Overview

When considering financing for commercial property, it is essential to understand that the required deposit typically ranges from 20% to 40% of the purchase price. Notably, a minimum deposit of 30% is often mandated for business real estate loans. This variability is influenced by several factors, including:

- The type of asset

- Prevailing market conditions

- The financial profile of the borrower

Lenders perceive higher risks associated with commercial real estate investments, which results in stricter deposit requirements. Understanding these nuances can empower you to make informed decisions in your property investments.

Introduction

Navigating the landscape of commercial property financing presents significant challenges, particularly regarding the diverse deposit requirements that vary across markets and property types. As potential investors prepare to commit substantial resources, understanding the specific deposit needed for commercial property becomes crucial. This knowledge not only aids in securing favorable financing terms but also lays the groundwork for long-term financial success.

However, with market conditions fluctuating and lender expectations shifting, how can investors accurately determine the appropriate deposit amount that strikes a balance between risk and opportunity?

Define Commercial Property Deposit

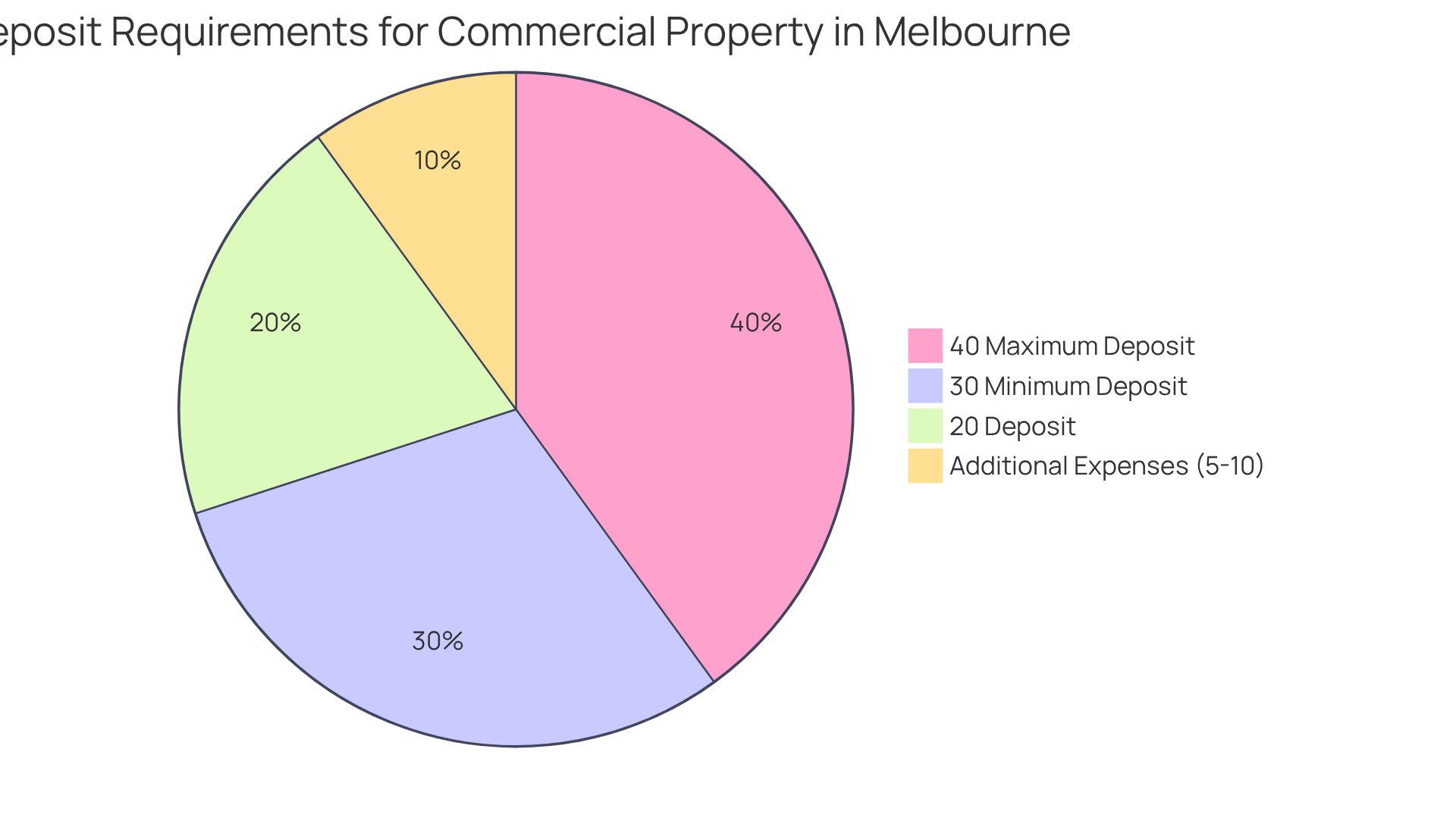

A business asset advance represents the initial payment made by a buyer when acquiring a business asset, typically expressed as a percentage of the asset's purchase price. This payment is a clear indication of the buyer's commitment to the transaction. In 2025, the deposit needed for commercial property in Melbourne generally ranges from 20% to 40%, with a minimum contribution requirement of 30% for business real estate loans. This reflects the heightened risk that financial institutions associate with commercial real estate investments, which often entail larger sums and longer-term obligations.

Current trends reveal that while the average contribution remains within this spectrum, specific percentages can be influenced by factors such as location and market conditions. In particularly desirable areas, even larger contributions may be necessary to attract sellers. Furthermore, prospective investors must recognize that most financiers prefer to see savings accumulated for at least 3 months. They should also be prepared for additional expenses amounting to 5-10% of the asset value beyond the initial funds. Understanding what deposit is needed for commercial property is crucial for successfully navigating the business real estate market.

