Overview

Investors have access to a variety of loans designed specifically for investment properties. These include:

- Conventional loans

- DSCR financing

- Hard money loans

- FHA financing

- VA financing

Each type is tailored to meet different financial needs and situations.

However, it is crucial to recognize that these loans often come with higher interest rates and stricter borrowing standards. This reality necessitates larger down payments and a robust financial profile to mitigate the risks associated with rental properties. Are you prepared to meet these requirements? Understanding these factors can significantly influence your investment strategy and success.

Introduction

Understanding the intricacies of investment property loans is essential for anyone looking to venture into real estate. These specialized financing options are tailored for generating income, setting them apart from traditional home mortgages.

With various types of loans available—such as conventional, DSCR, and hard money financing—investors face the challenge of determining which option best aligns with their financial goals.

What factors should investors consider to navigate this complex landscape and secure the most advantageous loan for their investment property? This exploration not only highlights the nuances of each loan type but also empowers investors to make informed decisions that align with their aspirations.

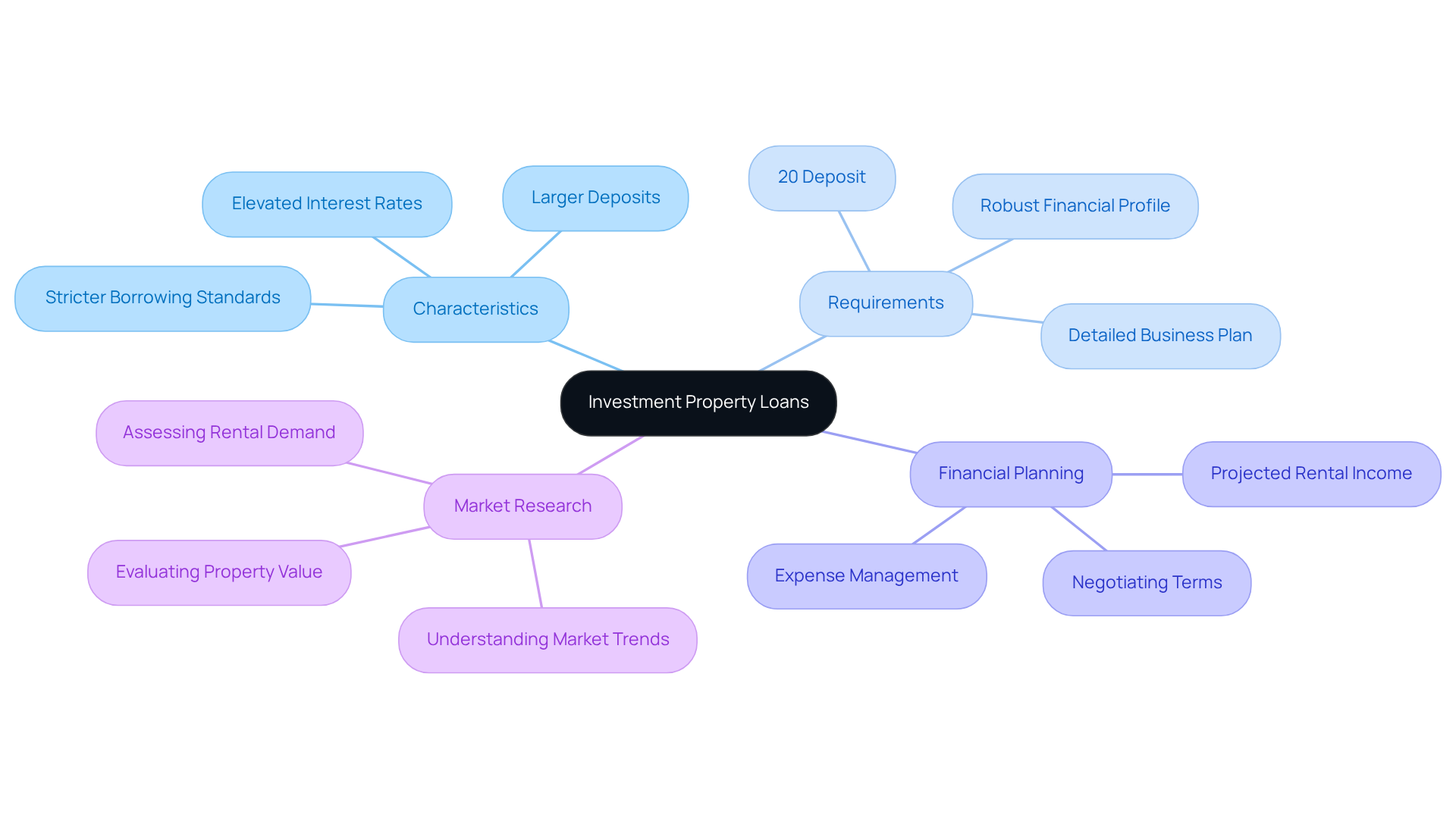

Defining Investment Property Loans

When considering investment real estate financing options, it’s important to understand what kind of loan can you get for an investment property, as these specialized mortgages are designed to fund revenue-generating assets. Unlike conventional home financing, which serves main residences, these funds specifically cater to investors who want to know what kind of loan can you get for an investment property that will function as income-generating assets. As of 2025, the average interest rate for financing real estate in Australia hovers around 6.00% annually, reflecting current market conditions.

