Overview

When considering financing for commercial property, various loan options are available, including:

- Term loans

- Lines of credit

- Bridging finance

- SMSF financing

- Construction financing

Each of these caters to distinct business needs and circumstances. Understanding these options is crucial for any business owner looking to secure the right financial support.

Eligibility and loan terms are influenced by several factors, such as:

- Creditworthiness

- Business financials

- Property type

- Intended use of the loan

It is essential to grasp these elements to navigate the commercial loan application process successfully. By being informed, you can make better decisions that align with your financial goals.

Are you aware of how these factors might affect your loan application? Taking the time to assess your financial situation and understanding the available options can significantly impact your success in obtaining the necessary funding. Don't hesitate to seek guidance as you explore these avenues.

Introduction

Understanding the landscape of commercial property loans is crucial for businesses aiming to expand or invest in income-generating assets. As lending activity surges and a variety of financing options emerge, entrepreneurs can harness these financial products to fulfill their specific needs. However, the complexity of commercial loans prompts an essential question:

- How can businesses navigate the intricacies of loan eligibility?

- What are the terms associated with these loans?

- What is the application process to secure the most advantageous financing options?

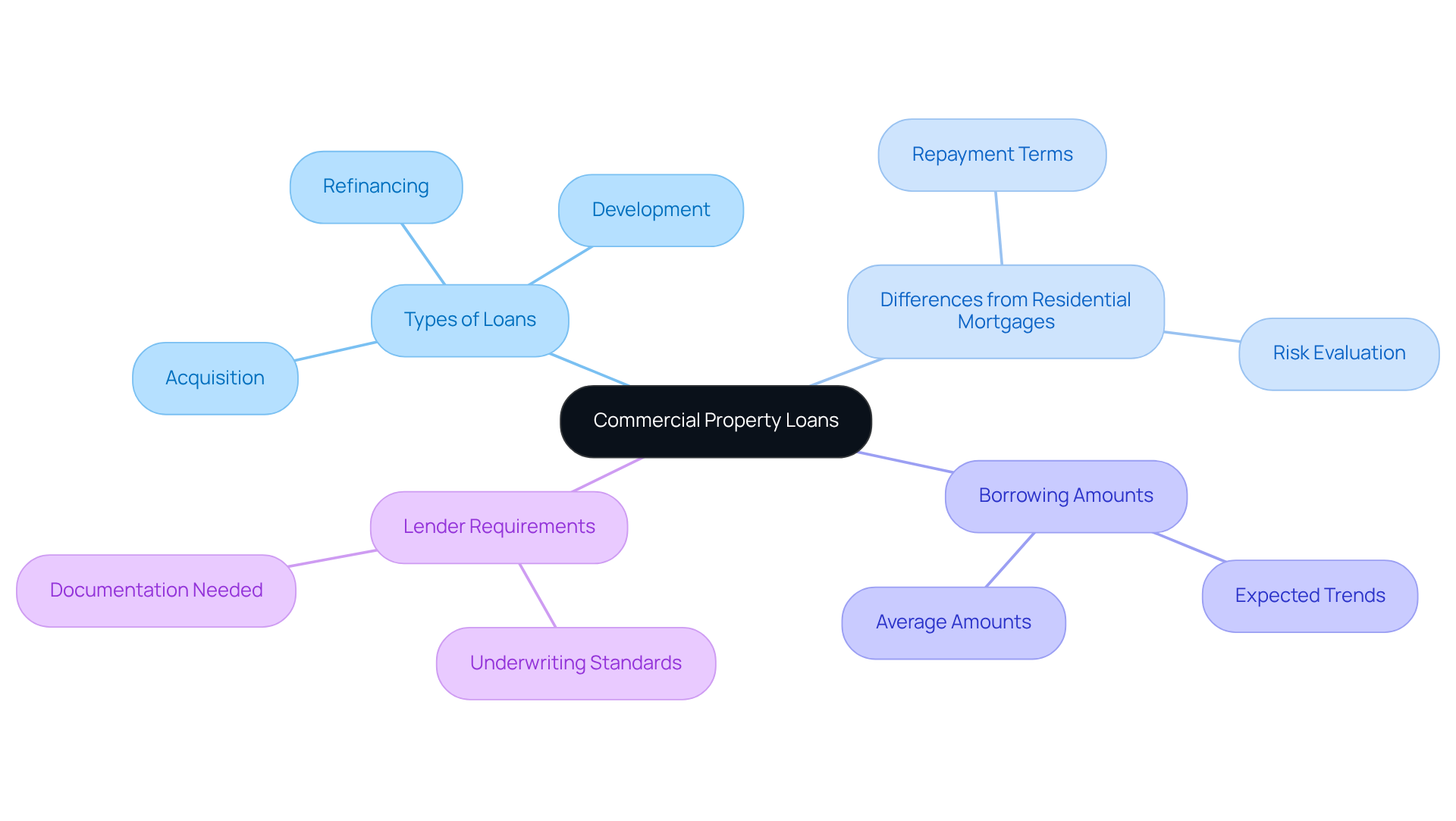

Defining Commercial Property Loans