Outline Typical Deposit Requirements

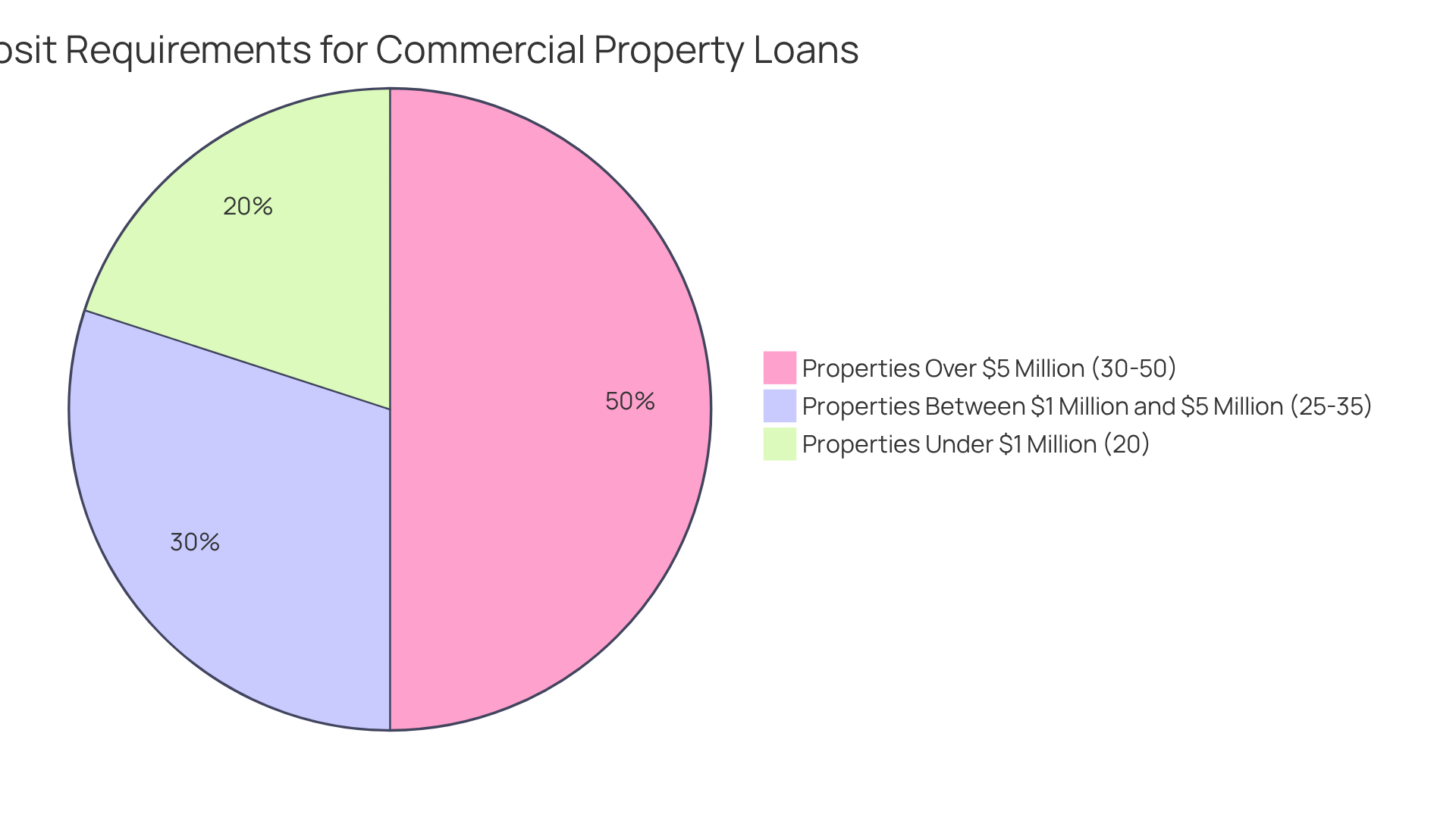

Most lenders typically require an upfront payment, often referred to as what deposit do you need for commercial property, ranging from 20% to 35% of the purchase cost. For example, to determine what deposit do you need for commercial property assessed at $1 million, it would necessitate an upfront payment between $200,000 and $350,000. However, in specific situations—particularly for specialized assets or higher-risk investments—lenders may demand payments as high as 40%. Properties situated in desirable areas or those with reliable tenants often qualify for reduced security requirements, reflecting the perceived stability and lower risk associated with these investments.

For assets valued under $1 million, the usual loan-to-value ratio (LVR) is up to 80%, requiring a 20% initial payment. Conversely, assets valued over $5 million generally necessitate an initial payment of 30% to 50%. Demonstrating financial stability can significantly aid in negotiating favorable terms for the security. Lender requirements for funds can vary considerably; for instance, some may ask for a minimum of 25% for assets in competitive markets, while others might permit smaller contributions for less desirable locations. Understanding what deposit do you need for commercial property is essential for potential investors looking to secure advantageous financing terms.

