Overview

Business finance brokerage serves a crucial function in helping companies secure funding by acting as intermediaries between clients and a wide array of lenders, including private investors and banks. These brokerages provide tailored financial solutions that streamline the loan application process. This assistance is particularly vital for businesses grappling with challenges such as unfavorable credit histories or complex application procedures.

Furthermore, by facilitating access to diverse funding sources, business finance brokerages empower companies to navigate financial hurdles effectively. They not only enhance the chances of loan approval but also optimize the terms of financing. This dual benefit can significantly impact a business's growth trajectory and financial health.

In addition, the expertise of these brokerages can make a substantial difference in the loan acquisition process. Their knowledge of the lending landscape allows them to match clients with the most suitable lenders, ensuring that businesses receive the best possible financial solutions. This tailored approach is essential in today's competitive market, where every advantage counts.

Ultimately, engaging with a business finance brokerage can be a game-changer for companies seeking funding. By leveraging their expertise, businesses can streamline their loan applications and improve their chances of securing the necessary capital to thrive.

Introduction

In the dynamic realm of business finance, securing the right funding presents a formidable challenge for many enterprises. As traditional banking relationships diminish, the rise of business finance brokerages has transformed how companies approach financing. These intermediaries, such as Finance Story based in Melbourne, not only streamline the loan application process but also provide access to a diverse range of lenders, spanning boutique firms to mainstream banks.

With a commitment to personalized service and tailored solutions, brokerages excel at addressing the unique financial challenges encountered by businesses, whether they are startups or established corporations.

This article explores the vital role of business finance brokerages, the services they offer, and how they empower clients to navigate the complexities of securing the capital essential for growth and success.

