Overview

Owner-occupied home loans represent a unique category of mortgages tailored for individuals intending to reside in the property as their primary dwelling. These loans typically offer lower interest rates and more favorable terms compared to non-owner-occupied loans, making them an attractive option for potential homeowners.

The significance of these loans cannot be overstated; they play a crucial role in fostering homeownership, enhancing financial stability, and encouraging community investment. By catering to borrowers perceived as lower risk, owner-occupied loans pave the way for improved financing conditions, ultimately benefiting both lenders and borrowers alike.

Are you considering a home purchase? Understanding the advantages of owner-occupied home loans could be your first step toward financial empowerment. With the right financing, you can secure a stable future in your own home.

Introduction

Understanding the nuances of owner-occupied home loans is crucial for anyone navigating the complex world of real estate financing. These loans, specifically designed for individuals who intend to make their purchased property their primary residence, provide significant financial advantages, including lower interest rates and favorable repayment terms.

Furthermore, the importance of accurately representing the intended use of the property cannot be overstated, as missteps can lead to costly repercussions.

What are the key characteristics and benefits of owner-occupied home loans?

How do they differ from non-owner-occupied options in today's competitive market?

Exploring these questions will empower you to make informed financial decisions.

Define Owner Occupied Home Loan

The owner occupied home loan meaning is a mortgage specifically designed for individuals who intend to live in their residence as their primary dwelling. This type of financing empowers individuals to buy, construct, or improve a home, which is relevant to the owner occupied home loan meaning, as it is a residence they will inhabit. The Australian Taxation Office defines a residence as owner-occupied when the individual and their family reside there and keep personal belongings within the home. Typically, these financial agreements offer reduced interest rates compared to investment financing, which aligns with the owner occupied home loan meaning since it reflects the perceived lower risk for lenders when the borrower resides in the property. As of July 2025, interest rates for owner-occupied mortgages start at 4.74% per annum, significantly lower than the 5.45% for investment properties. This disparity underscores the advantages of what is meant by owner occupied home loan meaning, positioning them as an attractive option for homebuyers.

Consider this: a homeowner with a $500,000 mortgage over 30 years could experience reduced monthly payments due to these lower rates. Mortgage brokers often highlight that owner-occupiers are perceived as more trustworthy, which frequently leads to improved financing conditions. As Denise Raward notes, 'Typically, principal and interest repayments are recommended for financing properties under the owner occupied home loan meaning,' emphasizing the structured repayment options available to borrowers.

At Finance Story, we strive to make the process of obtaining an owner occupied home loan meaning seamless and enjoyable. We provide personalized guidance and access to the best market products tailored to your unique situation. We encourage you to reach out to discover more about our straightforward three-step guide to securing your mortgage.

It is crucial for individuals seeking funds to understand that misrepresenting the use of the property can result in significant repercussions, including potential denial of financial assistance. Overall, the owner occupied home loan meaning encompasses not only the facilitation of homeownership but also the financial benefits that can significantly influence a borrower's long-term financial well-being.

