Overview

Finance broking serves as a vital intermediary service that connects borrowers with lenders. This role is essential in facilitating the organization of credit and financial products while negotiating favorable terms on behalf of clients. Have you ever wondered how finance brokers navigate the complex financial landscape? Their expertise is crucial in providing personalized funding solutions tailored to both individual and business needs. This personalized approach not only enhances the borrowing experience but also empowers clients to make informed financial decisions.

Furthermore, by leveraging the knowledge of finance brokers, clients can access opportunities that may otherwise remain hidden. In addition, the brokers' ability to negotiate on behalf of their clients ensures that they secure the best possible terms, fostering a sense of trust and reliability in the financial process.

Introduction

In a financial landscape marked by complexity and rapid change, finance broking has emerged as a vital intermediary service connecting borrowers with lenders. This profession not only facilitates the arrangement of loans but also tailors financial solutions to meet the unique needs of each client.

As businesses navigate the intricacies of securing funding, the role of brokers has evolved significantly, adapting to technological advancements and shifting market demands. Furthermore, from residential home loans to commercial property financing, finance brokers are equipped with the expertise to negotiate favorable terms and provide personalized support throughout the borrowing process.

This article delves into the defining characteristics, historical evolution, and diverse financing solutions offered by finance brokers, highlighting their indispensable role in today’s financial ecosystem.

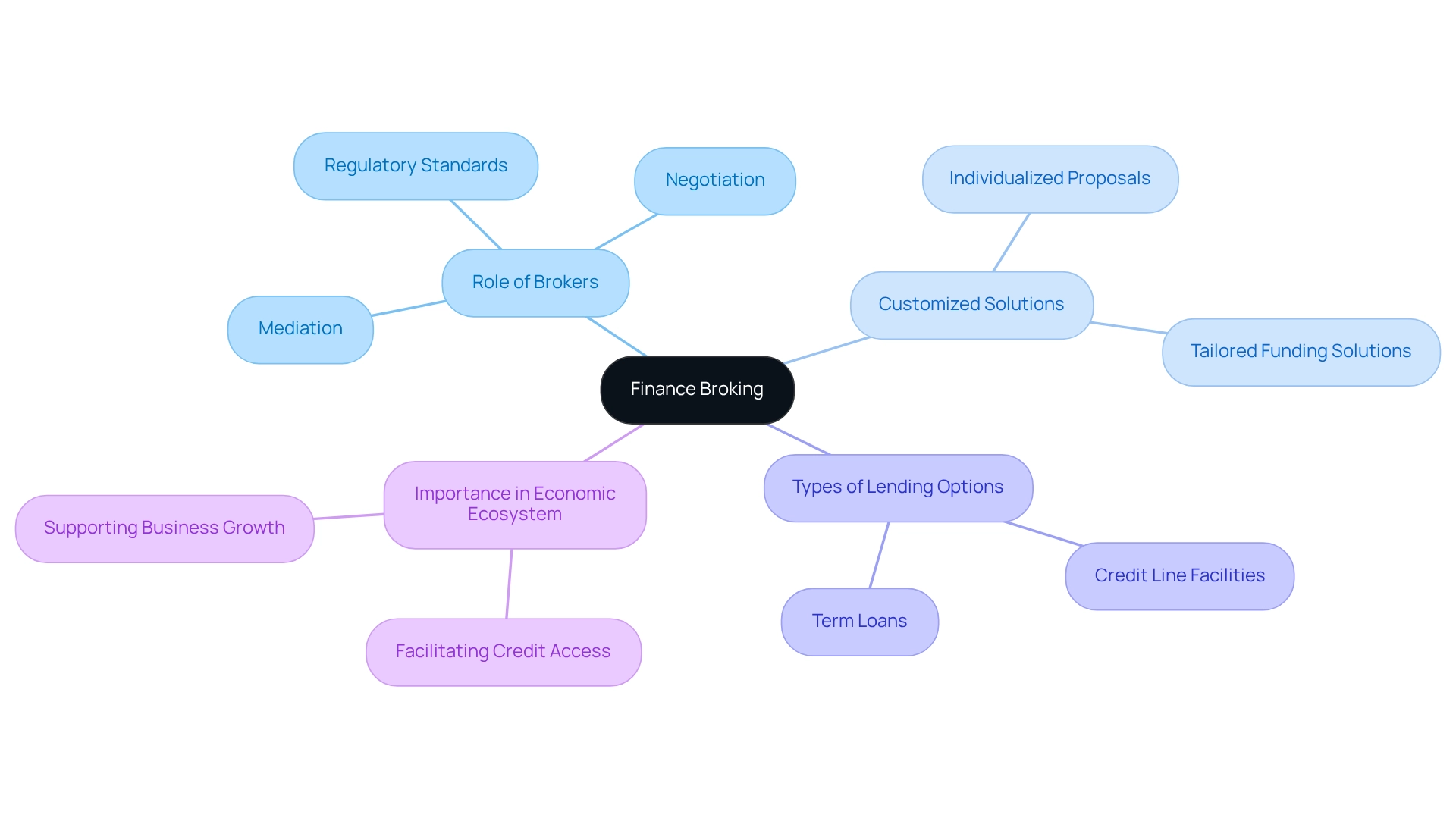

Defining Finance Broking: An Overview

What is finance broking? It serves as a crucial mediator between borrowers and lenders, helping to facilitate the organization of credit and various financial offerings. Brokers negotiate terms and conditions on behalf of their clients, ensuring they secure the most favorable financing options available.

