Overview

The article centers on identifying the premier small business loan providers, detailing their essential features and benefits. It underscores the significance of assessing critical factors such as:

- Interest rates

- Financing conditions

- Fees

- Approval processes

- Customer service

- Flexibility

These elements collectively empower businesses to choose the most suitable lender tailored to their unique financial needs.

Introduction

Navigating the world of small business financing can be a daunting task. With a myriad of loan providers vying for attention in today’s competitive landscape, businesses must seek the funds necessary for growth. Understanding the key criteria for evaluating potential lenders becomes essential. Factors such as interest rates, loan terms, customer service, and lender reputation all play pivotal roles in determining the right fit for a business's unique needs.

Furthermore, the diverse array of loan products available—from traditional term loans to innovative financing options like invoice factoring and merchant cash advances—demands that small business owners equip themselves with the knowledge to make informed decisions. This article delves into the essentials of selecting the right small business loan provider, exploring the advantages offered by various lenders. It provides a roadmap to secure the financing that aligns with business goals.

Key Criteria for Evaluating Small Business Loan Providers

When assessing minor enterprise funding sources, several key factors warrant your attention:

-

Interest Rates: The cost of borrowing stands as a primary concern. It is essential to compare annual percentage rates (APRs) across various financial institutions, as even slight variations can significantly impact total repayment amounts. Current average interest rates for small business financing in 2025 reflect a competitive landscape, making it crucial to explore your options. Notably, 47% of manufacturing companies secured the full amount of funding requested, underscoring the importance of understanding financing options.

-

Financing Conditions: Delve into the length of financing and the repayment timetable. Certain financiers offer adaptable conditions that can be customized to your cash flow requirements, which is particularly beneficial for companies with fluctuating revenues. Finance Story specializes in crafting refined and highly tailored case presentations for banks, ensuring that financing proposals align with the evolving needs of businesses.

-

Fees and Charges: Stay vigilant regarding hidden fees, such as origination fees, late payment penalties, and prepayment penalties. These additional costs can accumulate, impacting the overall expense of the loan.

-

Approval Process: The speed and ease of the application process can vary significantly. Many creditors now prioritize swift approvals, which is vital for enterprises requiring prompt funding. Interestingly, minor banks and credit unions have demonstrated higher approval rates, with minor banks achieving a complete approval rate of 52% for credit requests. Moreover, it is important to recognize that 70% of small business funding is provided by banks with less than $250 billion in assets, highlighting the potential advantages of considering smaller lenders.

-

Customer Service: The quality of customer support can greatly influence your borrowing experience. Seek financial providers known for their attentive and supportive service, as this can significantly impact the loan process.

-

Creditor Reputation: Investigate the creditor's history and customer reviews. A trustworthy financier is more likely to offer a favorable borrowing experience, which is crucial for cultivating long-term professional relationships.

-

Flexibility: Assess whether the financial institution provides options for modifying repayment conditions or payment timelines during monetary challenges. This adaptability can be vital for sustaining cash flow during difficult periods. Additionally, many of the top small business loan providers evaluate personal credit ratings and financial situations, particularly for newer enterprises, when determining interest rates. By thoroughly assessing these criteria, borrowers can navigate the lending landscape more effectively and identify the top small business loan providers that align with their organizational goals. As the future of lending products leans towards digital, API-first solutions, staying informed about evolving options will further empower entrepreneurs in their financing decisions.

Overview of Loan Products Offered by Leading Providers

In 2025, the top small business loan providers offer a diverse range of products tailored to meet various commercial needs. Here’s an overview of common credit types:

- Term Loans: Conventional financing with a predetermined repayment plan, ideal for enterprises seeking a lump sum for expansion or major expenses.

- Line of Credit: A flexible borrowing option that allows companies to access funds up to a specified limit, paying interest only on the amount withdrawn. This is particularly beneficial for managing cash flow fluctuations.

- Equipment Financing: Specifically designed for purchasing equipment, this loan type uses the equipment itself as collateral, simplifying the approval process.

- Invoice Financing: This method enables companies to borrow against outstanding invoices, providing immediate cash flow while awaiting customer payments. Invoice factoring, a popular option, allows companies to sell their receivables for quick capital without incurring debt. For instance, a case study on invoice factoring illustrates how companies can leverage their accounts receivable to gain immediate access to cash, enhancing operational flexibility.

The top small business loan providers offer various financial products, including SBA Financing, which is supported by the Small Business Administration and typically provides lower interest rates and extended repayment terms, making it an appealing choice for small enterprises. Merchant Cash Advances, available from the top small business loan providers, provide a lump sum in exchange for a portion of upcoming credit card sales, suitable for enterprises with high sales volumes, though it can be costly. Short-Term Financing from these top small business loan providers is designed for urgent funding needs, featuring shorter repayment durations that are perfect for immediate expenses. Lastly, refinancing options offered by the top small business loan providers allow companies looking to refinance their current loans to benefit from tailored solutions that address their evolving requirements, ensuring adaptability to shifting market conditions.

