Overview

SMSF property loans in Australia represent specialized financial products that empower members of Self-Managed Super Funds (SMSFs) to leverage their retirement savings for property investments. This strategy aims to enhance long-term financial growth through capital appreciation and rental income.

The benefits of these loans are significant, including:

- Tax advantages

- Portfolio diversification

However, it is crucial to recognize the associated risks, such as:

- Higher costs

- Complex regulations

Therefore, informed decision-making and strict compliance are essential in the application process for these loans.

Introduction

In the realm of retirement planning, Self-Managed Super Funds (SMSFs) have emerged as a powerful tool for savvy investors aiming to harness their superannuation savings into lucrative property investments. These specialized loans not only enable fund members to purchase real estate but also offer unique tax advantages and greater control over investment decisions. However, navigating the complexities of SMSF property loans requires a keen understanding of the associated risks and regulatory landscape.

Furthermore, evaluating the benefits while recognizing potential pitfalls is essential. This comprehensive guide delves into the essentials of SMSF property loans, empowering investors to make informed decisions that align with their long-term financial goals.

Define SMSF Property Loans and Their Purpose

A Self-Managed Super Fund (SMSF) property loans Australia option represents a specialized financial product designed specifically for SMSFs to secure funds for property acquisitions aimed at profit. The primary objective of these financial products is to empower fund members to leverage their superannuation savings for property investments, potentially enhancing their retirement savings through capital growth and rental income, especially with SMSF property loans Australia.

Unlike traditional home loans, self-managed super fund loans are subject to stringent regulations that necessitate compliance with superannuation laws. Importantly, the asset acquired must serve as a financial resource rather than a personal residence, ensuring alignment with the fund's retirement goals and adherence to the legal framework governing self-managed superannuation funds, particularly when utilizing SMSF property loans Australia.

Recent data indicates a notable upward trend in self-managed superannuation fund real estate, with female member balances experiencing an impressive growth of 26%, compared to a 22% increase for male members. This shift underscores the escalating importance of SMSF property loans Australia in real estate funding strategies.

By utilizing SMSF property loans Australia for real estate financing, members can strategically position themselves for long-term financial growth and stability in retirement. Finance Story is here to assist you in building a robust case and ensuring compliance with regulations, preparing you to identify the right lender for your commercial real estate needs.

BOOK A CHAT.