At Finance Story, we recognize that every enterprise has distinct needs. Therefore, we are committed to providing customized business funding solutions that effectively address those requirements. Our expertise in crafting polished and highly individualized financing proposals allows us to present your case to a comprehensive panel of lenders, including boutique lenders, private investors, and mainstream banks.

We offer a diverse range of lending options, including credit line facilities and term loans, tailored to meet the varied requirements of those we serve. This role is essential in the economic ecosystem, as brokers help individuals understand what is finance broking to navigate the complexities of securing loans, whether for personal, business, or investment purposes.

Typically, brokers are licensed professionals who adhere to regulatory standards, ensuring they operate in the best interests of their clients. Furthermore, we emphasize refinancing alternatives to adapt to the evolving economic needs of businesses.

The Evolution of Finance Broking: Historical Context

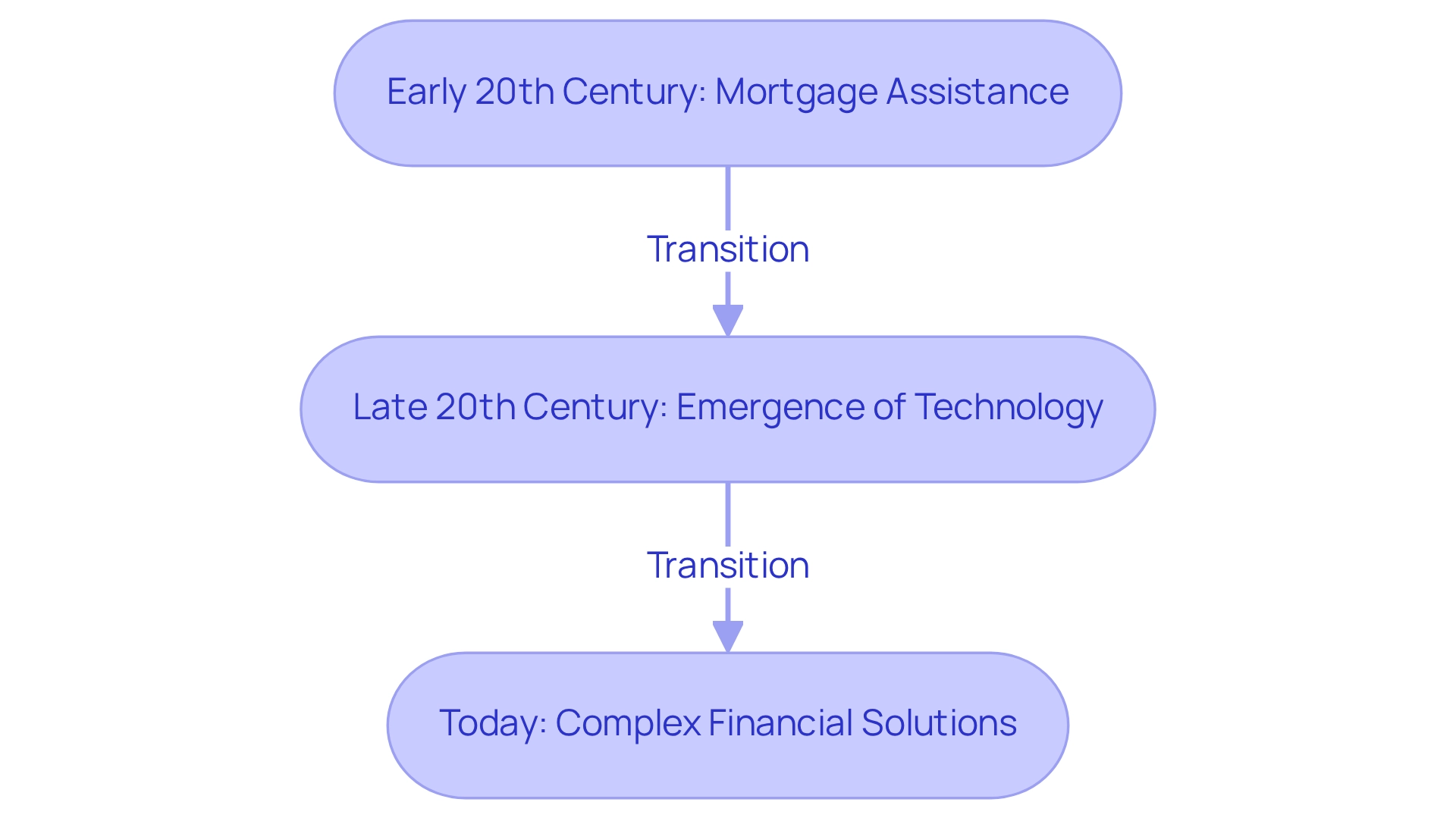

The origins of what is finance broking can be traced back to the early 20th century, when individuals began acting as intermediaries between banks and borrowers. Initially, these brokers primarily assisted in securing home mortgages. However, as the economic landscape evolved, so too did their responsibilities. The late 20th century saw the emergence of technology and the internet, which transformed the industry, allowing brokers to connect with a wider array of lenders and financial products. Today, what is finance broking is crucial, as finance brokers play a pivotal role in the lending process, with a significant portion of loans arranged through brokers rather than directly with banks. This shift is driven by the increasing complexity of financial products and the growing demand for personalized financial solutions.

Finance Story specializes in crafting polished and highly individualized business cases to secure funding for various commercial property investments, including:

- Warehouses

- Retail premises

- Factories

- Hospitality ventures

Furthermore, customers benefit from access to a comprehensive range of lenders, including high street banks and innovative private lending panels. This ensures they have the best options available to meet their evolving business needs.

Key Characteristics and Functions of Finance Brokers

Finance brokers embody essential characteristics that empower them to effectively assist their clients in understanding what is finance broking. These traits include:

- Strong negotiation skills

- A thorough understanding of financial products

- The ability to accurately assess individuals' financial situations

At Finance Story, we recognize that purchasing a home is one of the most exhilarating experiences in people's lives. Our brokers are committed to ensuring this process is as seamless and enjoyable as possible. Our home financing products feature:

- Competitive interest rates

- Flexible repayment plans

- Personalized service tailored to individual needs

Brokers typically undertake tasks such as:

- Evaluating clients' requirements

- Exploring available financing options

- Negotiating terms with lenders

- Guiding clients throughout the application process

They also provide ongoing support, helping individuals understand their financial obligations and ensuring informed decision-making. As Natasha B. from VIC expressed, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey."

