Overview

Currently, the interest rate on commercial property loans ranges from 6.2% to 9.5%. This range is influenced by various factors, including lender preferences, borrower profiles, and property types. Understanding these variables is crucial for making informed financing decisions.

The competitive dynamics of the lending market play a significant role in these rates. Typically, favorable terms are offered for stable assets, whereas riskier properties may incur higher rates. This distinction underscores the importance of evaluating your specific circumstances when seeking financing.

Are you aware of how these factors might impact your borrowing options? By recognizing the nuances of commercial property loans, you can better navigate your financial landscape and secure the best possible terms.

Introduction

Understanding the intricacies of interest rates on commercial property loans is crucial for investors navigating the complex landscape of real estate financing. Currently, rates range from 6.2% to 9.5%, influenced by various factors such as borrower profiles and market conditions. As economic indicators shift, potential borrowers must decipher how these fluctuations will impact their investment strategies and profitability.

What strategies can investors employ to secure favorable loan terms amidst this evolving financial terrain?

Define Interest Rates in Commercial Property Loans

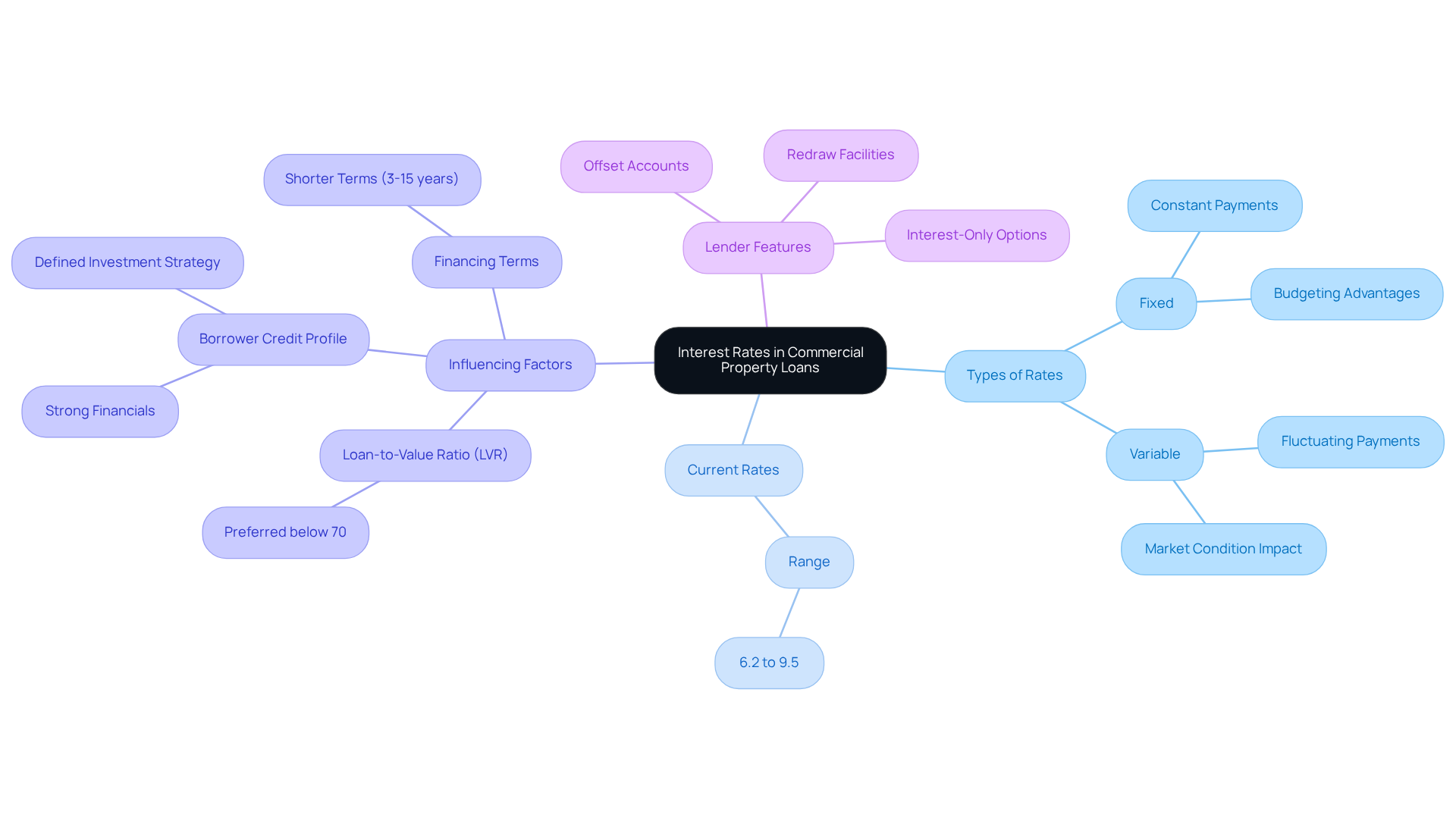

When considering financing, many investors often ask what is the interest rate on commercial property loans, as it reflects the expense incurred when borrowing resources for the acquisition or development of commercial real estate. Typically expressed as a percentage of the borrowed amount, these charges can be categorized as either fixed or variable. Fixed charges remain constant throughout the borrowing term, offering consistency in repayment amounts, which is advantageous for effective budgeting and financial organization. Conversely, variable costs fluctuate in response to market conditions, potentially resulting in lower initial payments but introducing the risk of escalating expenses over time.

As we approach mid-2025, it is important to consider what is the interest rate on commercial property loans, which currently ranges from 6.2% to 9.5%. These figures are influenced by various factors, including the lender, financing structure, and borrower profile. Generally, lenders extend more favorable terms for stable assets located in capital cities, while riskier properties may face higher charges. Notably, the industry median borrowing cost for most commercial real estate financing is approximately 3% above the effective federal funds rate, underscoring the competitive dynamics within the lending market.

