Overview

In Australia, small business finance options encompass traditional bank loans, government grants, alternative lending, crowdfunding, and invoice financing. These diverse avenues are specifically designed to meet the varied needs of small enterprises. Understanding these funding options is crucial for entrepreneurs; it empowers them to make informed financial decisions and effectively navigate the challenges of a competitive economic landscape.

Are you aware of which option aligns best with your business goals? By exploring these avenues, you can position your enterprise for success.

Introduction

In the dynamic landscape of Australia’s economy, small businesses are essential, playing a critical role in job creation and innovation. However, many entrepreneurs find navigating the complexities of small business finance to be a formidable challenge. With a plethora of funding options available—from traditional bank loans to government grants and alternative lending solutions—grasping the most effective path forward is vital for sustained growth and success.

As the financial landscape continues to evolve, small business owners must arm themselves with the knowledge and strategies necessary to secure the right financing, enabling them to adapt to shifting market conditions and seize emerging opportunities. This article explores the fundamental aspects of small business finance in Australia, providing insights into available resources, the significance of financial health, and effective strategies for obtaining the essential support needed to thrive in a competitive environment.

Understanding Small Business Finance in Australia

Small business finance options in Australia encompass a diverse array of funding alternatives designed to support the growth and operational needs of these entities. This includes traditional loans, grants, and innovative financing solutions that address the unique challenges faced by small businesses. As of 2025, the landscape of small business finance is evolving, with lending to medium enterprises witnessing a significant increase of 16%, rising from $281 billion in August 2019 to $326 billion in August 2022.

This upward trend reflects a growing confidence among medium and large enterprises (SMEs) as they adapt to shifting market conditions. With over 2.6 million small enterprises operating in Australia, this sector is vital to the economy, significantly contributing to job creation and fostering innovation. In recent years, particularly during the pandemic, many SMEs have adeptly navigated financial challenges through tailored financing strategies. For example, Jess and Ben, owners of a rural catering service, faced severe disruptions due to lockdowns and cancellations.

However, with support from their bank, they reimagined their business model, showcasing resilience and adaptability in the face of adversity. Jess remarked, 'We endured lockdown and a wave of cancellations, and with the assistance of our bank, redefined our operation.' As independent business owners assess funding options, understanding the complexities of repayment terms is crucial. For those seeking to acquire freehold properties, leveraging property equity can be a strategic move. For instance, when purchasing a commercial property valued at $1 million, a lender may permit borrowing up to 70% of its value, resulting in a $700,000 loan.

This scenario indicates that a deposit of $300,000 is necessary, along with additional funds for the commercial portion of the purchase, which totals $1.4 million. Many entrepreneurs may find that their available equity from existing properties can cover these expenses, making it essential to accurately evaluate one's financial situation. Additionally, it is important to consider other costs such as valuation, legal, and stamp duty fees, which are critical for a comprehensive understanding of the financing process.

As we move into 2023, SMEs are poised to continue playing a pivotal role in the Australian economy, bolstered by increasing confidence in their ability to secure financing. Customized commercial and residential lending solutions, such as those offered by Finance Story, provide the expertise and relationship-focused support necessary for navigating these economic waters. Understanding the small business finance options available in Australia is essential for entrepreneurs to make informed decisions that align with their goals and financial health.

The current landscape offers a variety of solutions, from conventional bank loans to creative funding options, ensuring that small enterprises can access the necessary support to thrive in a competitive environment. As the economy evolves, staying informed about financing trends and strategies will be key to leveraging opportunities for growth.

Types of Small Business Financing Options

Small enterprises in Australia can tap into a range of small business finance options tailored to meet diverse needs and circumstances. Understanding these options is crucial for business owners aiming to secure funding effectively. Here’s a comprehensive overview:

- Bank Financing: Conventional bank financing remains a preferred choice, generally requiring collateral and a robust credit history. These loans can provide significant funding, though they may involve lengthy approval processes and stringent eligibility criteria.

- Government Grants: Financial assistance programs provided by the government, which do not require repayment, are designed to support specific projects or sectors. This makes them an appealing option for businesses looking to innovate or expand without incurring debt.

- Alternative Lenders: Non-bank institutions increasingly offer flexible financing solutions. These lenders often feature faster approval processes and more lenient criteria compared to traditional banks, making them a viable option for businesses that may struggle to secure funding through conventional means.