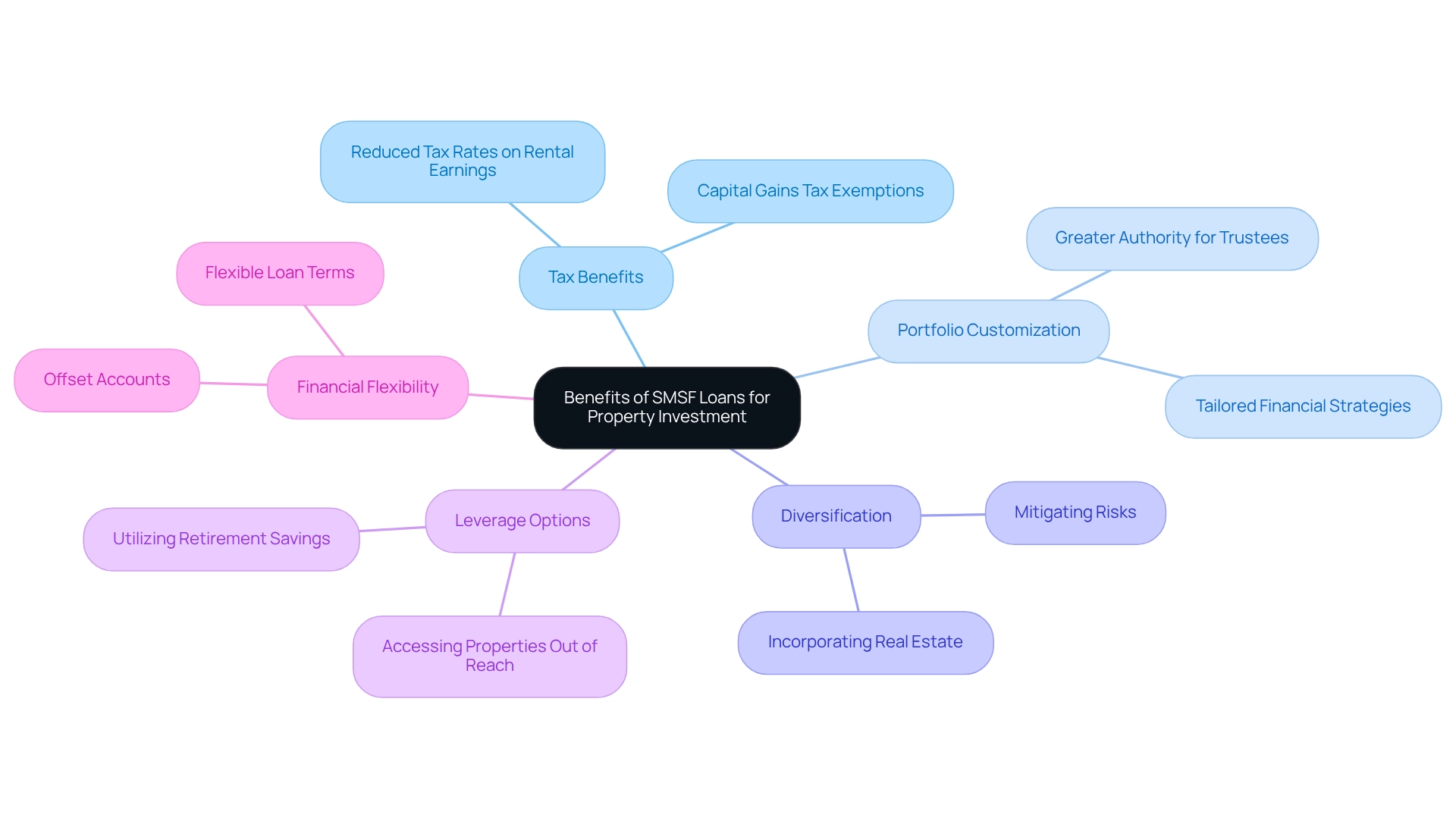

Explore Benefits of SMSF Loans for Property Investment

Self-managed superannuation fund loans present substantial tax benefits, particularly with reduced tax rates on rental earnings, typically capped at 15%. Furthermore, assets held within a self-managed super fund may qualify for exemptions from capital gains tax if retained until retirement, significantly enhancing their appeal for long-term strategies. Trustees utilizing self-managed super funds to acquire real estate gain greater authority over their decisions, allowing them to tailor their portfolios to specific financial objectives. This autonomy is crucial for customizing financial strategies that align with individual retirement goals.

Moreover, SMSFs can diversify their portfolios by incorporating real estate, thereby mitigating risks associated with fluctuations in other asset classes. This diversification proves especially beneficial in an unpredictable market, providing a safeguard against potential losses. The leverage options available through self-managed superannuation fund borrowing, specifically smsf property loans Australia, enable fund members to utilize their retirement savings to purchase properties that might otherwise be financially out of reach. This capability can significantly enhance their financial potential, leading to increased asset accumulation over time.

Historically, real estate has demonstrated robust capital growth, rendering it an attractive option for trustees aiming to build wealth for retirement. Current trends in SMSF property loans Australia indicate the inclusion of features such as offset accounts and flexible financing terms, which enhance the financial management capabilities of SMSFs, offering borrowers greater liquidity and financial flexibility to manage their resources effectively.