Understanding how these charges are determined is crucial for individuals pursuing loans, as they significantly impact the overall cost of funding and the viability of investment initiatives. Key factors influencing what is the interest rate on commercial property loans include the loan-to-value ratio (LVR), the borrower's credit profile, and the specific terms of the financing. For instance, lenders typically prefer LVRs below 70% for commercial properties, which can lead to more favorable financing conditions. Additionally, borrowers with strong financials and a well-defined investment strategy are more likely to secure advantageous terms.

In 2025, commercial lenders are increasingly offering flexible credit products that incorporate features such as offset accounts, redraw facilities, and interest-only repayment options. These innovations can substantially enhance cash flow management for investors, making it imperative for those seeking funds to evaluate not only the costs but also the comprehensive features of the financing when making decisions. Finance Story excels at crafting refined and highly tailored business cases for presentation to banks, ensuring clients can optimize their financing outcomes. Furthermore, it is essential for individuals seeking credit to understand all associated charges beyond the borrowing cost, as this awareness is pivotal in effectively assessing financing options. Additionally, Finance Story provides access to a broad spectrum of lenders, expanding the choices available for securing the ideal financing.

Examine Factors Influencing Commercial Loan Interest Rates

Several critical factors influence what is the interest rate on commercial property loans, including the individual's credit score, loan-to-value ratio (LVR), property classification, and broader economic conditions. A high credit score is crucial, as it typically leads to lower borrowing costs, reflecting reduced risk for lenders. For instance, individuals with strong credit histories often secure terms that can save them thousands over the financing period. Conversely, lower credit scores can result in higher costs, underscoring the importance for borrowers to maintain good credit health.

The LVR, which compares the loan amount to the property's assessed value, also plays a significant role in determining interest rates. Generally, a lower LVR is associated with more favorable terms, as it indicates a lower risk for the lender. For example, keeping an LVR below 80% can enhance an individual's likelihood of obtaining better terms.

