Overview

Commercial loan terms in Australia are pivotal for businesses seeking financing, encompassing critical aspects such as interest rates, repayment durations, and the types of loans available. Understanding these terms—ranging from secured versus unsecured loans to the influence of creditworthiness and economic conditions—empowers entrepreneurs to make informed decisions. This knowledge not only aligns with their financial goals but also meets their operational needs. By grasping these elements, business owners can navigate the lending landscape with confidence, ensuring they select the best options for their unique circumstances.

Introduction

In the dynamic landscape of business financing, commercial loans serve as essential instruments that enable organizations to realize their operational objectives and foster growth. These specialized financial products address a wide array of needs, from property acquisition to cash flow management, and feature distinct terms that set them apart from personal loans.

As the Australian market continues to evolve, it is imperative for business owners to comprehend the intricacies of commercial loans to effectively navigate the complexities of borrowing. With interest rates on the rise and lending criteria becoming increasingly stringent, the stakes are higher than ever.

Therefore, it is crucial for businesses to understand the nuances of loan types, terms, and the application process. This article explores the key aspects of commercial loans, offering insights that empower businesses to make informed financing decisions and unlock their full potential.

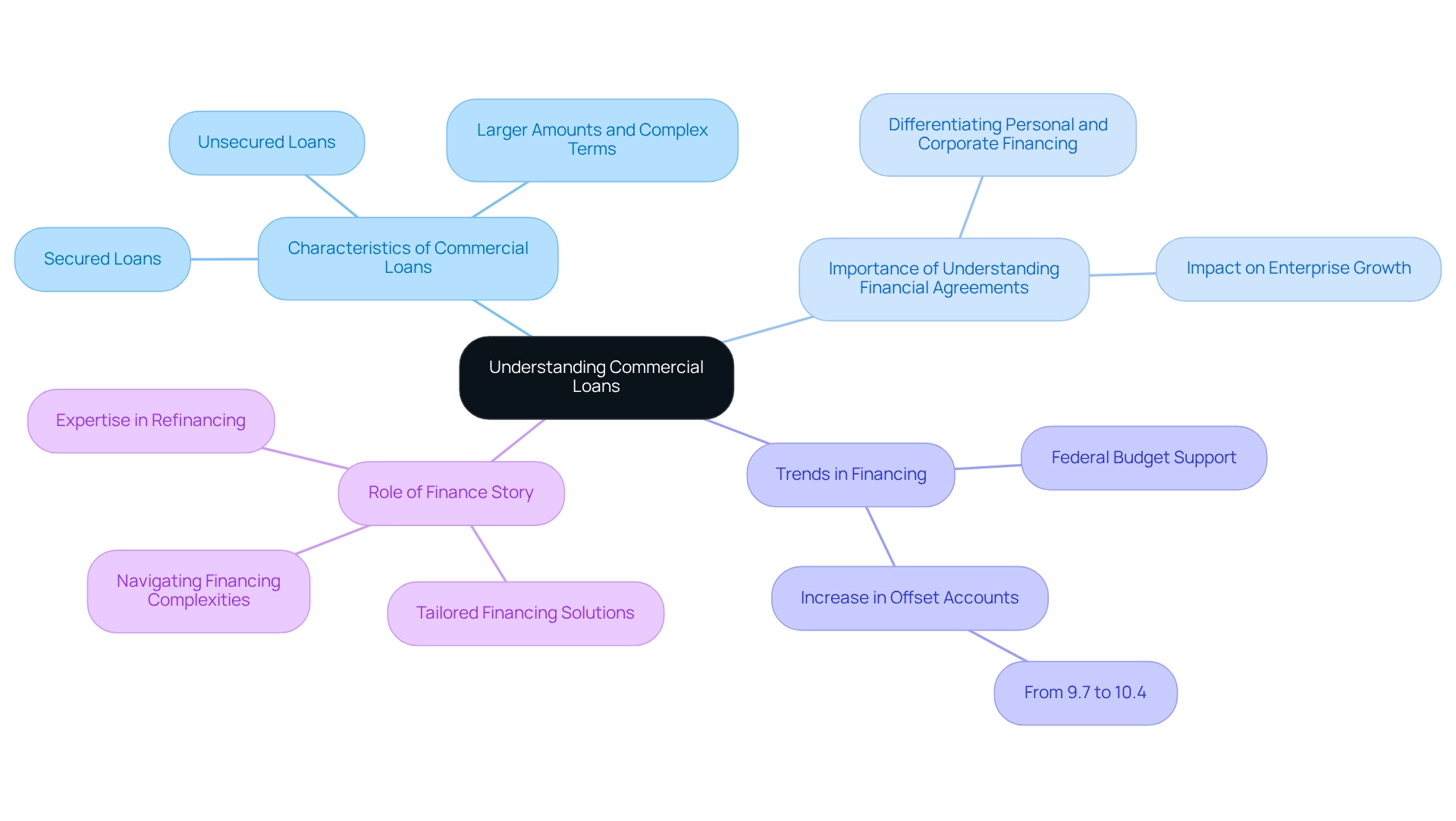

Understanding Commercial Loans: An Overview

Commercial financing options represent specialized financial products tailored to meet the diverse operational needs of enterprises, including property acquisition, equipment purchases, and cash flow management. Unlike personal financing, which typically involves smaller amounts and simpler terms, business financing is generally larger and incorporates stipulations specifically designed for corporate requirements. In Australia, commercial loan terms can be classified as secured or unsecured; secured options require collateral—such as real estate or equipment—to mitigate the lender's risk.

