Overview

In Australia, commercial finance brokers serve as vital intermediaries between businesses in need of funding and lenders. They meticulously evaluate financial requirements and negotiate favorable loan terms. This article underscores their client-centric approach, extensive networks of lenders, and expertise in navigating the complex lending landscape. Such attributes are essential for assisting companies in securing necessary financing, particularly during challenging economic conditions.

Have you considered how a finance broker could streamline your funding process? With their deep understanding of the market, these professionals can help you identify the best financing options tailored to your unique needs. Their ability to connect you with a range of lenders not only enhances your chances of approval but also ensures you receive competitive terms.

Furthermore, navigating the intricacies of loan applications can be daunting. That's where the expertise of commercial finance brokers truly shines. They guide you through each step, making the process smoother and more efficient. By leveraging their knowledge, you can avoid common pitfalls and secure the financing your business requires to thrive.

In conclusion, engaging with a commercial finance broker can be a game-changer for your business. Their authoritative presence in the finance industry, coupled with a supportive approach, empowers you to make informed decisions. Don't hesitate to explore how these professionals can assist you in achieving your financial goals.

Introduction

In a landscape where businesses increasingly seek financial support to thrive, commercial finance brokers emerge as essential allies in navigating the complexities of securing funding. These professionals bridge the gap between lenders and businesses, offering tailored solutions that align with specific financial needs and objectives.

As the demand for innovative financing options grows, brokers are not only facilitating access to capital but also empowering businesses to overcome challenges posed by stringent lending criteria and economic fluctuations.

This article delves into the pivotal roles and responsibilities of commercial finance brokers, highlighting their importance in Australia’s evolving financial ecosystem.

What challenges are you facing in securing funding? Discover how these brokers provide diverse solutions to help businesses flourish.

Define Commercial Finance Brokers: Roles and Responsibilities

In Australia, commercial finance brokers serve as vital intermediaries between companies in need of funds and lenders offering financial products. Their primary responsibilities encompass evaluating customers' financial requirements, researching suitable loan options, and negotiating favorable terms with lenders. Unlike traditional lenders, brokers prioritize their clients' interests, ensuring that the funding solutions they propose align with specific goals. This client-centric approach is crucial, particularly as commercial and asset finance volumes have surged by over 20%, highlighting the increasing demand for effective funding solutions.

At Finance Story, we understand business intricately, collaborating closely with our partners to develop robust business cases tailored to their diverse lending needs. Our extensive access to a panel of lenders—including boutique lenders, private investors, and mainstream banks—ensures that we can present a variety of financing options, ultimately leading to more successful outcomes in securing necessary funding.

In addition to facilitating loan acquisition, intermediaries provide essential market insights, guiding individuals through the complexities of the lending landscape. Their expertise is particularly beneficial for obtaining loans for enterprises, as evidenced by the consensus among industry leaders that intermediaries should focus on relationship building and leveraging technology to enhance their services. Philip Knight, Credit and Risk Director, noted, "This year we’re commemorating our tenth anniversary of providing loans of up to £1m ($1.3m), assisting intermediaries in better serving their customers through fully adaptable financing." This adaptability is vital in a competitive market, where agents are increasingly recognized for their professionalism and deep understanding of the finance sector.

Moreover, commercial finance brokers Australia play a pivotal role in supporting companies facing challenging financial situations, ensuring that clients receive personalized assistance throughout the loan process. As Natasha B. from VIC expressed, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." At Finance Story, we are becoming synonymous with finding solutions even in difficult circumstances, providing bespoke mortgage services to aid in your financing journey. The process for agents utilizing non-bank services is straightforward, involving access to bank statements for credit approval, which further enhances their capability to assist clients effectively.

Contextualize the Importance of Commercial Finance Brokers in Australia

In Australia, the role of commercial finance brokers has become increasingly vital as companies navigate a complex lending environment marked by economic uncertainty. Mid-sized companies, essential for driving innovation and job creation, often face challenges in securing funding. Brokers play a crucial role in facilitating access to a diverse range of financial products, particularly as non-bank lenders gain prominence in the market. This evolution allows agents to provide tailored financing options that align with individual circumstances, including specialized loan proposals crafted by experts like Finance Story.

During periods of economic fluctuation, traditional lending criteria frequently tighten, complicating the ability of enterprises to secure necessary funds. For example, brokers can assist clients in organizing their financial information in a clear and concise manner, significantly improving their chances of obtaining the funds needed for expansion. As Alex Kourti, Director, notes, "Allocating time to refresh your accounting software and organize the necessary information in a clear and concise manner will significantly improve your likelihood of obtaining the funds required to expand your enterprise."

