Overview

This article serves as a comprehensive step-by-step guide for purchasing business premises through a Self-Managed Superannuation Fund (SMSF). It underscores the critical importance of compliance and strategic planning in this investment journey. Key steps are outlined, including:

- The establishment of the SMSF

- Conducting thorough due diligence

- Securing appropriate financing

Additionally, the article highlights the benefits and regulatory obligations tied to SMSF property investments. By equipping readers with essential knowledge, it empowers them to navigate this complex investment process with confidence and clarity.

Introduction

In the dynamic realm of retirement planning, Self-Managed Super Funds (SMSFs) stand out as an instrumental asset for discerning investors aiming to acquire business property. By granting unparalleled control over retirement savings, SMSFs not only unveil lucrative investment opportunities but also offer substantial tax benefits.

As individuals navigate the intricacies of property acquisition through SMSFs, grasping the regulatory framework and financing options is crucial. This article explores the fundamental elements of SMSFs, detailing:

- Their structure

- The step-by-step process for purchasing business premises

- The significance of seeking professional guidance to enhance investment potential

With an increasing trend towards property investment within SMSFs, informed decision-making is essential to unlocking the complete advantages of this investment strategy.

Understand SMSFs and Their Role in Business Property Acquisition

Self-Managed Superannuation Funds (SMSFs) empower individuals to take charge of their retirement savings, offering a unique opportunity for an SMSF to purchase business premises. This financial strategy not only generates revenue but also fosters capital appreciation, making SMSFs an attractive option for discerning investors. Key aspects to consider include:

- Structure of Self-Managed Super Funds: Typically established by individuals or small groups, these funds offer the flexibility to tailor strategies that align with personal financial objectives. This independence is crucial for enhancing financial outcomes.

- Advantages of Utilizing Self-Managed Superannuation Funds for Real Estate Acquisition: Investing in real estate through an SMSF can yield substantial tax benefits, including reduced capital gains tax and the ability to leverage the fund for real estate financing. As of 2025, SMSFs maintain a significant portion of their assets in non-residential real estate, reflecting a growing trend among investors.

- Regulatory Framework: Governed by the Australian Taxation Office (ATO), SMSFs must adhere to stringent regulations regarding real estate acquisitions. Compliance is vital to avoid penalties and uphold the fund's integrity.

Recent statistics reveal that 74% of SMSF assets are allocated to various asset categories, with a notable 9.9% in non-residential real estate. This trend underscores the increasing allure of SMSFs for real estate investment, particularly as they provide a means for individuals to broaden their asset portfolio without compromising personal financial goals. Moreover, case studies indicate that while compliance challenges persist—evidenced by 2.8% of SMSFs receiving auditor contravention reports—many of these issues are resolved, emphasizing the necessity of effective governance. By understanding these fundamental aspects, readers can appreciate how SMSFs can facilitate the purchase of business premises, paving the way for informed decision-making in their investment endeavors.

