Overview

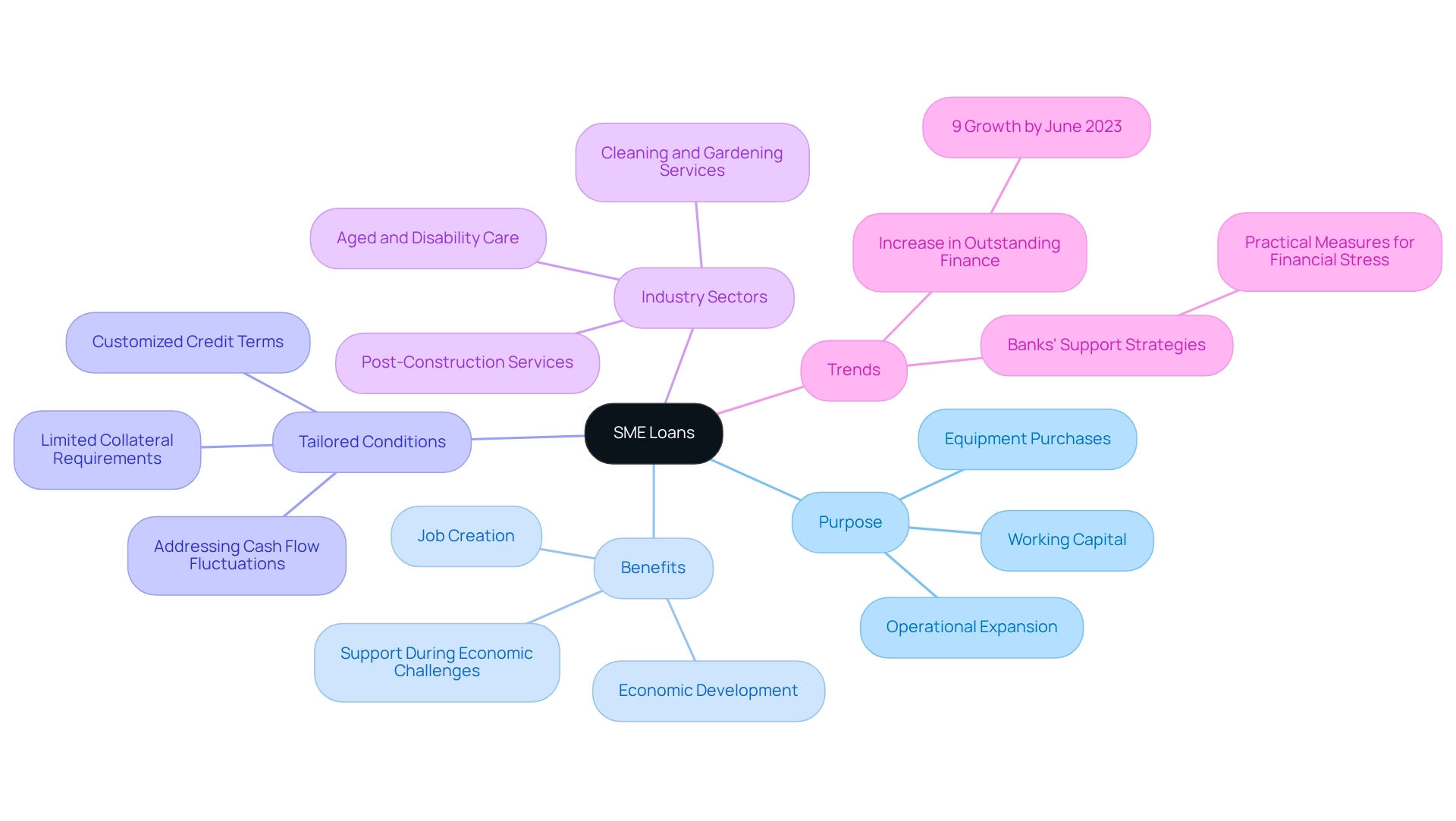

SME loans are specialized financial products tailored to meet the funding needs of small and medium enterprises. These loans enable businesses to access essential capital for various purposes, including:

- Working capital

- Equipment purchases

- Operational expansion

The importance of SME loans cannot be overstated; they play a crucial role in fostering business growth and ensuring economic stability. By providing tailored financing options, these loans empower SMEs to navigate challenges effectively, contributing significantly to job creation and innovation in the economy.