As we look ahead to 2025, the landscape of business financing in Australia reveals a notable trend, with the balance of offset accounts increasing from 9.7% to 10.4% of total credit limits over the year leading up to June 2024. This statistic underscores the growing importance of strategic financial management among companies, as they work to optimize their borrowing costs and enhance cash flow.

Expert insights highlight that a comprehensive understanding of financial agreements is critical for enterprise growth. Financial professionals emphasize that businesses must differentiate between personal and corporate financing, as the terms, interest rates, and repayment structures can vary significantly. For instance, corporate financing often entails higher interest rates due to the increased risk associated with entrepreneurial ventures; however, it also presents opportunities for substantial capital that can drive growth.

Finance Story excels in crafting tailored and sophisticated cases for presentation to banks, ensuring that small business owners secure the financing options best suited to their unique needs. Our expertise in refinancing and obtaining customized funding for property investments empowers us to assist clients in navigating the complexities of the financing process, helping them understand repayment conditions and make informed decisions.

Case studies illustrate the effective application of commercial loan terms in Australia, demonstrating their role in fostering enterprise growth nationwide. Many small to medium enterprises (SMEs) have leveraged these funds to invest in technological advancements or expand their operational capabilities, resulting in increased productivity and competitive market positioning. The Australian Banking Association has recently endorsed the 2025-26 Federal Budget, which aims to bolster confidence in the financial system and provide essential support to businesses facing economic challenges.

As Anna Bligh, CEO of the Australian Banking Association, remarked, "This Budget provides extra support to Australians in the short-term whilst at the same time helping to address some of our longer-term challenges."

In conclusion, understanding the intricacies of financial agreements is vital for entrepreneurs aiming to leverage funding for growth. By recognizing the differences between corporate and personal financing and staying informed about current trends and statistics, businesses can make educated decisions regarding commercial loan terms in Australia that align with their financial goals and operational needs. With a strong reputation for professionalism and in-depth knowledge of the finance industry, Finance Story is well-positioned to assist small business owners in navigating the complexities of business financing, ensuring they secure the most suitable funding options tailored to their specific requirements.

Key Terms and Conditions of Commercial Loans

Key commercial loan terms in Australia related to business financing encompass interest rates, repayment durations, and various charges, all of which significantly influence the total cost of borrowing. As of April 2025, average interest rates for business financing in Australia are expected to range between 5% and 7%, depending on the lender and specific financing conditions. These rates may be either fixed or variable, each option carrying unique implications for borrowers throughout the term.

Typical repayment periods for business loans under commercial loan terms in Australia vary considerably, generally spanning from 1 to 25 years. This flexibility allows companies to select a duration that aligns with their financial strategies and cash flow forecasts. However, it is essential for borrowers to comprehend the associated fees under these terms, which may include establishment fees, ongoing fees, and early repayment penalties.

For instance, establishment fees can range from 1% to 3% of the loan amount, while ongoing charges may be billed monthly or yearly, impacting the overall expense of financing.

Expert insights underscore the importance of thoroughly examining the commercial loan terms in Australia, along with the key conditions of business loans. Tim Coy, research manager for the Real Estate sector at Deloitte, notes that the real estate industry is expected to gain greater clarity in the next 12 to 18 months, potentially affecting borrowing decisions. Financial analysts stress that understanding these components is vital for organizations to accurately assess their financing options, particularly the commercial loan terms in Australia, and to plan their budgets effectively.

Moreover, as firms further along in their AI implementation anticipate a significant increase in personnel, this trend may streamline decision-making processes and enhance operational efficiency in securing loans.

Finance Story specializes in crafting refined and highly customized cases for presentation to banks, ensuring that small enterprise owners can secure the appropriate funding for their property investments. We offer a comprehensive range of lenders to accommodate various circumstances, whether you are purchasing a warehouse, retail premise, factory, or hospitality venture. Furthermore, we assist in restructuring financing options to adapt to the evolving needs of your enterprise.

Practical illustrations demonstrate how commercial loan terms in Australia are shaped by interest rates and repayment conditions on business financing. Companies like Alpaca RE and JLL have adeptly navigated the complexities of financing by leveraging advanced technologies to enhance decision-making processes. For example, Alpaca RE's AI platform facilitates superior investment opportunities through automated data analysis, while JLL's in-house model supports space utilization and predictive insights.

These case studies emphasize the necessity of adapting to market conditions and employing innovative solutions to optimize financial outcomes. By grasping the nuances of commercial loan terms in Australia, enterprises can make informed decisions that align with their growth objectives. Additionally, it is crucial to consider the government's stance on data sharing regarding products, as this clarity can significantly influence the understanding of financing terms.

