Overview

This article provides a comprehensive comparison of owner-occupied loans and investment loans, emphasizing their distinct features and suitability for various borrowers.

- Owner-occupied loans generally offer lower interest rates and more favorable terms for individuals purchasing a primary residence.

- In contrast, investment loans are tailored for generating rental income, but they often come with higher costs and risks.

Therefore, the choice between the two types of loans largely depends on the borrower's financial goals and overall stability. Are you considering which loan type aligns best with your financial objectives?

Introduction

Navigating the world of mortgages can be daunting, particularly when it comes to distinguishing between owner-occupied loans and investment loans. Each type of financing presents its own set of features, benefits, and challenges, making it crucial for borrowers to grasp their unique characteristics.

As the mortgage landscape evolves, a pertinent question emerges: how can individuals ascertain which loan type aligns best with their financial goals?

This article explores the key differences between owner-occupied and investment loans, offering insights that empower potential borrowers to make informed decisions.

Define Owner-Occupied Loans and Investment Loans

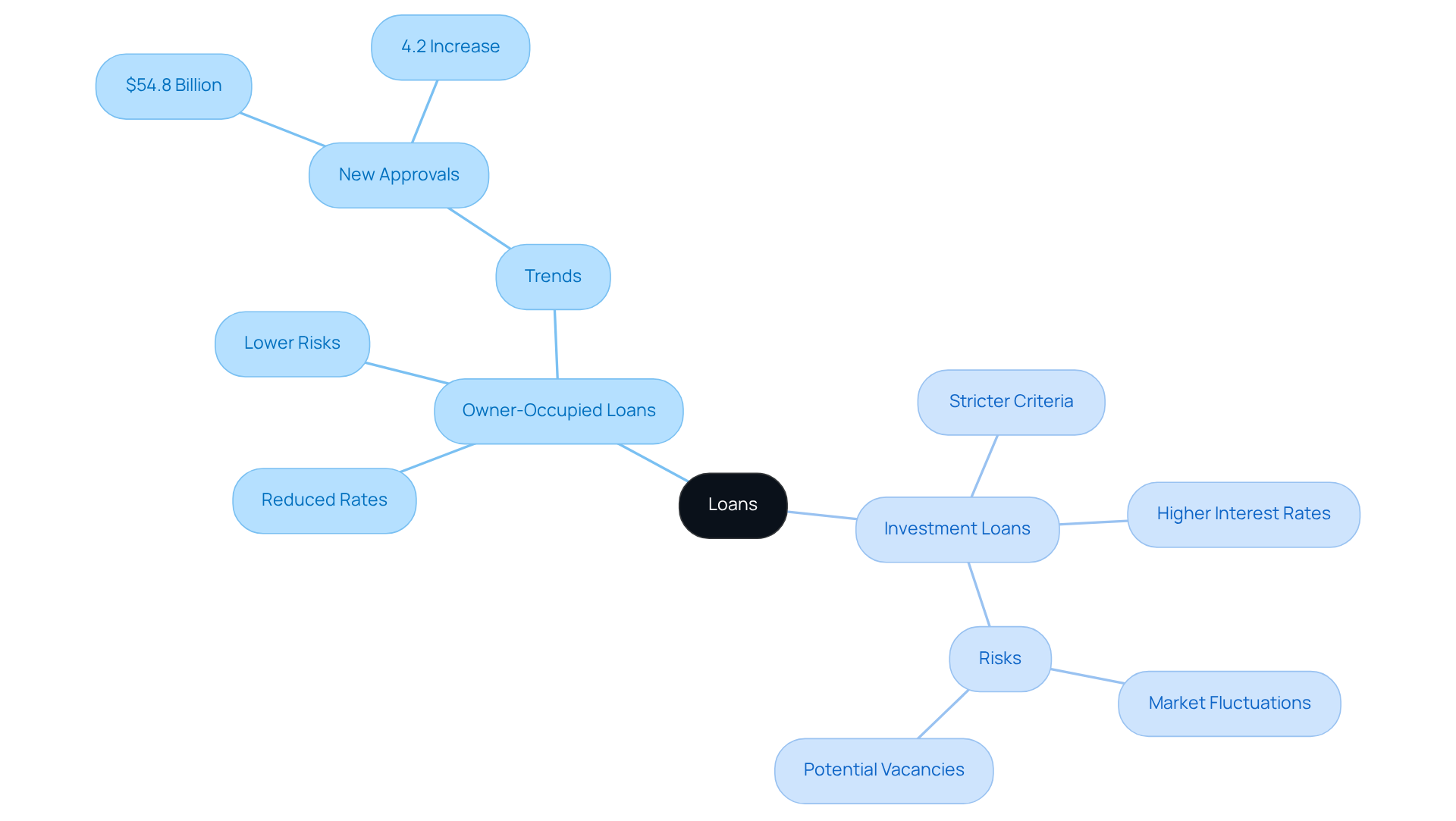

Owner-occupied mortgages are secured by borrowers who intend to reside in the property as their primary home. These financial products typically offer reduced rates and more favorable conditions, as creditors perceive them to be less risky. Conversely, financing options are tailored for properties acquired with the goal of generating rental income or capital appreciation. Given the inherent risks associated with investment properties—such as market fluctuations and potential vacancies—these financial products generally come with higher interest rates and stricter lending criteria.

