Overview

This article delves into the intricacies of business loan interest in Australia, shedding light on the pivotal factors that influence interest rates and the diverse types of loans available. Key elements such as:

- Credit scores

- Loan amounts

- Prevailing economic conditions

play a significant role in shaping interest rates. Moreover, various loan types are tailored to meet specific business needs, ultimately guiding the financing decisions of Australian enterprises. Understanding these dynamics is crucial for making informed financial choices.

Introduction

In the dynamic landscape of Australian business, securing the right financing is pivotal for unlocking growth and innovation. Small and medium enterprises (SMEs) play a crucial role in driving a significant portion of the workforce, making it essential to understand the intricacies of business loans.

With a myriad of options available—from term loans and lines of credit to government-backed alternatives—businesses can tailor their financing to meet specific financial needs. However, various factors influence the journey to obtaining these funds, including:

- Interest rates

- Credit scores

- Economic conditions

This article explores the essential aspects of business loans, detailing their purpose, types, and the critical factors that impact financing decisions. Ultimately, it aims to guide business owners toward making informed financial choices that align with their strategic objectives.

Define Business Loans and Their Purpose

A commercial credit is a specialized financial product designed to provide essential funding for various enterprise-related costs. These financial aids serve multiple purposes, including acquiring equipment, managing cash flow, and facilitating operational growth. The primary objective of a loan for enterprises is to grant access to capital that may otherwise be difficult to obtain, enabling businesses to invest in opportunities that drive growth and enhance profitability.

In Australia, the significance of loans for enterprises is underscored by the fact that small and medium-sized entities (SMEs) represent approximately two-thirds of the workforce. This statistic highlights the critical role that funding plays in supporting the expansion of these businesses. Recent trends indicate a positive shift in the financial landscape, with exceptional funding to companies increasing by nearly 9% by June 2023 compared to the previous year. This growth signifies improved access to funding alternatives, which is vital for enterprises aiming to expand and innovate. As noted by journalist Amy Bradney-George, companies generating $10 million or more saw a rise of 6.6%, reflecting a broader trend of growth among larger firms that also rely on funding.

Experts assert that financial assistance is crucial for small business owners seeking to expand their operations. It provides the necessary resources to capitalize on new opportunities, whether through acquiring new technology or entering new markets. Furthermore, statistics reveal that a significant portion of Australian enterprises utilize business loan interest in Australia specifically for growth, underscoring their reliance on external funding to achieve strategic objectives.

Creating a loan proposal for your upcoming project requires expertise, knowledge, and skill to meet the increasing expectations surrounding resource acquisition for development of any scale. Finance Story specializes in crafting refined and highly customized cases for presentation to banks, ensuring that small business owners can secure the appropriate funding for their commercial property investments. With access to a comprehensive array of lenders, including high street banks and innovative private lending panels, Finance Story can assist you in exploring refinancing options to adapt to the evolving needs of your enterprise.

Successful instances of financing utilization illustrate how companies have effectively leveraged these resources to enhance their operations and stimulate growth. For instance, numerous businesses have invested in cutting-edge machinery through financing, resulting in improved efficiency and profitability. By understanding the various objectives of financial assistance, proprietors can make informed decisions that align with their strategic goals, ultimately leading to lasting success.