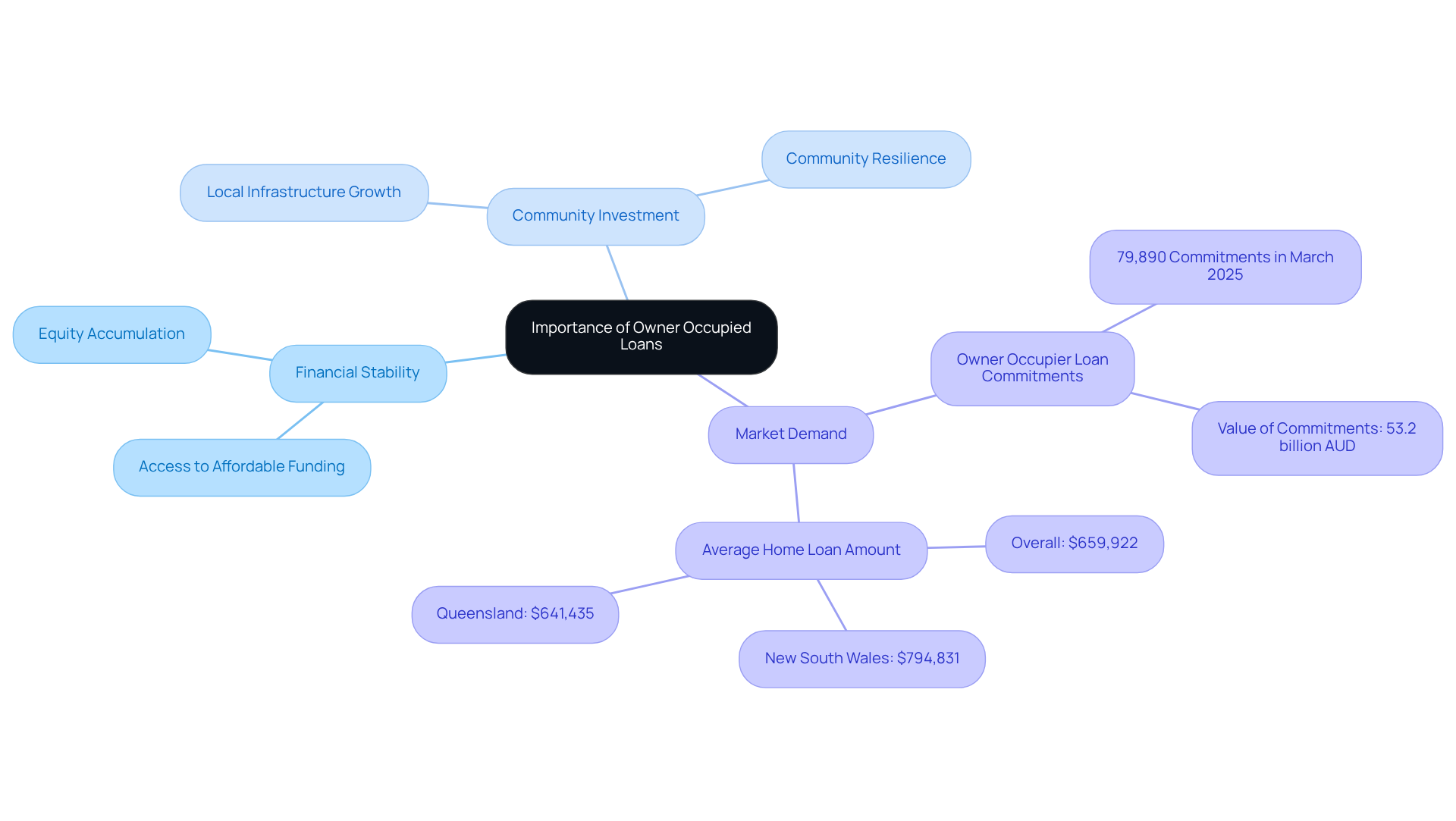

Contextualize the Importance of Owner Occupied Loans

The owner occupied home loan meaning plays a pivotal role in fostering homeownership, a fundamental aspect of financial stability for countless families. By facilitating access to affordable funding, these financial resources empower individuals to invest in their futures and accumulate equity over time. Homeownership not only strengthens personal financial security but also enhances community stability, as homeowners are generally more inclined to invest in their neighborhoods compared to renters.

In Australia, the demand for mortgages that align with the owner occupied home loan meaning continues to thrive, underscoring the aspiration for homeownership, often regarded as a cornerstone of the 'Great Australian Dream.' Recent data indicates that owner-occupier borrowing commitments reached 79,890 in the March quarter of 2025, demonstrating a steadfast commitment to homeownership despite fluctuating market conditions.

Communities that champion the owner occupied home loan meaning typically witness increased investment in local infrastructure and services, further propelling economic growth. Furthermore, expert insights reveal that homeownership significantly contributes to community resilience, as homeowners are more likely to engage in long-term planning and invest in their neighborhoods, cultivating a sense of belonging and stability.