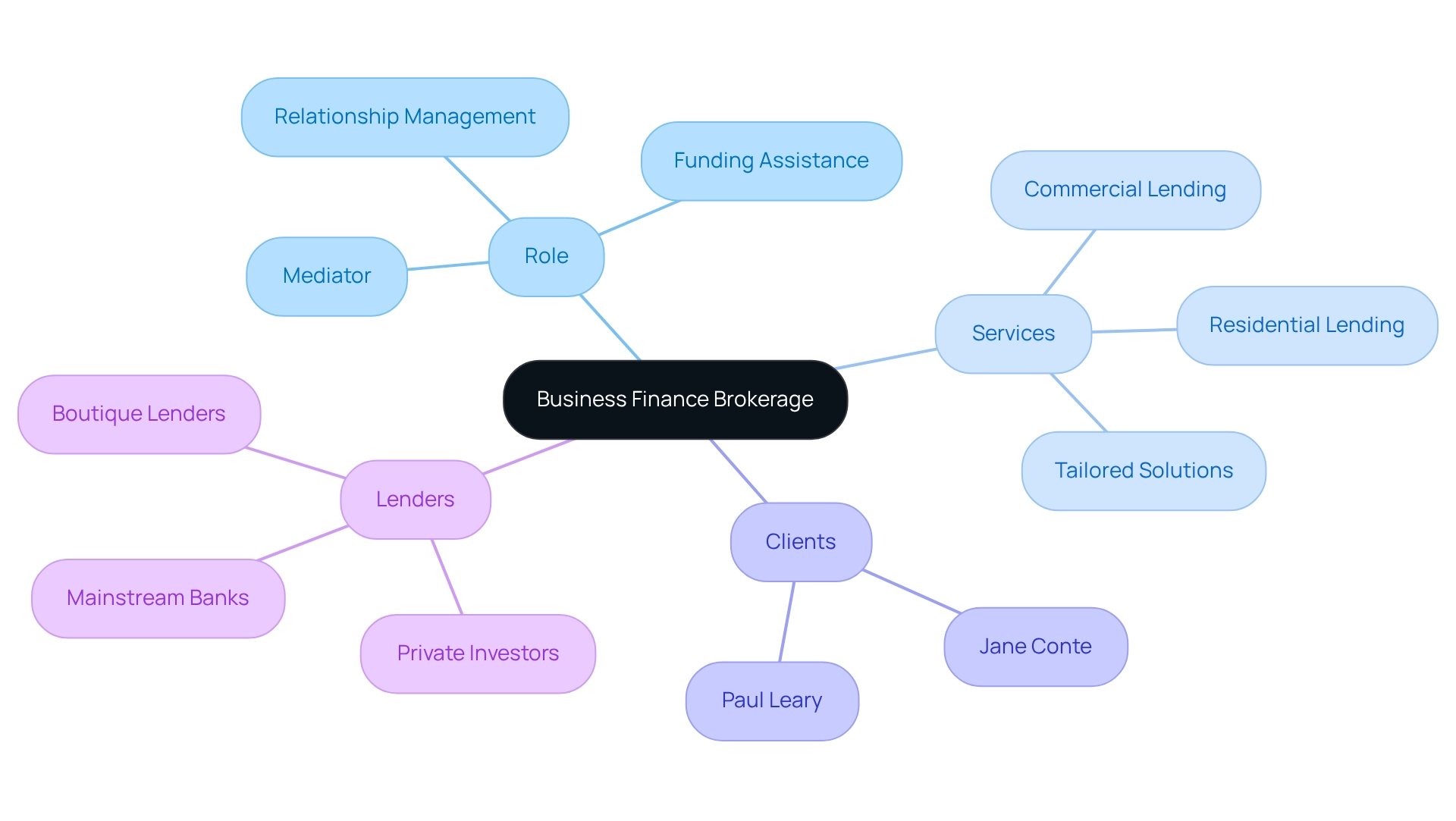

Define Business Finance Brokerage

Finance Narrative, a business finance brokerage based in Melbourne, plays a crucial role as a mediator, assisting companies in securing funding from a variety of lenders. Specializing in tailored commercial and residential lending solutions, Finance Narrative understands the unique financial needs of its clients, whether they are small startups or established corporations.

By leveraging strong connections with a diverse array of lenders—including boutique lenders, private investors, and mainstream banks—this business finance brokerage delivers customized financing solutions that align with the specific objectives and circumstances of each client. This relationship-driven support is vital as organizations navigate complex financial landscapes with the assistance of business finance brokerage to seek optimal funding options for growth and expansion.

Have you considered how personalized financial strategies could enhance your business's potential? Our clients, such as Paul Leary from QLD and Jane Conte from VIC, have experienced the tangible benefits of our tailored approach, reinforcing our reputation as a trusted partner in their financial journeys.

