Overview

Business loan options encompass a variety of types, including:

- Term loans

- Lines of credit

- Equipment financing

- Invoice financing

- SBA financing

Each of these serves distinct purposes for enterprises. Understanding these options is crucial for entrepreneurs, as it empowers them to make informed financial decisions. In today's evolving economic landscape, these factors significantly influence funding requests and loan eligibility criteria. Therefore, it is vital to grasp the nuances of each financing type to navigate the complexities of business funding effectively.

Introduction

In the dynamic landscape of business finance, understanding the intricacies of securing a loan is paramount for entrepreneurs eager to fuel their growth. As businesses evolve, the demand for diverse financing options continues to rise, with loans playing a crucial role in enabling expansion, acquiring essential equipment, or managing day-to-day operations. The shifting economic climate and the emergence of new lending solutions present small business owners with a plethora of choices that can significantly impact their financial trajectory. This article delves into the essential aspects of business loans, exploring:

- Types

- Eligibility requirements

- Application processes

- The importance of expert guidance to navigate the complexities of financing in 2025.

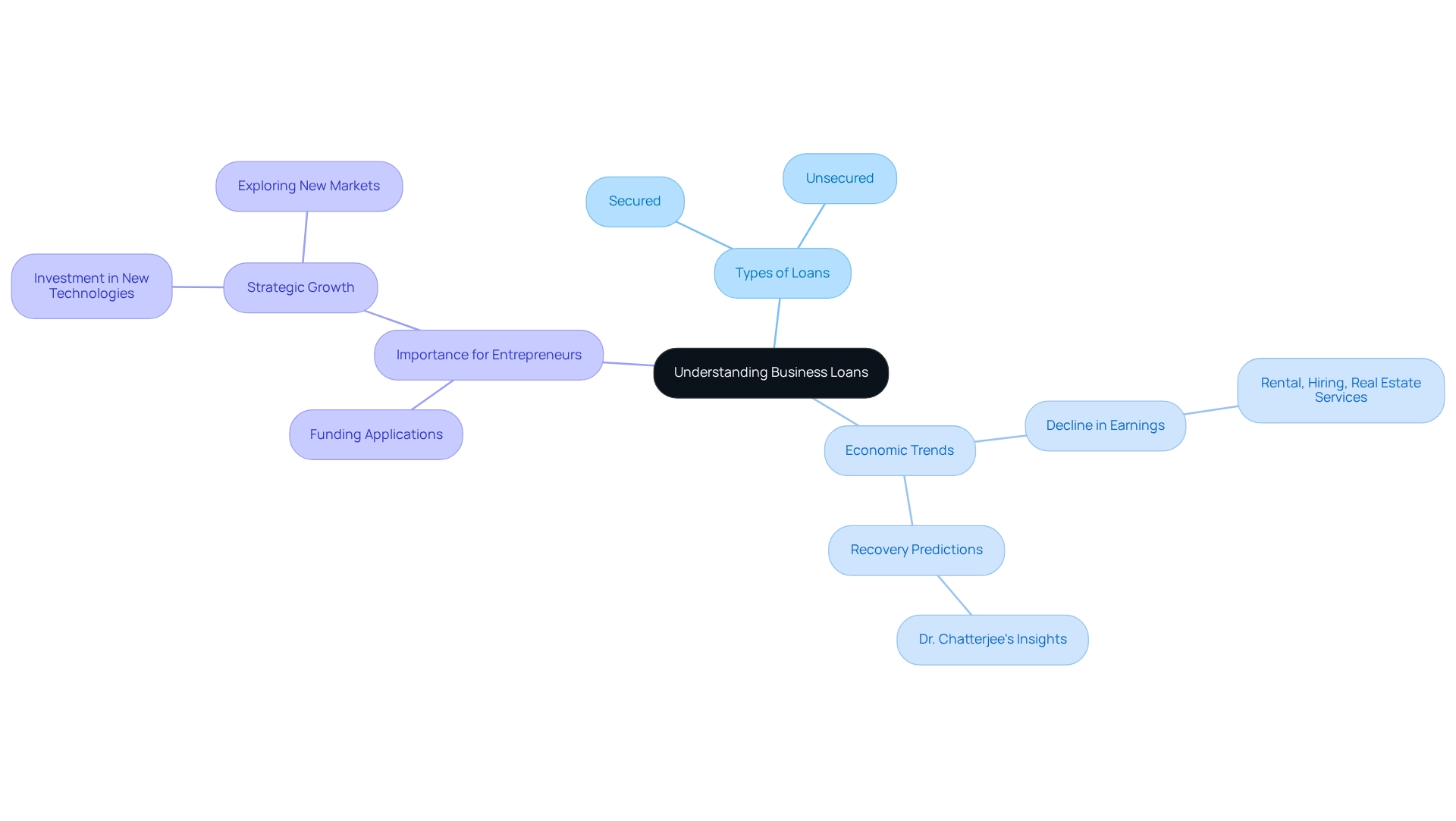

Understanding Business Loans: An Overview

A commercial credit represents a crucial financial agreement in which a lender provides capital to an enterprise for various purposes, including growth, equipment procurement, or managing operational expenses. These credits are categorized as secured or unsecured, depending on the presence of collateral. As we look to 2025, the commercial financing landscape is evolving, marked by a notable increase in the number of enterprises seeking funding for expansion. This trend reflects a growing confidence among entrepreneurs in pursuing growth opportunities.

Understanding the complexities of business loan options is essential for entrepreneurs who aim to effectively support their ventures. This knowledge lays the groundwork for exploring specific financing avenues and informs decision-making in practical scenarios. Recent trends reveal a challenging economic environment, with rental, hiring, and real estate services experiencing a decline in earnings of -0.7% compared to the previous year.

This context is significant, as it may influence financing requests. Experts predict that as the economy stabilizes, there will be an uptick in funding applications, particularly among those looking to expand their operations. Dr. Chatterjee anticipates that by early 2025, the economy is poised for recovery, assuming no major disruptions occur.

Such optimism is echoed in the Australian Banking Association's response to the 2025-26 Federal Budget, which aims to bolster confidence in the financial system while providing essential support to enterprises.

