Overview

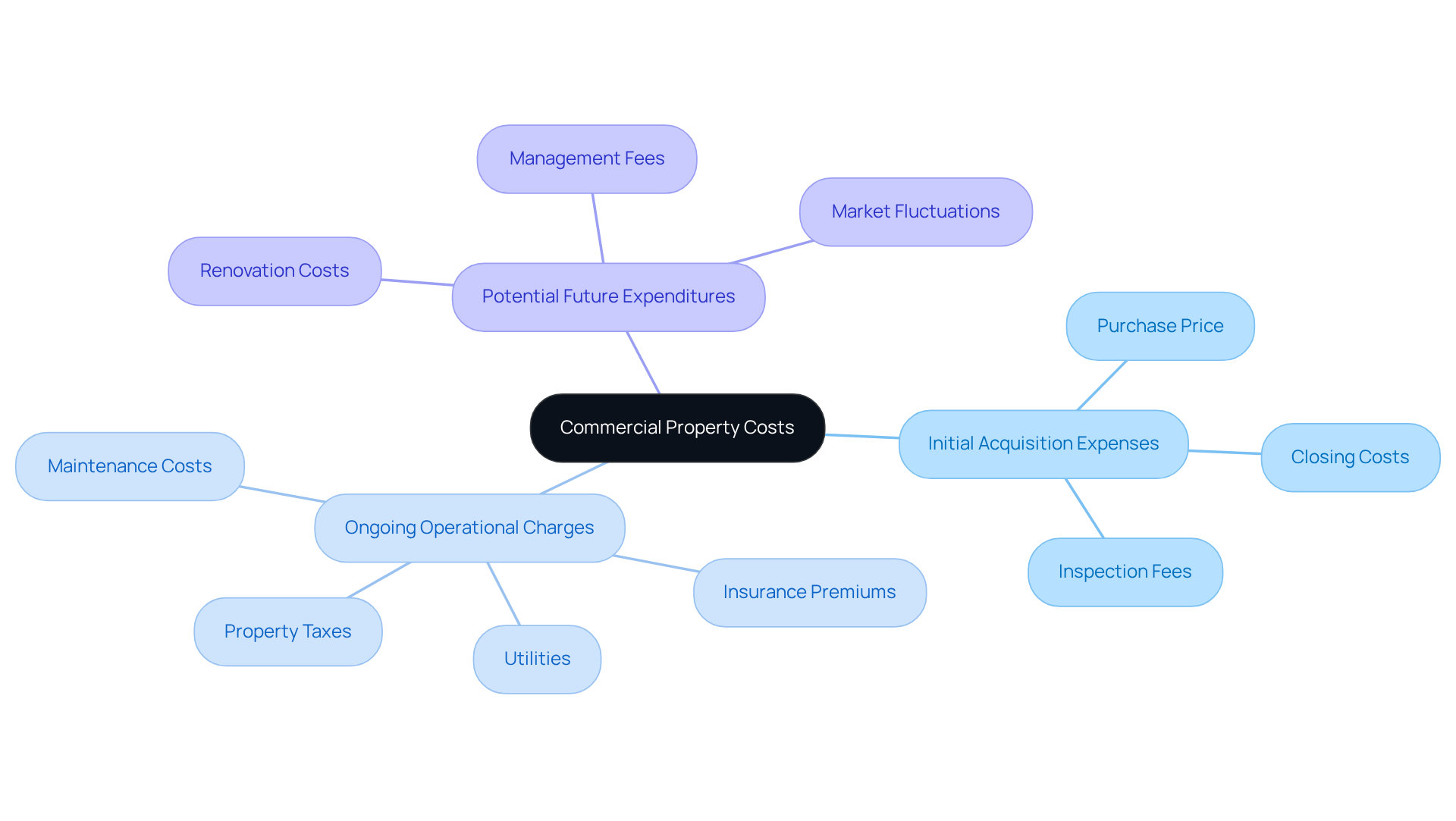

Understanding the costs involved in purchasing commercial property is essential for any investor. These costs encompass initial acquisition expenses, ongoing operational charges, and potential future expenditures related to management and maintenance. Key expenses include:

- The purchase price

- Stamp duty

- Legal fees

- Ongoing costs such as property management and insurance

Furthermore, recognizing these financial commitments is crucial for making informed investment decisions and maximizing your return on investment (ROI). Are you aware of how these costs could impact your overall financial strategy?

