Overview

When embarking on the journey of starting a business, it is essential to explore four key financing options:

- Self-funding

- Crowdfunding

- Business loans

- Venture capital

Each option presents distinct advantages and challenges that can significantly impact your entrepreneurial success. This article offers a thorough overview of these financing avenues, emphasizing the importance of aligning your funding strategies with your unique needs and current market trends. By doing so, you can enhance your chances of achieving success in your business endeavors.

Introduction

In the dynamic world of entrepreneurship, securing adequate financing stands as a crucial step toward achieving success. As businesses explore a variety of funding options—from traditional loans to cutting-edge crowdfunding platforms—grasping the nuances of each method is essential for making informed decisions.

With the emergence of alternative financing solutions and a growing preference for flexible funding avenues, entrepreneurs must arm themselves with the knowledge necessary to align their financial strategies with their unique aspirations.

This exploration will delve into the diverse financing methods available in 2025, shedding light on their advantages, challenges, and the critical considerations that can ultimately influence the trajectory of a startup's growth.

Understanding Business Financing: An Overview

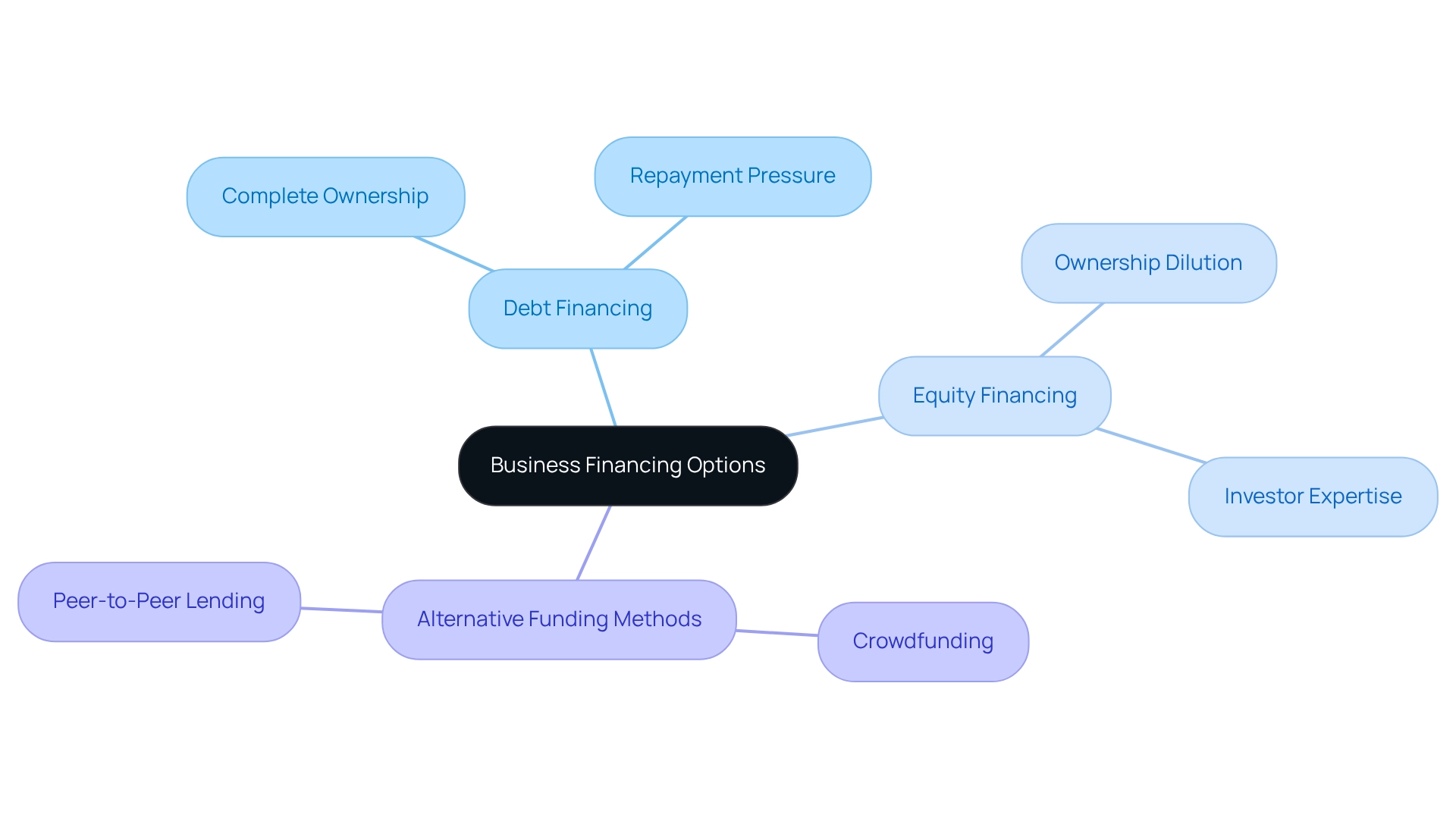

Individuals can explore four financing options to consider when starting a business or expanding their ventures. Understanding these options is essential for making informed choices that align with specific organizational objectives. Financing can be broadly categorized into two main types: debt and equity, each presenting distinct advantages and disadvantages.