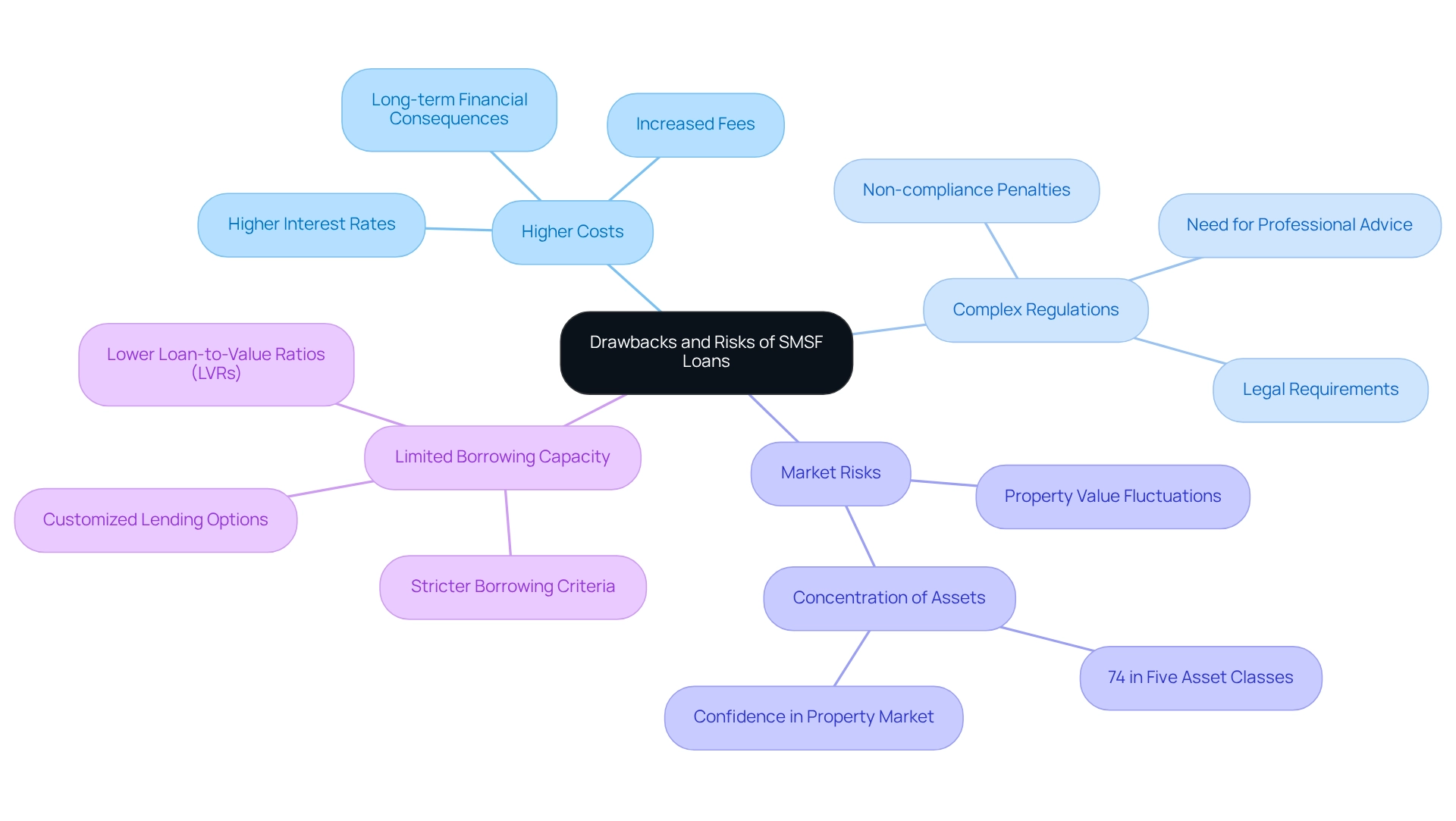

Examine Drawbacks and Risks of SMSF Loans

Self-managed super fund loans, specifically smsf property loans Australia, present several drawbacks and risks that potential investors must carefully consider, including higher costs such as typically incurring higher interest rates and fees compared to traditional home loans. This rise in expenses can significantly affect overall returns, making it crucial for investors to assess the long-term financial consequences. However, with the appropriate guidance from Finance Story, investors can establish a solid argument for their self-managed super fund commercial real estate investments, potentially reducing some of these expenses.

Complex Regulations: The regulatory environment overseeing self-managed super funds is complicated. Non-compliance with these regulations can result in severe penalties, including the loss of valuable tax concessions. Understanding these legal requirements is essential for maintaining compliance and protecting the benefits of smsf property loans Australia. Finance Story provides professional advice to navigate the complexities of SMSF property loans Australia, ensuring that investors remain compliant while pursuing their commercial real estate objectives, particularly in light of liquidity issues associated with real estate as an illiquid asset. If a self-managed super fund needs to sell real estate assets, the process can be lengthy, possibly impacting the fund's liquidity and financial stability. Comprehending these liquidity difficulties is essential for investors utilizing SMSF property loans Australia, particularly when evaluating commercial properties.

