Overview

This article delves into the various commercial property loan terms available in Australia, outlining their distinct structures, eligibility criteria, and the key factors that influence these loans. Understanding these terms is crucial for businesses aiming to invest in real estate. Additionally, the article highlights the significant role of mortgage brokers in navigating the complexities of the financing process. By doing so, it ensures that companies can secure favorable loan conditions tailored to their specific needs.

Introduction

Navigating the world of commercial property loans can indeed be a daunting task for business owners, particularly within an ever-evolving financial landscape. These specialized financing solutions are essential for acquiring, refinancing, or developing commercial real estate. However, they come with unique challenges and considerations that distinctly set them apart from traditional residential loans.

As businesses increasingly recognize the significance of real estate investments—driven by factors such as low interest rates and economic growth—the necessity for a comprehensive understanding of commercial loan structures, terms, and eligibility criteria becomes paramount.

This article delves into the intricacies of commercial property loans in Australia, exploring the various types available, key definitions, and the critical factors that influence loan terms. Furthermore, it highlights the invaluable role of mortgage brokers in securing favorable financing options.

Understanding Commercial Property Loans: An Introduction

Business real estate financing options are tailored solutions specifically designed for the purchase, refinancing, or development of business real estate, including commercial property loan terms in Australia. Unlike residential financing, which primarily serves individual homebuyers, business funding targets companies looking to invest in assets such as office buildings, retail spaces, warehouses, and industrial facilities. These financial agreements, exemplified by commercial property loan terms in Australia, typically involve larger amounts and specific conditions, highlighting the unique risks and potential rewards associated with business property investments.

In 2025, the landscape of business financing in Australia is shaped by several macroeconomic factors, including low interest rates, strong economic performance, and population growth. These factors are driving companies to invest in real estate, particularly in sectors such as retail and hospitality. For context, industrial and logistic investments in Sweden's real estate market total 4.3 billion EUR, providing a comparative perspective on global investment trends.

The Australian Bureau of Statistics has recently shifted to quarterly lending indicators, offering a clearer view of the evolving market dynamics.

Understanding the fundamentals of financial agreements related to real estate is crucial for entrepreneurs aiming to leverage real estate for growth and development. These financial products not only aid in acquiring valuable assets but also serve as strategic tools for enhancing operational capacity and market presence. Current trends indicate a growing interest in financing for real estate, with businesses increasingly recognizing the importance of commercial property loan terms in Australia within their overall financial strategy.

Experts emphasize the necessity of comprehending the intricacies of business property financing. Financial professionals assert that a thorough understanding of commercial property loan terms and conditions can significantly impact an organization’s ability to secure favorable financing options. As the market continues to evolve, staying informed about the latest trends and developments in commercial property loan terms will be vital for companies striving to thrive in a competitive environment.

At Finance Story, we specialize in crafting polished and highly personalized cases for presentation to banks, ensuring our clients secure financing solutions tailored to their unique situations. We provide access to a comprehensive range of lenders, including high street banks and innovative private lending panels, to accommodate diverse financing needs. Additionally, we offer refinancing options to help businesses adapt to their changing requirements.

Case studies illustrate successful acquisitions under commercial property loan terms in Australia, demonstrating how businesses have effectively utilized these loans to achieve their growth objectives. For instance, the case study titled 'Macroeconomic Factors Supporting Market Growth' highlights how low interest rates and robust economic performance are encouraging companies to invest in real estate, particularly in sectors like retail and hospitality. By navigating the complexities of business financing with the right expertise, companies can position themselves for long-term success in the dynamic real estate market.

As Yolanda Mega, Operations Manager at Finance Story, states, "Get in touch with us. We are happy to help." This statement reflects Finance Story's commitment to providing personalized support and expert guidance, reinforcing its reputation for professionalism and a deep understanding of the finance sector.

By leveraging these insights, business owners can make informed decisions regarding real estate financing and enhance their financial strategies.

