Overview

Owner-occupied loans are specialized mortgages tailored for individuals intending to reside in the property as their primary home. These loans present significant benefits, including:

- Lower interest rates

- Higher loan-to-value ratios

They are particularly advantageous for borrowers, thanks to their favorable financial terms and the potential for government incentives. However, it is crucial to recognize the occupancy requirement and the associated market risks that come with these loans.

Introduction

Understanding the nuances of owner-occupied loans is crucial for anyone navigating the housing market, especially as homeownership continues to influence personal wealth. These specialized mortgages not only provide lower interest rates but also come with distinct eligibility criteria that can significantly affect a buyer's financial journey.

However, with the appeal of favorable terms arises the challenge of strict occupancy requirements—what occurs when life circumstances shift? This article explores the key features, benefits, and potential drawbacks of owner-occupied loans, equipping readers with the essential knowledge needed to make informed decisions in a dynamic financial landscape.

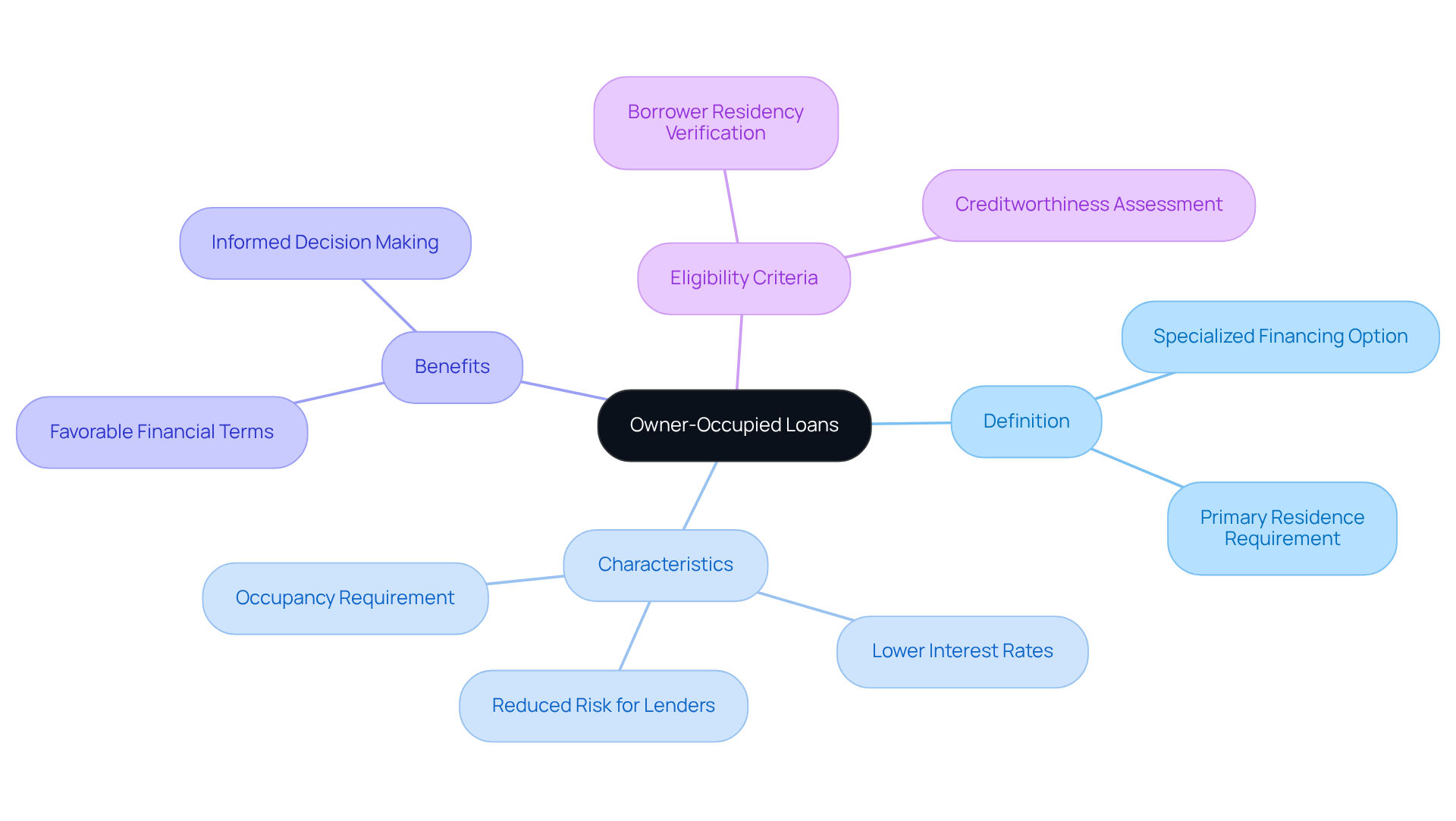

Define Owner-Occupied Loans

A residence-based mortgage is a specialized financing option designed for individuals intending to occupy the property as their primary residence. This type of financing empowers borrowers to purchase a home they will live in, distinguishing it from investment properties. A key characteristic of what is an owner occupied loan is that the borrower must reside in the home, which influences the terms, interest rates, and eligibility criteria associated with the financing.

Typically, these mortgages offer lower interest rates compared to investment loans, reflecting the reduced risk for lenders when the borrower occupies the property. This makes residence-based mortgages an attractive option for those looking to secure a home while enjoying favorable financial terms. By understanding these advantages, potential homeowners can make informed decisions about their financing options.