- Crowdfunding: This method involves raising small amounts of money from a large number of individuals, typically via online platforms. Crowdfunding can be an effective way to gauge market interest in a product or service while securing necessary funds.

- Invoice Financing: This approach allows businesses to borrow against their outstanding invoices, improving cash flow without waiting for client payments. It is particularly advantageous for companies with extended payment cycles.

- Equity Financing: This entails selling a stake in the business to investors in exchange for capital. While it can provide substantial funding, it also involves relinquishing a portion of ownership and control.

- Financing Options for Leasehold Enterprises: For businesses operating within a lease or lacking a physical structure, financing options may be limited to cash savings or equity from owned properties. For example, an entrepreneur with a home valued at $1.3M and $300k owed could access up to $740k in equity to support acquisitions, supplemented by any available cash savings.

- Essential Guide to Financing Freehold Property Ventures: When acquiring a freehold property venture, such as a commercial property priced at $1M and a business valued at $400k, lenders typically allow borrowing against the commercial property only. With a maximum loan-to-value ratio (LVR) of 70%, an entrepreneur would need to provide a total of $700k, which could be sourced from property equity and cash savings, excluding additional costs like legal fees and stamp duty.

Each of the small business finance options in Australia has its own set of requirements, benefits, and drawbacks. For instance, while bank loans may offer lower interest rates, they often demand extensive documentation and a solid credit history. Conversely, alternative lenders may provide quicker access to funds but at higher costs.

Thus, it is essential for entrepreneurs to evaluate their specific circumstances and financial goals before selecting a financing route.

As of 2025, statistics indicate that approximately 842,800 commercial credit card accounts exist in Australia, with an average monthly balance of $15,166. This underscores the reliance on credit resources among small enterprises, highlighting the importance of understanding all available small business finance options in Australia. Furthermore, recent government initiatives have introduced various grants aimed at supporting small business finance options, reflecting a commitment to fostering economic growth and stability in the sector.

As Anna Bligh, CEO of the Australian Banking Association, stated, "This Budget provides extra support to Australians in the short-term whilst at the same time helping to address some of our longer-term challenges." Additionally, the Australian Banking Association's response to the Federal Budget illustrates the broader economic context and government support for small enterprises, emphasizing the importance of choosing an informed partner like Finance Story, recognized for its professionalism and deep understanding of the finance sector.

The Role of Business Loans in Small Business Growth

Business loans are a vital lifeline for small businesses, providing essential capital for various strategic initiatives, including:

- Expansion: Securing funding to open new locations or enhance production capacity can significantly boost a business's market presence and revenue potential.

- Equipment Purchase: Investing in new machinery or technology not only enhances operational efficiency but also positions enterprises to meet rising demand and innovate their offerings.

- Working Capital: Access to sufficient cash flow is essential for managing daily expenses, especially during times of low sales, ensuring that organizations can sustain operations without interruption.

- Marketing Initiatives: Allocating funds towards marketing campaigns can attract new customers and drive sales growth, which is essential for sustaining competitive advantage.

In Australia, minor enterprises, which represent 97% of all enterprises and contribute to one-third of gross value added and approximately 42% of private-sector employment, frequently depend on small business finance options to navigate challenges and seize opportunities. Despite their critical role, many minor enterprises face hurdles such as lower survival rates compared to larger firms, underscoring the necessity of small business finance options.

The effect of financial assistance on small enterprise development is significant. A recent study suggested that companies using financing for expansion reported a 30% rise in revenue within the first year. This demonstrates how strategic financial decisions can lead to substantial growth outcomes.

Furthermore, with variable rate commercial financing accounting for roughly two-thirds of the lending sector for enterprises, borrowers are increasingly preferring adaptable funding choices that align with their growth strategies.

At Finance Story, we focus on developing refined and highly customized proposals to present to banks, ensuring that entrepreneurs can obtain the appropriate funding for their requirements. Our access to a full suite of lenders, including high street banks and innovative private lending panels, allows us to cater to various circumstances, whether you are purchasing a warehouse, retail premise, factory, or hospitality venture.

As Jason Bertalli, Director of BNR Accountants, observes, "I comprehend your situation, but I’m not going to be a shadow guarantor for your financing to your enterprise, particularly in challenging times." This highlights the challenges that lesser enterprises encounter in obtaining funding.

Ultimately, by utilizing financial assistance effectively, including refinancing alternatives, enterprises can not only improve their operational capabilities but also position themselves for long-term success in a competitive environment.

