Overview

Utilizing a Self-Managed Super Fund (SMSF) to acquire commercial property empowers individuals to take control of their retirement savings. This approach not only offers tax efficiencies but also provides significant investment flexibility. This article delineates the essential steps for:

- Establishing an SMSF

- Selecting suitable properties

- Navigating the financial and regulatory landscape

It underscores the critical importance of compliance and strategic planning in order to maximize investment potential.

Introduction

In the realm of retirement planning, Self-Managed Super Funds (SMSFs) stand out as a powerful tool for savvy investors eager to take charge of their financial futures. With the capability to invest in commercial properties, SMSFs offer a unique combination of autonomy, tax benefits, and strategic investment opportunities. However, the complexities of establishing and managing an SMSF can be overwhelming. This article explores the essential steps for:

- Setting up an SMSF

- Selecting the right commercial property

- Understanding the financial and tax implications involved

As the trend of SMSFs continues to gain momentum in Australia, grasping these concepts is vital for anyone looking to leverage this investment vehicle effectively.

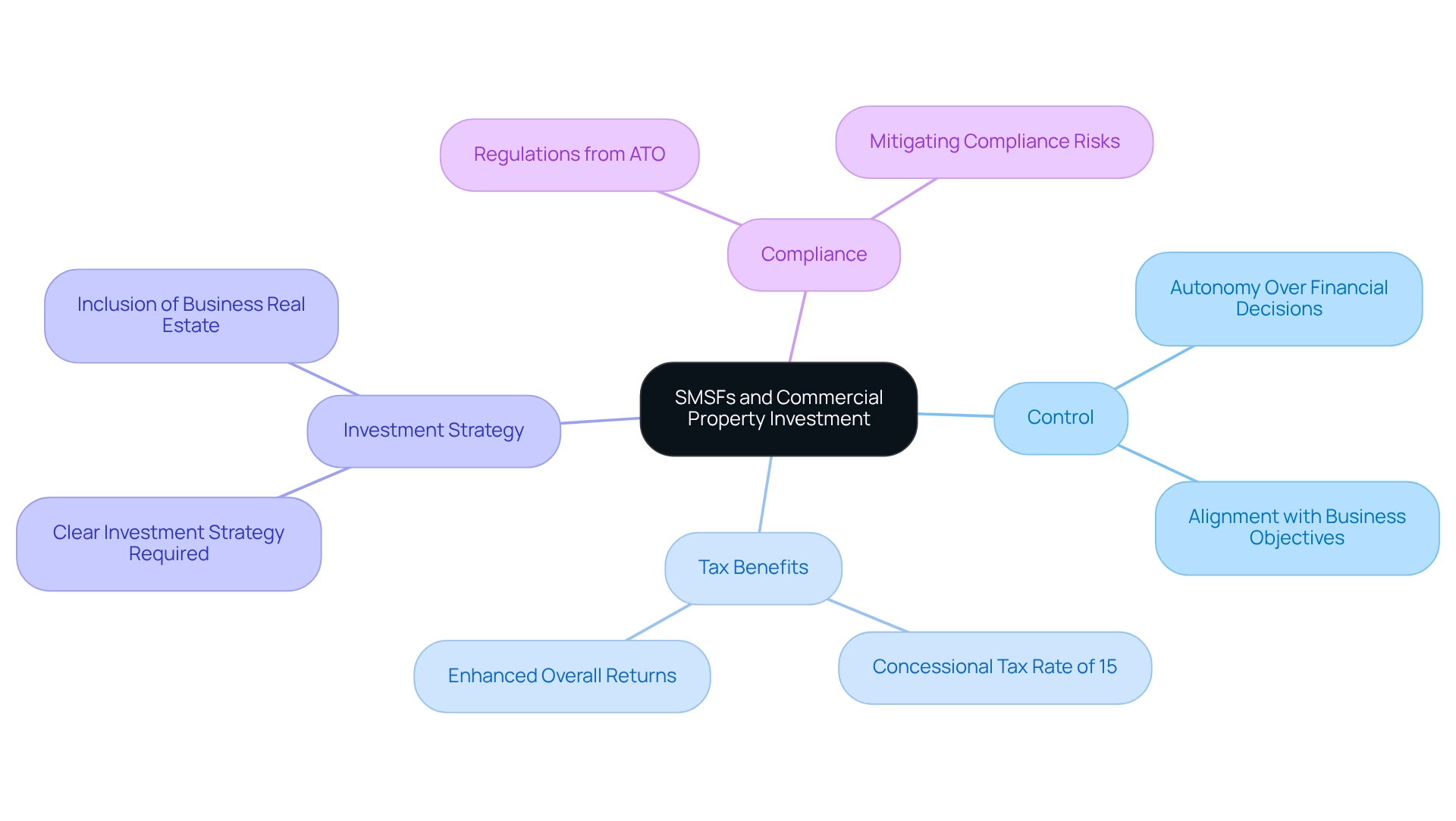

Understand SMSFs and Their Role in Commercial Property Investment

Self-Managed Super Funds (SMSFs) serve as private superannuation funds that empower members to take control of their retirement savings, particularly by using SMSF to buy commercial property, while offering the flexibility to invest in a variety of assets. Consider the essential aspects:

- Control: SMSFs provide complete autonomy over financial decisions, enabling members to tailor their portfolios to meet specific financial goals and risk tolerance. This level of control is particularly beneficial for small business owners looking to align their financial strategies with their business objectives.

- Tax Benefits: Allocations within a self-managed super fund are taxed at a concessional rate of 15%, often lower than individual tax rates. This tax efficiency can significantly enhance overall returns, making SMSFs an attractive option for business real estate investments.

- Investment Strategy: An SMSF must maintain a clear investment strategy that aligns with the members' retirement objectives. This strategy should explicitly include the acquisition of business real estate if it contributes positively to the overall financial plan, allowing for potential growth in retirement savings.

- Compliance: SMSFs are subject to stringent regulations from the Australian Taxation Office (ATO), which encompass rules regarding related-party transactions and in-house assets. Adhering to these regulations is crucial to mitigate compliance risks and uphold the fund's integrity.

Recent statistics reveal a notable increase in SMSFs across Australia, with numerous investors recognizing the advantages of utilizing these funds for business asset acquisitions. For instance, using SMSF to buy commercial property provides benefits such as control over rental income, tax efficiency, and asset protection. Successful case studies illustrate how business owners have leveraged SMSFs to enhance their retirement savings while maintaining control over their assets. Financial advisors underscore that while SMSFs offer substantial flexibility, they also necessitate diligent management to navigate compliance and diversification challenges. Overall, understanding these aspects is vital for anyone contemplating using SMSF to buy commercial property for business real estate.