Introduction

In the dynamic landscape of modern economies, small and medium enterprises (SMEs) serve as the backbone, driving innovation and job creation. Yet, the journey of entrepreneurship is often fraught with financial hurdles, making access to capital a critical factor for success.

SME loans emerge as specialized financial instruments designed to meet the unique needs of these businesses, offering a lifeline for growth, operational expansion, and sustainability. As demand for such financial solutions continues to rise, understanding the various types of SME loans, their eligibility requirements, and the application process becomes essential for business owners looking to harness these resources effectively.

This article delves into the intricacies of SME loans, underscoring their significance in fostering economic stability and empowering small businesses to thrive amidst challenges.

Defining SME Loans: What They Are and Their Purpose

SME financing, or Small and Medium Enterprise financing, involves specialized financial products that address the unique funding needs of small and medium-sized enterprises, which raises the question, what does SME loan mean? These products serve multiple purposes, including working capital, equipment purchases, and operational expansion. The primary goal of SME financing is to equip enterprises with the necessary funds for growth and sustainability, thereby fostering economic development and job creation.

Unlike conventional financing, SME options often feature tailored terms and conditions that specifically address the challenges faced by smaller companies, such as fluctuating cash flows and limited collateral. By 2025, the average amount for SME financing in Australia is projected to reflect a growing recognition of the importance of these products, with significant increases in outstanding capital to enterprises noted in recent statistics—an increase of nearly 9% by June 2023. This trend underscores the rising reliance on SME financing as a vital resource for development. The benefits of SME financing extend beyond mere funding; they provide essential support for enterprises navigating economic challenges. Financial experts emphasize the importance of customized credit conditions, which can significantly enhance a company's ability to manage its finances effectively.

For example, sectors such as aged and disability care, cleaning and gardening services, and post-construction services are witnessing rapid growth, highlighting the necessity for accessible financing options to support these emerging opportunities. Finance Story is dedicated to developing refined and tailored cases for presentation to banks, ensuring that small business owners can secure the appropriate funding solutions for their specific needs.

Recent insights from industry leaders, including ABA CEO Anna Bligh, stress that banks possess effective strategies to assist clients under economic pressure. This highlights the critical role of SME financing in today's economic landscape, as banks actively offer solutions tailored to the needs of small enterprises. By understanding what does SME loan mean and its advantages, small businesses can better leverage these resources for their growth and success. Furthermore, the evolution of SME financing over time has made it increasingly accessible and relevant to the changing needs of businesses, ensuring it remains a cornerstone of financial support for small enterprises.