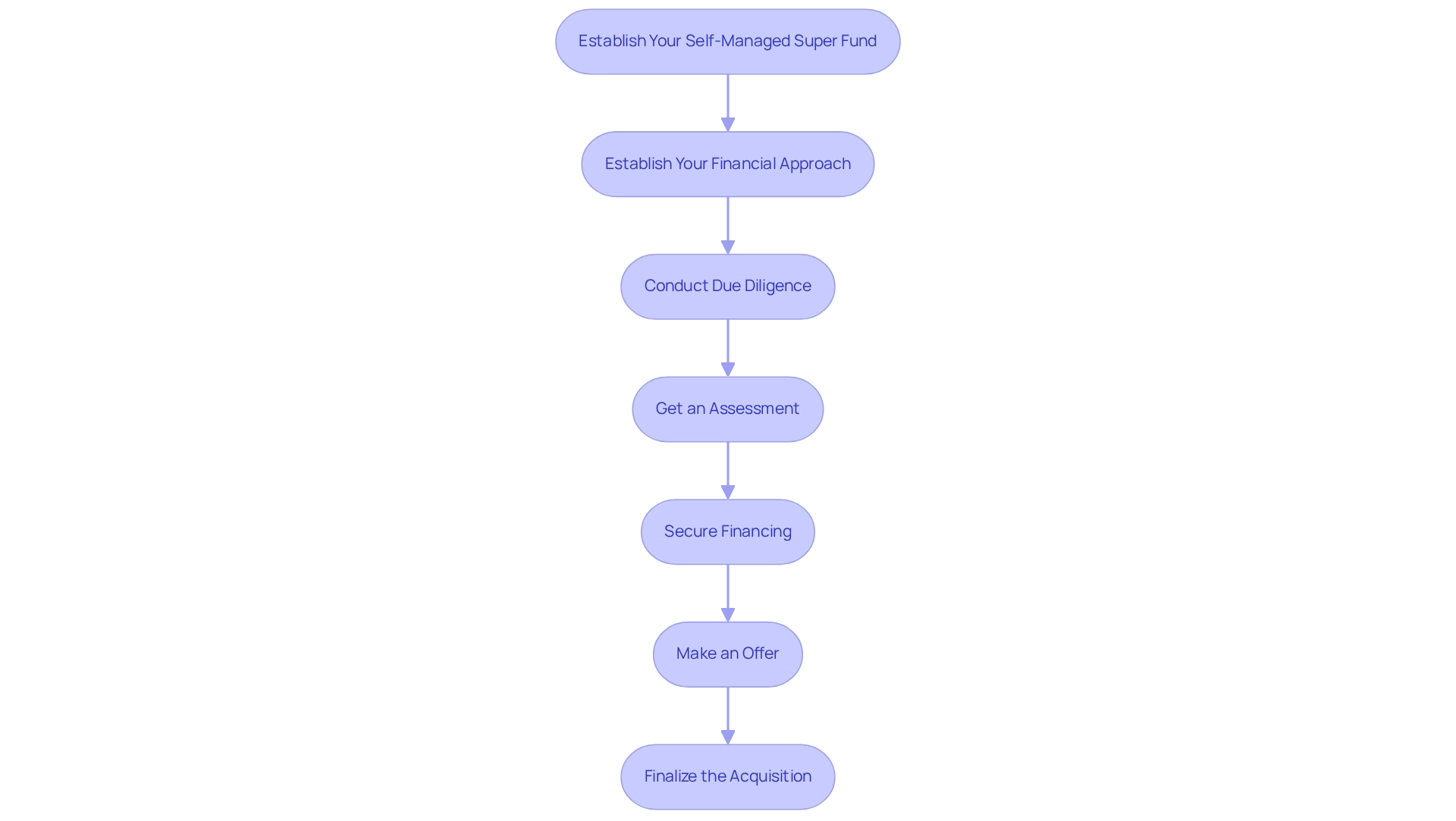

Follow the Step-by-Step Process for Purchasing Business Premises with an SMSF

To proceed with an SMSF purchase of business premises, follow these essential steps:

-

Establish Your Self-Managed Super Fund: If you do not already have a self-managed super fund, initiate the setup process. This includes choosing a trustee arrangement, registering with the Australian Taxation Office (ATO), and developing a financial strategy.

-

Establish Your Financial Approach: Clearly outline the purpose of the asset acquisition and how it aligns with your fund's financial goals. Document this strategy and review it regularly to ensure it remains relevant.

-

Conduct Due Diligence: Thoroughly research potential real estate assets, considering factors such as location, market trends, and expected rental income. This groundwork is crucial for informed decision-making.

-

Get an Assessment: Before submitting a bid, obtain a professional evaluation of the asset to ensure it aligns with the fund's investment standards and to prevent overpayment.

-

Secure Financing: If funding is needed, explore the different loan alternatives available specifically for an SMSF purchase of business premises. This may include loans from private lenders or mainstream financial institutions.

-

Make an Offer: After identifying a suitable location, proceed to make an offer. Ensure that the offer adheres to superannuation regulations to avoid any legal complications.

-

Finalize the Acquisition: Once your proposal is accepted, conclude the required legal paperwork and transfer the funds from the self-managed superannuation fund to complete the SMSF purchase of business premises.

By adhering to these steps, you can efficiently manage the buying process while ensuring compliance with self-managed superannuation fund regulations. This approach ultimately positions your fund for potential growth in real estate investment.