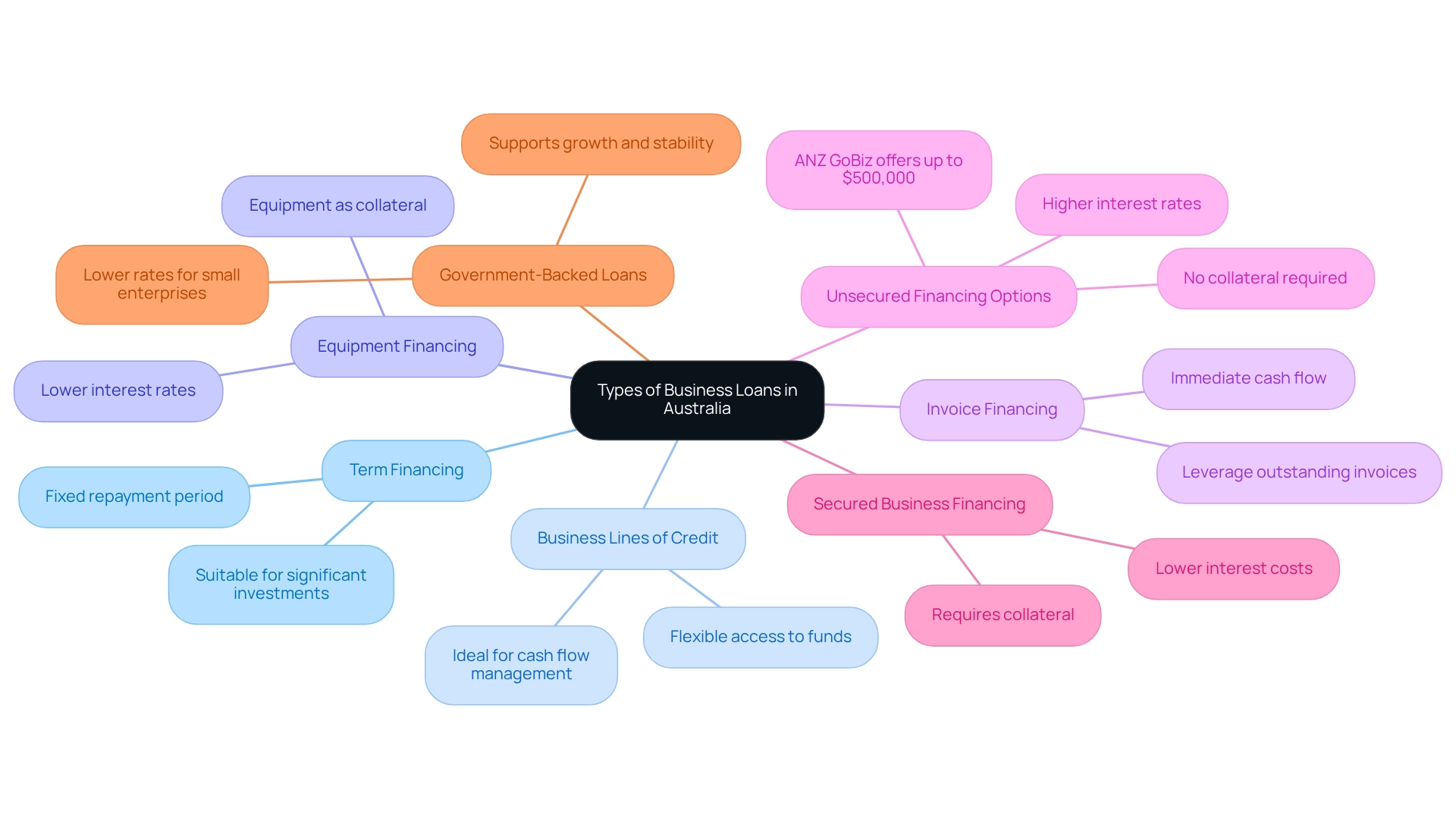

Explore Types of Business Loans in Australia

In Australia, a diverse array of financial products is available, each tailored to meet specific monetary needs:

- Term Financing: These traditional arrangements involve borrowing a lump sum that is repaid over a fixed period with interest. They are particularly suitable for significant investments, such as purchasing equipment or expanding operations.

- Business Lines of Credit: This flexible financing option allows businesses to draw funds as needed, up to a predetermined limit. It is ideal for managing cash flow fluctuations, providing quick access to capital when required.

- Equipment Financing: Specifically designed for acquiring equipment, this type of funding uses the equipment itself as collateral. This often results in lower interest rates, making it a cost-effective option for businesses.

- Invoice Financing: Businesses can leverage their outstanding invoices to secure immediate cash flow, allowing them to operate without waiting for customer payments. This method can be particularly beneficial for maintaining liquidity.

- Unsecured Financing Options: These funds do not require collateral, making them accessible to a wider variety of enterprises. ANZ GoBiz offers unsecured financing of up to $500,000 for business credit and overdrafts. However, business loan interest in Australia typically comes with higher rates due to the increased risk for lenders.

- Secured Business Financing: Conversely, secured options require collateral, which can reduce interest costs. However, this option related to business loan interest in Australia puts company assets at risk if repayments are not met, necessitating careful consideration.

- Government-Backed Loans: Supported by government initiatives, these loans aim to help small enterprises access funding at lower rates, fostering growth and stability in the sector.

At Finance Story, we specialize in crafting polished and highly individualized cases to present to banks, ensuring that your loan proposal meets the increasingly heightened expectations of lenders. We provide access to a comprehensive range of lenders, including high street banks and innovative private lending panels, tailored to your specific circumstances. Furthermore, we emphasize refinancing choices to assist organizations in adapting to their evolving needs. Understanding the distinctions between these options is crucial for making informed financial decisions. By assessing the specific needs of their enterprise, owners can select the most suitable financing option.

Analyze Factors Affecting Business Loan Interest Rates

Several key factors influence business loan interest in Australia.

-

Credit Score: A higher credit score typically results in lower interest rates, as it indicates a lower risk to lenders. Current data indicates that the average credit score for Australian small enterprises hovers around 650. A score of 650 can lead to less favorable borrowing terms, while higher scores can significantly enhance the conditions of the financing. It is essential for business owners to understand how their credit score affects their funding options.