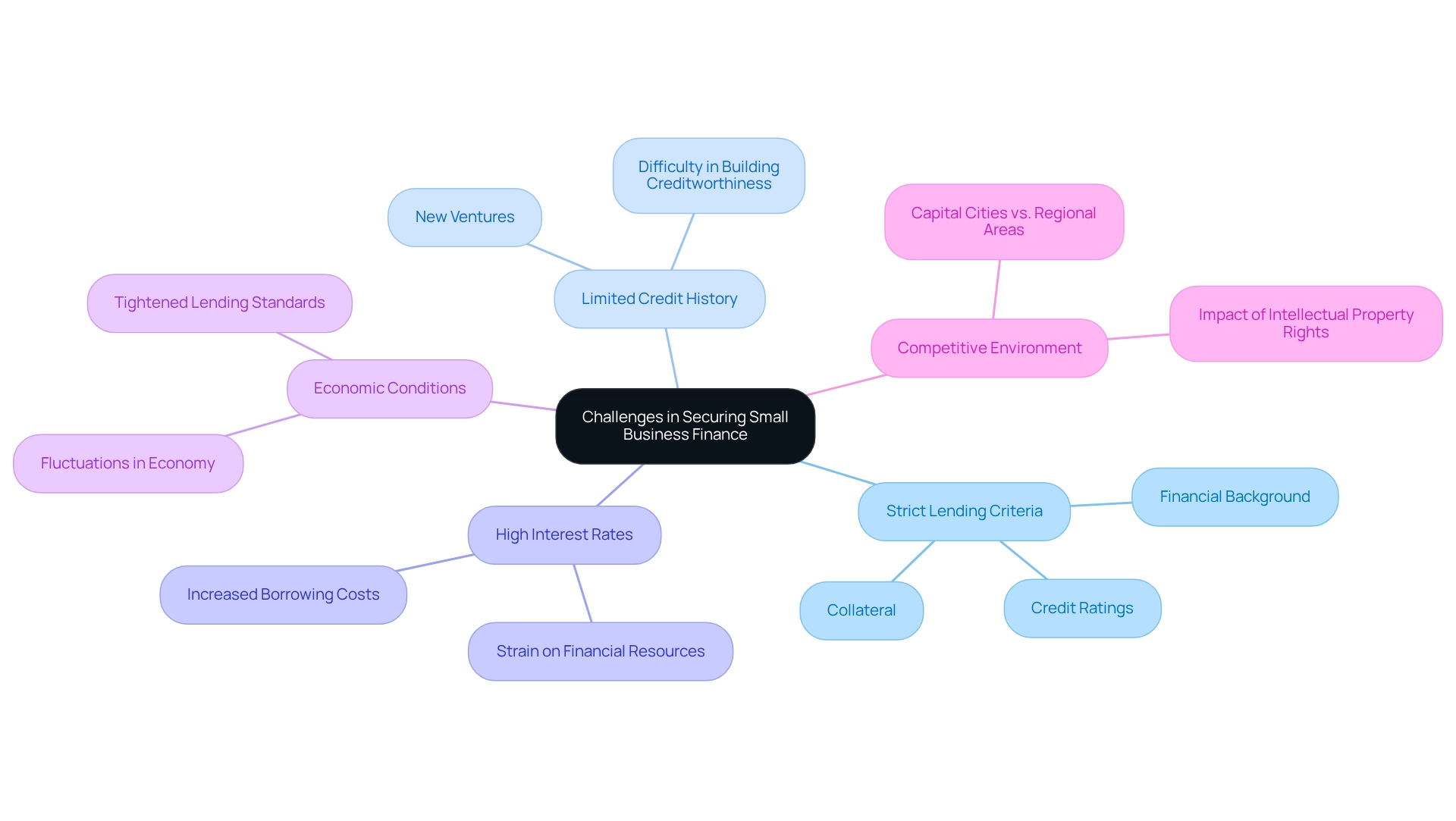

Challenges in Securing Small Business Finance

Obtaining funding can be especially challenging for small enterprises due to various interconnected elements:

- Strict Lending Criteria: Numerous lenders enforce rigorous standards, including credit ratings, financial background, and collateral. This can create substantial obstacles for small enterprises, especially those lacking established credit profiles.

- Limited Credit History: New ventures often find it difficult to build creditworthiness, making it hard to secure financing. This absence of a strong credit history can lead to denials or unfavorable loan conditions.

