Overview

This article highlights the effective use of an owner-occupied commercial mortgage calculator, essential for evaluating financing options for businesses looking to purchase or refinance properties they intend to occupy. It details the advantages of these loans and outlines the key features of the calculator. Moreover, it underscores the critical nature of accurate data input and result interpretation, empowering businesses to make informed financial decisions. This guidance is vital for managing cash flow and securing favorable loan terms. Are you ready to explore how this tool can transform your financial strategy?

Introduction

Navigating the intricacies of financing a business property can feel overwhelming, particularly with the multitude of options available. Owner-occupied commercial mortgages emerge as a compelling solution for entrepreneurs aiming to purchase or refinance properties they will occupy. These mortgages offer distinct advantages, including lower interest rates and enhanced flexibility.

But how can business owners ensure they are making the most informed financial decisions when utilizing tools like the owner-occupied commercial mortgage calculator? This guide explores the essential features of the calculator, outlines the critical data inputs necessary for accurate calculations, and explains how to interpret the results, empowering businesses in their financial journey.

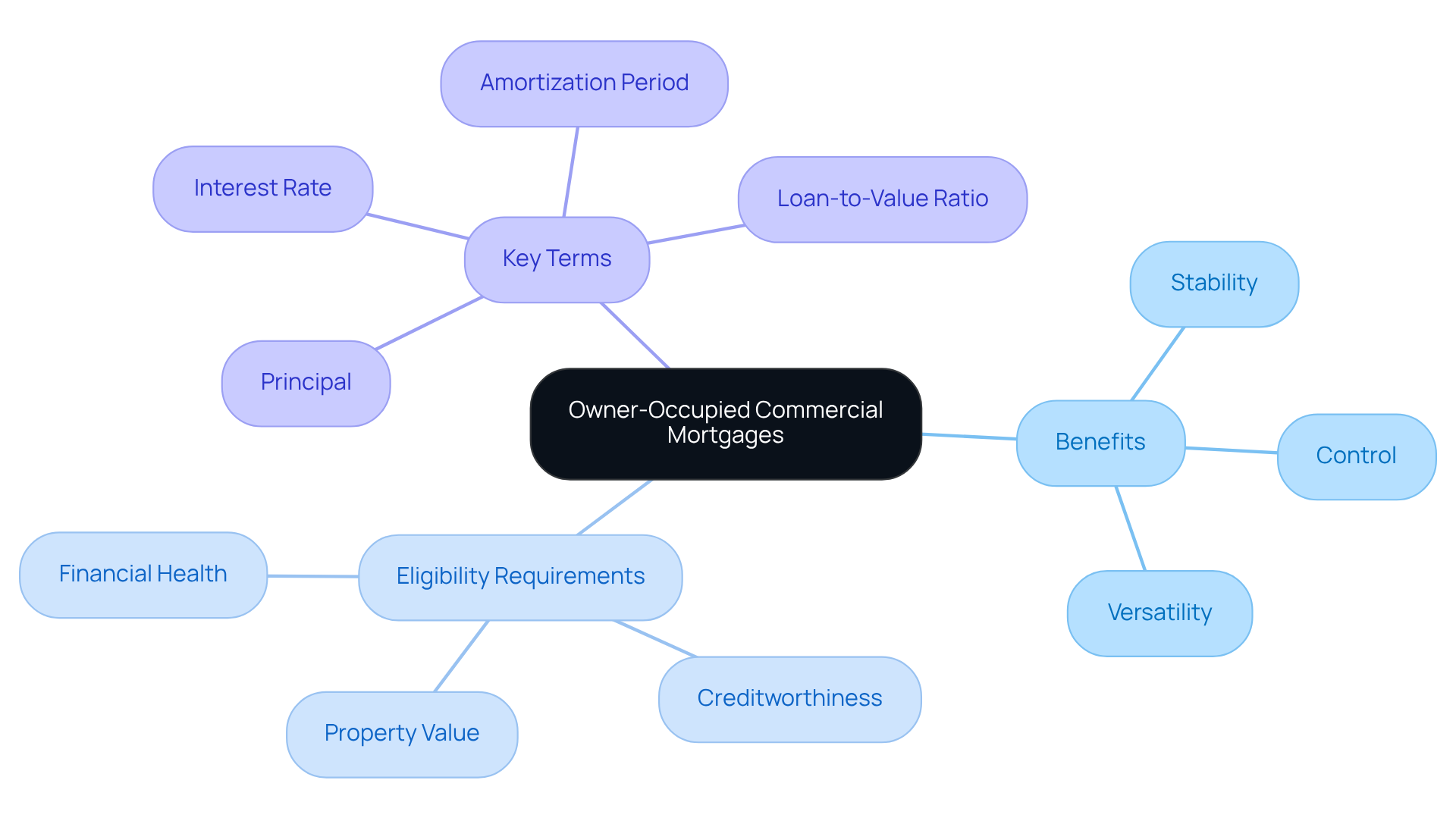

Understand Owner-Occupied Commercial Mortgages

