Overview

This article delves into how borrowers can unlock the lowest interest rates for commercial property loans by grasping essential factors such as economic conditions, borrower profiles, and loan features. It underscores the significance of preparing financial documents and researching lenders, illustrating that a strategic approach to these elements can greatly enhance the likelihood of securing favorable loan terms.

Have you considered how economic conditions might affect your borrowing potential? Understanding these dynamics is crucial. Furthermore, knowing your borrower profile can set you apart in the eyes of lenders. By presenting a strong financial picture, you increase your chances of obtaining the best rates available.

In addition, it’s vital to prepare your financial documents meticulously. This preparation not only reflects professionalism but also signals to lenders that you are serious about your investment. Researching lenders is equally important; different lenders offer varying terms and conditions, and finding the right fit can make all the difference in your loan experience.

Ultimately, adopting a strategic approach to these factors can significantly improve your outcomes. By being informed and prepared, you position yourself to negotiate better terms and secure the financing that aligns with your business goals.

Introduction

Navigating the world of commercial property loans can be a daunting task for many entrepreneurs and investors. These specialized financial products are essential for acquiring, refinancing, or developing commercial real estate; however, they differ significantly from traditional residential loans.

With unique terms, varying interest rates, and specific qualification criteria, understanding commercial loans is crucial for making informed financial decisions. As businesses increasingly seek to capitalize on favorable market conditions, the importance of knowing how to secure the right loan, identify influential factors affecting interest rates, and prepare essential financial documents cannot be overstated.

This article delves into the intricacies of commercial property loans, providing valuable insights and practical tips to empower borrowers in their quest for optimal financing solutions.

Understand Commercial Property Loans

Business property financing options represent specialized financial products tailored for the acquisition, refinancing, or development of business real estate. Unlike residential mortgages, which focus on personal homes, business financing is aimed at properties such as office buildings, retail spaces, and industrial facilities. These products come with unique conditions, interest rates, and eligibility standards that set them apart from home mortgages.