Recent data reveals that, despite rising interest rates and inflation, 60% of SMEs in Australia plan to invest in their businesses within the next six months, indicating a growing confidence in the market. This trend underscores the importance of intermediaries in facilitating access to capital, especially as initial capital expenditure plans for 2023-24 are expected to be 11% greater than the previous financial year.

Furthermore, the rise of non-bank lenders has dramatically transformed the landscape of commercial finance brokers in Australia. These lenders often provide more flexible terms and expedited approval processes, which intermediaries can leverage to benefit their clients. Consequently, commercial finance brokers are essential not only in securing funding but also in ensuring that companies can thrive even amidst challenging economic conditions. Their ability to offer personalized support and innovative solutions, including refinancing options and customized loans, positions them as trustworthy advisors, crucial for the success of businesses across Australia.

Explore Financing Solutions Provided by Commercial Finance Brokers

[Commercial finance brokers Australia](https://blog.financestory.com.au/understanding-commercial-loans-australia-a-comprehensive-overview) offer a comprehensive range of funding options specifically designed to meet the unique needs of businesses. These solutions encompass:

- Commercial property loans

- Growth-focused business loans

- SMSF loans

- Expat mortgages

By leveraging established relationships with various lenders, including major banks and innovative private lending groups, commercial finance brokers Australia can offer clients competitive funding choices that align with their financial goals. This approach not only enhances the likelihood of successful outcomes but also expedites the funding process by engaging with commercial finance brokers Australia on behalf of clients.

Finance Story is dedicated to crafting refined and customized proposals for banks, ensuring that small business owners secure the appropriate funding for their commercial property investments. Their expertise in refinancing, offered by commercial finance brokers Australia, allows businesses to adjust their loans to meet evolving needs, whether for:

- A large warehouse

- Retail space

- Factory

- Hospitality project

Case studies illustrate the vital role of commercial finance brokers Australia in sourcing and structuring loans tailored to organizational requirements, whether for short-term working capital or long-term financing. By utilizing their industry knowledge, commercial finance brokers Australia can effectively identify funding opportunities that align with the operational objectives of businesses, ultimately supporting their growth and success. As Catherine Oliver states, "With access to the right financial expertise, you can obtain the funding you need to grow your enterprise." This underscores the importance of intermediaries in navigating the complexities of funding options for small business owners.