Owner-occupied commercial mortgage calculator is designed for businesses seeking to purchase or refinance properties they will occupy. These loans typically offer more favorable conditions compared to those for investment properties, featuring lower interest rates and higher loan-to-value ratios. This makes them an attractive option for entrepreneurs. For instance, a small retail business might secure an owner-occupied loan to acquire its storefront, allowing it to build equity while avoiding the uncertainties associated with leasing.

The benefits of owner-occupied commercial loans go beyond financial terms. They provide companies with stability and control over their operational space, which is crucial for growth and expansion. Moreover, these loans can be utilized for various property types, including office spaces, retail locations, and warehouses, enhancing their versatility.

Eligibility requirements for owner-occupied loans generally include the business's financial health, creditworthiness, and the property's value. Lenders evaluate these factors to assess the risk linked to the loan. As of 2025, average borrowing rates for the owner occupied commercial mortgage calculator range from approximately 2% to 12%, depending on the lender and the specific circumstances of the borrower.

Financial experts stress the significance of grasping these eligibility criteria. For example, a well-prepared business with a robust credit history is more likely to secure favorable terms. As one specialist noted, "A strong financial base not only enhances your prospects of approval but can also lead to better rates and terms."

Before utilizing a loan calculator, it is essential to familiarize yourself with key terms such as principal, interest rate, amortization period, and loan-to-value ratio. This understanding will empower you to navigate the calculator effectively, enabling you to comprehend how your inputs influence the overall financing structure.