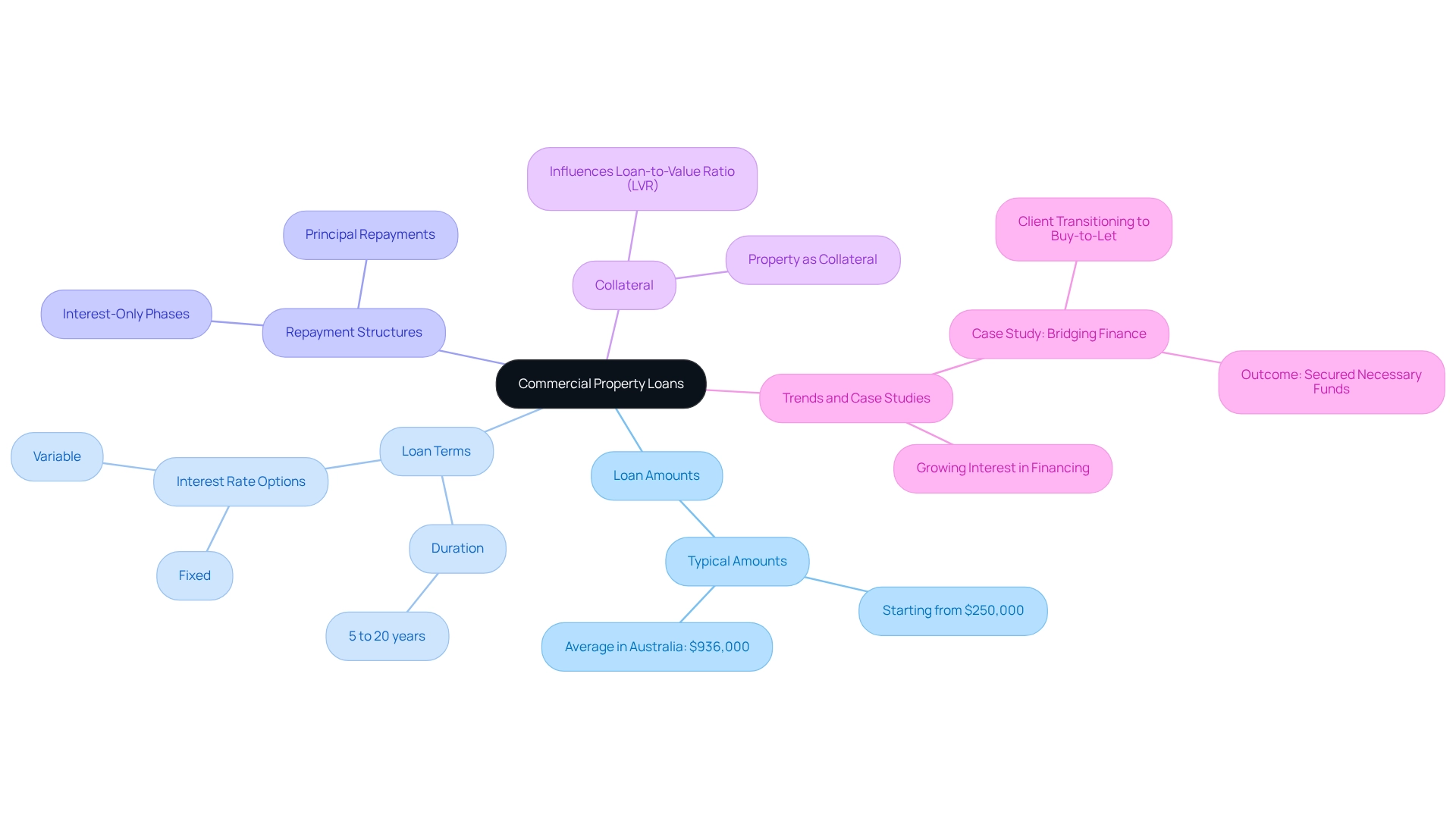

Key features of commercial property loans include:

- Loan Amounts: Typically larger than residential loans, often starting from $250,000, reflecting the higher value of commercial properties.

- Loan Terms: Generally range from 5 to 20 years, providing flexibility with both fixed and variable interest rate options.

- Repayment Structures: Many business financing options feature interest-only phases, followed by principal repayments, facilitating manageable cash flow during the initial stages of property ownership.

- Collateral: The property itself usually serves as collateral, influencing the loan-to-value ratio (LVR) and the overall risk assessment by lenders.

Understanding these characteristics is crucial for borrowers, as it enables them to evaluate their financial needs and select the most suitable credit products available in the market. Recent trends indicate a growing interest in business property financing, particularly as companies seek to capitalize on favorable market conditions. For instance, in 2025, the average financing amount for business property financing in Australia has reached approximately $936,000, signaling a rise in investment in business real estate.

Case studies illustrate the effectiveness of these financial aids. For example, a client transitioning from a residential to a buy-to-let mortgage encountered complex income verification issues. By leveraging a regulated bridging financing option, the brokerage facilitated the necessary funds for the new purchase, showcasing the adaptability of business financing in addressing diverse client needs. This flexibility, combined with expert knowledge on the distinctions between business and personal financing, underscores the importance of selecting the right funding choice to achieve financial objectives effectively.