Key characteristics of real estate financing include:

- Elevated interest rates

- Stricter borrowing standards compared to conventional mortgages

Investors must recognize that lenders often mandate a larger deposit, typically around 20% of the asset's value, which raises the question of what kind of loan can you get for an investment property to mitigate risks associated with rental properties. Moreover, these financial products may offer various repayment arrangements, providing flexibility in managing cash flow from rental income.

To effectively secure financing for real estate, comprehensive planning and an understanding of the financial landscape are essential. Investors should prioritize presenting a robust financial profile, complete with a detailed business plan outlining projected rental income and expenses. This strategy not only enhances the likelihood of credit approval but also empowers investors to negotiate more favorable terms.

Understanding what kind of loan can you get for an investment property, as opposed to conventional mortgages, is crucial for navigating the housing market adeptly. When evaluating investment financing, it is important to understand what kind of loan can you get for an investment property, as it is primarily assessed based on the potential revenue generated by the asset rather than just the borrower's personal earnings. This distinction underscores the importance of conducting thorough market research and financial evaluations before making investment decisions.

Financial specialists emphasize the necessity of grasping the nuances of real estate funding. A well-informed investor is better equipped to leverage financing options that align with their financial objectives, ultimately leading to more successful real estate acquisitions and enhanced portfolio performance. Additionally, exploring refinancing options can adapt to evolving business needs, enabling investors to optimize their financing strategies as their portfolios grow.

