Overview

This article serves as a comprehensive step-by-step guide for securing a small business loan from direct lenders. Understanding the various loan types is crucial, as is preparing a strong application. To enhance your chances of obtaining financing tailored to your business's needs, it is essential to:

- Gather financial documents

- Develop a clear business plan

- Follow up diligently with lenders

These steps collectively increase your likelihood of success in navigating the loan process.

Introduction

In the dynamic realm of small business financing, grasping the diverse loan options available is crucial for unlocking growth and success. Entrepreneurs often navigate a complex landscape filled with:

- Secured loans

- Unsecured loans

- Lines of credit

- More, each designed to meet distinct financial needs.

As economic conditions evolve and the demand for business finance fluctuates, knowing how to effectively prepare and apply for a loan becomes imperative. This article explores the essentials of small business loans, offering insights on:

- Crafting a compelling application

- Engaging with direct lenders

- Managing the post-application process

With expert guidance, business owners can confidently embark on their financing journey, ensuring they secure the necessary funds to fuel their ambitions.

Understand Small Business Loans

Small business funding, particularly from a small business loan direct lender, is crucial for entrepreneurs, providing various types designed to address specific financial requirements. At Finance Story, we provide access to a comprehensive range of providers, including a small business loan direct lender, ensuring you discover the right financing solution. The primary types include:

- Secured Financing: These funds require collateral, such as property or equipment, which the provider can claim in case of default. They typically offer lower interest rates due to the decreased risk for lenders, making them an appealing choice for companies with valuable assets.

- Unsecured Loans: Unlike secured loans, these do not require collateral, making them more accessible. However, they frequently carry elevated interest rates, rendering them appropriate for enterprises lacking substantial assets.

- Lines of Credit: This flexible financing option enables enterprises to borrow up to a predetermined limit, paying interest only on the amount utilized. It is particularly useful for managing cash flow fluctuations, providing a safety net during lean periods.

- Term Financing: Conventional financing with a fixed repayment schedule, term financing is ideal for larger purchases or investments, providing predictable payment structures.

- Equipment Financing: Specifically created for acquiring equipment, this type of financing uses the equipment itself as collateral, enabling enterprises to obtain necessary tools without substantial upfront expenses.

- SBA Financing: Supported by the Small Business Administration, these funds offer advantageous conditions but frequently entail a prolonged application procedure, making them suitable for enterprises that can tolerate waiting for financial support.

Recent patterns suggest that while 82% of small enterprise applicants attained at least partial funding approval from small banks, the overall need for financial resources has diminished due to increasing expenses and economic unpredictability. As reported by Forbes, the majority of companies possess under $100,000 in debt, despite the average small enterprise credit amount being around $663,000. In 2025, the terrain of small enterprise financing continues to evolve, with a significant shift towards unsecured financing as companies seek flexibility amid challenging economic conditions. Furthermore, the influence of economic circumstances on small enterprises has emphasized the challenges in obtaining funding, with new sources and products arising but still restricted in comparison to conventional bank loans. Grasping these choices is essential for identifying which kind of financing from a small business loan direct lender aligns best with your objectives and financial circumstances. Our expertise at Finance Story ensures that we create polished and highly tailored cases to present to lenders, satisfying their expectations and securing the right financing for your commercial property investments and refinances.

