Overview

This article delves into the crucial distinctions and advantages of owner-occupied versus investment loans.

Owner-occupied loans generally present lower interest rates and more favorable terms, a reflection of the perceived lower risk by lenders. This assertion is reinforced by emphasizing the financial benefits of owner-occupied loans, including access to government incentives and reduced borrowing costs.

In stark contrast, investment loans are often accompanied by higher rates and more stringent requirements.

Are you aware of how these differences could impact your financial decisions? Understanding these nuances is essential for making informed choices in your financial journey.

Introduction

Navigating the intricacies of home financing can indeed feel overwhelming, particularly when it comes to distinguishing between owner-occupied and investment loans. These two mortgage types serve distinct purposes, each offering unique benefits and challenges that can profoundly influence a borrower’s financial journey. As the real estate market continues to evolve, one must consider: how can individuals make informed decisions that align with their financial aspirations while maneuvering through the complexities of these loan options?

By exploring the critical differences and advantages of owner-occupied versus investment loans, we unveil essential insights for both prospective homeowners and investors.

Define Owner-Occupied and Investment Loans

Owner-occupied vs investment loan options include mortgages that are secured by individuals intending to reside in the property as their primary home. These loans typically offer reduced financing rates and more favorable conditions, as lenders view them as less risky. In 2025, the average variable rate for new owner-occupier mortgages hovers around 5.83% per year, reflecting a competitive borrowing environment.

Conversely, financing options are designed for properties acquired for owner-occupied vs investment loan purposes, either to generate rental income or appreciate in value. Such financial products typically have higher borrowing costs and stricter lending standards, particularly when evaluating owner-occupied vs investment loan options, due to the increased risk associated with rental properties. For instance, financing agreements frequently require larger down payments and may impose a lower maximum value-to-loan ratio (LVR) compared to those for owner-occupied vs investment loan mortgages.

Recent trends reveal a growing interest in owner-occupied financing, with commitments for owner-occupier properties reaching 79,890 in the March quarter of 2025. In contrast, commitments for investment properties have shown fluctuations due to varying market conditions. Understanding the differences between owner-occupied vs investment loan is essential for borrowers, as they can significantly influence financial decisions and long-term investment strategies.

Engaging with Finance Story about your next home mortgage is straightforward. With tailored support and access to premier market offerings, small business owners can save time and effort while securing the most suitable financing options. Case studies demonstrate that transitioning from an investment loan to an owner-occupied arrangement can lead to reduced rates, making it a financially astute choice for homeowners.

Experts emphasize that the distinctions between credit types, including owner-occupied vs investment loan, not only affect rates but also shape the overall borrowing experience. This underscores the importance of informed decision-making throughout the mortgage process.

Explore Benefits of Owner-Occupied and Investment Loans

When comparing owner-occupied vs investment loan mortgages, it is clear that owner-occupied mortgages present a range of advantages, particularly in terms of reduced rates that can yield substantial savings throughout the duration of the agreement. Engaging with Finance Story for your next home mortgage is as straightforward as 1, 2, 3. Our expert brokerage services are designed to save you time and effort, enabling us to identify the best value products on the market tailored to your specific needs. Furthermore, borrowers may qualify for government grants or incentives aimed at first-time homebuyers, such as the Albanese Federal Government's extended programs like the first home buyer deposit scheme, which significantly alleviates the financial burden.

Recent statistics reveal that the average new owner-occupier lending amount reached $660,000 in March 2025, with total new lending for owner-occupied residences (excluding refinancing) amounting to $54 billion for the same quarter. This data reflects the increasing interest in homeownership, despite the challenges posed by rising real estate prices. This highlights the strategic advantages of owner-occupied vs investment loan mortgages in today's economic landscape, where escalating real estate costs and economic conditions present obstacles for potential buyers.

Analyze Drawbacks of Owner-Occupied and Investment Loans

When comparing owner-occupied vs investment loan mortgages, it is clear that owner-occupied options typically offer more advantageous terms; however, they can restrict flexibility for borrowers. For example, if a homeowner decides to lease their property, transitioning to a different financing option may be necessary, potentially incurring additional refinancing costs. In contrast, the differences between owner-occupied vs investment loan financing often entail higher rates and usually require a larger deposit, making them less accessible for many individuals.