Examine Factors Affecting Deposit Amount

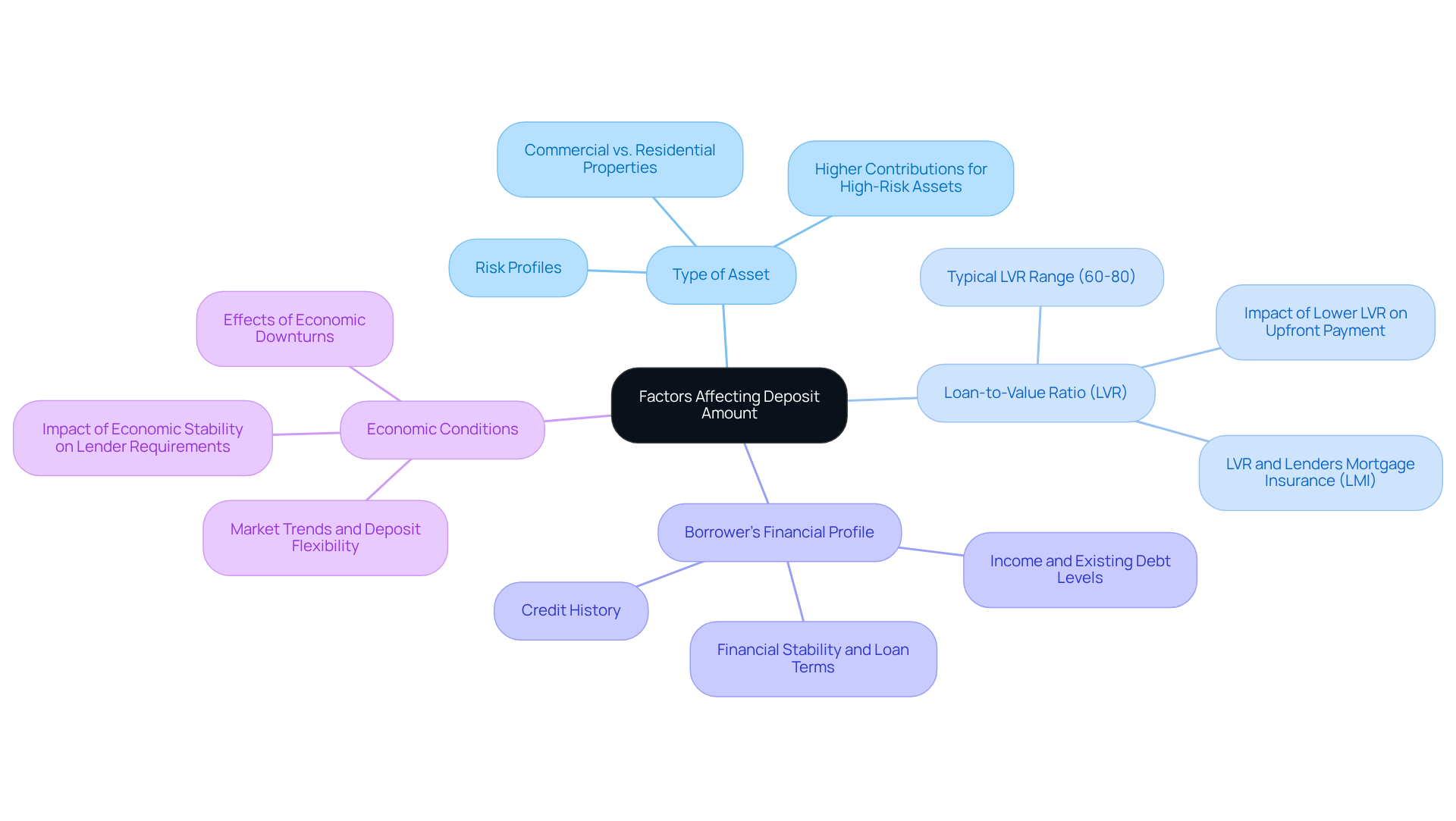

Various elements significantly influence what deposit do you need for commercial property financing, with the type of asset being a key factor. Different categories of commercial properties—such as retail, office, and industrial—exhibit varying financial requirements due to their distinct risk profiles. For example, financial institutions often demand larger upfront payments for assets considered riskier, such as retail locations in volatile markets, compared to more secure investments like industrial real estate. As financial analyst Carly Dircks states, "When acquiring an investment asset in Australia, most financiers favor a 20% contribution of the asset’s purchase price."

The Loan-to-Value Ratio (LVR) also plays a crucial role, with lenders typically setting LVRs between 60% and 80% for commercial real estate. A lower LVR necessitates a larger upfront payment, which can range from 30% or more for high-risk investments. This becomes particularly significant in 2025, as market conditions have led to stricter lending standards, especially for properties in high-demand locations, which may require greater upfront payments due to perceived stability.

Moreover, the borrower’s financial profile is pivotal. A solid credit history and financial stability can result in more favorable account conditions, while borrowers perceived as higher risk may encounter stricter criteria. Economic conditions further influence savings expectations, as financial institutions adjust their standards according to current market trends. For instance, during periods of economic stability, lenders may offer more flexible savings options, whereas downturns often lead to stricter requirements.

Understanding what deposit do you need for commercial property is essential for prospective investors, as the type of asset not only affects the initial payment but also influences the overall financing strategy. Engaging with an informed mortgage advisor can provide valuable insights into how these elements interact, ensuring clients are adequately prepared to navigate the complexities of business financing. Additionally, it is crucial to consider extra expenses associated with acquiring business real estate, such as stamp duty and legal fees, which can increase the total amount required.