Address Challenges in Securing Financing: The Broker's Role

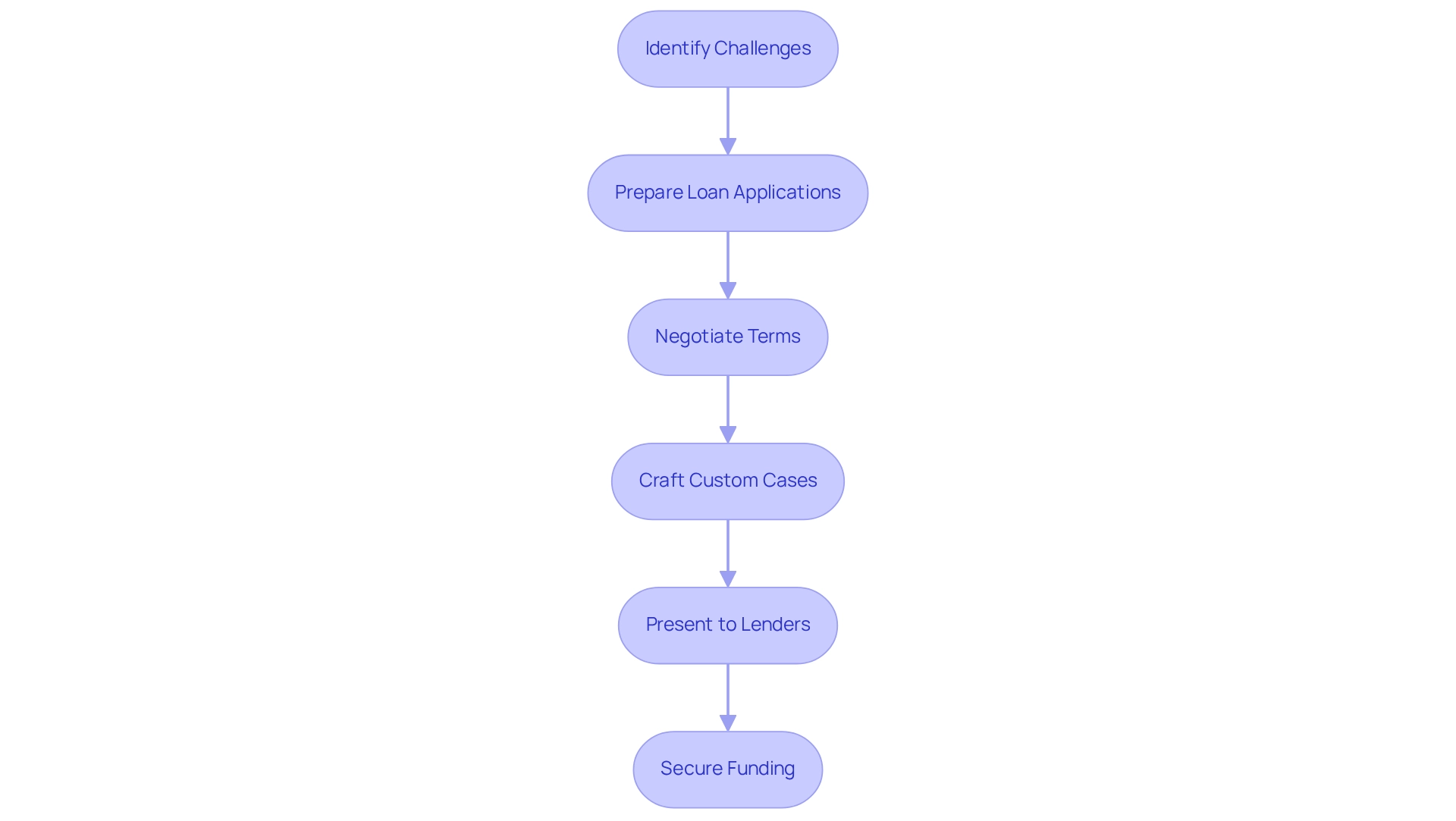

Obtaining funding in Australia presents significant challenges for enterprises, particularly in 2025. Stringent lending criteria, insufficient credit histories, and complex documentation requirements often obstruct access to essential funds. Commercial finance brokers Australia play a crucial role in helping businesses navigate these hurdles. They assist individuals in preparing comprehensive loan applications, ensuring that all necessary documentation is meticulously organized. Furthermore, brokers advocate for their clients, negotiating terms that may be difficult to secure through direct interactions with lenders. By understanding the unique circumstances of each client, brokers can devise tailored strategies that significantly enhance the likelihood of obtaining favorable financing solutions. Finance Story excels in crafting refined and highly customized cases for presentation to banks, ensuring clients can secure the appropriate loan for their needs, whether for acquiring a commercial property or refinancing existing loans. We offer a broad selection of lenders, from high street banks to innovative private lending groups, to meet any situation.

A 2016 Small Enterprise Credit Survey revealed that many small enterprises, particularly minority-owned and micro-enterprises, faced considerable financial challenges, underscoring the importance of expert advice in overcoming these obstacles. In fact, nearly one-third of companies expressed doubt about their ability to survive without additional government support until sales rebound, highlighting the essential role intermediaries play in facilitating access to necessary funding.

Expert guidance from financial advisors emphasizes that intermediaries not only simplify the loan application process but also provide invaluable insights into the lending landscape, empowering enterprises to make informed decisions. By leveraging their extensive networks and market knowledge, commercial finance brokers Australia enable businesses to tackle financing challenges and secure the capital essential for growth and sustainability. Schedule your free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy, to discuss your needs and objectives, ensuring you have the necessary support to navigate these complex financial waters.

Conclusion

The role of commercial finance brokers in Australia has never been more critical as businesses confront the complexities of securing necessary funding. These professionals serve as essential intermediaries, bridging the gap between businesses and lenders while providing tailored financial solutions that align with the unique needs of each client. By assessing financial requirements, researching suitable loan options, and negotiating favorable terms, brokers facilitate access to diverse financing products, particularly in an environment marked by economic fluctuations and tightening lending criteria.

As the landscape evolves, brokers have adapted by leveraging their networks and expertise to offer innovative financing solutions. From commercial property loans to business expansion financing, their ability to present competitive options from a wide array of lenders ensures that clients are well-positioned to secure the capital needed for growth. Furthermore, the emergence of non-bank lenders enhances their capabilities, allowing for more flexible terms and quicker approval processes that can be crucial in times of financial uncertainty.

Ultimately, the impact of commercial finance brokers extends beyond merely securing loans; they empower businesses to navigate challenges and seize opportunities for expansion. Their client-centric approach, coupled with in-depth market insights, positions them as trusted advisors in the financial ecosystem. As more businesses recognize the value of these partnerships, the role of brokers will continue to be pivotal in fostering a resilient and thriving business community across Australia. Embracing the expertise of commercial finance brokers is not just a strategic decision—it is a vital step toward achieving long-term financial success.