Identify Factors Affecting Interest Rates

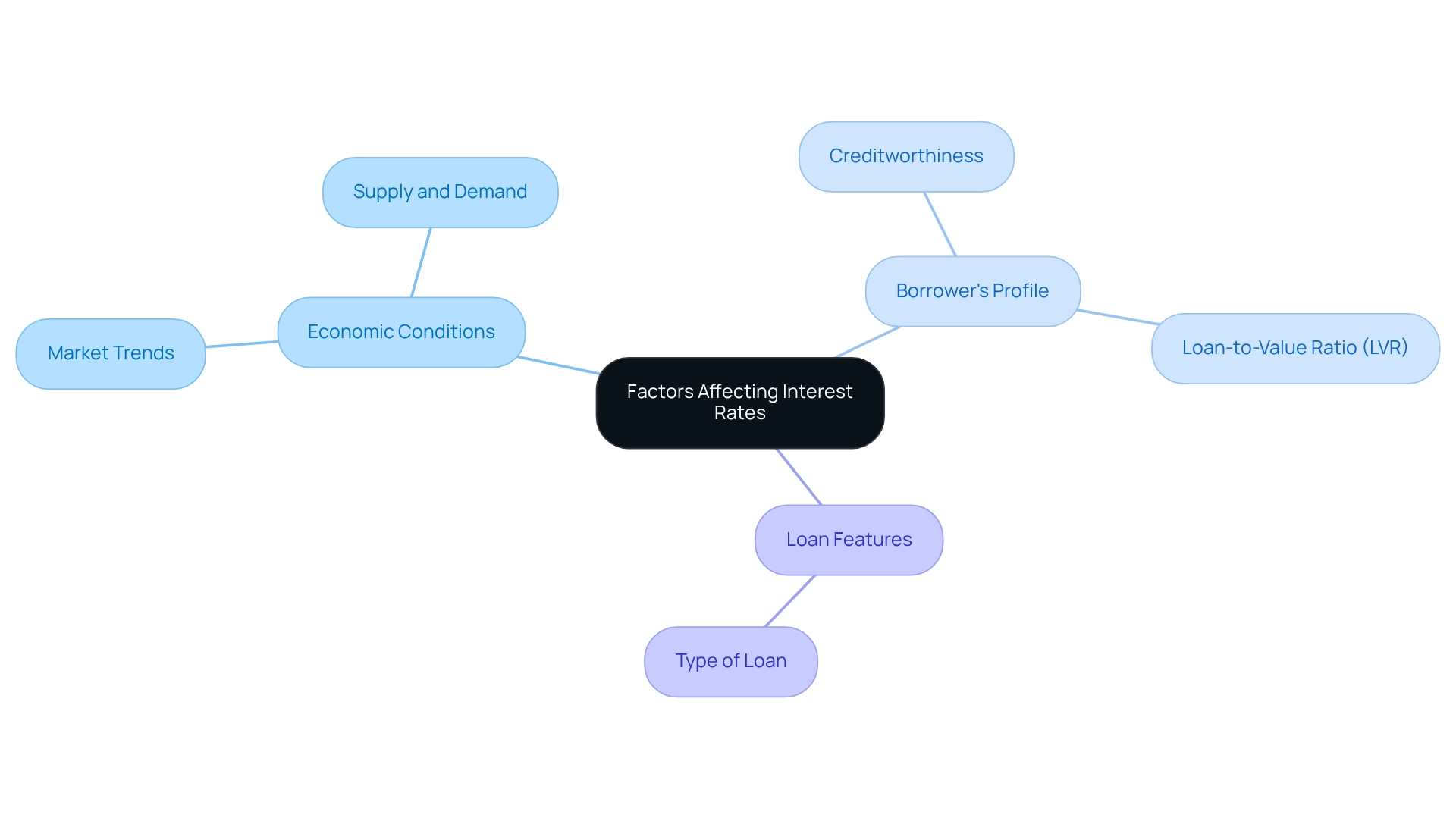

Understanding the various elements that influence the lowest interest rate commercial property loan can empower borrowers to secure more favorable conditions. Here are the primary factors to consider:

Economic Conditions:

- Market Trends: Interest rates are often swayed by the overall economic climate, including inflation rates and the Reserve Bank of Australia's cash rate decisions.

- Supply and Demand: When demand for commercial properties is high, interest levels may rise as lenders perceive greater risks.

Borrower's Profile:

- Creditworthiness: Lenders evaluate the borrower's credit history, financial stability, and business performance. A robust credit profile can lead to lower borrowing costs.

- Loan-to-Value Ratio (LVR): A lower LVR, which represents the ratio of the borrowed amount to the property value, typically results in better interest terms, indicating reduced risk for the lender.

Loan Features:

- Type of Loan: Fixed-rate loans may carry different rates compared to variable-rate loans. Understanding these distinctions can aid borrowers in selecting the most suitable option for their financial situation.

