Overview

Understanding how to utilize equity for purchasing commercial property is crucial for making informed investment decisions. Begin by assessing your current market value and calculating any outstanding mortgage balances. Leverage your available equity through financing options such as Home Equity Lines of Credit (HELOCs) or cash-out refinancing. Furthermore, a thorough evaluation of your equity, along with a careful consideration of the financial implications and associated risks, is essential. This comprehensive approach will empower you to navigate the complexities of the commercial real estate market with confidence.

Introduction

Navigating the world of commercial real estate can indeed be daunting, particularly when it comes to understanding and leveraging equity. As property values fluctuate and financing options evolve, the potential to utilize equity for purchasing commercial properties presents both opportunities and challenges. This article explores the essential steps for successfully using equity to acquire commercial property, examining how investors can:

- Assess their available equity

- Evaluate financing options

- Mitigate associated risks

What strategies can investors implement to maximize their equity while safeguarding their investments in an unpredictable market?

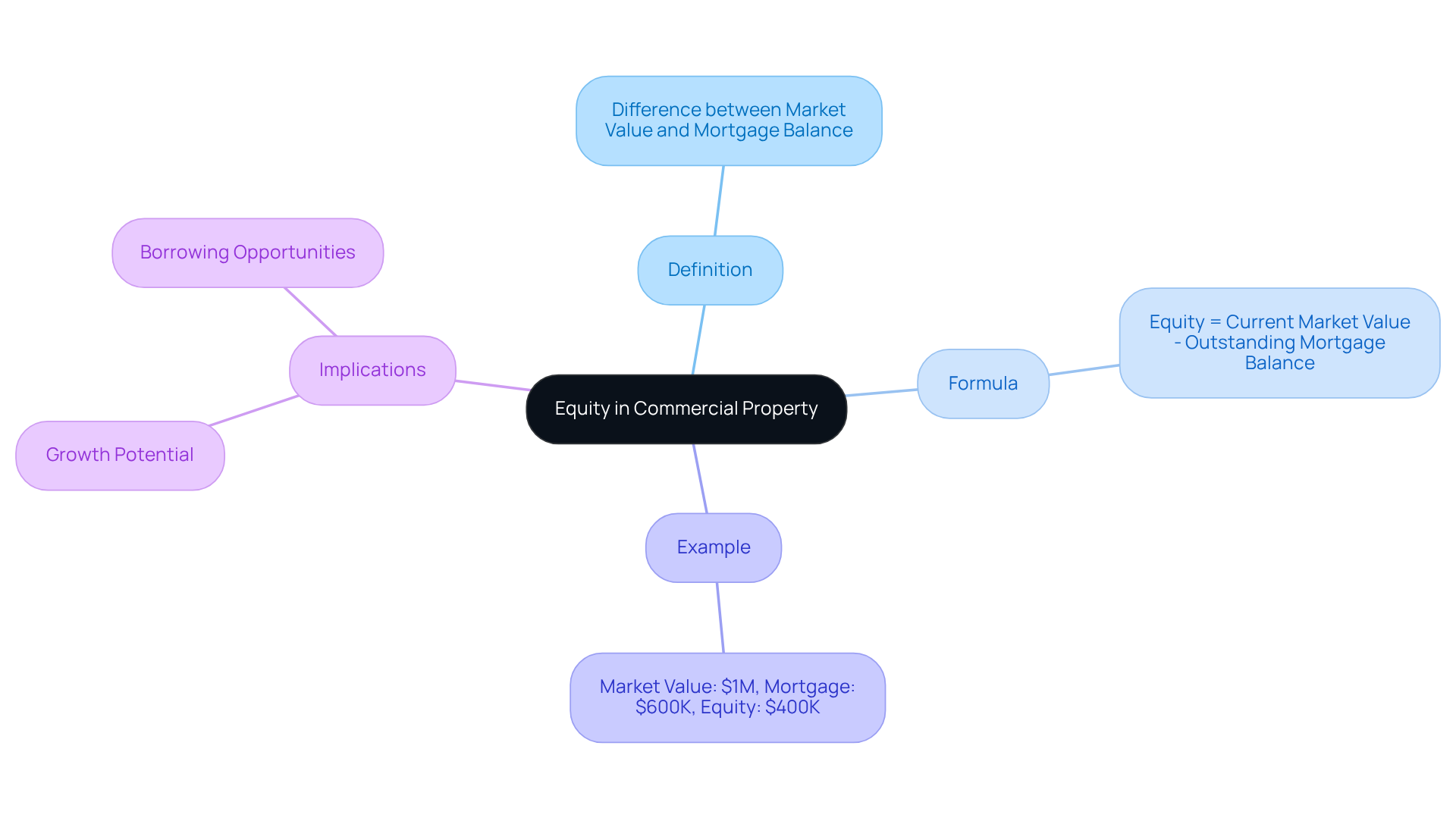

Understand Equity in Commercial Property

Equity in commercial real estate represents the difference between the asset's current market value and the outstanding mortgage balance. To calculate your equity, apply the formula:

Equity = Current Market Value - Outstanding Mortgage Balance

For example, if your commercial property is valued at $1 million and you owe $600,000 on your mortgage, your equity would amount to $400,000. Understanding this concept is essential, as it directly impacts your ability to borrow against your asset when using equity to buy commercial property for future endeavors or acquisitions.