For instance, while debt funding enables entrepreneurs to maintain complete ownership of their enterprise, it also necessitates consistent repayments, which can pressure cash flow. On the other hand, equity financing involves giving up a portion of ownership in exchange for capital, which may dilute control but can provide valuable expertise and networking opportunities from investors.

In 2025, the landscape of business financing is evolving, marked by a notable shift towards innovative funding solutions. Recent statistics suggest that venture capital funding for new businesses reached approximately $3.9 billion in 2021, with considerable investments expected in emerging sectors such as AR/VR and employee training.

Significantly, AR/VR gaming is anticipated to generate $17.6 billion in consumer expenditure in 2024, underscoring the potential market for new businesses in this sector. This trend emphasizes the importance of understanding the four financing options available to entrepreneurs, as access to capital can greatly affect their success in a competitive landscape.

Current trends in business funding indicate an increasing inclination towards financing options that cater to the distinct requirements of new ventures. Entrepreneurs are increasingly exploring alternative funding methods like crowdfunding and peer-to-peer lending, which provide diverse avenues for securing capital without the stringent requirements often associated with traditional bank loans. Additionally, the rise of FinTech companies is reshaping the financing landscape, equipping startups with innovative tools to manage their finances more effectively.

Shane, the Founder and Funding Specialist Director at Finance Story, emphasizes the necessity of a tailored approach to financing. With extensive experience in enhancing operations and a deep understanding of loan repayment criteria, he guides individuals in assessing their specific needs, risk tolerance, and long-term objectives when considering their options. Shane's unique perspectives on the beneficial influence that thoughtfully chosen property, automation, and technology solutions can exert on an enterprise's long-term profit and cash flow are invaluable for entrepreneurs. For leasehold businesses, utilizing property equity and cash savings can be crucial for acquisitions, while freehold property businesses require careful consideration of loan structures and equity utilization.

Successful case studies demonstrate how new businesses have employed various funding strategies to achieve growth. For example, Forethought, an AI company, recently completed a $65 million Series C funding round, showcasing a real-world instance of successful funding in the tech sector. Companies that effectively utilized a mix of debt and equity funding have often reported enhanced operational flexibility and improved market positioning.

In summary, understanding the four financing options available to entrepreneurs in 2025 is crucial for those aiming to thrive in competitive markets. By assessing their unique situations and remaining updated on contemporary trends, new ventures can make strategic funding choices that foster their growth and sustainability. Aligning funding strategies with market trends, such as the willingness of 50% of customers to pay a premium for sustainable brands, can further enhance their chances of success.

Furthermore, the impact of technological advancements, such as the deployment of 5G technology, is poised to transform operations, offering new prospects for startups to secure funding and enhance their operational capabilities.