By considering these factors, borrowers can position themselves more favorably when seeking the lowest interest rate commercial property loan for financing business properties, ultimately opening the door to reduced interest costs.

Research and Compare Lenders

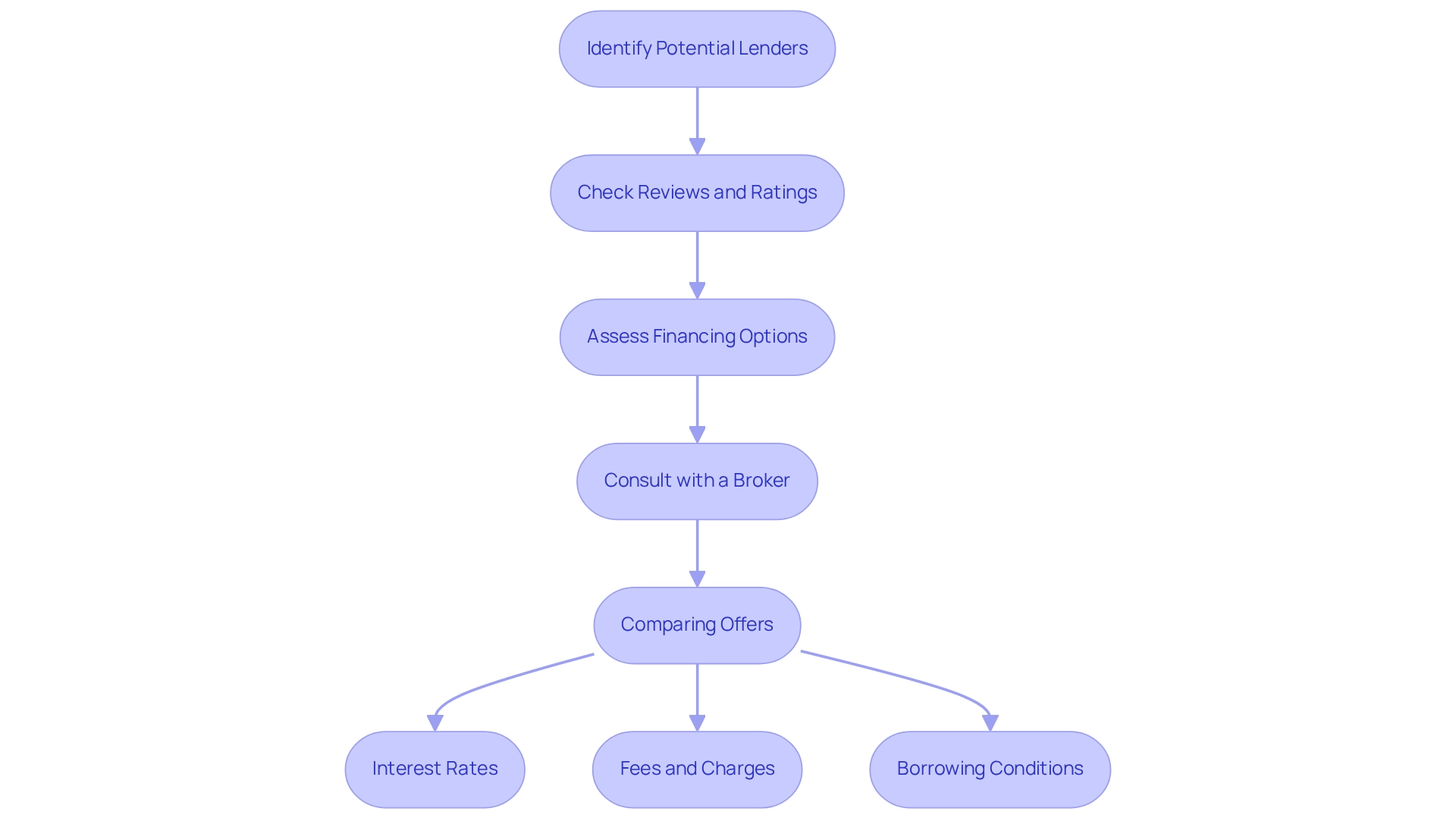

Identifying the appropriate lender is essential for obtaining the lowest interest rate commercial property loan with the best possible terms. Here’s a streamlined approach to effectively research and compare lenders:

Steps to Research Lenders:

- Identify Potential Lenders: Start by compiling an extensive list of banks, credit unions, and alternative financiers that focus on commercial property financing.