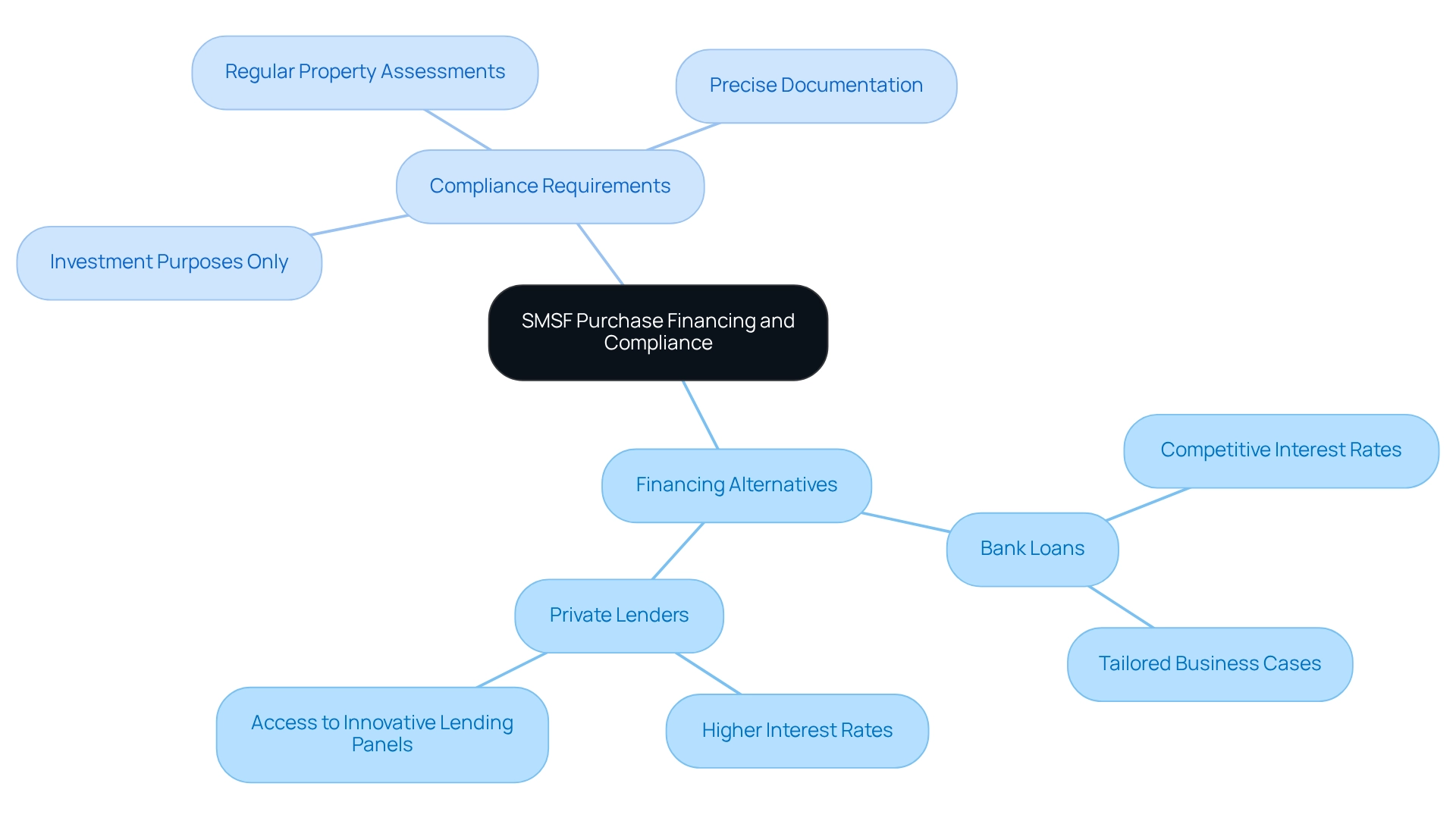

Explore Financing Options and Compliance Requirements for SMSF Purchases

When planning an SMSF purchase business premises, it is essential to explore various financing alternatives while remaining vigilant about compliance obligations.

