Overview

A commercial mortgage loan represents a specialized financing option tailored for the acquisition or refinancing of income-generating business properties, including office buildings and retail spaces. Understanding the unique features of these loans is crucial. Factors such as loan amounts, interest rates, and repayment terms play a significant role in influencing a business's capacity to secure funding and effectively manage its financial health.

Furthermore, grasping these elements can empower business owners to make informed decisions that align with their financial goals. Are you aware of how these factors could impact your business's financial strategy? By delving into the specifics, you can better navigate the complexities of commercial financing.

In addition, each of these features can vary widely, affecting not only the immediate costs but also the long-term financial stability of your business. Therefore, it is essential to approach commercial mortgage loans with a comprehensive understanding, ensuring that you are equipped to leverage the best possible terms for your unique situation.

Ultimately, being well-informed about commercial mortgage loans allows you to take proactive steps in securing the funding necessary for your business's growth and success.

Introduction

Understanding the nuances of commercial mortgage loans is essential for businesses aiming to expand their real estate portfolios. These specialized financial instruments not only facilitate the acquisition of income-generating properties but also offer a multitude of opportunities for growth and stability. However, navigating the complexities of commercial financing can present significant challenges, particularly in a landscape characterized by fluctuating interest rates and stringent lending criteria.

What strategies can businesses implement to effectively leverage these loans and secure their financial future?