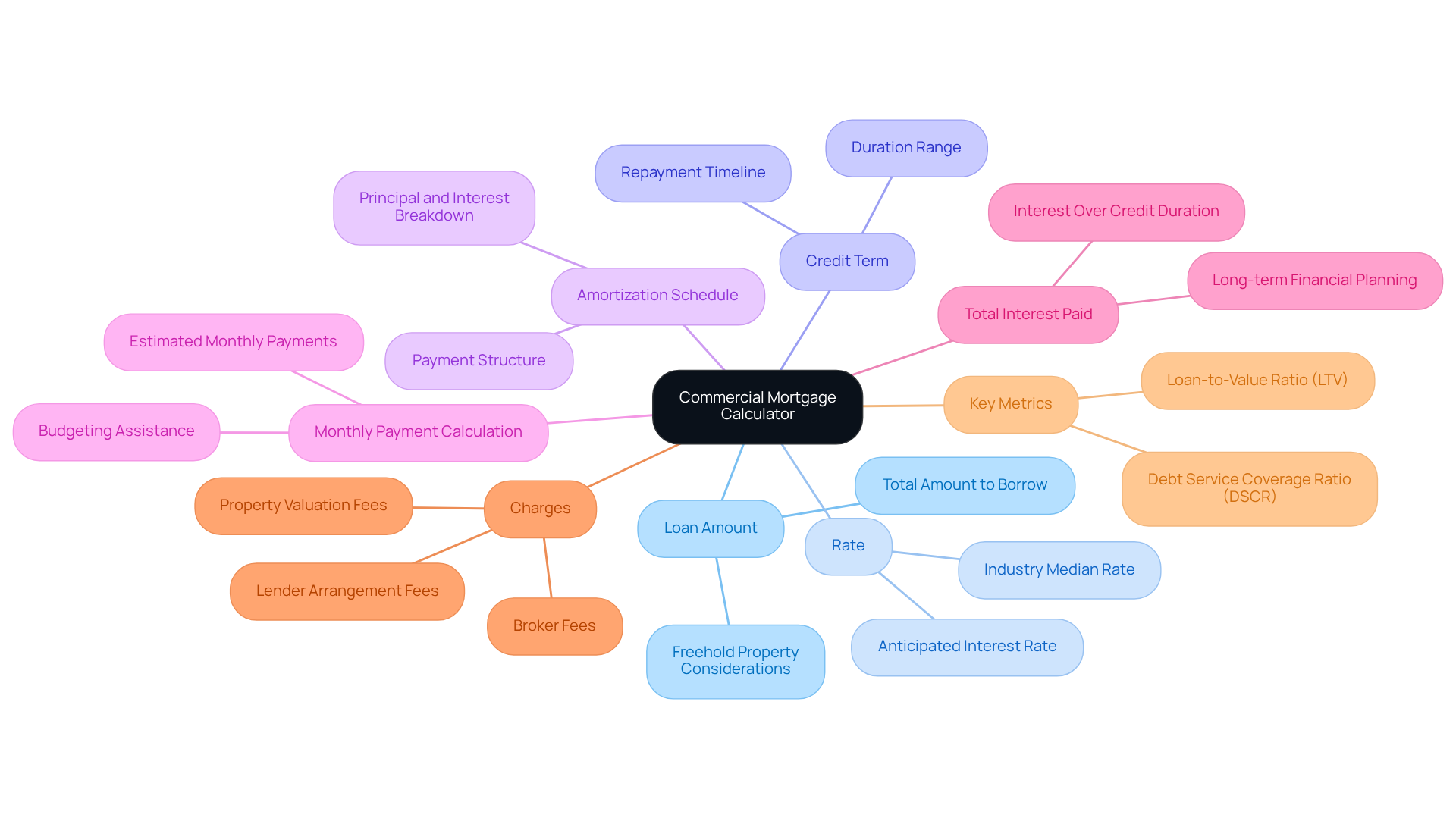

Explore the Features of the Commercial Mortgage Calculator

An owner occupied commercial mortgage calculator serves as an essential tool for entrepreneurs, enabling them to evaluate potential mortgage payments and assess loan affordability. Understanding its key features is crucial:

- Loan Amount: Input the total amount you wish to borrow, vital for determining your financing needs. When considering a freehold property, keep in mind that lenders typically permit borrowing against the commercial property rather than the business itself, unless substantial assets are involved.

- Rate: Enter the anticipated interest rate, which fluctuates based on market conditions and your credit profile. The industry median financing rate for most commercial real estate mortgages is approximately 3% higher than the effective federal funds rate, providing a benchmark for your calculations.

- Credit Term: Specify the duration of the credit, which usually ranges from 6 months to over 40 years. This helps you understand the repayment timeline and the flexibility of available options.

- Amortization Schedule: This feature illustrates how your payments will be structured over time, detailing the division of principal and interest.

- Monthly Payment Calculation: The calculator estimates your monthly payments based on the inputs provided, assisting you in budgeting effectively.

- Total Interest Paid: Gain insight into the total interest you will pay throughout the credit duration, which is essential for long-term financial planning.

- Charges: Be aware of potential fees associated with commercial loans, such as lender arrangement fees, broker fees, and property valuation fees, as these can significantly influence your total costs.

- Key Metrics: Understanding the loan-to-value ratio (LTV) and debt service coverage ratio (DSCR) is vital, as these metrics aid in assessing your borrowing capacity and the risks associated with financing. For example, when borrowing against a residential property for a commercial purchase, lenders often permit a maximum LVR of 80%, affecting how much equity you can utilize.