Prepare Your Loan Application

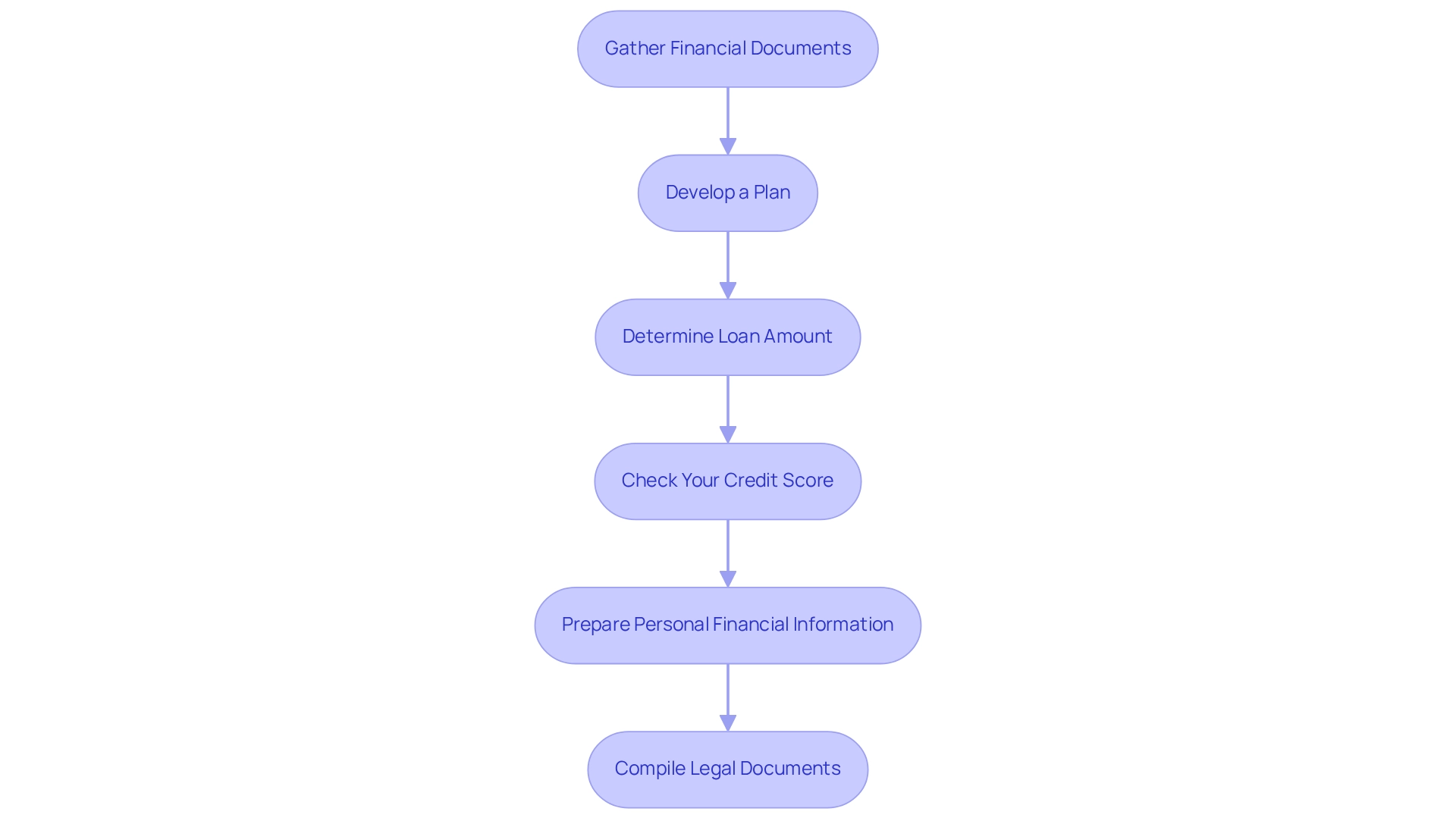

To effectively prepare your loan application, follow these essential steps:

-

Gather Financial Documents: Collect your company financial statements, including profit and loss statements, balance sheets, and cash flow statements for the past three years. These documents provide creditors with a clear view of your financial condition and are essential for developing refined, highly tailored cases that a small business loan direct lender can help you with, and that Finance Story excels in.

-

Develop a Plan: Outline your objectives, strategies, and how the funding will facilitate growth. Include detailed financial projections to demonstrate potential profitability and sustainability. Customizing your proposal to align with the expectations of a small business loan direct lender can significantly improve your odds of approval.

-

Determine Loan Amount: Clearly specify the amount of funding you need and its intended use. Being precise about the funding's purpose helps a small business loan direct lender understand your financial needs better, especially when presenting to a range of lenders, from high street banks to private lending panels.

-

Check Your Credit Score: Review both your personal and commercial credit scores. Address any discrepancies or issues, as around 20% of small enterprise funding requests are denied due to credit problems, highlighting the significance of a robust credit profile. Maintaining a strong credit profile is essential for securing favorable loan terms from a small business loan direct lender and ensuring financial flexibility.

-

Prepare Personal Financial Information: Lenders frequently ask for personal financial statements from entrepreneurs, detailing income and assets. This information helps them assess your overall financial stability and repayment capability, which is critical for securing a small business loan direct lender.

-

Compile Legal Documents: Ensure you have all necessary legal documents, such as commercial licenses, registrations, and partnership agreements. These documents confirm your enterprise's legitimacy and operational compliance. By carefully preparing these documents, you will present a comprehensive application that effectively addresses the concerns of a small business loan direct lender, thereby increasing your chances of securing the necessary funding.