Moreover, macroeconomic factors such as inflation rates, the Reserve Bank of Australia's cash rate, and the overall demand for commercial properties can cause fluctuations in what is the interest rate on commercial property loans. As these economic indicators change, so too can borrowing costs, emphasizing the necessity for those seeking loans to remain informed about market dynamics.

In 2025, grasping how these factors interact will be essential for businesses pursuing commercial property financing. By actively managing their credit profiles and understanding the implications of LVR, borrowers can better position themselves to negotiate more favorable loan terms, ultimately advancing their financial goals.

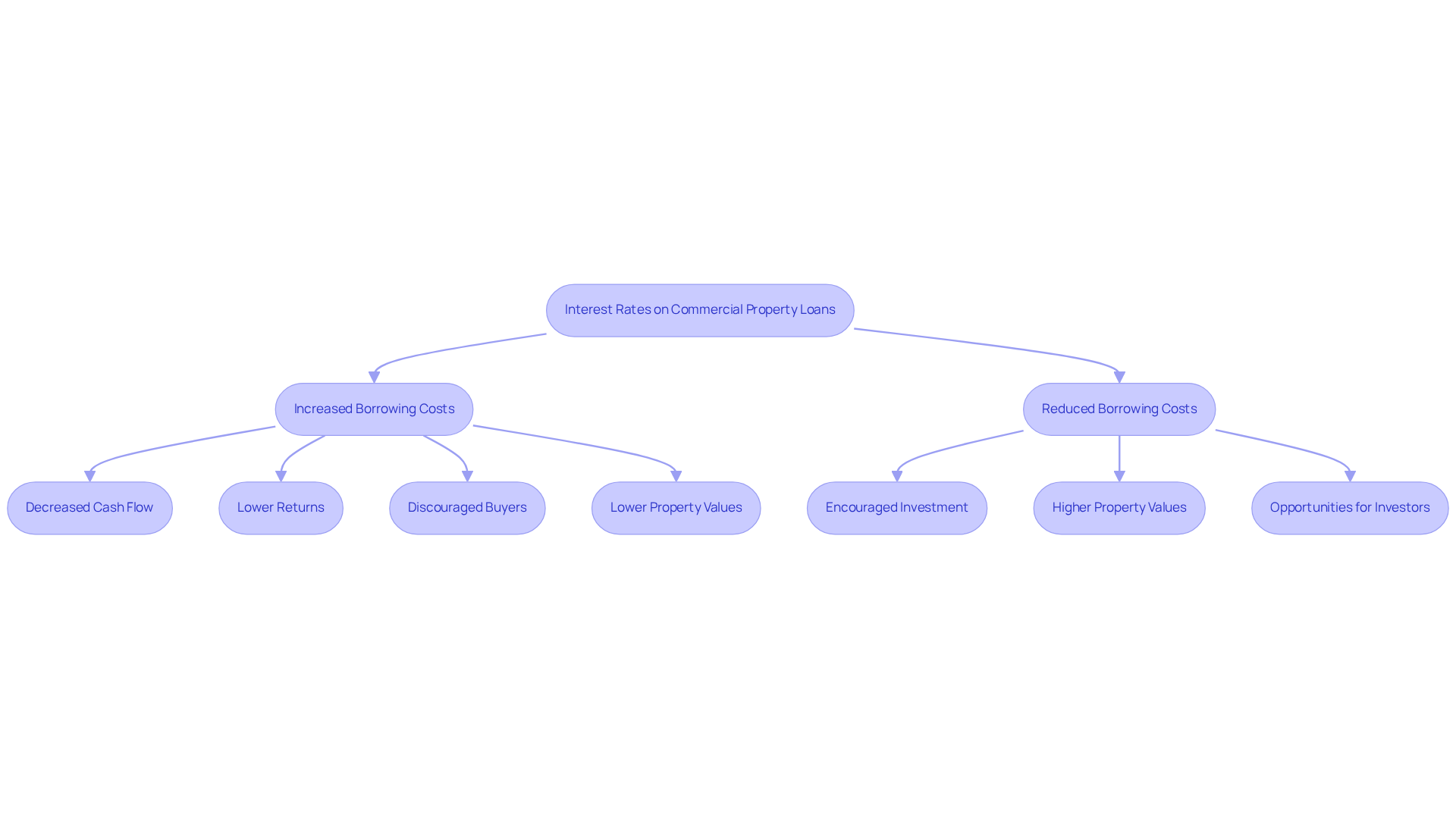

Analyze the Impact of Interest Rates on Commercial Property Investments

Understanding what is the interest rate on commercial property loans is crucial as interest levels play a significant role in shaping the landscape of commercial property investments by influencing borrowing expenses and overall profitability. As borrowing costs increase, one might wonder what is the interest rate on commercial property loans, which becomes pricier, resulting in decreased cash flow and lower returns on investment. This scenario often discourages potential buyers, leading to decreased demand and subsequently lower property values. For instance, the national vacancy percentage for the industrial market stood at only 1.0% at the close of 2023. However, the pressure on income returns and capital values has increased due to borrowing costs, raising the question of what is the interest rate on commercial property loans.

On the other hand, reduced borrowing costs foster a more advantageous lending atmosphere, encouraging investment efforts and raising the question of what is the interest rate on commercial property loans, possibly pushing property values higher. Investors must stay alert regarding lending trends, such as what is the interest rate on commercial property loans, as these fluctuations can greatly impact their financial results. As economists foresee a drop in borrowing costs in 2025, opportunities may emerge for investors to take advantage of reduced assets, particularly in sectors such as industrial properties, where rents have increased by 13.6% in the first three quarters of 2023.

At Finance Story, we provide access to a full range of lenders, ensuring you secure the right financing solutions tailored to your needs. Understanding these dynamics is essential for making informed decisions in the commercial real estate market.

Explore Types of Commercial Loans and Their Interest Structures