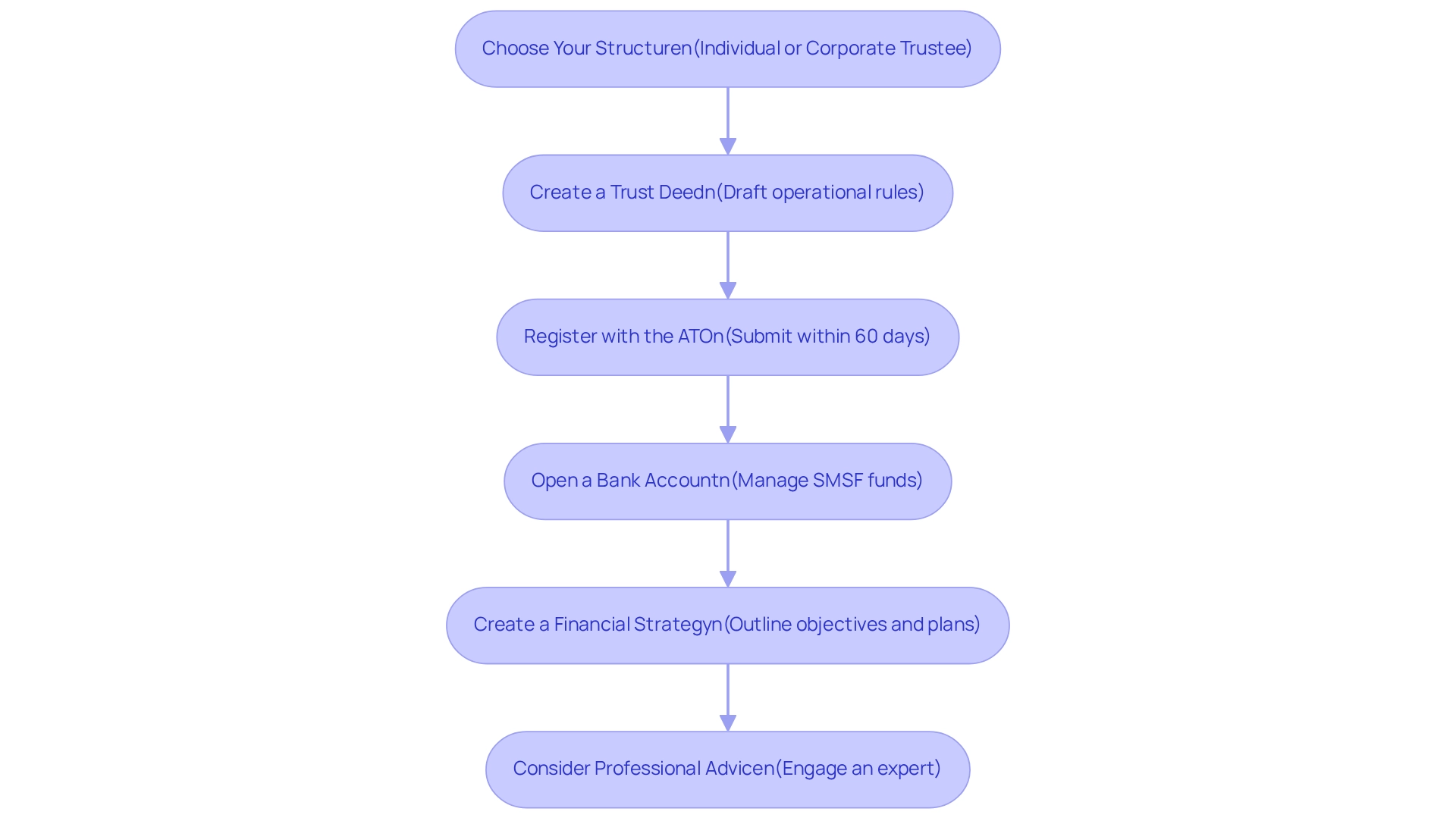

Establish Your Self-Managed Super Fund (SMSF)

To establish your Self-Managed Superannuation Fund (SMSF) for business property holdings, follow these critical steps:

-

Choose Your Structure: Determine whether your SMSF will operate with individual trustees or a corporate trustee. Each option presents distinct advantages and challenges that should align with your investment goals, especially when considering business properties.

-

Create a Trust Deed: Draft a detailed trust deed that specifies the operational rules of your SMSF. This document must adhere to superannuation regulations to ensure compliance, particularly regarding business real estate investments.

-

Register with the ATO: Within 60 days of establishment, submit your SMSF for registration with the Australian Taxation Office (ATO) to obtain legal recognition, which is essential for investing in business properties.

-

Open a Bank Account: Set up a bank account in the name of your SMSF to manage its funds and transactions effectively, ensuring seamless operations for your business investments.

-

Create a Financial Strategy: Develop a documented financial strategy that outlines your monetary objectives, risk tolerance, and specific plans for investing in business real estate. This strategy should illustrate the reduced limitations associated with business real estate compared to residential options.

-

Consider professional advice: Engaging a financial advisor or accountant with expertise in SMSFs can be invaluable when using SMSF to buy commercial property, as it ensures compliance and optimizes your fund's setup while navigating the complexities of these acquisitions.

Completing these steps will not only ensure your SMSF is legally compliant but also strategically position it for future investments using SMSF to buy commercial property. Notably, as of 2025, there are over 600,000 SMSFs registered in Australia, reflecting the increasing trend of individuals taking control of their retirement savings. However, prospective trustees should be prepared for the commitment, as managing an SMSF typically requires approximately 100 hours each year. Furthermore, the average cost to set up an SMSF in Australia is expected to be around AUD 3,000 in 2025, underscoring the importance of careful planning and professional guidance.