Furthermore, it's crucial to mention that SBA financing usually has interest rates ranging from 5.50% to 8%, which can affect your total funding expenses. If cash flow is a concern, consider options like factoring, where companies sell their outstanding accounts receivable to a third-party firm for an immediate cash advance, as noted by financial advisor Jim Pendergast.

Apply for the Loan with a Direct Lender

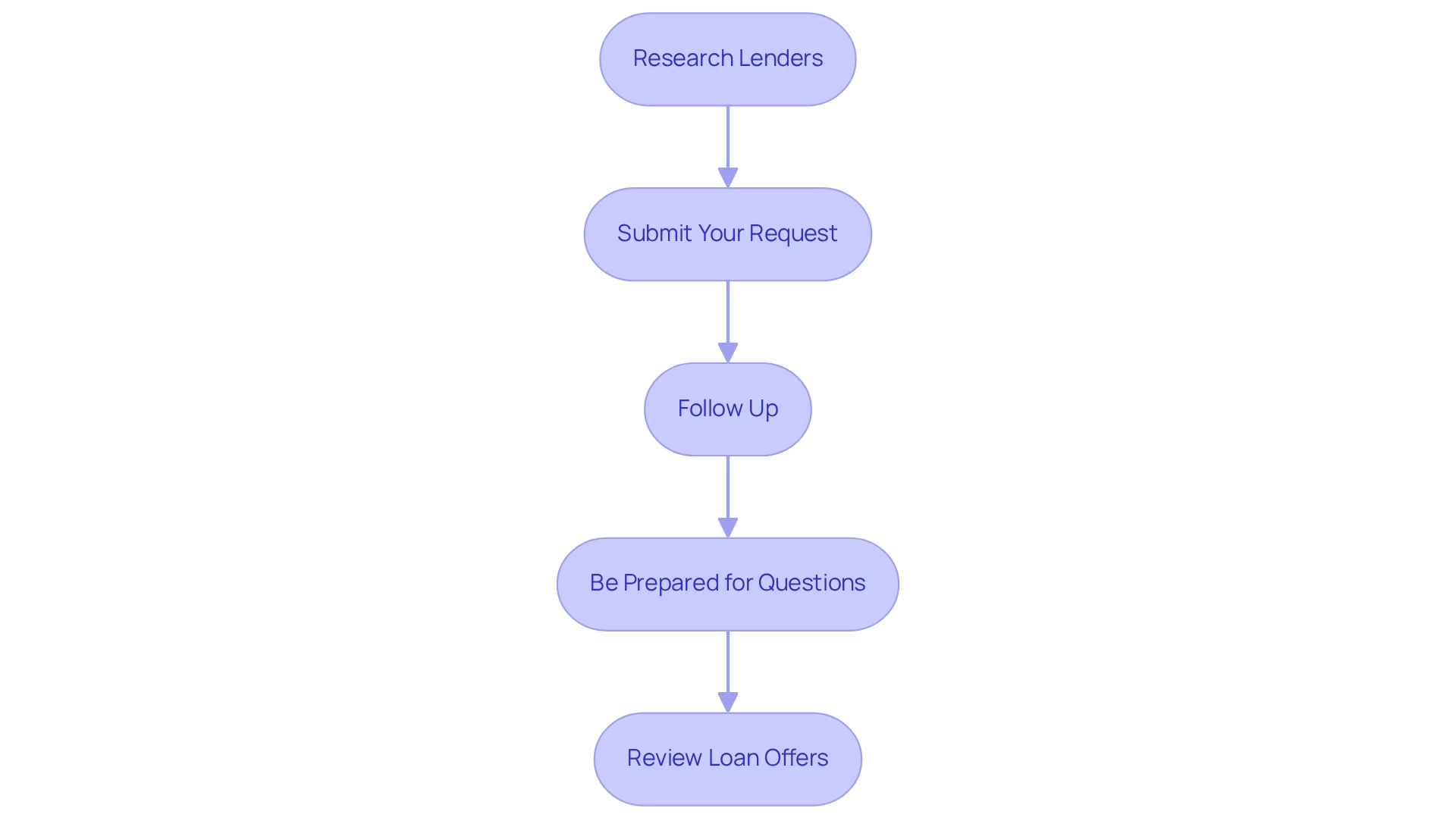

Applying for a loan with a direct lender involves several essential steps that can streamline the process and improve your chances of securing funding:

-

Research financiers by beginning to pinpoint direct sources that are small business loan direct lenders focusing on small enterprise funding. Compare their terms, interest rates, and customer reviews to find the best fit for your needs. As the financial landscape changes due to rising interest rates, it’s crucial to stay informed about how these factors may affect your loan options. At Finance Story, we offer knowledge in crafting refined and highly personalized business cases that can assist you in presenting a persuasive proposal to financiers.