Understanding these loan products enables organizations to select the most suitable financing option for their unique circumstances. Significantly, Finance Story focuses on developing refined and highly customized business cases to present to financiers, ensuring that small business owners can secure the appropriate funding for their commercial property investments and refinances. We offer access to a comprehensive array of top small business loan providers, including high street banks and innovative private lending panels, to accommodate diverse financing needs. Statistics indicate that customers utilizing flexible financing services experience a 30% increase in repayment rates on average, underscoring the importance of selecting the right type of credit. As minor enterprises increasingly plan to invest in digital marketing—18% in 2024—having access to suitable financing options becomes essential for sustained growth. Furthermore, as highlighted by finance author Janet Gershen-Siegel, minor banks have a credit approval rate of approximately 52%, which can be a viable option for enterprises seeking funding.

Distinct Advantages of Each Small Business Loan Provider

Various funding sources from top small business loan providers offer distinct benefits tailored to different borrower requirements. Notable providers and their strengths include:

- OnDeck: Known for its swift approval process and flexible repayment terms, OnDeck is ideal for businesses needing quick access to capital. They offer both term financing and lines of credit, addressing urgent financial needs.

- Bizcap: This provider distinguishes itself with a progressive lending strategy, offering flexible financing even to businesses with less-than-ideal credit ratings. Their rapid access to funds is a significant advantage for small and medium enterprises (SMEs), particularly those facing cash flow challenges.

- Commonwealth Bank: Recognized for its structured term financing and commercial overdrafts, Commonwealth Bank provides a comprehensive range of financial products, making it perfect for businesses seeking a one-stop solution for their financial needs.

- Lend Capital: This financial institution offers a variety of funding options, including unsecured loans and credit facilities, making it an excellent choice for businesses that may lack collateral to secure a loan.

- Rapid Finance: Acknowledged for its absence of minimum credit criteria, Rapid Finance is accessible for startups and businesses with limited credit history, allowing them to secure funding without traditional barriers.

- Knote: Utilizing AI-powered assessments and minimal documentation requirements, Knote streamlines the application process, making it a superb choice for tech-savvy entrepreneurs seeking efficiency.

- Sapphire Finance: Recognized among the top small business loan providers, delivering customized solutions for specific sectors and leveraging specialized expertise that can greatly assist companies operating in niche markets.

By evaluating these unique advantages, businesses can make informed decisions about which lender aligns best with their operational needs and financial goals. Notably, cash flow data indicates rising average daily balances for loan applicants, reflecting a resource alignment for growth amidst the evolving landscape of financing options available to entrepreneurs. Since 2010, over 87% of small enterprise financing requests in Canada have been approved annually, showcasing a positive approval environment for small businesses. Furthermore, veteran-owned enterprises have reported the highest percentage (26%) of annual revenues between $1M and $10M, underscoring the financial success of specific demographics. The acceptance of alternative payment methods has also surged, with cash flow data revealing a 23% increase in businesses accepting payments through platforms like Venmo and Zelle, indicating a shift towards more flexible payment solutions in response to consumer demand.