Market Risks: Property values are influenced by market changes, which can negatively impact the overall performance and financial stability of the self-managed super fund. Investors must be prepared for the possibility of declining real estate values, which could affect their financial strategy for smsf property loans Australia. A recent case analysis highlighted that 74% of self-managed superannuation fund assets are concentrated in five asset classes, with a significant portion allocated to real estate, demonstrating a diversified approach despite the inherent risks.

Limited Borrowing Capacity: Lenders frequently impose stricter borrowing criteria for self-managed superannuation fund loans, including lower loan-to-value ratios (LVRs). This restriction can limit the quantity of assets that can be acquired with smsf property loans Australia, potentially obstructing funding opportunities. Finance Story can assist in discovering customized lending options that align with personal investment strategies, especially in relation to smsf property loans Australia.

In summary, understanding these factors is essential for making informed choices regarding self-managed superannuation fund property investments. As Dominic Beattie, Editor at Savings.com.au, emphasizes, maintaining a strict separation between editorial and commercial interests ensures that the content you read is based purely on merit. This principle is vital when assessing self-managed superannuation fund loans and their associated risks.

Guide to Applying for an SMSF Property Loan

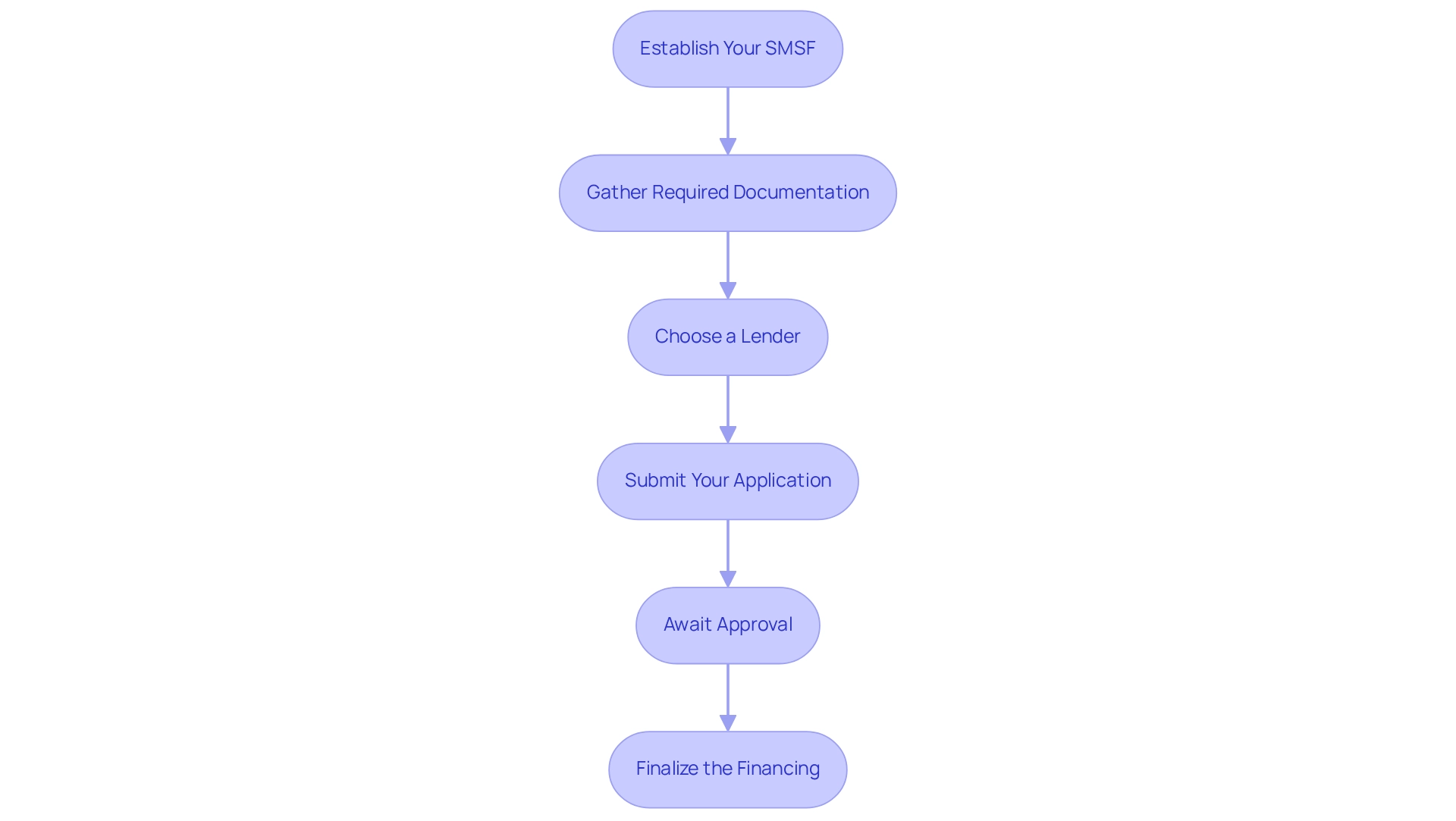

-

Establish Your SMSF: Ensure your Self-Managed Super Fund (SMSF) is correctly established by drafting a trust deed and adhering to all regulatory requirements. This foundational step is crucial for compliance and effective real estate investment.

-

Gather Required Documentation: Compile essential documents such as financial statements, tax returns, and specific details about the property you intend to purchase. Having these documents ready will streamline the application process.

-

Choose a Lender: Conduct thorough research to identify lenders that specialize in SMSF property loans in Australia. Compare interest rates, fees, and terms to choose the lender that best aligns with your financial objectives and strategy. Finance Story can assist in building a compelling argument and ensuring adherence to regulations, simplifying the process of locating the right lender for your commercial real estate.

-

Submit Your Application: Complete the financing application form and submit it alongside your documentation. Be prepared to respond to any questions from the lender regarding your fund structure and financial strategies, as this will facilitate a more seamless approval process.

-