-

Submit Your Request: Complete the lender's form with accurate information. Ensure that you attach all necessary documents to support your request. Remember, the average small business funding amount is $38,000, which is often only 50% of the amount initially requested. Understanding this can help you set realistic expectations. Our group focuses on customizing financing proposals that align with the growing demands of creditors, making sure your request stands out.

-

Follow Up: After submitting your request, follow up with the lender to confirm they received it and to inquire about the expected timeline for a decision.

-

Be Prepared for Questions: Lenders may contact you for additional information or clarification. Responding promptly can help maintain momentum in the approval process. With our insights into borrowing repayment criteria, you can anticipate typical questions and prepare your responses accordingly.

-

Review Loan Offers: If your application is approved, carefully review the loan terms, including interest rates, repayment schedules, and any associated fees. Ensure these terms correspond with your professional needs before accepting the offer. As Janet Gershen-Siegel observes, "But as times evolve and the Fed continues to raise interest rates, small enterprise finance will transform accordingly," emphasizing the significance of comprehending the present lending landscape. At Finance Story, we guide you through this process, ensuring you understand the implications of the terms offered.

By following these steps and taking into account the changing financial environment, you can manage the process effectively, enhancing your chances of securing a small business loan direct lender to support your business growth. Furthermore, citing case studies, like the one named 'Impact of Amounts on Small Business Growth,' can offer additional insights into how funding amounts can affect your operational requirements and growth ambitions.