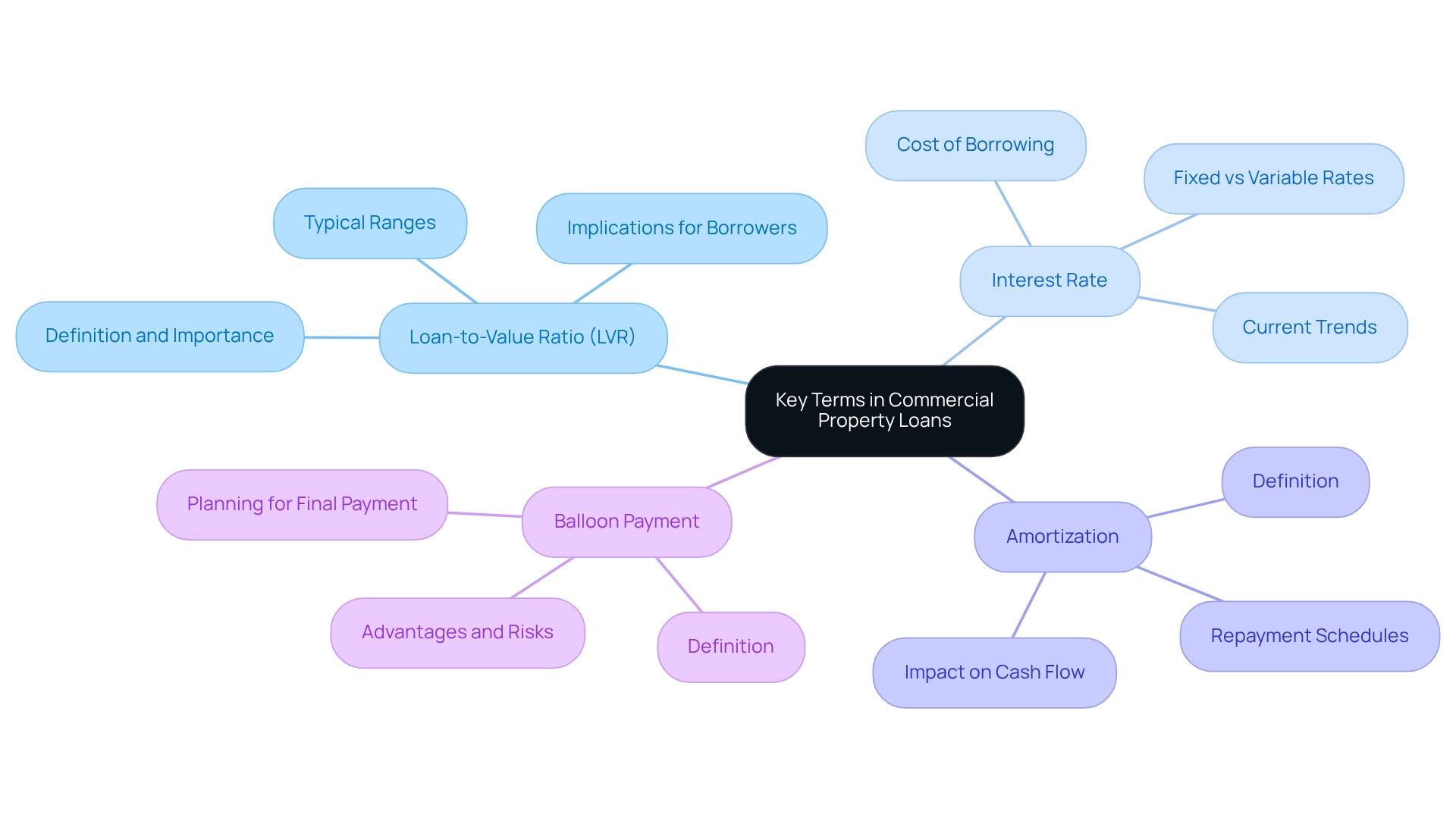

Key Terms and Definitions in Commercial Property Loans

Key concepts in business real estate financing are essential for borrowers aiming to navigate the complexities of funding efficiently. A solid grasp of these terms can profoundly influence investment decisions and financial outcomes. Below are some of the most significant concepts:

-

Loan-to-Value Ratio (LVR): This pivotal ratio assesses the amount of the loan relative to the property's appraised value. In business real estate, LVR typically ranges from 60% to 80%. A lower LVR signifies reduced risk for lenders, potentially leading to more advantageous credit terms for borrowers. Particularly in freehold real estate ventures, lenders often allow a maximum LVR of 70% against the asset. This means that for an asset valued at $1 million, a borrower could secure financing of up to $700,000, necessitating a deposit of $300,000. Understanding this is crucial for small business owners seeking to finance their investments effectively.

-

Interest Rate: The interest rate signifies the cost of borrowing and can be either fixed or variable. Business real estate financing generally carries higher interest rates compared to residential financing, reflecting the increased risk associated with business investments. Current interest rates for commercial property loan terms in Australia for 2025 are shaped by broader economic trends, including anticipated rate reductions that could invigorate market activity. As noted by Luci Ellis, economic spokesperson at Westpac, "That would follow a similar pattern to what we’ve seen from international peers including the Federal Reserve and RBNZ and mark an acceleration from our previous forecast of one cut per quarter."

-

Amortization: This term pertains to the gradual repayment of a debt through regular payments over a specified period, which can vary from 5 to 30 years. Understanding the amortization schedule is vital for borrowers, as it affects cash flow and total borrowing costs.

-

Balloon Payment: A balloon payment refers to a substantial final payment due at the end of a borrowing term. This structure allows borrowers to enjoy lower monthly payments during the loan period, but it necessitates careful planning to ensure that the final payment can be met.

These commercial property loan terms in Australia are not just jargon; they play a crucial role in shaping the financial landscape for commercial real estate investors. For instance, when acquiring a freehold asset business, it's essential to recognize that borrowing against the venture is typically not feasible unless it has substantial resources. This implies that additional funds, such as equity from other assets, may be necessary to cover the total acquisition costs, which can encompass valuation, legal, and stamp duty fees.

The recent decline in investor credit commitments, which dropped to 48,876 in the December quarter of 2024—a 4.5% decrease from the previous quarter—underscores the necessity of understanding these terms in a fluctuating market. Moreover, the value of new loan commitments for property purchases in December 2023 was $24.4 billion, indicating robust market activity. As interest rates are projected to decline, the appetite for new acquisitions is likely to rise, prompting investors to re-enter the market or expand their portfolios.

This optimism is bolstered by a growing population and enhanced business confidence, which are anticipated to improve rental yields and overall investment returns. The case study titled 'Impact of Lower Interest Rates on Business Property Market' demonstrates how reduced rates can significantly affect market dynamics, resulting in increased demand for well-located business assets.