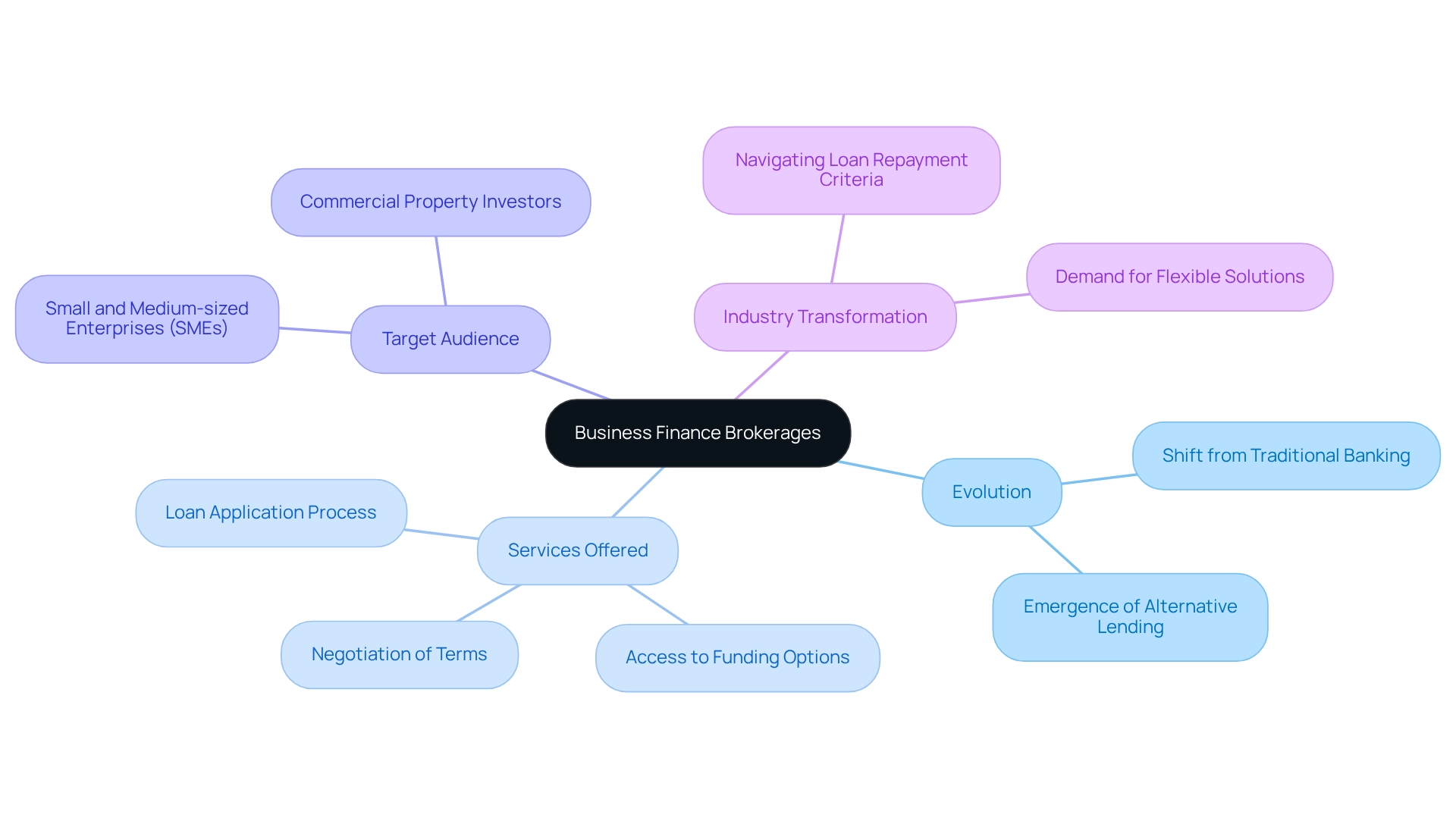

Contextualize the Role of Business Finance Brokerages

The landscape of business finance brokerage has evolved significantly over the past few decades. Traditionally, businesses relied heavily on banks for funding. However, as conventional banking relationships have diminished and alternative lending solutions have emerged, the business finance brokerage sector has stepped in to fill this void. They provide crucial services by streamlining the loan application process, negotiating favorable terms, and offering access to a broader array of funding options. This transformation is driven by the demand for more flexible and innovative solutions offered by business finance brokerage, particularly for small and medium-sized enterprises (SMEs) that may not meet the stringent requirements of traditional lenders.

At Finance Story, we excel in crafting refined and highly tailored cases for presentation to banks. Our goal is to empower small business owners to secure the optimal funding for their commercial property investments and refinancing needs. Our expertise enables us to navigate the complexities of loan repayment criteria and leverage a comprehensive range of lenders, including high street banks and cutting-edge private lending panels, to address the evolving demands of businesses.

Explore Key Characteristics and Services

Business finance brokerage firms offer a range of services tailored to meet the diverse needs of their clients. These services provided by the business finance brokerage are characterized by personalized attention, extensive networks of lenders, and expertise in various financing options. At Finance Story, we excel in providing customized refinancing solutions that empower clients to access equity and enjoy lower rates, regardless of whether they are self-employed or salaried individuals. Common services provided by business finance brokerage include:

- Loan Sourcing: Identifying suitable lenders based on the individual's financial profile and needs.

- Application Assistance: Helping clients prepare and submit loan applications, ensuring all necessary documentation is in order.

- Negotiation: Acting as intermediaries to negotiate favorable terms and conditions on behalf of clients.

- Advisory Services: Offering strategic guidance on funding options, repayment strategies, and financial management.

Furthermore, our expertise in crafting tailored loan proposals enables clients to secure financing for both residential property investments and commercial projects. These attributes empower brokerages to deliver customized solutions that significantly increase the chances of obtaining funding.