Finance Story, recognized for its professionalism and deep understanding of the finance sector, plays a pivotal role in aiding clients with loans. We prioritize developing refined and highly personalized cases to present to banks, ensuring that small enterprises secure the appropriate financing for their needs. Our extensive network encompasses a wide array of lenders, from high street banks to innovative private lending panels, accommodating various circumstances.

Moreover, we offer refinancing options for commercial financing, helping businesses adapt to their evolving requirements. Real-world examples illustrate the practical applications of funding for expansion, as many entrepreneurs leverage these resources to enhance their operational capabilities, invest in new technologies, or explore new markets. As companies navigate the complexities of financing, grasping the available options for business loans becomes increasingly vital, ensuring they can access the most suitable capital to achieve their objectives effectively.

Types of Business Loans: Exploring Your Options

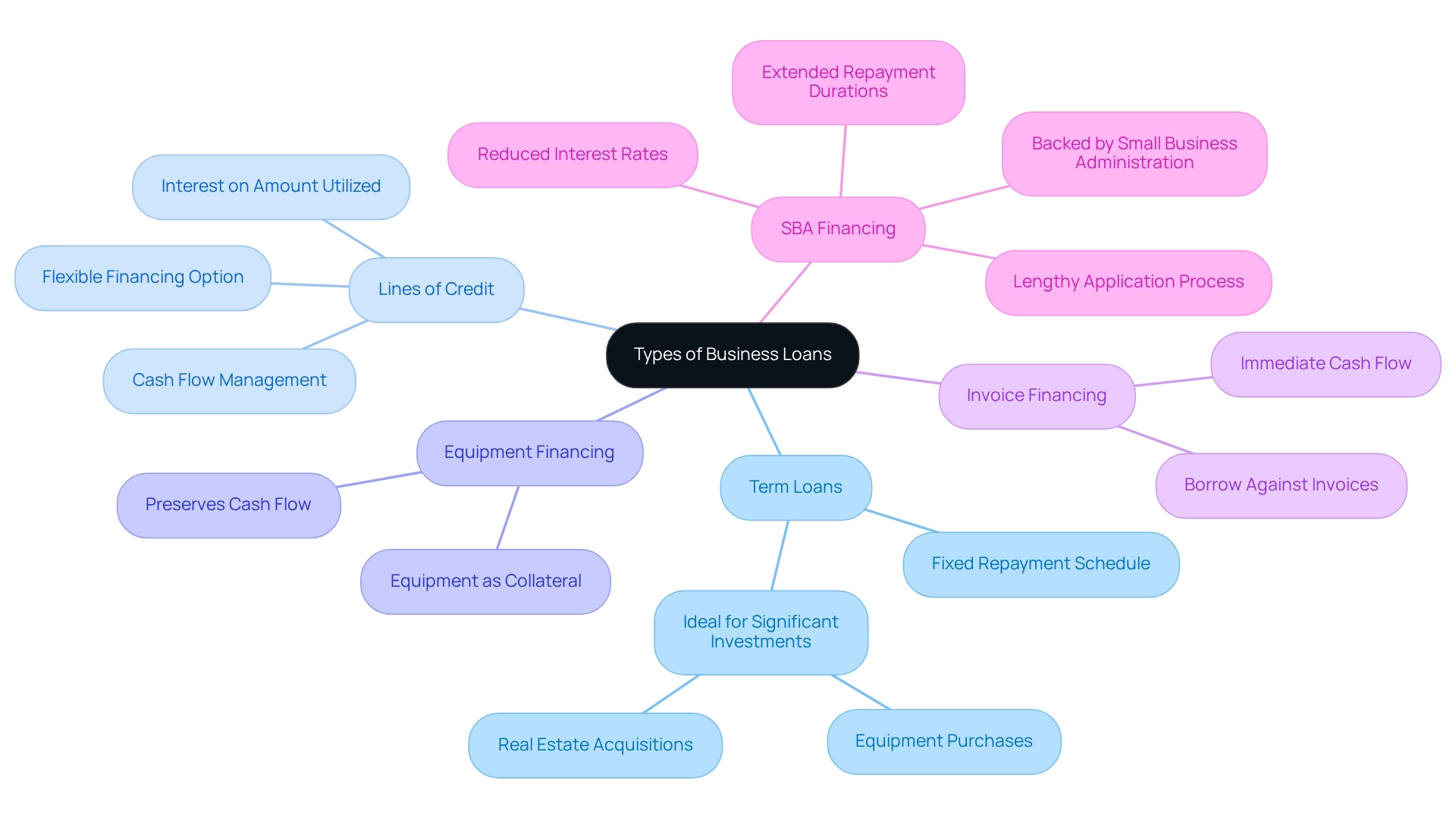

Financial assistance is crucial for small enterprises, particularly when evaluating the options for a business loan to meet specific fiscal requirements. The primary types of business loans include:

-

Term Loans: These traditional loans feature a fixed repayment schedule, making them ideal for significant investments such as equipment purchases or real estate acquisitions. In 2025, term loans remain a favored option among small enterprises, especially for those looking to make substantial capital investments.

-

Lines of Credit: This flexible financing option allows enterprises to borrow up to a predetermined limit, with interest charged only on the amount utilized. Lines of credit are particularly advantageous for managing cash flow variations, enabling companies to respond swiftly to unforeseen expenses or opportunities.

-

Equipment Financing: Specifically designed for purchasing equipment, this loan type uses the equipment itself as collateral. This method not only facilitates the acquisition of essential tools but also helps preserve cash flow for other operational needs.

-

Invoice Financing: This option permits companies to borrow against their outstanding invoices, providing immediate cash flow without the delay of waiting for customer payments. This can be especially beneficial for enterprises with extended payment cycles.

-

SBA Financing: Backed by the Small Business Administration, these funds offer favorable conditions for small enterprises, featuring reduced interest rates and extended repayment durations. However, they often entail a lengthy application process, which can pose a barrier for some.

Current trends indicate a growing preference for term financing and lines of credit among small enterprises in 2025. Recent statistics reveal that the average small enterprise funding amount requested in Australia is $94,845, with financing for commercial vehicles being the most common purpose. Additionally, during the December quarter of 2024, there were 18,274 refinanced investor credits, reflecting a 4.4% increase from the previous quarter.