Self-Funding: The Power of Personal Investment

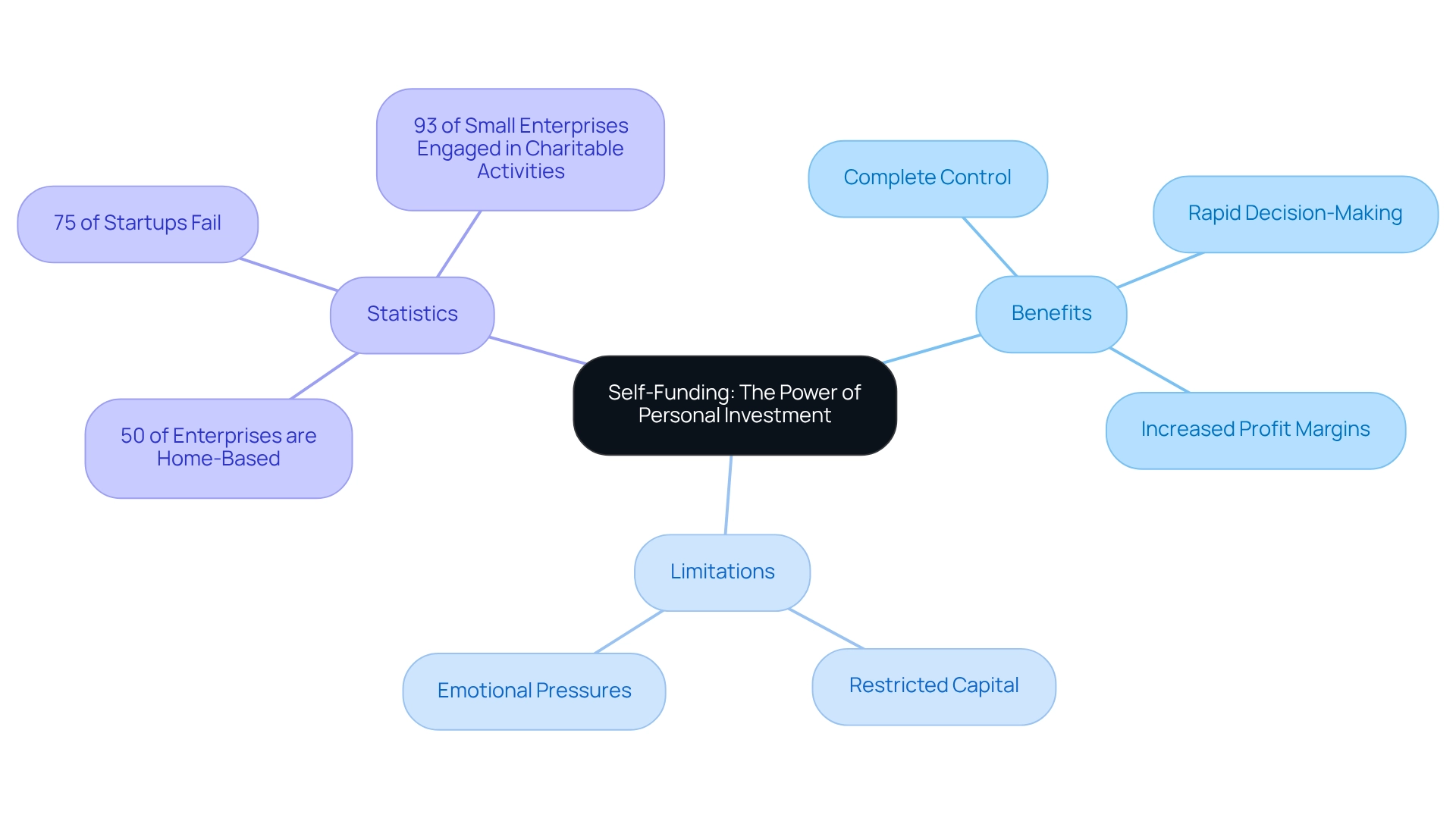

Self-funding, often referred to as bootstrapping, stands as one of the four primary financing options for launching a business. This approach allows individuals to utilize personal savings or income generated from their ventures to sustain operations. By choosing this method, entrepreneurs can retain complete control over their decisions and avoid the complexities associated with external funding. While self-funding may limit available capital, it cultivates a profound sense of ownership and accountability among founders.

Many entrepreneurs embark on their journey using personal savings, with a significant number also relying on income generated from their businesses. Notably, approximately 50% of enterprises in the US are home-based, underscoring the prevalence of self-funding. Besides self-funding, entrepreneurs can explore other financing options, such as home equity loans or tapping into retirement accounts, which may provide additional resources.

However, it is crucial to carefully assess the risks associated with these financing options, as personal financial stability may be jeopardized if the venture does not succeed.

The benefits of bootstrapping include the capacity to make rapid decisions without requiring external approval and the potential for increased profit margins, as there are no obligations to repay loans or share equity. Financial experts frequently emphasize that self-funding can lead to a more sustainable business model, compelling entrepreneurs to operate within their means and prioritize revenue generation from the outset. As Josh Howarth, Co-Founder & CTO, notes, despite being an entrepreneurial nation, only one in ten new ventures in the United States survives and achieves rapid growth over the long term, highlighting the importance of a robust financial strategy.

Conversely, the limitations of self-funding include restricted access to capital, which can hinder growth and scalability. Entrepreneurs must also brace themselves for the emotional and financial pressures that accompany investing personal resources into their businesses. Alarmingly, statistics reveal that approximately 75% of American startups fail within the first 15 years, underscoring the risks tied to self-funding and the necessity for a well-considered financial strategy.

Successful case studies further illustrate the potential of bootstrapping. For instance, numerous small businesses have thrived by reinvesting their initial income into expansion, demonstrating that with careful planning and execution, self-funding can be a viable path to success. Additionally, a survey indicated that 93% of small enterprises engaged in charitable activities over the past year, particularly those owned by millennials and Gen Zers. These initiatives not only strengthen community connections but also enhance job satisfaction and foster a positive image for small businesses.

Ultimately, while bootstrapping presents both opportunities and challenges, it remains a preferred choice among business founders seeking to establish their ventures on their own terms. It is also essential to acknowledge that inconsistent later-stage startups generate three times more capital during the efficiency phase compared to the scale phase, highlighting the financial dynamics that founders must navigate.

Crowdfunding: Harnessing the Power of the Crowd

Crowdfunding has emerged as a dynamic method for raising capital, empowering business owners to gather small contributions from a vast pool of individuals, primarily through online platforms. This innovative approach not only secures funding but also serves as a powerful marketing tool, enabling individuals to validate their concepts and cultivate a customer base prior to launching their products or services.