As we look ahead to 2025, average interest rates for financing in Australia are projected to hover around 6.5%, mirroring the current economic landscape. Moreover, reliance on rental income introduces considerable risks, particularly in volatile markets where vacancies can emerge unexpectedly. Mortgage experts highlight that these financial products can also present challenges, such as stricter lending criteria and the risk of increased financial stress during economic downturns.

Case studies demonstrate that investors frequently encounter obstacles in securing financing due to fluctuating property values and evolving market conditions. This underscores the complexities inherent in financing, particularly in the context of owner-occupied vs investment loan options, prompting potential investors to carefully assess their strategies.

Compare Suitability for Different Financial Needs

Owner-occupied mortgages serve individuals or families acquiring a home for personal use, making them particularly advantageous for first-time buyers. These financial agreements typically feature lower interest rates and access to government incentives, significantly easing the financial burden of homeownership. Furthermore, financing options are tailored for those looking to build wealth through real estate ventures. Individuals aiming to generate rental income or benefit from property appreciation will find that these financing options align closely with their financial objectives.

As of 2025, lending to first home purchasers has surged by 16%, highlighting a growing enthusiasm for homeownership among younger demographics. This trend is further supported by a broader increase in lending to all owner-occupiers, which has risen by 32%. The choice between owner-occupied vs investment loan ultimately hinges on the borrower's long-term goals and financial circumstances. Therefore, it is crucial for prospective borrowers to evaluate their personal needs meticulously.