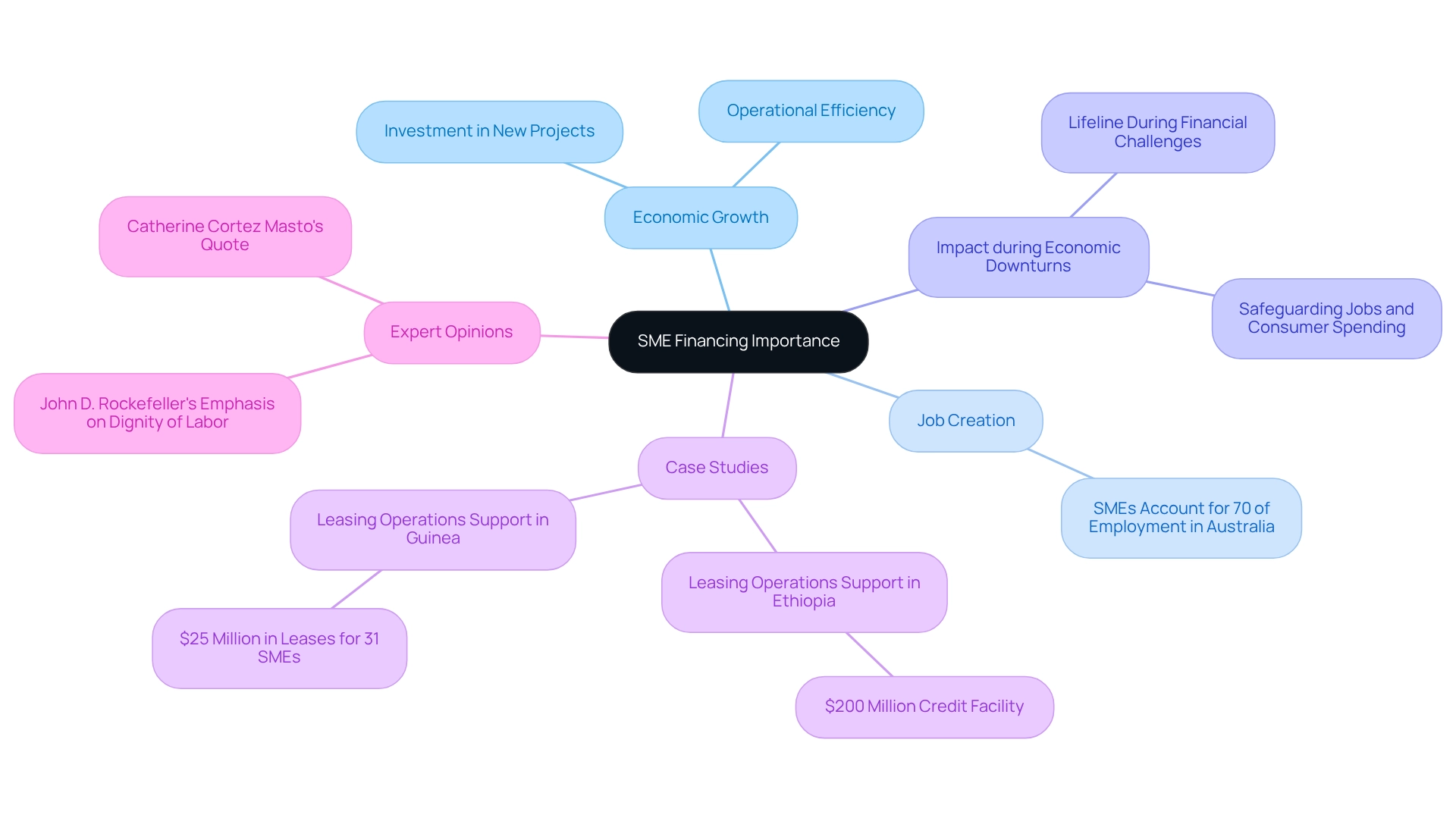

The Importance of SME Loans in Business Growth and Economic Stability

SME financing is crucial for fostering enterprise growth and ensuring economic stability. Small and medium enterprises (SMEs) constitute the backbone of the economy, making significant contributions to employment and innovation. Access to capital through SME financing empowers these enterprises to invest in new projects, expand their workforce, and enhance operational efficiency. For instance, recent initiatives in Guinea have successfully supported 31 SMEs with leases totaling $25 million, demonstrating the tangible impact of financial assistance on local businesses.

During economic downturns, such as the recent pandemic, SME financing acts as an essential lifeline, enabling enterprises to navigate financial challenges and retain their employees. This support not only benefits individual businesses but also stabilizes the broader economy by safeguarding jobs and sustaining consumer spending. In Australia, SMEs account for approximately 70% of total employment, highlighting their vital role in job creation and economic resilience.

As U.S. Senator Catherine Cortez Masto remarked, "Small enterprises are the economic engine of our communities and they need our support during these unprecedented times." This statement underscores the critical role that SME financing plays in assisting small businesses, particularly in challenging circumstances. Expert opinions further emphasize that supporting small enterprises is fundamental to maintaining a robust economy. Research indicates that knowing what does SME loan mean can mitigate the adverse effects of economic recessions, ensuring that businesses can continue to operate and contribute positively to the economy.

Furthermore, Finance Story specializes in developing polished and highly tailored cases for presentation to banks, ensuring that SMEs secure the appropriate financing solutions tailored to their unique requirements. We provide a comprehensive range of lenders, including high street banks and innovative private lending panels, to offer diverse financing options. For leasehold enterprises, leveraging property equity and cash savings becomes essential for acquisitions, allowing owners to effectively utilize their existing assets. The World Bank Group's support for leasing initiatives in Ethiopia established a $200 million credit facility, illustrating the significant impact of funding initiatives on SMEs.

In conclusion, SME financing options are not merely financial instruments; they are vital for the growth of enterprises and the overall stability of the economy. By facilitating access to capital, these financial products empower SMEs to thrive, innovate, and create jobs, ultimately benefiting the entire community.