As lending expert Phil Collard observes, "This is still being approached with caution, but SMEs are increasingly looking to expand their operations by leveraging loans to help fuel growth."

Moreover, as conventional banks struggle to meet the diverse needs of small enterprises, alternative lending options are gaining traction. Finance Story focuses on crafting refined and highly personalized cases to present to banks, ensuring that small enterprise owners can secure the appropriate funding for their commercial property investments. A case study highlighting the rise of alternative lending solutions illustrates how fintechs and non-bank lenders are effectively attracting small enterprises by providing faster access to capital and reduced costs.

This shift towards digital and embedded lending solutions is expected to stimulate growth in the small enterprise lending market.

In summary, understanding the options for a business loan available in 2025 is essential for small enterprise owners aiming to make informed financial decisions. Each type of credit serves distinct purposes, and selecting the appropriate one can significantly influence a company's growth trajectory.

Eligibility Requirements: What You Need to Qualify

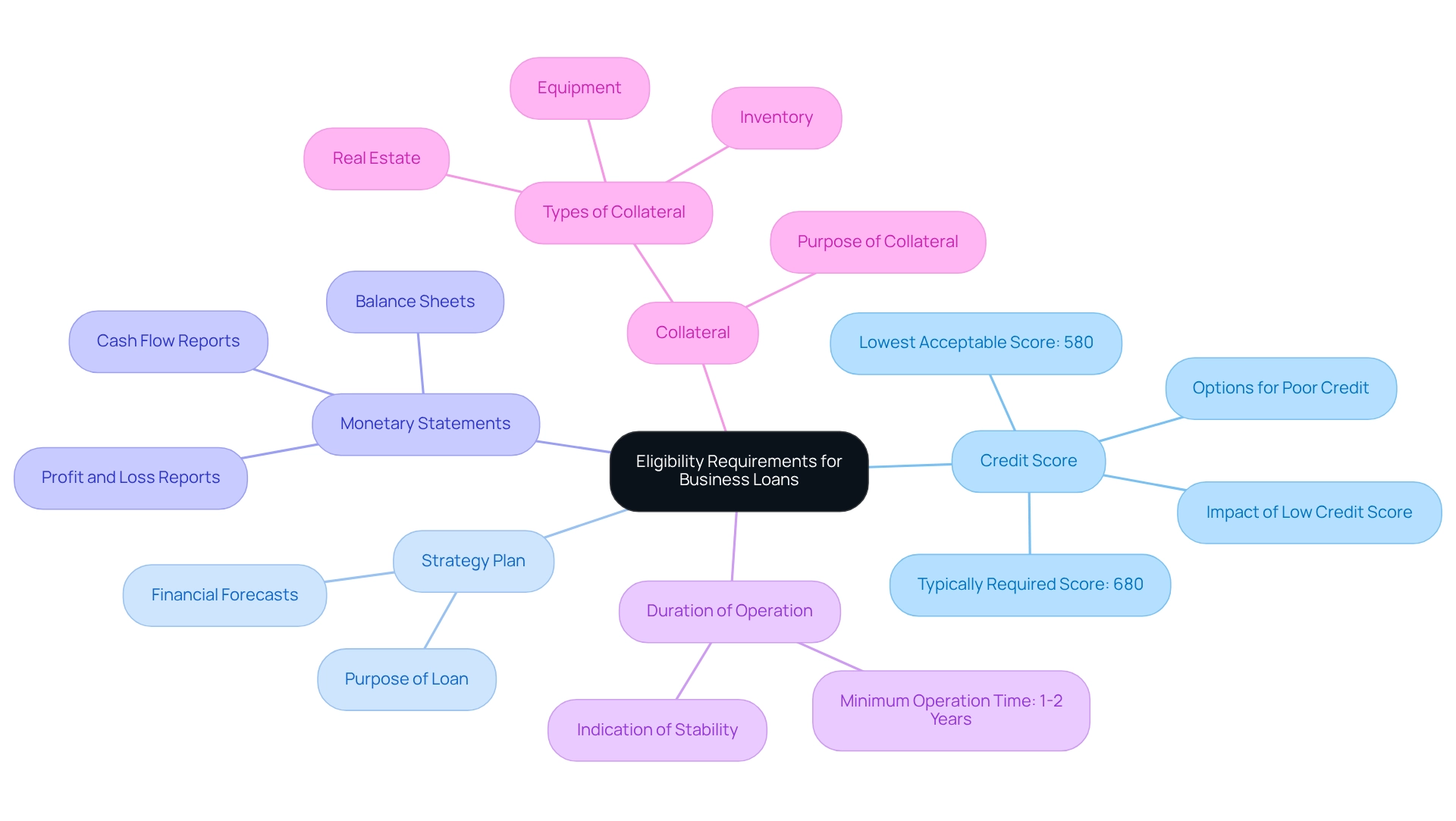

To determine the options for a business loan in 2025, it is essential to meet several crucial standards, which can vary depending on the financial institution. Key requirements typically include:

- Credit Score: A robust personal and business credit score is vital, serving as a primary indicator of the borrower's creditworthiness. In 2025, the typical credit score required for financing approval is usually around 680, although some financiers may accept scores as low as 580 for specialized funding. Notably, certain lenders focus on providing financing to enterprises with unfavorable credit records, addressing the options for a business loan for those requiring assistance.

- Strategy Plan: A thorough strategy plan is often necessary, outlining the loan's purpose and detailing how the funds will be utilized. This document should clearly express the organization's objectives and financial forecasts.

- Monetary Statements: Lenders generally request recent monetary statements, including profit and loss reports, balance sheets, and cash flow reports. These documents provide insight into the organization's financial health and operational efficiency.

- Duration of Operation: Many financiers prefer enterprises that have been operating for a minimum of one to two years, as this indicates stability and expertise in the market.

- Collateral: For secured loans, providing collateral may be necessary to mitigate the risk for the financial institution. This could include assets such as real estate, equipment, or inventory.

