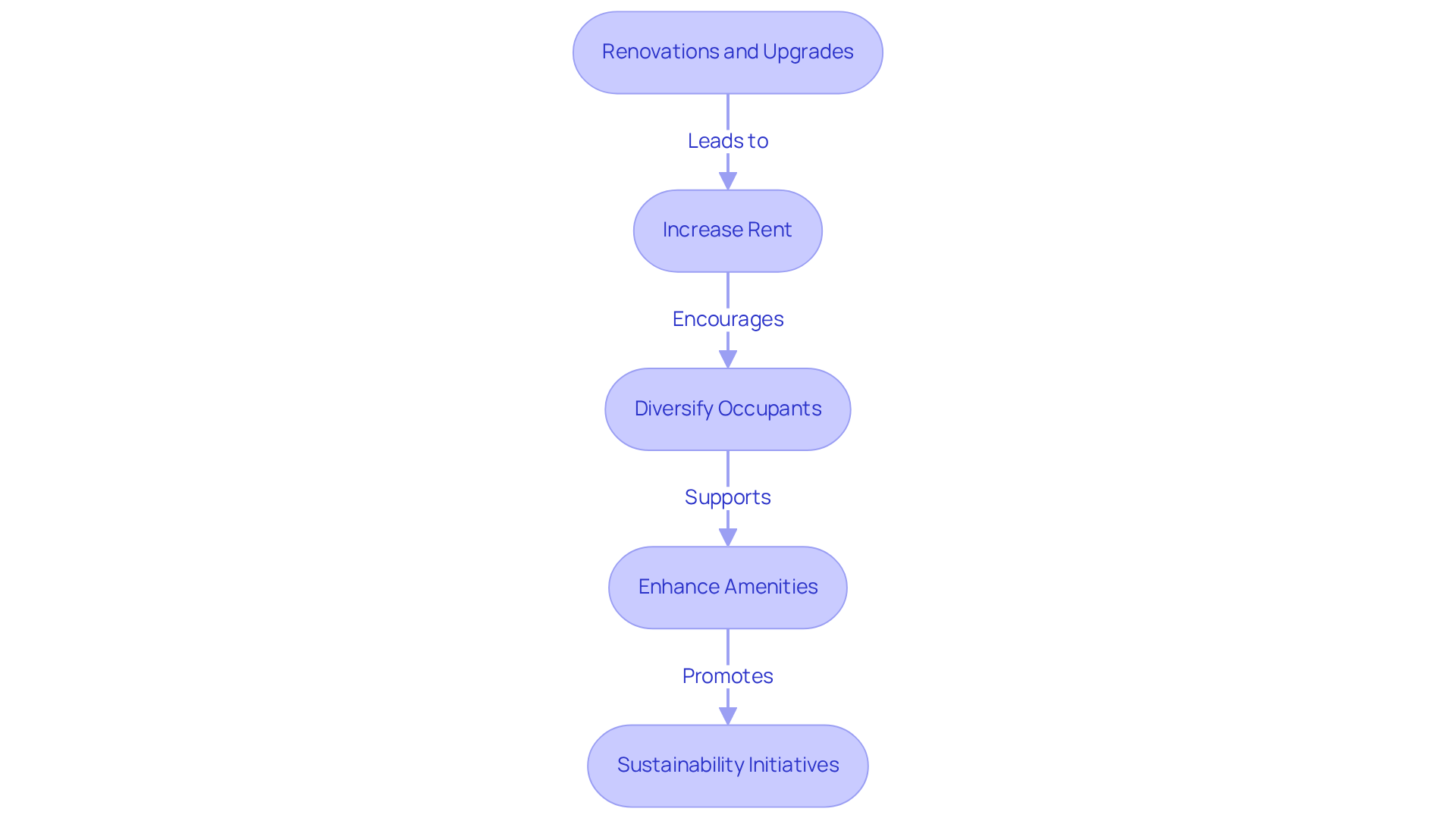

To maximize the value of your commercial property, consider implementing the following strategies:

-

Renovations and Upgrades: Investing in real estate enhancements—such as modernizing interiors, enhancing curb appeal, or upgrading facilities—can attract higher-paying tenants and significantly boost rental income. Successful renovations not only enhance aesthetics but also boost functionality, making the space more appealing. According to Mashvisor, the average return for business real estate is approximately 9.5%, emphasizing what to look for in commercial property investment to realize potential financial benefits.

-

Increase Rent: If market conditions permit, raising rents to reflect the asset's enhanced value can lead to increased revenue. Regularly assessing market trends ensures that rental rates remain competitive while maximizing income potential. As observed by commercial real estate specialists, knowing what to look for in commercial property investment is essential for establishing suitable rental rates.

-

Diversify Occupants: Attracting a variety of occupants minimizes risk and stabilizes income. For example, including retail areas within an office structure can foster a more vibrant atmosphere, attracting a wider variety of occupants and boosting overall asset value. Heather Porter emphasizes that cultivating strong relationships with renters contributes to stable rental income and enhances long-term ROI.

-

Enhance Amenities: Incorporating amenities like parking, safety features, or leisure spaces can greatly boost the appeal of the establishment to prospective renters. Properties that offer desirable amenities often command higher rents and experience lower vacancy rates. The significance of location and occupant strength cannot be exaggerated, as these factors are closely connected to property value.

-

Sustainability Initiatives: Implementing eco-friendly practices not only lowers operating expenses but also attracts environmentally conscious residents. Properties that prioritize sustainability can enhance their marketability and potentially qualify for tax incentives, further improving ROI. As the market increasingly values sustainability, this can be a key differentiator in attracting tenants.

By actively pursuing and implementing these value-add strategies, investors can significantly enhance their knowledge of what to look for in commercial property investment to boost profitability and ensure long-term success.

Conclusion

Understanding the intricacies of commercial property investment is crucial for investors aiming to achieve financial success in this dynamic market. By grasping the fundamentals—including the various types of commercial properties, their potential for income generation, and the associated risks—investors can make more informed decisions that align with their financial goals.

Key considerations, such as the evaluation of location, market potential, and understanding commercial leases, are essential components of a successful investment strategy. Factors like population dynamics, economic indicators, and lease structures not only influence investment viability but also play a significant role in long-term profitability. Furthermore, assessing financial requirements and exploring diverse funding options can empower investors to secure the necessary capital for their ventures.

Ultimately, pursuing value addition strategies—such as renovations, diversifying occupants, and implementing sustainability initiatives—can significantly enhance the attractiveness and profitability of commercial properties. Embracing these insights allows investors to navigate the complexities of commercial real estate with confidence, ensuring they capitalize on opportunities and achieve sustainable growth in their investment portfolios.