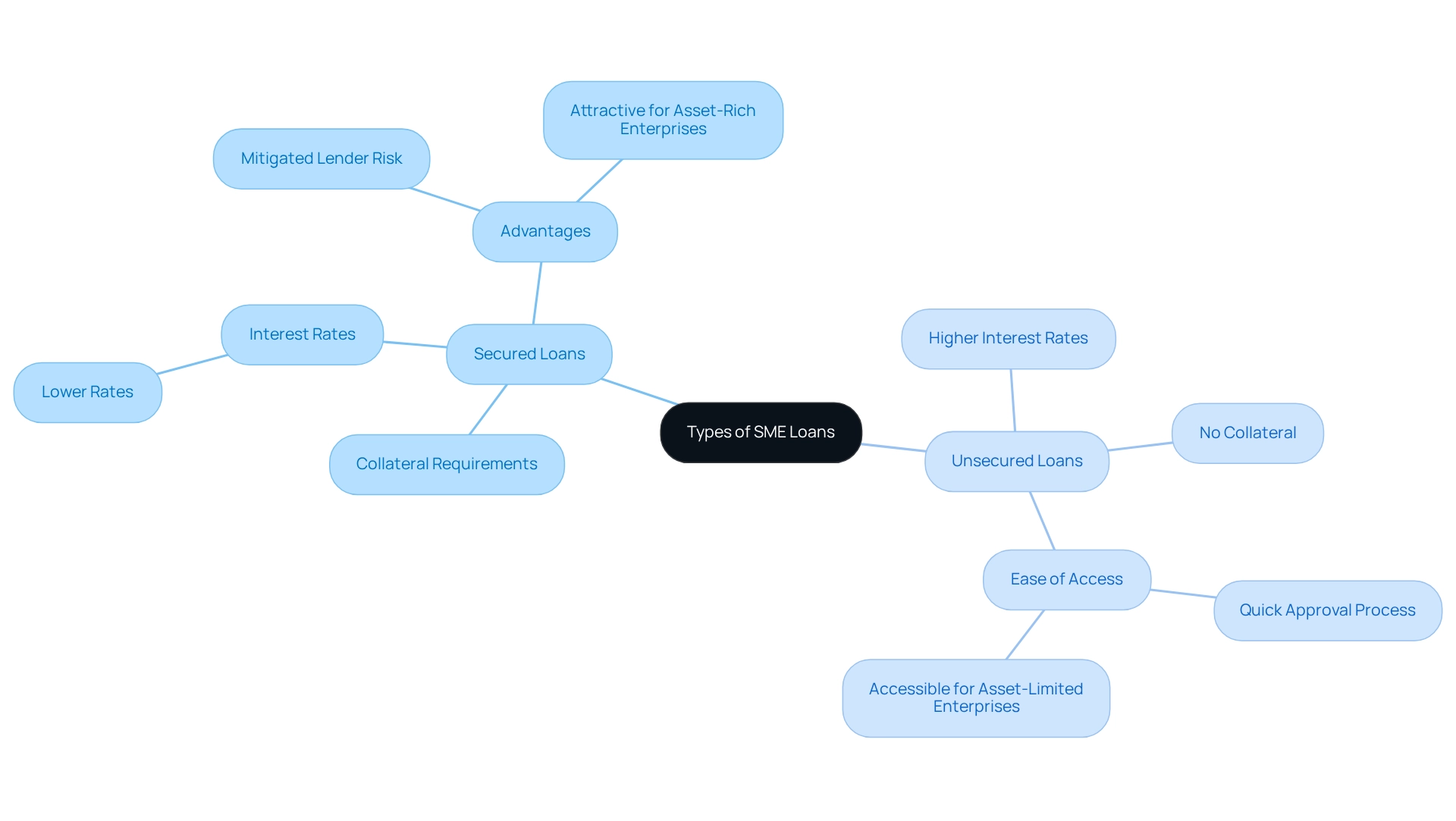

Types of SME Loans: Secured vs. Unsecured and Other Variations

SME financing is primarily divided into secured and unsecured types, each possessing distinct attributes that cater to various organizational needs. Secured credit necessitates collateral—such as property or equipment—which mitigates the lender's risk and often results in lower interest rates. For instance, the typical interest rate for secured SME financing in Australia in 2025 is considerably lower than that of unsecured options, making them an attractive choice for enterprises with valuable assets to leverage.