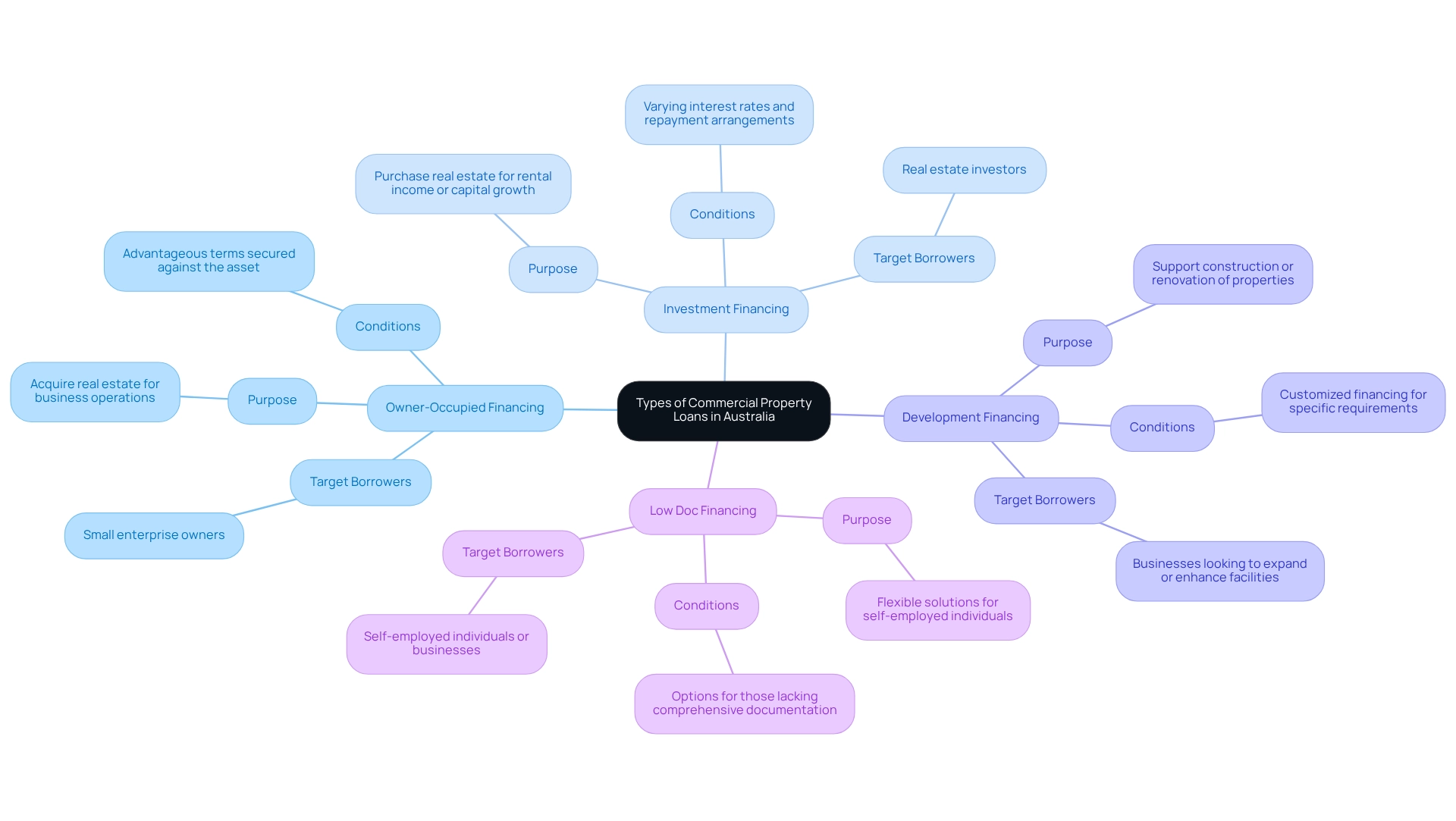

Types of Commercial Property Loans Available in Australia

In Australia, a diverse selection of commercial property loan terms addresses various financial requirements and investment strategies. The main categories consist of:

- Owner-Occupied Financing: Designed for enterprises acquiring real estate to conduct their activities, these financing options generally provide advantageous conditions as they are secured against the asset being utilized for commercial purposes. Finance Story focuses on developing refined and highly tailored cases to present to banks, guaranteeing that small enterprise owners can obtain the most favorable conditions available.

- Investment Financing: Targeted at investors looking to purchase real estate for rental income or capital growth, this financing often features varying interest rates and repayment arrangements in contrast to owner-occupied financing. Grasping the subtleties of these financial products is essential for borrowers, as Finance Story offers insights into the repayment standards that can influence cash flow management.

- Development Financing: These funds support the construction or renovation of commercial properties, enabling enterprises to expand or enhance their facilities. With expertise in refinancing, Finance Story assists clients in managing the intricacies of obtaining development financing customized to their specific requirements.

- Low Doc Financing: Created for self-employed individuals or enterprises lacking comprehensive documentation to verify income, these options offer a flexible solution for those who may encounter difficulties in conventional lending situations. Finance Story comprehends the unique situations of small enterprise proprietors and provides solutions that address their financial conditions.

Each type of financing serves distinct purposes and is regulated by specific requirements and commercial property loan terms in Australia. For example, the market share of owner-occupied mortgages compared to investment properties in Australia has demonstrated a significant trend, with owner-occupiers refinancing an average sum of about $585,000, while investors generally refinance approximately $654,000, according to Harrison Astbury, Editor and Financial Analyst. This distinction emphasizes the various financial tactics utilized by companies and investors alike.

Expert insights indicate that grasping the differences between owner-occupied and investment financing is essential for borrowers. Owner-occupied financing typically provides reduced interest rates and more advantageous conditions, making them an appealing choice for enterprises seeking to create a permanent foundation. In contrast, investment financing may offer greater flexibility regarding cash flow management, attracting those concentrated on generating rental income.

Recent case studies demonstrate the effective use of owner-occupied financing in various sectors, highlighting how businesses have utilized these financial products to secure their operational premises while enjoying potential tax benefits. As the Australian real estate market changes, especially considering recent government actions to limit foreign acquisitions of secondary residences effective April 1, 2025, comprehending these financing types becomes progressively crucial for both new and experienced investors. Additionally, it is noteworthy that offsets are popular among 67.1% of mortgagors with $50,000 or more in savings, indicating a trend in borrower preferences and financial strategies.

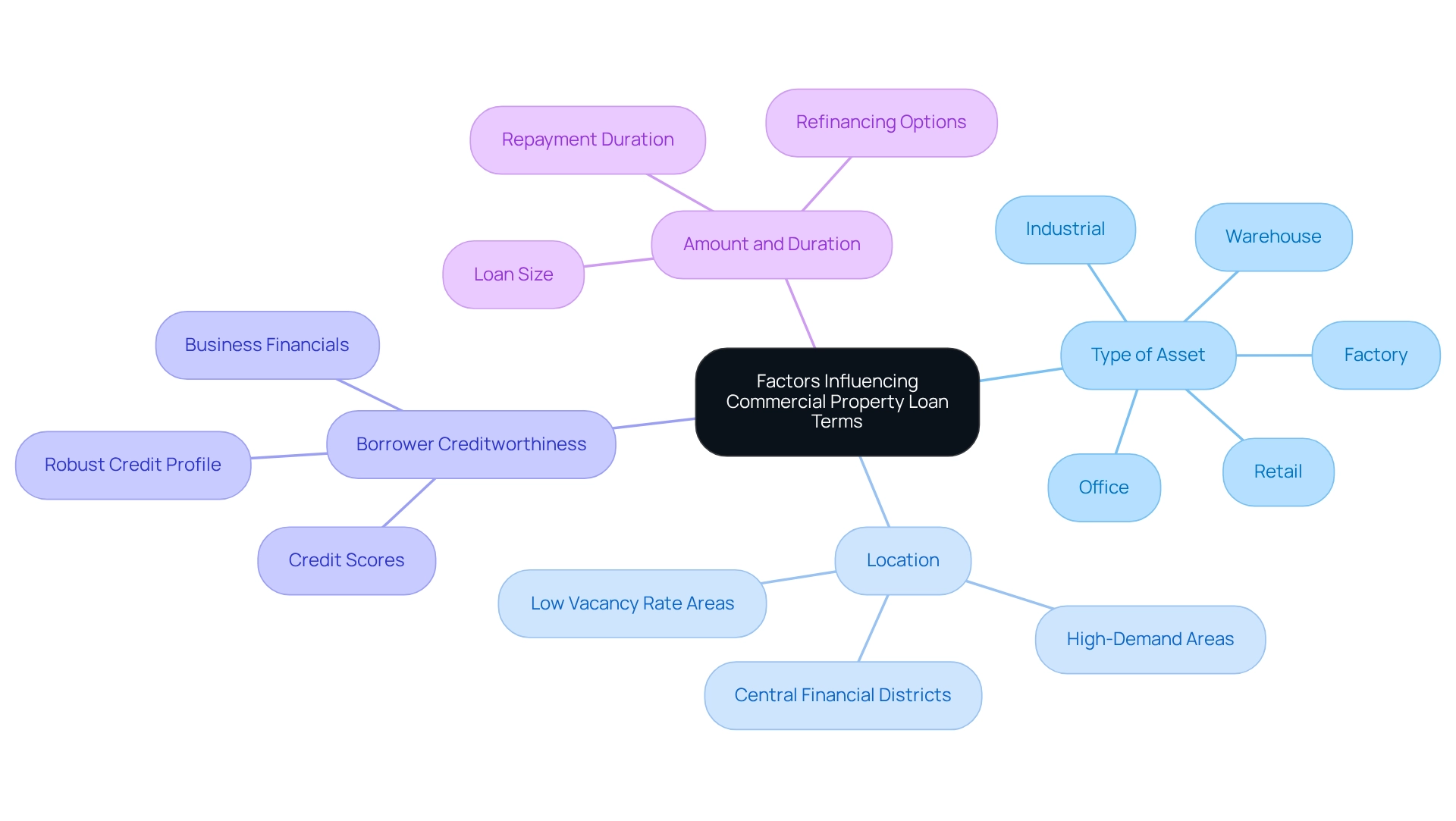

Factors Influencing Commercial Property Loan Terms

The conditions of commercial real estate loans hinge on several essential factors:

-

Type of Asset: The nature of the asset—whether retail, office, industrial, warehouse, or factory—significantly influences loan conditions. Each asset category carries its own risk profile, which directly impacts interest rates and the commercial property loan terms in Australia that lenders are willing to offer. For instance, assets in stable areas, like industrial warehouses, often attract more favorable commercial property loan terms compared to those in more volatile sectors, such as retail. Finance Story specializes in developing refined and highly tailored case studies for banks, ensuring that your asset type is effectively communicated to secure the most advantageous terms.

-

Location: The geographical positioning of an asset is paramount. Properties located in high-demand areas with low vacancy rates generally secure better commercial property loan terms in Australia. For example, commercial property loan terms are typically more favorable for properties in central financial districts due to their appeal and perceived income stability. By partnering with Finance Story, you gain access to a comprehensive array of lenders, including high street banks and innovative private lending panels, enhancing your chances of securing favorable financing based on location.

-

Borrower Creditworthiness: Lenders meticulously assess the financial health of borrowers, including credit scores and overall business financials. A robust credit profile can lead to more favorable commercial property loan terms in Australia, whereas a weaker profile may result in higher interest rates or stricter terms. Finance Story's expertise in understanding borrowing repayment criteria can assist you in presenting a compelling application that effectively showcases your creditworthiness.

-

Amount and Duration: The size of the borrowing and its repayment duration also play a crucial role in determining the terms. Larger loans or those with extended repayment periods may come with more stringent requirements, reflecting the heightened risk that lenders encounter. Finance Story can help you navigate these complexities, ensuring that your funding proposal aligns with your business's evolving needs, including refinancing options to adapt to changing circumstances.

Understanding these factors is essential for borrowers aiming to present compelling applications and negotiate favorable commercial property loan terms in Australia. A recent survey by the Deloitte Center for Financial Services indicated that 76% of real estate executives plan to invest in deep energy retrofits, highlighting a growing trend towards sustainability that could impact asset valuations and, consequently, credit terms. This trend is further emphasized by Kathy Feucht, Global Real Estate leader, who noted that this year’s commercial real estate outlook aims to assist leaders in overcoming recent challenges to better position their organizations for the future.

Moreover, financial specialists underscore that the relationship between property type and location is crucial in influencing commercial property loan terms in Australia. As the market evolves, staying informed about these dynamics can empower borrowers to make strategic decisions that align with their financial goals. It is also important to consider the average mortgage amount for owner-occupier residences in the ACT, which stands at $377,000, providing context for the types of financing being discussed.

Finally, the recent adjustment in published data for refinancing highlights the significance of precise information in understanding financing terms, especially in the context of the evolving market.

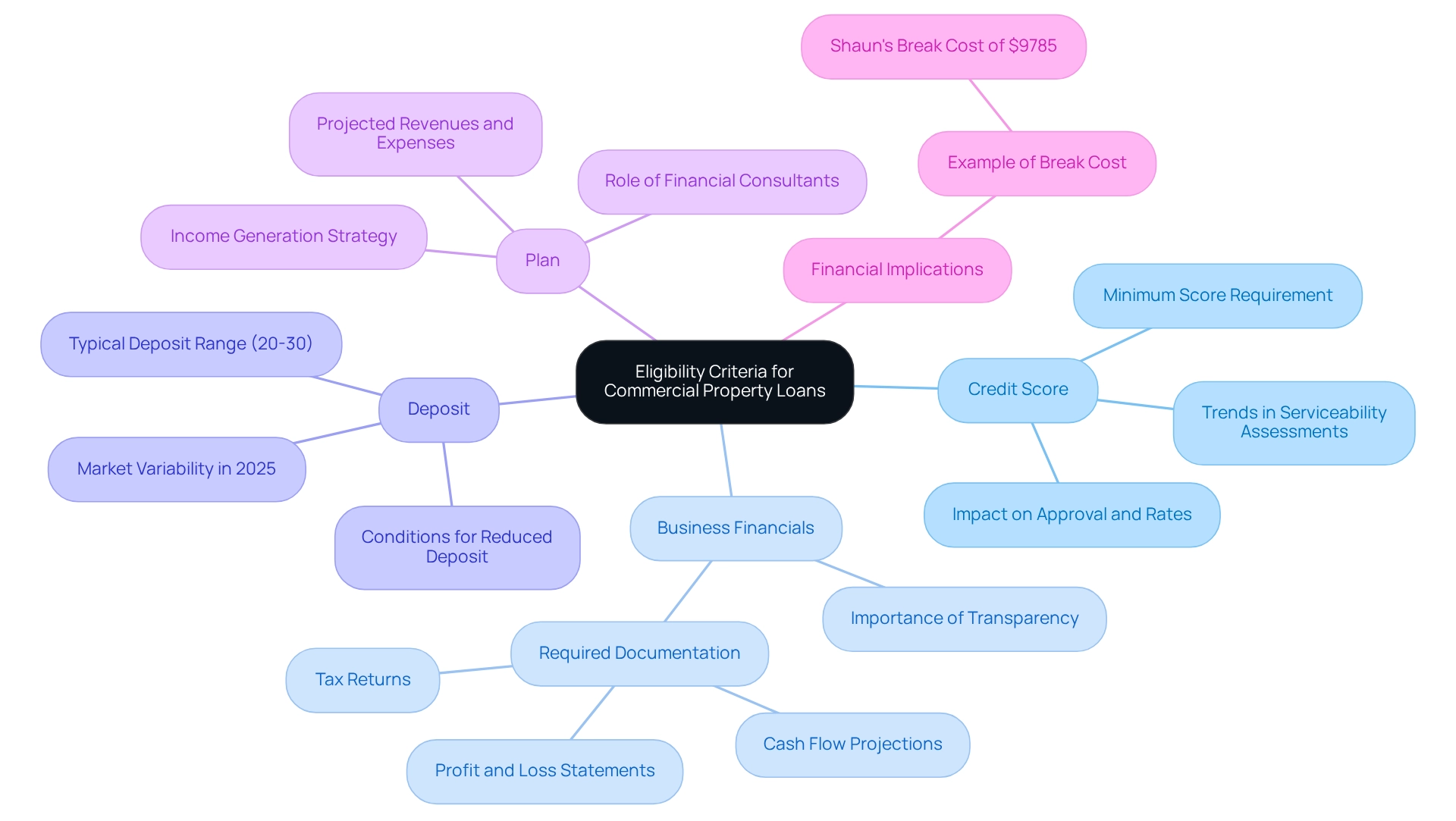

Eligibility Criteria for Commercial Property Loans

To qualify for a commercial property loan in Australia, borrowers must navigate several key criteria that significantly influence their chances of approval:

-

Credit Score: A minimum credit score is typically required, with most lenders favoring scores above 650. Higher credit scores not only improve the likelihood of approval but can also lead to more favorable interest rates. Recent trends indicate that lenders are increasingly cautious, with APRA noting improvements in serviceability assessments, which reflect a more stringent approach to evaluating creditworthiness. This careful strategy is highlighted by a case study that noted a significant reduction in credit being issued with insufficient interest cover ratios, contributing to a more stable lending environment.

-

Business Financials: Lenders generally require comprehensive financial documentation, including profit and loss statements, cash flow projections, and tax returns. These documents offer insight into the company's financial health and its capacity to service the loan. For example, a case study revealed that companies with well-documented financials had a significantly higher approval rate, underscoring the significance of transparency in financial reporting. Financial advisors stress that understanding the evolving lending landscape, particularly the commercial property loan terms in Australia and APRA's intention to modernize its formal data collections for commercial real estate lending, is crucial for borrowers. At Finance Story, we specialize in creating polished and highly customized cases to present to banks, enhancing your chances of securing the necessary funds.

-

Deposit: Most lenders anticipate a deposit of at least 20-30% of the asset's value. However, some institutions may provide loans with reduced deposit criteria under certain conditions, such as robust financials or a solid credit history. Understanding the average deposit requirements for commercial property loan terms in Australia in 2025 is crucial for prospective borrowers, as these terms can vary based on market conditions and lender policies. For 2025, borrowers should anticipate that the average deposit may still fall within this range, but specific lender offerings could provide more flexibility.

-

Plan: A comprehensive plan that details how the asset will generate income can significantly improve a borrower's application. This plan should detail projected revenues, expenses, and the overall strategy for property management. Financial consultants often emphasize that a thoroughly prepared enterprise strategy can be a crucial element in obtaining funding approval. As Harrison Astbury, a financial analyst, notes, "High interest rates put the kibosh on the litany of cashback offers out there, but there are still a number of lenders offering competitive options." At Finance Story, we guide you in crafting a compelling business case that aligns with lender expectations.

Meeting these criteria is essential for obtaining funding and ensuring a smooth approval process. As the lending landscape evolves, staying informed about eligibility requirements and preparing the necessary documentation can significantly improve a borrower's chances of success. Furthermore, borrowers should be aware of the potential financial implications of their borrowing choices, such as the example of Shaun's break cost of $9785, which illustrates the importance of understanding borrowing terms and conditions.

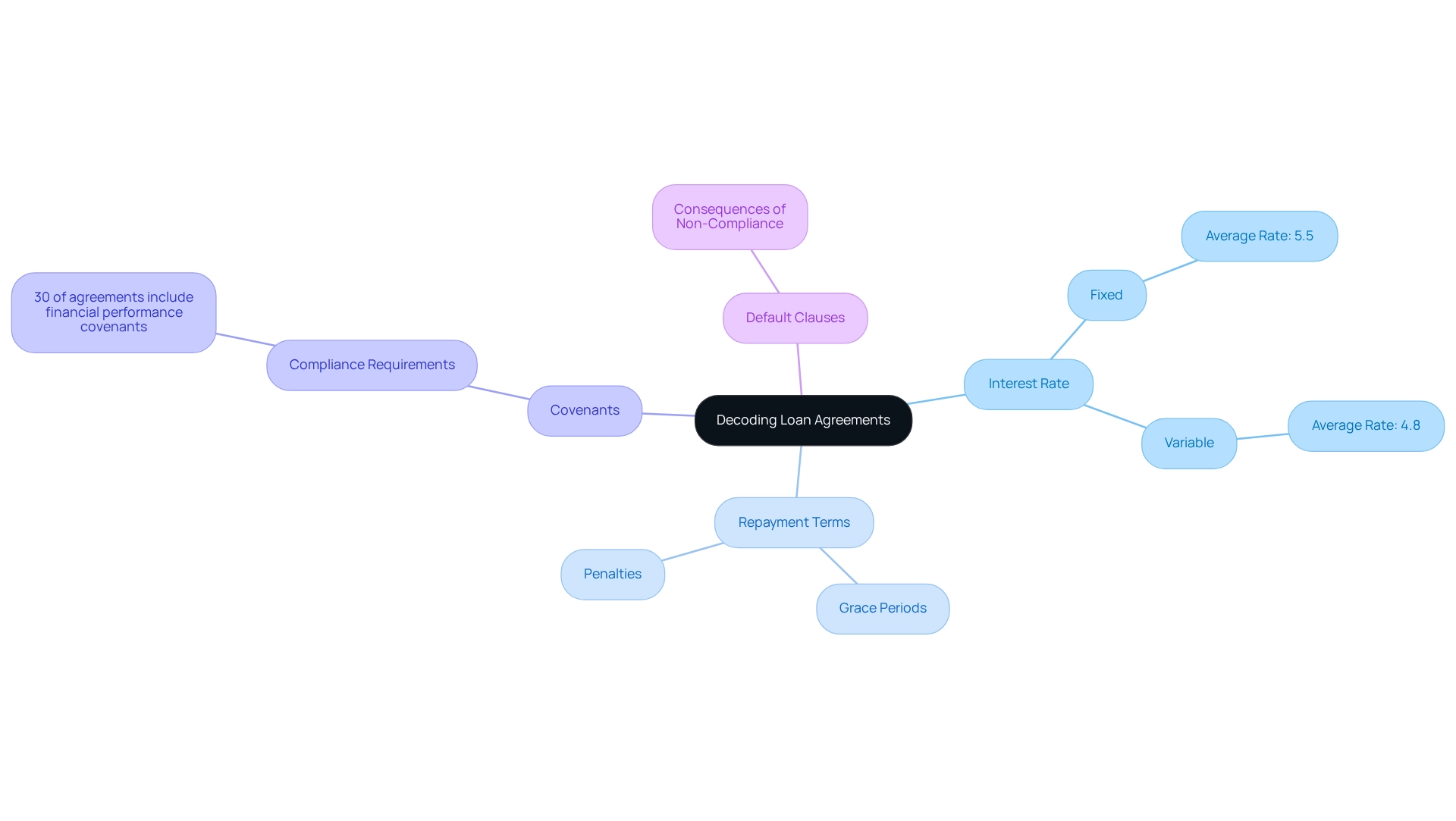

Decoding Loan Agreements: What Borrowers Need to Know

Credit agreements serve as legally binding contracts that delineate the terms of commercial property loans in Australia, encompassing vital elements such as interest rates, repayment schedules, and covenants. A thorough understanding of these components is essential for borrowers to manage their debts effectively and mitigate potential legal complications. Key components include:

-

Interest Rate: This can be either fixed or variable, significantly impacting the total repayment amount over the loan's duration. As of 2025, average interest rates for fixed business financing in Australia are around 5.5%, while variable rates are slightly lower at approximately 4.8%. The choice between these options can influence financial planning and cash flow management.

-

Repayment Terms: These outline the schedule for repayments, including any grace periods and penalties for late payments. Grasping the commercial property loan terms in Australia is crucial, as it affects the borrower’s liquidity and overall financial stability.

-

Covenants: These are conditions that borrowers must adhere to, such as maintaining specific financial ratios or securing adequate insurance coverage. Non-compliance can lead to default, which may have severe repercussions. Indeed, data indicate that around 30% of business financing agreements include covenants related to financial performance, underscoring their prevalence in the lending landscape.

-

Default Clauses: These provisions detail the consequences if the borrower fails to meet their obligations. Familiarity with these clauses is vital, as they can dictate lenders' actions in cases of non-compliance.

In the context of financial investments, particularly in sectors like agriculture, forestry, and fishing support services—offering a profit margin of 20.2%—understanding these agreement elements becomes even more critical for small enterprises considering financing options.

Legal experts stress the significance of comprehending these key elements of commercial property loan terms in Australia, as they establish the foundation for a successful borrowing experience. As Anna Bligh, Chief Executive Officer of the Australian Banking Association, remarked, "I look forward to the Banking Code of Practice continuing to enhance the banking experience for all customers," highlighting the importance of customer experience in managing credit agreements.

Moreover, Finance Story, recognized for its tailored mortgage services, has established a comprehensive complaints resolution process that aligns with ASIC guidelines, ensuring clients can express their concerns regarding banking services or compliance issues. This commitment to client support and transparency bolsters Finance Story's reputation for professionalism and deep understanding of the finance sector, positioning it as a trustworthy partner for small business owners seeking real estate financing. Additionally, with access to a wide array of lenders, including high street banks and innovative private lending panels, Finance Story provides various financing options tailored to meet the unique needs of each client.

By comprehending the intricacies of borrowing contracts, borrowers can navigate the challenges of business financing with enhanced confidence and security.

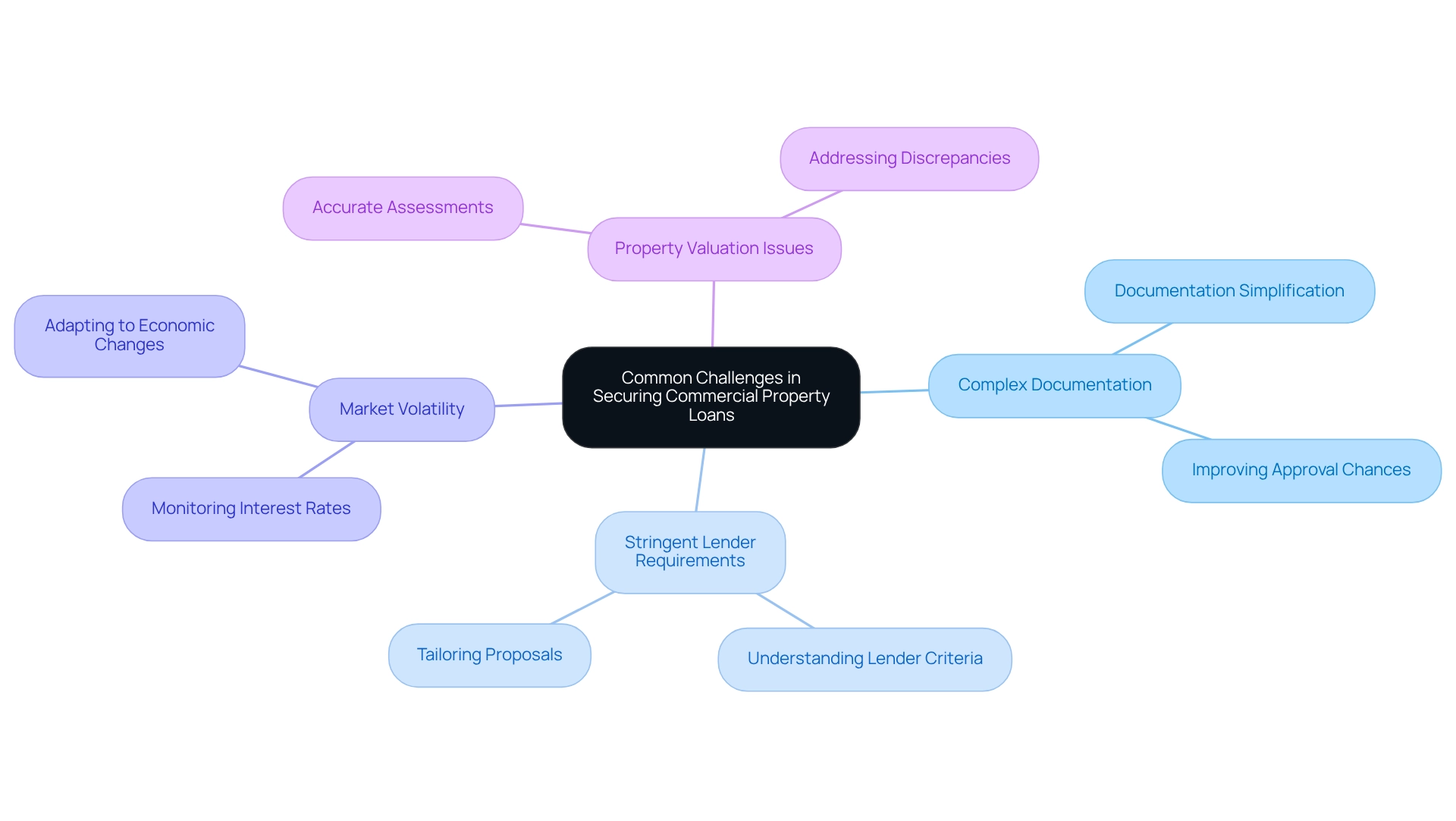

Common Challenges in Securing Commercial Property Loans

Securing financing for commercial property loan terms in Australia can present significant challenges that borrowers must navigate to achieve their financial goals. Key obstacles include:

- Complex Documentation: The application process often demands extensive documentation, which can be daunting for many borrowers. This complexity can lead to delays and confusion, particularly for those unfamiliar with the requirements. Finance Story specializes in simplifying this process, ensuring that all required documentation is in order, significantly improving the likelihood of approval.