When considering business property financing options, it's important to understand what kind of loan can I get for commercial property to aid in the acquisition, refinancing, or development of assets intended for business purposes. Unlike residential mortgages, which facilitate personal home purchases, business financing, often leading to inquiries about what kind of loan can I get for commercial property, is secured by income-generating properties such as office buildings, retail spaces, and industrial facilities. These financial products typically involve larger amounts and specific underwriting standards, reflecting the distinct risks and returns associated with business property investments. For instance, the average borrowing amount for business real estate financing in 2025 is expected to be significantly higher than that of residential mortgages, often exceeding several million dollars.

Successful applications for business property financing hinge on a thorough understanding of the financial landscape and what kind of loan can I get for commercial property, along with the specific requirements of lenders. Financial experts emphasize the importance of grasping the intricacies of what kind of loan can I get for commercial property, as these loans diverge significantly from residential mortgages in structure, repayment terms, and risk evaluation. As Warren Buffett notes, comprehending the economic fundamentals of an enterprise is crucial for making informed financial decisions—a principle that equally applies to real estate financing.

Furthermore, the real estate sector has witnessed a notable surge in lending activity, with property mortgages rising by 23.3% compared to the previous year. This growth underscores the demand for financial solutions, particularly as businesses seek to leverage real estate for expansion and operational needs. By recognizing these distinctions and trends, entrepreneurs can more adeptly navigate the complexities of securing funding for their ventures.