Types of Commercial Loans Available in Australia

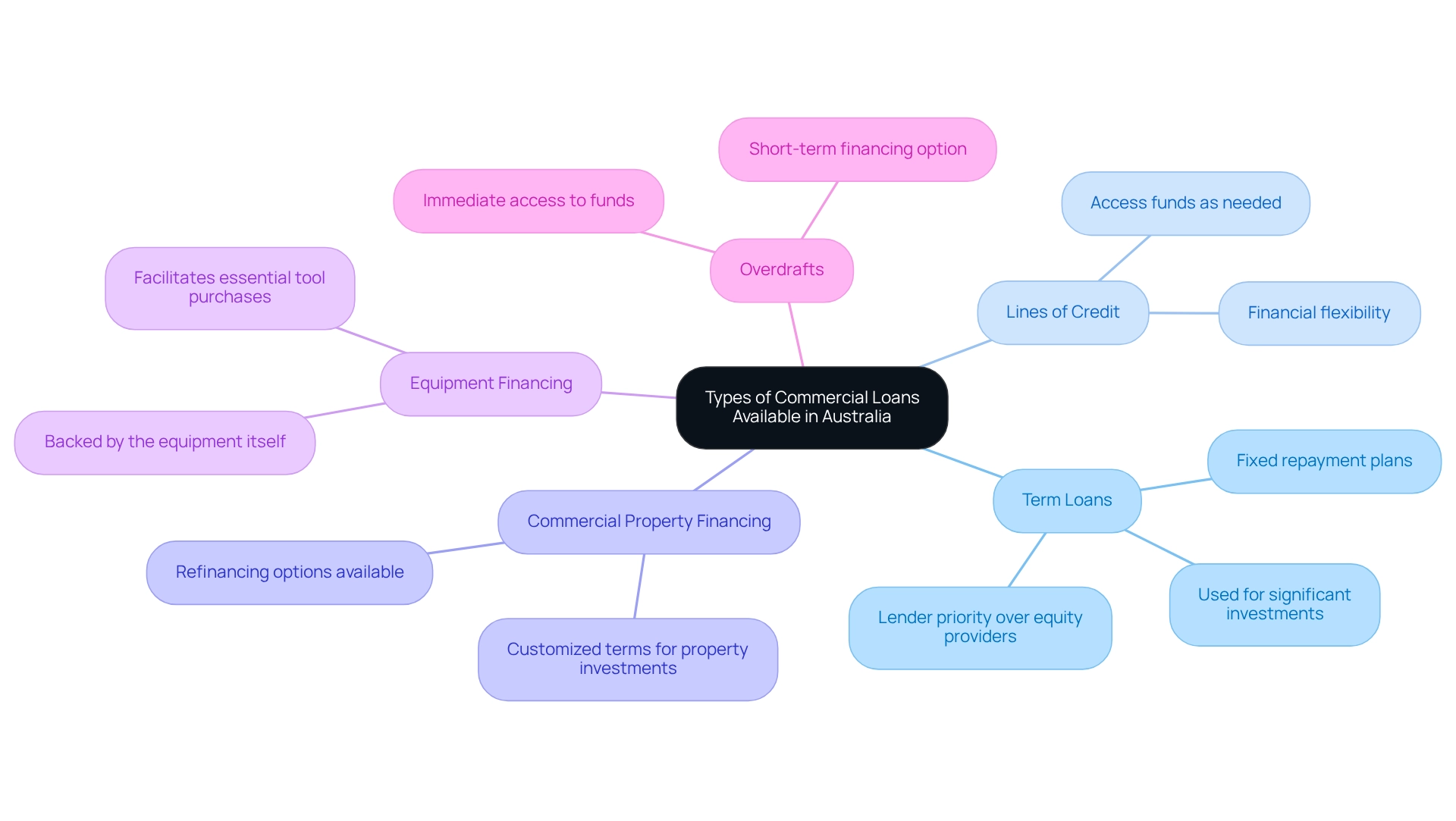

In Australia, a diverse range of commercial loan terms is available to meet the varying requirements of enterprises. The primary types include:

- Term Loans: These loans involve fixed amounts borrowed for a predetermined period, typically utilized for significant investments such as purchasing equipment or real estate. They provide reliable repayment plans, simplifying budgeting for organizations. Significantly, lenders take precedence over equity providers if the borrower is unable to pay, highlighting the dependability of these loans.

- Lines of Credit: This adaptable borrowing choice permits companies to access funds as required, making it perfect for handling cash flow variations. Businesses can access capital up to a predetermined limit, offering financial flexibility.

- Commercial Property Financing: Specifically designed for the acquisition or refinancing of commercial real estate, these options often come with customized terms that reflect the unique nature of property investments. Finance Story specializes in crafting refined and highly personalized cases to present to banks, ensuring that your funding proposal meets the increasingly elevated expectations of lenders. We provide a comprehensive selection of lenders, including high street banks and creative private financing panels, to accommodate your unique situation.

- Equipment Financing: These financial products are designed for purchasing machinery or equipment, often backed by the equipment itself. This kind of funding enables companies to invest in essential tools without straining their cash flow.

- Overdrafts: A short-term financing option that allows companies to withdraw more than their account balance, providing immediate access to funds during cash flow shortages.

Each financing type serves distinct purposes and is accompanied by specific conditions. For example, installment financing usually includes fixed interest rates, whereas lines of credit might possess variable rates that change with market conditions. Grasping these distinctions is essential for entrepreneurs to make knowledgeable choices regarding their funding alternatives.

Recent data shows that commercial loan terms remain favored among Australian enterprises, particularly for capital expenditures, whereas lines of credit are preferred for operational flexibility. As companies navigate their financial environments, insights from financial consultants indicate that assessing the intended use of funds and the repayment ability is crucial in choosing the appropriate type of financing. This strategic method can greatly influence a company's financial well-being and growth prospects.