Recent trends reveal that the owner-occupied mortgage market is undergoing significant transformations. In 2025, the total amount of new owner-occupier mortgage approvals reached approximately $54.8 billion, reflecting a 4.2% increase from the previous quarter. This growth is partially driven by first-time homebuyers, who are securing mortgages at a rate three times faster than the overall owner-occupier market, accounting for around 30% of new financing.

Experts in the mortgage industry stress the necessity of comprehending the distinctions between an owner occupied loan vs investment loan. For instance, while owner-occupied mortgages offer more favorable conditions, borrowers must be aware of the implications of occupancy fraud, which occurs when a borrower misrepresents their intention to live in a property to obtain a lower interest rate. Such actions can result in severe penalties, including the potential for credit recall.

Ultimately, the differences between owner occupied loan vs investment loan are crucial for borrowers to consider when navigating the mortgage landscape in Australia.

Compare Key Features of Owner-Occupied and Investment Loans

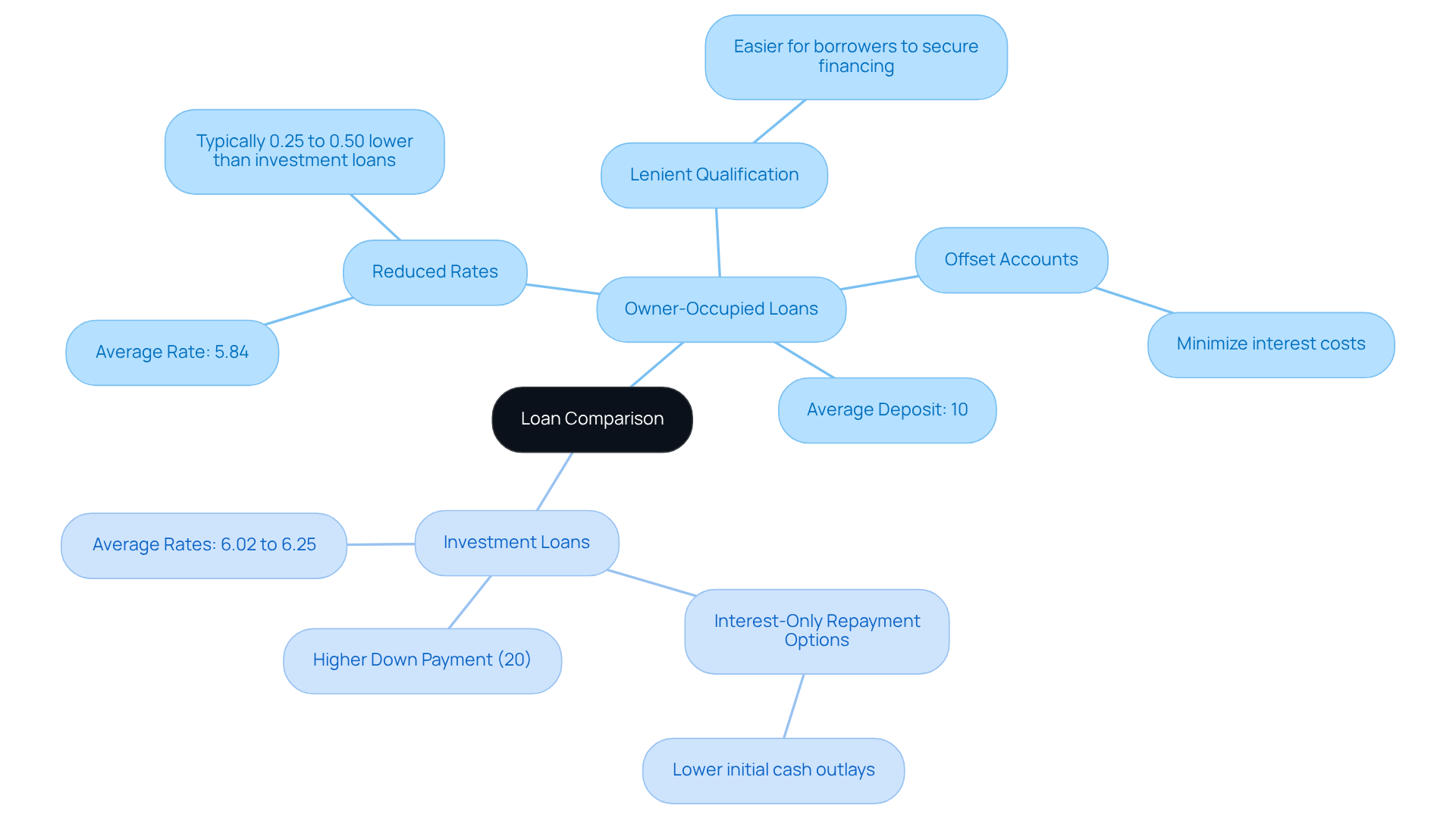

The comparison of owner occupied loan vs investment loan reveals that owner-occupied mortgages present a significant advantage, characterized by reduced rates that typically range from 0.25% to 0.50% lower than those associated with property financing. This benefit is further enhanced by more lenient qualification criteria, making it easier for borrowers to secure financing. Key features, such as offset accounts and redraw facilities, amplify the appeal of owner-occupied mortgages, enabling homeowners to minimize interest costs and access additional funds when necessary.

On the other hand, financing arrangements often necessitate a larger down payment, generally around 20% of the asset's worth, which can pose a challenge for certain investors. These credits may also entail higher charges and stricter terms, reflecting the increased risk that financiers associate with commercial properties. Notably, investment financing frequently provides interest-only repayment options, allowing investors to lower initial cash outlays and improve cash flow management. In contrast, the comparison of owner occupied loan vs investment loan typically favors principal and interest repayments, fostering a more structured approach to debt reduction.

Recent data reveals that the average deposit requirement for owner-occupied mortgages hovers around 10%, while investors are generally expected to contribute at least 20%. Currently, interest rates for owner-occupied mortgages average 5.84% per annum, compared to investment mortgages, which range from 6.02% to 6.25%. This disparity highlights the financial benefits of owner occupied loan vs investment loan for individuals looking to buy a home to live in rather than to invest in property. With Finance Story's tailored support and access to premier products, obtaining optimal home financing has never been more straightforward.

