Overview

This article provides a comprehensive guide on navigating the business loan process in Victoria with confidence. By understanding key concepts, types of loans, eligibility criteria, and the application process, you can empower yourself to make informed decisions. A solid grasp of financing options—such as secured and unsecured loans, interest rates, and repayment structures—is essential. Furthermore, meeting lender requirements is crucial for successfully securing funding that drives business growth. Equip yourself with this knowledge to enhance your chances of obtaining the necessary financial support.

Introduction

Navigating the world of business loans in Victoria can indeed feel daunting; however, it is a critical step for entrepreneurs seeking to expand their ventures or manage operational costs. Understanding the foundational aspects of business financing is essential for making informed decisions that significantly impact growth and sustainability.

By distinguishing between secured and unsecured loans and grasping the nuances of interest rates and repayment structures, business owners can shape a robust financial strategy. With a variety of loan types available—from term loans to lines of credit—it is imperative for business owners to equip themselves with the knowledge necessary to select the right option that aligns with their unique needs.

This article delves into the essentials of business loans in Victoria, offering insights into:

- Eligibility criteria

- Application processes

- The diverse financing solutions available to empower businesses on their journey to success.

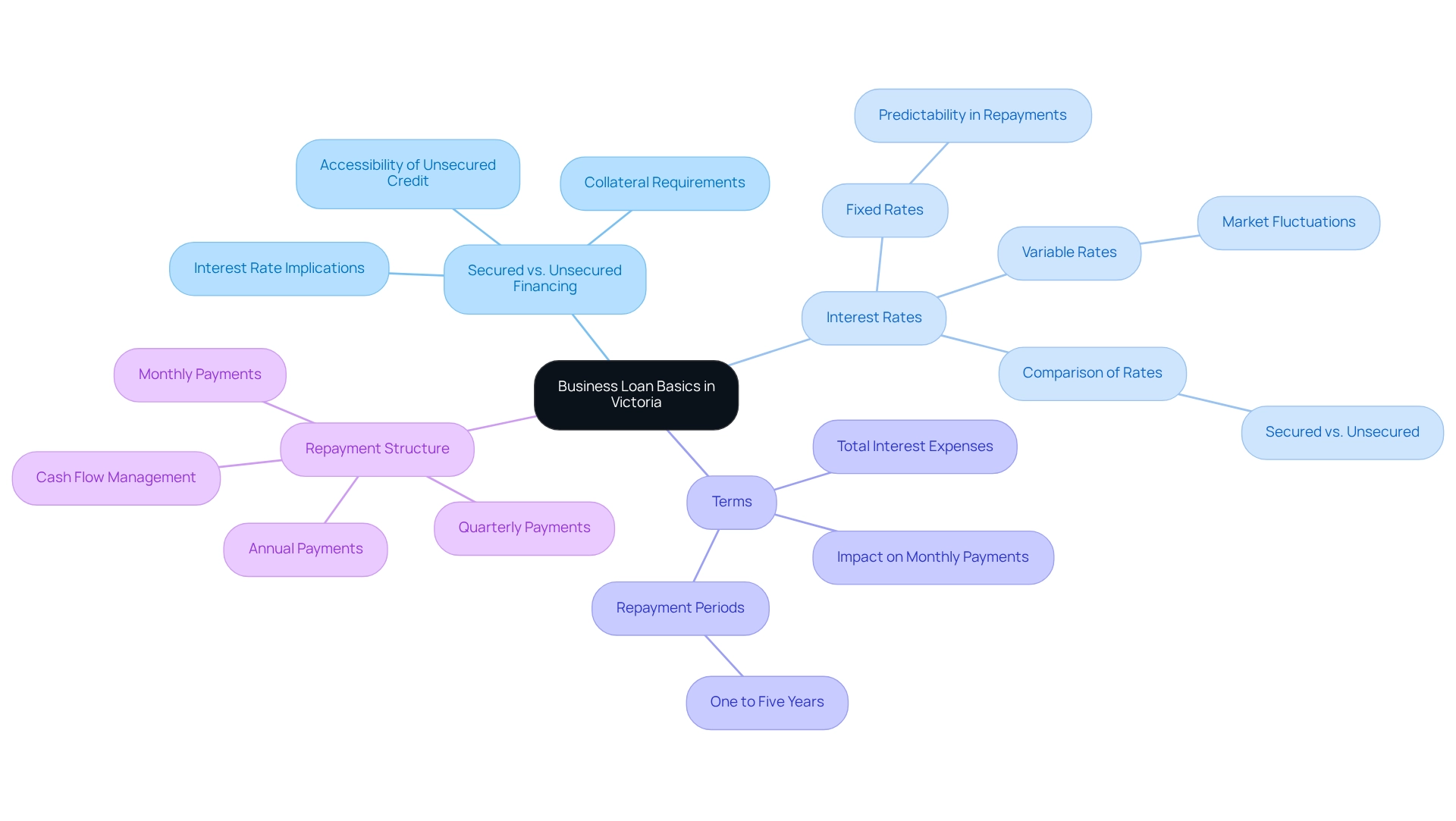

Understand Business Loan Basics in Victoria

In Victoria, a business loan VIC serves as an essential tool for various needs, including expansion, equipment acquisition, and operational expenses. A solid grasp of fundamental concepts is crucial.