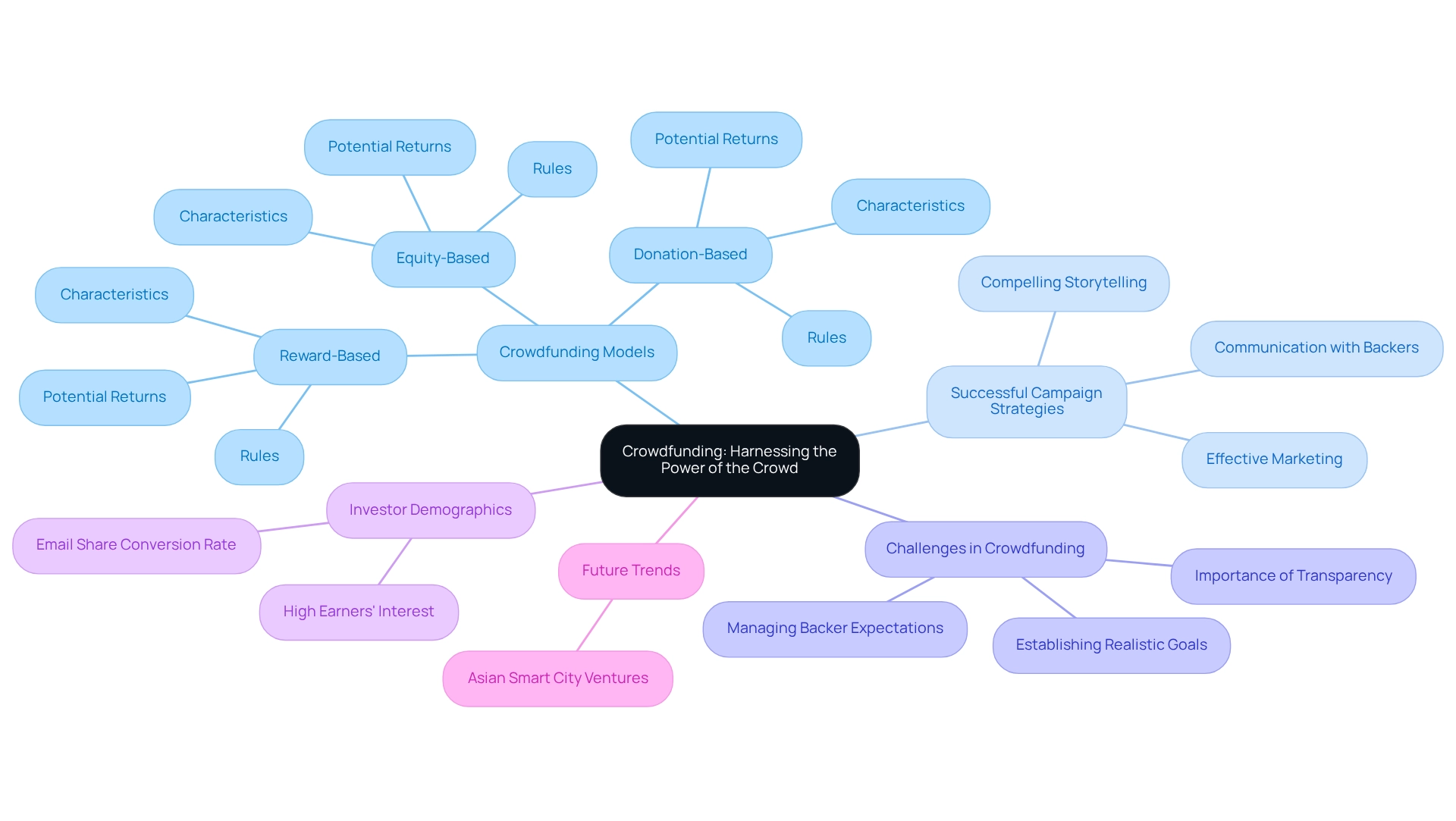

In 2025, the crowdfunding landscape is diverse, showcasing several models such as reward-based, equity-based, and donation-based crowdfunding. Each model presents unique rules and potential returns for investors, catering to different business needs and investor preferences. For instance, reward-based crowdfunding allows backers to receive non-monetary rewards, while equity-based crowdfunding offers a stake in the company, appealing to those seeking a financial return on their investment.

Successful crowdfunding campaigns hinge on compelling storytelling and strategic marketing efforts. Entrepreneurs must craft narratives that resonate with potential backers, emphasizing the value and impact of their projects. Additionally, effective marketing strategies are crucial for attracting attention and driving engagement.

According to recent statistics, individuals earning over $100,000 annually are particularly inclined to invest in new ventures through crowdfunding, indicating a significant opportunity for business owners targeting affluent supporters. Furthermore, 53% of email shares convert to donations, underscoring the effectiveness of leveraging digital communication in fundraising efforts.

However, running a crowdfunding campaign is not without its challenges. Entrepreneurs must establish realistic funding goals and manage backer expectations throughout the campaign. Insights from crowdfunding experts highlight the importance of transparency and communication with backers, which can significantly enhance the likelihood of success.

For example, case studies from successful campaigns illustrate how maintaining open lines of communication can foster trust and encourage continued support.

The success rates of crowdfunding campaigns vary by type, with equity-based campaigns often yielding higher returns for investors compared to other models. As the crowdfunding ecosystem continues to evolve, new platforms are emerging, offering innovative methods for new ventures to connect with potential investors. In 2025, the anticipated expansion of Asian smart city ventures, expected to generate around 50% of global revenue in the industry, highlights the growing importance of crowdfunding as a feasible financing choice for ambitious entrepreneurs.