Contextualize Owner-Occupied Loans in the Financial Landscape

Understanding what is an owner occupied loan is crucial to the housing market, especially in Australia, where homeownership significantly contributes to personal wealth. As we approach 2025, residential mortgages are set to represent a substantial share of new mortgage agreements, highlighting a strong demand among first-time homebuyers and those looking to enhance their living conditions.

The Australian mortgage sector has seen fluctuations in interest rates and borrowing standards, which directly affect the availability and attractiveness of residential financing. In an environment where investors often face rising costs and stricter requirements, understanding what is an owner occupied loan helps owner-occupants benefit from more favorable conditions. This makes these financing options a preferred choice for many individuals seeking stability in their housing situations.

Identify Key Characteristics of Owner-Occupied Loans

Key characteristics of owner-occupied loans include:

-

Lower Interest Rates: Typically, these loans offer lower interest rates compared to investment loans. Lenders perceive owner-occupiers as less risky borrowers, making this an attractive option for many.

-

Loan-to-Value Ratio (LVR): Owner-occupied mortgages often permit higher LVRs. This means borrowers can secure funding for a larger percentage of the property's worth, enhancing their purchasing power.

-

Repayment Choices: Numerous residential mortgages provide flexible repayment options. Borrowers can often make additional payments without penalties, which can significantly benefit their financial situation.

-

Government Incentives: First-time homebuyers may qualify for government grants or incentives when purchasing a residence with a primary residence mortgage. This aspect further enhances the appeal of what is an owner occupied loan.

-

Occupancy Requirement: It’s essential for borrowers to reside in the premises as their main home. Failing to meet this requirement may lead to penalties or a reclassification of the mortgage, which is crucial to understand before committing.