Understanding the significance of credit scores is crucial for entrepreneurs. A lower credit score can significantly hinder the chances of obtaining financing, as financial institutions often perceive it as a risk factor. However, some lenders focus on providing loans to companies with poor credit histories, which raises the question of what options exist for a business loan for those in need.

A recent case study on establishing credit for enterprises highlights effective strategies for improving creditworthiness. By maintaining low debt levels, making timely bill payments, and demonstrating economic activity through a dedicated account, companies can enhance their credit scores. This improvement not only increases the chances of approval but also opens access to better options.

In Australia, current eligibility criteria for loans in 2025 emphasize the need for a solid credit profile and a well-prepared plan, prompting many to inquire about the options for a business loan. Entrepreneurs have the right to request a complimentary copy of their credit score annually or within 90 days of being denied credit, allowing them to monitor and proactively improve their financial position.

Expert advice underscores the importance of understanding these eligibility requirements. As one lender pointed out, "A strong credit score is not merely a figure; it represents your enterprise's reliability and potential for expansion." Additionally, clients of Finance Story have praised their service, with one stating, "Professional, simple and excellent service."

By focusing on these essential aspects, owners can position themselves advantageously in the competitive financing arena, supported by Finance Story's reputation for professionalism and deep understanding of the finance sector.

The Application Process: Steps to Secure Your Loan

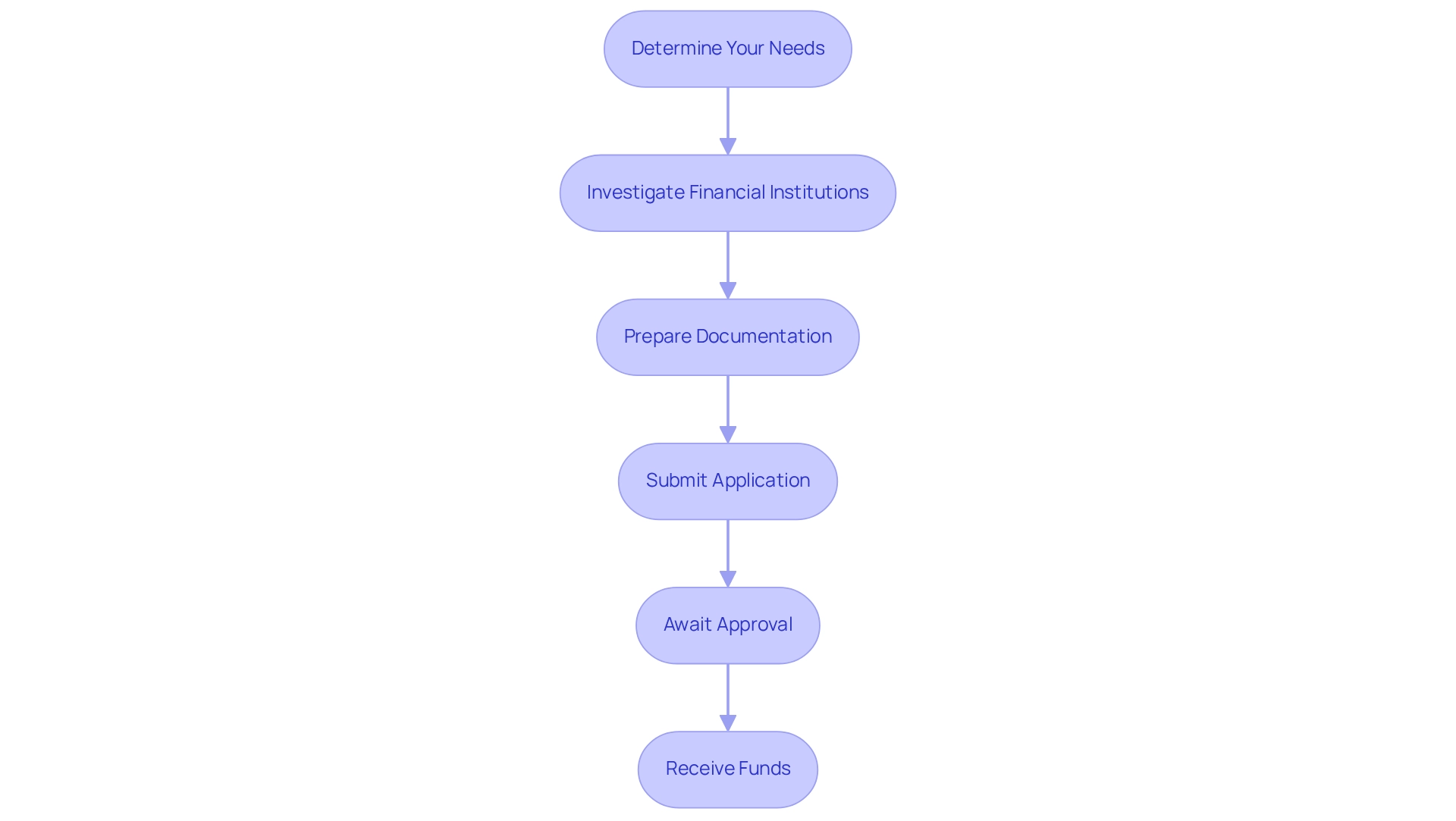

Securing business financing in 2025 requires a structured approach that can significantly boost your chances of approval. Here are the essential steps to follow:

-

Determine Your Needs: Begin by clearly defining the amount of funding needed and the specific purposes for which it will be allocated. This clarity will guide your discussions with financial institutions and help identify the options available for a business loan.

-

Investigate Financial Institutions: Take time to compare various providers and their offerings. Look for those that align with your business needs, considering factors such as interest rates, repayment terms, and any grace periods they may offer, during which you might only pay interest initially. Certain institutions provide a grace period that can ease the financial burden at the start of your loan. At Finance Story, we connect you to a wide range of financial institutions, including high street banks and innovative private funding groups, ensuring you find the best fit for your situation.

-

Prepare Documentation: Gather all necessary documents, including financial statements, tax returns, and a comprehensive operational plan. Statistics show that thorough documentation can expedite the approval process, as lenders typically require detailed information to evaluate your application. Our expertise in crafting polished and tailored business cases can greatly enhance the effectiveness of your proposal.