- High Interest Rates: Smaller enterprises frequently encounter elevated interest rates compared to larger companies, which increases the total cost of borrowing. This can strain financial resources and limit growth potential.

- Economic Conditions: Fluctuations in the economy can significantly affect lenders' willingness to extend credit. During economic downturns, for example, lenders may tighten their lending standards, further complicating access to finance for small enterprises. For leasehold operations or those without a physical structure, the financing environment can be even more limiting. In such situations, property owners may not have the option to borrow against commercial real estate. Instead, they must rely on cash savings or the equity in any property they own. For instance, if a residence is appraised at $1.3 million with $300,000 owed, borrowing up to 80% LVR could yield $740,000 in equity accessible for acquiring a company, augmented by any cash savings.

The difficulties faced by small enterprises in securing finance are underscored by recent trends in small business finance options in Australia. For instance, the majority of small enterprises in Australia operate in sectors such as transport, warehousing, retail, and healthcare, which are often more susceptible to economic fluctuations, as noted by Raja Abbas. Furthermore, capital cities in Australia possess three times the number of enterprises compared to regional areas, emphasizing the competitive environment and the distinct challenges encountered by smaller organizations in sparsely populated regions.

The economic dynamism observed in Australia supports productivity-enhancing resource reallocation, yet it also highlights a notable wage differential for firms holding intellectual property rights, particularly among smaller organizations. This dynamic can further complicate the financing environment for small enterprises, as lenders may favor established firms with IP rights over those lacking them. For example, Bizcap has provided vital monetary assistance to Australian SMEs, enabling them to navigate economic challenges and pursue growth opportunities.

Their flexible funding options, which feature rapid approvals and minimal documentation for amounts up to $5 million, illustrate how tailored financial products can assist local enterprises in overcoming financing obstacles. Understanding these challenges enables local enterprise owners to prepare thoroughly and pursue small business finance options in Australia when needed, ensuring effective management of the complexities of the financial environment. At Finance Story, we recognize these challenges and offer customized small business finance options in Australia to support small enterprises in a competitive landscape.

Preparing for a Business Loan Application: Key Requirements

To successfully navigate the loan application process, small enterprise owners must prepare a set of essential documents that can significantly enhance their chances of obtaining financing. These documents encompass:

- Enterprise Plan: A comprehensive enterprise plan is essential, as it delineates the operational model, market analysis, and monetary forecasts. A well-organized plan not only showcases the feasibility of the enterprise but also acts as a guide for future development. At Finance Story, we focus on developing refined and highly personalized case studies that can assist you in presenting your proposal effectively to lenders.

- Monetary Statements: Recent monetary statements, including profit and loss reports, balance sheets, and cash flow reports, are essential in demonstrating the organization's fiscal health. These documents offer lenders a clear overview of the company's performance and stability, which is crucial for understanding repayment criteria.

- Tax Returns: Supplying personal and corporate tax returns for the previous years is vital to establish a transparent financial history. This documentation assists lenders in evaluating the entity's revenue stability and tax adherence.

- Identification: Personal identification papers for all owners and key stakeholders are essential to confirm identities and ensure compliance with lending regulations.

- Collateral Documentation: Details regarding any assets that can be pledged as security for the credit are significant. This can encompass assets, tools, or stock, which may improve the security for creditors.

Furthermore, small enterprise owners should be mindful of particular eligibility requirements when seeking small business finance options in Australia. Finance Story works with a full range of lenders, including high street banks and innovative private lending panels, to help you find the best small business finance options in Australia for your needs. Having these documents organized and readily available can streamline the application process and significantly enhance the likelihood of approval. According to recent statistics, companies that provide a thorough plan along with their monetary documentation observe a higher success rate in credit applications. Moreover, expert guidance highlights that a strong enterprise plan is not merely a formality; it is an essential tool that can affect lenders' choices. For example, case studies have demonstrated that companies with well-prepared plans frequently obtain improved loan terms and conditions, highlighting the significance of careful preparation in reaching monetary objectives.

Prior to consulting with a lender, it is also crucial to organize paperwork including proof of identification, a project plan, financial reports for the previous three years, financial projections, ratio calculations, and personal financial information. Lastly, for those contemplating refinancing options, Finance Story can help you navigate the process to meet the changing demands of your enterprise. For those considering commercial hire-purchase, it generally necessitates an initial deposit and entails leasing while making payments plus interest, which can serve as an alternative financing option for minor enterprises.