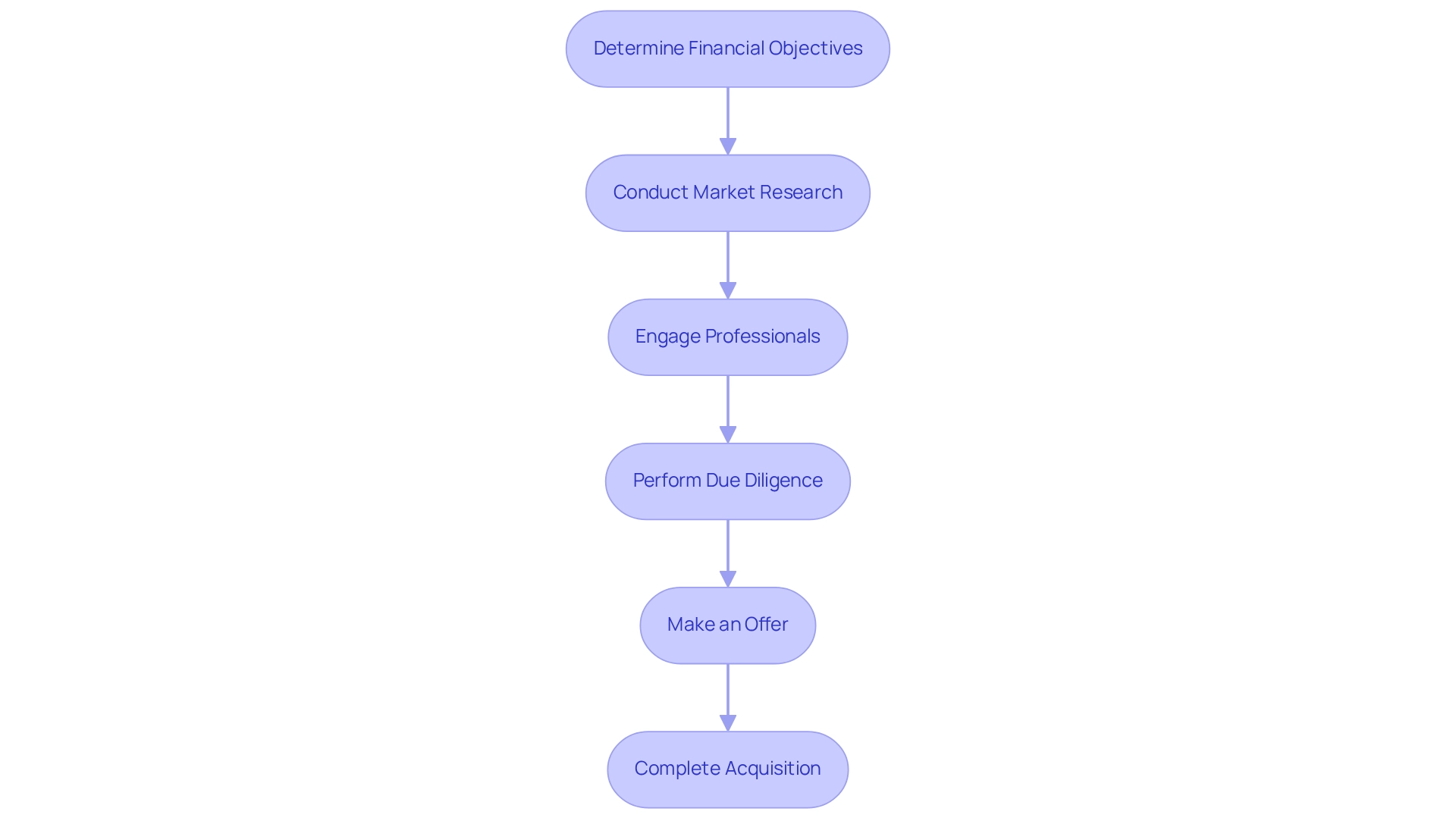

Select and Purchase Your Commercial Property

Choosing and acquiring business real estate involves several critical steps when using SMSF to buy commercial property:

-

Determine Your Financial Objectives: Clearly outline the type of business real estate that aligns with your financial strategy, whether it be office space, retail, or industrial.