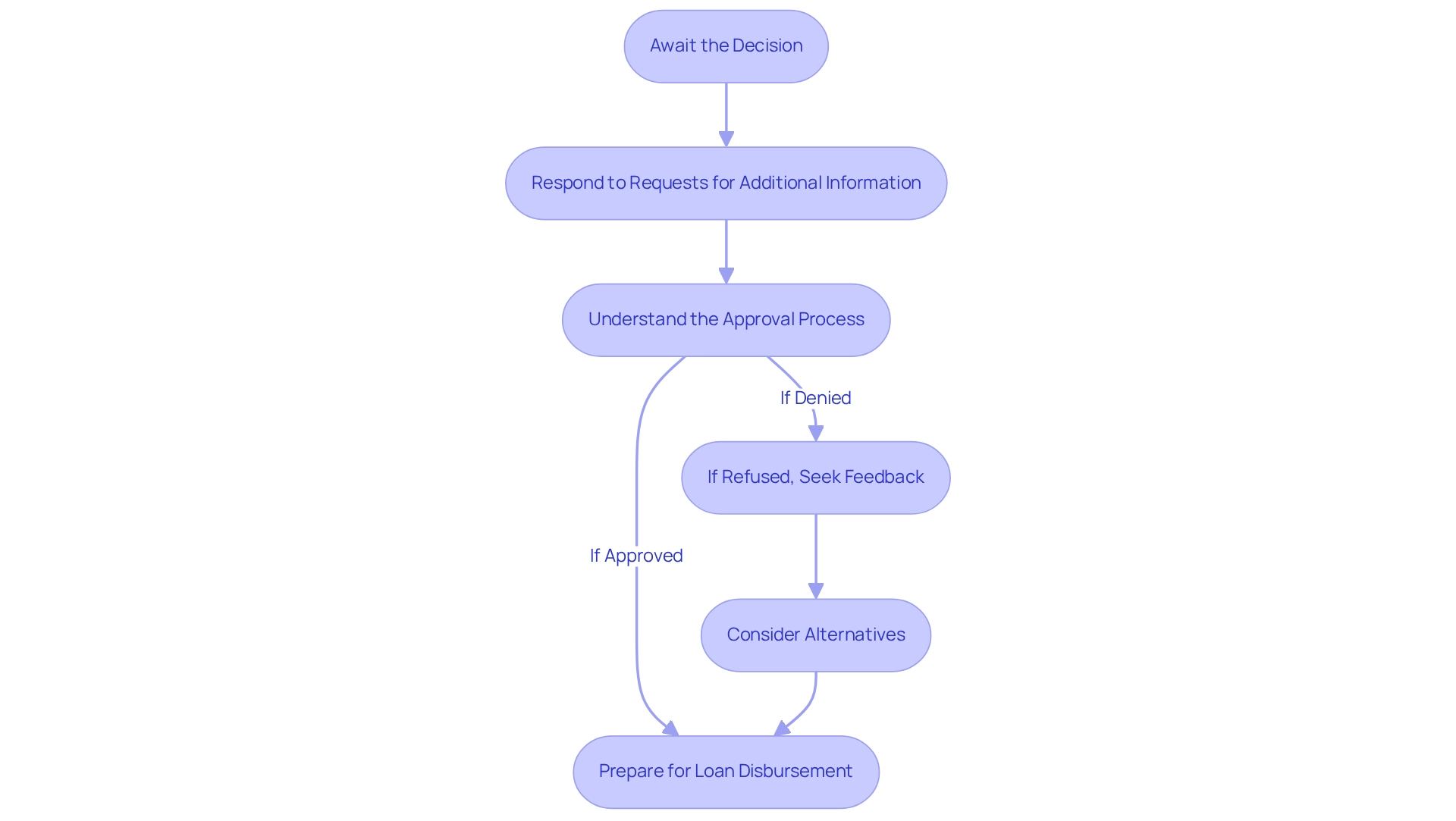

Navigate the Post-Application Process

After submitting your loan request, navigating the next steps is crucial for securing the financing you need.

-

Await the Decision: Lenders typically take several days to weeks to review applications. Use this time wisely to prepare for various outcomes, including potential requests for additional information.

-

Respond to Requests for Additional Information: If the financial institution requests more documents or clarification, respond promptly. Delays in providing requested information can prolong the approval process.

-

Understand the Approval Process: Upon approval, carefully review the loan agreement. Pay close attention to interest rates, repayment terms, and any associated fees to ensure you fully understand your obligations. Finance Story focuses on developing refined and tailored business cases that can assist you in presenting a compelling proposal to a small business loan direct lender. We also offer access to a complete variety of financial institutions, including high street banks and private lending groups, to meet your financing requirements.

-

If Refused, Seek Feedback: Should your request be denied, ask for specific reasons from the lender. Understanding the rationale behind the denial can provide valuable insights for improving future applications. With 30% of companies facing rejection for financing, this feedback is essential for refining your approach.

-

Consider Alternatives: If denied, explore alternative financing options such as peer-to-peer lending or crowdfunding. These avenues can provide the necessary capital to meet your enterprise needs.

-

Prepare for Loan Disbursement: If your application is approved, prepare for the disbursement of funds. Familiarize yourself with how and when the funds will be released to effectively plan your next steps.

By being proactive and informed during the post-application phase, you can enhance your chances of successfully managing your financing journey. Finance Story positions itself as a link between enterprises and lenders, focusing on obtaining necessary financing while allowing owners to concentrate on their operations. Understanding these steps is essential for small business owners looking to secure the support they need from a small business loan direct lender to thrive, whether they are purchasing a warehouse, retail premise, factory, or hospitality venture.

Conclusion

Navigating the world of small business financing is a critical endeavor for entrepreneurs seeking to fuel their growth and success. Understanding the various types of loans—such as secured, unsecured, lines of credit, and SBA loans—equips business owners with the knowledge needed to choose the right funding solution tailored to their unique financial situations. Each loan type serves distinct purposes, allowing businesses to align their financing strategies with their operational goals.

Preparing a compelling loan application is equally essential. By gathering comprehensive financial documents, crafting a solid business plan, and ensuring a strong credit profile, entrepreneurs can significantly enhance their chances of securing funding. Engaging directly with lenders and following a structured application process can streamline efforts and lead to successful loan approvals. Furthermore, being proactive during the post-application phase—responding promptly to requests for information and understanding loan terms—will further solidify a business’s position in the competitive financing landscape.

Ultimately, the journey to securing a small business loan is a multifaceted process that requires diligence, preparation, and a strategic approach. With expert guidance and a clear understanding of the financing options available, business owners can confidently navigate this complex terrain, ensuring they have the necessary resources to achieve their ambitions and drive their ventures forward. Embracing these principles will not only facilitate immediate financial needs but also pave the way for long-term success and sustainability in an ever-evolving economic environment.