-

Financing Alternatives: Self-managed super funds can leverage borrowing to acquire real estate, adhering to the 'limited recourse borrowing arrangement' (LRBA) rules. This stipulation ensures that, in the event of a default, the lender can only claim the property financed by the loan, thereby protecting other fund assets. Common financing avenues include:

- Bank Loans: Numerous banks offer loans specifically designed for SMSFs, typically featuring competitive interest rates. As of 2025, average interest rates for SMSF loans are projected to remain favorable, making them an appealing option for many investors. Finance Story focuses on crafting refined and exceptionally tailored business cases to present to banks, ensuring you secure the appropriate loan for your commercial real estate.

- Private Lenders: For those who may not meet the criteria for traditional bank loans, private lenders provide alternative financing solutions, though these often come with higher interest rates. Finance Story offers access to a comprehensive suite of lenders, including innovative private lending panels, to accommodate your specific circumstances.

-

Compliance Requirements: Adhering to the stringent regulations set forth by the Australian Taxation Office (ATO) is paramount for SMSFs. Key compliance mandates include:

- Ensuring that the property is solely for investment purposes and not utilized for personal benefit.

- Maintaining precise documentation of all transactions and ensuring consistency with the fund's financial strategy.

- Conducting regular property assessments to confirm that the investment aligns with the fund's financial objectives.

Understanding these funding choices and regulatory obligations empowers trustees to make informed decisions about their SMSF purchase business premises that align with their goals. Notably, the self-managed superannuation fund sector plays a vital role in the broader Australian superannuation system, with fewer than 0.1% of these funds having balances exceeding $50 million. Furthermore, a document titled "Trends in Self-Managed Super Funds" reveals that 74% of assets are concentrated in five asset categories, underscoring the importance of diversification strategies to effectively manage risk within self-managed super funds. As Shaun Backhaus, Director at DBA Lawyers, emphasizes, compliance with these regulations is crucial for the successful operation of SMSFs.