Furthermore, your ownership can grow over time as real estate values appreciate or as you pay down your mortgage, which creates additional opportunities for using equity to buy commercial property. By partnering with Finance Story, you can access tailored loan proposals designed to optimize your capital utilization, ensuring you secure the right financing options for your commercial real estate investments.

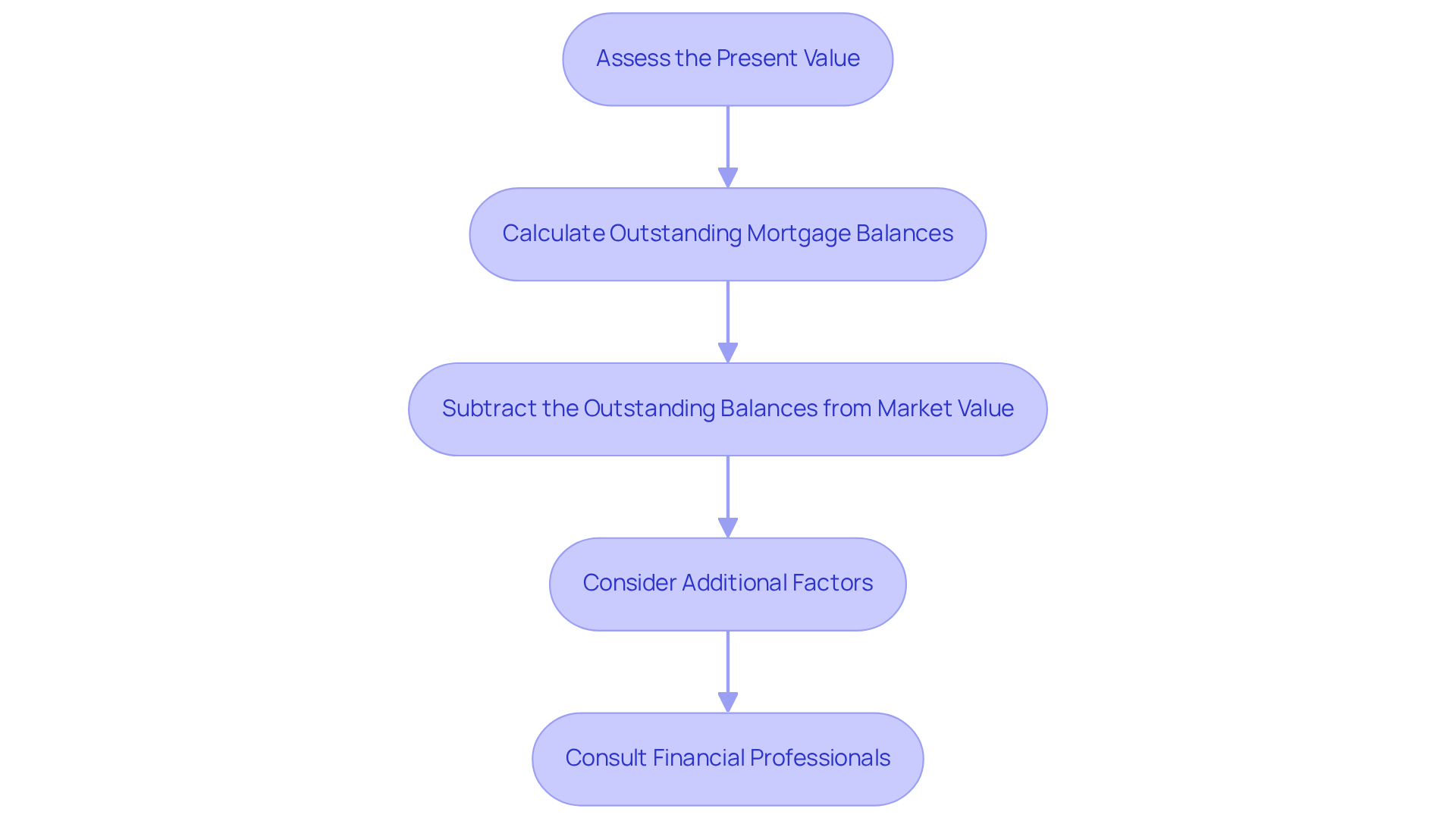

Assess Your Available Equity

To effectively assess your available equity, follow these essential steps:

-

Assess the Present Value: Investigate recent transactions of similar assets in your vicinity to estimate your asset's current value. Engaging a professional appraiser can yield a more precise evaluation, especially in light of the recent trends in appraisals for 2025, which indicate a growing emphasis on accurate valuations within a fluctuating market.