Conversely, unsecured credit does not require collateral, providing easier access for enterprises that may not possess significant assets. However, this convenience comes at a cost, as unsecured credit typically carries higher interest rates due to the increased risk for lenders. Recent data indicates that over 90% of credit applications in Australia are submitted by SMEs, as reported by Money.com.au, underscoring the critical role these funding options play in the commercial landscape.

Phil Collard, a Commercial Finance Expert, notes, "the vast majority of enterprises in Australia (around 98%) are small entities and more than 90% of funding requests are made by SMEs," highlighting the indispensable role of SME financing in supporting these organizations.

In addition to these primary categories, specialized SME financing options, such as government-supported funding, have gained popularity. These financial arrangements often feature favorable conditions designed to promote enterprise growth, reflecting the government's commitment to aiding small businesses. Prime Minister Anthony Albanese has emphasized the necessity of ensuring that small enterprises have access to fair and sustainable funding alternatives, aligning with the broader recognition of the need for protective measures in a challenging economic environment.

For entrepreneurs, it is crucial to understand what does SME loan mean, particularly the differences between secured and unsecured financing. By evaluating their specific circumstances and financial conditions, they can make informed decisions that align with their objectives. As the SME funding landscape continues to evolve in 2025, staying abreast of the latest trends and variations in credit types will empower small enterprise owners to navigate their financial journeys effectively. Furthermore, Finance Story is dedicated to crafting refined and highly personalized cases to present to lenders, ensuring that small enterprise owners can secure the appropriate funding for their commercial property investments and refinancing needs. Ongoing discussions regarding the implementation of limits on interest rates and fees for unsecured commercial financing to prevent exploitation, similar to limits on payday loans, further highlight the importance of understanding the current lending landscape.