-

Submit Application: Complete the application form meticulously, ensuring all required documentation is included. A well-prepared application can significantly shorten the approval time, which averages several weeks in Australia.

-

Await Approval: After submission, lenders will review your application. This process can vary in duration, but being prepared can help speed it up. Understanding the four Cs of credit—character, capacity, collateral, and capital—can also strengthen your business loan application. As highlighted in the case study "Understanding the Four Cs of Credit," knowledge of these principles can improve your chances of securing a loan.

-

Receive Funds: Once approved, funds are typically distributed swiftly, enabling you to implement your plans without unnecessary delays.

Real-world examples illustrate that companies that carefully prepare their applications often secure funding more efficiently. For instance, a modest startup that demonstrated a robust strategy and clear financial forecasts was able to obtain funding within two weeks, underscoring the importance of preparation.

Additionally, expert opinions highlight the necessity for flexibility in loan terms. Financial advisors recommend considering the potential effects of flexible interest rates, including early repayment charges, to ensure you choose the best option for your enterprise. As noted by a financial consultant, "If you’d prefer flexible interest rates, discuss the implications, such as early repayment fees."

By following these steps and understanding the nuances of the application process, small business owners can navigate the complexities of securing funding with greater confidence and success. Furthermore, consider seeking advice from Finance Story for expert recommendations on financing and funding requirements, as professional assistance can be vital in this process. We also specialize in refinancing solutions to help businesses adapt to their evolving needs, whether you are looking to finance a warehouse, retail location, factory, or hospitality project.

Factors Affecting Loan Approval and Interest Rates

Several critical factors can significantly influence both the approval of a business loan and the interest rates offered:

- Credit History: A robust credit history is essential for securing favorable loan terms. Lenders typically reward borrowers with strong credit scores with lower interest rates, while those with poor credit histories may face higher rates or even denial of their loan applications.

- Economic Stability: Lenders thoroughly assess the fiscal soundness of an enterprise, encompassing key metrics such as revenue, profit margins, and cash flow. A healthy monetary profile can enhance the likelihood of approval and lead to more competitive interest rates. At Finance Story, we focus on developing refined and highly personalized proposals that showcase your economic well-being to lenders, enhancing your likelihood of obtaining the most favorable conditions.

- Amount and Purpose: The requested amount and its intended use play a crucial role in the approval process. Lenders evaluate whether the amount corresponds with the organization's financial requirements and operational objectives, which can influence both approval likelihood and the conditions provided. For context, the average amount borrowed for owner-occupier residences in the Australian Capital Territory is $377,000, serving as a benchmark for small enterprises contemplating financing.

- Economic Conditions: Broader economic factors, including prevailing interest rate trends and overall market stability, significantly influence lending decisions. For example, in 2025, small enterprise owners are hopeful about obtaining capital, yet obstacles remain, especially for women, minority, and veteran entrepreneurs, who frequently encounter extra challenges in the lending environment.

A recent case study titled 'The Importance of Speed in Approval' highlights that 85% of small enterprise owners prioritize quick and easy financing processes, often opting for online applications. This preference underscores the necessity for lenders to adjust their processes to meet the needs of small enterprise clients effectively. As Vikram (Vik) Bhat, Vice Chair and US Financial Services Industry Leader, emphasizes, developing talent and encouraging professional advancement within teams is essential, connecting to the economic well-being of companies seeking funding.

Understanding these factors can streamline the application process and minimize confusion for borrowers, ultimately leading to better outcomes in securing financing. As the landscape changes, staying updated on how credit history influences interest rates and the overall economic conditions affecting commercial financing will be essential for small enterprise owners seeking financial assistance. With Finance Story's expertise in customized financing proposals and access to a complete array of lenders, including high street banks and innovative private lending panels, you can navigate these complexities with confidence.

We can assist with financing various commercial properties, including warehouses, retail premises, factories, and hospitality ventures, ensuring you have the right support for your investment needs.