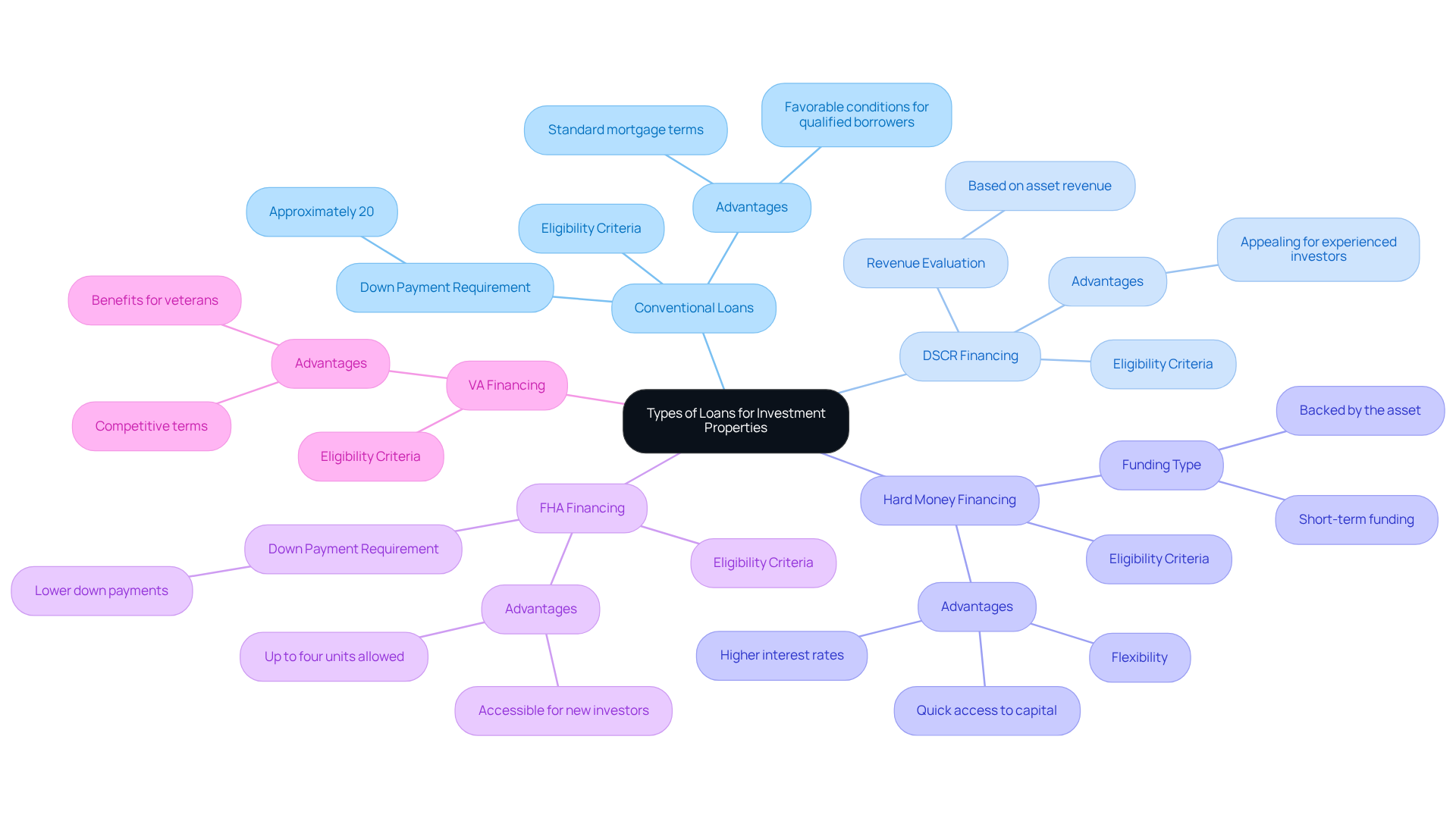

Types of Loans for Investment Properties

Investors often wonder what kind of loan can you get for an investment property, as there are a variety of financing options tailored to meet diverse financial needs and situations. Key options include:

- Conventional Loans: These standard mortgages typically require a higher credit score and a down payment of around 20%. They are commonly utilized for investment assets due to their advantageous conditions for qualified borrowers.

- DSCR Financing (Debt Service Coverage Ratio Financing): Tailored for investors with numerous assets, these options evaluate the revenue produced by the asset rather than the borrower's personal earnings, making them an appealing choice for experienced investors.

- Hard Money Financing: These short-term funding options are backed by the asset itself and are frequently used by investors seeking swift capital for acquisitions or improvements. They provide flexibility but usually come with higher interest rates.

- FHA Financing: Mainly meant for primary residences, FHA financing can also be utilized by certain investors for buildings with up to four units, provided the borrower resides in one unit. This option allows for lower down payments, making it accessible for new investors.

- VA Financing: Accessible to veterans, these options can be utilized for investment properties under specific conditions, offering competitive terms and benefits.

Each type of credit has distinct eligibility criteria and advantages, making it essential for investors to evaluate what kind of loan can you get for an investment property carefully. Finance Story specializes in crafting refined financing proposals, utilizing an extensive portfolio of financial institutions to obtain the best funding options for clients. For instance, a recent case involved a South African couple who faced delays and rejections from their existing lender before approaching Finance Story. With customized assistance and knowledge, they successfully obtained a traditional mortgage for their real estate in London, demonstrating the efficiency of this funding method. Comprehending the present market share of traditional financing can further assist investors in making informed choices, particularly with the various funding options accessible through Finance Story.