Types of Commercial Property Loans

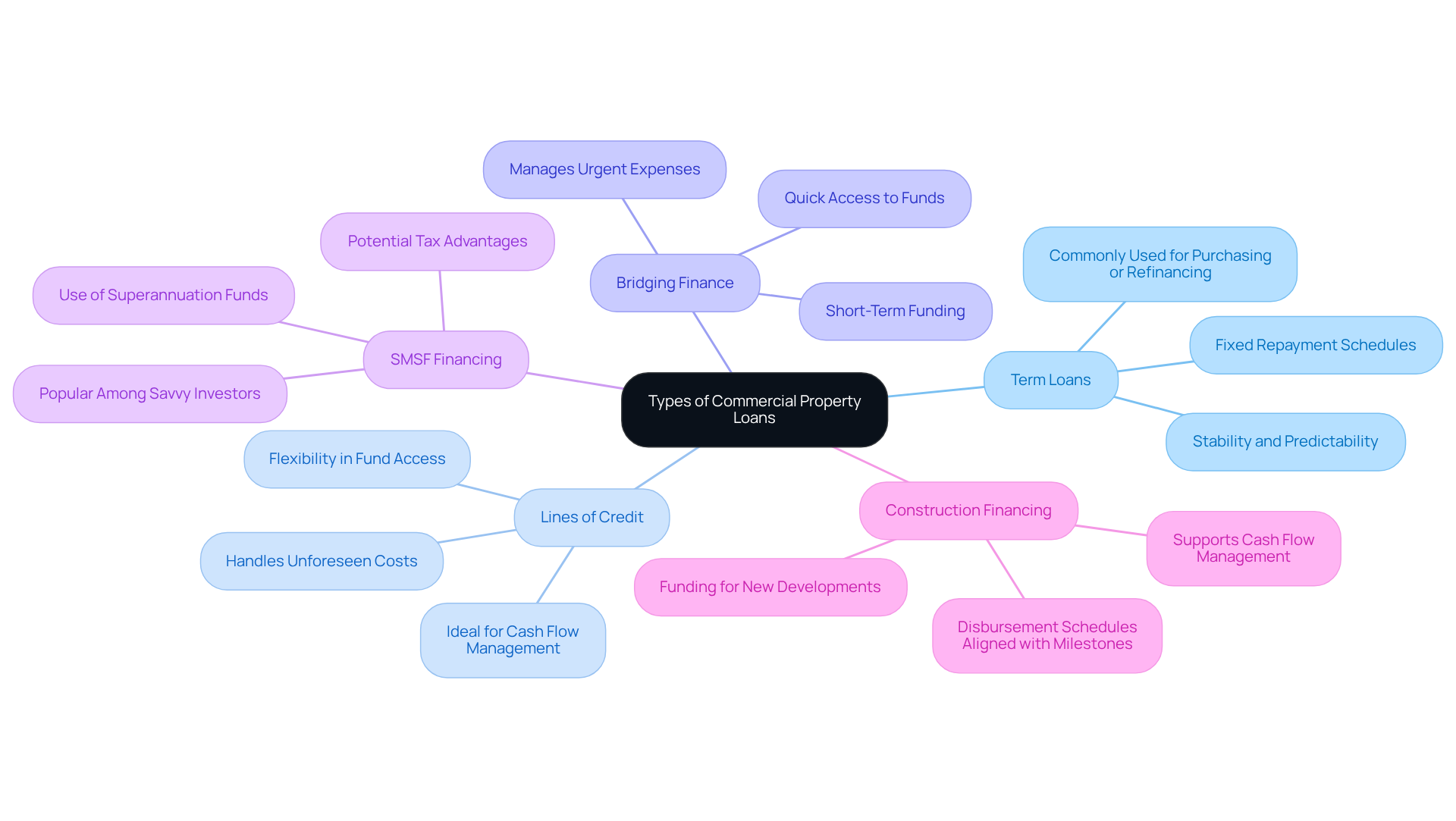

When considering financing for commercial properties, several loan types cater to diverse business needs:

-

Term Loans: These traditional loans feature fixed repayment schedules and are commonly used for purchasing or refinancing commercial properties. They offer stability and predictability in budgeting, making them a favored option among small enterprise owners.

-

Lines of Credit: Providing flexibility, lines of credit enable companies to access funds as required. This choice is especially advantageous for handling cash flow or tackling unforeseen costs, allowing organizations to sustain operational flexibility.

-

Bridging Finance: Created for short-term funding requirements, bridging finance assists in managing urgent expenses while anticipating long-term financial solutions. They are ideal for businesses that require quick access to funds during transitional periods.

-

Self-Managed Super Fund (SMSF) Financing: These financings enable individuals to use their superannuation funds for investing in business real estate, potentially offering substantial tax advantages. This option is increasingly popular among savvy investors looking to diversify their portfolios.

-

Construction Financing: Designed for funding the development of new business properties, these financial products often include disbursement schedules aligned with project milestones. This structure supports businesses in managing cash flow throughout the construction process.

The business lending environment is changing, with term financing retaining a substantial market portion in comparison to credit lines. Recent data shows that total financing commitments for business assets have experienced a year-over-year rise of 14%, indicating strong demand for funding solutions in this sector. Financial consultants frequently suggest term financing for its stability and predictability, especially for enterprises seeking to make significant investments in real estate.

Key Factors Affecting Loan Eligibility and Terms

Several key factors significantly influence a business's eligibility for commercial property loans and the terms offered by lenders:

- Creditworthiness: A robust credit score is essential. Lenders typically favor scores above 680 for favorable terms, reflecting the borrower's financial reliability and ability to repay.

- Business Financials: Lenders evaluate the financial health of the business, including income statements, cash flow, and existing debts, to assess repayment capacity. A strong financial profile can improve borrowing opportunities.

- Real Estate Type and Location: The characteristics of the estate and its geographical position play a crucial role in determining financing terms. Properties located in prime areas or with established rental histories often qualify for more competitive rates.