Furthermore, the Commonwealth funding in collaboration with the New South Wales Government enables simultaneous execution of Stage 1 and Stage 2, offering additional financing alternatives for enterprises. Bruce Wan, Head of Research for MaxCap Group, notes that for investors, there is improving access to a highly profitable set of private credit opportunities, previously only available to a cozy banking oligopoly. Moreover, Finance Story has established a comprehensive complaints resolution process that aligns with ASIC's Regulatory Guide RG 271, demonstrating the company's commitment to handling complaints fairly and enhancing customer satisfaction and trust.

Factors Influencing Commercial Loan Terms

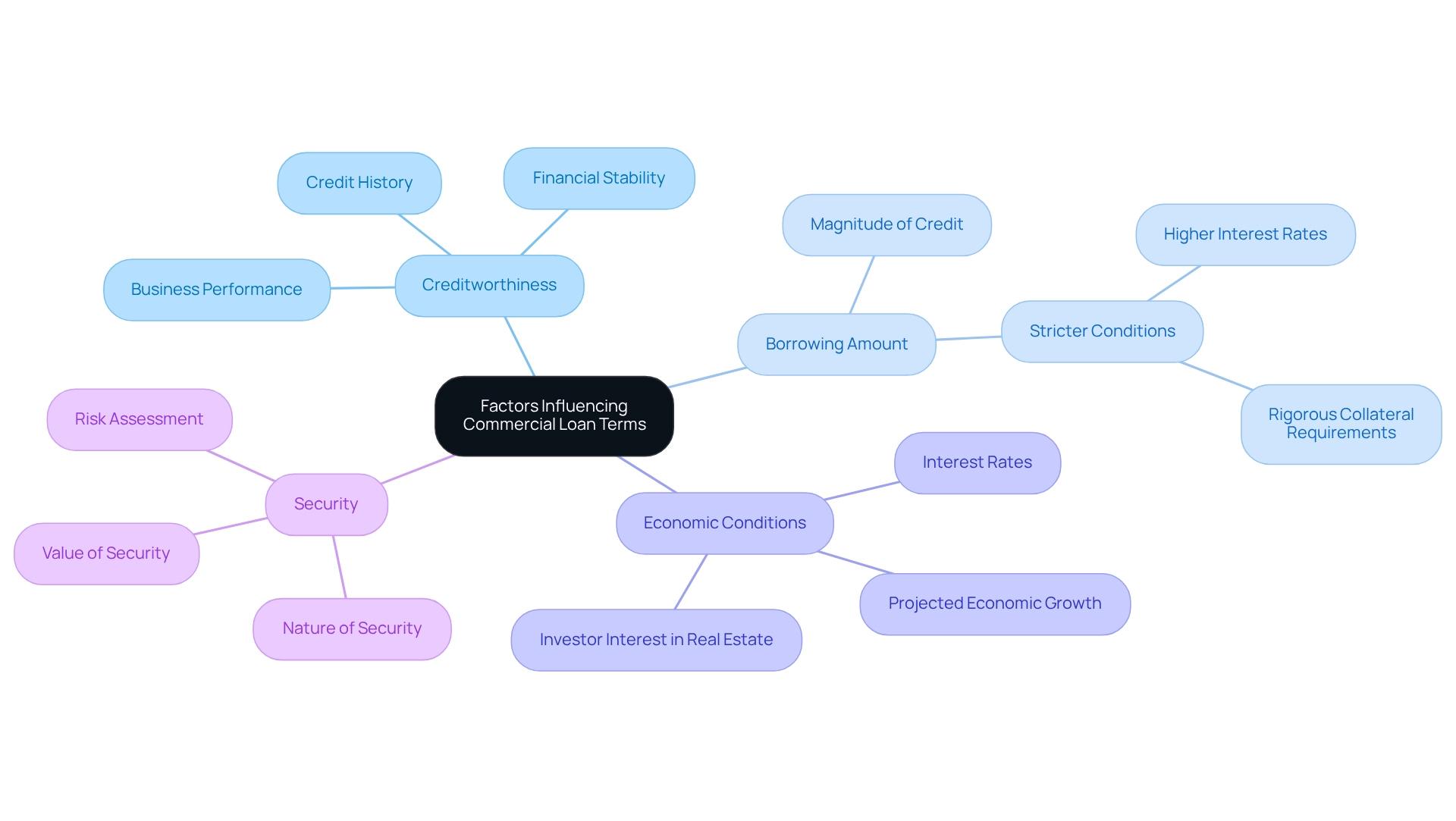

Several critical factors influence the terms of commercial loans in Australia, shaping the landscape for borrowers seeking financing:

-

Creditworthiness: Lenders meticulously evaluate a borrower's credit history, financial stability, and overall business performance. A robust credit profile not only increases the chances of approval but also results in more advantageous conditions, such as reduced interest rates and longer repayment durations. Finance Story specializes in assisting small business owners enhance their creditworthiness through customized funding proposals that reflect their unique financial circumstances.