Financial Health and Planning for Small Businesses

Preserving economic well-being is essential for the viability of small enterprises, particularly in the context of small business finance options in Australia, especially in the ever-changing economic environment of 2025. Key aspects that contribute to this financial stability include:

- Budgeting: Creating a comprehensive budget is crucial for tracking income and expenses, ensuring that the organization operates within its financial means. This practice not only assists in daily management but also equips companies for unexpected challenges. Recent statistics indicate that all small and medium enterprises (SMEs) reported an increase in operating expenses between January and June 2022, underscoring the importance of effective budgeting.

- Cash Flow Management: Effective cash flow management is vital to prevent shortages that could impede operations or hinder growth. Small enterprises must consistently track their cash flow to ensure they can fulfill obligations and seize opportunities as they arise.

- Financial Forecasting: Anticipating future revenues and expenses enables organizations to prepare for possible challenges and leverage opportunities. This proactive approach aids in making informed decisions that align with long-term goals.

- Debt Management: Strategically managing existing debts is essential to avoid over-leverage and maintain a healthy credit profile. By keeping debt levels under control, companies can ensure they possess the flexibility to invest in growth. As demonstrated by Sophia Ly, an entrepreneur who effectively utilized a loan from the bank to transform her subdued COVID-impacted venture into a flourishing online success story, efficient debt management can lead to transformative outcomes.

Moreover, a case study on the industry distribution of minor enterprises reveals that sectors such as transport, warehousing, retail, and healthcare are thriving, emphasizing the necessity for small business finance options in Australia tailored to these areas. As minor enterprise owners navigate the complexities of money management, adopting effective budgeting strategies can significantly enhance their economic well-being. Expert opinions stress that maintaining a strong economic foundation is not just about surviving but thriving in a competitive market.

By concentrating on these essential areas, minor enterprise owners can enhance their financial stability and prepare for long-term success.