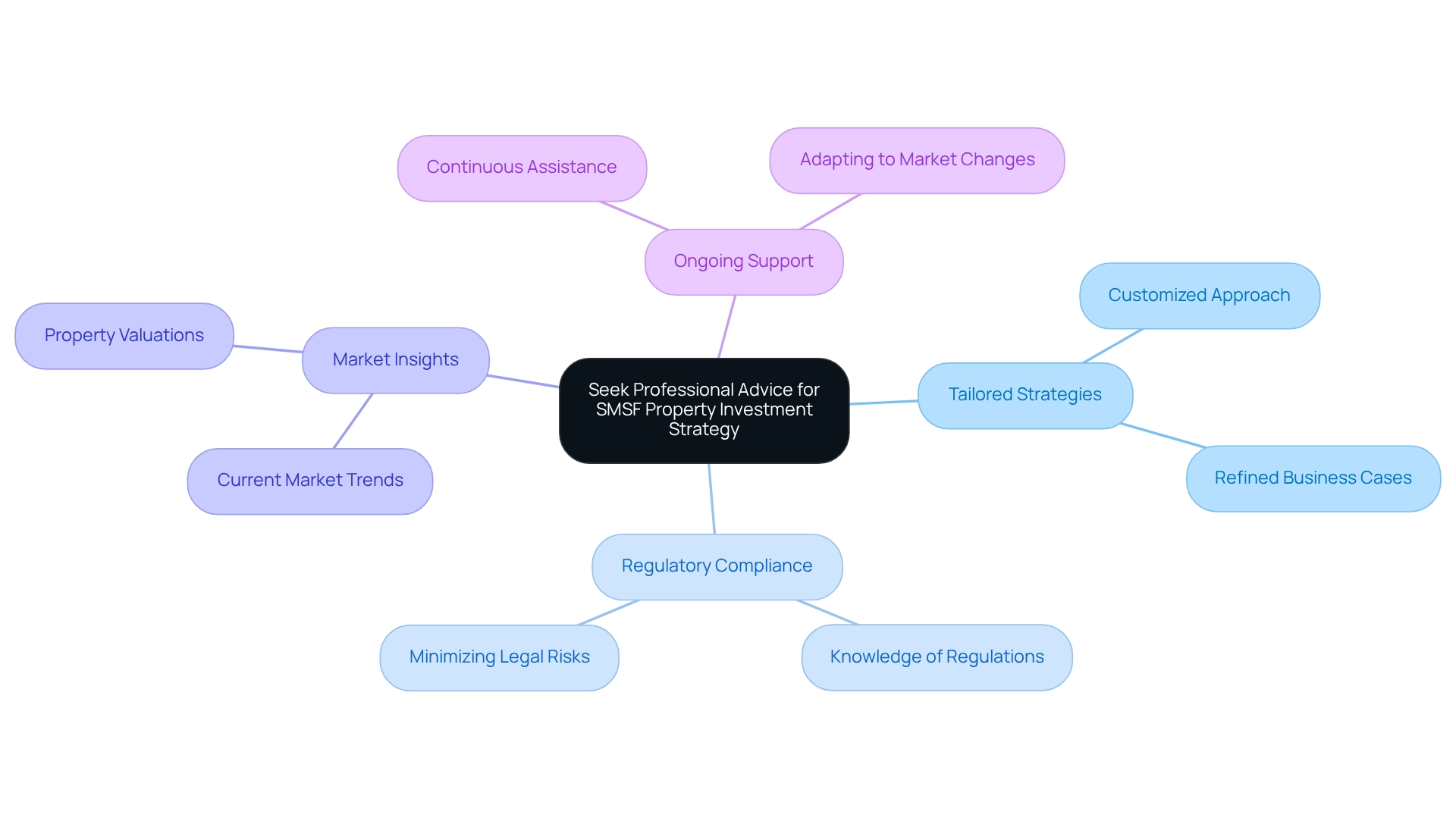

Seek Professional Advice to Optimize Your SMSF Property Investment Strategy

To maximize the potential of your self-managed super fund real estate venture, securing expert guidance is essential for several compelling reasons:

- Tailored Strategies: A financial advisor can create a customized approach that aligns with your financial objectives and risk tolerance, ensuring your self-managed super fund is positioned for success. At Finance Story, we specialize in developing refined and tailored business cases to present to lenders, helping you secure the appropriate funding for your commercial real estate endeavors from our extensive network of lenders.

- Regulatory Compliance: Experts possess in-depth knowledge of the complexities surrounding self-managed superannuation fund regulations, assisting you in ensuring compliance and minimizing the risk of penalties or legal issues that may arise from mismanagement. Our team at Finance Story provides expert advice to navigate these regulations effectively.

- Market Insights: Experienced consultants offer valuable insights into current market trends and property valuations, enabling you to make informed decisions that can enhance your portfolio's performance. We leverage our broad network of lenders, including high street banks and innovative private lending groups, to identify the best options for your SMSF.

- Ongoing Support: Engaging an expert provides continuous assistance as your financial strategy evolves, ensuring your SMSF remains aligned with your financial goals and adapts to changing market conditions. Finance Story is committed to being your partner throughout this journey, offering personalized support and compliance assistance.

Statistics reveal that 34 percent of unadvised self-managed super funds are seeking financial advice, a notable increase from 25 percent the previous year, highlighting the growing recognition of the importance of professional guidance. Furthermore, case studies indicate that individuals who maintain separate super accounts often do so to access more affordable life insurance or to diversify their portfolios, reflecting a strategic approach to financial management. This behavior underscores the significance of personalized guidance in balancing the benefits of self-managed super funds with traditional superannuation accounts. By incorporating expert insights, it becomes clear that professional financial counsel significantly impacts self-managed super fund performance, particularly in real estate. By leveraging this expertise at Finance Story, you can refine your strategy for an SMSF purchase business premises, leading to enhanced outcomes and a more secure financial future.

Conclusion

In conclusion, leveraging Self-Managed Super Funds (SMSFs) for business property acquisition not only offers substantial tax advantages but also fosters growth and diversification of retirement portfolios. By comprehensively understanding the intricacies of SMSFs, following the correct procedures, and engaging with professionals, investors can maximize their potential for success in this dynamic investment landscape.

Embracing this strategic approach to retirement planning is essential for realizing long-term financial goals and securing a prosperous future.