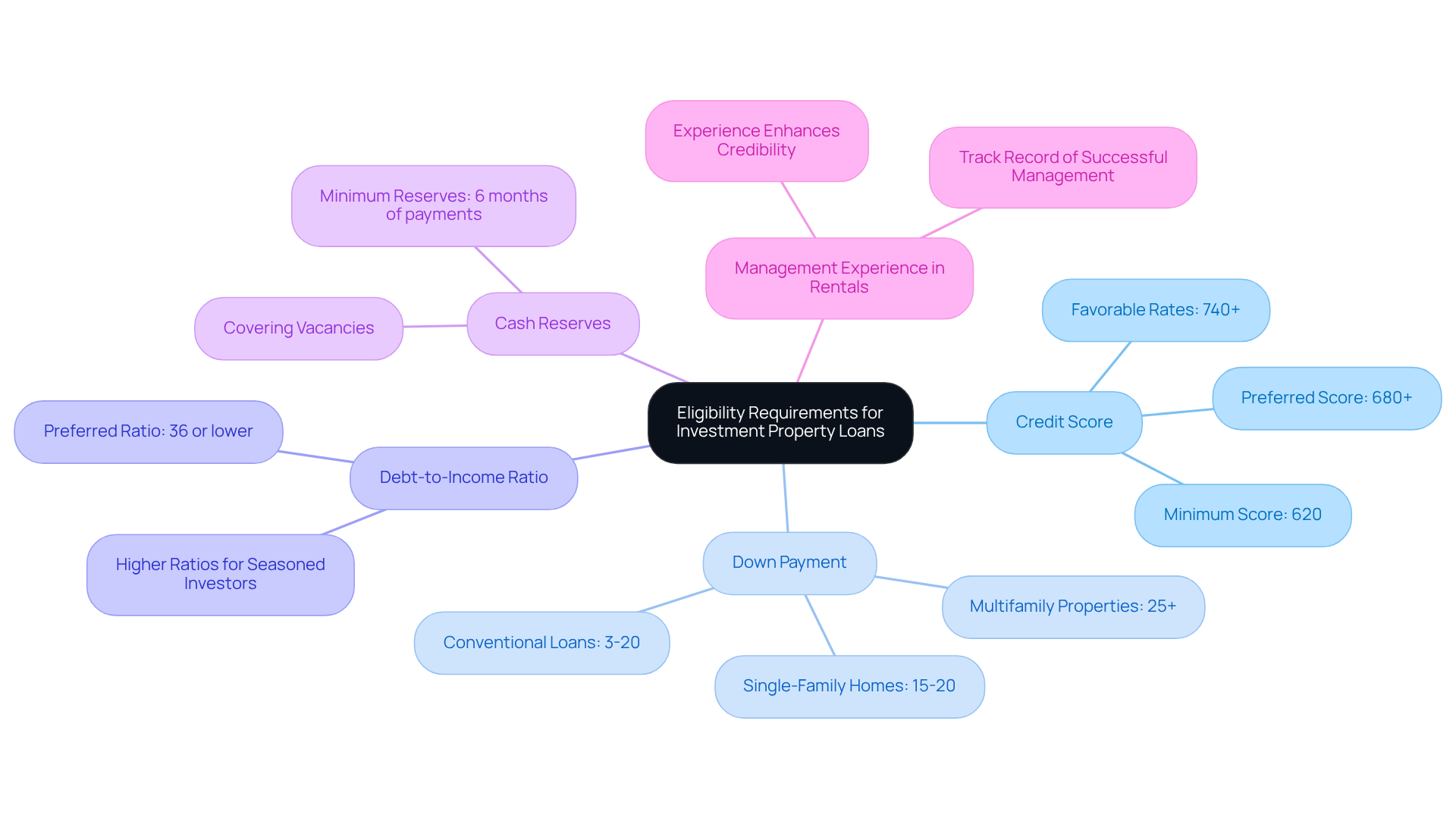

Eligibility Requirements for Investment Property Loans

The eligibility criteria for determining what kind of loan can you get for an investment property can vary significantly based on the financial institution and the type of financing. However, common criteria include:

- Credit Score: Most lenders typically require a minimum credit score of around 620, with more favorable rates available for scores exceeding 740. In 2025, many financial institutions are expected to prefer scores of 680 or above to secure advantageous credit conditions.