Evaluate Benefits and Drawbacks of Owner-Occupied Loans

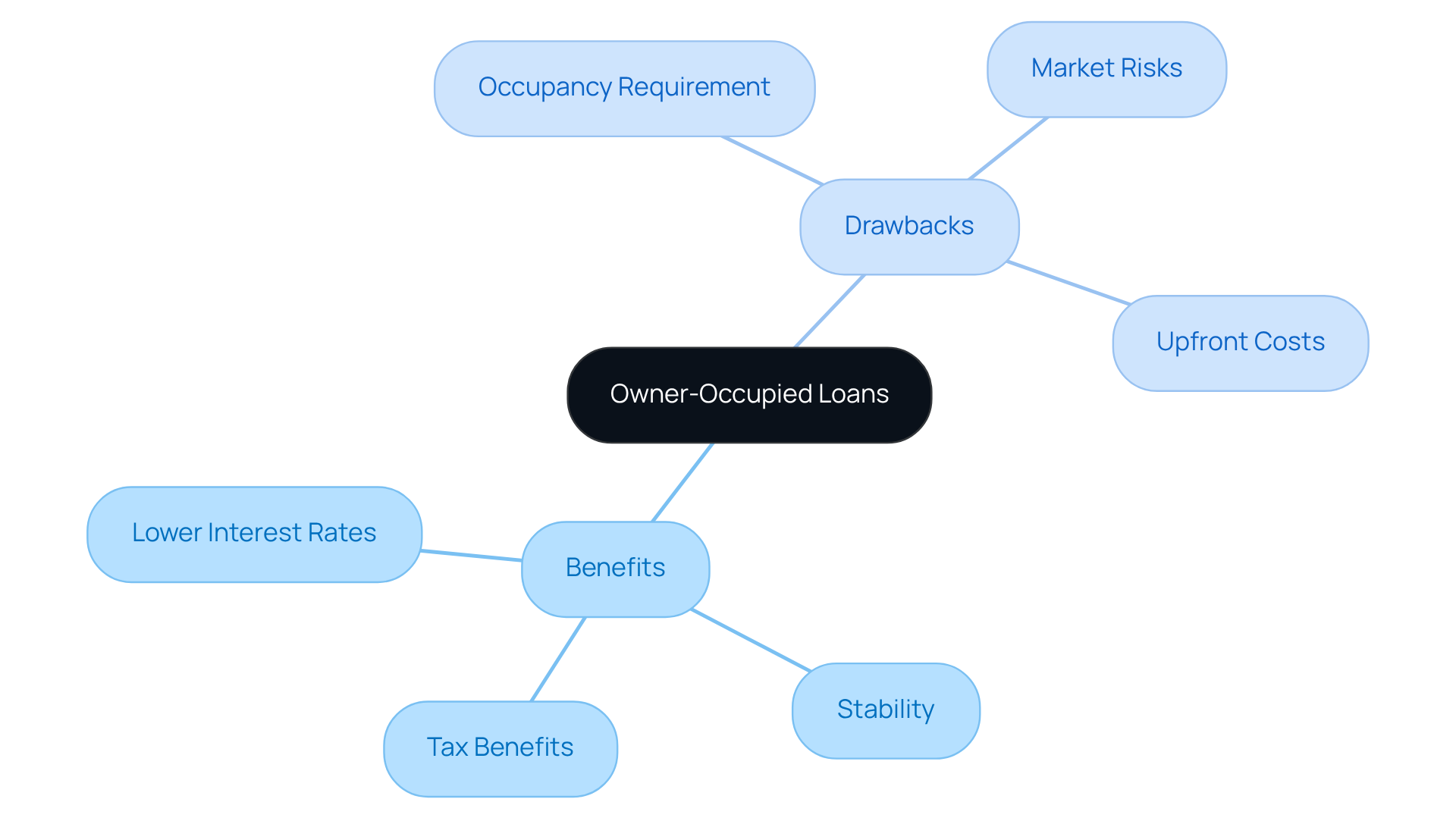

Exploring the benefits of owner-occupied loans reveals several compelling advantages:

- Lower Interest Rates: These loans typically feature lower rates, making them more affordable over time. This affordability can significantly impact your long-term financial health.

- Stability: Homeownership not only provides stability but also offers the potential for asset value appreciation, contributing to long-term wealth accumulation.

- Tax Benefits: While owner-occupied loans may not provide the same tax deductions as investment loans, homeowners can benefit from capital gains tax exemptions when selling their primary residence, enhancing their financial position.

On the other hand, it is essential to consider the drawbacks associated with these loans:

- Occupancy Requirement: Borrowers are required to live in the property, which can limit flexibility should circumstances change unexpectedly.

- Market Risks: Homeowners face exposure to market fluctuations that can affect property values and equity, necessitating careful consideration of market conditions.

- Upfront Costs: The process of purchasing a home often involves significant upfront costs, including deposits, fees, and potential renovations, which can pose a barrier for some buyers.

In conclusion, while understanding what is an owner occupied loan reveals numerous benefits, it also highlights certain limitations. It's crucial for potential borrowers to weigh these factors carefully to make informed financial decisions.

Conclusion

Owner-occupied loans are essential financial instruments for individuals aiming to secure a primary residence. By grasping the unique features and benefits of these loans, potential homeowners can navigate the complexities of the mortgage landscape with enhanced confidence. This type of financing not only provides lower interest rates and favorable terms but also aligns with the overarching goal of achieving homeownership, a cornerstone of personal wealth accumulation.

Key insights from the article underscore the appealing characteristics of owner-occupied loans, such as:

- Lower interest rates

- Flexible repayment options

- Potential government incentives for first-time buyers

Moreover, understanding the occupancy requirement alongside the associated drawbacks—like market risks and upfront costs—are crucial considerations for prospective borrowers. By weighing these factors, individuals can make informed decisions that align with their financial aspirations.

Ultimately, the importance of owner-occupied loans transcends individual financial advantages; they significantly influence the housing market and bolster community stability. As the demand for homeownership continues to rise, comprehending the nuances of these loans will empower potential buyers to take proactive steps toward securing their future. Engaging with financial advisors or mortgage professionals can further enrich this journey, ensuring that each decision is anchored in solid financial understanding and strategic planning.