-

Borrowing Amount: The magnitude of the borrowing plays a significant role in deciding the conditions. Larger credit amounts typically carry stricter conditions due to the heightened risk perceived by lenders. This can manifest in higher interest rates or more rigorous collateral requirements. At Finance Story, we recognize the subtleties of funding amounts and strive tirelessly to obtain the most favorable conditions for our clients, utilizing our complete array of lenders to accommodate any situation.

-

Economic Conditions: The wider economic setting, especially interest rates established by the Reserve Bank of Australia, greatly affects credit accessibility and conditions. As the Australian economy is projected to experience slightly higher growth and modestly lower inflation in 2025, these factors may lead to more competitive loan offerings. This outlook is further supported by the increasing investor interest in commercial real estate, as highlighted in the case study "Investor Sentiment and Market Dynamics," which notes that the anticipated decline in interest rates and strong demand for real estate due to population growth enhances the appeal of commercial real estate debt.

-

Security: The nature and value of the security offered can significantly affect the interest rate and repayment conditions. High-value, low-risk collateral can result in more favorable borrowing conditions, while less secure collateral may lead to increased costs for the borrower. Finance Story's knowledge in refinancing enables us to assist clients in showcasing their collateral effectively to lenders, ensuring they obtain the most favorable conditions.

Comprehending these elements is crucial for borrowers seeking to position themselves effectively when discussing commercial loan terms in Australia and requesting financing. For instance, companies that actively strive to enhance their creditworthiness—through timely payments, reducing debt levels, and maintaining transparent financial records—can significantly improve their chances of obtaining better loan terms.

As Bruce Wan, Head of Research for MaxCap Group, notes, "For investors, most importantly, there is improving access to a highly profitable set of private credit opportunities, previously only available to a cozy banking oligopoly." This sentiment reflects the evolving landscape of business financing, where borrowers who are well-prepared and informed about these influencing factors will be better equipped to navigate the complexities of securing business financing. Finance Story, with its professionalism and deep understanding of the finance sector, stands ready to assist small enterprise owners in achieving their financial goals efficiently by creating individualized cases tailored to their specific needs.

Navigating the Commercial Loan Application Process

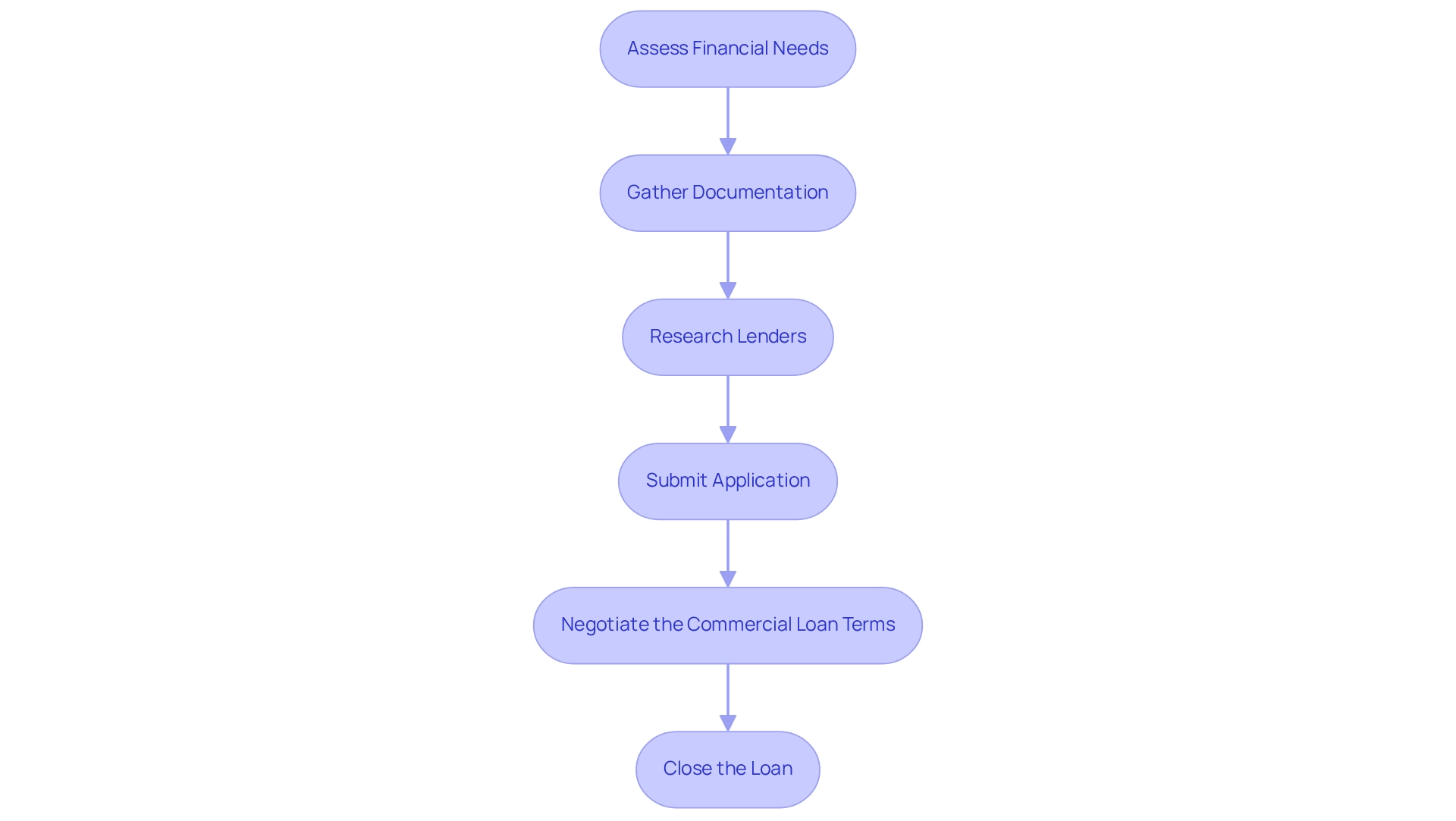

Navigating the commercial loan terms in Australia application process requires careful planning and execution, particularly when seeking customized funding solutions for your enterprise. Here are the essential steps to follow:

-

Assess Financial Needs: Begin by determining the specific amount required and the intended purpose of the funding. This clarity will guide your application and help lenders understand your objectives.

-

Gather Documentation: Compile all necessary documents, including financial statements, business plans, tax returns, and any other relevant information. Lenders typically expect comprehensive documentation, especially for amounts exceeding $2,000,000, which often necessitate annual reviews. Ensuring that your documentation is thorough can significantly impact your loan approval chances.

-

Research Lenders: Investigate potential lenders to identify those that align with your financing needs. Finance Story offers a full range of lenders, including high street banks and innovative private lending panels, to suit various circumstances. Compare their offerings, terms, and conditions to find the best fit for your situation. As Carl Dittrich notes, "The nature of commercial real estate financing has changed drastically over the past decade... thus, going forward, it will be essential to provide clients with access to a broad spectrum of alternative sources of financing." Understanding the evolving commercial loan terms in Australia available to borrowers is crucial in this step.

-

Submit Application: Complete the financing application meticulously, ensuring that all required documentation is included. A well-prepared application can significantly enhance your chances of approval. Finance Story specializes in creating refined and highly personalized cases to present to lenders, ensuring you find the right financing solutions tailored to your needs.

-

Negotiate the Commercial Loan Terms: Be prepared to discuss the conditions of the financing based on input from the lender. Understanding your business's unique needs will empower you to advocate for favorable conditions. Customized guidance from specialists such as Finance Story can result in successful financing outcomes, making this step crucial in the application process.

-

Close the Loan: Once your loan is approved, carefully review the loan agreement before signing. Ensure that you fully understand all terms and conditions to avoid any surprises later.

By adhering to these steps and leveraging expert guidance, borrowers can streamline the application process and improve their likelihood of securing the necessary financing under commercial loan terms in Australia. Finance Story can assist with various types of business properties, including warehouses, retail locations, factories, and hospitality ventures, as well as refinancing options to meet the evolving needs of your company. As the financial landscape continues to evolve, the insights from Finance Story become essential in navigating these complexities effectively.