- Check Reviews and Ratings: Investigate customer reviews and ratings on platforms like Google Reviews and Trustpilot to assess the reputation of each lender. Positive feedback can indicate reliability and quality service.

- Assess Financing Options: Examine the financing options offered by each provider, concentrating on interest charges, fees, and conditions. Pay attention to whether they provide fixed or variable pricing, along with any distinctive features that could enhance your financial situation.

- Consult with a Broker: Working with a mortgage broker who focuses on commercial financing can offer access to a wider variety of lenders and assist you in discovering attractive terms suited to your requirements.

Comparing Offers:

- Interest Rates: Scrutinize the interest rates from various lenders, ensuring clarity on whether they are fixed or variable.

- Fees and Charges: Consider factors beyond the interest rate to assess any application fees, ongoing fees, or exit fees that may apply, as these can greatly affect the total expense of the borrowing.

- Borrowing Conditions: Consider the flexibility of borrowing conditions, including repayment options and any penalties for early repayment, which can influence your economic strategy.

Staying updated on the changing landscape of the business financing market is crucial. By actively investigating and contrasting lenders, you can make knowledgeable choices that correspond with your monetary goals and secure the lowest interest rate commercial property loan for your business financing.

Prepare Your Financial Documents

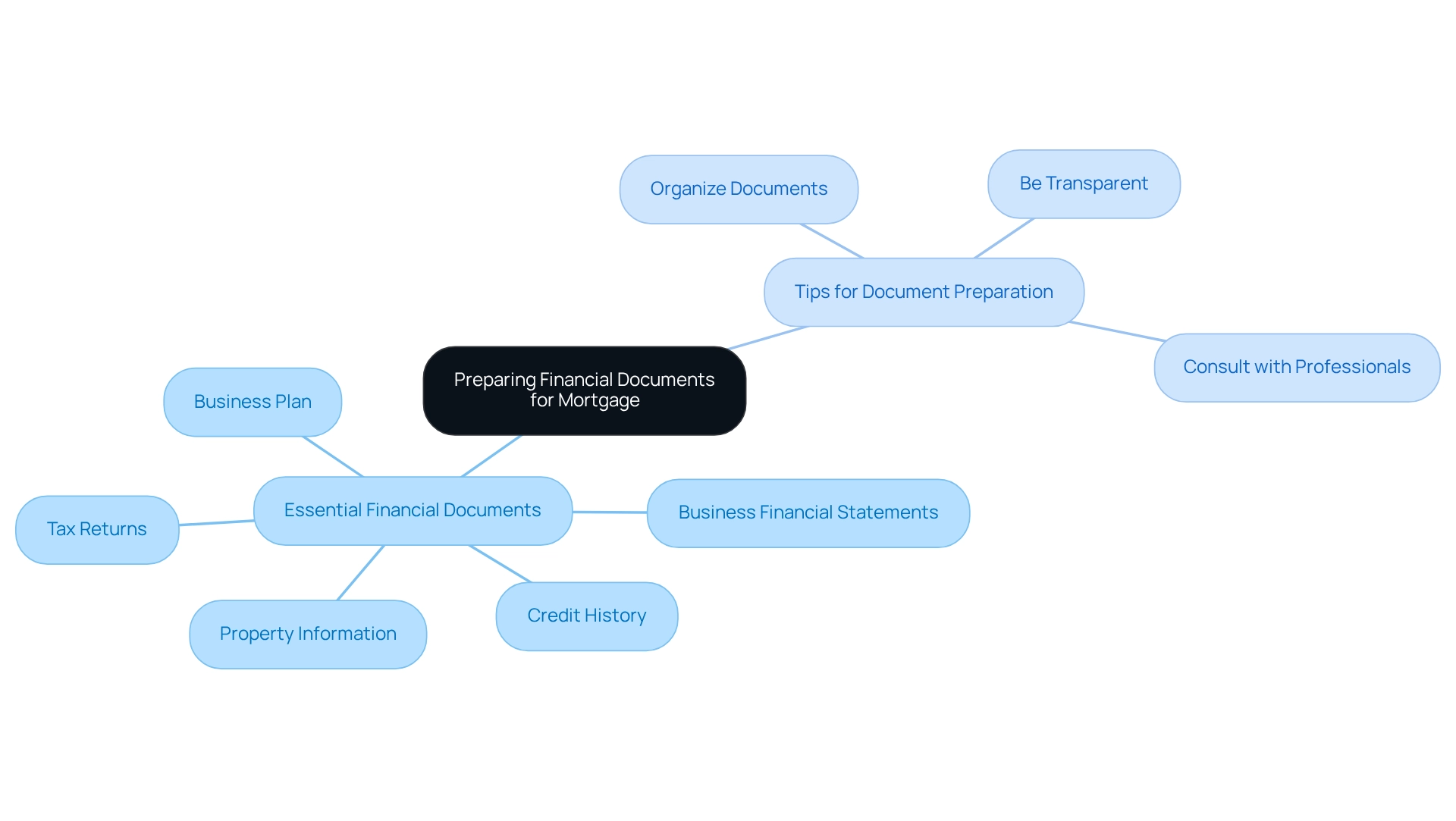

When seeking a commercial property mortgage, having the appropriate monetary documents prepared is essential for success. Adequate documentation not only demonstrates your business's economic condition but also significantly enhances the chances of loan approval. Here’s a comprehensive list of key documents to prepare:

Essential Financial Documents:

- Business Financial Statements: Include profit and loss statements, balance sheets, and cash flow statements for the past two to three years. These documents provide lenders with a clear view of your business's monetary performance and stability.

- Tax Returns: Prepare personal and business tax returns for the last two years. Lenders utilize these to confirm income and evaluate your overall economic status.

- Business Plan: A well-organized business plan detailing your business model, market analysis, and funding projections can significantly enhance your application.