-

Borrowing Amount: Larger borrowings may incur elevated charges due to the heightened risk linked with substantial sums. For example, banks might provide financing up to 70% of a property's worth for commercial property financing, which can influence the overall interest percentage offered.

-

Loan Term: Shorter loan durations often come with lower costs, while longer terms may have higher charges due to the extended risk period. This is particularly relevant in 2025, as businesses weigh the benefits of immediate financing against potential future refinancing opportunities.

-

Economic Conditions: Variations in the economy, including inflation and central bank strategies, can significantly influence interest levels. Economic uncertainty can lead to increased costs as lenders modify their risk evaluations.

-

Type of Loan: Secured loans typically have reduced costs compared to unsecured loans because of the collateral involved. This distinction is crucial for enterprises considering their financing options, especially when comparing traditional banks with non-bank lenders. Finance Story provides a comprehensive selection of lenders, including creative private lending groups, which may offer customized solutions featuring reduced interest charges and fewer eligibility requirements. This makes them a feasible choice for companies with weaker credit histories.

-

Lender Policies: Various lenders possess distinct criteria and risk evaluations, resulting in discrepancies in offered prices. Non-bank lenders, for instance, may provide lower interest terms and fewer qualification criteria, making them a feasible choice for companies with less robust credit histories.

-

Calculating Interest Charges: Grasping how to compute interest charges using formulas and online tools is crucial for evaluating the actual expense of borrowing. This knowledge enables small enterprise owners to make informed financial decisions.

As Finance Story highlights, 'Interest rates can influence an organization's capacity to invest and expand.' Understanding these elements is crucial for small enterprise owners aiming to navigate the intricacies of obtaining business loan interest in Australia. By leveraging this knowledge, companies can make informed decisions that align with their financial goals.