- Secured vs. Unsecured Financing: Secured options require collateral, significantly impacting your choice based on the assets you own. Conversely, unsecured credit does not necessitate collateral, making it more accessible but often accompanied by higher interest rates due to increased risk. Understanding the implications of these financing types is vital, especially as amounts for larger enterprises can reach millions of dollars.

- Interest Rates: These can be either fixed or variable. Fixed rates remain steady throughout the borrowing period, providing predictability in repayments, while variable rates may fluctuate based on market conditions, potentially affecting your total repayment amount. For 2025, average interest rates for secured credit are typically lower than those for unsecured credit, reflecting the reduced risk for lenders.

- Terms: The repayment period generally spans from one to five years for business financing. Understanding the duration of the term is essential, as it influences both your monthly payments and the total interest paid over the borrowing period. Extended credit terms may result in lower monthly payments but can lead to higher total interest expenses.

- Repayment Structure: Familiarize yourself with the repayment schedule, whether it’s monthly, quarterly, or annually. Each structure has different implications for your cash flow management, impacting your business's financial health.

Current statistics indicate that borrowing amounts for larger companies can reach millions of dollars, underscoring the necessity of grasping these fundamental terms to make informed decisions. For instance, a case study involving a client named Bec illustrates how personalized support during the application process can lead to successful outcomes. Bec's experience with Finance Story highlights the significance of effective communication and responsiveness, particularly when navigating the complexities of secured versus unsecured credit. Finance Story specializes in crafting polished and highly personalized cases to present to banks, ensuring clients can secure the right financing for their commercial property investments. Furthermore, Finance Story provides a comprehensive range of lenders, including high street banks and innovative private lending panels, to accommodate various circumstances, whether you are purchasing a warehouse, retail premise, factory, or hospitality venture. It’s also important to note that some borrowing establishment costs may be deductible over the course of the borrowing rather than at establishment, as noted by tax expert Marianna Agostino. By mastering these concepts, you will be well-equipped to navigate the funding application process with confidence and secure a business loan VIC necessary for your company's growth. Finance Story's specialized knowledge in managing challenging financial situations further enhances its ability to assist clients in achieving their financial objectives, including refinancing options to address the evolving needs of your organization.

Explore Types of Business Loans Available

In Victoria, enterprises have access to a diverse array of financing options tailored to meet their financial needs:

- Term Financing: These conventional funds come with a fixed repayment schedule, making them ideal for substantial investments such as equipment or property. Typically, they feature lower interest rates compared to other financing alternatives, potentially saving companies thousands over the life of the loan. However, it's important to consider that loan expenses may include interest and fees, which can significantly impact the total cost of borrowing.

- Lines of Credit: This flexible financing option allows enterprises to withdraw funds as needed, making it suitable for managing cash flow fluctuations. It provides a safety net for unexpected expenses or opportunities, ensuring that enterprises can maintain operational stability. Understanding the various financing types and preparing for the application process is crucial when considering this option.

- Equipment Financing: Specifically designed for purchasing equipment, this type of funding often uses the equipment itself as collateral. This can simplify the approval process and reduce initial costs, enabling companies to acquire necessary tools without straining their cash flow.

- Invoice Financing: This option enables companies to borrow against outstanding invoices, offering immediate cash flow relief. It is particularly beneficial for businesses facing delays in customer payments, allowing them to sustain operations without interruption.

- Short-term Financing: Typically for smaller amounts and shorter repayment periods, this financing is useful for urgent funding needs. While it can help companies quickly address immediate financial challenges, it may involve higher interest rates.

Furthermore, Finance Story provides access to a comprehensive range of lenders, including high street banks and innovative private lending panels, ensuring that organizations can find the right financing solution for their unique circumstances. Refinancing options are also available to help companies adapt to their evolving needs, whether they aim to refinance existing debts or secure new capital for commercial assets such as warehouses, retail spaces, factories, or hospitality projects. By understanding these options, enterprises can better align their funding strategies with their operational goals, ensuring they select the most suitable credit type for their specific situations. For instance, a case study on a business loan VIC for expansion illustrates how a local manufacturer effectively leveraged this type of financing to invest in new machinery, resulting in increased production capacity and revenue growth. This underscores the potential advantages of choosing the right financing solution and navigating the application process effectively. With Finance Story's expertise in crafting refined and highly tailored case studies, clients can confidently approach creditors, ensuring they secure the appropriate funding to meet their evolving operational needs.