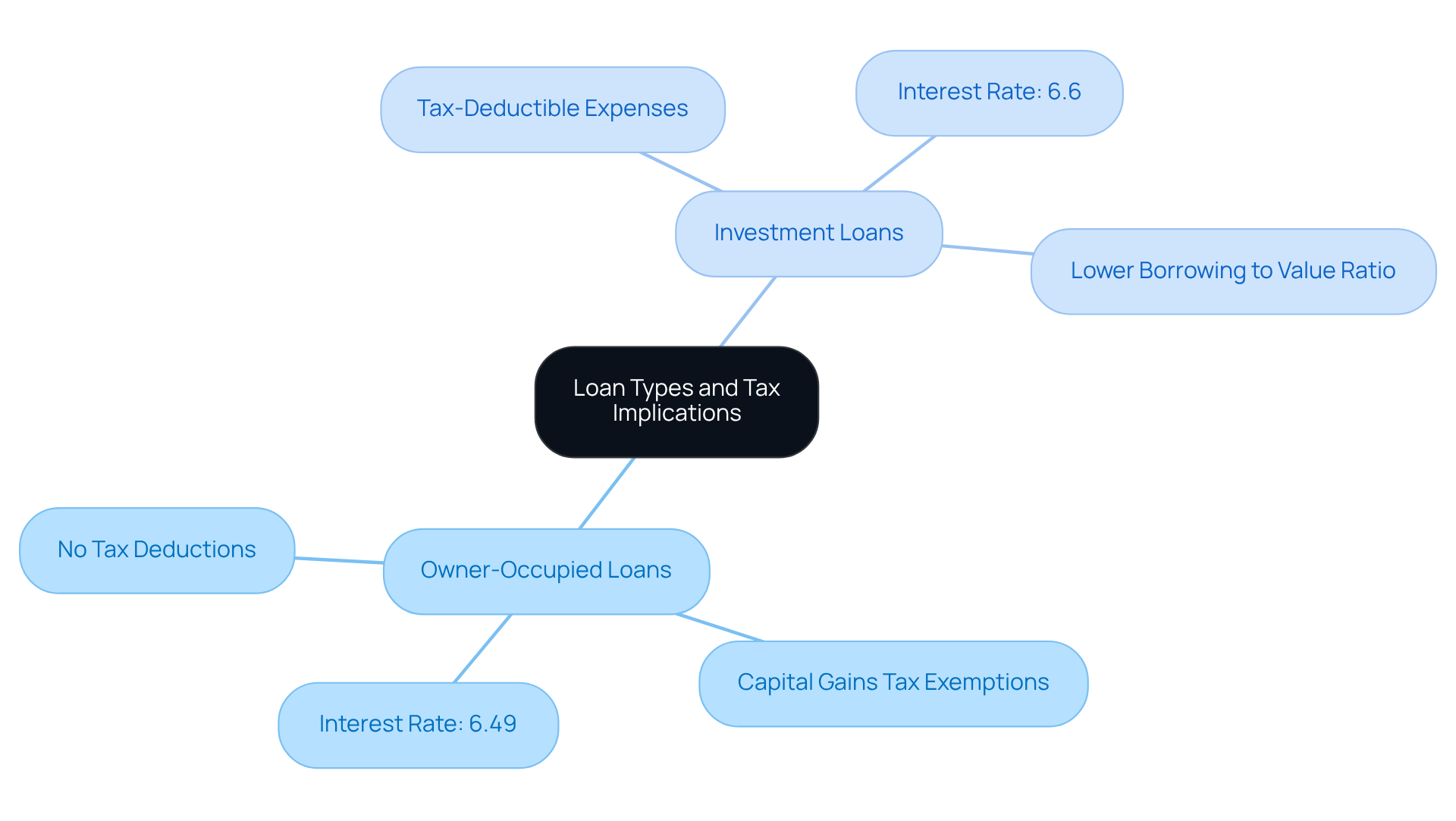

Tax Implications of Owner-Occupied vs Investment Loans

Mortgages for primary residences typically do not offer tax deductions on finance payments, as these are classified as personal expenses. However, homeowners can take advantage of capital gains tax exemptions when selling their primary residence. On the other hand, financing agreements allow borrowers to declare cost payments as tax-deductible expenses, significantly reducing taxable income. This tax benefit is crucial for investors, as it enhances the overall profitability of their property holdings. For instance, if funds from borrowing are utilized to generate rental income, the associated charges can be deducted, thereby improving the total financial return on the asset.

Furthermore, current interest rates from the Commonwealth Bank of Australia indicate:

- 6.49% for owner-occupied loan options

- 6.49% for investment loan options

- 6.6% for financing options

This underscores the financial implications of each choice. Additionally, the Borrowing to Value Ratio (BVR) for financing properties is generally lower, requiring a larger deposit when considering the differences between owner-occupied vs investment loan options. Understanding these differences, including the potential borrowing capacity for funding that may encompass rental income, is essential for making informed financial decisions that align with one’s funding strategy.