By familiarizing yourself with these features and factors, including the importance of equity and loan arrangements, you can utilize an owner occupied commercial mortgage calculator to make informed decisions regarding your funding options, ensuring that you choose the optimal financing solution tailored to your needs.

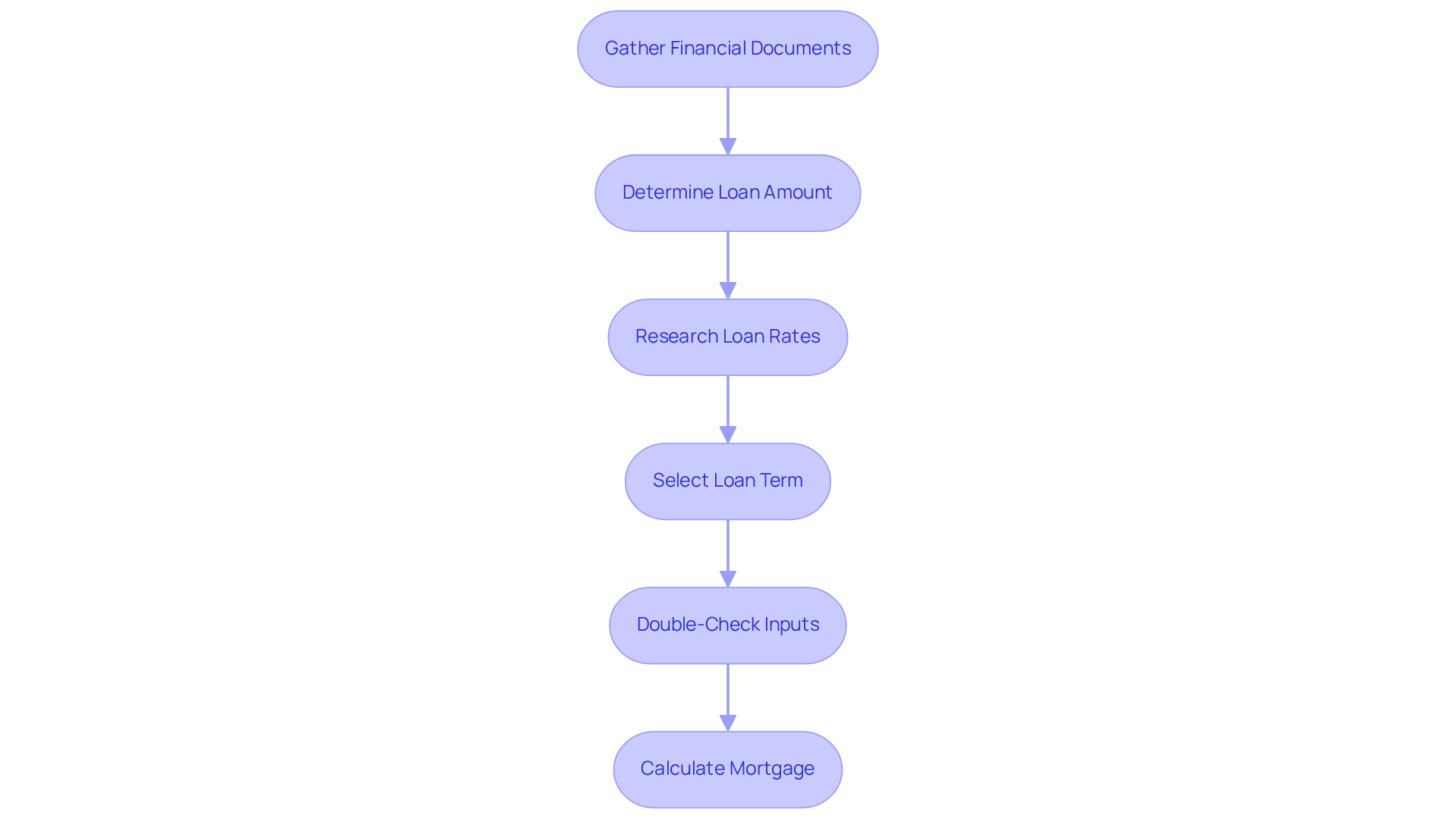

Input Data Correctly for Accurate Calculations

To achieve precise calculations with the commercial mortgage calculator, follow these essential steps for accurate data input:

-

Gather Financial Documents: Compile your business's income statements, credit reports, and details of any existing debts. This documentation reflects your financial well-being and capacity to repay the debt, making it crucial for your calculations.