- Credit History: Obtain a copy of your credit report to understand your credit standing. Resolve any discrepancies before applying to present a clear monetary picture.

- Property Information: Gather comprehensive details about the property you intend to purchase, including its valuation, location, and any existing leases, to establish its potential income streams.

Tips for Document Preparation:

- Organize Documents: Keep all documents systematically organized and easily accessible to streamline the application process.

- Be Transparent: Provide accurate and honest information to avoid complications during the approval process, as transparency is key to building trust with lenders.

- Consult with Professionals: If needed, seek help from accountants or financial advisors to ensure your documents are comprehensive and meet lender requirements.

Being well-prepared with your financial documents can significantly enhance your chances of securing a commercial property loan with the lowest interest rate. Accurate and organized documentation not only reflects your business's viability but also aids lenders in their risk assessment, ultimately leading to a smoother approval process.

Conclusion

Navigating the complexities of commercial property loans is essential for entrepreneurs and investors aiming to make informed financial decisions. By understanding the unique features of these loans—such as larger loan amounts, varied terms, and specific repayment structures—borrowers can align their financing options with their business goals. As demand for commercial properties continues to rise, recognizing the factors that influence interest rates, including economic conditions and borrower profiles, empowers individuals to negotiate better terms and secure favorable financing.

Furthermore, thorough research and comparison of lenders play a crucial role in identifying the best loan products. Evaluating interest rates, fees, and terms, along with consulting experienced brokers, positions borrowers to obtain competitive offers that meet their financial needs. Additionally, preparing essential financial documents not only showcases a business's viability but also streamlines the loan application process, thereby increasing the likelihood of approval.

In summary, a comprehensive understanding of commercial property loans, coupled with strategic research and meticulous preparation, equips borrowers with the necessary tools to navigate the financing landscape effectively. This proactive approach not only enhances the chances of securing the right loan but also supports long-term success in the commercial real estate market.