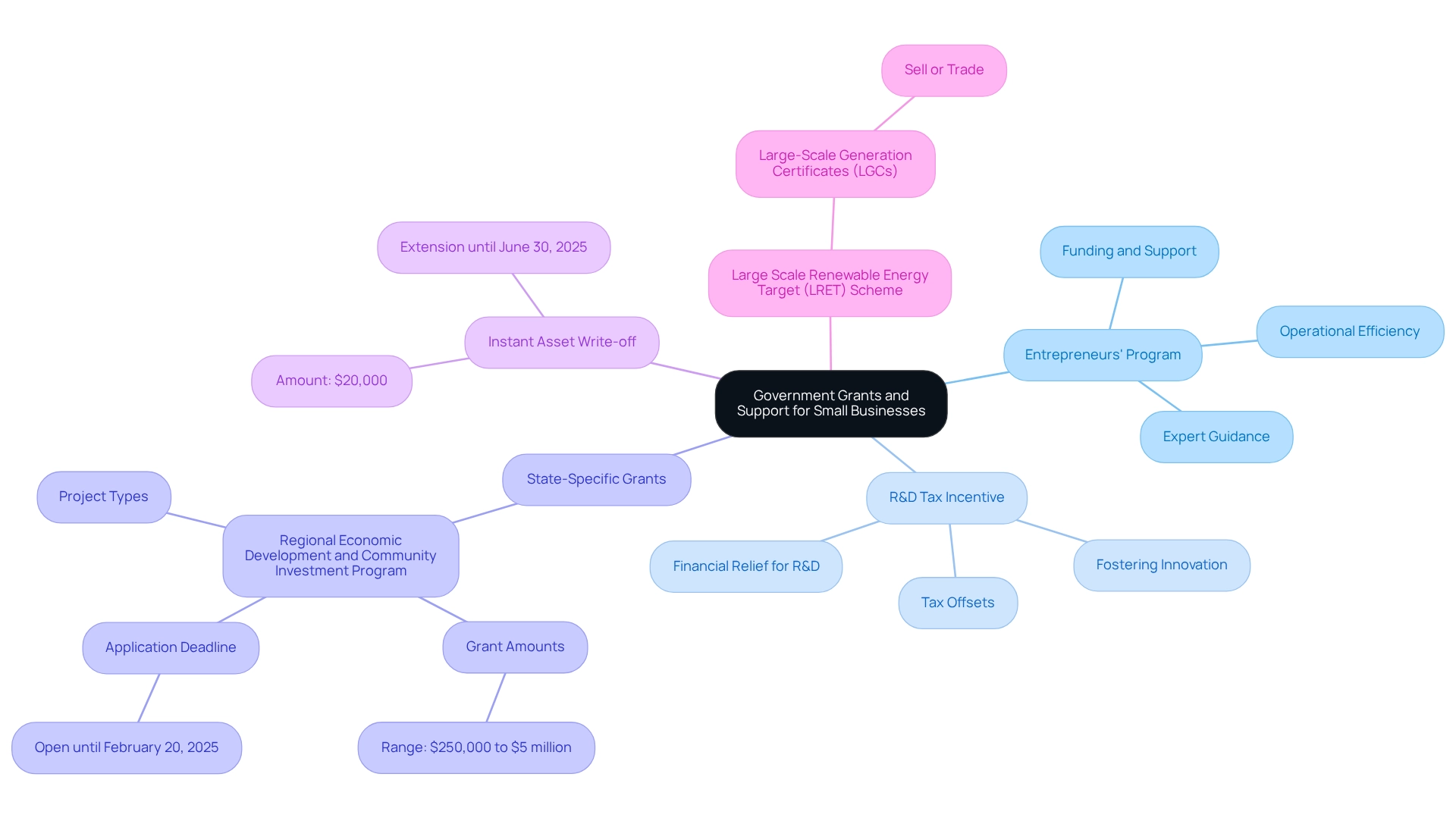

Government Grants and Support for Small Businesses

The Australian government presents a robust array of grants and support initiatives designed to empower local enterprises. Key initiatives include:

- Entrepreneurs' Program: This program provides funding and tailored support to startups and small businesses, with the goal of enhancing their competitiveness in the market. It facilitates access to expert guidance and resources that assist in refining strategies and improving operational efficiency.

- Research and Development (R&D) Tax Incentive: This initiative offers substantial tax offsets for eligible R&D activities, fostering innovation and technological advancement within small enterprises. By alleviating the financial burden associated with research, companies can allocate more resources toward developing new products and services.

- State-Specific Grants: Various states have established their own grant programs to address the unique needs of local enterprises. These programs may include funding for technology upgrades, export initiatives, or community development projects. For example, the Regional Economic Development and Community Investment Program in New South Wales provides grants ranging from $250,000 to $5 million for projects that stimulate regional economic growth, with applications open until February 20, 2025. This program supports initiatives that enhance regional economic growth and community connection, underscoring the government's commitment to fostering local development.

Leveraging these resources can significantly alleviate economic pressures and promote development for small business finance options in Australia. The extension of the $20,000 instant asset write-off until June 30, 2025, announced on May 14, 2024, further illustrates the government's dedication to providing small business finance options by enabling enterprises to invest in essential assets without immediate financial strain. By capitalizing on these opportunities, owners of modest enterprises can enhance their operational capabilities and utilize small business finance options to drive sustainable growth.

As noted by Simone Barker, "Connect with Simone Barker on LinkedIn to keep on top of the evolving grants landscape," highlighting the importance of remaining informed about available funding opportunities. Furthermore, companies generating energy on-site from renewable sources may earn large-scale generation certificates (LGCs) under the Large Scale Renewable Energy Target (LRET) Scheme, which can be sold or traded, providing an additional avenue for economic support.