-

Calculate Outstanding Mortgage Balances: Gather your mortgage statements to ascertain the total amount owed on loans secured by the real estate. This step is crucial, as it directly influences your ownership calculation.

-

Subtract the Outstanding Balances from Market Value: Utilize the formula: Current Market Value minus Outstanding Balances equals Available Equity. For instance, if your asset is appraised at $1 million and you owe $600,000, your available equity would amount to $400,000.

-

Consider Additional Factors: Account for any liens or extra debts associated with the asset that may impact your ownership calculation. This comprehensive approach will provide a clearer picture of your financial standing.

Recent sales statistics for commercial properties in Melbourne reveal a robust environment, with values generally on the rise. This trend presents an opportune moment for using equity to buy commercial property. As you navigate this process, consulting with financial professionals, such as those at Finance Story, is advisable. They specialize in creating polished and highly individualized business cases for securing funds. Understanding the risks associated with real estate ventures—such as market fluctuations and financing challenges—while using equity to buy commercial property and combining it with the right strategy and mindset, can significantly enhance your overall approach. Finance Story offers a comprehensive selection of lenders and customized financing options to support your commercial real estate investment objectives.

Leverage Equity for Financing Options

Once you have assessed your available equity, you can leverage it for various financing options:

-

Home Equity Line of Credit (HELOC): This adaptable choice allows you to borrow against your assets as needed, making it ideal for using equity to buy commercial property or financing renovations. HELOCs typically offer lower interest rates compared to traditional loans, providing a cost-effective means to access funds.

-

Cash-Out Refinance: By refinancing your existing mortgage for more than you owe, you can take the difference in cash. This approach provides a lump sum for using equity to buy commercial property, allowing you to seize market opportunities.

-

Home Loans: These second mortgages allow you to borrow a fixed sum against your ownership stake, often at lower interest rates than unsecured loans. This can serve as a reliable source of financing for real estate ventures by using equity to buy commercial property.

-

Partnerships or Joint Ventures: Collaborating with other investors can enhance your purchasing power. By pooling resources, you can utilize your assets for larger commercial real estate ventures, especially using equity to buy commercial property, distributing risk and maximizing potential returns.

-

Private Lenders: Consider exploring options with private lenders who may offer more flexible terms based on your ownership status. This can be particularly advantageous if traditional banks present challenges in securing financing.

In 2025, trends indicate a growing interest in using equity to buy commercial property, particularly through HELOCs, as many borrowers appreciate the flexibility and reduced costs associated with these lines of credit. As the market evolves, understanding how to effectively utilize your assets will be crucial for successful investment strategies.