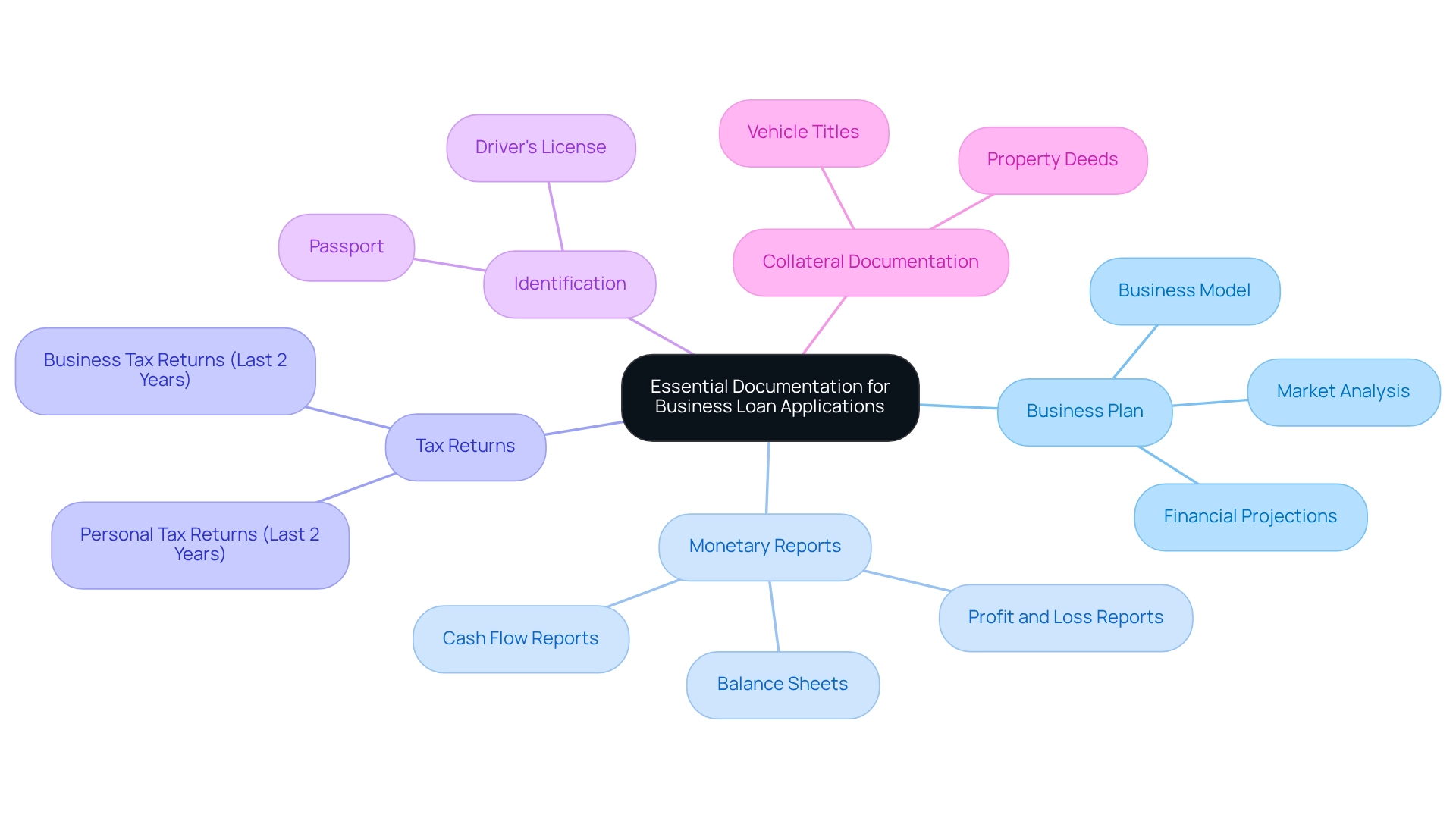

Essential Documentation for Business Loan Applications

When seeking a loan for a venture, understanding the options available for a business loan and preparing a thorough set of documentation to support your application is essential. The following essential documents are typically required:

- Business Plan: A well-structured business plan is vital, detailing your business model, market analysis, and financial projections. This document not only outlines your strategy but also demonstrates to lenders your understanding of the market and your path to profitability. Lenders look for assurance in a company's profitability or a practical strategy for attaining profitability when evaluating loan requests. At Finance Story, we specialize in crafting refined and highly personalized cases that effectively present your proposal to banks, enhancing your chances of securing the necessary funds.

- Monetary Reports: Lenders will require recent monetary statements, including profit and loss reports, balance sheets, and cash flow reports. These documents offer a glimpse of your company's economic well-being and are essential for evaluating your repayment ability.

- Tax Returns: Both personal and business tax returns for the past two years are necessary. These documents assist creditors in assessing your financial history and stability.

- Identification: Personal identification documents, such as a driver's license or passport, are needed to verify your identity.

- Collateral Documentation: If you are applying for a secured credit, you must provide documentation proving ownership of the collateral, which may include property deeds or vehicle titles.

In 2025, the average quantity of documents needed for financial credit applications has risen to around 10, indicating financial institutions' increased examination of applicants. Statistics suggest that lenders frequently perform personal credit checks on entrepreneurs or guarantors to evaluate financial stability, further highlighting the significance of comprehensive documentation.

A well-prepared enterprise plan is not merely a formality; it plays a crucial role in loan applications. Financial specialists emphasize that having a clear understanding of what are the options for a business loan can significantly improve your chances of obtaining funding. Philana Kwan, Marketing Coordinator at Driva, states, "Our extensive network of over 30 lenders empowers you to make informed comparisons, helping you discover the solution that aligns perfectly with your requirements."

For instance, a case study on managing loan refusals highlights the importance of understanding the reasons behind any application denials. By seeking feedback and refining your documentation, organizations can enhance their chances of success in future applications.

Real-world instances of effective business plans demonstrate how comprehensive market analysis and financial forecasts can appeal to financiers, highlighting the viability of the enterprise. As you prepare your application, ensure that all essential documents are organized and easily accessible, as this will streamline the process and showcase your professionalism to prospective financiers. With Finance Story's expertise in customized funding proposals and access to a full range of lenders, including high street banks and innovative private lending panels, you can navigate the complexities of securing financing for your commercial property investments, whether it be a warehouse, retail premise, factory, or hospitality venture, with confidence.