Evaluate Pros and Cons of Each Loan Type

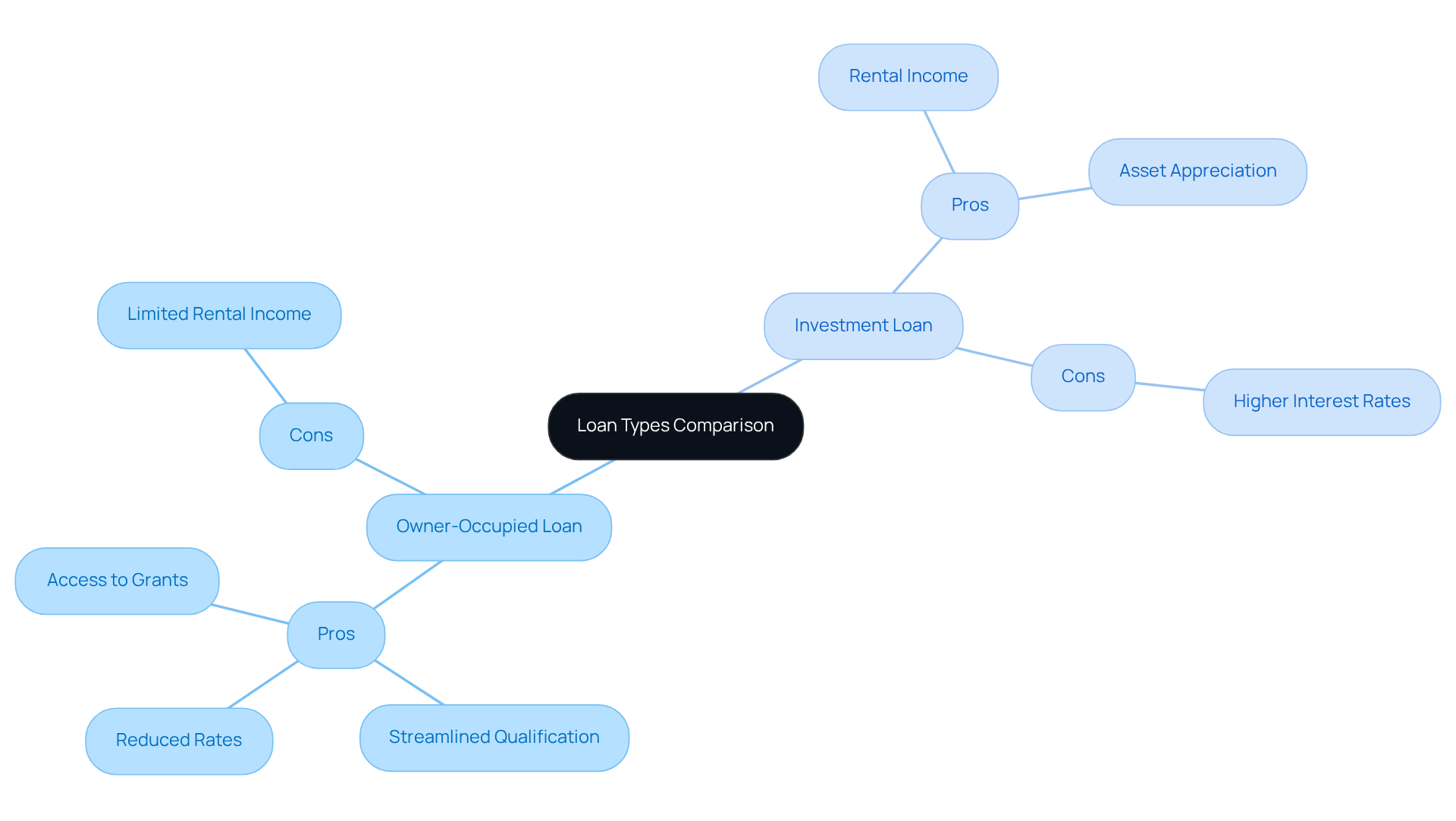

When comparing owner occupied loan vs investment loan, it's clear that owner-occupied mortgages offer a range of advantages, including reduced rates, streamlined qualification processes, and potential access to government grants or incentives tailored for first-time homebuyers. These benefits render them an appealing choice for individuals aiming to secure a primary residence. However, it is crucial to note that they may limit the borrower's capacity to generate rental income, thereby constraining opportunities for financial growth.

On the other hand, when considering owner occupied loan vs investment loan, investment financing offers the prospect of rental income and asset appreciation, making it an attractive option for those looking to build wealth through real estate. Nevertheless, these financing solutions typically entail slightly elevated interest rates compared to owner-occupied mortgages, alongside higher costs and inherent risks. Investors often face challenges such as fluctuating rental markets, which can impact cash flow, and the ongoing demands of property management, requiring both time and resources.

Furthermore, funding options may not suit individuals with limited financial stability. Lenders generally require a robust financial profile, often necessitating a deposit of approximately 20%. However, some lenders may accept lower deposits with Lenders Mortgage Insurance (LMI). As we approach mid-2025, the landscape for funding options remains competitive, with lenders meticulously assessing borrowers' financial situations. This scrutiny is vital, as failure to repay a financial advance can lead to severe consequences, including damage to credit ratings and potential asset loss.

Ultimately, while there are substantial opportunities for wealth creation in the comparison of owner occupied loan vs investment loan financing, it is essential to recognize the accompanying risks that warrant careful consideration. Investors should evaluate the benefits of potential rental income and tax advantages against the challenges posed by market volatility and the obligations of property management.

Assess Suitability for Various Financial Needs