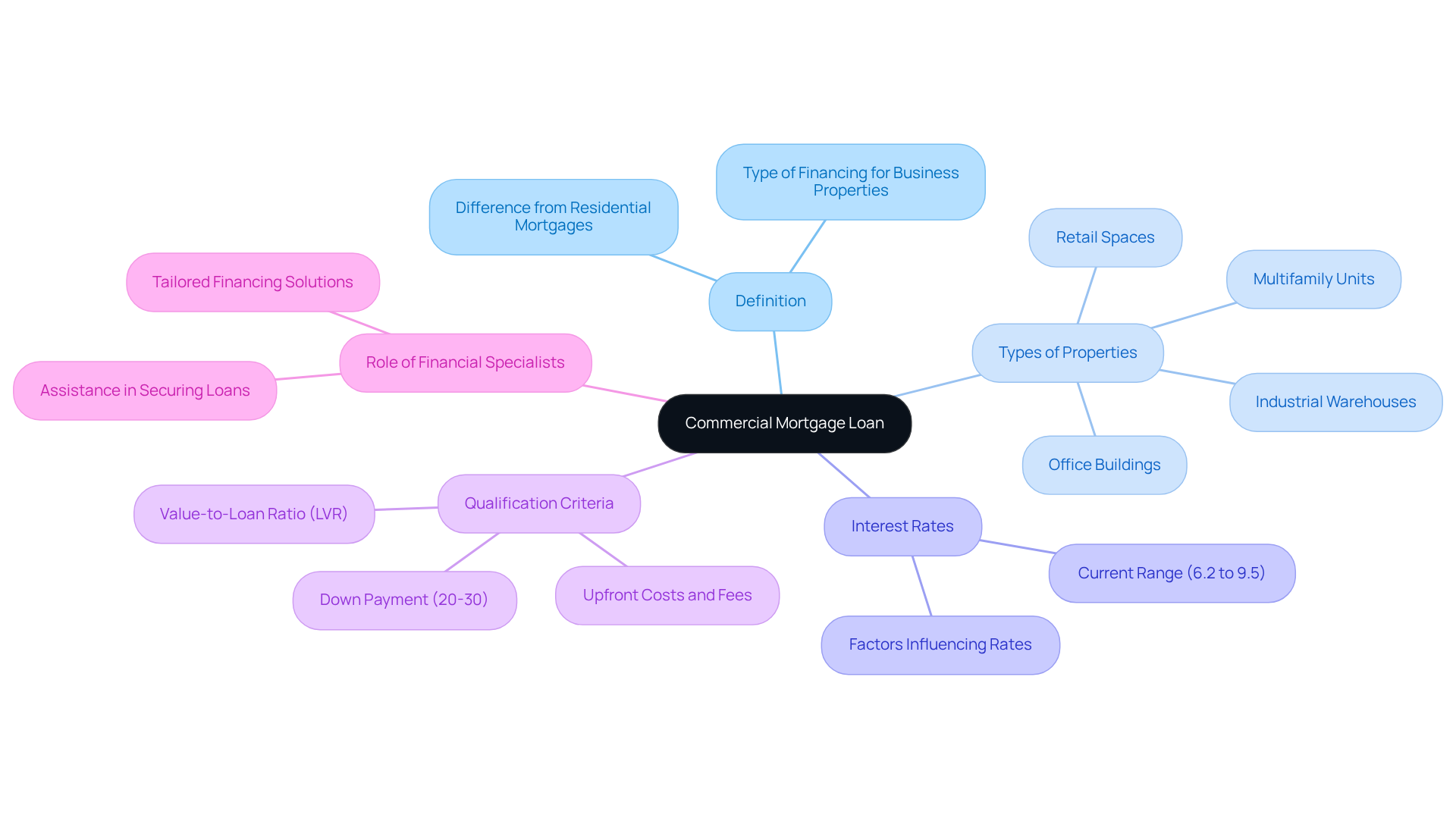

Define Commercial Mortgage Loan

A business mortgage is a type of financing that answers the question of what is a commercial mortgage loan, as it is specifically tailored for the acquisition or refinancing of business properties. Unlike residential mortgages, which are secured by personal homes, what is a commercial mortgage loan involves financing supported by income-generating assets such as office buildings, retail spaces, industrial warehouses, and multifamily units. These financial instruments are primarily utilized by companies to secure property, which raises the question of what is a commercial mortgage loan for operational or investment purposes.

As we look to 2025, the landscape for business mortgage financing is evolving, with average interest rates in Australia ranging from 6.2% to 9.5%. This shift reflects the heightened perceived risks associated with business properties, leading to stricter qualification criteria and higher interest rates compared to residential financing. Successful applications hinge on a comprehensive understanding of the unique aspects of business financing, particularly the importance of maintaining a favorable value-to-loan ratio (LVR) and being cognizant of potential upfront costs and fees.

Moreover, most lenders require a down payment of at least 20 to 30 percent for business financing, a critical factor in the application process. As financial specialists at Finance Story emphasize, navigating these complexities is essential for companies aiming to leverage mortgage loans effectively. With their expertise in crafting tailored and refined cases, Finance Story can assist small entrepreneurs in securing the right funding solutions that cater to their specific needs.

In addition, in 2025, lenders are offering more flexible products than ever before, which can significantly streamline the financing process for small business owners. Are you prepared to explore these options and take your business to the next level?

Explore Types of Commercial Mortgage Loans

A variety of business mortgage options are available, each tailored to meet specific corporate needs. These include:

- Standard Commercial Mortgages: Traditional financing for acquiring commercial properties, typically requiring a down payment of about 20% and offering either fixed or variable interest rates. Banks usually necessitate a credit score of at least 660 for approval.

- Bridge Loans: Short-term financial solutions designed to address urgent needs until a more permanent funding option is secured. These loans are often utilized in real estate transactions, providing quick access to funds.

- Construction Loans: Specifically crafted for financing the construction of new commercial properties or significant renovations of existing structures. These funds are generally disbursed in stages as construction progresses.

- SBA Financing: Backed by the Small Business Administration, these financial products offer favorable terms for small businesses seeking to acquire real estate, making them an attractive option for qualified borrowers.

- Hard Money Loans: Short-term loans secured by real estate, typically offered by private lenders. They come with higher interest rates and less stringent qualification criteria, making them accessible for those who may not qualify for traditional financing.

- Equity Financing: This involves raising capital through the sale of shares in the business, which can then be used to purchase real estate. This strategy allows companies to leverage their equity for real estate investments.

Understanding what is a commercial mortgage loan along with other loan categories is crucial for businesses aiming to navigate the complexities of commercial real estate financing effectively. Finance Story specializes in crafting tailored and highly customized cases to present to lenders, ensuring clients have access to a diverse range of private lenders and mainstream financial institutions. This expertise is particularly valuable in overcoming challenges in securing financing, especially in difficult circumstances. Moreover, Finance Story assists clients in restructuring their commercial financing to adapt to the evolving needs of their businesses. Considering repayment terms is essential, as they dictate the duration and payment schedule of the financing, influencing the overall financial strategy of the business. By fostering strong, long-term relationships with clients, Finance Story ensures they feel understood and supported in their financial decisions.