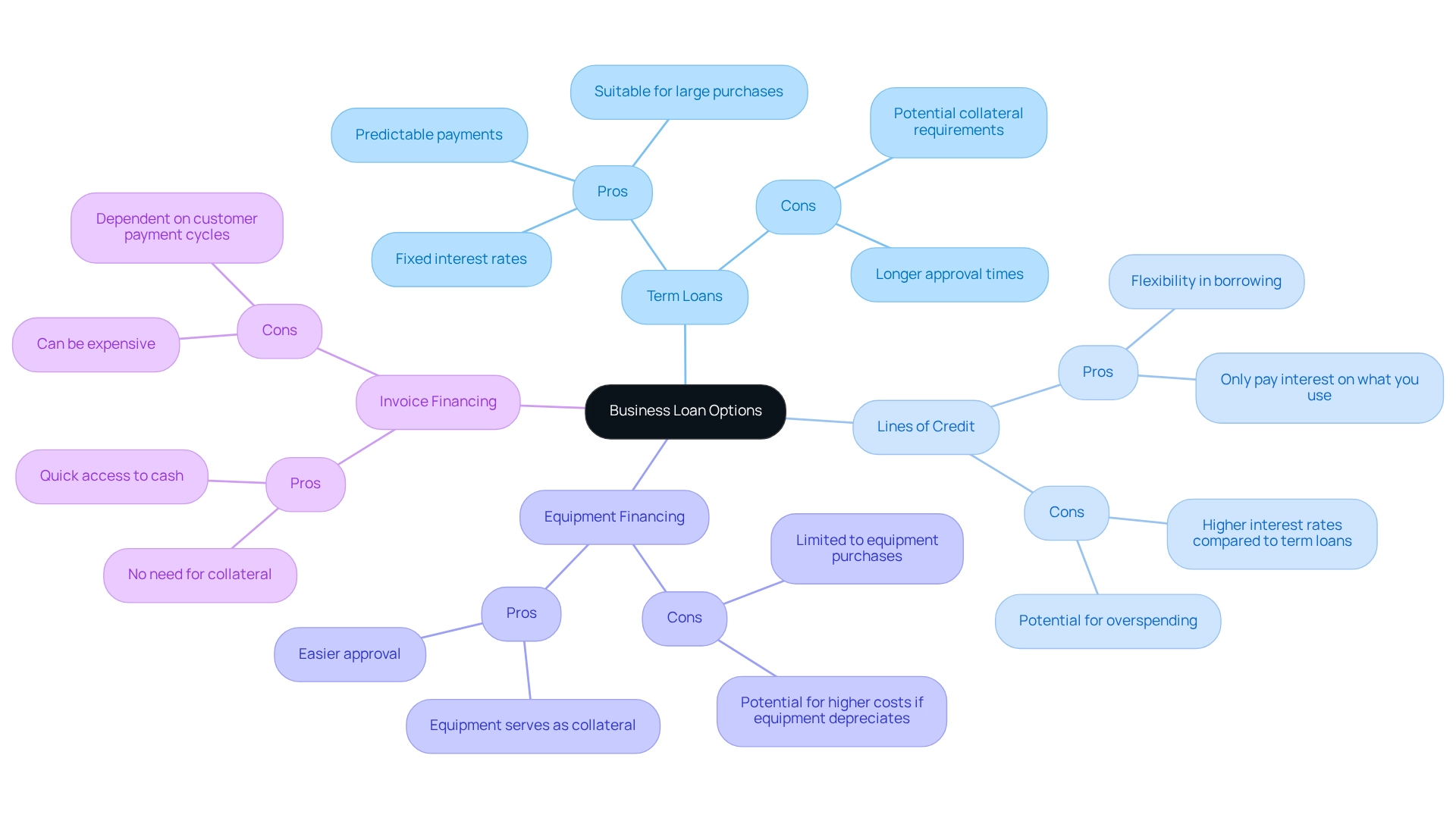

Pros and Cons of Various Business Loan Options

Each type of business loan presents its own unique advantages and disadvantages:

-

Term Loans:

- Pros: Fixed interest rates, predictable payments, suitable for large purchases.

- Cons: Longer approval times, potential collateral requirements.

-

Lines of Credit:

- Pros: Flexibility in borrowing, only pay interest on what you use.

- Cons: Higher interest rates compared to term loans, potential for overspending.

-

Equipment Financing:

- Pros: Easier approval, equipment serves as collateral.

- Cons: Limited to equipment purchases, potential for higher costs if equipment depreciates.

-

Invoice Financing:

- Pros: Quick access to cash, no need for collateral.

- Cons: Can be expensive, dependent on customer payment cycles.

When considering these financing options, it is crucial to understand the loan repayment criteria that lenders evaluate.

At Finance Story, we emphasize the importance of demonstrating that your company can comfortably meet repayment obligations. This includes showcasing strong profits and providing a comprehensive plan with cash flow projections. Our expertise in crafting customized financing proposals ensures that you present a compelling case to financial institutions, whether you are looking to acquire commercial property or restructure an existing agreement.

By collaborating with us, you gain access to a diverse range of lenders, empowering you to find the best financing solution tailored to your specific needs.