Await Approval: After submission, the lender will evaluate your application, a process that may take several weeks. Maintain communication with the lender for updates and be ready to provide any additional information they may require.

-

Finalize the Financing: Once approved, carefully review the financing agreement before signing. Ensure you fully understand all terms and conditions, including repayment schedules and associated fees. This diligence will help you avoid potential pitfalls in your investment journey, particularly in the context of SMSF property loans in Australia, where the process typically involves several main steps from initial discussions to settlement day, ensuring a comprehensive approach to securing financing. As of June 2022, approximately 66% of SMSFs in Australia are structured with corporate trustees, reflecting a growing trend towards this model, which can enhance compliance and operational efficiency.

Conclusion

Investing through Self-Managed Super Funds (SMSFs) presents a distinctive opportunity to leverage superannuation savings for property acquisitions, potentially resulting in substantial financial benefits. SMSF property loans empower investors to utilize their retirement funds for purchasing investment properties, offering tax advantages such as reduced tax rates on rental income and potential exemptions from capital gains tax. The autonomy afforded to SMSF trustees facilitates customized investment strategies that align with individual retirement objectives, while also diversifying portfolios to mitigate risks associated with market fluctuations.

Nevertheless, the path to investing through SMSF property loans is fraught with challenges. Higher costs, complex regulations, liquidity issues, market risks, and limited borrowing capacity are critical factors that prospective investors must navigate. A comprehensive understanding of these drawbacks is essential for making informed decisions and ensuring compliance with the intricate legal framework governing SMSFs.

The application process for an SMSF property loan necessitates meticulous planning and adherence to regulatory requirements. From establishing the SMSF to selecting the appropriate lender, each step plays a pivotal role in securing financing for property investments. With the right guidance and resources, such as those provided by Finance Story, investors can adeptly manage the complexities involved and position themselves for long-term financial growth.

In summary, while SMSF property loans offer an appealing avenue for retirement investment, it is crucial for investors to carefully weigh the benefits against the inherent risks. Equipped with knowledge and expert support, individuals can confidently navigate the landscape of SMSF property investments, ultimately striving towards a more secure and prosperous retirement.