Business financing encompasses a variety of alternatives, each designed with specific pricing frameworks to meet diverse funding needs. One of the most common options is conventional term financing, which typically offers fixed or variable charges. As of mid-2025, the fees for these credits range from 6.2% to 9.5%, influenced by factors such as the provider, credit structure, and borrower profile. On the other hand, lines of credit offer greater borrowing flexibility but often come with higher interest rates, making them ideal for businesses that need quick access to funds.

Furthermore, specialized financing options play a critical role in commercial funding. For instance, construction financing often includes interest-only periods during the building phase, allowing clients to manage cash flow effectively while their projects progress. Bridge financing presents another viable option, offering short-term funding solutions for businesses requiring immediate capital to bridge gaps between transactions.

For borrowers seeking the most appropriate financing solution for their commercial property ventures, understanding what is the interest rate on commercial property loans and the distinctions in interest structures among these loan types is essential. With the current competitive landscape, employing informed borrowing strategies can significantly enhance a business's financial positioning.

Conclusion

Understanding the intricacies of interest rates on commercial property loans is essential for any investor navigating the real estate market. Currently ranging from 6.2% to 9.5%, these rates are influenced by various factors, including the lender's terms, the borrower's profile, and the overall economic landscape. Fixed and variable rates each offer unique advantages and challenges, making it crucial for borrowers to assess their financial strategies carefully.

Key considerations such as:

- Credit scores

- Loan-to-value ratios

- Macroeconomic conditions

play a significant role in determining the interest rates applicable to commercial loans. A strong credit profile and a favorable LVR can lead to better borrowing terms. Understanding economic trends can help investors anticipate changes in borrowing costs. Furthermore, the emergence of flexible loan products enhances the options available to borrowers, enabling them to optimize their financing strategies.

In light of these insights, it is vital for potential borrowers to stay informed and proactive in managing their financial health. By understanding how interest rates impact commercial property investments, investors can make more informed decisions that align with their financial goals. Engaging with experienced financial advisors and leveraging a broad range of lending options can provide the necessary support for navigating the complexities of commercial property financing successfully.