Introduction

Understanding the financial landscape of commercial property acquisition is essential for both investors and business owners. The diverse costs associated with purchasing commercial real estate can profoundly impact overall profitability and return on investment. Expenses can range from initial acquisition fees to ongoing operational charges, presenting a challenge in navigating these financial complexities.

What hidden costs may arise during the purchasing process, and how can stakeholders ensure they are fully prepared to manage them?

Define Commercial Property Costs

Understanding what costs are involved in buying commercial property is essential, as commercial real estate expenses encompass all expenditures related to the acquisition and ownership of commercial assets. Understanding what costs are involved in buying commercial property can help categorize these expenses into three main types:

- Initial acquisition expenses

- Ongoing operational charges

- Potential future expenditures associated with management and maintenance

Understanding what costs are involved in buying commercial property is crucial for investors and business proprietors, as these expenses can significantly impact the total return on investment (ROI). By grasping the nuances of these costs, stakeholders can make informed decisions that enhance their financial outcomes.

Explore Types of Costs in Commercial Property Purchases

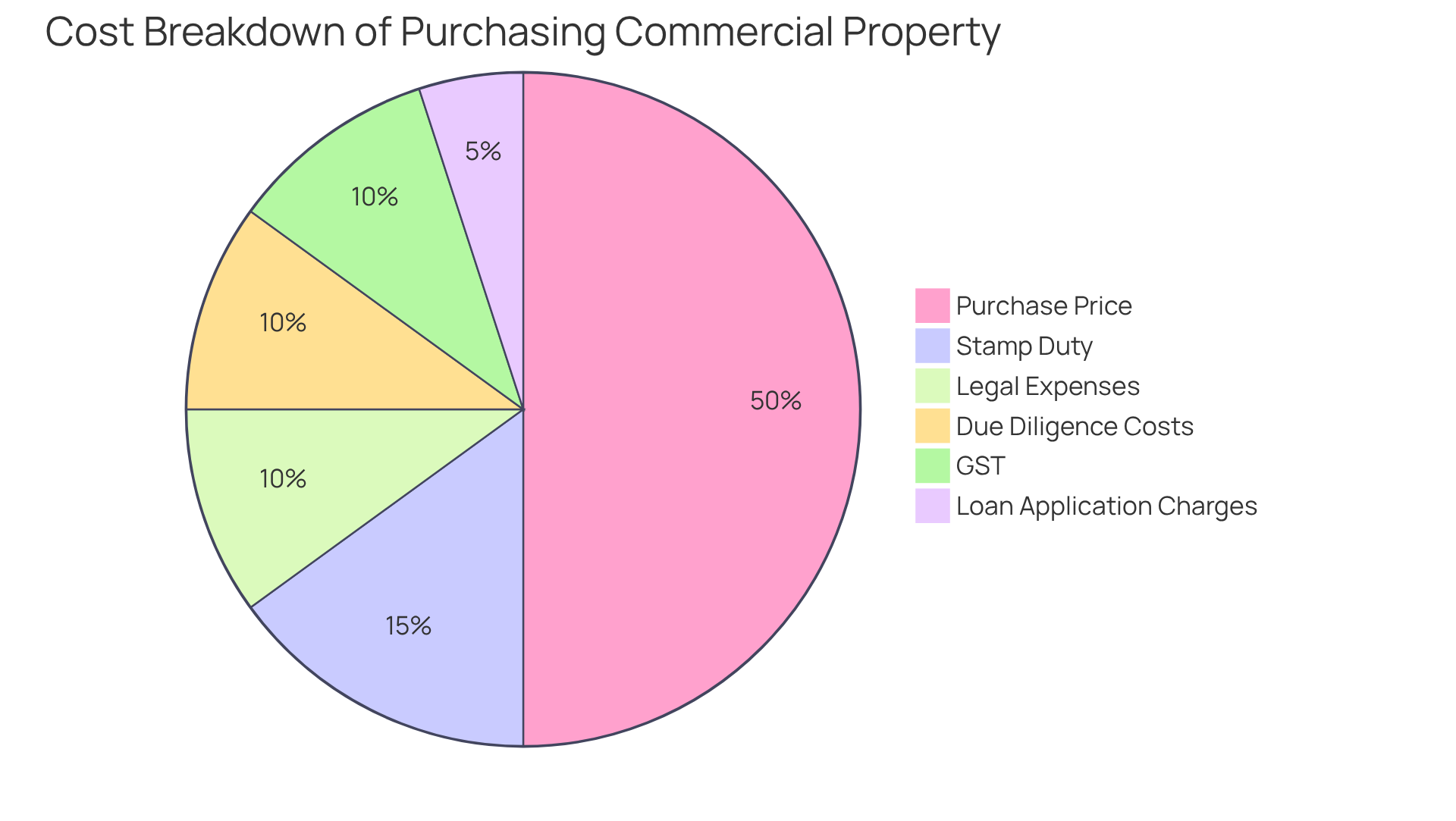

When considering the purchase of commercial property, it is crucial for buyers to understand what costs are involved in buying commercial property that will impact their investment. These include:

- Purchase Price: This represents the most significant expense, encompassing the agreed-upon amount for the property.

- Stamp Duty: A government tax levied based on the purchase price, which can differ by state.

- Legal Expenses: Costs related to hiring legal professionals to manage contracts and conduct thorough due diligence.

- Due Diligence Costs: Expenses incurred during the investigation of the asset, including necessary inspections and appraisals.

- Loan Application Charges: Fees from lenders associated with processing the loan request, which may include valuation and establishment costs.

- Goods and Services Tax (GST): This tax is applicable to commercial real estate transactions, typically around 10% of the purchase price.

It is essential to understand what costs are involved in buying commercial property to make informed financial decisions in commercial real estate.