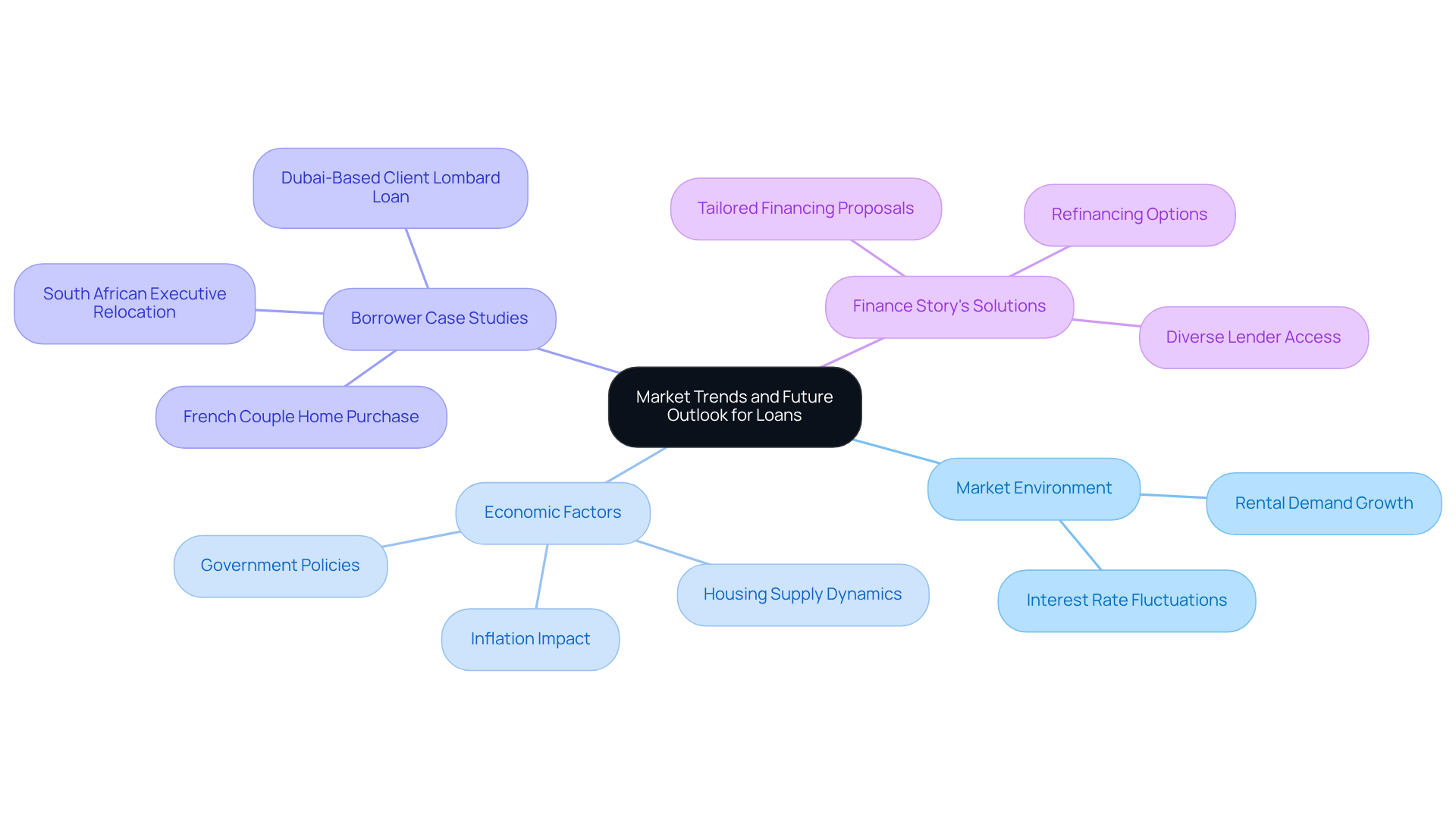

Market Trends and Future Outlook for Owner-Occupied and Investment Loans

The current market environment signals a significant shift towards real estate assets, propelled by increasing rental demand and the potential for capital growth. As we approach 2025, rental demand statistics in Australia reveal a robust market, with numerous regions witnessing substantial growth in rental yields. This trend is further bolstered by fluctuating interest rates, which may afford borrowers more competitive options for financing between owner-occupied vs investment loan.

At Finance Story, we specialize in crafting refined and highly customized business cases to present to lenders, ensuring that small business owners secure the right funding for their commercial investments. Our expertise in tailored financing proposals allows us to navigate the complexities of the lending landscape efficiently, providing access to a comprehensive array of lenders, including high street banks and innovative private financing panels. Moreover, we offer refinancing options to adapt to the evolving needs of your business.

Looking ahead, several economic factors will profoundly impact the lending environment. Inflation rates, housing supply dynamics, and government policies are anticipated to play crucial roles in shaping the future of financing options. Real estate experts suggest that as these elements evolve, borrowers must remain vigilant and informed to adeptly navigate the market's complexities.

Case studies exemplify the adaptability of borrowers in this shifting landscape. For instance, a South African executive recently relocated to the UK and successfully secured financing for a property, underscoring the significance of tailored financial solutions in addressing unique needs. Similarly, a French couple transitioned from renting to owning a home in London, highlighting Finance Story's capability to facilitate timely and efficient home purchases.

In conclusion, grasping these market trends and future outlooks is vital for borrowers aiming to align their financial strategies with emerging opportunities in both owner-occupied vs investment loan sectors.

Conclusion

Understanding the distinctions between owner-occupied and investment loans is crucial for making informed financial decisions. Owner-occupied loans typically offer more favorable terms, including lower interest rates and potential access to government incentives, making them particularly appealing for first-time homebuyers. In contrast, investment loans come with higher costs and stricter criteria, reflecting the increased risk associated with properties intended for rental income or capital appreciation.

Key insights reveal that owner-occupied loans not only provide financial advantages but also align closely with the goals of individuals seeking to establish a primary residence. On the other hand, investment loans cater to those looking to build wealth through real estate, albeit with greater financial scrutiny and potential risks. As market trends evolve, borrowers must remain vigilant and consider how their choices will impact their long-term financial strategies.

Ultimately, the decision between owner-occupied and investment loans hinges on personal financial circumstances and objectives. By carefully evaluating these options, individuals can position themselves to take advantage of emerging opportunities in the real estate market. Engaging with expert financial advice can further enhance the potential for success in navigating these complex loan types, ensuring that borrowers make choices that align with their aspirations for homeownership or investment growth.