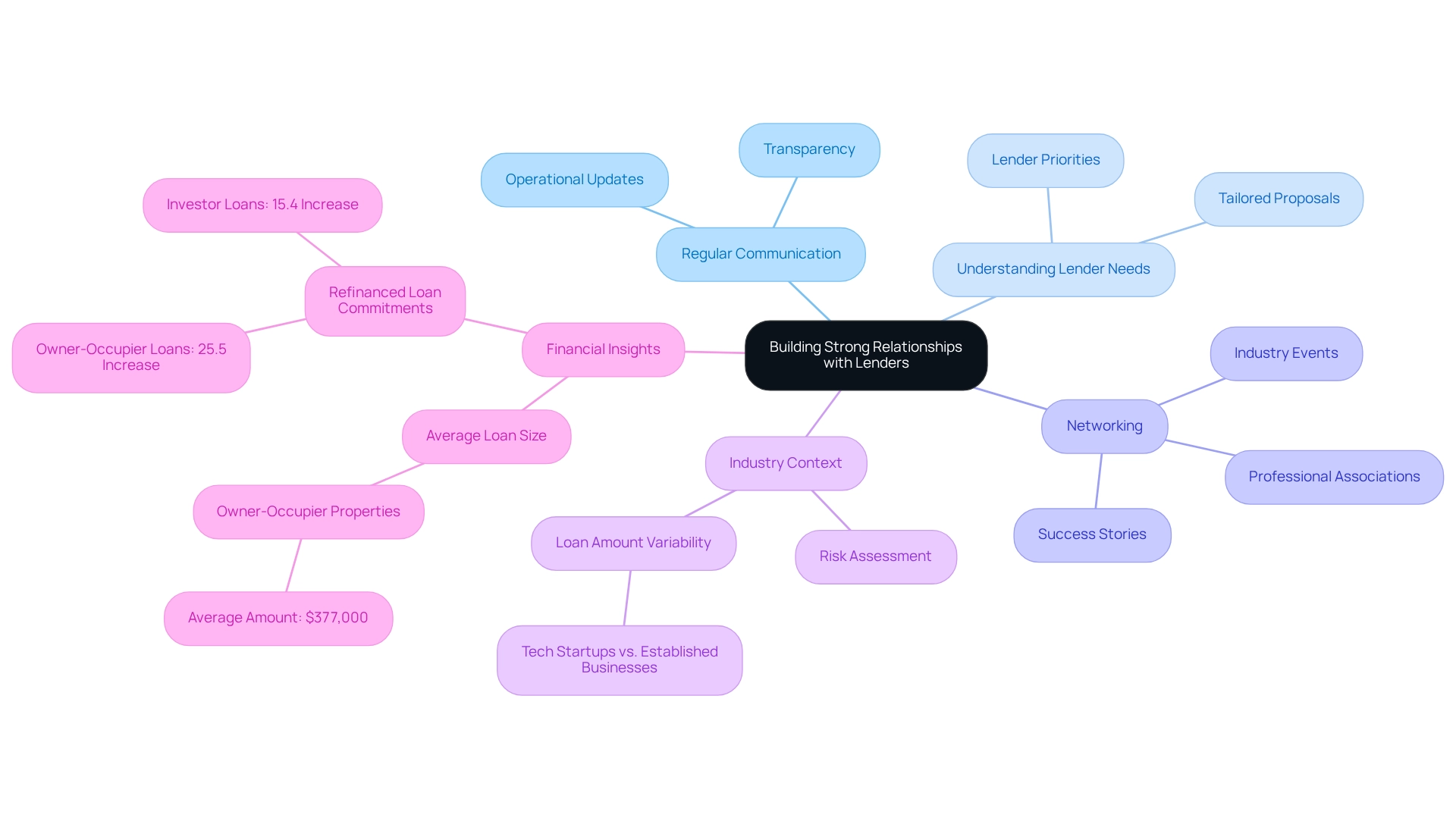

Building Strong Relationships with Lenders

Building strong connections with lenders is crucial for small enterprises seeking small business finance options in Australia. Here are key strategies to consider:

- Regular Communication: Maintaining open lines of communication with lenders about operational developments and financial performance is vital. This transparency fosters trust and can lead to more favorable lending terms.

- Understanding Lender Needs: Familiarizing oneself with what lenders prioritize in a borrower can significantly improve the effectiveness of loan applications. Tailoring proposals to align with lender expectations can enhance approval chances. At Finance Story, we focus on developing refined and highly personalized case studies that align with the growing demands of lenders, ensuring that your proposals are distinctive.

- Networking: Actively interacting with lenders at industry events or via professional associations can enhance relationships and generate new financing opportunities. Statistics suggest that effective networking can enhance the chances of obtaining funding, with many small enterprises reporting favorable results from such interactions. In fact, the value of refinanced credit commitments in Australia has demonstrated a notable change, with a 25.5% rise for owner-occupier mortgages and a 15.4% increase for investor financing, highlighting the dynamic financing landscape.

For instance, a tech startup operating in a volatile market may find it challenging to secure a substantial line of credit compared to an established enterprise in the healthcare sector, which is perceived as lower risk. This demonstrates how grasping the industry context and fostering connections can affect funding amounts and conditions. As highlighted in a case study, the sector in which a company functions influences the credit amount due to differing levels of risk linked to various industries.

Furthermore, PieLAB stresses that with their long-term investment focus, the founders and executives they collaborate with can keep running their enterprises as normal while gaining from extra capital, networks, and access to professional guidance and mentoring. This highlights the significance of establishing robust connections with creditors.