- Loan-to-Value Ratio (LVR): This ratio compares the borrowed amount to the asset's value and is critical. Lower LVRs generally lead to better terms, indicating reduced risk for lenders.

- Purpose of the Loan: The intended use of the loan—whether for purchasing, refinancing, or construction—can also influence the terms and conditions set by lenders. Understanding these factors is essential for small enterprise proprietors and property investors seeking the best financing alternatives.

Navigating the Commercial Loan Application Process

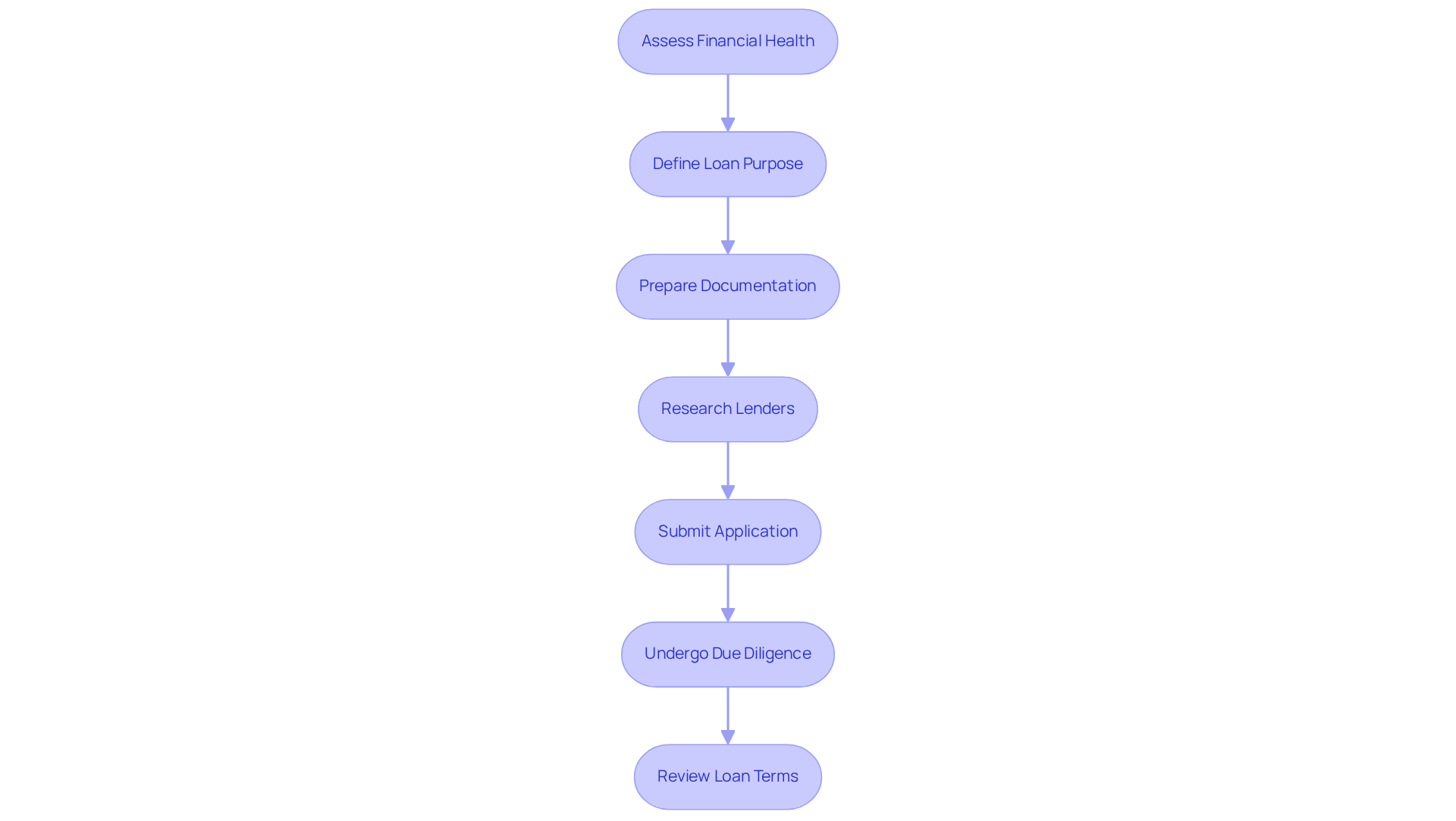

Navigating the commercial loan application process involves several key steps that can significantly enhance the likelihood of approval:

-

Assess Financial Health: Businesses should begin by evaluating their financial situation, including credit scores and cash flow. A strong credit score is crucial, as lenders often prioritize applicants with solid financial histories. Finance Story focuses on assisting enterprises in comprehending their financial well-being and enhancing their prospects of obtaining advantageous credit conditions.

-

Define Loan Purpose: Clearly articulating the purpose of the loan helps lenders understand the organization's needs and intentions. This clarity can strengthen the application by demonstrating a well-thought-out plan, which is essential when presenting tailored proposals to lenders.

-

Prepare Documentation: Collect essential documents such as financial statements, tax returns, and a comprehensive plan for the enterprise. A comprehensive application package is vital; lenders typically require the last two years of financial statements and personal tax returns from directors or guarantors. Additionally, a checklist of required documentation includes identification, cash flow forecasts, and security documents. This preparation can streamline the process and reduce the risk of delays. At Finance Story, we emphasize the importance of polished and individualized business cases to present to banks effectively.

-

Research Lenders: Explore various lenders to find those that specialize in commercial financing and offer favorable terms. By understanding the lending landscape, you can better determine what kind of loan can I get for commercial property that suits your specific needs. Finance Story provides access to a comprehensive range of lenders, including mainstream banks and creative private lending groups, helping you find out what kind of loan can I get for commercial property like warehouses, retail locations, factories, and hospitality projects.

-

Submit Application: Complete the application process, ensuring all information is accurate and comprehensive. Incomplete or inconsistent documentation can raise red flags and delay processing. Our expertise in developing customized financial proposals can assist you in avoiding typical pitfalls during this stage.

-

Undergo Due Diligence: Be prepared for lenders to conduct thorough due diligence, including property appraisals and financial assessments. This step is essential for lenders to assess the risk linked to the financing.

-

Review Loan Terms: Once approved, thoroughly examine the loan terms and conditions prior to signing to ensure they align with company objectives. Understanding the implications of interest rates, repayment schedules, and any fees is essential for long-term financial health. Finance Story can guide you through this process, ensuring you understand the repayment criteria and how they impact your business.

Successful instances, like Rameshwara Prabhu's purchase of a business asset with customized assistance from a mortgage broker, emphasize the significance of strategic planning and professional advice. Rameshwara obtained an 80% LVR financing of $2,020,000 for a $2,525,000 business property, demonstrating the efficiency of a thoroughly prepared application. As pointed out by financial advisors, "The basis of any successful loan application for a company lies in thorough, precise documentation that clearly illustrates your company's financial health, operational stability, and repayment ability." By following these steps and being aware of common pitfalls, such as documentation gaps and overly optimistic forecasts, businesses can navigate the complexities of securing commercial financing more effectively.

Conclusion

Understanding the various options available for financing commercial properties is crucial for any business owner or investor aiming to expand their real estate portfolio. The landscape of commercial property loans is distinct from residential mortgages, involving larger sums and unique underwriting criteria. By grasping the different types of loans—such as term loans, lines of credit, and construction financing—businesses can make informed decisions that align with their financial strategies.

Key factors influencing loan eligibility, including creditworthiness, business financial health, and the type of property being financed, play a significant role in determining the terms offered by lenders. Navigating the commercial loan application process requires careful preparation, from assessing financial health to submitting comprehensive documentation. Success stories, like that of Rameshwara Prabhu, highlight the importance of strategic planning and professional guidance in securing favorable financing.

In conclusion, the ability to effectively navigate the complexities of commercial property financing can greatly impact a business's growth and sustainability. As demand for commercial real estate continues to rise, understanding the nuances of loan options and the application process becomes increasingly vital. Business owners are encouraged to leverage expert resources and conduct thorough research to identify the best financing solutions that meet their specific needs, ultimately paving the way for successful investments in commercial real estate.