Choosing the Right Small Business Loan Provider for Your Needs

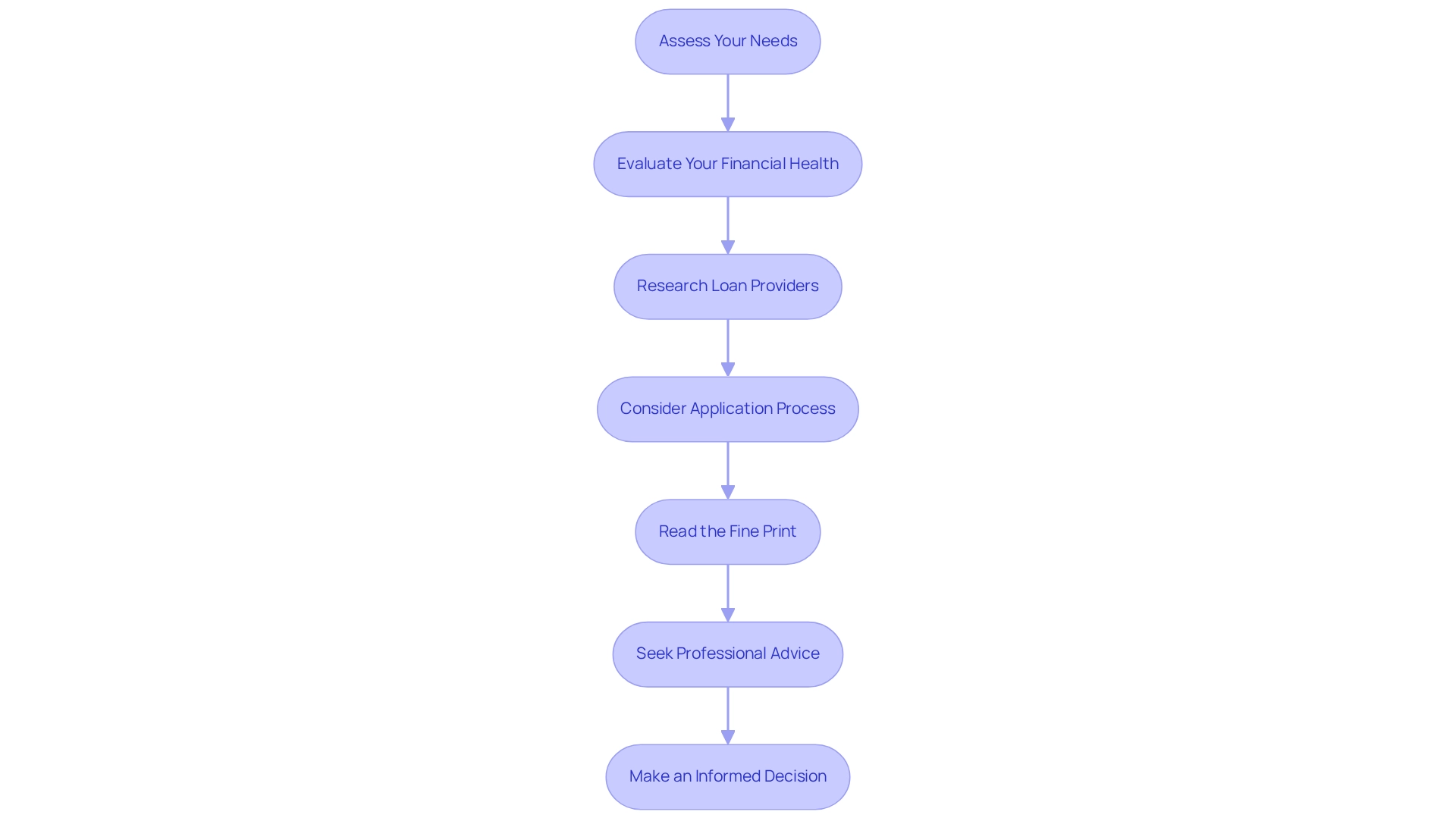

Choosing the perfect top small business loan providers requires a systematic approach that encompasses several key steps:

-

Assess Your Needs: Clearly define the funding amount required and the loan's intended purpose. Are you seeking short-term cash flow assistance or planning for a long-term investment?

-

Evaluate Your Financial Health: Analyze your credit score, revenue, and overall financial condition. Understanding your financial position will help determine which financial institutions you may qualify for and the terms you can expect.

-

Research the top small business loan providers: Compare them based on the criteria established earlier. Focus on those that offer products aligned with your needs and have a solid reputation in the market. At Finance Story, we specialize in creating polished and highly individualized business cases to present to banks, ensuring you have the best chance of securing the right financing for your commercial property investments, whether it be a warehouse, retail premise, factory, or hospitality venture.

-

Consider the Application Process: Various financial institutions have differing application procedures. If time is critical, prioritize those known for efficient approvals. Working with Finance Story provides access to a full suite of lenders, including high street banks and innovative private lending panels, streamlining your application experience.

-

Read the Fine Print: Before finalizing any agreement, meticulously review the terms and conditions. Pay close attention to interest rates, fees, and repayment schedules to avoid unexpected issues later.

-

Seek Professional Advice: If unsure, consult with a financial advisor or finance consultant. Their expertise can provide tailored guidance based on your specific circumstances. Our team at Finance Story is prepared to help you comprehend repayment criteria and navigate the intricacies of financial support.

-

Make an Informed Decision: After gathering all relevant information, weigh the advantages and disadvantages of each option. Choose the lender that ranks among the top small business loan providers, offering the best combination of terms, support, and flexibility to foster your business growth. By following these steps, small business owners can confidently select a loan provider that aligns with their financial needs and growth aspirations.

Conclusion

Navigating the small business financing landscape is a critical endeavor for entrepreneurs seeking growth and stability. The evaluation of potential lenders hinges on several key criteria:

- Interest rates

- Loan terms

- Fees

- Approval processes

- Customer service

- Lender reputation

- Flexibility

Each of these factors plays a significant role in determining which lender can best meet a business’s unique requirements. By understanding these elements, small business owners can make informed decisions that align with their financial strategies.

Furthermore, the diverse range of loan products available—from traditional term loans to innovative options like invoice financing and merchant cash advances—offers tailored solutions to meet various business needs. Recognizing the distinct advantages of different lenders can further empower business owners to select a provider that complements their operational goals. Whether it’s rapid approval for urgent cash flow needs or flexible repayment terms for long-term investments, the right financing option can significantly impact a business’s success.

Ultimately, the process of choosing the right small business loan provider is multifaceted and requires careful consideration. By assessing their specific needs, evaluating their financial health, and conducting thorough research on potential lenders, entrepreneurs can navigate this complex landscape with confidence. Armed with the right information and resources, small business owners can secure the financing necessary to fuel their growth and achieve their aspirations in an increasingly competitive market.