- Down Payment: Investors should anticipate providing a down payment of at least 15-25%, based on what kind of loan can you get for an investment property and the policies of the financial institution. When considering multifamily buildings, it's important to know what kind of loan can you get for an investment property, as down payments may reach 25% or more.

- Debt-to-Income Ratio: In determining what kind of loan can you get for an investment property, lenders generally seek a debt-to-income ratio of 36% or lower, although some may permit higher ratios for seasoned investors, particularly those demonstrating strong rental income.

- Cash Reserves: Numerous financial institutions require borrowers to maintain sufficient cash reserves to cover several months of mortgage payments, leading to the inquiry of what kind of loan can you get for an investment property to ensure they can manage expenses even during vacancies. This often necessitates reserves equivalent to six months of principal, interest, taxes, and insurance payments.

- Management Experience in Rentals: Certain lenders may consider the borrower's experience in managing rental units, which can influence approval decisions. Demonstrating a track record of successful asset management can enhance an investor's credibility and increase their chances of understanding what kind of loan can you get for an investment property.

At Finance Story, we specialize in crafting refined and highly tailored business cases to present to banks, ensuring that small business owners can effectively meet the eligibility criteria and obtain the funding they require for their real estate.

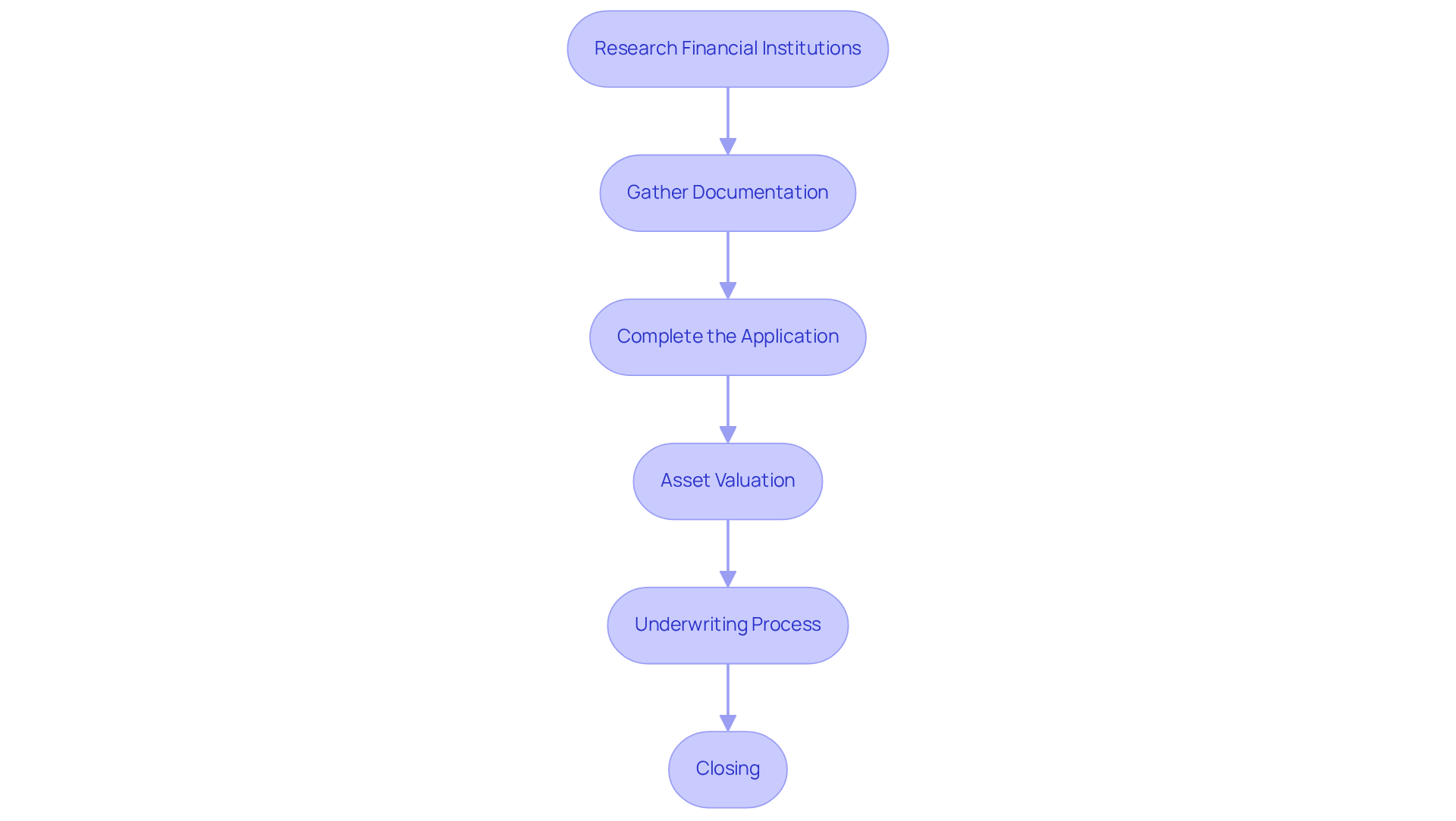

Navigating the Application Process for Investment Property Loans

Successfully navigating the application process for property financing involves careful planning and execution to understand what kind of loan you can get for an investment property. To position yourself for success, consider these essential steps:

-

Research Financial Institutions: Begin by evaluating various providers and their financing options. Explore choices that align with your investment strategy, taking into account factors such as interest rates, loan terms, and borrowing costs. Engaging with specialized lenders can offer tailored financing solutions that meet your unique needs.

-

Gather Documentation: Compile the necessary documentation to support your application. Commonly required documents include proof of income, tax returns, credit reports, and specific information regarding the asset you intend to purchase. Having these documents prepared can significantly expedite the application process.

-