Break Down Closing Costs for Commercial Properties

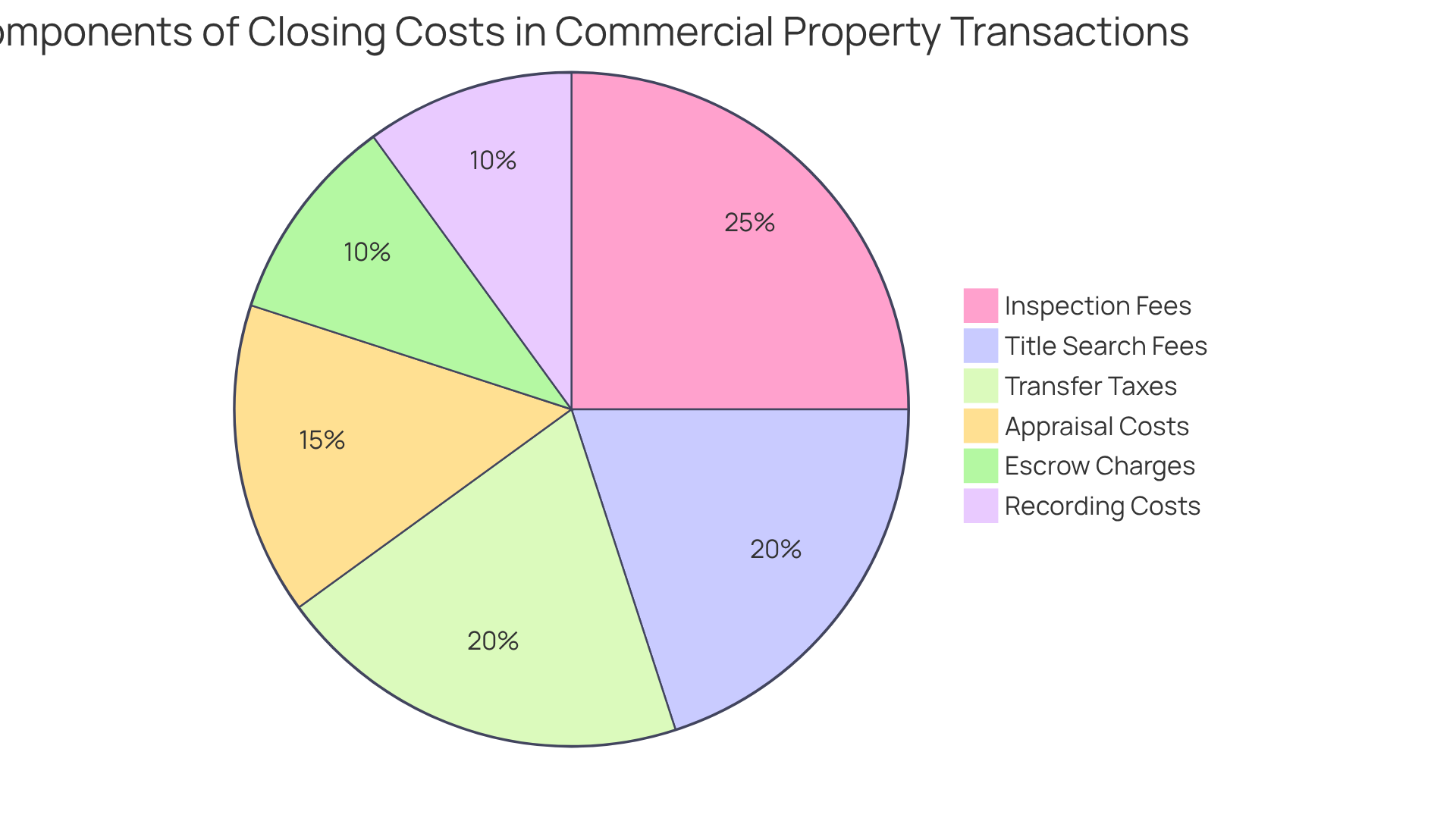

Closing costs in commercial property transactions can vary significantly, encompassing several key components that investors must understand:

- Title Search Fees: These fees are incurred to verify the property's title, ensuring there are no liens or claims against it. In Melbourne, title search charges for commercial real estate in 2025 can range from a few hundred to several thousand dollars, depending on the complexity of the title. Typically, title search fees average around $500 to $1,200.

- Appraisal Costs: Lenders often require an evaluation to determine the asset's market value, which can range from $300 to $1,500 or more, based on the asset's size and location.

- Inspection Fees: Professional inspections are vital for assessing the condition of the asset and identifying potential issues. These fees can vary widely, generally ranging from $500 to $2,000.

- Transfer Taxes: Local governments impose taxes on the transfer of ownership, which can significantly increase closing costs. In Victoria, this tax is calculated based on the property's sale price.

- Escrow Charges: These fees are paid to the escrow firm managing the closing process, ensuring all conditions are met before the transaction is completed. Escrow fees typically range from $300 to $1,000.

- Recording Costs: These expenses are associated with officially documenting the real estate transfer with the local government, usually ranging from $50 to $200.

As Franklin D. Roosevelt once stated, "Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world." Understanding what costs are involved in buying commercial property is crucial for anyone aiming to invest in commercial real estate, as these expenses can greatly influence the overall budget and financial planning for the acquisition. Finance Story's specialized expertise in navigating these financial situations ensures that clients are well-informed and supported throughout the process.