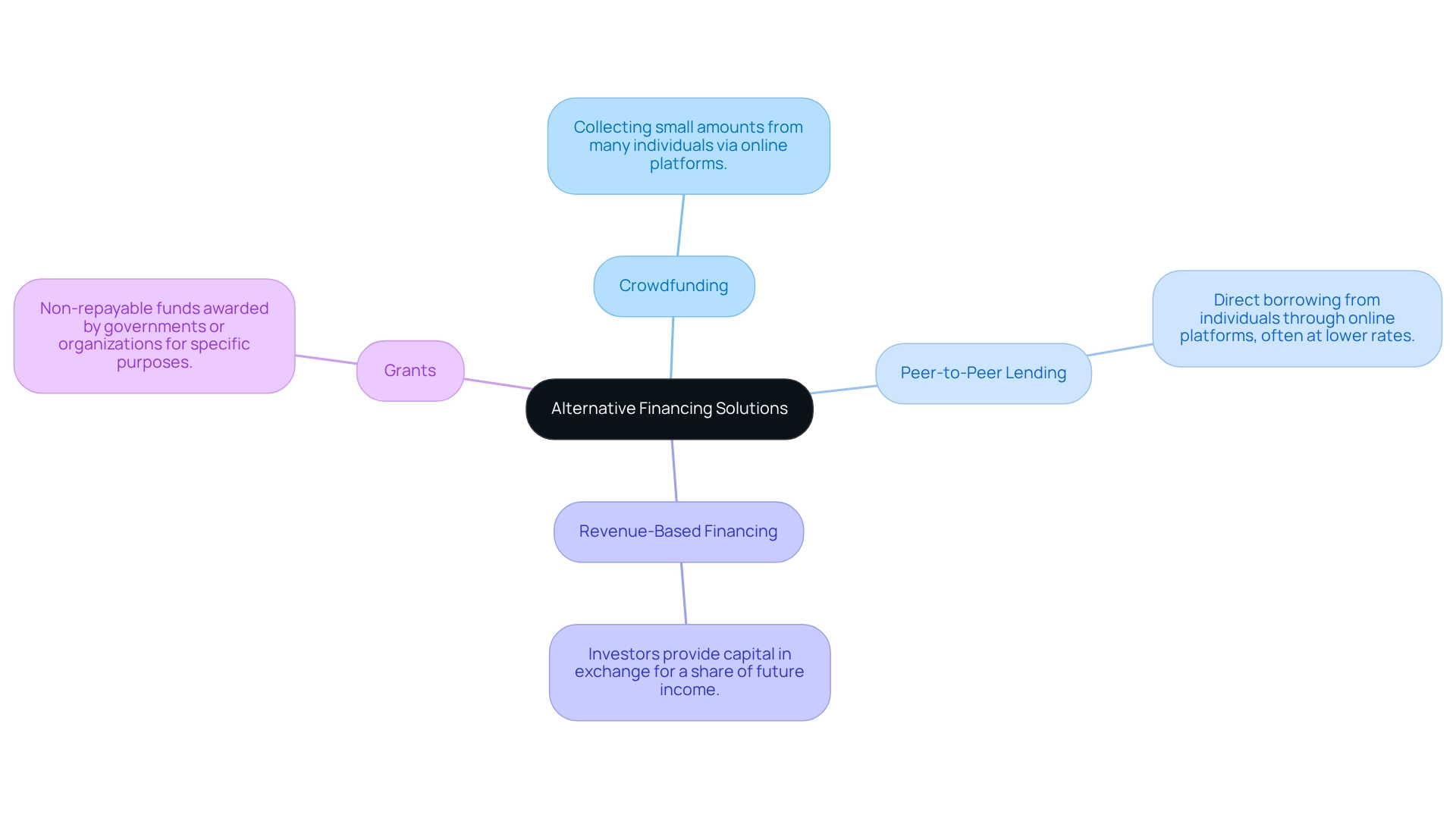

Alternative Financing Solutions: Beyond Traditional Loans

In addition to conventional financing options, a variety of alternative funding solutions are available to consider:

- Crowdfunding: This method involves collecting small amounts from numerous individuals, often through online platforms, enabling businesses to tap into a wider audience.

- Peer-to-Peer Lending: By facilitating direct borrowing from individuals via online platforms, this approach provides insight into business loan options, typically at lower rates than traditional financial institutions.

- Revenue-Based Financing: Here, investors provide capital in exchange for a share of future income, offering flexibility for businesses with fluctuating earnings.

- Grants: These are non-repayable funds awarded by governments or organizations, generally aimed at specific sectors or objectives, presenting an excellent opportunity for eligible enterprises.

Exploring these alternatives could significantly enhance your funding strategy, aligning it more closely with your business needs.

The Value of Expert Guidance in Securing Business Loans

Navigating the financing landscape can be complex. However, enlisting the assistance of a finance consultant, such as those at Finance Story, significantly enhances your chances of securing the funding you require. In 2025, statistics indicate that companies employing finance advisors achieve a higher success rate in approvals, with expert guidance being pivotal to this outcome.

A business finance consultant can assist you in several key areas:

- Identifying Tailored Loan Options: Consultants leverage their industry expertise to pinpoint the most suitable loan options that align with your specific business needs, whether you are looking to purchase a warehouse, retail premise, factory, or hospitality venture.

- Preparing Compelling Documentation: They aid in crafting a convincing proposal and organizing financial records, essential for impressing creditors and obtaining the appropriate funding. This includes developing polished and highly individualized business cases that reflect your unique circumstances.

- Negotiating Favorable Terms: With their understanding of the borrowing environment, consultants can negotiate improved conditions with financial institutions, potentially saving you money throughout the financing duration. Finance Story provides access to a comprehensive suite of lenders, including high street banks and innovative private lending panels, ensuring you find the best fit for your circumstances.

- Providing Ongoing Support: Throughout the application process, consultants offer continuous support, ensuring that all requirements are met and that you remain informed at every step.

The impact of expert guidance on loan approval rates cannot be overstated. In 2025, companies that sought help from finance consultants reported significantly higher approval rates compared to those who navigated the process independently. This underscores the value of having a knowledgeable partner by your side.

As Val Srinivas, a senior research leader in Banking & Capital Markets, observes, "Expert guidance is crucial in navigating the complexities of finance, ensuring that clients are well-prepared to meet lender expectations."

Real-world instances illustrate how financial consultants have effectively assisted clients in navigating challenging funding applications, thereby improving their likelihood of securing essential financing. By establishing robust, enduring connections with clients, these consultants ensure that each organization feels acknowledged and supported in their monetary decisions, ultimately resulting in more advantageous outcomes in the acquisition process.

Furthermore, as the finance industry evolves, innovative methods such as generative AI are being explored to modernize financial services, potentially enhancing the efficiency and effectiveness of obtaining commercial funding.

Key Takeaways: Making Informed Decisions About Business Loans

When considering a loan for your company, keep these key takeaways in mind:

- Understand the various types of loans available and their specific purposes. This includes tailored options for commercial property investments, such as warehouses, retail premises, factories, and hospitality ventures.

- Assess your eligibility and prepare the necessary documentation before applying. Ensure you meet the criteria set by different lenders.

- Be aware of the factors that influence loan approval and interest rates. Your company's financial health and the type of property involved play significant roles in this process.

- Explore alternative financing options if traditional loans do not meet your needs. We offer a full range of lenders to suit diverse circumstances, including refinancing your existing commercial loans.

- Seek expert guidance from Finance Story to navigate the complexities of the loan process effectively. Our expertise in creating polished business cases for banks can significantly enhance your chances of approval. Schedule your free personalized consultation with our Head of Funding Solutions, Shane Duffy, to discuss your needs and goals.

Conclusion

Understanding the multifaceted world of business loans is essential for entrepreneurs seeking to drive growth in their ventures. This article has explored the various types of loans available—from term loans and lines of credit to equipment financing and SBA loans—each with its unique advantages and requirements. By comprehensively assessing eligibility criteria, including credit scores, business plans, and financial statements, business owners can position themselves favorably in the lending landscape.

The application process can be intricate. However, following a structured approach—determining needs, researching lenders, preparing documentation, and submitting applications—greatly enhances the likelihood of securing funding. Furthermore, understanding the factors that influence loan approval and interest rates can empower entrepreneurs to make informed decisions that align with their financial goals.

As the financing landscape continues to evolve, exploring alternative solutions like crowdfunding and peer-to-peer lending can provide viable options for those who may not fit traditional lending profiles. Nevertheless, the value of expert guidance cannot be overstated. Engaging with finance consultants, such as those at Finance Story, can significantly improve loan approval rates and help businesses navigate the complexities of securing funding.

In conclusion, by arming themselves with knowledge and seeking professional support, entrepreneurs can effectively leverage business loans to fuel their growth, adapt to changing economic conditions, and achieve their objectives. The right financing strategy can pave the way for sustainable success, ensuring that businesses not only survive but thrive in the competitive marketplace of 2025 and beyond.