Complete the Application: Accurately fill out the financing application, ensuring all required information is provided. Incomplete applications can lead to delays, making attention to detail crucial.

-

Asset Valuation: After submitting your application, the financial institution will typically require an evaluation of the asset to ascertain its market value. This step is essential for determining the loan amount for which you may qualify.

-

Underwriting Process: During the underwriting phase, the financial institution will review your application, credit history, and the property appraisal. This process can take several weeks, so patience is vital. Maintaining 6-12 months of reserves to cover mortgage payments can reassure lenders of your financial preparedness.

-

Closing: If your application is approved, you will progress to the closing stage, where you will sign the loan documents and finalize the purchase. Understanding each step of this process can streamline your experience and enhance your chances of securing the necessary financing.

By diligently following these steps and conducting thorough research, you can effectively position yourself for success in understanding what kind of loan you can get for investment property financing.

Conclusion

Understanding the various types of loans available for investment properties is crucial for any investor aiming to expand their portfolio. These specialized loans are tailored to meet the unique financial needs associated with revenue-generating assets, distinguishing them from conventional home financing. As the market evolves, recognizing the right loan options can significantly impact investment success.

This article outlines several key financing options, including:

- Conventional loans

- DSCR financing

- Hard money loans

- FHA financing

- VA financing

Each type comes with its own set of eligibility criteria, such as credit score requirements, down payment expectations, and debt-to-income ratios. Furthermore, the importance of a robust financial profile and comprehensive planning cannot be overstated, as these factors enhance the likelihood of securing favorable loan terms.

Ultimately, navigating the investment property loan landscape requires diligence and informed decision-making. Investors are encouraged to conduct thorough research and prepare meticulously for the application process. By doing so, they can not only secure the necessary financing but also position themselves for long-term success in the competitive real estate market. Embracing these insights will empower investors to make strategic choices that align with their financial goals and maximize their investment potential.