- Stringent Lender Requirements: Lenders frequently impose strict criteria that can obstruct qualification for credit. This is especially true for smaller businesses, which may face higher scrutiny compared to larger corporations that typically have more robust financial histories. With Finance Story's expertise, borrowers can better understand these requirements and tailor their proposals to meet lender expectations.

- Market Volatility: The current economic landscape is characterized by fluctuating interest rates and unpredictable market conditions. These factors can significantly affect credit terms and availability, making it essential for borrowers to stay informed about market trends. As Kathy Feucht, Global Real Estate leader, noted, "This year’s commercial real estate outlook aims to help leaders turn the corner on the recent challenging years to better position their organizations for the road ahead."

- Property Valuation Issues: Discrepancies in property valuations can present substantial challenges, potentially leading to decreased financing amounts or heightened deposit requirements. Precise assessments are essential for obtaining advantageous financing conditions. Finance Story's expertise in creating polished and individualized business cases can help address these issues effectively.

Understanding these challenges is essential for borrowers aiming to navigate commercial property loan terms in Australia effectively during the financing process. For instance, recent statistics reveal that credit commitments classified as 'Other' experienced a significant 3.9% rise from the September quarter to the December quarter of 2024, reflecting an increasing demand for varied financing options. Additionally, the value of new owner-occupier first home buyer loan commitments rose by 1.5% in the same period, underscoring the dynamic nature of the lending landscape.

Furthermore, the uncertain economic outlook presents extra risks, especially for smaller enterprises that may be more susceptible to unfavorable conditions. As highlighted in recent analyses, while larger companies often manage their debts effectively, smaller enterprises face higher earnings volatility and lower resilience, making it imperative for them to seek expert guidance. The case study titled 'Uncertain Economic Outlook' illustrates this point, emphasizing the necessity for smaller enterprises to navigate these challenges carefully.

By recognizing these challenges and leveraging the expertise of mortgage brokers like Finance Story, borrowers can develop strategies to overcome documentation hurdles and secure the financing they need. Finance Story offers a full range of lenders, including high street banks and innovative private lending panels, ensuring that clients have access to the best options available. Furthermore, we focus on refinancing loans to accommodate the changing requirements of enterprises.

Finance Story is committed to building strong, long-term relationships with clients, ensuring they receive the support necessary to navigate these complexities. This proactive approach not only simplifies the application process but also empowers borrowers to make informed decisions in a complex financial environment. Small business owners are encouraged to reach out to Finance Story for assistance with their financing needs.

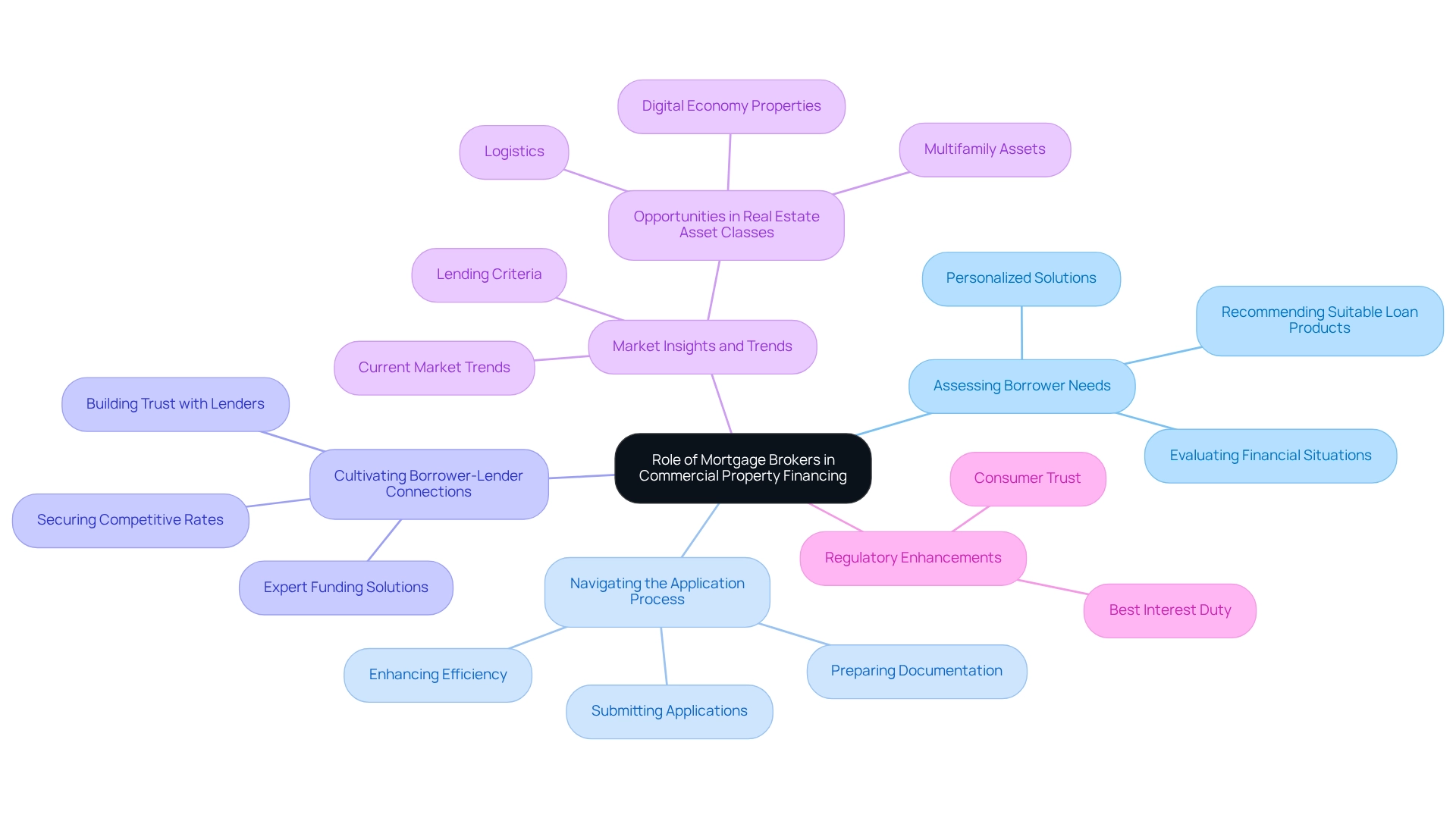

The Role of Mortgage Brokers in Commercial Property Financing

Mortgage brokers play a pivotal role as intermediaries in the realm of commercial property financing, guiding borrowers through the complexities of commercial property loan terms in Australia while facilitating essential connections with lenders. Their multifaceted responsibilities encompass several critical areas:

- Assessing Borrower Needs: Brokers conduct comprehensive evaluations of borrowers' financial situations and objectives, enabling them to recommend the most suitable loan products tailored to individual circumstances. For instance, Finance Story prides itself on understanding commercial needs 100%, ensuring that clients receive personalized solutions that align with their goals. As Natasha B. from VIC states, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey."