Additionally, the average borrowing amount for owner-occupier properties in the Australian Capital Territory is roughly $377,000, which underscores the small business finance options available to entrepreneurs.

By prioritizing these strategies and utilizing the expertise of Finance Story in refinancing and securing customized funding solutions—including access to a comprehensive range of lenders appropriate for various commercial properties such as warehouses, retail locations, factories, and hospitality enterprises—entrepreneurs can greatly enhance their chances of acquiring favorable financing and support, ultimately aiding their long-term success.

Key Takeaways: Navigating Small Business Finance Options

Navigating small business finance options in Australia requires a comprehensive understanding of the various resources and strategies available. Here are crucial insights to consider:

- Get Acquainted with Funding Alternatives: Small business owners should explore multiple financing avenues, including traditional credit options, government grants, and alternative funding sources. Understanding the distinctions among these small business finance options in Australia will help you select the most suitable path for your needs. At Finance Story, we specialize in crafting refined and tailored proposals to present to financiers, ensuring you secure the right funding for your commercial property investments, including refinancing options for your existing debts.

- Prepare for Financing Applications: Successful financing applications demand meticulous preparation. Gather all necessary documentation, such as financial statements and operational plans, and familiarize yourself with lender requirements to streamline the process. Our expertise in customized loan proposals can guide you through this essential step efficiently.

- Maintain Economic Well-being: Effective budgeting and cash flow management are vital for sustaining economic health. Implementing strategic planning can aid in forecasting future expenses and revenues, ensuring your business remains resilient.

- Utilize Government Grants: Government grants can provide significant financial support. Small businesses should actively seek out these opportunities, as they can enhance funding capabilities without the burden of repayment.

- Build Relationships with Lenders: Establishing strong connections with lenders can enhance financing prospects. Regular communication and demonstrating a solid understanding of your company's financial landscape can foster trust and lead to better credit terms. With access to a comprehensive array of lenders, including high street banks and innovative private lending panels, Finance Story can help you identify the best options for your situation, whether you are acquiring a warehouse, retail space, factory, or hospitality venture.

It's important to note that an SME is generally defined as having fewer than 200 employees or an annual turnover of under $50 million. Recent statistics indicate that the average amount requested for a small enterprise is approximately $94,845, with many businesses seeking funding for growth-related initiatives, such as acquiring equipment or managing operational capital. This trend reflects a careful yet optimistic approach among SMEs looking to leverage funding for expansion. Furthermore, the significance of financing resources is underscored by expert insights, which highlight that many businesses face challenges due to inadequate leadership and insufficient market research. Dr. Pratiti Chatterjee observes that the hospitality sector, in particular, is grappling with declining profit margins, exacerbated by tight household budgets that limit discretionary spending. By familiarizing themselves with small business finance options in Australia and best practices for loan applications, business owners can markedly enhance their chances of securing the necessary funding to drive growth and success in 2025.

Moreover, corporate credit card spending in Australia reached an unprecedented $8.64 billion in June 2024, signaling a growing dependence on credit for operational needs. By leveraging this information and understanding the common reasons for small business failures, owners can navigate the financial landscape more effectively and position their businesses for success.

To take the next step, schedule your free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy. Discuss your needs and goals, and let us begin collaborating to create your next chapter.

Conclusion

Navigating the financial landscape for small businesses in Australia presents both challenges and opportunities filled with potential. By understanding the diverse financing options available—from traditional bank loans and government grants to alternative lending solutions—entrepreneurs are equipped with the essential tools to make informed decisions that foster growth. The significance of financial health cannot be overstated; effective budgeting and cash flow management are fundamental to sustaining operations and capitalizing on market opportunities.

As the economy continues to evolve, small business owners must remain proactive in cultivating relationships with lenders and exploring government support programs designed to alleviate financial pressures. Establishing a solid foundation through meticulous preparation for loan applications and leveraging available grants can significantly enhance the chances of securing necessary funding.

Ultimately, the resilience and adaptability of small businesses will play a pivotal role in shaping Australia’s economic landscape. By staying informed and strategically navigating the complexities of small business finance, entrepreneurs can position themselves not only to survive but to thrive in a competitive environment. Embracing these insights and resources can lead to sustainable growth and long-term success, ensuring that small businesses continue to drive innovation and job creation across the nation.