Review Eligibility Criteria for Business Loans

To qualify for a business loan in Victoria, applicants must typically meet several key criteria that lenders evaluate to determine eligibility:

- Business Viability: Lenders assess the financial health of your business, focusing on revenue, profit margins, and growth potential. A strong operational model is essential for securing funding, particularly when considering customized solutions that can support your specific growth plans.

- Credit History: A strong credit score is vital, with many lenders requiring a minimum score that can vary by institution. As of 2025, the average credit score required for a business loan VIC is around 650, reflecting the significance of maintaining a positive credit history. Grasping this aspect is essential, as it directly influences your capacity to obtain financing options that correspond with your objectives.

- Time in Business: Most lenders prefer businesses that have been operational for at least 12 months, as this demonstrates stability and experience in the market. This criterion is particularly relevant when seeking long-term loan solutions or refinancing options for commercial properties.

- Financial Documentation: Applicants should be prepared to provide comprehensive financial statements, tax returns, and cash flow projections to substantiate their application. This documentation is essential for financiers to assess the company's financial viability and customize the appropriate funding solution for your needs.

- Personal Guarantees: Some lenders may require personal guarantees from company owners, particularly for unsecured financing, which adds a layer of security for the lender.

Furthermore, financing conditions generally vary from 3 to 36 months, which is a significant factor for small enterprise owners when developing their funding strategies. Understanding these criteria is crucial for assessing your readiness to apply for a business loan VIC. For example, a local tech startup successfully obtained financing to support research and development for a new product line, which was crucial in hiring skilled professionals and acquiring necessary resources. This investment led to a successful product launch, significant media coverage, and a rapid increase in customer acquisition, showcasing the importance of meeting these eligibility requirements. This case exemplifies how adhering to the outlined criteria can lead to successful outcomes.

As Mike Vacy-Lyle, CBA Group Executive Business Banking, stated, "We also acknowledge the significance of balancing the needs of borrowers and depositors, and we will continue to evaluate our pricing and make additional adjustments as necessary." This emphasizes the importance of comprehending lender viewpoints, especially concerning credit history and financing costs.

In summary, being aware of the eligibility requirements for a business loan VIC not only prepares you for the application process but also enhances your chances of securing the necessary funds to advance your venture.

Follow the Step-by-Step Application Process

To successfully apply for a business credit in Victoria, follow these essential steps:

- Determine Your Loan Amount: Clearly assess your funding needs and the specific purposes for which the loan will be used. This clarity will direct your application and assist financial institutions in understanding your requirements.

- Research Financing Sources: Investigate various financial institutions and their offerings. Concentrate on those that focus on your industry type or the particular loan you need, as this can greatly influence your approval chances. At Finance Story, we provide access to a full range of lenders, including high street banks and innovative private lending panels, ensuring you find the right fit for your circumstances.

- Prepare Your Documentation: Compile all necessary documents, including financial statements, a detailed plan, and personal identification. Well-structured documentation is essential for a seamless procedure. Our expertise in creating polished business cases can help you present your proposal effectively to lenders.

- Finish the Form: Accurately fill out the form, ensuring that all information aligns with your documentation. Attention to detail here can prevent delays.

- Submit Your Request: Send your request to your selected financial institution. Numerous financial institutions now provide online submission options, enhancing the process's convenience.

- Follow Up: After submission, proactively check in with the lender to inquire about your status. Be prepared to provide any additional information they may request to support your business loan VIC application. By adhering to these steps, you can navigate the application process with confidence, significantly enhancing your chances of securing the necessary funding. For tailored financial strategies, consider booking your free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy. Discuss your needs and goals, and let us help you create your next chapter.

Conclusion

Understanding the landscape of business loans in Victoria is crucial for entrepreneurs aiming to elevate their ventures. This article has emphasized the significance of grasping essential concepts such as secured versus unsecured loans, interest rates, loan terms, and repayment structures. Such foundational knowledge empowers business owners to make informed decisions that align with their financial strategies and operational goals.

Furthermore, the exploration of various loan types—from term loans to lines of credit—demonstrates the diverse financing solutions available to meet unique business needs. Each option presents distinct advantages, whether for equipment financing, managing cash flow, or addressing urgent funding requirements. By recognizing these differences, businesses can tailor their financing approaches to optimize growth and sustainability.

Finally, understanding the eligibility criteria and the step-by-step application process is vital for securing the right financing. By preparing thoroughly and following the outlined steps, entrepreneurs can enhance their chances of approval and ensure they are well-equipped to navigate the complexities of the loan landscape. With expert guidance from professionals like Finance Story, businesses can confidently pursue the funding necessary to fuel their ambitions and achieve long-term success.