When comparing owner occupied loan vs investment loan, it's clear that owner-occupied mortgages are designed for individuals or families looking to buy a home for personal use. This makes them particularly suitable for first-time homebuyers or those aiming for stability in their living situations. These financial agreements typically offer reduced interest rates and more favorable conditions, greatly assisting purchasers in securing their primary home.

On the other hand, financing options cater to individuals focused on wealth growth through real estate. Investors must carefully evaluate their financial capacity, risk tolerance, and long-term objectives when selecting this type of credit. For instance, experienced investors may opt for financing options to diversify and expand their property portfolios. In contrast, first-time buyers often find greater advantages in the comparison of owner occupied loan vs investment loan, which lay the groundwork for homeownership.

As of July 2025, the investment loan landscape continues to evolve. Lenders are adjusting their criteria and interest rates to align with market conditions, making it crucial for potential borrowers to remain informed about their options.

Conclusion

Understanding the differences between owner-occupied loans and investment loans is essential for making informed financial decisions. Owner-occupied mortgages typically offer lower interest rates and more favorable terms, making them an attractive option for individuals seeking a primary residence. In contrast, investment loans cater to those looking to generate income or build wealth through real estate, albeit with higher costs and risks associated with property investment.

Key arguments highlighted in the article include the advantages of owner-occupied loans, such as:

- Reduced rates

- Lenient qualification criteria

- Potential access to government incentives

Conversely, investment loans present opportunities for:

- Rental income

- Asset appreciation

But come with challenges like:

- Market volatility

- Stringent lending requirements

Ultimately, the choice between these two types of loans hinges on individual financial goals, risk tolerance, and personal circumstances.

As the mortgage landscape continues to evolve, it is crucial for potential borrowers to stay informed about their options. Whether aiming for homeownership or wealth accumulation, understanding the nuances of owner-occupied and investment loans can significantly impact financial outcomes. Therefore, careful consideration and thorough research are vital steps in selecting the right loan type to meet specific needs and objectives.