Identify Key Characteristics and Requirements

The owner occupied home loan meaning encompasses key characteristics such as lower interest rates, flexible repayment options, and various types of financing, including fixed-rate and variable-rate options. To qualify for an owner-occupied mortgage, it is essential to understand the owner occupied home loan meaning, which generally requires individuals to meet specific criteria, including:

- Proof of income

- A good credit score

- A deposit that typically ranges from 5% to 20% of the property's value

Notably, deposits less than 20% may require Lenders Mortgage Insurance (LMI), which adds to the overall cost.

As of May 2025, the average borrowing amount for owner-occupiers is approximately $660,000, reflecting an 8% increase over the past year. This indicates a trend in rising borrowing capacity. Additionally, lenders may require individuals to demonstrate their ability to repay the amount through documentation such as bank statements and payslips. It is also essential for borrowers to understand the owner occupied home loan meaning, which requires them to reside in the property as their main home. Neglecting to notify the lender about a shift in occupancy can result in significant legal repercussions, including fines or the necessity to refinance the mortgage as an investment property.

This compliance is crucial. Lenders may impose higher interest rates or demand repayment if they discover any misrepresentation regarding occupancy. As of May 2025, the average mortgage interest rate for owner-occupiers is 5.83% p.a., and understanding the owner occupied home loan meaning is crucial as owner-occupiers represent approximately two-thirds of new property financing, emphasizing the competitive nature of the market.

Are you ready to explore your financing options? Talking to Finance Story about your next mortgage is as simple as 1, 2, 3. Save yourself the time and let us do all the hard work to find the very best value products on the market. We can meet with you at a time that fits your busy lifestyle and determine what is significant to you regarding your next home financing, ensuring you have access to the latest products and tailored assistance.