As one anonymous surveyed founder noted, "What excites me most about being an Australian venture is the vibrant and supportive entrepreneurial ecosystem that fosters innovation and growth."

In summary, crowdfunding is one of the four financing options to consider when starting a business, as it offers a multifaceted opportunity by combining funding with marketing potential. By understanding the various forms of crowdfunding, utilizing effective strategies, and studying successful case examples, entrepreneurs can navigate the intricacies of this funding alternative and enhance their likelihood of achieving their objectives.

Business Loans: Navigating Traditional Financing

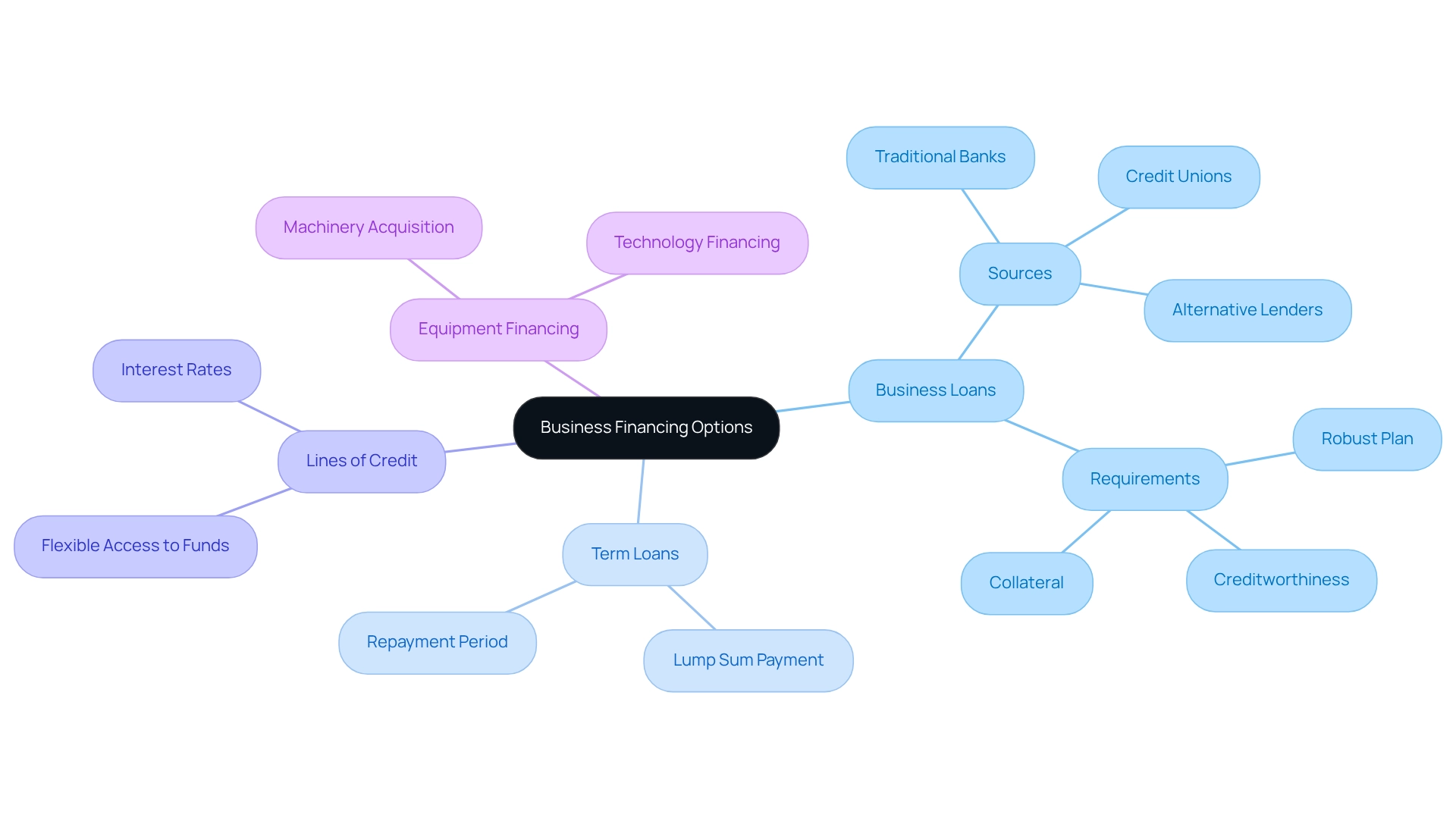

Among the four financing options available to launch a business, business loans serve as a crucial pathway for startups seeking to secure significant capital for their operations. These loans can be sourced from traditional banks, credit unions, or alternative lenders, each presenting distinct terms and conditions tailored to diverse organizational needs. To successfully obtain a loan, entrepreneurs typically need to present a robust plan, demonstrate creditworthiness, and often provide collateral.