Discuss Implications for Financing Options

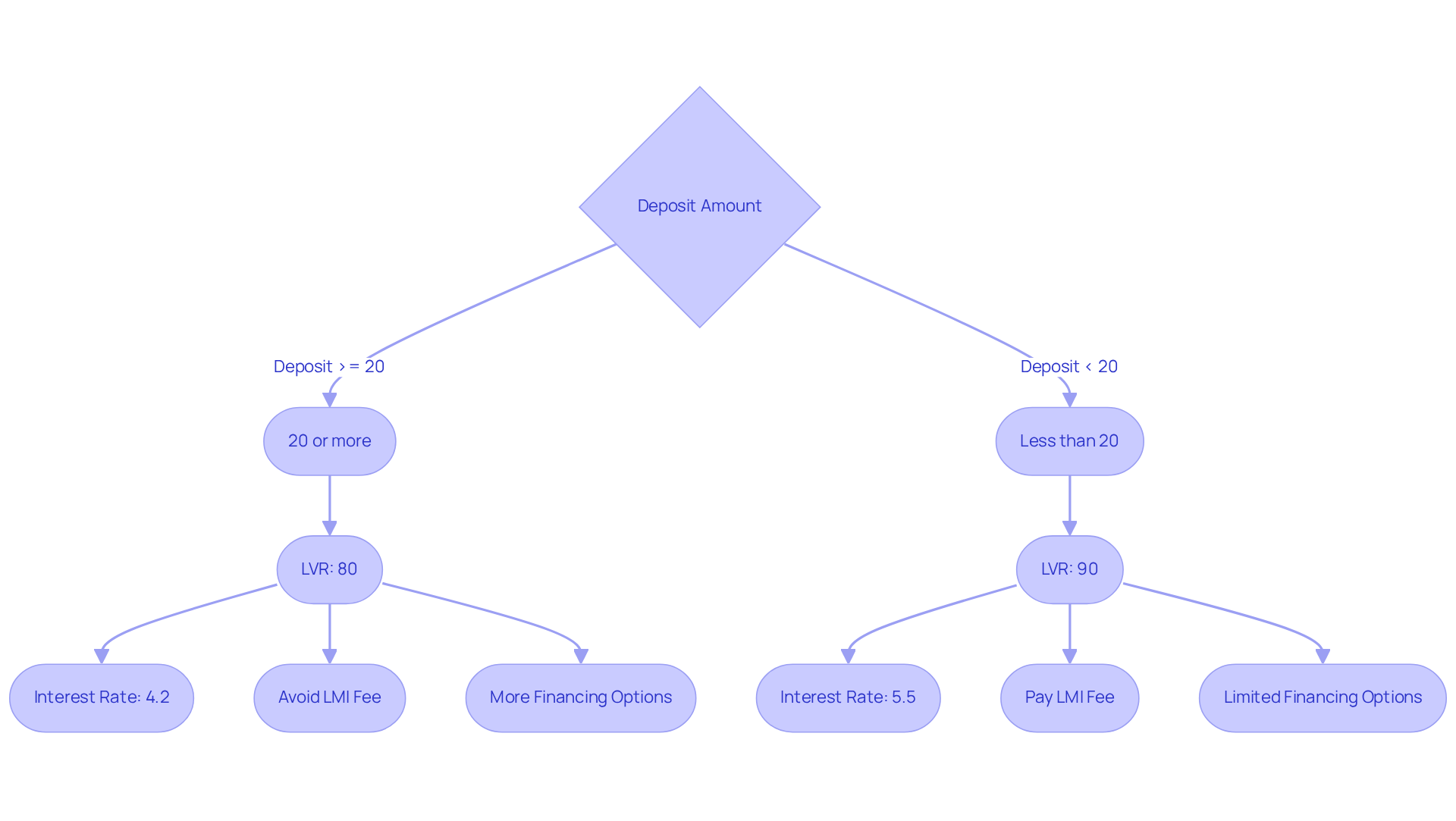

Determining what deposit do you need for commercial property financing is pivotal in deciding the available financing options. A larger upfront payment typically results in a lower Loan-to-Value Ratio (LVR), which can lead to more favorable loan conditions, including reduced interest rates and lower monthly repayments. For instance, borrowers who contribute 20% or more often secure interest rates that are 0.5% to 1.5% lower than those with lesser contributions. Conversely, a reduced amount may limit financing choices and lead to elevated interest rates, as lenders perceive heightened risk.

Consider Mr. Davies, who initially contemplated a 10% down payment, resulting in a 90% LVR and the necessity of paying Lenders Mortgage Insurance (LMI). After consulting with his mortgage broker, he raised his upfront payment to 20%, lowering his LVR to 80% and avoiding a $15,000 LMI fee. This strategic decision secured him a reduced interest rate of 4.2%, ultimately saving him approximately $75,000 over the life of the loan. Mr. Davies exemplifies the financial advantages of exceeding minimum funding requirements, highlighting how a larger contribution can significantly enhance loan terms.

Furthermore, purchasers with substantial down payments frequently gain access to a broader array of financial institutions, including private funding alternatives, which can offer more flexible repayment arrangements and terms. Statistics indicate that most lenders require a deposit of 20-30% for business loans, leading to the question: what deposit do you need for commercial property, as some high-risk assets may necessitate deposits of up to 50%. Interest rates for business real estate loans typically range between 4-8%. Understanding these implications is essential for buyers to navigate the complexities of commercial property financing effectively and align their choices with their financial objectives.

Conclusion

Understanding the deposit requirements for commercial property financing is essential for any prospective investor. The commitment demonstrated through an upfront payment not only reflects the buyer's dedication but also significantly influences the financing terms available. As outlined, the typical deposit ranges from 20% to 40% in 2025, with various factors impacting the required amount, such as property type, location, and the borrower’s financial profile.

Key insights reveal that:

- A higher deposit can lead to better loan conditions, including lower interest rates and more favorable repayment options.

- The type of commercial asset also plays a crucial role in determining deposit expectations.

- External market conditions and the borrower's financial stability further shape the financing landscape.

For instance, properties in high-demand areas may necessitate larger contributions due to perceived stability, while specialized or high-risk assets might require even higher deposits.

Ultimately, being well-informed about the necessary deposit for commercial property financing empowers investors to make strategic decisions that align with their financial goals. Engaging with mortgage advisors and thoroughly understanding the implications of deposit amounts can provide a competitive edge in navigating the complexities of commercial real estate financing. Taking these steps not only prepares investors for successful transactions but also positions them to capitalize on opportunities in the dynamic property market.