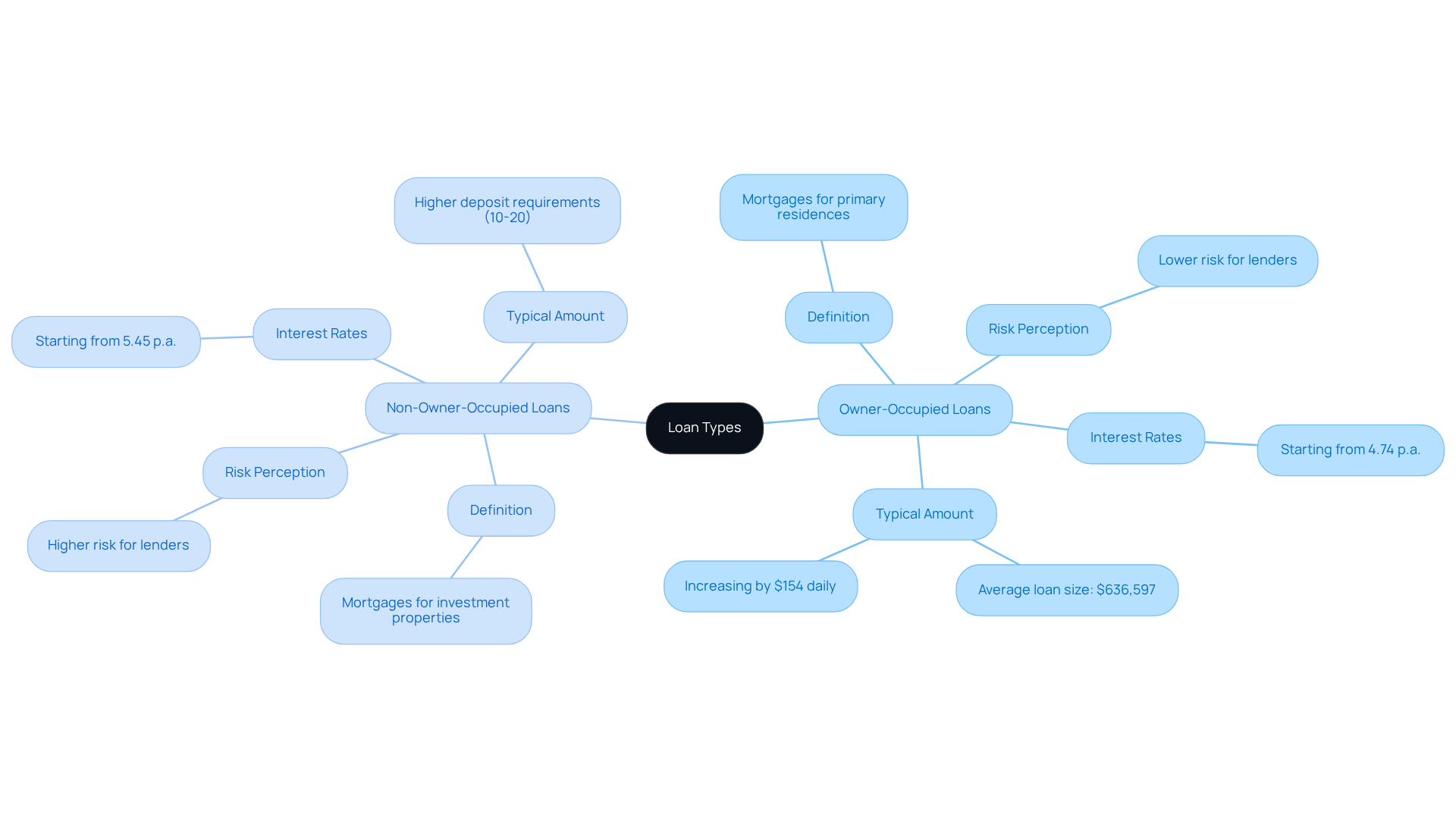

Differentiate Between Owner Occupied and Non-Owner Occupied Loans

The distinction between financing types is fundamentally shaped by the intended use of the asset, particularly in terms of owner occupied home loan meaning versus non-owner-occupied financing. The owner occupied home loan meaning pertains to mortgages that cater to borrowers who will reside in the property, while non-owner-occupied mortgages, often referred to as investment financing, are designed for properties that will be rented out or held for investment purposes. Lenders typically perceive the owner occupied home loan meaning as a lower risk, which leads to more competitive interest rates and favorable terms. For instance, as of July 2025, owner-occupier mortgages feature interest rates starting from 4.74% per annum, whereas non-owner-occupied mortgages begin at 5.45% per annum. This disparity in rates reflects the higher perceived risk associated with investment properties.

Real-world examples further underscore these distinctions. Consider a first-time homebuyer who inadvertently applies for an investment credit instead of recognizing the owner occupied home loan meaning; they may face significantly higher interest rates, which could adversely affect their overall financial strategy. Furthermore, the typical owner-occupier mortgage amount has reached a record peak of $636,597, increasing by $154 each day, while investor financing has surged, expanding more than five times quicker than owner-occupier mortgages in recent months.

Understanding the owner occupied home loan meaning is vital for borrowers aiming to select the loan type that aligns best with their financial goals, especially in a competitive market where interest rates and lending criteria are constantly changing.

Conclusion

Understanding the significance of owner-occupied home loans is essential for prospective homeowners navigating the complexities of the mortgage landscape. These loans are specifically tailored for individuals intending to reside in the property, offering not only a pathway to homeownership but also financial benefits that enhance long-term economic stability. The lower interest rates and favorable terms associated with owner-occupied loans reflect the reduced risk perceived by lenders, making them a compelling choice for many.

Key insights highlighted throughout the article include:

- The importance of understanding eligibility criteria

- The distinctions between owner-occupied and non-owner-occupied loans

- The broader implications of homeownership on community stability

The data presented demonstrates a strong commitment to homeownership in Australia, with owner-occupier borrowing commitments showing resilience even amid market fluctuations. This underscores the integral role these loans play in fostering individual financial security and community investment and growth.

Ultimately, recognizing the value of owner-occupied home loans extends beyond personal finance; it speaks to the heart of the aspiration for homeownership that many hold. By empowering individuals to secure their own homes, these loans contribute to a more stable and engaged society. For those considering mortgage options, understanding the meaning of owner-occupied home loans is a crucial step toward achieving the dream of homeownership and making lasting contributions to their communities.