Shane, the Founder and Funding Specialist Director at Finance Story, brings a wealth of expertise in company growth and customized financial solutions. With over thirty years of experience in high-level consultancy roles, he understands the intricacies of securing loans and the importance of crafting an engaging case for potential financiers. His insights into the positive effects of strategically chosen financial solutions can significantly bolster a startup's long-term profitability and cash flow.

When embarking on a business venture, it is essential to examine the four financing options available, which encompass:

- Term loans that provide a lump sum to be repaid over a specified period

- Lines of credit that offer flexible access to funds

- Equipment financing specifically designed for acquiring necessary machinery or technology

While these loans can furnish the vital funds required to initiate or expand a venture, they also impose a repayment obligation that can strain cash flow if not managed judiciously.

In 2025, the landscape for business loans for new ventures is transforming, with average interest rates remaining competitive, making it imperative for entrepreneurs to stay abreast of current market conditions. Statistics reveal that companies securing funding are more likely to navigate challenging times effectively and experience accelerated growth. Additionally, 37% of founders emphasize the necessity of having flexible access to funds, which is crucial for managing cash flow and scaling operations.

As one anonymous founder remarked, "What excites me most about being an Australian venture is the vibrant and supportive entrepreneurial ecosystem that fosters innovation and growth." This collaborative community of emerging businesses, incubators, and investors provides invaluable resources and networking opportunities, propelling innovation and growth within the sector.

Case studies indicate that the average age of business founders is 42, challenging the stereotype of youthful entrepreneurs and underscoring the significance of experience in securing funding. This maturity often translates into a more strategic approach to loan acquisition, enhancing the likelihood of success.

Expert advice underscores the importance of understanding lender requirements, including credit scores and financial history, to improve the chances of obtaining favorable loan terms. Shane's extensive commercial and technical experience equips him to guide entrepreneurs through these complexities, aiding them in navigating the loan landscape effectively.