Examine the Impact of Interest Rates on Business Financing

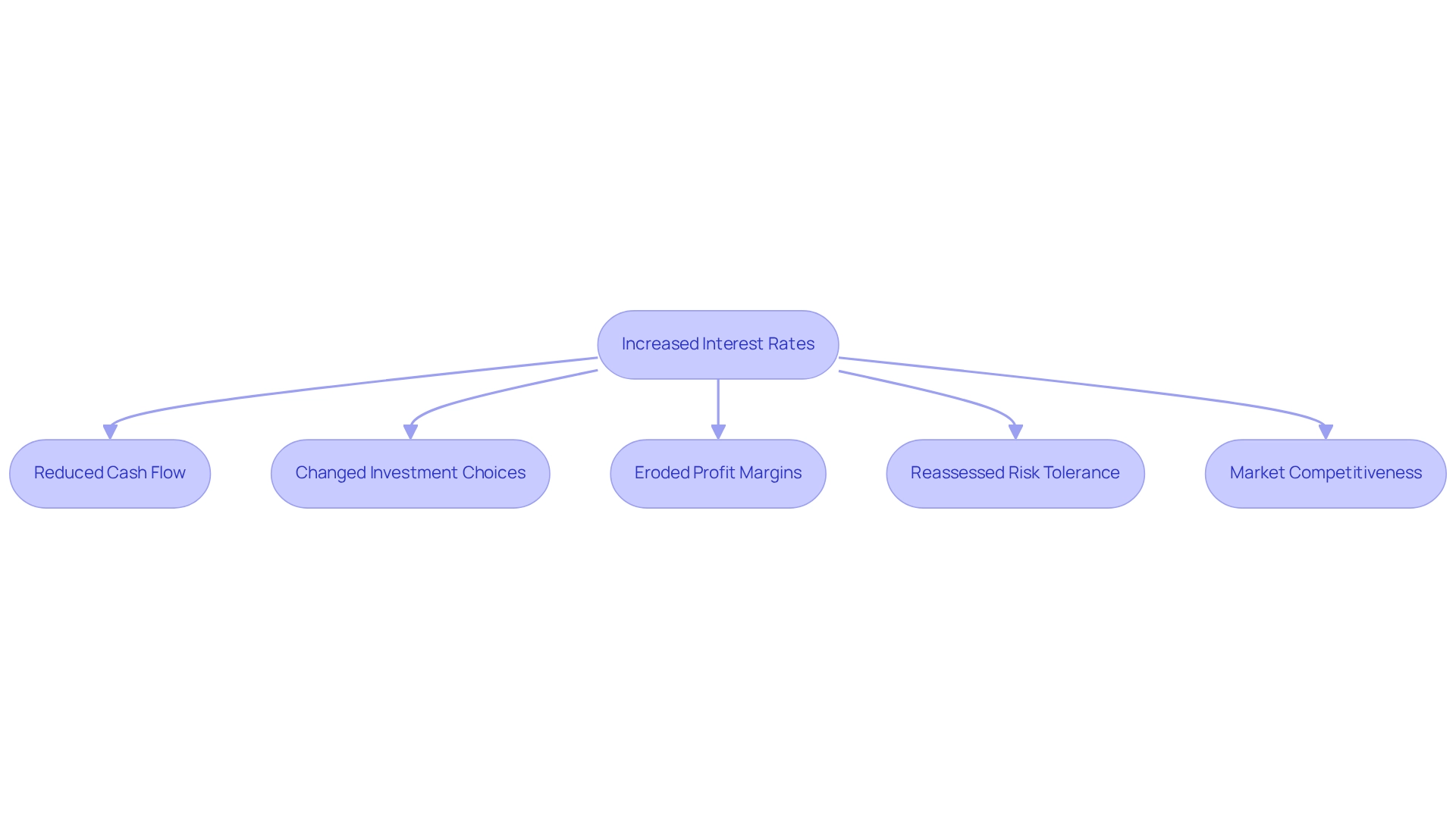

The levels of business loan interest in Australia significantly influence company financing choices, particularly in the economic landscape of 2025. As rates rise, the implications for small businesses are profound, leading to several key outcomes:

-

Reduced Cash Flow: Higher interest rates result in increased loan repayments, straining cash flow. This limitation restricts a company's capacity to invest in growth opportunities, making it crucial for owners to closely monitor their financial health, particularly in light of business loan interest in Australia. Finance Story specializes in crafting refined and highly customized case studies to present to lenders, ensuring that small enterprises can secure necessary funds even in challenging situations.

-

Investment Choices: The cost of funding can deter companies from pursuing new projects or acquiring equipment. Many businesses may choose to delay or forgo investments altogether, opting instead to conserve cash in uncertain times. Statistics reveal that a significant percentage of enterprises have modified their investment strategies due to rising interest rates, underscoring the need for meticulous financial planning. Understanding the business loan interest Australia repayment criteria is essential for making informed decisions about funding alternatives.

-

Profit Margins: Increased interest expenses can erode profit margins, compelling companies to manage their debt levels more cautiously. This careful approach is vital for maintaining profitability in a challenging financial landscape. Finance Story's access to an extensive portfolio of lenders enables companies to explore diverse financing options tailored to their specific needs, helping to mitigate the impact of rising costs.

-

In a high-interest environment, companies often reassess their risk tolerance, especially concerning business loan interest in Australia. Many may adopt more conservative financial strategies, prioritizing stability over aggressive growth due to concerns about business loan interest in Australia. Financial analysts emphasize that grasping these dynamics is crucial for making informed decisions. Grant Cardone advises, "Avoid debt that doesn’t pay you. Make it a rule that you never use debt that won’t make you money," highlighting the importance of strategic debt management.

-

Market Competitiveness: Companies that secure lower borrowing costs can gain a competitive edge. These enterprises are better positioned to allocate resources toward marketing, innovation, and growth, enabling them to thrive even as interest levels rise. Finance Story's expertise in tailored mortgage brokerage solutions ensures that clients can navigate these challenges effectively.

The influence of business loan interest in Australia on cash flow is particularly significant for small enterprises, which often operate with tighter margins. Proactive measures, such as evaluating funding options like business loan interest Australia and optimizing operations, can help alleviate the adverse effects of rising costs. A case study titled "Proactive Measures for Small Enterprises" illustrates that businesses implementing these strategies have successfully navigated the challenges posed by fluctuating interest rates, ultimately enhancing their financial resilience.

As small business owners navigate this landscape, staying informed and adaptable is essential. The choices made today regarding funding can have lasting effects on cash flow and overall company health. Testimonials from satisfied clients, such as Natasha B from VIC, underscore the effectiveness of Finance Story in assisting businesses through these financial challenges, reinforcing the importance of tailored financing solutions for various commercial properties, including warehouses and retail spaces, as well as refinancing options to adapt to evolving business needs.

Conclusion

Securing the right business loan is an essential step for small and medium enterprises in Australia, providing the necessary funding to drive growth and innovation. By understanding the various types of loans available—such as term loans, lines of credit, and government-backed options—business owners can tailor their financing to meet specific needs. Furthermore, recognizing the factors that influence interest rates, including credit scores, loan amounts, and economic conditions, empowers businesses to make informed financial decisions that align with their strategic objectives.

As interest rates continue to fluctuate, their impact on cash flow, investment decisions, and overall profitability becomes increasingly significant. Higher rates can strain resources and alter investment strategies, compelling businesses to reassess their financial health and risk tolerance. However, by leveraging expert advice and exploring diverse financing options, businesses can navigate these challenges effectively.

Ultimately, the ability to secure appropriate financing not only supports immediate operational needs but also positions businesses for long-term success. Staying informed about the financing landscape and understanding the implications of interest rates will enable business owners to make strategic choices that foster resilience and growth in an ever-evolving economic environment.