Challenges in Securing Commercial Loans and How to Overcome Them

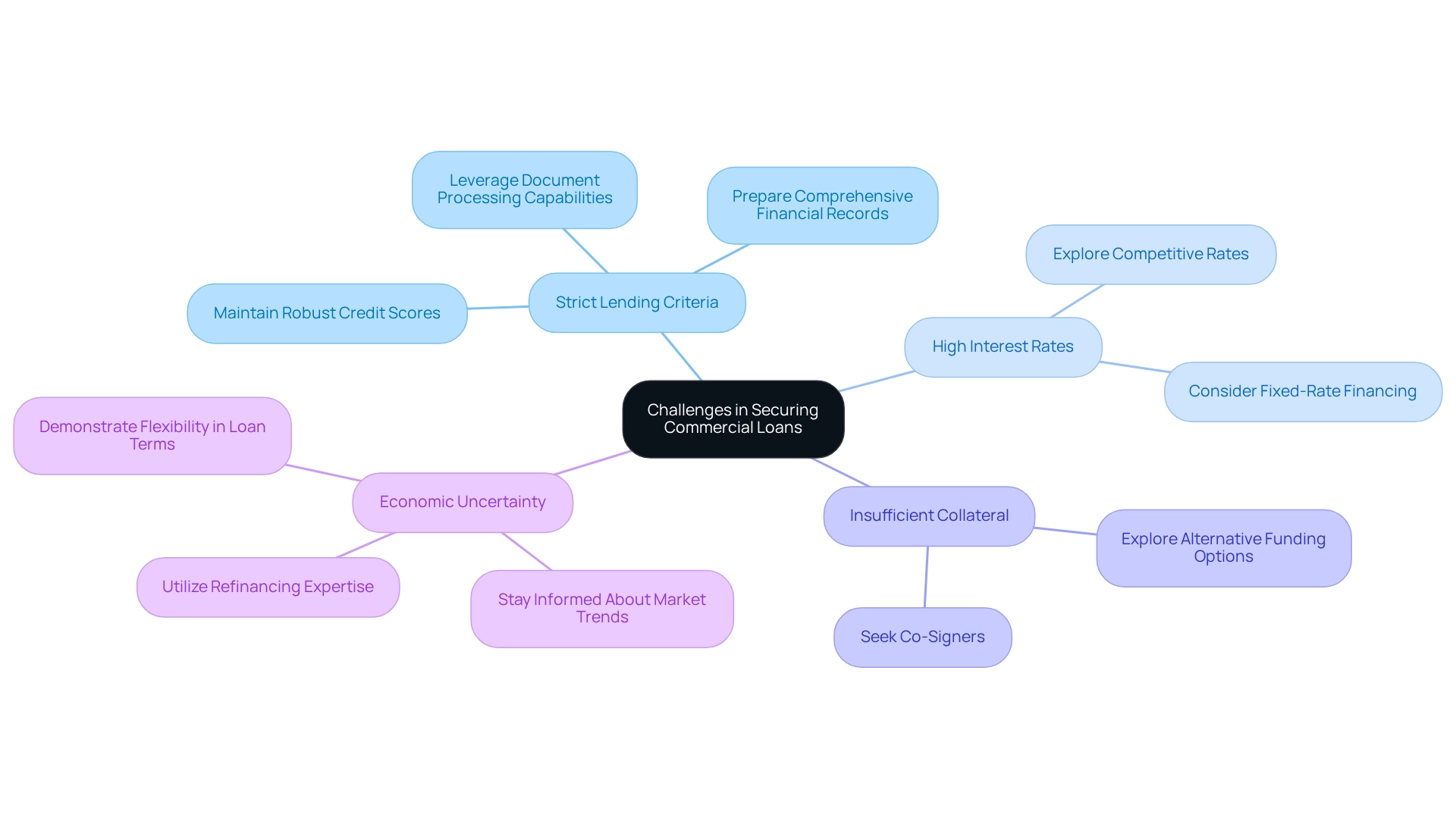

Navigating the landscape of commercial loan terms in Australia presents numerous challenges that require strategic insight. Key obstacles include:

-

Strict Lending Criteria: Many lenders impose stringent requirements, making it difficult for businesses to qualify for loans. To enhance their opportunities, borrowers should focus on maintaining robust credit scores and preparing comprehensive financial records that showcase their enterprise's stability and growth potential, particularly when considering commercial loan terms in Australia. At Finance Story, we specialize in crafting polished and highly tailored cases for banks, significantly improving your chances of approval. Leveraging document processing capabilities can enhance the extraction and analysis of both structured and unstructured data, thereby improving servicing and investment discovery.

-

High Interest Rates: The volatility of interest rates can greatly affect borrowing costs. To mitigate this, businesses are encouraged to explore competitive rates and consider fixed-rate financing, which offers predictability in repayment amounts over time. Our extensive network of lenders, including high street banks and innovative private lending panels, ensures that you can find the best commercial loan terms in Australia tailored to your specific needs.

-

Insufficient Collateral: Companies that lack adequate collateral may struggle to secure financing. In such cases, exploring alternative funding options, such as unsecured credit or seeking co-signers, can provide viable pathways to financing. Finance Story is here to guide you through these options, ensuring you grasp the implications and benefits.

-

Economic Uncertainty: Fluctuations in the economy can impact lending options and conditions. Staying informed about market trends and demonstrating flexibility in commercial loan terms can enhance an enterprise's attractiveness to lenders. Our expertise in refinancing enables us to assist you in adapting your financial strategies to align with evolving market conditions.

In 2025, companies are facing increased scrutiny from lenders, with many reporting that strict lending criteria have intensified. A recent case study titled "Not Paying Bills on Time" highlighted a small enterprise that struggled with late payments to suppliers, ultimately affecting its creditworthiness. By implementing accounts payable automation software, the organization streamlined its payment processes, improved supplier relationships, and regained its financial footing, illustrating a practical solution to overcoming lending challenges.

Expert opinions underscore the significance of preparation and adaptability in this landscape. Financial consultants advocate for companies to proactively address these challenges by enhancing their financial profiles and exploring various funding options. As Lao Tzu wisely stated, "The journey of a thousand miles begins with a single step."

By taking these steps, borrowers can significantly bolster their chances of securing the necessary financing to support their growth and operational needs.