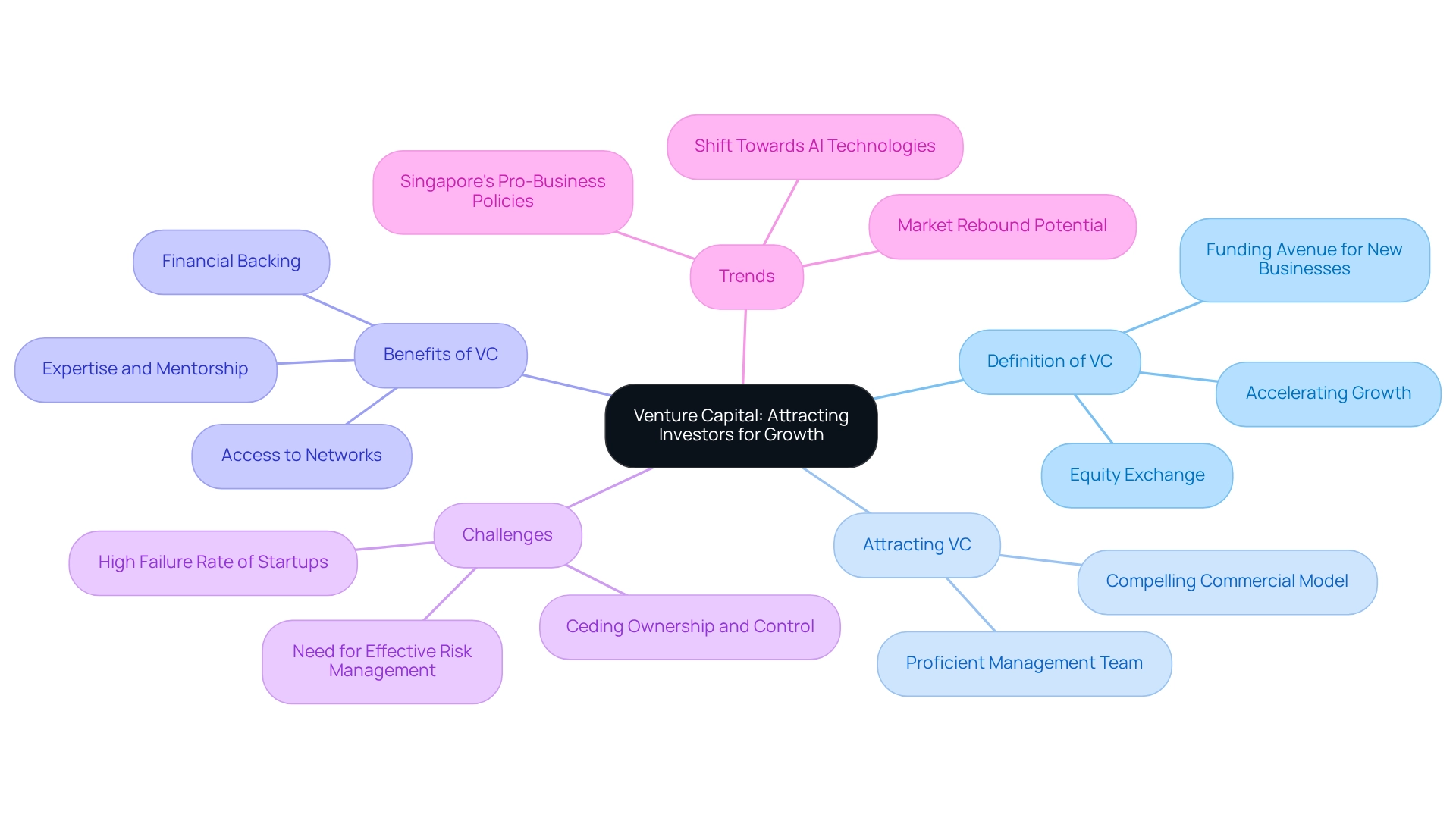

Venture Capital: Attracting Investors for Growth

Venture capital (VC) stands as a pivotal funding avenue for new businesses, especially those positioned for swift growth within technology and innovation sectors. This investment type involves companies or individuals supplying funds in exchange for equity, significantly accelerating a new venture's growth trajectory. Beyond mere financial backing, VC investors provide invaluable expertise, mentorship, and access to extensive networks, thereby enhancing the startup's prospects for success.

To attract venture capital, entrepreneurs must craft a compelling commercial model that clearly demonstrates market demand and delineates a viable path to profitability. A proficient management team is equally crucial, as investors typically seek strong leadership capable of navigating the complexities of scaling a business. In 2025, the average level of venture capital funding for new businesses is projected to rise, reflecting an increasing confidence in entrepreneurial ventures, particularly in sectors like artificial intelligence, which saw a record $73 billion in mega deals in 2024.

However, securing VC funding presents its own set of challenges. Founders must be ready to cede a portion of ownership and control, a significant consideration that can influence long-term strategic decisions. Notably, only one in ten new ventures in the United States survives and achieves sustained rapid growth, underscoring the potential hurdles for business owners and the critical need for effective risk management.

Despite these obstacles, the prospect of rapid growth and the opportunity to leverage investor expertise render venture capital an appealing option for many startups.

Recent trends indicate a shift in investment focus towards AI technologies, suggesting a potential market rebound reminiscent of the recovery following the global financial crisis, which was driven by mobile technology. As Marc Cadieux, President of Silicon Valley Bank, notes, "Our strong connections with leading business creators and investors shape our understanding and provide us with a perspective distinct from any other bank." Furthermore, Singapore's strategic location and pro-business policies bolster its venture capital landscape, offering four financing options to consider when starting a business.

As the venture capital landscape evolves, understanding these dynamics will empower business founders to navigate the complexities of funding effectively and position their startups for success.