By acting as advocates for their clients, finance brokers demonstrate what is finance broking by enhancing the borrowing experience and increasing the likelihood of securing favorable loan terms. With access to a wide array of lenders, Finance Story is well-positioned to offer customized refinancing solutions and residential property investment options for both first-time buyers and seasoned investors, even in challenging circumstances.

Types of Financing Solutions Offered by Finance Brokers

Finance brokers offer a comprehensive array of funding options tailored to meet the diverse needs of their clients. This includes:

- Residential home loans

- Commercial property loans for various types of properties such as:

- Warehouses

- Retail premises

- Factories

- Hospitality ventures

- Business finance

- Self-managed superannuation fund (SMSF) loans

- Expat mortgages

Each financing solution is meticulously designed to address specific requirements, whether for purchasing a home, acquiring commercial property, or facilitating business expansion.

At Finance Story, we prioritize the development of refined and highly personalized business cases to present to lenders, ensuring that our clients secure the best financing options available. Our extensive network of lenders, ranging from mainstream banks to innovative private lending groups, allows us to provide a multitude of choices, ensuring clients find the most suitable financing solutions for their unique circumstances, highlighting what is finance broking as a significant advantage of collaborating with a finance broker. Furthermore, we offer refinancing options for commercial loans, adapting to the evolving needs of businesses.

Are you ready to explore the optimal financing solutions for your situation? Let us guide you in achieving your financial goals.

Conclusion

In today's financial landscape, the role of finance brokers has never been more critical. They act as essential intermediaries, linking borrowers to a plethora of lending options while negotiating terms tailored to their clients' unique financial situations. As technology has advanced, finance broking has evolved from merely facilitating home loans to providing a wide array of customized financing solutions for both personal and business needs.

Successful finance brokers are characterized by their strong negotiation skills, extensive knowledge of financial products, and a steadfast commitment to understanding their clients' individual requirements. This personalized approach not only enhances the borrowing experience but also significantly boosts the chances of securing favorable loan terms. Whether dealing with residential home loans or intricate commercial financing, brokers like those at Finance Story are adept at navigating the complexities of the financial ecosystem, ensuring their clients remain well-informed and supported throughout the process.

Ultimately, finance brokers are pivotal players in the lending arena, offering vital expertise and access to a diverse range of financing solutions. As clients strive to adapt to ever-evolving financial needs, the importance of having a dedicated broker to guide them cannot be overstated. By leveraging their resources and relationships with various lenders, finance brokers empower individuals and businesses alike to confidently and effortlessly achieve their financial goals.