-

Determine Loan Amount: Establish the total amount you need to borrow, factoring in the property purchase price and any additional costs, such as renovations or closing fees. A clearly specified sum is vital for acquiring a realistic estimate.

-

Research Loan Rates: Examine current market rates for commercial mortgages. Understanding the prevailing rates allows you to input a realistic figure into the calculator, enhancing the accuracy of your results.

-

Select Loan Term: Choose a loan term that aligns with your business strategy. Consider how long you plan to occupy the property and your financial goals, as this will impact your monthly repayments and overall interest paid.

-

Double-Check Inputs: Before calculating, meticulously review all entered data for accuracy. Ensuring that your inputs represent your actual financial condition is crucial for acquiring a dependable assessment of your payment obligations.

By diligently following these steps, you can significantly enhance the accuracy of the calculator's output, providing you with a reliable estimate of your loan obligations.

Interpret the Results to Make Informed Decisions

Interpreting the results from an owner occupied commercial mortgage calculator is crucial for making informed financial decisions. Consider these key aspects:

-

Monthly Payment: Assess whether the estimated monthly payment aligns with your budget. Evaluating your enterprise's cash flow alongside other financial commitments is vital for ensuring sustainability. Financial analysts recommend that your monthly payment should not exceed 30% of your cash flow, a prudent guideline that aligns with the expertise offered by Finance Story in helping businesses secure tailored financing solutions.

-

Total Charges Paid: Scrutinize the overall cost you will incur throughout the credit's duration. For instance, a business credit of $500,000 at a 5% rate over 20 years can lead to approximately $300,000 in total expenses paid. High total interest can significantly impact your financial health, potentially costing you much more than the principal amount borrowed.

-

Amortization Schedule: Review the amortization schedule to understand how your payments will reduce the principal balance over time. This knowledge is essential for planning future financial needs and ensuring stable cash flow. Businesses that have successfully navigated their financing often emphasize the importance of understanding their amortization schedules to avoid cash flow issues, an area where Finance Story provides valuable guidance.

-

Loan-to-Value Ratio: Ensure that the loan-to-value ratio meets industry standards. A higher ratio may indicate increased risk, potentially affecting your ability to secure favorable loan terms. Understanding this ratio is crucial for making informed decisions about your financing options.

By thoroughly analyzing these components, you can utilize an owner occupied commercial mortgage calculator to make well-informed decisions about whether to proceed with the mortgage application or explore alternative financing options. This careful assessment not only aids in managing your current financial situation but also positions your business for future growth. Leveraging the expertise of Finance Story can further enhance your understanding of these criteria and improve your chances of securing the right financing through a full range of lenders.

Conclusion

Mastering the owner-occupied commercial mortgage calculator is essential for any entrepreneur seeking favorable financing for their business property. This guide outlines the unique advantages of owner-occupied loans, including lower interest rates and greater control over business premises. It also emphasizes the importance of understanding eligibility criteria and key financial terms to facilitate informed decision-making.

Throughout this article, we explored critical aspects of utilizing the calculator, such as:

- Inputting accurate data

- Interpreting results

- Grasping the implications of monthly payments, total charges, and loan-to-value ratios

By following these insights and tips, businesses can effectively assess their borrowing capacity and make sound financial choices that align with their growth objectives.

Ultimately, leveraging the owner-occupied commercial mortgage calculator not only aids in navigating the complexities of commercial financing but also empowers businesses to take charge of their financial futures. By applying the knowledge and strategies discussed, entrepreneurs can confidently approach their mortgage applications and position themselves for success in their respective markets.