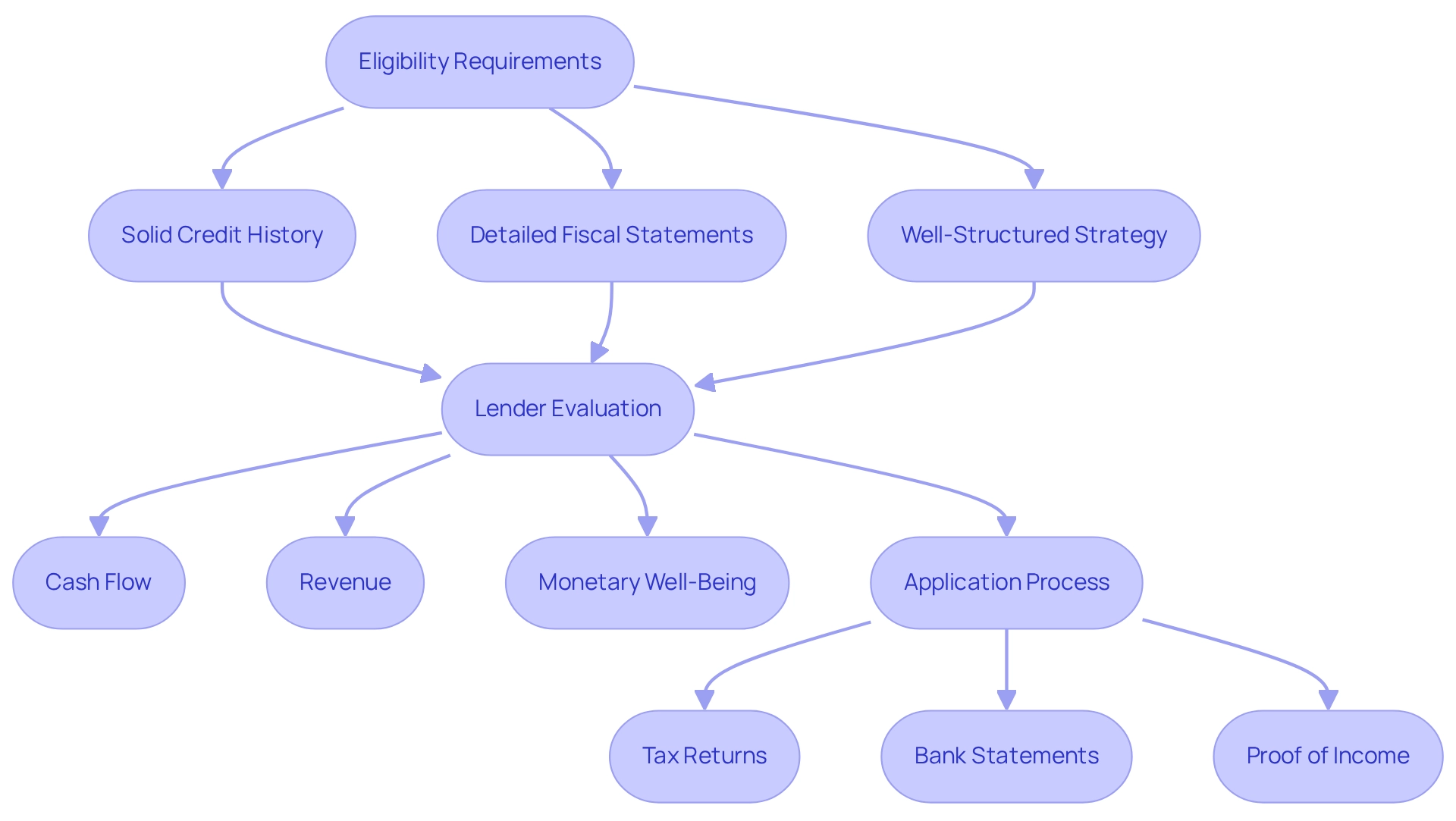

Eligibility Requirements and Application Process for SME Loans

To qualify for SME funding, enterprises must typically meet specific eligibility requirements. These include:

- Demonstrating a solid credit history

- Providing detailed fiscal statements

- Presenting a well-structured strategy

Lenders evaluate various aspects, such as cash flow, revenue, and overall monetary well-being, to establish borrowing eligibility. As of 2025, the average credit score needed for SME financing approval is around 650, reflecting a trend towards more accessible funding options for enterprises. This trend is crucial, as Jon Sutton, CEO of ScotPac, emphasizes, "We really need the SME sector to be firing on all cylinders," highlighting the importance of robust financial support for SMEs in the current economic climate.

At Finance Story, we focus on developing refined and highly personalized case studies to present to banks. This ensures that your funding proposal meets the increasingly heightened expectations of lenders. We collaborate with a full range of lenders, including high street banks and innovative private lending panels, to secure the best financing options for your needs. The application process generally involves submitting an application form along with essential supporting documents, including:

- Tax returns

- Bank statements

- Proof of income

It is vital for entrepreneurs to prepare thoroughly, ensuring that all necessary information is precise and comprehensive. This preparation can significantly influence both the speed and success of their financial application.

Recent statistics indicate that exceptional funding to enterprises increased by almost 9% compared to the prior year, underscoring what does SME loan mean in terms of rising financial needs. Moreover, the essential function of SMEs in the Australian economy cannot be overstated, as illustrated in a case study that underscores the necessity for ongoing assistance and resources for these enterprises. Lenders also highlight the significance of a clear and persuasive plan, as it plays a pivotal role in the decision-making process. By understanding these requirements and preparing accordingly, businesses can enhance their chances of securing the necessary funding to thrive in a competitive landscape.

Conclusion

Access to SME loans is essential for small and medium enterprises, serving as a vital resource for growth, operational expansion, and economic stability. These specialized financial products address the unique challenges faced by SMEs, equipping them with the capital necessary to invest in new projects, hire staff, and enhance efficiency. By understanding the various types of SME loans, including secured and unsecured options, business owners can make informed decisions that align with their specific needs and circumstances.

The eligibility requirements and application process for SME loans highlight the importance of preparation and a solid financial foundation. As businesses navigate the complexities of securing funding, they must present a compelling case to lenders, emphasizing their financial health and growth potential. With the right support and tailored financing solutions, SMEs can thrive even in challenging economic climates, reinforcing their role as the backbone of the economy.

Ultimately, SME loans are not merely financial instruments; they are essential tools that empower small businesses to innovate, create jobs, and contribute to overall economic resilience. As the demand for these loans continues to rise, understanding their intricacies becomes crucial for entrepreneurs aiming to harness their full potential. Embracing the opportunities that SME loans present can lead to sustainable growth and a lasting impact on local communities and the economy at large.