Address Client Challenges and Solutions

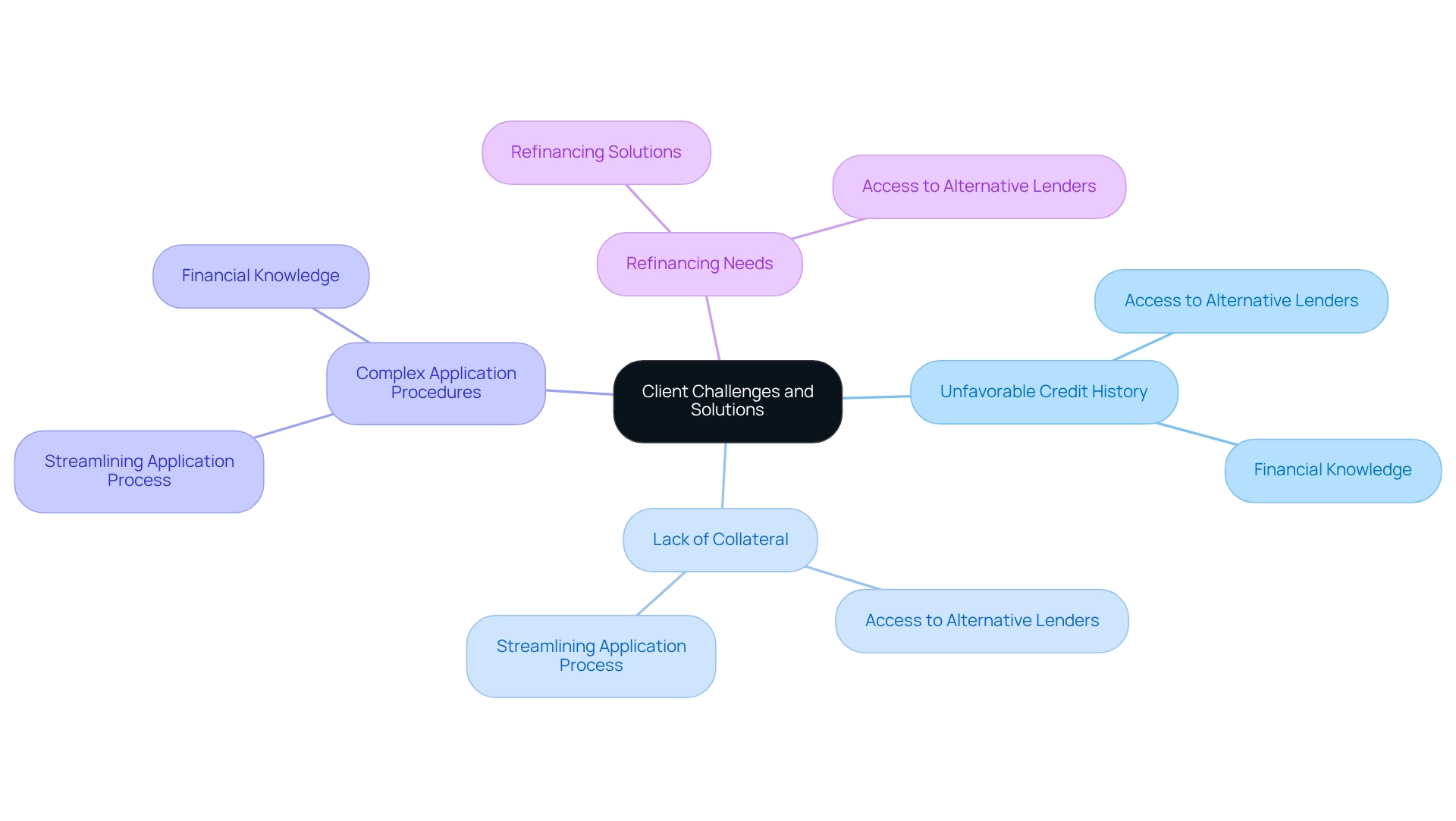

Clients pursuing funding frequently encounter a range of obstacles, including unfavorable credit history, lack of collateral, and complex application procedures. Business finance brokerages, such as Finance Story, play an essential role in overcoming these challenges by:

-

Providing Access to Alternative Lenders: Brokerages connect clients with non-traditional lenders who may exhibit greater flexibility in their lending criteria. Finance Story showcases a broad spectrum of private, boutique commercial investors alongside conventional funding sources, ensuring clients have access to diverse options.

-

Providing Financial Knowledge: Educating clients about their funding options and helping them understand the implications of various loan arrangements is vital. Finance Story emphasizes the development of refined and highly personalized cases to present to banks, enhancing clients' understanding of their financing journey.

-

Streamlining the Application Process: By managing paperwork and communication with lenders, brokerages alleviate the burden on clients, allowing them to focus on their core activities. For example, a small business owner with limited credit history may struggle to secure a loan from traditional banks. A business finance brokerage like Finance Story can assist by identifying alternative lenders willing to evaluate the owner's business plan and growth potential, ultimately facilitating access to necessary funds.

-

Refinancing Solutions: Beyond initial financing, Finance Story also aids clients in refinancing existing loans to better align with their evolving operational needs. This can include negotiating improved terms or accessing new funding sources that correspond with the client's current financial situation.

As Natasha B. from VIC remarked, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." This testimonial underscores Finance Story's commitment to supporting clients through their financing challenges.

Conclusion

The transformative role of business finance brokerages, such as Finance Story, underscores their critical importance in today’s evolving financial landscape. Acting as intermediaries between businesses and a diverse array of lenders, these brokerages simplify the often-complex process of securing funding. They provide personalized service tailored to the unique needs of each client while leveraging extensive networks to identify the most suitable financing options. This adaptability proves particularly crucial for small and medium-sized enterprises that may encounter challenges in securing traditional bank loans.

The services offered by business finance brokerages encompass a wide range of solutions, including:

- Loan sourcing

- Application assistance

- Negotiation

- Financial education

By addressing common client challenges—such as poor credit history and complex application processes—brokerages facilitate access to alternative lending sources that are more accommodating. This support empowers businesses to concentrate on their core operations while navigating the financial complexities essential for growth.

In conclusion, the rise of business finance brokerages signifies a notable shift in how companies approach financing. With their expertise and commitment to personalized service, these intermediaries serve as invaluable partners in helping businesses secure the capital necessary for success. Positive experiences from clients illustrate that the tailored solutions and strategic guidance provided by brokerages not only enhance the likelihood of obtaining funding but also foster long-term financial stability and growth. Embracing the services of a business finance brokerage can be a game-changer for any enterprise aiming to thrive in today’s competitive marketplace.