Identify Key Features of Commercial Mortgage Loans

Commercial mortgage loans encompass several critical features that borrowers must consider:

-

Loan Amounts: These loans can vary significantly, ranging from tens of thousands to millions of dollars, depending on the property type and lender policies. Finance Story specializes in crafting refined and highly personalized business cases to present to banks, ensuring that borrowers secure the appropriate funding amount for their specific needs.

-

Loan-to-Value Ratio (LVR): The LVR represents the maximum loan amount relative to the property's value, typically ranging from 65% to 80% for business properties. Recent trends indicate that maximum LVRs have tightened, with many lenders now capping them around 65% for residential property development. Understanding these ratios is vital for borrowers aiming to maximize their financing potential.

-

Interest Rates: As of 2025, business mortgage rates are generally higher than residential rates, reflecting the increased risk associated with business properties. Current interest rates for commercial mortgages are influenced by various factors, including economic conditions and lender appetite, with the Bank of England base rate currently at 4.5%. Finance Story's expertise can assist borrowers in navigating these rates effectively, ensuring they understand how to secure the best possible terms.

-

Repayment Terms: Commercial financing often features shorter repayment durations, usually ranging from 5 to 20 years, with options for interest-only payments during the initial phase, facilitating improved cash flow management. Grasping these concepts is crucial for small enterprises to align their funding with their operational requirements.

-

Prepayment Penalties: Borrowers should be aware that some business loans may impose penalties for early repayment, which can influence overall funding strategies. Finance Story can provide insights into these penalties, helping borrowers plan accordingly.

-

Collateral Requirements: The property itself typically serves as security for the financing, and lenders may also request personal guarantees from owners to mitigate risk. Collaborating with knowledgeable brokers from Finance Story can significantly enhance the chances of securing favorable terms and understanding collateral implications.

Understanding what is a commercial mortgage loan and its attributes is essential for borrowers navigating the complexities of business funding, especially in a competitive lending environment where engaging informed brokers can greatly improve the likelihood of obtaining advantageous conditions.