By accessing a wide range of lenders, brokers secure competitive rates and favorable commercial property loan terms in Australia. Their established relationships with a diverse array of lenders—including boutique lenders, private investors, and mainstream banks—allow Finance Story to curate expert funding solutions for various journeys involving commercial property loan terms.

- Navigating the Application Process: Brokers streamline the often complex application process by assisting borrowers in preparing necessary documentation and submitting applications, thereby enhancing efficiency and reducing potential delays. Finance Story's ongoing relationship with clients ensures that they are supported throughout this process, alleviating the constant worry often associated with financing.

Providing expert advice on commercial property loan terms in Australia, brokers offer valuable insights into current market trends and lending criteria. This empowers borrowers to make informed decisions that align with their financial goals. Pleased clients emphasize that the knowledge of Finance Story's brokers is essential in maneuvering through the real estate sector, particularly in challenging situations.

Utilizing a mortgage broker can significantly enhance a borrower’s chances of securing advantageous financing. Statistics show that brokers have a high success rate in securing business loans, reflecting their expertise and the trust they establish with lenders. Moreover, the introduction of best interest duty has bolstered consumer confidence in mortgage brokers, ensuring that clients receive tailored advice that prioritizes their financial well-being.

The role of mortgage brokers in business real estate financing is underscored by their capacity to cultivate successful borrower-lender connections, particularly regarding commercial property loan terms in Australia. Case studies reveal that many borrowers have achieved their financial goals through the strategic guidance of brokers, who adeptly navigate the complexities of commercial property loan terms. For example, insights from the case study titled "Opportunities in Real Estate Asset Classes" highlight key asset classes that present opportunities for real estate owners and investors, including digital economy properties and logistics.

As nearly 50% of succession plans for CEOs in real estate start from scratch, the importance of strategic financial planning cannot be overstated. Brokers play a crucial role in this process. Tim Coy, research manager at Deloitte’s Center for Financial Services, points out that the knowledge of mortgage brokers is essential in navigating the business real estate landscape. As the market evolves, the insights offered by financial specialists emphasize the growing significance of brokers in obtaining funding that addresses the specific requirements of enterprises in 2025.

Key Takeaways on Commercial Property Loan Terms in Australia

Understanding the commercial property loan terms in Australia is essential for any enterprise seeking to invest in real estate. Here are the key takeaways:

-

Distinct Structures: Commercial property loans differ significantly from residential loans in their structure, terms, and requirements. While residential financing usually emphasizes personal creditworthiness and income, the commercial property loan terms in Australia evaluate the overall financial stability of the enterprise and the potential revenue produced by the property.

-

Essential Terminology: Familiarity with key terms and definitions is vital for navigating the financing process effectively. Terms such as loan-to-value ratio (LVR), interest rates, and amortization schedules can significantly affect the commercial property loan terms in Australia available to companies.

-

Customized Financing Options: Numerous varieties of financing are accessible, each crafted to address distinct organizational requirements and situations. Options include fixed-rate financing, variable-rate financing, and interest-only financing, allowing businesses to choose the structure that best aligns with their financial strategy.

-

Influencing Factors: Elements such as real estate type, location, and borrower creditworthiness play a significant role in determining financing terms. For instance, properties in prime locations may attract more favorable commercial property loan terms in Australia due to their potential for higher returns.

-

Eligibility and Agreements: Meeting eligibility criteria and thoroughly understanding financing agreements can enhance the chances of securing favorable funding. Companies ought to be ready to supply comprehensive financial records and show their capacity to repay the debt.

-

Broker Support: Collaborating with a mortgage broker can provide invaluable support and access to a broader range of lending options. Brokers can assist companies in navigating intricate financing procedures and recognizing the optimal funding options customized to their particular requirements.

In 2025, the environment for business financing in Australia is changing, with total balances in offset accounts exceeding $300 billion as of the December 2024 quarter. This growth reflects a robust market environment, bolstered by slightly higher economic growth and lower inflation, which may lead to more favorable lending conditions. According to the "Outlook for Australian Commercial Real Estate Debt," this environment is expected to enhance borrower sentiment and increase lending volumes.

As Bruce Wan, Head of Research for MaxCap Group, notes, "For investors, most importantly, there is improving access to a highly profitable set of private credit opportunities, previously only available to a cozy banking oligopoly." As companies investigate commercial property investments, understanding the commercial property loan terms in Australia and the distinctions between commercial and residential loans will be crucial for making informed financial decisions.

To further assist you in navigating these complexities, we invite you to schedule your free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy. Discuss your needs and goals, and let us help you create tailored financial strategies that align with your business objectives. Please select a time that suits you from our live calendar.

Conclusion

Navigating the landscape of commercial property loans in Australia demands a comprehensive understanding of the various factors influencing financing options. This article has delved into the unique characteristics of commercial loans, emphasizing their distinct structures compared to residential loans. Key terms such as loan-to-value ratio, interest rates, and amortization schedules are essential elements that can significantly impact a borrower's financial outcomes.

Different types of commercial property loans cater to diverse business needs, from owner-occupied loans to investment and development loans. Each type presents its own set of requirements and considerations, highlighting the importance of aligning the right loan product with specific financial strategies and goals. Moreover, factors such as property type, location, and borrower creditworthiness play a pivotal role in determining loan terms, further underscoring the necessity for meticulous planning and preparation.

Understanding eligibility criteria and loan agreements is critical for securing favorable financing. By being well-informed and prepared with comprehensive financial documentation, borrowers can enhance their chances of approval and favorable terms. Furthermore, leveraging the expertise of mortgage brokers can provide invaluable support in navigating the complexities of the lending landscape, ensuring access to a broader range of options tailored to individual circumstances.

As the commercial property loan market continues to evolve, staying informed about trends and changes will be crucial for businesses looking to invest in real estate. By grasping the intricacies of commercial loans and utilizing available resources, borrowers can strategically position themselves for long-term success in a competitive environment. Taking proactive steps today will pave the way for informed financial decisions and successful real estate investments in the future.