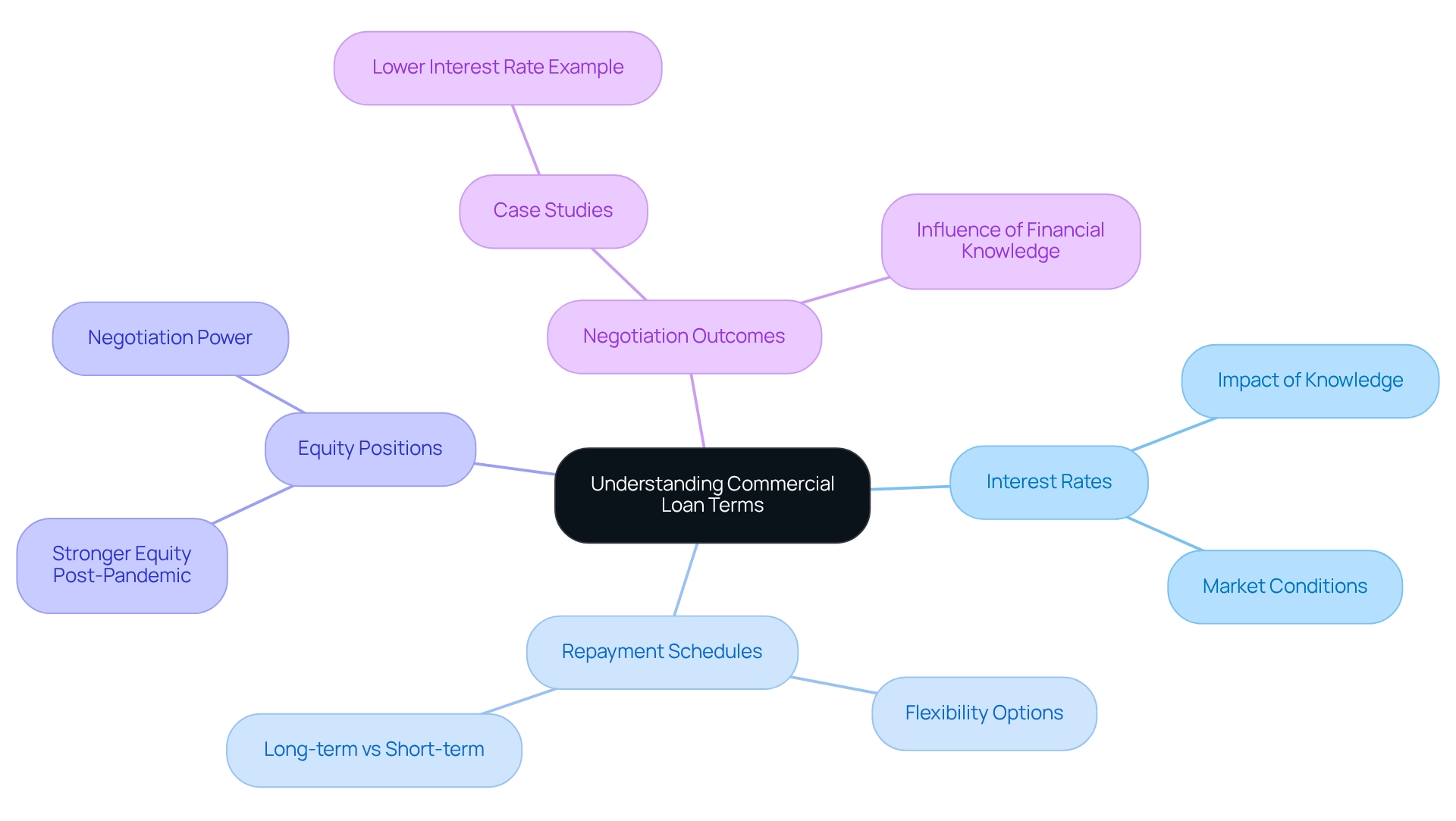

The Importance of Understanding Commercial Loan Terms

Understanding the complexities of commercial loan terms in Australia is essential for entrepreneurs, significantly impacting their financial wellbeing and operational success. At Finance Story, we excel in crafting tailored cases that empower borrowers to secure optimal financing options. A thorough comprehension of interest rates, repayment schedules, and associated fees enables borrowers to make informed decisions and enhances their bargaining power with lenders.

Today, borrowers typically possess stronger equity positions than before the pandemic, alleviating immediate financial pressure and allowing for more favorable negotiation of financing conditions. This increased equity enables businesses to approach creditors with greater confidence, potentially securing customized financial solutions that meet their specific needs, whether for a large warehouse, retail location, factory, or hospitality project.

Moreover, understanding the factors that influence financing conditions can lead to more advantageous outcomes during negotiations. Companies that successfully navigate the lending landscape often cite their grasp of borrowing conditions as a pivotal factor in securing favorable funding. A recent case study highlighted how a small business, by understanding its financing conditions, negotiated a lower interest rate, resulting in significant savings over the life of the loan.

Statistics reveal that the total value of new credit commitments for investors has fluctuated, with recent data indicating 48,876 investor credit commitments—a 4.5% decline from the previous quarter but a 13.2% increase compared to the same quarter last year. This underscores the importance of informed borrowing in a competitive market, especially as businesses face potential challenges from rising insolvencies among medium and large enterprises, which could influence lending conditions.

Ultimately, a comprehensive understanding of commercial loan terms in Australia prepares firms to utilize financing effectively while fostering growth and sustainability. By enhancing their knowledge and collaborating with experts like Finance Story, business owners can improve their negotiation outcomes, ensuring they secure the best possible terms for their financial needs.

Conclusion

Understanding commercial loans is integral for business owners aiming to leverage financing for growth. This article has explored the various types of commercial loans available in Australia, including term loans, lines of credit, and equipment financing, each serving distinct business needs. The importance of comprehending key terms and conditions, such as interest rates, repayment periods, and fees, has been emphasized, as these factors significantly influence the overall cost of borrowing.

Additionally, the article highlighted the critical elements affecting loan terms, such as creditworthiness, loan amounts, economic conditions, and collateral. By grasping these factors, businesses can better position themselves when negotiating loan terms, ultimately enhancing their chances of securing favorable financing.

Navigating the commercial loan application process has also been addressed, underscoring the importance of thorough preparation and documentation. Recognizing the potential challenges in securing loans, such as strict lending criteria and high-interest rates, equips borrowers with strategies to overcome these obstacles effectively.

In conclusion, a robust understanding of commercial loans empowers business owners to make informed financing decisions that align with their operational objectives. With the right knowledge and expert guidance, businesses can unlock their full potential, ensuring they secure the most suitable financing options tailored to their unique needs. As the landscape of commercial lending continues to evolve, staying informed and adaptable will be crucial for sustained growth and success.