-

Conduct Market Research: Thoroughly analyze the market to identify potential assets that meet your criteria. Key factors to consider include location, pricing, and the potential for capital growth. Notably, the Australian business real estate market is witnessing strong foreign funding, aiding in its expansion and diversification.

-

Engage Professionals: Collaborate with a real estate agent specializing in commercial real estate. Their expertise will be invaluable in navigating the search and negotiation processes.

-

Perform Due Diligence: Prior to making an offer, conduct comprehensive due diligence. This should encompass real estate inspections, financial evaluations, and legal verifications to ensure the investment is sound.

-

Make an Offer: Once you identify a suitable location, submit a formal offer. Be prepared to negotiate terms and conditions to reach a mutually beneficial agreement.

-

Complete the acquisition by working closely with your solicitor to finalize the acquisition agreement after your offer is accepted, ensuring all legal requirements are met. By following these steps, you can effectively obtain a commercial asset using SMSF to buy commercial property, which positions you for potential returns in a market projected to see significant developments, such as the construction of approximately 850,000 square meters of multi-storey warehouses in Sydney from 2023 to 2027.

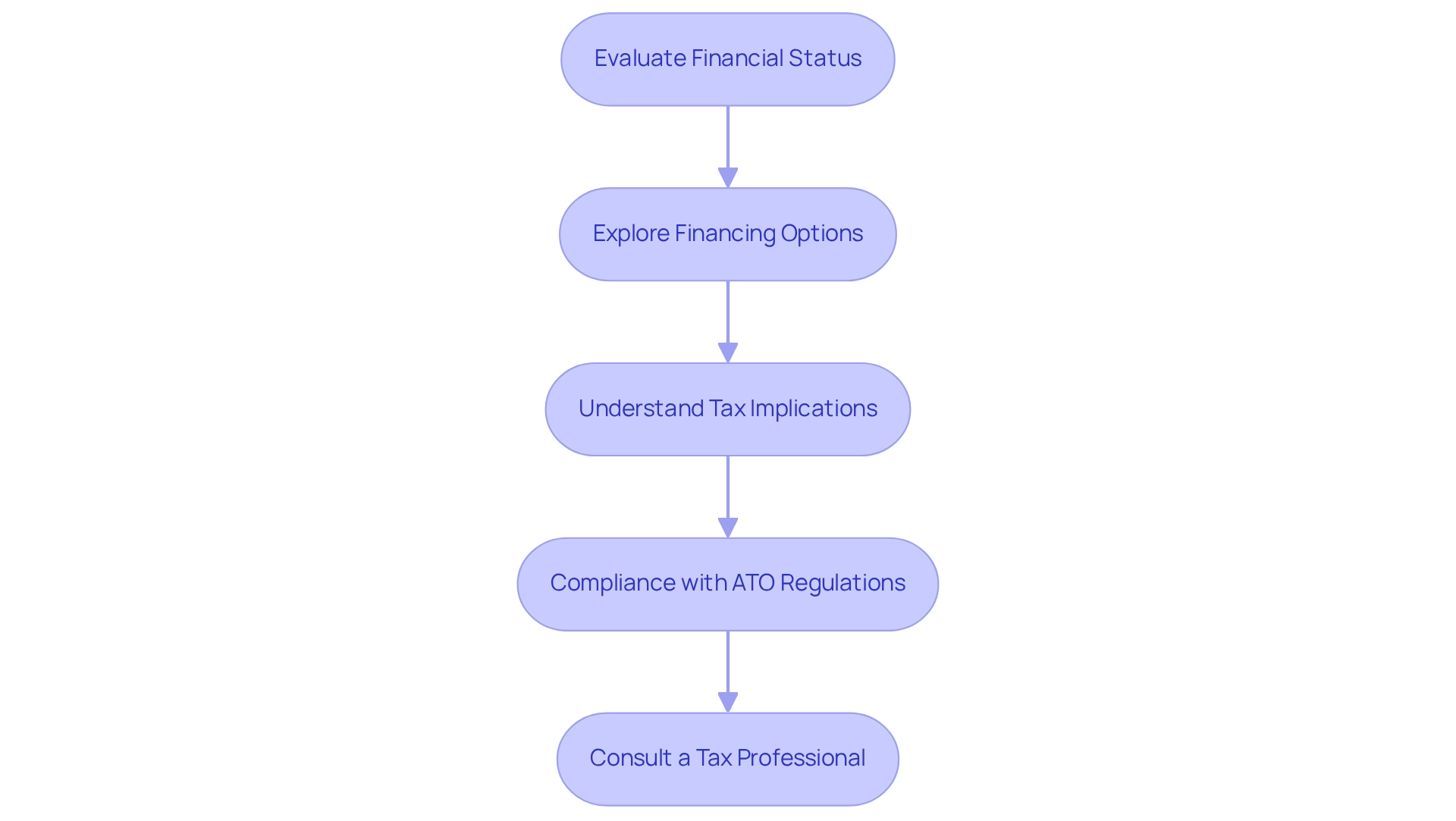

Navigate Financing and Tax Considerations for Your Investment

Navigating financing and tax considerations is crucial for optimizing your self-managed super fund (SMSF) investments, especially when using SMSF to buy commercial property.

-

Evaluate Your Self-Managed Super Fund's Financial Status: Begin by confirming that your SMSF has sufficient resources to cover the purchase cost, including related charges such as stamp duty and ongoing expenses. With the average SMSF member holding approximately $791,000 in assets, this can be a significant resource for real estate investment.

-

Explore Financing Options: If your SMSF lacks enough cash for a full purchase, consider a Limited Recourse Borrowing Arrangement (LRBA). This financing method allows your SMSF to secure funds while limiting the lender's claim solely to the asset, thereby protecting other SMSF assets.

-

Understand Tax Implications: Rental income generated from the asset is subject to a concessional tax rate of 15%. Additionally, properties held for more than 12 months may qualify for a capital gains tax discount upon sale, thereby enhancing the investment's profitability.