Comparative Analysis of Financing Options: Making the Right Choice

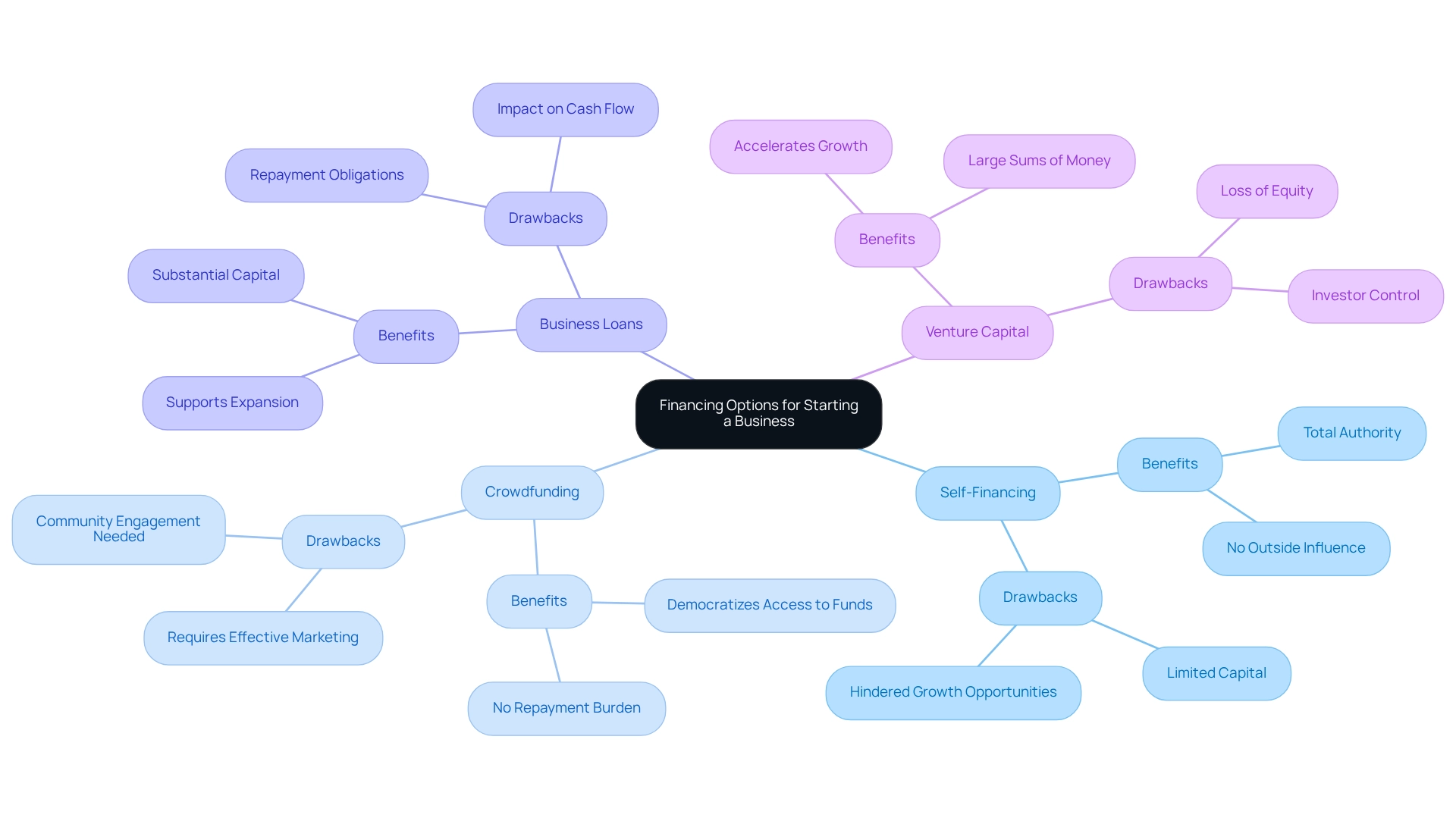

When assessing funding alternatives, individuals must thoughtfully consider the four financing options to start a business, evaluating the benefits and drawbacks of each to make informed choices that align with their objectives.

-

Self-financing permits total authority over the venture, allowing individuals to make choices without outside influence. However, this method may limit available capital, potentially hindering growth opportunities.

-

Crowdfunding has emerged as a popular alternative, democratizing access to funds. It requires effective marketing and community engagement to attract backers. Yet, successful campaigns can generate significant capital without the burden of repayment.

-

Business loans are another viable option, providing substantial capital to fuel growth. While they can support expansion, entrepreneurs must be mindful of repayment obligations and the potential impact on cash flow. For leasehold enterprises, utilizing cash savings or the equity in any owned property can be crucial for securing necessary funds. For instance, if a company owner possesses a residence worth $1.3M with $300k owed, they could access up to $740k in equity to invest in their enterprise, enhancing their financial flexibility. Furthermore, crafting customized loan proposals is crucial for successfully obtaining financing, as it shows lenders the feasibility and potential of the venture.

-

Venture capital can accelerate growth by injecting large sums of money into the company. However, this often comes at the cost of equity and control, as investors typically seek a say in business operations.

Understanding these dynamics is crucial, especially in light of emerging trends. For instance, the UAV manufacturing industry is projected to grow by 44.7% in 2023, while the commercial banking sector is expected to increase by 43.0%. Entrepreneurs should consider these growth trends when choosing a funding method, as they can impact the potential success of their ventures.

Additionally, with 23% of jobs globally anticipated to evolve because of industry changes in the coming five years, startups might encounter difficulties in locating skilled personnel. This makes it crucial to synchronize funding strategies with workforce requirements.

As Rosalie Macmillan aptly puts it, "HR superheroes, assemble – 2024 awaits! Are you ready to level up and lead the change?" This sentiment reflects the need for entrepreneurs to adapt to evolving market conditions and workforce dynamics.

Ultimately, the appropriate funding option will involve consideration of the four financing options to start a business, depending on the specific needs, industry, and growth stage of the business. Financial advisors stress the significance of aligning funding options with long-term goals to improve the chances of success. By understanding the implications of industry growth and workforce changes, entrepreneurs can make more informed financing decisions.

Additionally, refinancing options should be considered as they can provide flexibility and support for evolving business needs.

Conclusion

Navigating the landscape of business financing in 2025 reveals a myriad of options, each with unique advantages and challenges. From self-funding that fosters complete control to the dynamic realm of crowdfunding, entrepreneurs have access to diverse avenues for securing capital. Traditional business loans remain a staple, offering substantial funds with the responsibility of repayment, while venture capital presents an enticing opportunity for rapid growth, albeit at the cost of equity and control.

Understanding these financing methods is crucial for entrepreneurs aiming to align their financial strategies with their business goals. The rise of innovative funding solutions, coupled with the need for tailored approaches, emphasizes the importance of assessing individual circumstances and market trends. Entrepreneurs are encouraged to leverage insights from successful case studies and industry dynamics to make informed decisions that can propel their startups toward success.

Ultimately, the choice of financing should reflect a thorough evaluation of the specific needs of the business, industry landscape, and growth potential. By remaining informed and adaptable, entrepreneurs can harness the right financial strategies that not only support their immediate objectives but also pave the way for sustainable growth in an ever-evolving marketplace. As the entrepreneurial ecosystem continues to thrive, the ability to navigate financing options effectively will play a pivotal role in determining the success of emerging ventures.