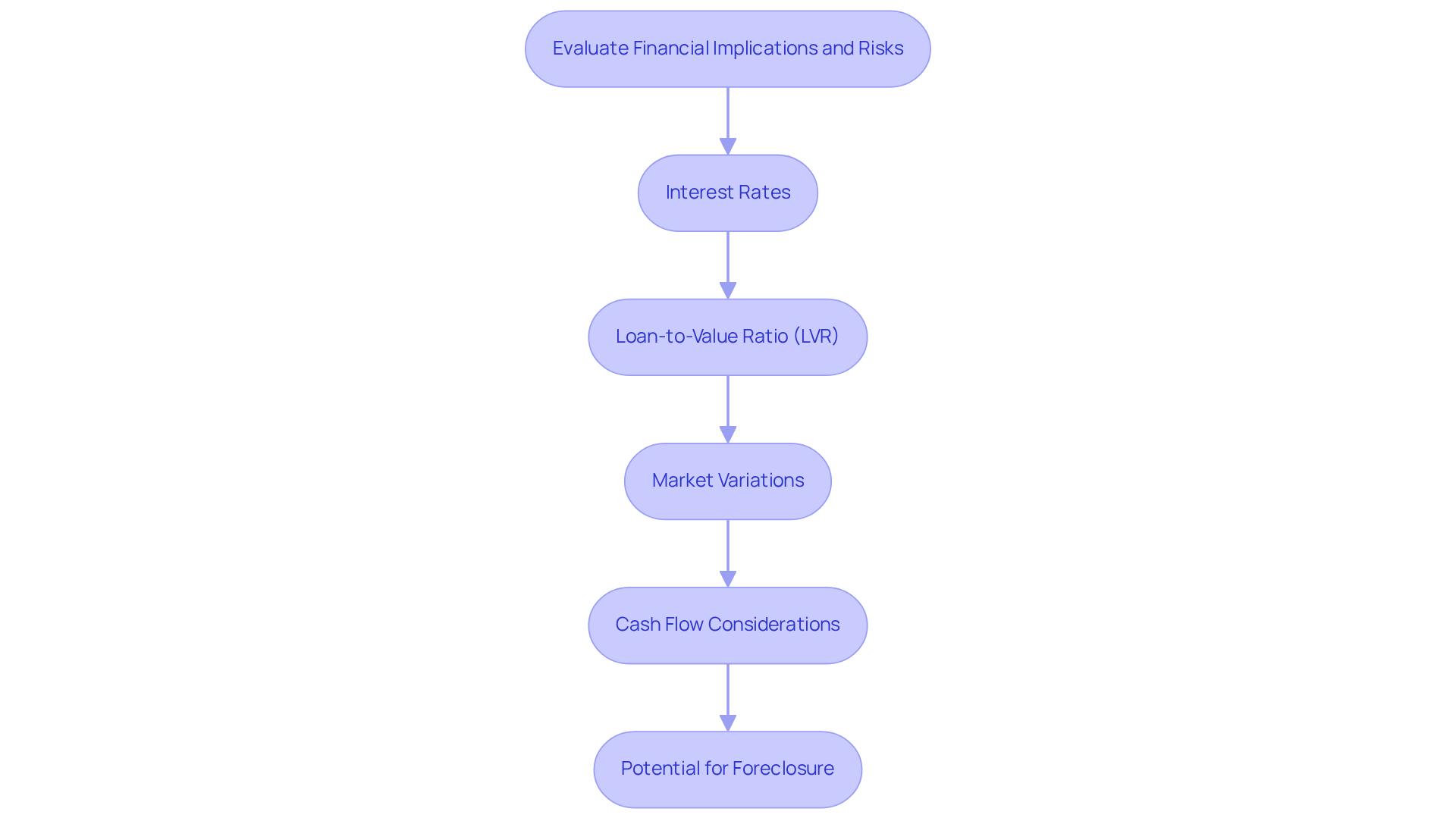

Evaluate Financial Implications and Risks

Before leveraging your equity, it is essential to assess the financial implications and risks involved:

-

Interest Rates: Familiarize yourself with the interest rates linked to various financing options. Elevated rates can substantially increase your repayment amounts, impacting your overall financial health.

-

Loan-to-Value Ratio (LVR): Lenders assess your LVR, which compares your loan amount to the asset's value. A higher LVR often leads to increased interest rates or potential loan denial. Currently, numerous lenders uphold a maximum LVR of approximately 70% for commercial real estate, indicating that careful planning is crucial to prevent surpassing this limit. For leasehold businesses, specific financing options may include personal guarantees or alternative lending solutions.

-

Market Variations: Property values are subject to economic volatility. A downturn in the market can diminish your assets, complicating future refinancing or sales of real estate. For instance, if property values decrease considerably, your capacity to utilize assets may be restricted, resulting in possible financial pressure.

-

Cash Flow Considerations: Ensure your business can manage the additional debt service. Conduct a thorough cash flow analysis to confirm that you can meet monthly payments without jeopardizing your financial stability. This is particularly important in light of recent interest rate adjustments, which have seen reductions of 25 basis points on eligible business loans, effective from May 30, 2025.

-

Potential for Foreclosure: Leveraging equity heightens the risk of foreclosure if you fail to meet your loan obligations. It is vital to have a contingency plan in place to mitigate this risk and safeguard your investment.

By meticulously evaluating these factors, including the specific financing options available for leasehold businesses, and considering using equity to buy commercial property, you can make informed decisions that align with your financial objectives while minimizing potential risks.

Conclusion

Understanding and utilizing equity in commercial property can be a game-changer for investors looking to expand their portfolios. By grasping the concept of equity, assessing available funds accurately, and leveraging these resources through various financing options, investors can strategically position themselves for success in the commercial real estate market.

Key insights discussed include:

- The importance of calculating your equity

- Exploring financing avenues like HELOCs and cash-out refinancing

- Carefully evaluating the financial implications and risks associated with these decisions

Each step outlined in this guide is crucial for making informed choices that align with your investment goals while maximizing the potential of your assets.

Ultimately, the journey of using equity to buy commercial property requires a proactive approach and a thorough understanding of market dynamics. By staying informed and seeking professional guidance when necessary, investors can navigate this landscape with confidence, ensuring that their financial strategies not only meet current needs but also pave the way for future growth. Embracing these principles can lead to successful investments that harness the power of equity effectively.