-

Compliance with ATO Regulations: It is essential to ensure that all transactions comply with ATO regulations, including leasing arrangements and related-party transactions. Adhering to these regulations is vital to avoid penalties and maintain the tax concessions of the fund.

-

Consult a Tax Professional: Engaging a tax advisor is critical for navigating the complexities of SMSF taxation. Their expertise will help ensure compliance with current laws while optimizing your investment strategy.

By meticulously considering these financial and tax aspects, you can refine your investment strategy while ensuring regulatory compliance. Furthermore, consider diversifying your SMSF portfolio using SMSF to buy commercial property, such as office buildings, warehouses, and retail premises. For tailored guidance and to explore your options, BOOK A CHAT with Finance Story.

Conclusion

Understanding the intricacies of Self-Managed Super Funds (SMSFs) is crucial for anyone looking to harness their potential for commercial property investment. Control, tax benefits, and strategic planning are paramount when establishing an SMSF. By taking charge of their retirement savings, individuals can customize their investment strategies to align with personal financial goals while navigating compliance requirements.

Setting up an SMSF involves several key steps:

- Choosing the right structure

- Developing a robust investment strategy

Engaging professional advice can greatly enhance the setup process and ensure adherence to regulations. Once established, selecting and purchasing commercial property requires diligent market research and due diligence, allowing investors to make informed decisions that align with their investment objectives.

Navigating financing and tax considerations is equally important. Understanding the SMSF's financial position, exploring borrowing options, and being aware of tax implications can significantly influence the success of the investment. By approaching these elements with care and expertise, SMSF investors can position themselves favorably in the dynamic commercial property market.

Ultimately, leveraging SMSFs for commercial property investment offers a pathway to enhanced retirement savings, but it demands a commitment to ongoing management and compliance. As the trend of SMSFs continues to grow in Australia, being well-informed and strategic can unlock substantial benefits for those willing to take control of their financial futures.