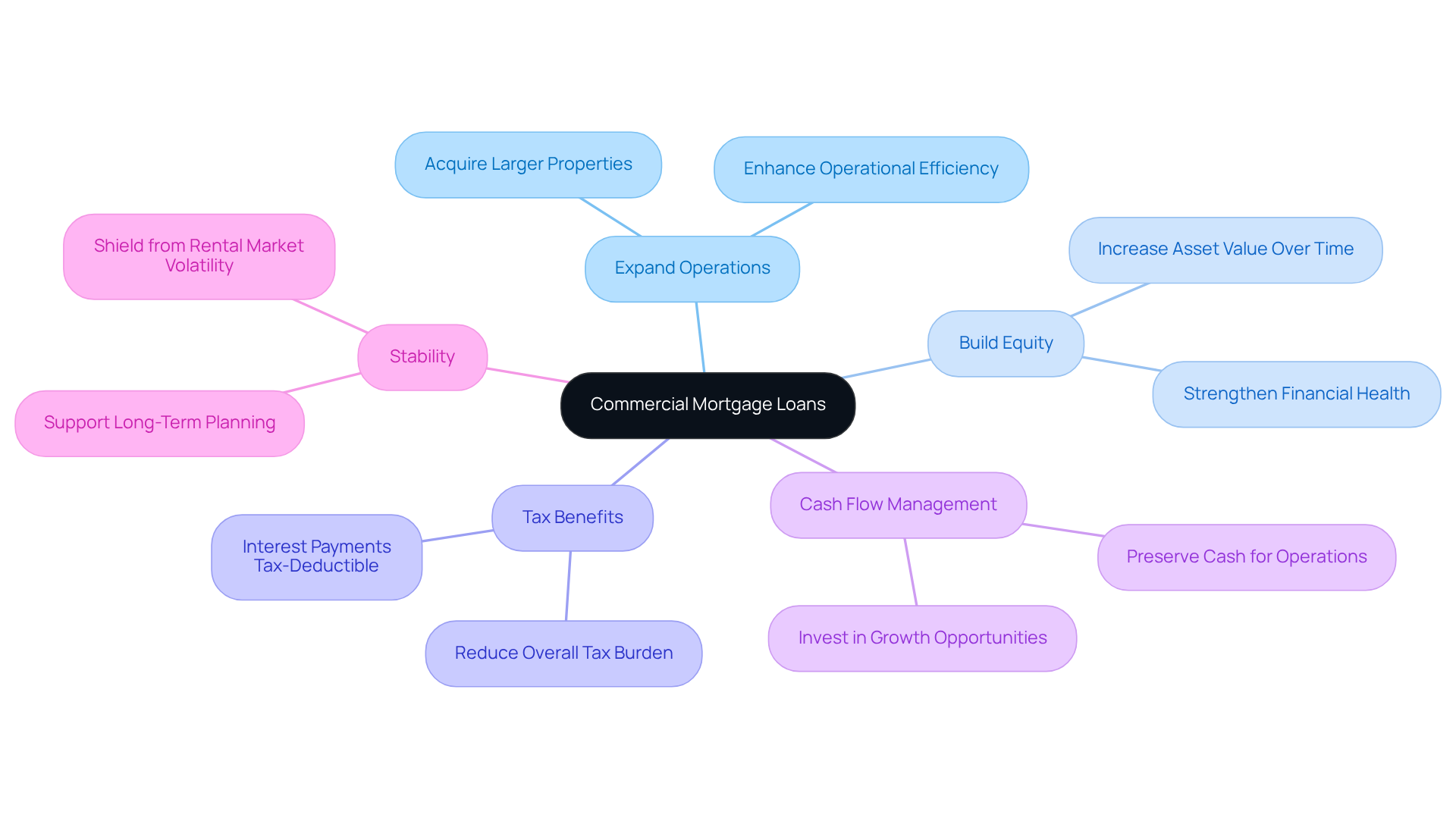

Understand the Importance of Commercial Mortgage Loans in Business Financing

For enterprises aiming to acquire or enhance real estate assets, understanding what is a commercial mortgage loan is essential, as it provides vital funds for purchasing income-generating properties like office buildings and retail spaces. By leveraging commercial mortgages, businesses can unlock several significant advantages:

- Expand Operations: Access to financing empowers businesses to acquire larger or additional properties, fostering growth and enhancing operational efficiency.

- Build Equity: Ownership of business property can lead to increased equity over time, creating a valuable asset that bolsters the enterprise's financial health.

- Tax Benefits: Interest payments on commercial mortgages are often tax-deductible, which can substantially reduce the overall tax burden for companies.

- Cash Flow Management: Financing property acquisitions allows companies to preserve cash flow for other operational necessities, such as hiring staff or investing in inventory, thereby enhancing overall financial flexibility.

- Stability: Owning property provides stability, shielding enterprises from the volatility of rental markets. This stability is essential for long-term planning and growth, particularly in a shifting economic landscape.

Looking ahead to 2025, the lending market is projected to expand significantly, with a compound annual growth rate of 16.5%. This growth reflects the increasing demand for funding options that support company expansion and operational needs. For instance, many enterprises are capitalizing on mortgage loans to seize new opportunities, particularly in sectors like construction and real estate, where brokers anticipate robust financing demand. By understanding what is a commercial mortgage loan, businesses can secure the necessary funding to facilitate their expansion and position themselves for sustained growth in a competitive market.

Conclusion

Understanding commercial mortgage loans is crucial for businesses aiming to invest in or refinance income-generating properties. These specialized financial instruments provide the necessary funding to acquire various commercial real estate assets, enabling companies to enhance their operational capabilities and financial standing.

This article delves into several key aspects of commercial mortgage loans, including:

- Their definition

- Types

- Features

- Importance in business financing

It highlights the distinct nature of these loans compared to residential mortgages, emphasizing the necessity of a solid understanding of loan-to-value ratios, interest rates, and repayment terms. Furthermore, it outlines the advantages that commercial mortgages offer, such as:

- The potential for equity building

- Tax benefits

- Improved cash flow management

In light of the evolving lending landscape and the projected growth in the commercial mortgage market, businesses are encouraged to explore their financing options proactively. Engaging with knowledgeable brokers can significantly enhance the chances of securing favorable terms, ultimately supporting long-term growth and stability. By recognizing the importance of commercial mortgage loans, enterprises can position themselves effectively in a competitive market, ensuring they have the resources to thrive and expand.