Assess Ongoing Costs After Purchase

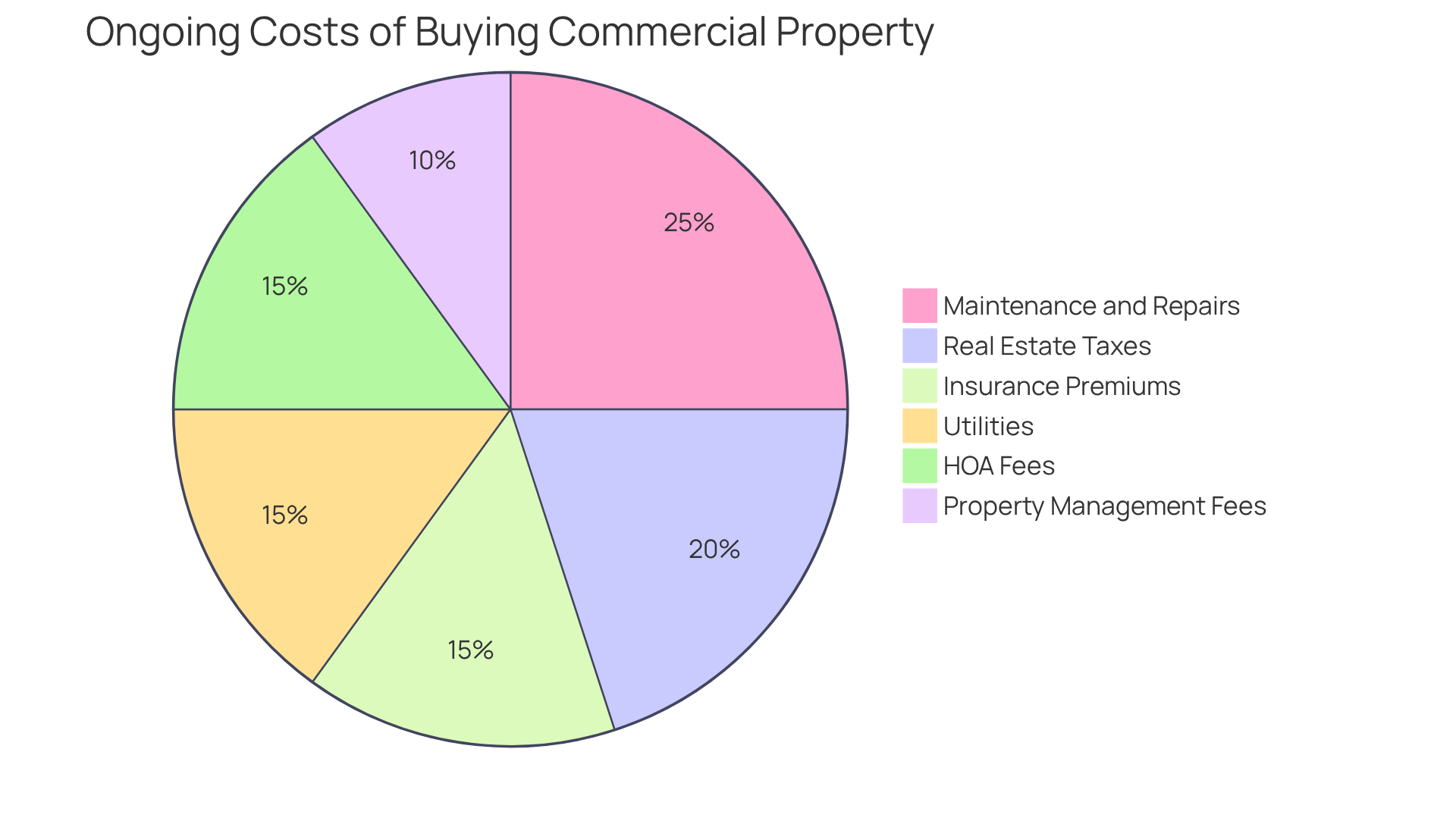

Upon acquiring commercial property, owners must understand what costs are involved in buying commercial property, as these are crucial for maintaining their investment. Effective financial management requires understanding what costs are involved in buying commercial property.

-

Property Management Fees: These are costs linked to hiring a property management company to oversee operations, typically ranging from 4% to 12% of rental income. Are you prepared to allocate a portion of your earnings for this essential service?

-

Maintenance and Repairs: Regular upkeep is necessary to sustain the condition of the asset. These expenses can vary significantly based on the property's age and type. How will you budget for these inevitable costs?

-

Insurance Premiums: Protecting your investment against risks such as fire, theft, and liability is vital. These insurance expenses can vary widely, so it’s essential to shop around for the best coverage.

-

Real Estate Taxes: Local governments impose ongoing taxes based on the assessed value of the asset. Are you aware of how these taxes can impact your overall profitability?

-

Utilities: Expenses for essential services like water, electricity, and gas may fall on the owner's shoulders, depending on lease agreements. Have you considered how these costs will affect your cash flow?

-

HOA or Body Corporate Fees: In multi-tenant properties, these fees cover shared services and maintenance of common areas, adding another layer of financial responsibility.

By understanding what costs are involved in buying commercial property, property owners can make informed decisions that enhance their investment's profitability.

Conclusion

Understanding the costs associated with buying commercial property is essential for anyone venturing into this investment realm. These expenses can be categorized into:

- Initial acquisition costs

- Ongoing operational charges

- Potential future expenditures

Each category plays a crucial role in determining the overall financial viability of the investment.

This article highlights several key expenses, including:

- The purchase price

- Stamp duty

- Legal fees

- Ongoing costs such as property management fees, maintenance, and taxes

Each of these elements significantly contributes to the total cost of ownership and impacts the return on investment. By grasping these financial intricacies, investors can navigate the complexities of commercial real estate with greater confidence and clarity.

Ultimately, a thorough understanding of the costs involved in buying commercial property empowers stakeholders to make informed decisions that enhance their financial outcomes. As the commercial property market continues to evolve, staying informed about these costs will be essential for anyone looking to invest wisely and sustainably in real estate. By approaching the purchase with a comprehensive budget and a strategic mindset, investors can optimize their investments and secure their financial future.